Professional Documents

Culture Documents

Calculation of Risk and Return: Kotak

Uploaded by

Rajesh InsbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculation of Risk and Return: Kotak

Uploaded by

Rajesh InsbCopyright:

Available Formats

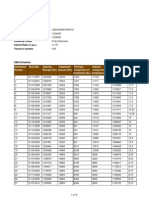

CALCULATION OF RISK AND RETURN: kotak

NAV

Date

(Rs.)

3/1/2010

11.71

4/1/2010

11.71

5/1/2010

11.71

6/1/2010

11.71

7/1/2010

11.71

8/1/2010

11.71

11/1/2010

11.72

12/1/2010

11.72

13/01/2010

11.72

14/01/2010

11.72

15/01/2010

11.72

18/01/2010

11.72

19/01/2010

11.72

20/01/2010

11.72

21/01/2010

11.73

22/01/2010

11.73

25/01/2010

11.73

27/01/2010

11.73

28/01/2010

11.73

29/01/2010

11.73

avg

returns

0

0

0

0

0

0.085397

0

0

0

0

0

0

0

0.085324

0

0

0

0

0

0.170721

avg

returns

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

0.1707

diff(dx)

dx^2

returns

-0.1707

-0.1707

-0.1707

-0.1707

-0.1707

-0.0853

-0.1707

-0.1707

-0.1707

-0.1707

-0.1707

-0.1707

-0.1707

-0.0853

-0.1707

-0.1707

-0.1707

-0.1707

-0.1707

Sum

0.02913849

0.02913849

0.02913849

0.02913849

0.02913849

0.007276585

0.02913849

0.02913849

0.02913849

0.02913849

0.02913849

0.02913849

0.02913849

0.007289022

0.02913849

0.02913849

0.02913849

0.02913849

0.02913849

0.509919937

0.163822744

-5.236E-06

0.890732

0.009792

-0.2261

-0.51189

-0.2651

-0.38657

-2.05748

0.151471

-0.46023

-0.56407

2.319079

0.109578

-0.56005

-1.91026

-1.34

-0.32322

-2.74152

0.325731

3.654204

-3.8859

51

avg

returns

diff(dy)

dy^2

dx*dy

bankex

-30885 30885.89

953938246

-5272.22

-30885 30885.01

953883830

-5272.07

-30885 30884.77

953869259

-5272.03

-30885 30884.49

953851606

-5271.98

-30885 30884.73

953866850

-5272.02

-30885 30884.61

953859347

-2634.55

-30885 30882.94

953756139

-5271.72

-30885 30885.15

953892581

-5272.1

-30885 30884.54

953854797

-5271.99

-30885 30884.44

953848383

-5271.97

-30885 30887.32

954026480

-5272.47

-30885 30885.11

953889994

-5272.09

-30885 30884.44

953848631

-5271.97

-30885 30883.09

953765232

-2636.67

-30885 30883.66

953800455

-5271.84

-30885 30884.68

953863260

-5272.01

-30885 30882.26

953713889

-5271.6

-30885 30885.33

953903346

-5272.13

-30885 30888.65

954108959

-5272.69

sum

18123541281

-94896.1

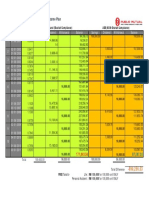

CALCULATION OF RISK AND RETURN:

NAV

Date

(Rs.)

3/1/2011

12.38

4/1/2011

12.38

5/1/2011

12.39

6/1/2011

12.39

7/1/2011

12.39

10/1/2011

12.4

11/1/2011

12.4

12/1/2011

12.4

13/01/2011

12.41

14/01/2011

12.41

17/01/2011

12.42

18/01/2011

12.42

19/01/2011

12.42

20/01/2011

12.43

21/01/2011

12.43

24/01/2011

12.44

25/01/2011

12.44

27/01/2011

12.44

28/01/2011

12.45

31/01/2011

12.46

avg

returns

0

0.080775

0

0

0.08071

0

0

0.080645

0

0.08058

0

0

0.080515

0

0.080451

0

0

0.080386

0.080321

0.033915

avgreturns diff(dx)

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

0.0339

-0.0339

0.046875

-0.0339

-0.0339

0.04681

-0.0339

-0.0339

0.046745

-0.0339

0.04668

-0.0339

-0.0339

0.046615

-0.0339

0.046551

-0.0339

-0.0339

0.046486

0.046421

sum

dx^2

returns

0.00114921

0.00219731

0.00114921

0.00114921

0.0021912

0.00114921

0.00114921

0.00218511

0.00114921

0.00217904

0.00114921

0.00114921

0.00217299

0.00114921

0.00216695

0.00114921

0.00114921

0.00216093

0.00215494

0.03004977

0.03976892

4.2192E-05

-2.56437

-2.08129

-1.44396

-0.83524

-2.93755

0.925546

2.03321

-3.67879

-2.92087

0.109947

0.799294

-0.28978

2.071035

1.292975

2.081703

-2.77729

-2.46885

-1.04583

1.890975

-12.0609

52

avgreturns

bankex

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

-12.06

diff(dy)

dy^2

dx*dy

9.495627

9.978715

10.61604

11.22476

9.122452

12.98555

14.09321

8.381213

9.139131

12.16995

12.85929

11.77022

14.13104

13.35298

14.1417

9.282707

9.591152

11.01417

13.95097

sum

90.16694

99.57475

112.7002

125.9952

83.21913

168.6244

198.6186

70.24473

83.52371

148.1076

165.3614

138.5381

199.6862

178.3019

199.9878

86.16864

91.99019

121.3119

194.6297

2696.895

-0.3219

0.467757

-0.35988

-0.38052

0.427024

-0.44021

-0.47776

0.391781

-0.30982

0.568095

-0.43593

-0.39901

0.658722

-0.45267

0.658304

-0.31468

-0.32514

0.512003

0.647622

0.113787

CALCULATION OF RISK AND RETURN: (RELIANCE)

NAV

Date

(Rs.)

3/1/2010

12.23

4/1/2010

12.24

5/1/2010

12.24

6/1/2010

12.24

7/1/2010

12.24

8/1/2010

12.24

11/1/2010

12.25

12/1/2010

12.25

13/01/2010

12.25

14/01/2010

12.25

15/01/2010

12.25

18/01/2010

12.26

19/01/2010

12.26

20/01/2010

12.26

21/01/2010

12.26

22/01/2010

12.26

25/01/2010

12.26

27/01/2010

12.27

28/01/2010

12.27

29/01/2010

12.27

avg

returns

0.081766

0

0

0

0

0.081699

0

0

0

0

0.081633

0

0

0

0

0

0.081566

0

0

0.017193

avgreturns diff(dx)

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.0171

0.064666

-0.0171

-0.0171

-0.0171

-0.0171

0.064599

-0.0171

-0.0171

-0.0171

-0.0171

0.064533

-0.0171

-0.0171

-0.0171

-0.0171

-0.0171

0.064466

-0.0171

-0.0171

sum

dx^2

returns

0.004182

0.000292

0.000292

0.000292

0.000292

0.004173

0.000292

0.000292

0.000292

0.000292

0.004164

0.000292

0.000292

0.000292

0.000292

0.000292

0.004156

0.000292

0.000292

0.021061

0.033294

0.001964

0.890732

0.009792

-0.2261

-0.51189

-0.2651

-0.38657

-2.05748

0.151471

-0.46023

-0.56407

2.319079

0.109578

-0.56005

-1.91026

-1.34

-0.32322

-2.74152

0.325731

3.654204

-0.20452

54

avgreturns

bankex

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

-0.204

diff(dy)

dy^2

dx*dy

1.094732

0.213792

-0.0221

-0.30789

-0.0611

-0.18257

-1.85348

0.355471

-0.25623

-0.36007

2.523079

0.313578

-0.35605

-1.70626

-1.136

-0.11922

-2.53752

0.529731

3.858204

sum

1.198438

0.045707

0.000488

0.094797

0.003734

0.033333

3.435383

0.12636

0.065655

0.129651

6.365926

0.098331

0.126772

2.911325

1.290493

0.014213

6.438995

0.280615

14.88574

37.54595

0.070792

-0.00366

0.000378

0.005265

0.001045

-0.01179

0.031694

-0.00608

0.004382

0.006157

0.162821

-0.00536

0.006088

0.029177

0.019426

0.002039

-0.16358

-0.00906

-0.06598

0.073756

CALCULATION OF RISK AND RETURN:

NAV

Date

(Rs.)

returns

avgreturns diff(dx)

dx^2

returns

avgreturns diff(dy)

dy^2

dx*dy

3/1/2011

12.96

bankex

4/1/2011

12.96

0

0.028

-0.028 0.000784 -2.56437

-0.603 -1.96137 3.846983 0.054918

5/1/2011

12.96

0

0.028

-0.028 0.000784 -2.08129

-0.603 -1.47829 2.185327 0.041392

6/1/2011

12.97 0.07716

0.028 0.04916 0.002417 -1.44396

-0.603 -0.84096 0.70722 -0.04134

7/1/2011

12.97

0

0.028

-0.028 0.000784 -0.83524

-0.603 -0.23224 0.053937 0.006503

10/1/2011

12.97

0

0.028

-0.028 0.000784 -2.93755

-0.603 -2.33455 5.450115 0.065367

11/1/2011

12.97

0

0.028

-0.028 0.000784 0.925546

-0.603 1.528546 2.336454

-0.0428

12/1/2011

12.97

0

0.028

-0.028 0.000784 2.03321

-0.603 2.63621 6.949602 -0.07381

13/01/2011

12.97

0

0.028

-0.028 0.000784 -3.67879

-0.603 -3.07579 9.460466 0.086122

14/01/2011

12.98 0.077101

0.028 0.049101 0.002411 -2.92087

-0.603 -2.31787 5.372519 -0.11381

17/01/2011

12.99 0.077042

0.028 0.049042 0.002405 0.109947

-0.603 0.712947 0.508293 0.034964

18/01/2011

12.99

0

0.028

-0.028 0.000784 0.799294

-0.603 1.402294 1.966428 -0.03926

19/01/2011

12.99

0

0.028

-0.028 0.000784 -0.28978

-0.603 0.31322 0.098107 -0.00877

20/01/2011

13 0.076982

0.028 0.048982 0.002399 2.071035

-0.603 2.674035 7.150465 0.13098

21/01/2011

13

0

0.028

-0.028 0.000784 1.292975

-0.603 1.895975 3.594722 -0.05309

24/01/2011

13.01 0.076923

0.028 0.048923 0.002393 2.081703

-0.603 2.684703 7.207629 0.131344

25/01/2011

13.01

0

0.028

-0.028 0.000784 -2.77729

-0.603 -2.17429 4.727552 0.06088

27/01/2011

13.02 0.076864

0.028 0.048864 0.002388 -2.46885

-0.603 -1.86585 3.48139 -0.09117

28/01/2011

13.02

0

0.028

-0.028 0.000784 -1.04583

-0.603 -0.44283

0.1961 0.012399

31/01/2011

13.03 0.076805

0.028 0.048805 0.002382 1.890975

-0.603 2.493975 6.219909 0.121718

avg

0.028362

sum

0.026203 -0.60305

sum

71.65856 0.282529

0.001379

0.003943

55

CALCULATION OF RISK AND RETURN: (HDFC)

NAV

Date

(Rs.)

4/1/2010

93.15

5/1/2010

93.79

6/1/2010

94.22

7/1/2010

93.38

8/1/2010

93.29

11/1/2010

94.08

12/1/2010

93.93

13/01/2010

94.96

14/01/2010

95.23

15/01/2010

95.18

18/01/2010

95.56

19/01/2010

94.71

20/01/2010

94.62

21/01/2010

92.85

22/01/2010

92.32

25/01/2010

91.55

27/01/2010

89.11

28/01/2010

89.68

29/01/2010

90.21

avg

returns

0.687064

0.458471

-0.89153

-0.09638

0.846822

-0.15944

1.096561

0.28433

-0.0525

0.399244

-0.88949

-0.09503

-1.87064

-0.57081

-0.83406

-2.66521

0.639659

0.59099

-0.17344

avgreturns diff(dx)

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

-0.1734

0.860464

0.631871

-0.71813

0.07702

1.020222

0.013961

1.269961

0.45773

0.120896

0.572644

-0.71609

0.078373

-1.69724

-0.39741

-0.66066

-2.49181

0.813059

0.76439

sum

dX^2

returns

0.740398

0.399261

0.515711

0.005932

1.040852

0.000195

1.612802

0.209517

0.014616

0.327921

0.51279

0.006142

2.880625

0.157937

0.436466

6.209118

0.661065

0.584292

16.31564

0.952063

0.393818

0.009792

-0.2261

-0.51189

-0.2651

-0.38657

-2.05748

0.151471

-0.46023

-0.56407

2.319079

0.109578

-0.56005

-1.91026

-1.34

-0.32322

-2.74152

0.325731

3.654204

-0.20452

57

avgreturns

bankex

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

-0.2045

diff(dy)

dy^2

dx*dy

0.214292

-0.0216

-0.30739

-0.0606

-0.18207

-1.85298

0.355971

-0.25573

-0.35957

2.523579

0.314078

-0.35555

-1.70576

-1.1355

-0.11872

-2.53702

0.530231

3.858704

sum

0.045921

0.000466

0.094489

0.003673

0.03315

3.43353

0.126715

0.065399

0.129291

6.368449

0.098645

0.126416

2.909619

1.289357

0.014094

6.436457

0.281145

14.8896

37.54595

0.18439

-0.01365

0.220747

-0.00467

-0.18575

-0.02587

0.452069

-0.11706

-0.04347

1.445111

-0.22491

-0.02787

2.895086

0.451262

0.078431

6.321766

0.431109

2.949556

14.78629

CALCULATION OF RISK AND RETURN:

NAV

Date

(Rs.)

3/1/2011

119.29

4/1/2011

118.9

5/1/2011

117.64

6/1/2011

116.64

7/1/2011

114.5

10/1/2011

112.51

11/1/2011

112.46

12/1/2011

114.03

13/01/2011

112.42

14/01/2011

111.3

17/01/2011

110.95

18/01/2011

111.42

19/01/2011

110.98

20/01/2011

110.98

21/01/2011

111.16

24/01/2011

111.76

25/01/2011

111.42

27/01/2011

109.52

28/01/2011

107.01

31/01/2011

107.22

avg

returns

-0.32693

-1.05971

-0.85005

-1.83471

-1.73799

-0.04444

1.396052

-1.41191

-0.99626

-0.31447

0.423614

-0.3949

0

0.162191

0.539763

-0.30422

-1.70526

-2.29182

0.196243

-0.55552

avgreturns diff(dx)

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

-0.555

0.228066

-0.50471

-0.29505

-1.27971

-1.18299

0.51056

1.951052

-0.85691

-0.44126

0.240535

0.978614

0.160098

0.555

0.717191

1.094763

0.250777

-1.15026

-1.73682

0.751243

sum

dx^2

returns

0.052014

0.254736

0.087055

1.637645

1.399468

0.260671

3.806604

0.734293

0.194714

0.057857

0.957686

0.025631

0.308025

0.514363

1.198505

0.062889

1.323097

3.01654

0.564367

16.45616

0.930652

0.346207

-2.56437

-2.08129

-1.44396

-0.83524

-2.93755

0.925546

2.03321

-3.67879

-2.92087

0.109947

0.799294

-0.28978

2.071035

1.292975

2.081703

-2.77729

-2.46885

-1.04583

1.890975

-0.60305

58

avgreturns diff(dy)

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-0.603

-1.96137

-1.47829

-0.84096

-0.23224

-2.33455

1.528546

2.63621

-3.07579

-2.31787

0.712947

1.402294

0.31322

2.674035

1.895975

2.684703

-2.17429

-1.86585

-0.44283

2.493975

sum

dy^2

dx*dy

3.846983

2.185327

0.70722

0.053937

5.450115

2.336454

6.949602

9.460466

5.372519

0.508293

1.966428

0.098107

7.150465

3.594722

7.207629

4.727552

3.48139

0.1961

6.219909

71.65856

-0.44732

0.746111

0.248127

0.297203

2.76175

0.780414

5.143382

2.63567

1.022792

0.171488

1.372305

0.050146

1.48409

1.359777

2.939112

-0.54526

2.146209

0.76912

1.873582

24.80869

You might also like

- Roland's Personal Financial StatementDocument6 pagesRoland's Personal Financial StatementRoland Bon IntudNo ratings yet

- 300LT MM 20100707Document432 pages300LT MM 20100707Павел АнгеловNo ratings yet

- Rekapitulasi Cash Flow Garuda Jaya: Tanggal Account Konsumen Tipe DaerahDocument24 pagesRekapitulasi Cash Flow Garuda Jaya: Tanggal Account Konsumen Tipe DaerahOdo Did Dan KetenanganNo ratings yet

- 8 16 25 Promotional Arrears Calculator For W.B.govt EmployeesDocument10 pages8 16 25 Promotional Arrears Calculator For W.B.govt EmployeesSnehasis Karmahapatra100% (1)

- Bill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)Document6 pagesBill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)jjayNo ratings yet

- StatementDocument5 pagesStatementNavneet BaliNo ratings yet

- JOD13969Document2 pagesJOD13969Abhishek SinghviNo ratings yet

- Bank Monitoring Dec - 2011Document164 pagesBank Monitoring Dec - 2011chisteaNo ratings yet

- Atenet 12Document11 pagesAtenet 12mesfin esheteNo ratings yet

- Home Loan AmortizationDocument6 pagesHome Loan AmortizationsunyrawatNo ratings yet

- 1001013184-Integrated BillDocument2 pages1001013184-Integrated BillChandra Kiran Reddy VNo ratings yet

- Nic & Noy Account Owner: Jean Munta W/ Ice BoxDocument4 pagesNic & Noy Account Owner: Jean Munta W/ Ice BoxRoland Bon IntudNo ratings yet

- Controle FinanceiroDocument3 pagesControle FinanceirokatysoutaoNo ratings yet

- Sumona Chakraborty 2010Document6 pagesSumona Chakraborty 2010LoveSahilSharmaNo ratings yet

- ODL Securities: Account: 71909 Name: Test Currency: USD Closed TransactionsDocument4 pagesODL Securities: Account: 71909 Name: Test Currency: USD Closed TransactionsJuan Pablo ArangoNo ratings yet

- So Nhat Ky Chung 2020 Đã X LýDocument273 pagesSo Nhat Ky Chung 2020 Đã X LýLan Anh NguyễnNo ratings yet

- 603301508355Document17 pages603301508355Minakshi SharmaNo ratings yet

- Ocr Level 2 Certificate in Bookkeeping & Accounting Skills Unit M10: Maintaining The JournalDocument9 pagesOcr Level 2 Certificate in Bookkeeping & Accounting Skills Unit M10: Maintaining The Journalvikkiv246No ratings yet

- HDFC Bank LTDDocument6 pagesHDFC Bank LTDS.KamalarajanNo ratings yet

- NZ 7 Ab SV Dwa 11 Heb HDocument1 pageNZ 7 Ab SV Dwa 11 Heb HShyam GuptaNo ratings yet

- Investment Fund InvestigationDocument5 pagesInvestment Fund InvestigationZvo UnilNo ratings yet

- United TractorDocument120 pagesUnited TractornindyanandiNo ratings yet

- Kế hoạch giao hàng 2021Document32 pagesKế hoạch giao hàng 2021Hoang Anh NguyenNo ratings yet

- Raport Financiar Balti1Document8 pagesRaport Financiar Balti1Inga BoldescuNo ratings yet

- Loan Impairment Entries1Document7 pagesLoan Impairment Entries1bowoerryNo ratings yet

- SONConnect ServletDocument6 pagesSONConnect ServletVenkat MulaNo ratings yet

- Scan - Doc0014Document1 pageScan - Doc0014Rosszy RossNo ratings yet

- Evershed Kroll White Consulting Ledgers Upto 19.02.24Document22 pagesEvershed Kroll White Consulting Ledgers Upto 19.02.24MILINDSWNo ratings yet

- NY-DOT Cost 710 - 0611Document207 pagesNY-DOT Cost 710 - 0611akamola52No ratings yet

- dp97 v2Document13 pagesdp97 v2zubishuNo ratings yet

- GSTR7 37vpne00462a1d1 102018Document2 pagesGSTR7 37vpne00462a1d1 102018A Prabhakar RaoNo ratings yet

- Payment DetailDocument2 pagesPayment DetailAbhishek_Tiwar_6394No ratings yet

- Raaf SampleDocument48 pagesRaaf SamplePrincess Claris ArauctoNo ratings yet

- Mutual FundsDocument28 pagesMutual FundssaiyuvatechNo ratings yet

- Clase 2 - Herramientas Útiles 1Document2,934 pagesClase 2 - Herramientas Útiles 1ANA GUZMANNo ratings yet

- Circular No 1353 - Accts Dated 03.10.2023 - Eng-1Document5 pagesCircular No 1353 - Accts Dated 03.10.2023 - Eng-1piyush jainNo ratings yet

- DateDocument1 pageDateitsmeletmegoNo ratings yet

- DateDocument1 pageDateitsmeletmegoNo ratings yet

- DateDocument1 pageDateitsmeletmegoNo ratings yet

- GSTR7 23bple00705f1ds 012024Document2 pagesGSTR7 23bple00705f1ds 012024Umang NagarNo ratings yet

- Rent 2017-18 PDFDocument1 pageRent 2017-18 PDFhuman humanNo ratings yet

- Annual Statement of Provident Fund Accounts For The Year Ended 2003Document3 pagesAnnual Statement of Provident Fund Accounts For The Year Ended 2003ଜିଲ୍ଲା ମୂଖ୍ୟ ଚିକିତ୍ସାଧିକାରୀ, ମାଲକାନଗିରିNo ratings yet

- TransactionHistoryUX506 02 2024Document1 pageTransactionHistoryUX506 02 2024Jotish SutharNo ratings yet

- DDO-STO/PAO Reconcillation ReportDocument2 pagesDDO-STO/PAO Reconcillation ReportreddybindubNo ratings yet

- BHAWANIDocument2 pagesBHAWANIKanchan BhandariNo ratings yet

- Stock VolatilityDocument2 pagesStock VolatilitygulabraniNo ratings yet

- Saldos Actualizados Al 8 de July de 2013Document3 pagesSaldos Actualizados Al 8 de July de 2013Irma FreyreNo ratings yet

- 022STUDocument1 page022STUmaf1otulNo ratings yet

- Suspense SDocument15 pagesSuspense SPrarthi BhoirNo ratings yet

- YERWA Financial DetailsDocument1 pageYERWA Financial Detailsgopi_dey8649No ratings yet

- Demand Details: ProfileDocument2 pagesDemand Details: ProfileMukesh PadwalNo ratings yet

- Assignment 6 DataeDocument2 pagesAssignment 6 DataeTrevor AguirreNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancesoumyojit2013No ratings yet

- 771621769Document2 pages771621769mahfuzurkhanNo ratings yet

- To:All R.Os and Forex Designated Branches: FX Market Information ReportDocument2 pagesTo:All R.Os and Forex Designated Branches: FX Market Information ReportShobharaj HegadeNo ratings yet

- 2) Cash Flow at 16% Lump Sum PDFDocument1 page2) Cash Flow at 16% Lump Sum PDFfara yasidNo ratings yet

- Mayor 1Document1 pageMayor 1saraNo ratings yet

- Checks Issued by The City of Boise Idaho - 4Document52 pagesChecks Issued by The City of Boise Idaho - 4Mark ReinhardtNo ratings yet

- LNL Iklcqd /: Page 1 of 11Document11 pagesLNL Iklcqd /: Page 1 of 11Pilotsaicharan AirbusNo ratings yet

- Energy Maps For Mobile Wireless Networks: Coherence Time Versus Spreading PeriodDocument1 pageEnergy Maps For Mobile Wireless Networks: Coherence Time Versus Spreading PeriodRajesh InsbNo ratings yet

- ER DiagramsDocument1 pageER DiagramsRajesh Insb100% (1)

- Hi̇story of AssertivenessDocument3 pagesHi̇story of AssertivenessRajesh Insb100% (1)

- History of ER DiagramsDocument7 pagesHistory of ER DiagramsRajesh Insb100% (1)

- Uses For Existing ProductsDocument8 pagesUses For Existing ProductsRajesh InsbNo ratings yet

- Merit Validation and Authentication-AbstractDocument4 pagesMerit Validation and Authentication-AbstractRajesh InsbNo ratings yet

- Tools, Platform/Languages Used Selected SoftwareDocument37 pagesTools, Platform/Languages Used Selected SoftwareRajesh InsbNo ratings yet

- Create AccountDocument4 pagesCreate AccountRajesh InsbNo ratings yet

- Image Segmentation Using Gaussian Mixture ModelDocument1 pageImage Segmentation Using Gaussian Mixture ModelRajesh InsbNo ratings yet

- UDP Based Chat Application AbstractDocument5 pagesUDP Based Chat Application AbstractRajesh InsbNo ratings yet

- UDP Based Chat Application UMLDocument5 pagesUDP Based Chat Application UMLRajesh InsbNo ratings yet

- Chapter-1 Techinical AnalysisDocument90 pagesChapter-1 Techinical AnalysisRajesh Insb100% (1)

- Abstract:-: Mesh Based Multicast Routing in MANET: Stable Link Based ApproachDocument9 pagesAbstract:-: Mesh Based Multicast Routing in MANET: Stable Link Based ApproachRajesh InsbNo ratings yet

- Project Title:-Impact of Celebrity Endorsement On Buying Behavior of Consumers and Source of Brand Building AbstractDocument9 pagesProject Title:-Impact of Celebrity Endorsement On Buying Behavior of Consumers and Source of Brand Building AbstractRajesh InsbNo ratings yet

- Project Over-View: Anti - Phishing Is The Solution To Get Rid of This Problem. ThisDocument1 pageProject Over-View: Anti - Phishing Is The Solution To Get Rid of This Problem. ThisRajesh InsbNo ratings yet

- Project Title: Anti Phishing - The Fraud Detection In: Online BankingDocument2 pagesProject Title: Anti Phishing - The Fraud Detection In: Online BankingRajesh InsbNo ratings yet

- Langauge Specification: Introduction To JavaDocument7 pagesLangauge Specification: Introduction To JavaRajesh InsbNo ratings yet

- AbstractDocument2 pagesAbstractRajesh InsbNo ratings yet

- Chapters Content Page No: Literature ReviewDocument2 pagesChapters Content Page No: Literature ReviewRajesh InsbNo ratings yet

- Calculations of Sharpe Performance Index (Spi)Document2 pagesCalculations of Sharpe Performance Index (Spi)Rajesh InsbNo ratings yet

- File No.7Document6 pagesFile No.7Rajesh InsbNo ratings yet

- Graphs Details: S.no Name Page. NoDocument1 pageGraphs Details: S.no Name Page. NoRajesh InsbNo ratings yet

- Data Collection and AnalysisDocument7 pagesData Collection and AnalysisRajesh InsbNo ratings yet

- File No.4Document1 pageFile No.4Rajesh InsbNo ratings yet

- Date NAV (RS.) Returns Avgreturns Diff (DX) DX 2 Returns Avgreturns Diff (Dy)Document4 pagesDate NAV (RS.) Returns Avgreturns Diff (DX) DX 2 Returns Avgreturns Diff (Dy)Rajesh InsbNo ratings yet

- Date NAV (RS.) Returns Avgreturns Diff (DX) Dy 2 Returns Avgreturns Diff (Dy) BankexDocument4 pagesDate NAV (RS.) Returns Avgreturns Diff (DX) Dy 2 Returns Avgreturns Diff (Dy) BankexRajesh InsbNo ratings yet