Professional Documents

Culture Documents

1001013184-Integrated Bill

Uploaded by

Chandra Kiran Reddy VOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1001013184-Integrated Bill

Uploaded by

Chandra Kiran Reddy VCopyright:

Available Formats

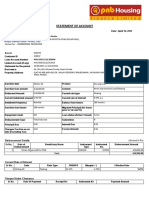

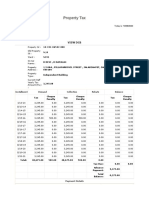

ANANTAPUR MUNICIPAL CORPORATION

ANANTAPUR DISTRICT

INTEGRATED DEMAND BILL FOR 2017-18

Remittance into the Account of the Commissioner

Demand Bill No : I/100100074123 Date : 23/04/2017

Assessment No : 1001013184 Old Assessment No : 34451

Name : D. Vijaya

House No : 11-433-1 Revenue Ward : Revenue Ward No 12

Block : Block No 1 Locality : Obbulludavan Nagar

Water Consumer No : Sewerage Consumer No :

Current Year Arrear Arrear Total Demand Adjustments Net Amount

Tax Head

1st Half 2nd Half Total Amount Interest / Paid Payable

a b c d e f g = d+e+f h i=g-h

PT* / PT on Land

55.00 55.00 110.00 0.00 0.00 110.00 0.00 110.00

Water Charges 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Sewerage

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Charges

Total 55.00 55.00 110.00 0.00 0.00 110.00 0.00 110.00

*PT - Property Tax

NET AMOUNT PAYABLE WITH INTEREST

Property Tax / Property Tax (On Land) Water Sewerage Total

If paid before

Amount(Rs.) Interest(Rs.) Total(Rs.) Charges(Rs.) Charges(Rs.) Dues(Rs.)

a b c d = b+ c e f g = d+e+f

30/04/2017 110.00 0.00 110.00 0.00 0.00 110.00

31/05/2017 110.00 0.00 110.00 0.00 0.00 110.00

30/06/2017 110.00 0.00 110.00 0.00 0.00 110.00

31/07/2017 110.00 1.00 111.00 0.00 0.00 111.00

31/08/2017 110.00 2.00 112.00 0.00 0.00 112.00

30/09/2017 110.00 3.00 113.00 0.00 0.00 113.00

31/10/2017 110.00 4.00 114.00 0.00 0.00 114.00

30/11/2017 110.00 5.00 115.00 0.00 0.00 115.00

31/12/2017 110.00 6.00 116.00 0.00 0.00 116.00

31/01/2018 110.00 8.00 118.00 0.00 0.00 118.00

28/02/2018 110.00 10.00 120.00 0.00 0.00 120.00

31/03/2018 110.00 12.00 122.00 0.00 0.00 122.00

Commissioner

Acknowledgement for Demand Bill for Anantapur Municipal Corporation,ANANTAPUR district

Assessment No : 1001013184 Demand Bill No : I/100100074123

Name and Address : D. Vijaya

11-433-1, Obbulludavan Nagar,

Revenue Ward No 12, Anantapur,

Signature of the receiver with Name & Mobile No

This Bill is issued as per the following Act :

Property Tax & Property

1. Section-266(1) of AP Municipal Corporations Act, 1994 (formerly GHMC Act, 1955).

Tax on land

Section 341 to 371 of AP Municipal Corporations Act, 1994 (formerly GHMC Act, 1955) and

2. Water Charges

water supply bye-laws.

Section 319 to 336 of AP Municipal Corporations Act, 1994 (formerly GHMC Act, 1955) and

3. Sewerage Charges

sewerage bye-laws.

Guidelines for the Tax Payer

1. The Single Demand Bill for both 1st half and 2nd half years is issued for the convenience of the public.

2. Tax payers are at liberty to pay tax either half year wise or both at a time.

3. 5% rebate will be given if tax is paid for both half years at a time before 30th April of current financial year.

4. Property tax can be paid through: Cash or Cheque at eSeva, Mee Seva centres or Municipal Office or Online through

Credit Card/Debitcard/Net Banking.

5. Due dates for payment of property tax without interest for current financial year: First half year 30th June, Second half

year: 31st December.

6. A simple interest @ 2% per month will be charged in case of failure to pay property tax by due dates as above.

7. If the tax payers fail to pay the property tax within 15 days from the date of receipt of this Demand Bill, the same amount

can be collected by issuing a distraint warrant u/s Section-269 of AP Municipal Corporations Act, 1994 (formerly GHMC Act,

1955).

8. Please bring this bill while paying at Office counter or eSeva or Mee Seva centers.

Powered by www.egovernments.org Visit your city portal at anantapur.cdma.ap.gov.in

You might also like

- 1021047119-Integrated Bill PDFDocument2 pages1021047119-Integrated Bill PDFPcrNo ratings yet

- 1021047119-Integrated BillDocument2 pages1021047119-Integrated BillPcrNo ratings yet

- Tirupati property tax billDocument1 pageTirupati property tax billSowmya DNo ratings yet

- Asansol Municipal Corporation Property Tax ReceiptDocument1 pageAsansol Municipal Corporation Property Tax ReceiptRaj MishraNo ratings yet

- Feb. 2017 Rs. 2,320.00 05-04-2017Document2 pagesFeb. 2017 Rs. 2,320.00 05-04-2017Shakir AbdullahNo ratings yet

- Vendor Balance Detail ReportDocument25 pagesVendor Balance Detail ReportEbrahimi Accounting Services LTD.No ratings yet

- 1073041055-Integrated BillDocument2 pages1073041055-Integrated BillSekharNo ratings yet

- 1 Jan To 4 JanDocument2 pages1 Jan To 4 Janshahidkhair786No ratings yet

- Edo Cta VenefemDocument14 pagesEdo Cta VenefemCarlosOlivierNo ratings yet

- Chennai Metro Water3Document1 pageChennai Metro Water3Vasanth NairNo ratings yet

- Statement For Contract # 1025374208: Muhammad Haroon KhanDocument7 pagesStatement For Contract # 1025374208: Muhammad Haroon KhanMuhammad JameelNo ratings yet

- Apr. 2017 Rs. 2,110.00 05-06-2017: 19.29 GB UsageDocument2 pagesApr. 2017 Rs. 2,110.00 05-06-2017: 19.29 GB UsageMuhammad NomanNo ratings yet

- Jul. 2016 Rs. 2,030.00 05-09-2016: 22.28 GB UsageDocument3 pagesJul. 2016 Rs. 2,030.00 05-09-2016: 22.28 GB UsagealvinaNo ratings yet

- Dubai Mobile BillDocument3 pagesDubai Mobile Billshahid2opuNo ratings yet

- Cynthia M Florida Rent LedgerDocument8 pagesCynthia M Florida Rent Ledgerkelley gregoryNo ratings yet

- Screenshot 2022-05-25 at 3.18.23 PM 2Document26 pagesScreenshot 2022-05-25 at 3.18.23 PM 2Muraleedharan MenonNo ratings yet

- Mobile Services: Tax InvoiceDocument4 pagesMobile Services: Tax InvoiceAnonymous zwCV8ZNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Postpaid Bill 9701196688 404550067Document5 pagesPostpaid Bill 9701196688 404550067rajaNo ratings yet

- ST CloudDocument1 pageST CloudSherry SherdNo ratings yet

- July Bill 2016Document6 pagesJuly Bill 2016Vipin SinghNo ratings yet

- Cynthia M Florida Rent LedgerDocument8 pagesCynthia M Florida Rent Ledgerkelley gregoryNo ratings yet

- Your Bill For Mobile ServicesDocument3 pagesYour Bill For Mobile ServicesHayley CannonNo ratings yet

- Ufone statement for mobile number 03352433275 details usage and charges for August 2020Document11 pagesUfone statement for mobile number 03352433275 details usage and charges for August 2020Syed Shariq HassanNo ratings yet

- Statement For Ufone # 03327067752: Account DetailsDocument8 pagesStatement For Ufone # 03327067752: Account Detailsسید رضیNo ratings yet

- Statement of Account: P. Galauran - Caloocan City Metro ManilaDocument1 pageStatement of Account: P. Galauran - Caloocan City Metro ManilaCarl Joseph OrtegaNo ratings yet

- Inv 000029 1Document2 pagesInv 000029 1MshiboniumNo ratings yet

- Statement For Customer #1046913Document3 pagesStatement For Customer #1046913Hamza NajamNo ratings yet

- Chennai Metro Water Board Receipt for Water Tax PaymentDocument1 pageChennai Metro Water Board Receipt for Water Tax PaymentlkjdfkallNo ratings yet

- Monthly Report 157150Document2 pagesMonthly Report 157150Martins MartinsNo ratings yet

- Installment Inquiry Form - Amortization Ledger - UBAY: Du Ek Sam, Inc. (DES-UBAY)Document4 pagesInstallment Inquiry Form - Amortization Ledger - UBAY: Du Ek Sam, Inc. (DES-UBAY)Sweet AcaylarNo ratings yet

- Fixedline and Broadband ServicesDocument5 pagesFixedline and Broadband ServicesKumar MNo ratings yet

- Radj Mahal Pty LTD - Account TransactionsDocument3 pagesRadj Mahal Pty LTD - Account TransactionsChristelle DivinagraciaNo ratings yet

- Your Koodo Bill: Account SummaryDocument8 pagesYour Koodo Bill: Account SummaryDawn ClevelandNo ratings yet

- Ivory Residences Cleaning Accessories 012123Document1 pageIvory Residences Cleaning Accessories 012123Jomari Chris BeronNo ratings yet

- ABITTEX Trial Balance Report with Account DetailsDocument1 pageABITTEX Trial Balance Report with Account DetailsAnilNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument25 pagesBureau of Local Government Finance Department of FinanceMary Jane Katipunan CalumbaNo ratings yet

- Statement of Account: BranchDocument2 pagesStatement of Account: BranchNihar DemblaNo ratings yet

- Larsen Water Supplier BillDocument6 pagesLarsen Water Supplier BillVasu SaxenaNo ratings yet

- Aurangabad Municipal Corporation Payment ReceiptDocument1 pageAurangabad Municipal Corporation Payment Receiptgitik guptaNo ratings yet

- Fixedline and Broadband ServicesDocument5 pagesFixedline and Broadband ServicesvpjatNo ratings yet

- General Ledger (Summary) 9/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 9/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Siddhivinayak Apartment Society BillDocument36 pagesSiddhivinayak Apartment Society BillPratz AddictionNo ratings yet

- SOA Acct 1184350 1704067200 1704931200Document1 pageSOA Acct 1184350 1704067200 1704931200hrd.avdiNo ratings yet

- Durgapur Municipal Corporation Property Tax ReceiptDocument1 pageDurgapur Municipal Corporation Property Tax ReceiptRaj MishraNo ratings yet

- Print Dup Bill 1Document1 pagePrint Dup Bill 1basharatNo ratings yet

- SalarybillDocument2 pagesSalarybillAsan JawabNo ratings yet

- Oct. 2016 Rs. 2,100.00 05-12-2016Document3 pagesOct. 2016 Rs. 2,100.00 05-12-2016MUHAMMAD USMAN IQBALNo ratings yet

- Tekla 2020Document19 pagesTekla 2020Fredric Gatinao Pelonia Jr.No ratings yet

- MTNL Delhi Dolphin: Final AmountDocument5 pagesMTNL Delhi Dolphin: Final AmountKushal SinhaNo ratings yet

- House Tax ReceiptDocument2 pagesHouse Tax ReceiptAkshaya Raman RamNo ratings yet

- 7 Apr 2013 7 Mar 2013 - 6 Apr 2013 1.20456338: Bill Date Bill Period Account NumberDocument5 pages7 Apr 2013 7 Mar 2013 - 6 Apr 2013 1.20456338: Bill Date Bill Period Account Numbermohamed elmakhzniNo ratings yet

- Cynthia M Florida Ledger 2Document2 pagesCynthia M Florida Ledger 2kelley gregoryNo ratings yet

- Invoice_from_bb_1432235532Document2 pagesInvoice_from_bb_1432235532Kochu KuchuNo ratings yet

- 16 StatementofAccount LBHBSBL0000036011Document4 pages16 StatementofAccount LBHBSBL0000036011girija mohapatraNo ratings yet

- Jan2011Document2 pagesJan2011v_sonkerNo ratings yet

- Statement For Contract # 1001752315: Amir ShehzadDocument11 pagesStatement For Contract # 1001752315: Amir Shehzadhoney wellNo ratings yet

- generateDupBill PDFDocument1 pagegenerateDupBill PDFrathinexusNo ratings yet

- What's Cooking: Digital Transformation of the Agrifood SystemFrom EverandWhat's Cooking: Digital Transformation of the Agrifood SystemNo ratings yet

- TenderDocument26 pagesTenderShiyas IbrahimNo ratings yet

- MAS CPAR - EconomicsDocument7 pagesMAS CPAR - EconomicsJulie Ann LeynesNo ratings yet

- Bank F3Document1 pageBank F3Minh NguyễnNo ratings yet

- Reading Explorer 1 Vocabulary ListDocument12 pagesReading Explorer 1 Vocabulary ListMelisNo ratings yet

- CO VallejoDocument9 pagesCO VallejoTeyangNo ratings yet

- Chapter 17 International Banking - Reserves Debt and RiskDocument47 pagesChapter 17 International Banking - Reserves Debt and Riskngletramanh203No ratings yet

- BALAMURUGAN D - CibilDocument3 pagesBALAMURUGAN D - CibilVijay UNo ratings yet

- DBA Macroeconomics Topic 1Document13 pagesDBA Macroeconomics Topic 1raul velazquez tepepaNo ratings yet

- Causes of Poverty in Pakistan (HILAL)Document21 pagesCauses of Poverty in Pakistan (HILAL)S.M.HILAL89% (19)

- Wastewater Treatment Plant BCG Vaccine Laboratory GuindyDocument199 pagesWastewater Treatment Plant BCG Vaccine Laboratory GuindyankurNo ratings yet

- International Equity Markets ExplainedDocument36 pagesInternational Equity Markets ExplainedVrinda GargNo ratings yet

- Corporate Financial AccountingDocument4 pagesCorporate Financial AccountinghareshNo ratings yet

- New Table of ContentsDocument4 pagesNew Table of ContentsSuvro AvroNo ratings yet

- Section B - Group 2 - DHFL Governance Failure - Final ReportDocument14 pagesSection B - Group 2 - DHFL Governance Failure - Final Reportpgdm22srijanbNo ratings yet

- Unit 2 Supply Chain in Cash Transfer ProgrammingDocument20 pagesUnit 2 Supply Chain in Cash Transfer ProgrammingPMU Chimhanda District HospitalNo ratings yet

- Hsslive-XII-english NotesDocument3 pagesHsslive-XII-english NotesAreej HassanNo ratings yet

- STMT Ent BookDocument2 pagesSTMT Ent BookNasir GhaniNo ratings yet

- Q1. Explain The Basic Elements of Income Statement? Income StatementDocument5 pagesQ1. Explain The Basic Elements of Income Statement? Income StatementMina TahirNo ratings yet

- New 301 Presentation-2Document26 pagesNew 301 Presentation-2api-636032198No ratings yet

- Investments Canadian Canadian 8th Edition Bodie Solutions Manual 1Document14 pagesInvestments Canadian Canadian 8th Edition Bodie Solutions Manual 1theresa100% (42)

- CompendiumDocument18 pagesCompendiumpranithroyNo ratings yet

- T24 TellerDocument57 pagesT24 TellerJaya NarasimhanNo ratings yet

- Senior Officers: Executive Vice PresidentsDocument3 pagesSenior Officers: Executive Vice PresidentsShingieNo ratings yet

- Performance Evaluation of Public and Private Sector Mutual FundsDocument73 pagesPerformance Evaluation of Public and Private Sector Mutual Fundssmart boyNo ratings yet

- Raihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsDocument4 pagesRaihan Rohadatul 'Aisy - 205154055 - Tugas Consolidations-Changes in Ownership InterestsRaihan Rohadatul 'AisyNo ratings yet

- Morrissette ProfileAngelInvestors 2007Document16 pagesMorrissette ProfileAngelInvestors 2007pattitil.ppNo ratings yet

- Manage Credit Risk & Improve ProfitsDocument11 pagesManage Credit Risk & Improve ProfitsHakdog KaNo ratings yet

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Macro Cheat SheetDocument3 pagesMacro Cheat SheetMei SongNo ratings yet

- Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Document11 pagesChapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2 Chapter 25 Acctg FOR Derivatives & Hedging Transactions Part 2 Afar Part 2Jan OleteNo ratings yet