Professional Documents

Culture Documents

1073041055-Integrated Bill

Uploaded by

SekharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1073041055-Integrated Bill

Uploaded by

SekharCopyright:

Available Formats

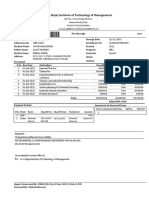

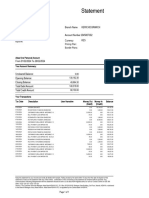

VIJAYAWADA MUNICIPAL CORPORATION

KRISHNA DISTRICT

INTEGRATED DEMAND BILL FOR 2020-21

Remittance into the Account of the Commissioner

Demand Bill No : I/107300502187 Date : 02/04/2020

Assessment No : 1073041055 Old Assessment No : 95610

Name : BABBURI YADUNANANDA PRASAD S/O THIRUPATHAIAH

House No : 75-10-7 Revenue Ward : Revenue Ward 27

VIJAYAWADA MUNICIPAL

Block : Block No 27 Locality :

CORPORATION

Water Consumer No : Sewerage Consumer No :

Current Year Arrear Arrear Total Demand Adjustments Net Amount

Tax Head

1st Half 2nd Half Total Amount Interest / Paid Payable

a b c d e f g = d+e+f h i=g-h

PT* / PT on Land

223.00 223.00 446.00 0.00 0.00 446.00 24.00 422.00

Water Charges 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Sewerage

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Charges

Total 223.00 223.00 446.00 0.00 0.00 446.00 24.00 422.00

*PT - Property Tax

NET AMOUNT PAYABLE WITH INTEREST

Property Tax / Property Tax (On Land) Water Sewerage Total

If paid before

Amount(Rs.) Interest(Rs.) Total(Rs.) Charges(Rs.) Charges(Rs.) Dues(Rs.)

a b c d = b+ c e f g = d+e+f

30/04/2020 422.00 0.00 422.00 0.00 0.00 422.00

31/05/2020 422.00 0.00 422.00 0.00 0.00 422.00

30/06/2020 422.00 0.00 422.00 0.00 0.00 422.00

31/07/2020 422.00 4.00 426.00 0.00 0.00 426.00

31/08/2020 422.00 8.00 430.00 0.00 0.00 430.00

30/09/2020 422.00 12.00 434.00 0.00 0.00 434.00

31/10/2020 422.00 16.00 438.00 0.00 0.00 438.00

30/11/2020 422.00 20.00 442.00 0.00 0.00 442.00

31/12/2020 422.00 24.00 446.00 0.00 0.00 446.00

31/01/2021 422.00 32.00 454.00 0.00 0.00 454.00

28/02/2021 422.00 40.00 462.00 0.00 0.00 462.00

31/03/2021 422.00 48.00 470.00 0.00 0.00 470.00

Commissioner

Acknowledgement for Demand Bill for Vijayawada Municipal Corporation,KRISHNA district

Assessment No : 1073041055 Demand Bill No : I/107300502187

Name and Address : BABBURI YADUNANANDA PRASAD

S/O THIRUPATHAIAH

75-10-7, VIJAYAWADA MUNICIPAL

CORPORATION, Revenue Ward 27,

Vijayawada,

Signature of the receiver with Name & Mobile No

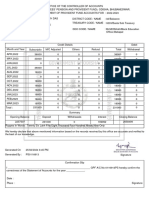

This Bill is issued as per the following Act :

Property Tax & Property

1. Section-266(1) of Municipal Corporations Act, 1955 (formerly GHMC Act, 1955).

Tax on land

Section 341 to 371 of Municipal Corporations Act, 1955 (formerly GHMC Act, 1955) and water

2. Water Charges

supply bye-laws.

Section 319 to 336 of Municipal Corporations Act, 1955 (formerly GHMC Act, 1955) and

3. Sewerage Charges

sewerage bye-laws.

Guidelines for the Tax Payer

1. The Single Demand Bill for both 1st half and 2nd half years is issued for the convenience of the public.

2. Tax payers are at liberty to pay tax either half year wise or both at a time.

3. 5% rebate will be given if tax is paid for both half years at a time before 30th April of current financial year.

4. Property tax can be paid through: Cash or Cheque at eSeva, Mee Seva centres or Municipal Office or Online through

Credit Card/Debitcard/Net Banking.

5. Due dates for payment of property tax without interest for current financial year: First half year 30th June, Second half

year: 31st December.

6. A simple interest @ 2% per month will be charged in case of failure to pay property tax by due dates as above.

7. If the tax payers fail to pay the property tax within 15 days from the date of receipt of this Demand Bill, the same amount

can be collected by issuing a distraint warrant u/s Section-269 of Municipal Corporations Act, 1955 (formerly GHMC Act,

1955).

8. Please bring this bill while paying at Office counter or eSeva or Mee Seva centers.

Powered by www.egovernments.org Visit your city portal at vijayawada.cdma.ap.gov.in

You might also like

- TRADING COURSE'sDocument51 pagesTRADING COURSE'sDHAVAL40% (5)

- Nairobi City Water & Sewerage Company LTDDocument1 pageNairobi City Water & Sewerage Company LTDSophy73% (11)

- Payment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Document2 pagesPayment Date: 10/15/2020 Payment #: Payment Amt: $0.00 Home State Health 11720 Borman Drive St. Louis, MO 63146 1-855-694-4663Daya AnandaNo ratings yet

- Voltility Indices Trading (Volatilitaires)Document4 pagesVoltility Indices Trading (Volatilitaires)Josias Adeyemi50% (2)

- MD Wasim Bhuyian: Statement of Account Savings Bank DepositsDocument2 pagesMD Wasim Bhuyian: Statement of Account Savings Bank DepositsSalahuddin Nayan71% (7)

- Loan Account Statement: Generated byDocument7 pagesLoan Account Statement: Generated byShaoon HowladerNo ratings yet

- CityhallsystemsDocument1 pageCityhallsystemsMatthew TavaresNo ratings yet

- Full and Final Payslip P1305Document1 pageFull and Final Payslip P1305ArmaanNo ratings yet

- City Bank StatementDocument1 pageCity Bank StatementAbu Shadot100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Prateek AgarwalNo ratings yet

- Laying & Testing of Fire Detection Cable Methods StatementDocument23 pagesLaying & Testing of Fire Detection Cable Methods StatementJanaka Kavinda100% (1)

- General Motors Case 1Document2 pagesGeneral Motors Case 1Backup BackupNo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument1 pageG. L. Bajaj Institute of Technology & Management: Fee ReceiptSwarochis Singh G L Bajaj IMRNo ratings yet

- 1021047119-Integrated BillDocument2 pages1021047119-Integrated BillPcrNo ratings yet

- 1021047119-Integrated Bill PDFDocument2 pages1021047119-Integrated Bill PDFPcrNo ratings yet

- CashbookDocument4 pagesCashbookmalbog.officialNo ratings yet

- Factory Feb BillDocument3 pagesFactory Feb BillSumit AgarwalNo ratings yet

- Laporan Hystory Pyment - Lubis PDFDocument1 pageLaporan Hystory Pyment - Lubis PDFAgung GustianNo ratings yet

- 4727 Febrero 2020 ConciliarDocument2 pages4727 Febrero 2020 Conciliarthejosealva01No ratings yet

- Ebesun Co4Document8 pagesEbesun Co4Chidinma NnoliNo ratings yet

- Installment ScheduleDocument2 pagesInstallment ScheduleMichael LieNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAPPLE MARINENo ratings yet

- Ebesun Co 2-1Document8 pagesEbesun Co 2-1Chidinma NnoliNo ratings yet

- Ebesun Co3Document5 pagesEbesun Co3Chidinma NnoliNo ratings yet

- Installment Schedule Document 2012709784Document2 pagesInstallment Schedule Document 2012709784InsanNo ratings yet

- LaporanHistoryPayment 020420113952Document1 pageLaporanHistoryPayment 020420113952putri indah nurul insaniNo ratings yet

- LaporanHistoryPayment 021020216507 PDFDocument1 pageLaporanHistoryPayment 021020216507 PDFAgung GustianNo ratings yet

- Cash BookDocument14 pagesCash BookSi Brian TohNo ratings yet

- Data Statistik 2Document183 pagesData Statistik 2eka putriNo ratings yet

- Account Slip 0116913 PSDocument2 pagesAccount Slip 0116913 PSbiswanathdas2888No ratings yet

- LaporanHistoryPayment 013320111238Document1 pageLaporanHistoryPayment 013320111238Hendri Hizam fachriNo ratings yet

- Account StatementDocument4 pagesAccount StatementjctsanjayNo ratings yet

- Water Bill FebruaryDocument1 pageWater Bill FebruaryDavid HangoNo ratings yet

- Journal of Disbursement 2023 NioganDocument69 pagesJournal of Disbursement 2023 NioganNazzer Balmores NacuspagNo ratings yet

- CRPTDocument3 pagesCRPTYudi PrasetyoNo ratings yet

- Digitally Signed by Ministerul Finantelor Publice Date: 2020.01.27 15:51:00 EET Reason: Document MFP Location: Signature1Document2 pagesDigitally Signed by Ministerul Finantelor Publice Date: 2020.01.27 15:51:00 EET Reason: Document MFP Location: Signature1CristinaNo ratings yet

- G EJy BNK IXYJry 9 W VDocument1 pageG EJy BNK IXYJry 9 W Vdurga workspotNo ratings yet

- Type Meter Number: Account NoDocument1 pageType Meter Number: Account NoCharleenNo ratings yet

- Journal of Disbursement 2023 TakunganDocument52 pagesJournal of Disbursement 2023 TakunganNazzer Balmores NacuspagNo ratings yet

- Sikatuna MCWDDocument1 pageSikatuna MCWDLeah Mae NolascoNo ratings yet

- Centro MCWDDocument1 pageCentro MCWDLeah Mae NolascoNo ratings yet

- TREZ465 ExtrasEP PDFCLI 6752770 XML SIGNED 22022023h1511Document1 pageTREZ465 ExtrasEP PDFCLI 6752770 XML SIGNED 22022023h1511poroina mareNo ratings yet

- LD - Answer KeyDocument10 pagesLD - Answer KeyJeffrey Lois Sereño MaestradoNo ratings yet

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptDocument1 pageG. L. Bajaj Institute of Technology & Management: Fee ReceiptSneha ChaudharyNo ratings yet

- B2B 012024 05PRCPS6451R1ZP GSTR2B 16022024Document7 pagesB2B 012024 05PRCPS6451R1ZP GSTR2B 16022024vbsingh163No ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- Comprobte ArbitriosDocument1 pageComprobte ArbitriosMilagros AponteNo ratings yet

- TDS Oct-2023Document13 pagesTDS Oct-2023sulthaninvst03No ratings yet

- Ws 48 PKGDocument1 pageWs 48 PKGIsaacNo ratings yet

- 2402 O02invDocument2 pages2402 O02invKenny Diego ChenNo ratings yet

- Loan Account Statement: As of 18-03-2021 11:52:43 GMT +0530Document1 pageLoan Account Statement: As of 18-03-2021 11:52:43 GMT +0530Raghu ReddyNo ratings yet

- Histori TransaksiDocument1 pageHistori TransaksiyortaniosabangNo ratings yet

- Water Bill Jan 01Document1 pageWater Bill Jan 01buildingplans2008No ratings yet

- 01:07:2023Document10 pages01:07:2023zusiphejaneNo ratings yet

- YashomDocument5 pagesYashomTTS DATABASE DATANo ratings yet

- Chennai Metro WaterDocument1 pageChennai Metro WaterlkjdfkallNo ratings yet

- Credit 080638 220603024504Document7 pagesCredit 080638 220603024504arman sitorusNo ratings yet

- CashbookDocument2 pagesCashbookJoshua AssinNo ratings yet

- Erp UniversityDocument1 pageErp Universityhowerth parianNo ratings yet

- Estadocuenta - 2022-10-18T165507.554Document3 pagesEstadocuenta - 2022-10-18T165507.554Josh MejiaNo ratings yet

- Garden Side Bill Month of May 2022Document4 pagesGarden Side Bill Month of May 2022Sandesh PatilNo ratings yet

- Punong Barangay'S Certification (PBC) : Landbank of The Philippines Tagbilaran CityDocument1 pagePunong Barangay'S Certification (PBC) : Landbank of The Philippines Tagbilaran CityqesgdriveNo ratings yet

- Global Review of Human Settlements: A Support Paper for Habitat: United Nations Conference on Human SettlementsFrom EverandGlobal Review of Human Settlements: A Support Paper for Habitat: United Nations Conference on Human SettlementsNo ratings yet

- CRP - Ia No.108 of 2022 in Aop No.3 of 2022Document19 pagesCRP - Ia No.108 of 2022 in Aop No.3 of 2022SekharNo ratings yet

- DeclaratiDocument1 pageDeclaratiSekharNo ratings yet

- Repeal Act HIGH COURT OF JUDICATURE AT MADRASDocument27 pagesRepeal Act HIGH COURT OF JUDICATURE AT MADRASSekharNo ratings yet

- 2020 01 31logDocument6 pages2020 01 31logSekharNo ratings yet

- Chapter 1 Solutions PDFDocument11 pagesChapter 1 Solutions PDFManas220398No ratings yet

- Gender Race and Class in Media A Critical Reader 5th Edition Dines Test BankDocument36 pagesGender Race and Class in Media A Critical Reader 5th Edition Dines Test Bankservantmerceryxfced100% (33)

- Multifactor Models and The CapmDocument6 pagesMultifactor Models and The CapmNguyễn Dương Trọng KhôiNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet

- 16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Document1 page16.72 US Dollars To Indonesia Rupiahs. Convert USD in IDR (Currency Matrix)Fahira AnwarNo ratings yet

- 45PV Promo Order July 2023Document1 page45PV Promo Order July 2023Marques Da DeolindaNo ratings yet

- Global EconomyDocument1 pageGlobal EconomyDiana CamachoNo ratings yet

- Assam Economic SurveyDocument232 pagesAssam Economic SurveyBarna GanguliNo ratings yet

- Cognition, Competition, and Catallaxy in Memory of Friedrich August Von HayekDocument40 pagesCognition, Competition, and Catallaxy in Memory of Friedrich August Von HayekxiiiiNo ratings yet

- Imec G 20Document11 pagesImec G 20sinhamonika22No ratings yet

- Summary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRDocument1 pageSummary of Accounts Held Under Customer Id: Xxxxx1382 As On October 31, 2021 I. Operative Account in INRabhishek ranaNo ratings yet

- Equity CrowdfundingDocument13 pagesEquity CrowdfundingantonyNo ratings yet

- Problems and Prospects of Readymade Garments Export in BangladeshDocument25 pagesProblems and Prospects of Readymade Garments Export in BangladeshBoni AminNo ratings yet

- Tybaf Sem5 Fm-Ii Nov18Document5 pagesTybaf Sem5 Fm-Ii Nov18rizwan hasmiNo ratings yet

- Republic of The Philippines Province of Surigao Del Sur Municipality of MadridDocument3 pagesRepublic of The Philippines Province of Surigao Del Sur Municipality of Madridnoemar bunielNo ratings yet

- Ratios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDocument5 pagesRatios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDan Miguel SangcapNo ratings yet

- Question 3Document25 pagesQuestion 3Ahmed AbdirahmanNo ratings yet

- Under Separate Cover Attachments: Community and Resources Committee 26 April 2022Document118 pagesUnder Separate Cover Attachments: Community and Resources Committee 26 April 2022maverick_1901No ratings yet

- O O O O O O: Practice Test 7 MULTIPLE CHOICE: (8 Points)Document5 pagesO O O O O O: Practice Test 7 MULTIPLE CHOICE: (8 Points)Nguyễn Đức MinhNo ratings yet

- Ethicon Price List 2019Document20 pagesEthicon Price List 2019Magdalena Oktavia KristantiNo ratings yet

- Semi-Periphery Countries: Sociological TheoryDocument11 pagesSemi-Periphery Countries: Sociological TheoryLebogangNo ratings yet

- Presented By: Charu Kapoor (ISMS)Document8 pagesPresented By: Charu Kapoor (ISMS)charu kapoorNo ratings yet

- Annex-V Commodity CodeDocument399 pagesAnnex-V Commodity CodemirzanadeembaigNo ratings yet

- Ingles Cuestionario Quimestre 2-1Document3 pagesIngles Cuestionario Quimestre 2-1Ana AlvaradoNo ratings yet

- Analisis Laporan Keuangan SyariahDocument18 pagesAnalisis Laporan Keuangan SyariahVia ManiezNo ratings yet

- Jones 2018 - Towards A Theory of DisintegrationDocument13 pagesJones 2018 - Towards A Theory of DisintegrationPatrick Prateek WagnerNo ratings yet