Professional Documents

Culture Documents

No.1 /2013-Central Excise: Explanation.-For The Purposes of This Entry, Gold

Uploaded by

patelpratik1972Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No.1 /2013-Central Excise: Explanation.-For The Purposes of This Entry, Gold

Uploaded by

patelpratik1972Copyright:

Available Formats

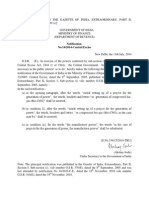

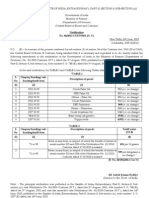

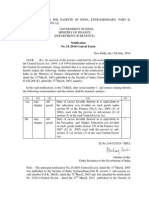

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)] GOVERNMENT OF INDIA MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE) Notification No.1 /2013-Central Excise New Delhi, the 21st January, 2013 G.S.R. (E). - In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 12/2012-Central Excise, dated the 17th March, 2012 which was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 163(E) dated the 17th March, 2012, namely: -

In the said notification, in the Table,(i) for S. No. 189 and the entries relating thereto, the following shall be substituted189 71 Gold bars, other than tola bars, bearing manufacturers engraved serial number and weight expressed in metric units manufactured in a factory starting from the stage of-

(i) (a) Gold ore or concentrate; (b) Gold dore bar; or 5% -

(ii) Silver dore bar Explanation.-For the purposes of this entry, gold dore bar shall mean dore bars having gold content

3%

not exceeding 95% and silver dore bar shall mean dore bars having silver content not exceeding 95% accompanied by an assay certificate issued by the mining company, giving details of composition

(ii) in S. No. 191, against item (i), for the entry in column (4), the entry 5% shall be substituted. [F. No. B-1/5/2012-TRU]

[Raj Kumar Digvijay] Under Secretary to the Government of India

Note.- The principal notification No. 12/2012-Central Excise, dated the 17th March, 2012 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 163(E) dated the 17th March, 2012 and was last amended vide notification No.37/2012-Central Excise, dated the 11th October,2012 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R 760 (E) dated the 11th October,2012.

You might also like

- cs11 2013Document1 pagecs11 2013stephin k jNo ratings yet

- Ce05 2012Document1 pageCe05 2012Sharif H NadafNo ratings yet

- cs26 2013Document1 pagecs26 2013stephin k jNo ratings yet

- cs13 2013Document1 pagecs13 2013stephin k jNo ratings yet

- cs10 2013Document1 pagecs10 2013stephin k jNo ratings yet

- Notf. NO.8-2013 CeDocument1 pageNotf. NO.8-2013 Cepatelpratik1972No ratings yet

- cs09 2013Document2 pagescs09 2013stephin k jNo ratings yet

- Customs Tariff Notification No.25/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.25/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Gazette of India Notifies Nil Excise DutyDocument1 pageGazette of India Notifies Nil Excise DutyyagayNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- Central Excise Act amendment reducing rate from 45% to 30Document1 pageCentral Excise Act amendment reducing rate from 45% to 30kumar_k_2005No ratings yet

- Service Tax Notification Rescinds Previous NotificationDocument1 pageService Tax Notification Rescinds Previous NotificationDipesh Chandra BaruaNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- csnt71 2013Document1 pagecsnt71 2013stephin k jNo ratings yet

- Notification No.5 / 2013-Central ExciseDocument1 pageNotification No.5 / 2013-Central ExciseyagayNo ratings yet

- Notification No.7/2013-Central Excise: Vide G.S.R No.471 (E), DatedDocument2 pagesNotification No.7/2013-Central Excise: Vide G.S.R No.471 (E), Datedpatelpratik1972No ratings yet

- Customs Tariff Notification No.13/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.13/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Notification: Vide Number G.S.R. 146 (E) Dated, The 1Document1 pageNotification: Vide Number G.S.R. 146 (E) Dated, The 1patelpratik1972No ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document2 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- Notification No. 9 / 2013-Central Excise: ST STDocument1 pageNotification No. 9 / 2013-Central Excise: ST STpatelpratik1972No ratings yet

- Notification No.1/2012 - Service TaxDocument1 pageNotification No.1/2012 - Service TaxDipesh Chandra BaruaNo ratings yet

- 07-2012 Abatment ShoesDocument1 page07-2012 Abatment Shoeskumar_k_2005No ratings yet

- Customs 2013Document1 pageCustoms 2013api-246792629No ratings yet

- CST 45 2023Document1 pageCST 45 2023Raja SinghNo ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Central Excise Tariff Notification No.09/2014 Dated 11th July, 2014Document1 pageCentral Excise Tariff Notification No.09/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Central Tax Notification on MRO ServicesDocument1 pageCentral Tax Notification on MRO Servicesdinesh kasnNo ratings yet

- Central Excise Tariff Notification No.14/2014 Dated 11th July, 2014Document1 pageCentral Excise Tariff Notification No.14/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Cus 2212Document1 pageCus 2212patelpratik1972No ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- CBIC-CUS TARIFF NOTFN NO.05 DT.22.01.2024-Seeks To Amend Notification No.11-2021 Dated 1st February 2021 To Impose AIDC On Entries Falling Under 7112 7113 and 7118Document1 pageCBIC-CUS TARIFF NOTFN NO.05 DT.22.01.2024-Seeks To Amend Notification No.11-2021 Dated 1st February 2021 To Impose AIDC On Entries Falling Under 7112 7113 and 7118srinivasan subbaiyanNo ratings yet

- cs33 2013Document1 pagecs33 2013stephin k jNo ratings yet

- Customs Tariff Notification No.21/2014 Dated 11th July, 2014Document2 pagesCustoms Tariff Notification No.21/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Notification No. 26-2013-Central ExciseDocument2 pagesNotification No. 26-2013-Central Excisepatelpratik1972No ratings yet

- 11 2015 Dated 01 Marc 2015Document1 page11 2015 Dated 01 Marc 2015vinodNo ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Document1 page(To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Kishore KumarNo ratings yet

- Explanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasDocument1 pageExplanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasSushant SaxenaNo ratings yet

- st17 2014Document1 pagest17 2014hqpoolkolsouthNo ratings yet

- Central Excise Tariff Notification No.15/2014 Dated 11th July, 2014Document2 pagesCentral Excise Tariff Notification No.15/2014 Dated 11th July, 2014stephin k jNo ratings yet

- ,, - II, - , IIDocument66 pages,, - II, - , IIstephin k jNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- cs25 2013Document3 pagescs25 2013stephin k jNo ratings yet

- This Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994Document1 pageThis Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994T Ankamma RaoNo ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- 10 2018 Notification Dated 02 Feb 2018Document2 pages10 2018 Notification Dated 02 Feb 2018vinodNo ratings yet

- Customs Notification 33-2022Document2 pagesCustoms Notification 33-2022Raja SinghNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Notification No. 7 /2012-Central ExciseDocument2 pagesNotification No. 7 /2012-Central Excisekumar_k_2005No ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Document1 page(To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )monuNo ratings yet

- (To Be Published in The Gazette of India, Extraordinary, Part I), Section 3, Sub-Section (I) )Document1 page(To Be Published in The Gazette of India, Extraordinary, Part I), Section 3, Sub-Section (I) )Ojasvi NautiyalNo ratings yet

- 01-2023-ct-engDocument1 page01-2023-ct-engcadeepaksingh4No ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document2 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- csnt67 2013Document1 pagecsnt67 2013stephin k jNo ratings yet

- csnt66 2013Document1 pagecsnt66 2013stephin k jNo ratings yet

- Central Excise Tariff Notification No.18/2014 Dated 11th July, 2014Document2 pagesCentral Excise Tariff Notification No.18/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- 2013rev MS581Document2 pages2013rev MS581Nagaraja Rao MukhiralaNo ratings yet

- Kundalini Reiki Manual - REIKIDocument24 pagesKundalini Reiki Manual - REIKINur Anuar Mohamed96% (52)

- Ashok Paper Mills excise duty exemptionDocument1 pageAshok Paper Mills excise duty exemptionpatelpratik1972No ratings yet

- Directions in VastuDocument2 pagesDirections in VastuAlok JagawatNo ratings yet

- Notification No. 15-99Document1 pageNotification No. 15-99patelpratik1972No ratings yet

- Reiki Symbols: Keys to Focusing Healing EnergyDocument8 pagesReiki Symbols: Keys to Focusing Healing Energypatelpratik1972No ratings yet

- Karmic Reiki Practitioners ManualDocument10 pagesKarmic Reiki Practitioners ManualCrina Mihaela Danea100% (1)

- Reiki Symbols and MeaningsDocument31 pagesReiki Symbols and Meaningspatelpratik1972100% (3)

- Reiki Master Handbook-Full InglesDocument44 pagesReiki Master Handbook-Full Inglesanon-523638100% (13)

- Reiki 2 ManualDocument50 pagesReiki 2 Manualrincewind65100% (22)

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocument5 pagesNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972No ratings yet

- Blackarch Guide en PDFDocument20 pagesBlackarch Guide en PDFrexthrottleNo ratings yet

- Sugar Orders - 1987Document3 pagesSugar Orders - 1987patelpratik1972No ratings yet

- Textile RegulationsDocument1 pageTextile Regulationspatelpratik1972No ratings yet

- Direction To Procedures of YarnDocument4 pagesDirection To Procedures of Yarnpatelpratik1972No ratings yet

- GST-TITLEDocument7 pagesGST-TITLEpatelpratik1972No ratings yet

- Delegation of Powers - CEXDocument19 pagesDelegation of Powers - CEXpatelpratik1972No ratings yet

- Uranus v0.1 User GuideDocument5 pagesUranus v0.1 User Guidemaster1793No ratings yet

- Notification No. 68 63 C.EDocument2 pagesNotification No. 68 63 C.Epatelpratik1972No ratings yet

- Notification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The CentralDocument5 pagesNotification No. 10/95-Central Excise in Exercise of The Powers Conferred by Sub-Section (1) of Section 5A of The Centralpatelpratik1972No ratings yet

- Notification No.103 93 C.EDocument1 pageNotification No.103 93 C.Epatelpratik1972No ratings yet

- Notification No.136 94 C.EDocument7 pagesNotification No.136 94 C.Epatelpratik1972No ratings yet

- Notification 64 95Document7 pagesNotification 64 95patelpratik1972No ratings yet

- Notification No. 145 89 C.EDocument11 pagesNotification No. 145 89 C.Epatelpratik1972No ratings yet

- Notification No.1 95 C.EDocument9 pagesNotification No.1 95 C.Epatelpratik1972No ratings yet

- Notification No. 115 75 CEDocument1 pageNotification No. 115 75 CEpatelpratik1972No ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document2 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- Notification No. 397 86 C.EDocument2 pagesNotification No. 397 86 C.Epatelpratik1972No ratings yet

- Government of India Ministry of Finance (Department of Revenue)Document2 pagesGovernment of India Ministry of Finance (Department of Revenue)patelpratik1972No ratings yet

- Ce 3 2kDocument1 pageCe 3 2kpatelpratik1972No ratings yet

- Notification No.31 2000 EXDocument2 pagesNotification No.31 2000 EXpatelpratik1972No ratings yet

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (12)

- The Rape of the Mind: The Psychology of Thought Control, Menticide, and BrainwashingFrom EverandThe Rape of the Mind: The Psychology of Thought Control, Menticide, and BrainwashingRating: 4 out of 5 stars4/5 (23)

- Japanese Things: Being Notes on Various Subjects Connected with JapanFrom EverandJapanese Things: Being Notes on Various Subjects Connected with JapanRating: 4.5 out of 5 stars4.5/5 (9)

- Ceramics: Contemporary Artists Working in ClayFrom EverandCeramics: Contemporary Artists Working in ClayRating: 5 out of 5 stars5/5 (3)

- The Wire-Wrapped Jewelry Bible: Artistry Unveiled: Create Stunning Pieces, Master Techniques, and Ignite Your Passion | Include 30+ Wire-Wrapped Jewelry DIY ProjectsFrom EverandThe Wire-Wrapped Jewelry Bible: Artistry Unveiled: Create Stunning Pieces, Master Techniques, and Ignite Your Passion | Include 30+ Wire-Wrapped Jewelry DIY ProjectsNo ratings yet

- I'd Rather Be Reading: A Library of Art for Book LoversFrom EverandI'd Rather Be Reading: A Library of Art for Book LoversRating: 3.5 out of 5 stars3.5/5 (57)

- Hands of Time: A Watchmaker’s HistoryFrom EverandHands of Time: A Watchmaker’s HistoryRating: 4.5 out of 5 stars4.5/5 (5)

- The Existential Literature CollectionFrom EverandThe Existential Literature CollectionRating: 2.5 out of 5 stars2.5/5 (2)

- Hanok: The Korean House: Architecture and Design in the Contemporary HanokFrom EverandHanok: The Korean House: Architecture and Design in the Contemporary HanokRating: 4.5 out of 5 stars4.5/5 (3)

- How to Trade Gold: Gold Trading Strategies That WorkFrom EverandHow to Trade Gold: Gold Trading Strategies That WorkRating: 1 out of 5 stars1/5 (1)

- Extreme Bricks: Spectacular, Record-Breaking, and Astounding LEGO Projects from around the WorldFrom EverandExtreme Bricks: Spectacular, Record-Breaking, and Astounding LEGO Projects from around the WorldRating: 4 out of 5 stars4/5 (9)

- Gig Posters Volume 2: Rock Show Art of the 21st CenturyFrom EverandGig Posters Volume 2: Rock Show Art of the 21st CenturyRating: 4 out of 5 stars4/5 (1)

- STOICISM: The ultimate guide to apply stoicism in your life, discovering this ancient discipline to overcome obstacles and gain resilience, perseverance, confidence, mental toughness and calmness.From EverandSTOICISM: The ultimate guide to apply stoicism in your life, discovering this ancient discipline to overcome obstacles and gain resilience, perseverance, confidence, mental toughness and calmness.No ratings yet

- The LEGO Story: How a Little Toy Sparked the World's ImaginationFrom EverandThe LEGO Story: How a Little Toy Sparked the World's ImaginationRating: 3.5 out of 5 stars3.5/5 (14)

- The RVer's Bible (Revised and Updated): Everything You Need to Know About Choosing, Using, and Enjoying Your RVFrom EverandThe RVer's Bible (Revised and Updated): Everything You Need to Know About Choosing, Using, and Enjoying Your RVRating: 5 out of 5 stars5/5 (2)

- Cocktails 101: A Mixologist's Quick Guide to Mixing, Matching, Making, and Mastering the Art of Creating Amazing CocktailsFrom EverandCocktails 101: A Mixologist's Quick Guide to Mixing, Matching, Making, and Mastering the Art of Creating Amazing CocktailsNo ratings yet

- Gem & Jewelry Pocket Guide: A traveler's guide to buying diamonds, colored gems, pearls, gold and platinum jewelryFrom EverandGem & Jewelry Pocket Guide: A traveler's guide to buying diamonds, colored gems, pearls, gold and platinum jewelryRating: 5 out of 5 stars5/5 (1)

- Mapping America: The Incredible Story and Stunning Hand-Colored Maps and Engravings that Created the United StatesFrom EverandMapping America: The Incredible Story and Stunning Hand-Colored Maps and Engravings that Created the United StatesNo ratings yet

- Gem Identification Made Easy (4th Edition): A Hands-On Guide to More Confident Buying & SellingFrom EverandGem Identification Made Easy (4th Edition): A Hands-On Guide to More Confident Buying & SellingRating: 5 out of 5 stars5/5 (2)

- Intermediate Guide to Japanese Joinery: The Secret to Making Complex Japanese Joints and Furniture Using Affordable ToolsFrom EverandIntermediate Guide to Japanese Joinery: The Secret to Making Complex Japanese Joints and Furniture Using Affordable ToolsRating: 4 out of 5 stars4/5 (1)

- Dark Archives: A Librarian's Investigation Into the Science and History of Books Bound in Human SkinFrom EverandDark Archives: A Librarian's Investigation Into the Science and History of Books Bound in Human SkinRating: 4.5 out of 5 stars4.5/5 (121)

- The History of Browning Firearms: A Complete Chronicle of the Greatest Gunsmith of All TimeFrom EverandThe History of Browning Firearms: A Complete Chronicle of the Greatest Gunsmith of All TimeNo ratings yet

- The Lego Story: How a Little Toy Sparked the World’s ImaginationFrom EverandThe Lego Story: How a Little Toy Sparked the World’s ImaginationRating: 4.5 out of 5 stars4.5/5 (20)