Professional Documents

Culture Documents

MGMT 611G: Questions For Marriott Corporation Questions For Marriott Corporation

MGMT 611G: Questions For Marriott Corporation Questions For Marriott Corporation

Uploaded by

Sahid Xerfan NetoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MGMT 611G: Questions For Marriott Corporation Questions For Marriott Corporation

MGMT 611G: Questions For Marriott Corporation Questions For Marriott Corporation

Uploaded by

Sahid Xerfan NetoCopyright:

Available Formats

Questions for Marriott Corporation

Questions for Marriott Corporation

s

MGMT 611G

Marriott Corporation: The Cost of Capital Raghu Rau

What is the weighted average cost of capital for Marriott Corporation? Assume that the corporate tax rate for all companies is 44%. If Marriott used a single corporate hurdle rate for evaluating investment opportunities in each of its lines of business, what would happen to the company over time?

What is the cost of capital for the lodging, restaurant and contract service divisions of Marriott?

Note : Use arithmetic average risk premiums. Ignore floating rate debt.

What was the economic value added (EVA) of each of the divisions last year (1987)? Assume operating profits of 1987 are generated by the average invested capital of 86-87.

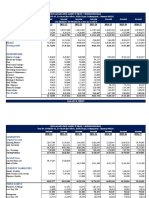

Cost of Capital for the Entire Firm

s

Cost of Equity, rs

s

After Tax Cost of Debt

s

Cost of Equity :

Target Debt Ratio is 60%, actual is (2499/(2499 + 3564) = 41% s = 1.11 u = s /(1 + (1 - t) B/S) t = 0.44 B = 2499 S = 3564 B/S = 0.70 = 0.80 u

Using the target debt ratio of : 60.00%

TS = u (1 + (1 - t) B/S) B/S= 1.50 = 1.47 TS

After tax rb = (Gov't Bond Rate + Credit Spread) x (1 - t)

Gov't Bond Rate Credit Spread 8.72% 1.30%

Using the Capital Asset Pricing Model :

rf = 8.72% (Long-term rate on US Gov't Bonds) rm-rf = 7.43% (Arithmetic Average, 1926-87) rs = rf + (rm - rf) TS rs = 19.64%

s rb s

5.61%

WACC :

WACC = (B/V) x After tax rb + (S/V) x rs = 11.22%

Cost of Capital for Lodging Division

Sample of Lodging Companies Market Value Leverage 14.00% 79.00% 69.00% 65.00% Beta Tax Rate (Assumed = Rate) 44.00% 44.00% 44.00% 44.00% Average Sales Weighted Average Unlevered Beta 0.70 0.43 0.40 0.67 0.55 Sales

Cost of Equity for lodging division

s

After Tax Cost of Debt, kd

s

Using the target debt ratio of : 74.00%

TS = u (1 + (1 - t) B/S) B/S= 2.85 TS = 1.41

After tax rb=

(Gov't Bond Rate + Credit Spread) x (1 - t)

Gov't Bond Rate Credit Spread = 5.63% rb 8.95% 1.10%

Hilton Holiday La Quinta Ramada

0.76 1.35 0.89 1.36

0.77 1.66 0.17 0.75 0.54

Using the Capital Asset Pricing Model :

rf = 8.72% Long-term rate on US Gov't Bonds rm-rf =7.43% Arithmetic Average, 1926-87

WACC :

WACC = (B/V) x after tax rb + (S/V) x rs = 9.16%

u = 0.54

s rs s rs

= =

rf + TS

x (rm - rf) 19.22%

Cost of Capital for Restaurant Division

Sample of Restaurant Companies Market Value Leverage 4.00% 10.00% 6.00% 1.00% 23.00% 21.00% Beta Tax Rate (Assumed = Rate) 44.00% 44.00% 44.00% 44.00% 44.00% 44.00% Average Sales Weighted Average Unlevered Beta 1.42 1.37 0.55 0.76 0.81 1.15 1.01 Sales

Cost of Equity

s

After Tax Cost of Debt

s

Using the target debt ratio of : 42.00%

TS = u (1 + (1 - t) B/S) B/S= 0.72 TS = 1.31

After tax rb =

(Gov't Bond Rate + Credit Spread) x (1 - t)

Church's Collins Foods Frisch's Luby's McDonald's Wendy's

1.45 1.45 0.57 0.76 0.94 1.32

0.39 0.57 0.14 0.23 4.89 1.05 0.93

Using the Capital Asset Pricing Model :

rf = 8.72% Long-term rate on US Gov't Bonds rm-rf = 7.43% Arithmetic Average, 1926-87

s rs = rf + TS s rs

Gov't Bond Rate s Credit Spread s rb = 5.89% s WACC :

s

8.72% 1.80%

* (rm - rf) 18.44%

WACC = (B/V) x rb + (S/V) x rs = 13.17%

u = 0.93

Cost of Capital for Contract Services Division

There is no sample of Contract Services Companies, but the u for Marriott must be the weighted average of the Divisional u's.

Identifiab le A ssets $ 2 ,77 7 .4 $5 6 7.6 $ 1 ,23 7 .7 $ 4 ,58 2 .7 R atio 0.6 1 0.1 2 0.2 7 B eta U nlev ered 0 .54 0 .93 1 .3 1 0 .80

Cost of Equity

s

After Tax Cost of Debt

s rb

Using the target debt ratio of : 40.00%

TS = u (1 + (1 - t) B/S) B/S= 0.67 = 1.80 TS

=(Gov't Bond Rate + Credit Spread) x (1 - t)

8.72% 1.40%

L od g in g R estauran ts C o ntra ct S e rv .

Using the Capital Asset Pricing Model :

rf = Bonds rm-rf = 87 8.72% Long-term rate on US Gov't

s

Gov't Bond Rate Credit Spread rb = 5.67%

WACC :

WACC = (B/V) x after tax rb + (S/V) * rs = 15.51%

7.43% Arithmetic Average, 1926-

u = 1.31

s rs

rf + * (rm - rf) = 22.08%

Summary of Marriott Corporation Cost of Capital Estimates

Unlevered Beta MARRIOTT Lodging Restaurants Contract Serv. 0.80 0.54 0.93 1.31 Target Levered Cost of Debt Equity Debt Beta Ratio 60.00% 1.47 5.61% 74.00% 1.41 5.63% 42.00% 1.31 5.89% 40.00% 1.80 5.67% Cost of Equity WACC

EVA

Invested Capital (average 86-87) Lodging 2507 ROIC WACC EVA

19.64% 11.22% 19.22% 9.16% 18.44% 13.17% 22.08% 15.51%

263.9(1 0.44) = 59% . 2507

9.16%

-82

Marginal Tax Rate is44.00% Market Risk Premium is7.43%

Contract Services

1155

170.6(1 0.44) = 8.3% 1155

13.17%

-57

565 Restaurants

82.5(1 0.44) = 8.2% 565

15.51%

-41

You might also like

- Case Solutions Sampa Video Inc.Document2 pagesCase Solutions Sampa Video Inc.Morsal100% (1)

- Marriott Corporation Case SolutionDocument9 pagesMarriott Corporation Case SolutionZaim Zain100% (2)

- JP Morgan Valuation Training MaterialsDocument49 pagesJP Morgan Valuation Training MaterialsAdam Wueger93% (28)

- Midland Energy Case StudyDocument5 pagesMidland Energy Case StudyLokesh GopalakrishnanNo ratings yet

- Accounting AnalyticsDocument5 pagesAccounting AnalyticsHari priyaNo ratings yet

- American Home Products: Free Cash Flows, WACC, and Implicit GrowthDocument5 pagesAmerican Home Products: Free Cash Flows, WACC, and Implicit GrowthJeronimo CabreraNo ratings yet

- Marriott Corporation - K - AbridgedDocument9 pagesMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- Marriott ExcelDocument2 pagesMarriott ExcelRobert Sunho LeeNo ratings yet

- Talbros AutomotiveDocument6 pagesTalbros AutomotiveAhmed NiazNo ratings yet

- Case 5 Midland Energy Case ProjectDocument7 pagesCase 5 Midland Energy Case ProjectCourse HeroNo ratings yet

- Midland Case CalculationsDocument24 pagesMidland Case CalculationsSharry_xxx60% (5)

- Marriott Case AnalysisDocument3 pagesMarriott Case AnalysisNikhil ThaparNo ratings yet

- American Home ProductDocument18 pagesAmerican Home Productclassmate100% (1)

- Sampa Video Inc.Document8 pagesSampa Video Inc.alina8763No ratings yet

- Midland CaseDocument8 pagesMidland CaseDevansh RaiNo ratings yet

- MarriotDocument3 pagesMarriotNaman SharmaNo ratings yet

- Marriot CaseDocument15 pagesMarriot CaseArsh00100% (7)

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- Marriott Case FinalDocument17 pagesMarriott Case FinalFabia BourdaNo ratings yet

- Marriott Corporation Case SolutionDocument4 pagesMarriott Corporation Case SolutionAsif RahmanNo ratings yet

- Marriot "The Cost of Capital"Document7 pagesMarriot "The Cost of Capital"dindo_waeNo ratings yet

- Example MidlandDocument5 pagesExample Midlandtdavis1234No ratings yet

- Sampa Video Inc - SolutionDocument3 pagesSampa Video Inc - SolutionKaustav BhattacharjeeNo ratings yet

- Case Study: Midland Energy Resources, IncDocument13 pagesCase Study: Midland Energy Resources, IncMikey MadRatNo ratings yet

- Sampa Video, Inc Case StudyDocument26 pagesSampa Video, Inc Case StudyFaradilla Karnesia100% (2)

- Excel Spreadsheet Sampa VideoDocument5 pagesExcel Spreadsheet Sampa VideoFaith AllenNo ratings yet

- R4acads Finacc ExtraDocument5 pagesR4acads Finacc ExtraChristine Herico CurryNo ratings yet

- CSC Ch21 - Alternative Investments Strategies, PerformanceDocument16 pagesCSC Ch21 - Alternative Investments Strategies, Performancelily northNo ratings yet

- Training - IfRS - MazarsDocument7 pagesTraining - IfRS - MazarsToni TriyuliantoNo ratings yet

- Mariott Wacc Cost of Capital DivisionalDocument6 pagesMariott Wacc Cost of Capital DivisionalSuprabhat TiwariNo ratings yet

- Midland FinalDocument8 pagesMidland Finalkasboo6No ratings yet

- Marriott CorporationDocument9 pagesMarriott CorporationMichelle Rodríguez100% (1)

- Marriott Case - Dakota ChristensenDocument5 pagesMarriott Case - Dakota Christensendchristensen5No ratings yet

- Group 3-Case 1Document3 pagesGroup 3-Case 1Yuki Chen100% (1)

- MIdland FInalDocument7 pagesMIdland FInalFarida100% (8)

- Midland Energy Resources (Final)Document4 pagesMidland Energy Resources (Final)satherbd21100% (3)

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- Marriott CorporationDocument7 pagesMarriott Corporationparth2kNo ratings yet

- Sampa VideoDocument18 pagesSampa Videomilan979No ratings yet

- Sampa Video Case SolutionDocument6 pagesSampa Video Case SolutionRahul SinhaNo ratings yet

- Assignment - Sampa VideoDocument5 pagesAssignment - Sampa Videobhatiasanjay11No ratings yet

- Marriott Solutions WACC LodgingDocument3 pagesMarriott Solutions WACC LodgingPabloCaicedoArellanoNo ratings yet

- American Chemical Corporation: Financial Analysis: June 2010Document9 pagesAmerican Chemical Corporation: Financial Analysis: June 2010BenNo ratings yet

- Marriott Corporation Case SolutionDocument6 pagesMarriott Corporation Case Solutionanon_671448363No ratings yet

- Nike Inc. Case StudyDocument3 pagesNike Inc. Case Studyshikhagupta3288No ratings yet

- Nabisco - Sol v0.1 PDFDocument13 pagesNabisco - Sol v0.1 PDFMohit Khandelwal100% (1)

- Midland Energy ResourcesDocument21 pagesMidland Energy ResourcesSavageNo ratings yet

- Midland Energy ResourcesDocument2 pagesMidland Energy Resourcesambreen khalidNo ratings yet

- Midland Energy A1Document30 pagesMidland Energy A1CarsonNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Cost of Capital - MidlandDocument5 pagesCost of Capital - MidlandOmar ChaudhryNo ratings yet

- 01 - Midland AnalysisDocument7 pages01 - Midland AnalysisBadr Iftikhar100% (1)

- Marriot Corporation Case SolutionDocument5 pagesMarriot Corporation Case Solutionmanoj1jsrNo ratings yet

- Weighted Average Cost of Capital: Timothy A. Thompson Executive Masters ProgramDocument24 pagesWeighted Average Cost of Capital: Timothy A. Thompson Executive Masters ProgramBharat AravamudhanNo ratings yet

- Marriot Corporation Cost of CapitalDocument32 pagesMarriot Corporation Cost of CapitalDevarsh MapuskarNo ratings yet

- Group2 Marriott V6Document54 pagesGroup2 Marriott V6Ibraheem RabeeNo ratings yet

- Mariott Valuation in Corporate FinanceDocument5 pagesMariott Valuation in Corporate FinanceRasheeq RayhanNo ratings yet

- DCF Presentation Ahemdabad 20 01 2018Document33 pagesDCF Presentation Ahemdabad 20 01 2018pre.meh21No ratings yet

- Relative Risk MeasuresDocument19 pagesRelative Risk MeasuresCarlos RojasNo ratings yet

- Group 2 Marriott SlideDocument47 pagesGroup 2 Marriott SlideIbraheem RabeeNo ratings yet

- CH 6 - Cost of Capital PDFDocument49 pagesCH 6 - Cost of Capital PDFJanta RajaNo ratings yet

- Understanding MPR and Balance Sheet Management & ABC BasisDocument32 pagesUnderstanding MPR and Balance Sheet Management & ABC Basisfidelity FinancialsNo ratings yet

- UNIT-3-A-Financial Statement AnalysisDocument52 pagesUNIT-3-A-Financial Statement AnalysisEswar RajNo ratings yet

- Kieso - Inter - ch10 - Ifrs Psak Ppe RevDocument59 pagesKieso - Inter - ch10 - Ifrs Psak Ppe RevJhoNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- 7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLDocument11 pages7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLAani RashNo ratings yet

- Chapter 1 IntroductionDocument40 pagesChapter 1 IntroductionSoka PokaNo ratings yet

- Walmart Versus MacyDocument2 pagesWalmart Versus MacyMelissa S AndersenNo ratings yet

- Part 2 Liquidity and Profitability Ratios - Qs 28 May 2023Document18 pagesPart 2 Liquidity and Profitability Ratios - Qs 28 May 2023rdjimenez.auNo ratings yet

- Delacruz Act1acctgDocument13 pagesDelacruz Act1acctghenry siyNo ratings yet

- 01 Icai Case Study QuestionDocument16 pages01 Icai Case Study QuestionFAMLITNo ratings yet

- Liquidation 2Document3 pagesLiquidation 2Kenneth CuencaNo ratings yet

- 9 Bonus & Right IssueDocument9 pages9 Bonus & Right Issueanilrj14pc8635jprNo ratings yet

- 07 Activity 1-EnTREPDocument2 pages07 Activity 1-EnTREPClar PachecoNo ratings yet

- Mgt101-15 - Accounting For InventoriesDocument69 pagesMgt101-15 - Accounting For InventoriesHaris AliNo ratings yet

- FM CHAPTER 2 TWO. PPT Slides - PPT 2Document90 pagesFM CHAPTER 2 TWO. PPT Slides - PPT 2Alayou TeferaNo ratings yet

- Capital Budgeting of The Himalaya Drug Company: Term Paper Made By:-Saumya TripathiDocument25 pagesCapital Budgeting of The Himalaya Drug Company: Term Paper Made By:-Saumya Tripathi1010180No ratings yet

- Capital Budgeting and Decision MakingDocument71 pagesCapital Budgeting and Decision MakingNEERAJ GUPTANo ratings yet

- BUSI 2505 Assignment 1Document8 pagesBUSI 2505 Assignment 1Mona GreenNo ratings yet

- Financial InvestmentDocument7 pagesFinancial InvestmentGerald de BrittoNo ratings yet

- AFA Assingments II Sem PDFDocument3 pagesAFA Assingments II Sem PDFmartin santuroNo ratings yet

- 10 Job Order CostingDocument5 pages10 Job Order CostingAllegria AlamoNo ratings yet

- Practice Question For Depreciation & ProvisionDocument2 pagesPractice Question For Depreciation & ProvisionAli QasimNo ratings yet

- The Determination and Allocation of Excess ScheduleDocument2 pagesThe Determination and Allocation of Excess ScheduleWawex DavisNo ratings yet

- ProjectionDocument3 pagesProjectionPrabhu SNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Al-Fadl 1 Limited Financial Statement For The Year End July 2023Document2 pagesAl-Fadl 1 Limited Financial Statement For The Year End July 2023SkymoonNo ratings yet

- Chapter 2 Inventory Solution 1 PDFDocument5 pagesChapter 2 Inventory Solution 1 PDFhtet sanNo ratings yet