Professional Documents

Culture Documents

NCMEC - 2006 Form 990

NCMEC - 2006 Form 990

Uploaded by

Berin Szóka0 ratings0% found this document useful (0 votes)

60 views49 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views49 pagesNCMEC - 2006 Form 990

NCMEC - 2006 Form 990

Uploaded by

Berin SzókaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 49

[site GRAPHIC print DO NOT PROCESS [As Filed bata~[ DIN; 9349013609147]

990 Return of Organization Exempt From Income Tax [ome Ne 1545-0047

6

intranet artratnoncen iene ues'es | DOOG

conti emits

eee

sence

1X For the 2006 calendar year, or tax yon beginning 01-01-2006 and nding 12-35-2006

I> The organization may have to use a copy of this return to satisty state reporting requirements

Check Fapphenble Prime of ganas 1D ERSTO Ver TESAERERTON BURBS

Trades cange bxnvoted crupRen 52-1320557,

Tur apd aust (or PO box mal sot debated Wo Svea aT] Telephone number

Tame cnange

(703) 274-3900

CRY ora ASS OFS, SPT accountng mano cach Anal

Prat eum ‘NEsANDRIN VA" 2295 Racca

PF tngat sum

TF tenendo return

TF kpptcaton pening

Section 501(c)(3) organizations and 4947(2)(1) nonexenpt charitable | M #d 1218 not spb to secton 527 eryntentons

frorte mist sttseh a completed Schedule A(rorm 390 or 990:82). Hea) thea soup return forafitates? Fes Wo

G Website: b HTTP //MANW MISSINGKIDS COM eee

& Websites PNTTP /WWWMISSINGKEPS COM ae) at atts ce? Pye Pie

2. organization type (check oy one) FF $B soe) (3) tosert mo) [7 a847(aya) or 527 (Ft tach ait See mstetons }

(a) 1 hs sparate retuned by an organcaton

K Check bere ® Te ogonazaton s not 50{0)(9) pporting orgnantion and ts gos recep awe | NCSD

romnally net more than 25,000 A retum # not required, but if the organzation chooses to file a retim, eee erence et aL

te'sre wea cmp tm F__Group Exemption Number

check Ff the oganeaton not gure to

L Gross receipts Add ines 6b, 8b, 9b, and 10b to lina 12 52,603,740 ‘Sach Sa (on 80, 90°62 or 906-8)

WEETIEEL_Revenue, expenses, and Changes in Net Assets or Fund Balances (See the instructions.)

1 Contnbutions, oft, rants, and similar amaunts recewved

© Contnbutins to donoradvised finds... te

Direct puble support (not included on ine 18) tb 756452

Indirect pubic support (not neluded online £4) te a73572

4 Government contabutions (grants) (ot eluded online 1) aa 35,964,299

fe Total add lines 1a through 14) (cash $ 43,994,323 _noncash$ 2 > te 43,994,323

2 Program service revenue including government fees and contracts (fom Park VII, line 93) 2 aa037

4 Interest on savings and temporary cath investments 7 aoa.5e7

5S Dividends and interest from secuntes 5 145,056

© Netrental ncome or oss) subtract ine Sbfromiine 62». ey & 6.242

7 Other mvestment income (descnbe >)» ea a a 7

2 Gross amount om sles ofassets (A) Secuntes (women

atherthan inventory. ss sama] ee

tb tes ctor cter ead ales expenses casero | ab

€ Gemor(lors) attach schedule). 179.083] 8

4 Natgnin or (oss) Combine ine 8c, columns (AVand(@). = si9.t02

9 Special vents and activities (attach schedule) Ifany amount som gaming, check here Pf

* Gross revenue (not neluding & ra

ontnbutions reported on ime 1b) > se | 8 aasiare

€ _Wetincome or thas} fom spacial avente Subtract ine 9B frm hae Ba se 2.673.364

10a Gross sales of ventory, les retums and allowances + [00

b Less costotgoodseold se [Om

© Gos poor es) fam ses of men (atch chef) Sabet ne 106 fone TOBY

11 other revenue (rom Part VII, n@ 103) 6 vw ee rr

12 _ Total revenue Add ines Se, 2,3,4,5,6¢,7,86,9¢,10¢,and11_. ft 2 wainar

13 Progrem-services (Fomine a4, column (B)) = = 2 + se ss sss 2 39,718,226

14 Managomant and general (bom ie 44, coli (C2) rr 711,502

45 Fundraising (Homline 44, column (0)) «ee ee ee ee ee La 3252.429

16 Payments to afiates (attach schedule). 16

17 _Totalexpensea Add lines 16 and 44, column(A) « «+ + + + + + + + © 7 wages

28 Excess or (Geen) forthe yeurSubtrectine 17 fominei2.. s s ys ss | 8 2,735,926

19 Wet assets orfund balances at begining ofyear (Hom line 73,column(Al) . - + =» [a9 31,507,723

20 other changes net assets or fund balances (attach explanation) ®@) . o 20 730,709

21 __Net assets orfund balances at end of veor Combine nes 18,39,0nd20 1 > + + 2 3974258

Sains Scares aaiae a

Form 9

EEXHEGY statement of

90 (2006)

Page 2

‘Ailerganizations must complete column (A) Columns (B), (G) and (D)are required fr section

Functional Expenses £01(c)(3) and (4) organizations and section 4347(a)(1) nonexempt charitable trusts but optional

for others (See theinstructins.)

‘Do net include amounts reported on tine cayrotar |] @)Prevam [ey Management | 6) eundrasing

‘6b, 8b, 9b, 10b, or 16 of Part I serves ‘and generat

‘22a Grants paid from donor advised funds (attach Schedule)

(cash $2 noncash $2 )

1 ths amount weladesforetan grants, check here > [— 228]

226 Other grants and allocations (attach schedule)

feesh $2 noncash $2

1 ths amount welodesforean gras, check here> J 226]

23 Specie asstance to ndwauals (attach schedule) 23

24 Benefits pad to or fr members (attach schedule) 2a

etc Listed in Part V-A (attach schedule) 25a] 1.423,610) 1,161,057 198,674 63,879

Compensation of farmer oticers, actors, kay employees

ste listed in Part V-B (attach schedule) 250] 209,183] 209,143

€ Compensation and cther datnbutions not eluded above to

disqualified persons (as defined under section 4958(f)(1)) and

persons deseribed in section 4958(c)(3)(8) (attach schedule) | 25e| 1,388,749 1,203,488 195,261

onlines 252, band © aces 26| 14,735,750] _ 15,879,510 39,598 auara

Eid veep cerita

Ines 25a, b and c 7 27 759,105 703,496) 12,351 43318

28 Employee benefits not cluded on hnes

29° Payroll taxes 29 1.289, 116| 1,092,303 73.531

30 Professional fundraising fees 30

31 Accounting fees 34 87.837 76,992 10,05

33° Supplies 3 1,380,362 1,359.49 26 18,028

34 Telephone 34 257.149] 827,984 4,525] 24,636

35 Postage and shipping 35 523,638 992,065 6.092 28,281

37 Equipment rental and maintenance 37

38 Printing and publications 38 235,236] 795,688 39,548

41 Interest a1 342,659] 323,348 1.793 12.518

42 Depreciation depletion, ete (attach schedule) D a2 432,087| 414,041 2.261 15,705

43 Other expenses not covered above (itemize)

‘a See Additional Data Table [asa

» [aap

. [ae

t ‘aat

° [a0

Total functional expenses. Aa ines 223 twough $39

{(Organtatons compleung columns (8)(D}, cary these totals

to ines 13-15 44] seezsi] 39,718,226 musa] 2252823

Joint Costs. Check PT” ifyou ara folowing SOP 98-2

[re any joint costs from a combined edu ational campaign and fundraising solicitation reported in (B) Program services?

ses,

‘enter (i) the aggregate amount ofthese joint costs §

(ii) the amount allocated to Management and general $

) the amount allocated to Program services §.

i) the amount ellocated to Fundraising $

>» ves F No

aaicaan a

Form 990 (2006)

Page 3

[EIIERHT statement of Program Service Accomplishments (See the instructions.)

Form 990 1@ available for puble inspection and, for some people, serves as the primary or sole souree of information sbout parcular

organization How the public perceives an organization n such cases may be determined by the information presented on its return

‘Therefore, please make sure the return is complete and accurate and fully describes, in Part I, the organizations programs and

accomplishments

What 16 the organrzation’s primary exempt purpose? ® NATIONAL RESOURCE AND TECHNICAL CENTER

FOR MISSING/EXPLOITED CHILOREN

pubetons ssod, et sais achevements ha re hot essuabe (Sec 80%(c\(3) and (4) omaizatns ar 4547(9) 4) honexempt

Program Service

Expenses

xenueed for sbi(e(3) and

(share ana aa),

Truss, but optonal or

orate rst mist ak cree te aroun of grants ad aes oh ote)

@ See Additional Data Table

(Grants and allocations THis emount includes foreign grants, check here

»

(Grants and allocations ihe amount includes foreign arants, check here>

ane ad alecenon TWh smount meludes foreign grants, check here»

e

[Grants and allocations THis emount includes foreign grants, check here

Other program services (attach schedule)

(Grants and allocations § )_Ifthus amount includes foreign grants, check here

1 Total of Program Service Expenses (should equal ine 44, column (B), Program services)... > eye a3e

Form 990 (2006)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Space Solar Power (SSP) - A Solution For Energy Independence & Climate ChangeDocument1 pageSpace Solar Power (SSP) - A Solution For Energy Independence & Climate ChangeBerin Szóka100% (23)

- PFF COPPA Review Reply CommentsDocument9 pagesPFF COPPA Review Reply CommentsBerin SzókaNo ratings yet

- CDT-PFF-EFF Joint Comments in Matter No. P104503Document12 pagesCDT-PFF-EFF Joint Comments in Matter No. P104503Berin SzókaNo ratings yet

- Before The Federal Communications Commission Washington, D.C. 20554Document7 pagesBefore The Federal Communications Commission Washington, D.C. 20554Berin SzókaNo ratings yet

- Benefits of Online Advertising PaperDocument24 pagesBenefits of Online Advertising PaperBerin SzókaNo ratings yet

- Privacy Polls v. Real-World Trade-OffsDocument8 pagesPrivacy Polls v. Real-World Trade-OffsBerin SzókaNo ratings yet

- Cyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary CommitteeDocument28 pagesCyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary CommitteeBerin SzókaNo ratings yet

- Appeals Opinion in Comcast v. FCCDocument21 pagesAppeals Opinion in Comcast v. FCCDealBookNo ratings yet

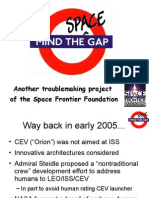

- Mind The Space Gap - Space Access PresentationDocument11 pagesMind The Space Gap - Space Access PresentationBerin SzókaNo ratings yet

- Online Advertising & User Privacy: Principles To Guide The Debate - 09.24.08 - by Berin Szoka & Adam ThiererDocument6 pagesOnline Advertising & User Privacy: Principles To Guide The Debate - 09.24.08 - by Berin Szoka & Adam ThiererBerin SzókaNo ratings yet

- Space Frontier Foundation's Views On The NSSO-Sponsored SBSP Study ReportDocument5 pagesSpace Frontier Foundation's Views On The NSSO-Sponsored SBSP Study ReportSpace Frontier FoundationNo ratings yet

- NHMC - Petition For Inquiry Into Hate SpeechDocument43 pagesNHMC - Petition For Inquiry Into Hate SpeechBerin Szóka100% (2)

![Cyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary Committee](https://imgv2-1-f.scribdassets.com/img/document/20439608/149x198/a69ef27cca/1254317217?v=1)