Professional Documents

Culture Documents

NCMEC - 2007 Form 990

NCMEC - 2007 Form 990

Uploaded by

Berin Szóka0 ratings0% found this document useful (0 votes)

158 views41 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

158 views41 pagesNCMEC - 2007 Form 990

NCMEC - 2007 Form 990

Uploaded by

Berin SzókaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 41

[efile GRAPHIC print DO NOT PROCESS [As Filed Data- J] DIN: 9349016304178]

990 Return of Organization Exempt From Income Tax jews Ne 1545-0047

tno nist ntl hatter coontcent orton | 007

roe ek serena

peer

I> the organization may have to use a copy of tis tur to satisfy state reporting requirements

‘For the 2007 calendar year, or tax yeor beginning 01-01-2007 and ending 17-35-2007

address cnmae expioeed chen 8a 521520557

eee Tn an ee FO TOT Ha se HT TT Taephane name

ta tar (703) 274-3900

Fat em Lae es aun toa CaF And

Froterispectyy

TF tenendo return

TF rplcaton pening

Section 501(€)() organizations and 4947(a)(1) nonexenpt charitable. | M 4d X18 not spat to sacton 527 errno

Seat Sach eometad shedate Aree 950 ce SOO | Hea) twa my eum frais? Toes FF Ho

a (Fe emer uber tates

Swenserm menmssnanscom fe) et atians maser? ves 0

J Organization type (check ondy one) FF %D sonic) (3) (insert no) [7 4947%a)(1) or FT 527. {IF "No," attach a tst See instructions )

1 ego Pte opment 54013) apnea omarion and sama ees ow | O) ies rams wu sb ane

Gross receipts Add nes 6b, 86,96, ond 10b tome 12 49,253,437 Ne eee tases ane

TEEEEE_ Revenue, expenses, and Changes in Net Assets or Fund Balances (See the instructions.)

& Dvect public support (not imcluded online 18). 6 70.420 579

€ Indirect puble support (not mcuded online ia)... «(oe 733.837

© Total (add lines 1a through 14) (cash $ 40,838,579 noncash $ 136,023. ) te 40,974,602

2 brogram service revenue including government fees ond contrects (Fom Part VT, ine 93) 2 23,554

3° Membership dues and assessments 2

ee 57,900

b Less sentalenpenses a a

Gross amount fom sales ofassets (a) Secwntes (@)oter

© Gain or(loss) (attach schedule). . (5) 239,031] 8c.

4 Net gainor (loss) Combine line 8c, columns (A) and (8) ooea| a 239031

Contrbution ported on me) @ ye 8 959.224

b Less diectexpenses atherthan findrisng expenses =» Da 313,204

109 Gross sales ofinventory,less returns and allowances... | 40m

fe ee is

12 _Totalrevenue Add ines 10.2, 3,4,5,6¢,7.84,9¢,10¢,andti | ss sss 2 aaaan avs

13” Program services (romine 4, colunm(®)) = + +> 7s Ts 3 35,457,150

3 |14 management and generat (om ine 44, column (C)) ry 325,909

§ [18 Fundraising (Hom line 44, column (09) 35 ras2.655

= |16 Payments to affiliates (attach schedule) . Beene ee ee 16

fi sree cspcees aa teat 00 Whi'aaf toh (aya warez

19° Netatsetsorfund balances at beginning ofyeur (Hem ne 73, columm(A)) 2 = 2 + (LAB 35,976,258

20 Other changes im net assets or fund balances (attach explanation). . - - - - - 20 2,077,997

Sains Scares aan ae

Form 9

EXQEDY statement of

90 (2007)

Page 2

‘Ailerganizations must complete column (A) Columns (B), (G) and (D)are required fr section

Functional Expenses £01(c)(3) and (4) organizations and section 4347(a)(1) nonexempt charitable trusts but optional

for others (See theinstructins.)

‘Do net include amounts reported on tine cayrotar |] @)Prevam [ey Management | 6) eundrasing

‘6b, 8b, 9b, 10b, or 16 of Part I serves ‘and generat

‘22a Grants paid from donor advised funds (attach Schedule)

(cash, noncash $, )

IF ths amount weladesforetan grants, check here > 228]

226 Other grants and allocations (attach schedule)

(eesh §, oncash $,

1 ths amount welodesforean gras, check here > J 226]

23 Specie asstance to ndwauals (attach schedule) 23

24 Benefits pad to or fr members (attach schedule) 2a

etc Listed in Part V-A (attach schedule) 25a] 1,673,551 1,389,209 218,027| 65,515

Compensation of farmer oticers, actors, kay employees

ste listed in Part V-B (attach schedule) 250] 50,815 50,815

€ Compensation and cther datnbutions not eluded above to

disqualified persons (as defined under section 4958(f)(1)) and

persons deseribed in section 4958(c)(3)(8) (attach schedule) | 25e| 1,566,974 144,074 222,900

on lines 252, band © aces 26|isse6116| _14.230.286 37,708 maze

Eid veep cerita

Ines 25a, b and c 7 27 909,697| 856,418 14.641 38,638

28 Employee benefits not cluded on hnes

29° Payroll taxes 29 1,338,216) 12487713 19,276 70,209

30 Professional fundraising fees 30

31 Accounting fees 34 115,968 103,285

33° Supplies 3 925,683 386,566 2.506 36,571

34 Telephone 34 205,980] Tas 3.65] 30,367

35 Postage and shipping 35 390,264] 369,350 4523] 16,441

37 Equipment rental and maintenance 37

38 Printing and publications 38 481674 468,540 13.034

41 Interest a

42 Depreciation depletion, ete (attach schedule) D a2 515,383| 486,256 | 2.035| 27,052

43 Other expenses not covered above (itemize)

‘a See Additional Data Table [asa

» [aap

. [ae

t ‘aat

° [a0

Total functional expenses. Aa ines 223 twough $39

{(Organtatons eompleung columns (8)(D), cay these totals

to ines 13-15) 44] srs7sna] 3547.50 s2s.s09] 1.892.655

Joint Costs. Check © [ifyou are following SOP S52

‘Are any yoint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services?» I Yes I” No

ses,

‘enter (i) the aggregate amount ofthese joint costs §

(ii) the amount allocated to Management and general $

) the amount allocated to Program services §.

iv) the amount seated to Fundraising $

cian ae

Form 990 (2007) Page 3

[EIIERH statement of Program Service Accomplishments (See the Instructions.)

Srgunzation wow ne pute ercanves an ovanaton m such ensee may be devermned by the formation presented one return

Reomplshments

‘What is the organization's primary exempt purpose? P National Resource And technical center for eens

jloited children aa

toynenon mt debe te exengt piper shevenets ETN SASS nS OTERO a, __| am SL ad

ra el Bens Uke gt sane (oun Hyon enn SC ena |e ae

@ See Additional Data Table

(Grants and allocations THis emount includes foreign grants, check here

»

(Grants and allocations ihe amount includes foreign arants, check here>

ane ad alecenon TWh smount meludes foreign grants, check here»

e

(Grants ond allocations & If this emount melades foreign grants, check hare

© Other program services (attach schedule)

(Grams and allocations $ )_Trthis amount includes foreign grants, check here PL

Total of Program Service Expenses [should equal ine 44, column (6), Program services) > 35457150

Form 990 (2007)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Space Solar Power (SSP) - A Solution For Energy Independence & Climate ChangeDocument1 pageSpace Solar Power (SSP) - A Solution For Energy Independence & Climate ChangeBerin Szóka100% (23)

- CDT-PFF-EFF Joint Comments in Matter No. P104503Document12 pagesCDT-PFF-EFF Joint Comments in Matter No. P104503Berin SzókaNo ratings yet

- PFF COPPA Review Reply CommentsDocument9 pagesPFF COPPA Review Reply CommentsBerin SzókaNo ratings yet

- Benefits of Online Advertising PaperDocument24 pagesBenefits of Online Advertising PaperBerin SzókaNo ratings yet

- Before The Federal Communications Commission Washington, D.C. 20554Document7 pagesBefore The Federal Communications Commission Washington, D.C. 20554Berin SzókaNo ratings yet

- Appeals Opinion in Comcast v. FCCDocument21 pagesAppeals Opinion in Comcast v. FCCDealBookNo ratings yet

- Privacy Polls v. Real-World Trade-OffsDocument8 pagesPrivacy Polls v. Real-World Trade-OffsBerin SzókaNo ratings yet

- Cyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary CommitteeDocument28 pagesCyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary CommitteeBerin SzókaNo ratings yet

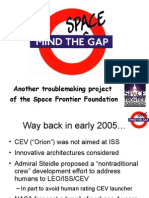

- Mind The Space Gap - Space Access PresentationDocument11 pagesMind The Space Gap - Space Access PresentationBerin SzókaNo ratings yet

- NHMC - Petition For Inquiry Into Hate SpeechDocument43 pagesNHMC - Petition For Inquiry Into Hate SpeechBerin Szóka100% (2)

- Online Advertising & User Privacy: Principles To Guide The Debate - 09.24.08 - by Berin Szoka & Adam ThiererDocument6 pagesOnline Advertising & User Privacy: Principles To Guide The Debate - 09.24.08 - by Berin Szoka & Adam ThiererBerin SzókaNo ratings yet

- Space Frontier Foundation's Views On The NSSO-Sponsored SBSP Study ReportDocument5 pagesSpace Frontier Foundation's Views On The NSSO-Sponsored SBSP Study ReportSpace Frontier FoundationNo ratings yet

![Cyberbullying Legislation: Why Education is Preferable to Regulation" [PFF - Szoka and Thierer] written testimony before the Subcommittee on Crime, Terrorism & Homeland Security, U.S. House Judiciary Committee](https://imgv2-2-f.scribdassets.com/img/document/20439608/149x198/a69ef27cca/1254317217?v=1)