Professional Documents

Culture Documents

Tax Rates For CWT (Expanded) PDF

Uploaded by

RoseAnnFloriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rates For CWT (Expanded) PDF

Uploaded by

RoseAnnFloriaCopyright:

Available Formats

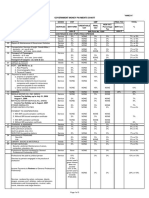

WI 010 WI 020

ATC WC 010

WI 021 WI 030

WI 031 WI 040

WI 041 WI 050 WI 060 WI 070 WI 080

WI 081 WI 090 WI 100 WC 100

WI 110 W1 120 WI 130 WI 140

WC 110 WC 120

WC 140

WI 141

Nature Of Income Payments Professional/Talent Fees paid to juridical persons/individuals (CPAs, lawyers, etc) Professional entertainers: If the current years gross income does not exceed P720,000.00 If the current years gross income exceeds P 720,000.00 Professional athletes: If the current years gross income does not exceed P720,000.00 If the current years gross income exceeds P 720,000.00 Movie, stage, radio, television and musical directors If the current years gross income does not exceed P720,000.00 If the current years gross income exceeds P 720,000.00 Management and technical consultants Business and Bookkeeping Agents and Agencies Insurance Agents and Insurance Adjusters Other recipient of talent fees If the current years gross income does not exceed P720,000.00 If the current years gross income exceeds P 720,000.00 Fees of Directors Who are not Employee of the Company Rentals : Real/personal properties, poles, Satellites and Transmission facilities, billboards used in business which the payor or obligor used in business has not taken or is not taking title or in which has no equity Cinematographic film rentals Prime Contractors/sub-contractors Income distribution to beneficiaries of estates and trusts Gross commission or service fees of custom, Insurance, stock, real estate, immigration and Commercial brokers and fees of agents of professional entertainer Payments to Medical Practitioners Through a Duly Registered Professional Partnership

Tax Rate 10% 10%

20% 10%

20% 10%

20% 10% 10 % 10 % 10%

20% 20 % 5%

5% 2% 15% 10 %

10 %

WI 151

WI 152 WI 156 WI 157 WC 156 WC 157

WI 158 WI 160 WI 159

WC 158 WC 160

WI 515

WC 515

WI 530 WI 535 WI 540 WI 610 WI 630 WC 535 WC 540 WC 610 WC 630

Payments for medical/dental/veterinary services Thru hospitals/clinics/health maintenance Organizations, including direct payments to Service providers Payments to partners of general professional Partnerships Payments made by Credit Cards Companies to Juridical Persons Payments made by Government Offices on their Local Purchase of Goods and services from Local/resident supplier Income Payments made by Top 10,000 private Corporations to Their Local/resident Suppliers of: Goods Services Additional Payments to Government Personnel From Importers, Shipping and Airline Companies or Their Agents for overtime importers services Commission, rebates, discounts & other similar Considerations paid/granted to independent and Exclusive distributors, medical/technical & sales Representatives & marketing agents & sub-agents Of multi-level marketing companies Gross payments to embalmers by funeral Companies Payments made by pre-need companies to Funeral parlors Tolling fee paid to refineries Income payments made to suppliers of agricultural products Income payments on purchases of minerals, Mineral products and quarry resources

10%

10% 1% of 2%

1% 2% 15 %

10%

1% 1% 5% 1% 1%

You might also like

- J.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineNo ratings yet

- WT Tax RatesDocument2 pagesWT Tax RatesericbacsalNo ratings yet

- BIR Form 2307 Tax CodesDocument16 pagesBIR Form 2307 Tax CodesAnalyn Velasco Matibag100% (1)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleRating: 3 out of 5 stars3/5 (1)

- Expanded Withholding Tax Rates and CodesDocument7 pagesExpanded Withholding Tax Rates and CodesJaemar FajardoNo ratings yet

- EWT RatesDocument6 pagesEWT RatesBobby Olavides SebastianNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ewt 20082Document384 pagesEwt 20082JonelChavezNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- BIR Form 2307Document20 pagesBIR Form 2307Lean Isidro0% (1)

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2307Document5 pages2307jblopez66No ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- 2307Document3 pages2307Anonymous yCFuth7BL80% (1)

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Document5 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239No ratings yet

- FinalDocument2 pagesFinalJessica FordNo ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- Withholding Tax RatesDocument35 pagesWithholding Tax RatesZonia Mae CuidnoNo ratings yet

- EWTDocument12 pagesEWTdawngarcia1797No ratings yet

- 2307 PDFDocument2 pages2307 PDFAnonymous BVowhxQPNo ratings yet

- 2307Document16 pages2307Mika AkimNo ratings yet

- BIR From 1601E - August 2008Document4 pagesBIR From 1601E - August 2008mba_roxascapiz50% (4)

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchNo ratings yet

- 1601E - August 2008Document4 pages1601E - August 2008HarryNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasgioNo ratings yet

- Detailed Chart of AccountsDocument7 pagesDetailed Chart of AccountsarthurmathieuNo ratings yet

- WITHHOLDING TAX OBLIGATIONSDocument152 pagesWITHHOLDING TAX OBLIGATIONSemytherese100% (2)

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Government Money Payments Chart - BirDocument3 pagesGovernment Money Payments Chart - BirVan Caz89% (9)

- Schedules of Alphanumeric Tax CodesDocument5 pagesSchedules of Alphanumeric Tax CodesKatherine YuNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Expanded Withholding TaxDocument6 pagesExpanded Withholding TaxFernando II SuguiNo ratings yet

- Dentist Chart of AccountDocument4 pagesDentist Chart of AccountrajawhbNo ratings yet

- Expanded Withholding TaxDocument3 pagesExpanded Withholding TaxCordero TJNo ratings yet

- Revenue Memorandum Order No. 3-2004Document4 pagesRevenue Memorandum Order No. 3-2004HarryNo ratings yet

- UAT - Tax CasesDocument14 pagesUAT - Tax Casesjef comendadorNo ratings yet

- 1600 Tax RatesDocument2 pages1600 Tax RatesmelizzeNo ratings yet

- ATC Codes 2018Document10 pagesATC Codes 2018AJ QuimNo ratings yet

- EPayments Import TemplateDocument10 pagesEPayments Import TemplateGhulam MustafaNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- ChartOfAccounts EWMCHDocument8 pagesChartOfAccounts EWMCHEast West Medical College & HospitalNo ratings yet

- A.J. Gen. MerchandisingDocument5 pagesA.J. Gen. MerchandisingErish Jay ManalangNo ratings yet

- Sample 2307 2017Document4 pagesSample 2307 2017jordzNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- How Do You See It?: East Africa Quick Tax Guide 2012Document11 pagesHow Do You See It?: East Africa Quick Tax Guide 2012Zimbo KigoNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Tax1 DeductionsDocument45 pagesTax1 DeductionsjoNo ratings yet

- New Payment Sections TemplateDocument1 pageNew Payment Sections Templateiaeste20078797No ratings yet

- Withholding Tax Bureau of Internal RevenueDocument10 pagesWithholding Tax Bureau of Internal RevenueFunnyPearl Adal GajuneraNo ratings yet

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Document32 pagesWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNo ratings yet

- How To Complete The IT14 Return: South African Revenue ServiceDocument8 pagesHow To Complete The IT14 Return: South African Revenue ServiceThuto TshepoNo ratings yet

- Creditable Tax ReportDocument131 pagesCreditable Tax ReportJieve Licca G. FanoNo ratings yet

- Philippines: Choose A TopicDocument3 pagesPhilippines: Choose A Topicjames luzonNo ratings yet

- Manage your health with a comprehensive wellness packageDocument5 pagesManage your health with a comprehensive wellness packageRoseAnnFloriaNo ratings yet

- Calculus PDFDocument374 pagesCalculus PDFJonnyy12No ratings yet

- Case 1 - The Charter CompanyDocument4 pagesCase 1 - The Charter CompanyRoseAnnFloriaNo ratings yet

- TaxationDocument43 pagesTaxationRoseAnnFloriaNo ratings yet

- Manila Water Company: Arbitration Brings Uncertainty - : Wednesday, 25 September 2013Document3 pagesManila Water Company: Arbitration Brings Uncertainty - : Wednesday, 25 September 2013RoseAnnFloriaNo ratings yet

- Forecasting: by Arthur S. CayananDocument11 pagesForecasting: by Arthur S. CayananRoseAnnFloriaNo ratings yet

- Banks Financial RatiosDocument9 pagesBanks Financial RatiosPisot_paNo ratings yet

- 01 - FS Analysis 2013Document19 pages01 - FS Analysis 2013RoseAnnFloriaNo ratings yet

- PA 2110-1 Gov Def 4-27-10 Edits Hunt AmDocument1 pagePA 2110-1 Gov Def 4-27-10 Edits Hunt AmRoseAnnFloriaNo ratings yet

- PA 2110-2 Gov Relationships 4-27-10 Edits Accepted AmDocument1 pagePA 2110-2 Gov Relationships 4-27-10 Edits Accepted AmRoseAnnFloriaNo ratings yet

- 02 - Specialized Industries 2013Document44 pages02 - Specialized Industries 2013RoseAnnFloriaNo ratings yet

- PA - 2010-2 - Using Risk Management in Internal Audit PlanningDocument4 pagesPA - 2010-2 - Using Risk Management in Internal Audit PlanningRoseAnnFloriaNo ratings yet

- Primary Related Standard: Practice Advisory 2060-1: Reporting To Senior Management and The BoardDocument2 pagesPrimary Related Standard: Practice Advisory 2060-1: Reporting To Senior Management and The BoardRoseAnnFloriaNo ratings yet

- PA 2050-2 Assurance Maps FINAL 07.2009Document3 pagesPA 2050-2 Assurance Maps FINAL 07.2009RoseAnnFloriaNo ratings yet