Professional Documents

Culture Documents

Income and Changes in Retained Earnings: Suggested Answers To Discussion Questions

Income and Changes in Retained Earnings: Suggested Answers To Discussion Questions

Uploaded by

FreeBooksandMaterialOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income and Changes in Retained Earnings: Suggested Answers To Discussion Questions

Income and Changes in Retained Earnings: Suggested Answers To Discussion Questions

Uploaded by

FreeBooksandMaterialCopyright:

Available Formats

CHAPTER 12 INCOME AND CHANGES IN RETAINED EARNINGS

SUGGESTED ANSWERS TO DISCUSSION QUESTIONS

1. The purpose of presenting subtotals such as Income from Continuing Operations and Income before Extraordinary Items is to assist users of the income statement in making forecasts of future earnings. By excluding the operating results of discontinued operations and the effects of unusual and nonrecurring transactions, these subtotals indicate the amount of income derived from the companys ongoing, normal operations. 2. The discontinued operations classification is used in the income statement only when a business discontinues an entire segment of its activities. Franks has two business segmentspizza parlors and the baseball team. Only if one of these segments is discontinued in its entirety will the company report discontinued operations. The sale or closure of a few parlors does not represent the disposal of the pizza parlor segment of the companys business activities. 3. Extraordinary items are gains and losses that are unusual in nature and not expected to recur in the foreseeable future. Examples of extraordinary items are (a) losses from unusual casualties, such as earthquakes, tornadoes, or acts of war, (b) losses as a result of the expropriation of assets by a foreign government, and (c) losses as a result of a prohibition under a newly enacted law. Gains and losses that do not qualify as extraordinary items include (a) losses or gains on the sale of plant assets or marketable securities, (b) losses incurred as a result of strikes or lawsuits, and (c) losses or gains relating to a segment of the business discontinued during the year. 4. The restructuring charges should be combined and presented as a line item in the companys income statement in determining operating income. In predicting future earnings for the company, the charges generally should not be considered to be costs that will be incurred in the future. In fact, if the program of downsizing is successful, operating results in the future could be expected to improve as a result of having incurred the restructuring charges. 5. In determining the cumulative effect of a change in accounting principle, the income of prior periods is recomputed under the assumption that the new accounting principle has always been in use. The difference between this recomputed past income and the income actually reported represents the cumulative effect of the change on the income of prior periods and is reported as a separate item in the income statement. A prior period adjustment represents a correction of an error in the amount of income reported in a prior period. Prior period adjustments are shown in the statement of retained earnings (or statement of stockholders equity) as an adjustment to the balance of retained earnings at the beginning of the period in which the error is identified. 6. The cumulative effect of an accounting change is the difference between the income reported in past years and the income that would have been reported had the new accounting method always been in use. Stegall Products had been using an accelerated depreciation method, and, therefore, reported more depreciation expense and lower net income than would have resulted from use of the straight-line method. The company will report this retroactive increase in the income of prior years as the cumulative effect of the accounting change. Thus, the change will increase the net income reported in the current year. 7. a. The current-year preferred dividend is deducted from net income to determine the earnings

The McGraw-Hill Companies, Inc., 2003

allocable to the common stockholders. (If the preferred stock is noncumulative, the preferred dividend is deducted only if declared; the preferred dividend on cumulative preferred stock is always deducted.) b. The call price of all preferred stock outstanding and the amount of all dividends in arrears on preferred stock are deducted from total stockholders equity to determine the aggregate book value allocable to the common stockholders. 8. No, the number of common shares used in computing earnings per share is not always the same as that used to determine book value per share. In computing earnings per share, earnings allocable to the common stockholders is divided by the weighted-average number of common shares outstanding throughout the period. In computing book value per share at a specified date, stockholders equity allocable to the common stockholders is divided by the number of common shares actually outstanding on that date. If the number of common shares outstanding has not changed during the period, the weighted-average number of common shares outstanding during the period will be equal to the number of common shares outstanding on a particular date. 9. a. The price-earnings ratio is computed by dividing the market price of a share of common stock by the annual earnings per share. b. The amount of basic earnings per share is computed by dividing the net income available for common stock by the weighted-average number of common shares outstanding during the year. c. The amount of diluted earnings per share is computed by dividing net income by the maximum potential number of shares outstanding after convertible securities are assumed to have been converted. 10. a. Shares used in computing basic earnings per share: Common shares outstanding throughout the year............................................................. 2,000,000

b. Shares used in computing diluted earnings per share: Common shares outstanding throughout the year............................................................. 2,000,000 Additional common shares that would exist if preferred stock had 450,000 been converted at the beginning of the year (150,000 3) ............................................ Total shares used in diluted earnings computation ........................................................... 2,450,000 11. The analyst should recognize the risk that the outstanding convertible securities may be converted into additional shares of common stock, thereby diluting (reducing) basic earnings per share in future years. If any of the convertible securities are converted, basic earnings per share probably will increase at a slower rate than net income. In fact, if enough dilution occurs, basic earnings per share could actually decline while net income continues to increase. 12. Date of declaration is the day the obligation to pay a dividend comes into existence by action of the board of directors. Date of record is the day on which the particular stockholders who are entitled to receive a dividend is determined. Persons listed in the corporate records as owning stock on this day will receive the dividend. Date of payment is the day the dividend is distributed by the corporation. Exdividend date (usually three business days prior to the date of record) is the day on which the right to receive a recently declared dividend no longer attaches to shares of stock. As a result, the market price of the shares usually falls by the amount of the dividend. 13. The purpose of a stock dividend is to make a distribution of value to stockholders as a representation of the profitability of the company while, at the same time, conserving cash. 14. A stock split occurs when there is a relatively large increase in the number of shares issued without any change in the total amount of stated capital (because the par value per share is reduced proportionately to the increase in the number of shares). A stock dividend occurs when there is a relatively small increase in the number of shares issued, with

The McGraw-Hill Companies, Inc., 2003

no change in the net assets of the company but a transfer from retained earnings to the paid-in capital section of the balance sheet. The par value of stock remains the same. The distinction in the accounting treatment of a stock dividend and a stock split stems directly from the difference in the effect on stated (legal) capital and retained earnings. There is no difference in the probable effect on per-share market price of a stock dividend and a stock split of equal size, although stock splits are usually much larger than stock dividends. 15. Prior period adjustments are entries made in the accounting records to correct material errors in the net income reported in prior years. In the year in which a prior period adjustment is recorded, it should appear in the statement of retained earnings (or statement of stockholders equity) as an adjustment to the balance of retained earnings at the beginning of the year. 16. Three items that may be shown in a statement of retained earnings as causing changes in the balance of retained earnings are: (1) Net income or net loss for the period (2) Dividends declared (both cash dividends and stock dividends) (3) Prior period adjustments 17. If the price of the stock declines in proportion to the distribution of shares in a stock dividend, at the time of that distribution the stockholder does not benefit. He/she holds exactly the same percentage of the outstanding shares, and the value per share has declined in proportion to the increased number of shares. Often, however, the value does not drop in proportion to the increased number of shares, meaning that the recipient of the shares has an immediate benefit. For example, if an investor who held 2,000 shares of stock that had a market value of $10 each received a 10% stock dividend, and the market price only declined 5%, the following would result: Market value before stock dividend: 2,000 shares @ $10 ............................................................................................................. Market value after stock dividend: (2,000 shares 110%) ($10 95%) ................................................................................ $20,000 $20,900

The investor has benefited by $900. He/she could sell about 95 shares [$900/($10 95%)] at $9.50 and still have a stock investment equal to the value before the stock dividend, although the investor would own a smaller percentage of the company after the sale. 18. A liquidating dividend is a return of the investment made in the company to the investor, in contrast to a non-liquidating dividend which is a return on the investment in the company. A liquidating dividend occurs when dividends are distributed in excess of a companys retained earnings. 19. The student is right in one senseboth stock splits and stock dividends are distributions of a companys shares to existing stockholders with the company receiving no payment in return. The student is incorrect, however, in stating that the two are exactly the same. The primary difference is one of magnitude. A stock dividend is usually relatively small5% to 20% of the outstanding shares. A stock split, on the other hand, is usually some multiple of the number of outstanding shares, like a 2:1 split (100% increase) or a 3:1 split (200% increase). The market price reacts strongly to a distribution as large as a stock split while stock dividends are often unnoticed in the stock price. 20. The statement of retained earnings shows for the Retained Earnings account the beginning balance, changes in the account balance during the period, and the ending balance. A statement of stockholders equity provides the same information, but includes every category of stockholders equity account (including retained earnings). Therefore, a statement of stockholders equity may appropriately be described as an expanded statement of retained earnings.

The McGraw-Hill Companies, Inc., 2003

Ex. 122

a. Extraordinary item b. None (Treasury stock is not an asset; it represents shares that have been reacquired by the company, not shares that have not yet been issued.) c. Stock dividend d. Stock subscription e. Prior period adjustment f. P/e ratio (Market price divided by earnings per share.) g. Discontinued operations (Showing the discontinued operations in a separate section of the income statement permits presentation of the subtotal, Income from Continuing Operations.) h. Diluted earnings per share i. Comprehensive income

Ex. 125

a. 1. Net income (all applicable to common stock) ............................................... $1,850,000 Shares of common stock outstanding throughout the year............................ 400,000 $4.63 Earnings per share ($1,850,000 400,000 shares) ....................................... 2. Net income .................................................................................................... $1,850,000 800,000 Less: Preferred stock dividend (100,000 8% $100)................................ Earnings available for common stock ........................................................... $1,050,000 Shares of common stock outstanding throughout the year............................ 300,000 $3.50 Earnings per share ($1,050,000 300,000 shares) ....................................... b. The earnings per share figure computed in part a (2) is a basic EPS figure. Although the company has outstanding both common and preferred stock, the preferred stock must be convertible into common stock in order to result in a diluted computation of earnings per share. The potential conversion of preferred stock into common stock is what necessitates disclosure of diluted EPS. Because the preferred stock in this exercise is not convertible, the EPS computation is basic.

Ex. 127

a. Apr. 30 Memorandum: Issued an additional 1,000,000 shares of capital stock in a 2-for-1 stock split. Par value reduced from $1 per share to $0.50 per share. June 1 Dividends.......................................................................... Dividends Payable ................................................ To record the declaration of a dividend of 60 cents per share on 2 million shares of stock outstanding. 1 Dividends Payable............................................................ Cash ...................................................................... To record payment of the dividend declared on June 1. 1 Retained Earnings............................................................. Stock Dividend to Be Distributed......................... Additional Paid-in Capital: Stock Dividends ....... To record declaration of a 5% stock dividend consisting of 100,000 shares (2,000,000 shares x 5%) of $0.50 par value common stock. Amount of retained earnings transferred to paid-in capital is based on market price of $19 a share. 1,200,000 1,200,000

July

1,200,000 1,200,000 1,900,000 50,000 1,850,000

Aug.

Sept. 10 Stock Dividend to Be Distributed.....................................

The McGraw-Hill Companies, Inc., 2003

50,000

4

Common Stock ..................................................... To record distribution of a stock dividend of 100,000 shares. Dec. 15 Retained Earnings............................................................. Stock Dividend to Be Distributed......................... To record declaration of a 50% stock dividend consisting of 1,050,000 shares of $0.50 par value common stock. 525,000

50,000

525,000

b. 2,100,000 shares 1,000,000 + 1,000,000 + 100,000 (Note: The Dec. 15 stock dividend has not been distributed at the end of year.) c. $0.50 par value per share ($1 par reduced to $0.50 par due to 2-for-1 stock split on April 30.) d. Stock splitNo effect Declaration/payment of cash dividendDecrease retained earnings Declaration/distribution of small stock dividendNo effect Declaration/distribution of large stock dividendNo effect

Ex. 128

The market value of the total DXY, Inc.s shares outstanding is $5,280,000 (80,000 $66) before the stock dividend. Because the issuance of new shares has no effect on the net assets of the company, there is no basis of predicting any change in total market value of the companys stock as a result of the stock dividend. The logical conclusion is, therefore, that the market price per share should fall to $60 ($5,280,000 88,000 shares). The fact that this exact result does not always follow in practice must be attributed to a lack of understanding on the part of the investing public and to other factors affecting per-share market price at the time of a stock dividend. Net Cash Flow (from Any Source) D NE NE D I

Ex. 129 Event a b c d e

Current Assets D NE NE D I

Stockholders Equity D NE NE D I

Net Income NE NE NE NE NE

The McGraw-Hill Companies, Inc., 2003

Ex. 1210 a. After a stock split, earnings per share are expressed in terms of the new shares. Therefore, a 4-for-1 stock split will cause earnings per share figures to be restated at one-fourth of their former amounts. d. Dividends declared or paid do not enter into the determination of net income. Therefore, the declaration and/or payment of a cash dividend on common stock has no effect upon earnings per share. e. Earnings per share are restated to reflect the increased number of shares resulting from a stock dividend. Therefore, a stock dividend causes a proportionate reduction in the earnings per share reported in past periods, as well as in the current period. (This effect parallels that of a stock split, only smaller.) f. Acquisition of treasury shares reduces the weighted average number of shares currently outstanding and, therefore, increases earnings per share.

Ex. 1213 a. There are no nonrecurring items, such as extraordinary items, discontinued operations, and effects of accounting changes, included in the determination of net earnings that would affect an evaluation of Tootsie Rolls financial statements. Tootsie Roll actually has two income statementsone that reports net earnings and the other comprehensive income. For an analysis that is intended to predict future performance of the company, net earnings is probably the amount that should be used. b. (1) The primary differences between the two classes of stock are as follows: The Class B common has ten votes per share compared to only one vote per share for the common stock. The Class B common is not traded on any stock exchange as is the common stock and is restricted as to transfer. The Class B common is convertible into shares of common stock. (2) The company issued a 3% stock dividend in 1998 as well as a 2:1 stock split. It issued additional 3% stock dividends in both 1999 and 2000. The impact of these distributions is to significantly increase the number of outstanding shares. For example, if you held 100 shares at the beginning of 1998, you would have 218 shares at the end of 2000, determined as follows: 1998: 100 x 103% = 103 103 x 2 = 206 1999: 206 x 103% = 212 2000: 212 x 103% = 218 c. (1) The amounts of paid-in capital for 2000 and 1999 are as follows: (IN THOUSANDS) Common stock Class B common stock Capital in excess of par value 2000 $22,907 11,150 256,698 $290,755 1999 $22,815 10,908 249,236 $282,959

The McGraw-Hill Companies, Inc., 2003

(2) The par value of $22,815 thousand is a relatively small part of total stockholders equity. In fact, it is only a little over 5% of total stockholders equity. Total paid-in capital, on the other hand, makes up a much larger percentage of stockholders equity ($282,959/$430,646 = 66%). In other words, the par value of common stock is only a small part of total stockholders equity. In addition to the Class B common and the capital in excess of par value, the company has a significant amount of retained earnings which also contributes to the total amount of stockholders equity.

The McGraw-Hill Companies, Inc., 2003

40 Minutes, Strong

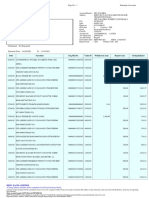

PROBLEM 126 QUICK DELIVERY SERVICE

General Journal

a.

2002 Jan 3 Dividends Dividends Payable To record declaration of $1 per share cash dividend payable on Feb. 15 to stockholders of record on Jan. 31. Feb 15 Dividends Payable Cash To record payment of dividend declared Jan. 3. 12 Treasury Stock Cash Purchased 6,000 shares of treasury stock at $40 per share. 9 Cash Treasury Stock Additional Paid-in Capital: Treasury Stock Transactions Sold 4,000 shares of treasury stock, which cost $160,000, at a price of $44 per share. June 1 Retained Earnings Stock Dividend to Be Distributed Additional Paid-in Capital: Stock Dividends Declared a 5% stock dividend (19,000 shares) on 380,000 outstanding shares. Market price $42, par value $1. To be distributed on June 30 to stockholders of record at June 15. 30 Stock Dividend to Be Distributed Capital Stock Issued 19,000 shares of capital stock as 5% stock dividend declared June 1. Aug 4 Cash Additional Paid-in Capital: Treasury Stock Transactions Treasury Stock Sold 600 shares of treasury stock, which cost $24,000, at a price of $37 per share. 31 Income Summary Retained Earnings To close Income Summary account for the year. 31 Retained Earnings Dividends To close Dividends account.

3 8 2 0 0 0 3 8 2 0 0 0

3 8 2 0 0 0 3 8 2 0 0 0

Apr

2 4 0 0 0 0 2 4 0 0 0 0

May

1 7 6 0 0 0 1 6 0 0 0 0 1 6 0 0 0

7 9 8 0 0 0 1 9 0 0 0 7 7 9 0 0 0

1 9 0 0 0 1 9 0 0 0

2 2 2 0 0 1 8 0 0 2 4 0 0 0

Dec

1 9 2 8 0 0 0 1 9 2 8 0 0 0

Dec

3 8 2 0 0 0 3 8 2 0 0 0

The McGraw-Hill Companies, Inc., 2003

PROBLEM 126 QUICK DELIVERY SERVICE (concluded)

b. QUICK DELIVERY SERVICE Partial Balance Sheet December 31, 2002

Stockholders equity: Capital stock, $1 par value, 500,000 shares authorized, 401,000 shares issued, of which 1,400 are held in the treasury Additional paid-in capital: From issuance of capital stock From stock dividends From treasury stock transactions Total paid-in capital Retained earnings* Less: Treasury stock, 1,400 shares at cost Total stockholders equity

$ $4 2 0 2 0 0 0 7 7 9 0 0 0 1 4 2 0 0

4 0 1 0 0 0

4 $5 3 $8

9 9 5 4 5 $8 7 9

9 3 4 8

5 6 2 8 6 2

2 2 6 8 0 8

0 0 0 0 0 0

0 0 0 0 0 0

*Computation of retained earnings at Dec. 31, 2002: Retained earnings at beginning of year Add: Net income for year Subtotal Less: Cash dividend declared Jan. 3 Stock dividend declared June 1 Retained earnings, Dec. 31, 2002

$2 7 0 4 6 0 0 19 2 8 0 0 0 $4 6 3 2 6 0 0 $ 3 8 2 0 0 0 7 9 8 0 0 0 11 8 0 0 0 0 $3 4 5 2 6 0 0

c.

Computation of maximum legal cash dividend per share at Dec. 31, 2002: Retained earnings at Dec. 31, 2002 Less: Restriction of retained earnings for treasury stock owned Unrestricted retained earnings Number of shares of capital stock outstanding (401,000 shares issued, minus 1,400 shares held in treasury) Maximum legal cash dividend per share ($3,396,600 divided by 399,600 shares)

$3 4 5 2 6 0 0 5 6 0 0 0 $3 3 9 6 6 0 0 3 9 9 6 0 0 $ 8 50

The McGraw-Hill Companies, Inc., 2003

30 Minutes, Strong

PROBLEM 127 TECH PROCESS, INC.

Current Assets NE D D I NE Stockholders Equity D NE D I NE Net Income NE NE NE NE NE Net Cash (from Any Source) NE D D I NE

a. Event 1 2 3 4 5 I = Increase D = Decrease NE = No effect

b. 1. Declaration of a cash dividend has no immediate effect upon net income or cash flows. It increases current liabilities (dividends payable), but has no effect on current assets. Also, retained earnings is decreased, resulting in a decrease in stockholders equity. 2. Payment of a cash dividend has no effect on revenue or expenses, but it reduces cash. Since it reduces cash, it also reduces current assets. The transaction has no effect on stockholders equity, which has already been decreased when the dividend was declared. 3. The purchase of treasury stock has no effect on either revenue or expenses and, therefore, does not affect net income. But cash is used to purchase the treasury stock, and this decreases cash and current assets. Because treasury stock is deducted from stockholders equity in the balance sheet, its purchase decreases stockholders equity. 4. Reissuance of treasury stock at a price less than its original cost results in a loss, but these losses are not recorded in the income statement. Instead additional paid-in capital is decreased for the amount of the loss. Therefore, this transaction does not affect net income. Since the treasury stock account is deducted from stockholders equity, reissuance of the stock increases the total amount of stockholders equity. Also, both cash and current assets are increased as a result of the cash received from sale of the stock. 5. Declaration of a stock dividend results in a reclassification of amounts from Retained Earnings to the Capital Stock and Additional Paid-in Capital accounts. It has no effect on cash, current assets, stockholders equity, or net income.

The McGraw-Hill Companies, Inc., 2003

10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Contoh Membuat Payslip & Slip GajiDocument3 pagesContoh Membuat Payslip & Slip GajiMD Razlan72% (53)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial Markets and Institutions NotesDocument59 pagesFinancial Markets and Institutions NotesParbon Acharjee100% (3)

- STI College Senior High School Tanay, Rizal: The Problem and It's BackgroundDocument6 pagesSTI College Senior High School Tanay, Rizal: The Problem and It's BackgroundJaedster MedinaNo ratings yet

- LSE AC341 Section 1 CG Week 2 - After SessionDocument127 pagesLSE AC341 Section 1 CG Week 2 - After Sessionparminder0011No ratings yet

- Safal Niveshak StockScan - Accelya KaleDocument1 pageSafal Niveshak StockScan - Accelya KaleVishal Safal Niveshak KhandelwalNo ratings yet

- MSQ-05 - Relevant Costing MSQ-05 - Relevant CostingDocument13 pagesMSQ-05 - Relevant Costing MSQ-05 - Relevant CostingJenny LelisNo ratings yet

- Department of Education: Second Quarter Examination Business MathematicsDocument3 pagesDepartment of Education: Second Quarter Examination Business MathematicsGlaiza FloresNo ratings yet

- CFA Level 1 SyllabusDocument3 pagesCFA Level 1 Syllabusjohn ramboNo ratings yet

- CLNEA2022007Document41 pagesCLNEA2022007Ivan LessiaNo ratings yet

- Commercial BanksDocument11 pagesCommercial BankssebabiitmNo ratings yet

- Vinall 2014 - ValuationDocument19 pagesVinall 2014 - ValuationOmar MalikNo ratings yet

- 04P Other Components of Shareholders EquityDocument7 pages04P Other Components of Shareholders EquityjulsNo ratings yet

- 7th CPC Pay Matrix Table For Central Government EmployeesDocument8 pages7th CPC Pay Matrix Table For Central Government EmployeesChellappa Gangadhar KNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument23 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceavnish sharmaNo ratings yet

- HowToCreateWealthInvestingInRealEstate EbookDocument55 pagesHowToCreateWealthInvestingInRealEstate EbookAtul BendaleNo ratings yet

- 2016 Icaz Cta Unisa Taxation Tutorial 102 PDFDocument70 pages2016 Icaz Cta Unisa Taxation Tutorial 102 PDFArtwell ZuluNo ratings yet

- The Global Capital Market: International BusinessDocument15 pagesThe Global Capital Market: International Businesssonia_hun885443No ratings yet

- Capital Gains Taxation Problems Part 1 PDFDocument4 pagesCapital Gains Taxation Problems Part 1 PDFMitchie Faustino0% (1)

- AssignmentDocument3 pagesAssignmenthrikilNo ratings yet

- 123Document9 pages123Julian DubaNo ratings yet

- Argentina and Mexico Crises Cause Similar Problems For Treasury InternationalTreasurer1994Aug8Document2 pagesArgentina and Mexico Crises Cause Similar Problems For Treasury InternationalTreasurer1994Aug8itreasurerNo ratings yet

- ACCTG 22 DepartmentalDocument12 pagesACCTG 22 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- 44946687_26042024164646_DL1.pdfDocument2 pages44946687_26042024164646_DL1.pdfssuryakanta905No ratings yet

- KVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9Document9 pagesKVS Lucknow XII ACC QP & MS (2nd PB) (23-24) - 1-9im subbing to everyone subbing to meNo ratings yet

- FM AssignmentDocument16 pagesFM AssignmentSarvagya GuptaNo ratings yet

- Slides 10Document29 pagesSlides 10Shirley LiuNo ratings yet

- Ecs E-5Document1 pageEcs E-5binchacNo ratings yet

- Company Presentation MaterialsDocument30 pagesCompany Presentation MaterialsZhangZaoNo ratings yet

- Mary Lawrence DisclosureDocument32 pagesMary Lawrence DisclosuredhmontgomeryNo ratings yet

- Proof of IncomeDocument3 pagesProof of IncomeKenan DuranNo ratings yet