Professional Documents

Culture Documents

Basics of Customs Duty calculations in India

Uploaded by

dskrishnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics of Customs Duty calculations in India

Uploaded by

dskrishnaCopyright:

Available Formats

Customs Duty, basics, types and calculations

Calculation of customs duty payable is as follows, w.e.f. 173-2012 Seq. (A) (B) (C) (D) (E) (F) (G) (H) (I) (J) (M) Duty Description Assessable Value Rs Basic Customs Duty Sub-Total for calculating CVD (A+B) CVD C x excise duty rate Sub-total for edu cess on customs B+D Edu Cess of Customs 2% of E SAH Education Cess of Customs 1% of E Sub-total for Spl CVD C+D+F+G Special CVD u/s 3(5) 4% of H Total Duty Total duty rounded to Rs. 4 2 1 12 10 Duty % Amount 1,000 100.00 1,100.00 132.00 232.00 4.64 2.32 1,238.96 49.56 49.56 288.52 289 4.64 2.32 132.00 100.00 Total Duty

Notes Buyer who is manufacturer, is eligible to avail Cenvat Credit of D and I above. A buyer, who is service provider, is eligible to avail Cenvat Credit of D above. . A trader who sells imported goods in India after charging Vat/sales tax can get refund of Special CVD of 4% i.e. I above

Basics of Customs Duty

You might also like

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Chemalite Cash Flow AnalysisDocument8 pagesChemalite Cash Flow AnalysisSaswata BanerjeeNo ratings yet

- Import ProcurementDocument23 pagesImport ProcurementGirish Raj100% (1)

- Cost Accounting Objective (MCQ)Document243 pagesCost Accounting Objective (MCQ)mirjapur0% (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Adjusted Present ValueDocument14 pagesAdjusted Present ValueGoGoJoJo100% (1)

- Chapter 10 Advance Accounting SolmanDocument21 pagesChapter 10 Advance Accounting SolmanShiela Gumamela100% (5)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- 2-Problems in CustomsDocument0 pages2-Problems in Customspsuresh_reddyNo ratings yet

- Calculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageDocument3 pagesCalculation of ATV, AV, CD, RD, SD, VAT, and AIT at Import StageAccounts Pivot Engg0% (1)

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- Acc 101Document24 pagesAcc 101Shyam RathiNo ratings yet

- CostingDocument3 pagesCostingSukhrut MNo ratings yet

- Calculation of Customs DutyDocument3 pagesCalculation of Customs DutyRavi KasaudhanNo ratings yet

- Financial Accounting and Auditing X - Costing (SEM VI)Document24 pagesFinancial Accounting and Auditing X - Costing (SEM VI)721DEEPIKA SOYANo ratings yet

- Unit-II-Cost of CapitalDocument80 pagesUnit-II-Cost of CapitalRU ShenoyNo ratings yet

- P-2 (ACT) : A-7 Foundation Course Examination AccountingDocument6 pagesP-2 (ACT) : A-7 Foundation Course Examination Accountingmohanraokp2279No ratings yet

- The Magnitude and Distribution of Fuel Subsidies: David CoadyDocument41 pagesThe Magnitude and Distribution of Fuel Subsidies: David CoadyPankaj DayaniNo ratings yet

- Chartered University College MA-2 Managing Cost & Finance ExamDocument5 pagesChartered University College MA-2 Managing Cost & Finance Examemon_paul_009No ratings yet

- Brief Guide to Indian Customs LawDocument88 pagesBrief Guide to Indian Customs LawVijay KumarNo ratings yet

- 0452 s14 Ms 22Document9 pages0452 s14 Ms 22simplesaiedNo ratings yet

- Multiple Choice Question: A/c-Part-1Document4 pagesMultiple Choice Question: A/c-Part-1ckvirtualizeNo ratings yet

- Solution Financial Management Strategy May 2009Document7 pagesSolution Financial Management Strategy May 2009samuel_dwumfourNo ratings yet

- Lebanese Association CPA February Exam 2020 RecapDocument6 pagesLebanese Association CPA February Exam 2020 Recapjad NasserNo ratings yet

- Accounting and Auditing MCQsDocument6 pagesAccounting and Auditing MCQsAsim TanveerNo ratings yet

- CA IPCC Nov 2010 Accounts Solved AnswersDocument13 pagesCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNo ratings yet

- Accounting MCQ On BasicDocument10 pagesAccounting MCQ On BasickaviyapriyaNo ratings yet

- Golden Bell Challenge: Acca F6 Taxation - June 2019Document215 pagesGolden Bell Challenge: Acca F6 Taxation - June 2019Phương NguyễnNo ratings yet

- Class 2 Indexation Module 1 Capital GainsDocument22 pagesClass 2 Indexation Module 1 Capital GainsTomy MathewNo ratings yet

- C.M.A One Word ReferenceDocument6 pagesC.M.A One Word ReferenceABDUL JALEELNo ratings yet

- AnswerDocument2 pagesAnswerNirmal K PradhanNo ratings yet

- CPA Advanced Taxation GuideDocument6 pagesCPA Advanced Taxation GuideEmmaNo ratings yet

- 17 CPA ADVANCED TAXATION Paper 17Document9 pages17 CPA ADVANCED TAXATION Paper 17kabendejunior4No ratings yet

- Customs Duty Calculation FormulaDocument4 pagesCustoms Duty Calculation Formulabibhas1No ratings yet

- 9706 w12 Ms 23Document7 pages9706 w12 Ms 23Diksha KoossoolNo ratings yet

- Acct557 w1 HomeworkDocument5 pagesAcct557 w1 HomeworkDaMaterial Gyrl MbaNo ratings yet

- 07MB105 Financial & Management Accounting - OKDocument21 pages07MB105 Financial & Management Accounting - OKKumaran Thayumanavan0% (1)

- ExportImportProceduresDocumentation MB085 QuestionDocument17 pagesExportImportProceduresDocumentation MB085 QuestionAiDLo33% (6)

- Accounting 2 MCQs on balance day adjustmentsDocument2 pagesAccounting 2 MCQs on balance day adjustmentsAkhileshNo ratings yet

- Presented By:-Ankita Sneha AgarwalDocument15 pagesPresented By:-Ankita Sneha AgarwalSneha AgarwalNo ratings yet

- Service Tax Return 3in Excel Format-1Document8 pagesService Tax Return 3in Excel Format-1priyaradhiNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Maninder BaggaNo ratings yet

- P14Document15 pagesP14Sridhar SriramanNo ratings yet

- Financial Reporting & Statement AnalysisDocument12 pagesFinancial Reporting & Statement AnalysisMariam YasserNo ratings yet

- COMPARATIVE ANALYSIS: San Miguel Corp and DMCI Holdings financial performanceDocument10 pagesCOMPARATIVE ANALYSIS: San Miguel Corp and DMCI Holdings financial performanceAliyah SandersNo ratings yet

- Essential Underpinning For Option PapersDocument4 pagesEssential Underpinning For Option PapersCaterina De LucaNo ratings yet

- Course: DCOM101 Course Title: Financial Accounting - 1: Student Regn. NoDocument2 pagesCourse: DCOM101 Course Title: Financial Accounting - 1: Student Regn. NoPalka KohliNo ratings yet

- Import Duty CalculatorDocument6 pagesImport Duty Calculatorshivam_dubey4004No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Konkan Railway MapDocument15 pagesKonkan Railway MapdskrishnaNo ratings yet

- Page 2Document1 pagePage 2dskrishnaNo ratings yet

- ESIC RD NotificationDocument8 pagesESIC RD NotificationdskrishnaNo ratings yet

- Page 3Document1 pagePage 3dskrishnaNo ratings yet

- NPS ReturnsDocument4 pagesNPS ReturnsdskrishnaNo ratings yet

- Checklist ITR 7 PDFDocument4 pagesChecklist ITR 7 PDFshaik nayazNo ratings yet

- Konkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडDocument2 pagesKonkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडdskrishnaNo ratings yet

- Bangaru KondaDocument49 pagesBangaru KondadskrishnaNo ratings yet

- Tax ReturnDocument2 pagesTax ReturndskrishnaNo ratings yet

- FSSAI Minutes 82Document1 pageFSSAI Minutes 82dskrishnaNo ratings yet

- Print 1Document1 pagePrint 1dskrishnaNo ratings yet

- Job Description 4Document4 pagesJob Description 4dskrishnaNo ratings yet

- Ministry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )Document1 pageMinistry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )dskrishnaNo ratings yet

- Ignou Act OrdinanceDocument1 pageIgnou Act OrdinancedskrishnaNo ratings yet

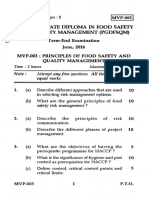

- MVP-003 June 2016Document2 pagesMVP-003 June 2016dskrishnaNo ratings yet

- Ignou NT AdvertisementDocument10 pagesIgnou NT AdvertisementdskrishnaNo ratings yet

- Ministry of Health and Family Welfare Notification: ART ECDocument1 pageMinistry of Health and Family Welfare Notification: ART ECdskrishnaNo ratings yet

- FSSAI Minutes 13Document1 pageFSSAI Minutes 13dskrishnaNo ratings yet

- FSSAI Minutes 83Document1 pageFSSAI Minutes 83dskrishnaNo ratings yet

- FSSAI Minutes 4Document1 pageFSSAI Minutes 4dskrishnaNo ratings yet

- FSSAI Minutes 17Document1 pageFSSAI Minutes 17dskrishnaNo ratings yet

- FSSAI Minutes 78Document1 pageFSSAI Minutes 78dskrishnaNo ratings yet

- FSSAI Minutes 18Document1 pageFSSAI Minutes 18dskrishnaNo ratings yet

- FSSAI Minutes 20Document1 pageFSSAI Minutes 20dskrishnaNo ratings yet

- FSSAI Minutes 6Document1 pageFSSAI Minutes 6dskrishnaNo ratings yet

- FSSAI Minutes 19Document1 pageFSSAI Minutes 19dskrishnaNo ratings yet

- FSSAI Minutes 5Document1 pageFSSAI Minutes 5dskrishnaNo ratings yet

- FSSAI Minutes 8Document1 pageFSSAI Minutes 8dskrishnaNo ratings yet

- FSSAI Minutes 9Document1 pageFSSAI Minutes 9dskrishnaNo ratings yet

- FSSAI Minutes 7Document1 pageFSSAI Minutes 7dskrishnaNo ratings yet