Professional Documents

Culture Documents

1 - Pdfsam - IAS & IFRS Bare Standard

Uploaded by

dskrishnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 - Pdfsam - IAS & IFRS Bare Standard

Uploaded by

dskrishnaCopyright:

Available Formats

2013

Technical Summary

IAS 1 Presentation of Financial Statements

as issued at 1 January 2013. Includes IFRSs with an effective date after 1 January 2013 but not the IFRSs they will replace.

This extract has been prepared by IFRS Foundation staff and has not been approved by the IASB. For the requirements reference must be made to International Financial Reporting Standards.

This Standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entitys financial statements of previous periods and with the financial statements of other entities. It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. A complete set of financial statements comprises: (a) a statement of financial position as at the end of the period; (b) a statement of profit and loss and other comprehensive income for the period; (c) a statement of changes in equity for the period; (d) a statement of cash flows for the period; (e) notes, comprising a summary of significant accounting policies and other explanatory information; and (f) a statement of financial position as at the beginning of the earliest comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements. An entity whose financial statements comply with IFRSs shall make an explicit and unreserved statement of such compliance in the notes. An entity shall not describe financial statements as complying with IFRSs unless they comply with all the requirements of IFRSs. The application of IFRSs, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. When preparing financial statements, management shall make an assessment of an entitys ability to continue as a going concern. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. When management is aware, in making its assessment, of material uncertainties related to events or conditions that

You might also like

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- IAS 1 Ts - Presentation of Financial StatementsDocument3 pagesIAS 1 Ts - Presentation of Financial StatementsJed DíazNo ratings yet

- IAS1Document2 pagesIAS1Atif RehmanNo ratings yet

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- Toa 1603 Presentation of Fs-Manila and CalambaDocument7 pagesToa 1603 Presentation of Fs-Manila and CalambaLariza LopegaNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- NullDocument3 pagesNulldhirajpironNo ratings yet

- Chapter 3 - IAS 1Document10 pagesChapter 3 - IAS 1Bahader AliNo ratings yet

- IAS 1 Financial Statement Presentation GuideDocument7 pagesIAS 1 Financial Statement Presentation GuideMd AladinNo ratings yet

- Ias 1 - IcanDocument51 pagesIas 1 - IcanLegogie Moses AnoghenaNo ratings yet

- IAS1:Presentation of Financial StatementsDocument2 pagesIAS1:Presentation of Financial StatementsSabrina LeeNo ratings yet

- Sap 1014Document6 pagesSap 1014AndreiNo ratings yet

- Ias 1 Presentation of Financial Statements - A Closer Look: Munich Personal Repec ArchiveDocument15 pagesIas 1 Presentation of Financial Statements - A Closer Look: Munich Personal Repec Archiveaditya pandianNo ratings yet

- IAS 1 - Summary PDFDocument2 pagesIAS 1 - Summary PDFArsh UllahNo ratings yet

- ACC205 Seminar 2 StudentDocument35 pagesACC205 Seminar 2 StudentDa Na ChngNo ratings yet

- Lecture 3 FASDocument25 pagesLecture 3 FASvuthithuylinh9a007No ratings yet

- IAS 34rDocument2 pagesIAS 34rCristina Andreea MNo ratings yet

- Saint Columban College Refreshment Course Financial Statement NotesDocument9 pagesSaint Columban College Refreshment Course Financial Statement Notesۦۦۦۦۦ ۦۦ ۦۦۦNo ratings yet

- ScanDocument37 pagesScanFritzie Mae Ruzhel GuimbuayanNo ratings yet

- Presentation of FSDocument2 pagesPresentation of FSTimmy KellyNo ratings yet

- Ias 1Document15 pagesIas 1ansaar9967% (3)

- Chapter 4Document8 pagesChapter 4Ji BaltazarNo ratings yet

- IFRS 1 First-time Adoption SummaryDocument2 pagesIFRS 1 First-time Adoption SummarypiyalhassanNo ratings yet

- Unit3 CFAS PDFDocument12 pagesUnit3 CFAS PDFhellokittysaranghaeNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- Ifa TheoryDocument1 pageIfa TheoryShekh FaridNo ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- FULLIFRS Vs IFRSforSMES BAGSITDocument220 pagesFULLIFRS Vs IFRSforSMES BAGSITVidgezxc LoriaNo ratings yet

- IAS34Document2 pagesIAS34Mohammad Faisal SaleemNo ratings yet

- IFRS Overview and FrameworkDocument5 pagesIFRS Overview and FrameworkAlexandra CavcaNo ratings yet

- Ind AS 1 Financial Statement OverviewDocument11 pagesInd AS 1 Financial Statement OverviewPavan KocherlakotaNo ratings yet

- IFRS1Document2 pagesIFRS1Jkjiwani AccaNo ratings yet

- 08_Handout_1(CFAS)Document12 pages08_Handout_1(CFAS)laurencedechosa907No ratings yet

- Interim Financial Reporting: IAS Standard 34Document18 pagesInterim Financial Reporting: IAS Standard 34JorreyGarciaOplasNo ratings yet

- IFRS 1 Technical SummaryDocument2 pagesIFRS 1 Technical SummaryShashank GuptaNo ratings yet

- Accounting Standards and IFRSDocument3 pagesAccounting Standards and IFRSsabyosachi NandiNo ratings yet

- IAS 1 - Financial StatementsDocument7 pagesIAS 1 - Financial StatementsJOEL VARGHESE CHACKO 2011216No ratings yet

- IFRS 1 Technical SummaryDocument2 pagesIFRS 1 Technical SummaryBheki Tshimedzi0% (1)

- Ias 34Document2 pagesIas 34Foititika.net100% (2)

- INTACC 3.1LN Presentation of Financial StatementsDocument9 pagesINTACC 3.1LN Presentation of Financial StatementsAlvin BaternaNo ratings yet

- UntitledDocument150 pagesUntitledRica Ella RestauroNo ratings yet

- IAS Standards IAS 1 Presentation of Financial StatementsDocument23 pagesIAS Standards IAS 1 Presentation of Financial StatementsmulualemNo ratings yet

- LkasDocument24 pagesLkasRommel CruzNo ratings yet

- IAS - 1 SlidesDocument17 pagesIAS - 1 SlidesSyed Salman SaeedNo ratings yet

- Module 03 - Presentation of Financial StatementsDocument19 pagesModule 03 - Presentation of Financial Statementspaula manaloNo ratings yet

- IAS 1 - Presentation of Financial StatementsDocument8 pagesIAS 1 - Presentation of Financial StatementsCaia VelazquezNo ratings yet

- Acc 102 - Module 3aDocument12 pagesAcc 102 - Module 3aPatricia CarreonNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Module 016 Week006-Finacct3 Notes To The Financial StatementsDocument6 pagesModule 016 Week006-Finacct3 Notes To The Financial Statementsman ibeNo ratings yet

- Ifrs Indian GAPP Cost V/s Fair Value: Components of Financial StatementsDocument8 pagesIfrs Indian GAPP Cost V/s Fair Value: Components of Financial Statementsnagendra2007No ratings yet

- Explanation Financial StatementsDocument3 pagesExplanation Financial StatementsitsmekuskusumaNo ratings yet

- Pas 1 Presentation of Financial StatementsDocument8 pagesPas 1 Presentation of Financial StatementsR.A.100% (1)

- FRS 1 (8 Jan 2010)Document43 pagesFRS 1 (8 Jan 2010)rexNo ratings yet

- Objective of IAS 1Document8 pagesObjective of IAS 1mahekshahNo ratings yet

- IAS 1 Financial Reporting RequirementsDocument7 pagesIAS 1 Financial Reporting RequirementshemantbaidNo ratings yet

- Topic I - Financial StatementsDocument13 pagesTopic I - Financial StatementsSean William CareyNo ratings yet

- IA3 1st HandoutDocument3 pagesIA3 1st HandoutUyara LeisbergNo ratings yet

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Page 2Document1 pagePage 2dskrishnaNo ratings yet

- ESIC RD NotificationDocument8 pagesESIC RD NotificationdskrishnaNo ratings yet

- Bangaru KondaDocument49 pagesBangaru KondadskrishnaNo ratings yet

- Page 3Document1 pagePage 3dskrishnaNo ratings yet

- NPS ReturnsDocument4 pagesNPS ReturnsdskrishnaNo ratings yet

- Konkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडDocument2 pagesKonkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडdskrishnaNo ratings yet

- Ministry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )Document1 pageMinistry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )dskrishnaNo ratings yet

- Print 1Document1 pagePrint 1dskrishnaNo ratings yet

- Tax ReturnDocument2 pagesTax ReturndskrishnaNo ratings yet

- Ministry of Health and Family Welfare Notification: ART ECDocument1 pageMinistry of Health and Family Welfare Notification: ART ECdskrishnaNo ratings yet

- Checklist ITR 7 PDFDocument4 pagesChecklist ITR 7 PDFshaik nayazNo ratings yet

- Konkan Railway MapDocument15 pagesKonkan Railway MapdskrishnaNo ratings yet

- FSSAI Minutes 4Document1 pageFSSAI Minutes 4dskrishnaNo ratings yet

- Job Description 4Document4 pagesJob Description 4dskrishnaNo ratings yet

- Ignou NT AdvertisementDocument10 pagesIgnou NT AdvertisementdskrishnaNo ratings yet

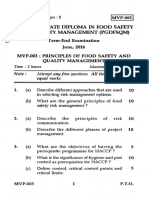

- MVP-003 June 2016Document2 pagesMVP-003 June 2016dskrishnaNo ratings yet

- Ignou Act OrdinanceDocument1 pageIgnou Act OrdinancedskrishnaNo ratings yet

- FSSAI Minutes 20Document1 pageFSSAI Minutes 20dskrishnaNo ratings yet

- FSSAI Minutes 78Document1 pageFSSAI Minutes 78dskrishnaNo ratings yet

- FSSAI Minutes 17Document1 pageFSSAI Minutes 17dskrishnaNo ratings yet

- FSSAI Minutes 82Document1 pageFSSAI Minutes 82dskrishnaNo ratings yet

- FSSAI Minutes 19Document1 pageFSSAI Minutes 19dskrishnaNo ratings yet

- FSSAI Minutes 83Document1 pageFSSAI Minutes 83dskrishnaNo ratings yet

- FSSAI Minutes 8Document1 pageFSSAI Minutes 8dskrishnaNo ratings yet

- FSSAI Minutes 5Document1 pageFSSAI Minutes 5dskrishnaNo ratings yet

- FSSAI Minutes 18Document1 pageFSSAI Minutes 18dskrishnaNo ratings yet

- FSSAI Minutes 7Document1 pageFSSAI Minutes 7dskrishnaNo ratings yet

- FSSAI Minutes 6Document1 pageFSSAI Minutes 6dskrishnaNo ratings yet

- FSSAI Minutes 13Document1 pageFSSAI Minutes 13dskrishnaNo ratings yet

- FSSAI Minutes 9Document1 pageFSSAI Minutes 9dskrishnaNo ratings yet