Professional Documents

Culture Documents

Declaration Form

Uploaded by

Dattatraya ParleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration Form

Uploaded by

Dattatraya ParleCopyright:

Available Formats

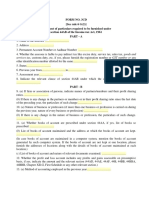

DECLARATION FORM

(see rule 26B)

Form for sending particulars of income under section 192(2B) for the year ending 31st March . 1. Name and address of the employee 2. Employment Number 3. Permanent Account Number 4. Residential Status : : : :

5. Particulars of income under any head of income other : Than salaries (not being a loss under any such head Other than the loss under the head Income from house Property) received in the financial year. Amount ( Rs.) . ...

(i) (ii) (iii) (iv)

Income from house property. ( In case of interest on Housing Loan) Profit and gains of business or profession. Capital gains. Income from other sources : (a) Interest (b) Other incomes (specify)

...

TOTAL ... 6. Tax deducted at source (enclose certificate(s) issued under section 203) Place : Date : Signature of the employee

Verification

I, .., do hereby declare that what is stated above is true to the best of my knowledge and belief. Verified today, the day of .. Year

Place : Date :

. Signature of the employee

You might also like

- Form 12CDocument2 pagesForm 12CAllahBaksh100% (2)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Introduction To Dental AnatomyDocument7 pagesIntroduction To Dental AnatomyAnchi JenNo ratings yet

- F 12 CDocument1 pageF 12 Cpremkumar.bathalaNo ratings yet

- Form 12CDocument1 pageForm 12Csadiqsein01No ratings yet

- Form 12C Income DetailsDocument1 pageForm 12C Income DetailsSireeshaVeluruNo ratings yet

- FRE Form12CDocument1 pageFRE Form12Cappsectesting3No ratings yet

- Form 12C Income DetailsDocument1 pageForm 12C Income DetailsRaghunath DhandapaniNo ratings yet

- Form 12C Income DetailsDocument2 pagesForm 12C Income DetailsGyanendra GautamNo ratings yet

- Form 12CDocument1 pageForm 12CSrinivasa Rao TNo ratings yet

- Form 12C PDFDocument1 pageForm 12C PDFKanishka MandalNo ratings yet

- Form 12C PDFDocument1 pageForm 12C PDFNithya RahulNo ratings yet

- Ministry of Finance (Department of Revenue)Document24 pagesMinistry of Finance (Department of Revenue)grameshchandraNo ratings yet

- Form 12C Income DetailsDocument1 pageForm 12C Income DetailsSudha SNo ratings yet

- Annexure III&IIIA Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA Form12C&ComputationSheetkalpNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form NoDocument1 pageForm Nomurali_mohan_5No ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- FRM pnd51Document2 pagesFRM pnd51Alex MilarNo ratings yet

- Other IncomeDocument2 pagesOther IncomeSandeep ReddyNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document4 pages(See Rule 31 (1) (A) ) : Form No. 16Ejaj HassanNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- FORM 16 TDS CERTIFICATE DECODEDDocument4 pagesFORM 16 TDS CERTIFICATE DECODEDSuman HalderNo ratings yet

- INCOME TAX DEDUCTION CLAIM FORMDocument3 pagesINCOME TAX DEDUCTION CLAIM FORMvizay237_430788222No ratings yet

- INCOME TAX DEDUCTION CLAIM FORMDocument3 pagesINCOME TAX DEDUCTION CLAIM FORMSunnyGouravNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFvizay237_430788222No ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFtpchoNo ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Akarsh ReghunathNo ratings yet

- SARALDocument1 pageSARALchintamani100% (2)

- NOTIFICATION NO. 294/2004 Dated: December 8, 2004Document5 pagesNOTIFICATION NO. 294/2004 Dated: December 8, 2004reetsdoshiNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Notification No 73 2022Document2 pagesNotification No 73 2022uslls visNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Page 26 of 151Document6 pagesPage 26 of 151jibsonly4uNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Income Tax Deduction Rules FormDocument3 pagesIncome Tax Deduction Rules FormRudolph Antony ThomasNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Annexure - 4 - Declaration Under Rule 37BCDocument2 pagesAnnexure - 4 - Declaration Under Rule 37BCprateek agrawalNo ratings yet

- Annual Tax Statement PAN Financial Year Assessment YearDocument3 pagesAnnual Tax Statement PAN Financial Year Assessment YearNiteshwar ShuklaNo ratings yet

- Workshop Students) ADM657Document15 pagesWorkshop Students) ADM657Riedhwan AwangNo ratings yet

- Contract Labour FORM IIDocument1 pageContract Labour FORM IIhdpanchal86No ratings yet

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocument16 pagesForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalNo ratings yet

- Amendment in TDS RulesDocument3 pagesAmendment in TDS RulesjohnsuthaNo ratings yet

- 730 1Document9 pages730 1Dattatraya ParleNo ratings yet

- 192 1 PDFDocument10 pages192 1 PDFDattatraya ParleNo ratings yet

- RefDocument5 pagesRefDattatraya ParleNo ratings yet

- 53 CRDocument6 pages53 CRDattatraya ParleNo ratings yet

- Workbench Tutorial AirfoilDocument10 pagesWorkbench Tutorial Airfoilfab1991No ratings yet

- CurricularSequence Aerospace EngineeringDocument6 pagesCurricularSequence Aerospace EngineeringDattatraya ParleNo ratings yet

- 04CHAP2Document18 pages04CHAP2Dattatraya ParleNo ratings yet

- EPL 0000600 ArticleDocument9 pagesEPL 0000600 ArticleDattatraya ParleNo ratings yet

- CFD Lecture1Document25 pagesCFD Lecture1GCVishnuKumar100% (1)

- Yan JDocument111 pagesYan JDattatraya ParleNo ratings yet

- Human Tissue Authority: Code of Practice 9 ResearchDocument23 pagesHuman Tissue Authority: Code of Practice 9 ResearchDattatraya ParleNo ratings yet

- ME Mech Design Final 1Document39 pagesME Mech Design Final 1kotkar1986No ratings yet

- Two-Dimensional Photoelastic Stress Analysis of Traumatized IncisorDocument4 pagesTwo-Dimensional Photoelastic Stress Analysis of Traumatized IncisorDattatraya ParleNo ratings yet

- Herat ValveDocument13 pagesHerat ValveBrahmanapalli Pavan KumarNo ratings yet

- Evaluation of The Non-Linear Fracture Parameters J and C With ANSYSDocument11 pagesEvaluation of The Non-Linear Fracture Parameters J and C With ANSYSPeti KovácsNo ratings yet

- DAutonomous Toggle Scissor JackDocument19 pagesDAutonomous Toggle Scissor JackAsad Ali100% (1)

- Calculation of Working Pressure of CylinderDocument6 pagesCalculation of Working Pressure of Cylindervilaschinke123No ratings yet

- VitezDocument5 pagesVitezDattatraya ParleNo ratings yet

- Ergonomic Pedal-Operated Car JackDocument24 pagesErgonomic Pedal-Operated Car JackDattatraya Parle50% (2)

- GP Journal v1n1p70 enDocument19 pagesGP Journal v1n1p70 enDattatraya ParleNo ratings yet

- Fluid Air Gas Turbine Velocity Range: 100-150 M/s 1500 RPM Duct Size: 300 MM Output Efficiency 70% Material: Light (Al-Alloy) Single StageDocument1 pageFluid Air Gas Turbine Velocity Range: 100-150 M/s 1500 RPM Duct Size: 300 MM Output Efficiency 70% Material: Light (Al-Alloy) Single StageDattatraya ParleNo ratings yet

- Uncertainties in Material Strength Geometric and Load VariablesDocument0 pagesUncertainties in Material Strength Geometric and Load VariablesDattatraya ParleNo ratings yet

- Mechanical JackDocument10 pagesMechanical JackDattatraya ParleNo ratings yet

- Ergonomic Pedal-Operated Car JackDocument24 pagesErgonomic Pedal-Operated Car JackDattatraya Parle50% (2)

- General Description: Support BookDocument24 pagesGeneral Description: Support BookDattatraya ParleNo ratings yet

- General Description: Support BookDocument24 pagesGeneral Description: Support BookDattatraya ParleNo ratings yet

- Design of Toggle Jack Considering Material Selection of Scerw - Nut CombinationDocument9 pagesDesign of Toggle Jack Considering Material Selection of Scerw - Nut CombinationDattatraya ParleNo ratings yet