Professional Documents

Culture Documents

Problem Set 8 Advanced Engineering Economics Fall 2013

Problem Set 8 Advanced Engineering Economics Fall 2013

Uploaded by

suhayb_1988Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 8 Advanced Engineering Economics Fall 2013

Problem Set 8 Advanced Engineering Economics Fall 2013

Uploaded by

suhayb_1988Copyright:

Available Formats

Problem Set 8 Advanced Engineering Economics Fall 2013

Instructions: Credit is given only for correct answers (there will be no partial credit). Each question is worth 5 points.

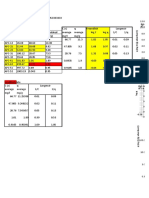

Problem 1 Use Exhibit 5.1-5.3 and calculate the following for the year 2009: (A) The return on invested capital using earnings before interest and taxes. (B) The return on capital employed using earnings before interest and taxes. (C) If the 2009 managerial balance sheet instead had $10 million in cash and $66 million in WCR instead of $12 million and $63 million, respectively, would the calculated return on invested capital change ? (D) Calculate the ROE using EBIT. (E) For the changes in (C) would your answer in (D) for ROE be different ?

Problem 2 Do Problem 7/Chapter 5 and then answer the following questions: (A) (B) (C) (D) (E) (F) (G) (H) (I) (J) Which firm has a negative working capital ? Is it bad to have a negative working capital ? What is the capital employed for each of firms 1-3 ? Which firm is financed the least by debt ? Which firm has the highest ROE ? Which firm has the highest financial multiplier ? Which firm has the highest operating margin ? Which firm has the highest turnover on invested capital ? Is it bad to have a high turnover on invested capital ? What does the EAT for firm 2 have to be so that its ROE is the same as that of firm 3 ?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- MFT GlossaryDocument48 pagesMFT Glossarysuhayb_1988No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Retailer Case Study Assignment MBA Retail Management - Fall 2019Document3 pagesRetailer Case Study Assignment MBA Retail Management - Fall 2019suhayb_1988No ratings yet

- Clark 12e TBA Ch10Document15 pagesClark 12e TBA Ch10suhayb_1988No ratings yet

- MFT Graduate Student HandbookDocument47 pagesMFT Graduate Student Handbooksuhayb_1988No ratings yet

- Final Take Home TestDocument4 pagesFinal Take Home Testsuhayb_1988No ratings yet

- CH 1Document22 pagesCH 1suhayb_1988No ratings yet

- ChaptersDocument31 pagesChapterssuhayb_1988No ratings yet

- Vis1ononeone Address: Office Number 215, Wanfeng Glasses City, Huifu West Road, Guangzhou, China Invoice CUSTOMER: Jamal DATE: 10/feb/2017Document1 pageVis1ononeone Address: Office Number 215, Wanfeng Glasses City, Huifu West Road, Guangzhou, China Invoice CUSTOMER: Jamal DATE: 10/feb/2017suhayb_1988No ratings yet

- BUL 6652: Regulatory and Reporting Environments in Business Syllabus - Spring 2019 Section 792Document9 pagesBUL 6652: Regulatory and Reporting Environments in Business Syllabus - Spring 2019 Section 792suhayb_1988No ratings yet

- ChapterDocument27 pagesChaptersuhayb_1988No ratings yet

- Sample FormatDocument1 pageSample Formatsuhayb_1988No ratings yet

- ISM6436 Spring 2018 V 3Document7 pagesISM6436 Spring 2018 V 3suhayb_1988No ratings yet

- Answers To End of Chapter Questions and Applications: 3. Imperfect MarketsDocument2 pagesAnswers To End of Chapter Questions and Applications: 3. Imperfect Marketssuhayb_1988No ratings yet

- ChapterDocument11 pagesChaptersuhayb_1988No ratings yet

- F ,&' /L) L CXRL), L: R - RT'TDocument11 pagesF ,&' /L) L CXRL), L: R - RT'Tsuhayb_1988No ratings yet

- Chapter 1 Analysis Of Stress: Σ = 153.3 Mpa, Σ = 23.1 MpaDocument22 pagesChapter 1 Analysis Of Stress: Σ = 153.3 Mpa, Σ = 23.1 Mpasuhayb_1988No ratings yet

- Multiple-Choice Questions: AnswerDocument162 pagesMultiple-Choice Questions: Answersuhayb_1988No ratings yet

- Modeling of Nano/Micro Systems Lab #9: ME 59700-19 Spring 2015 Professor Hansung KimDocument10 pagesModeling of Nano/Micro Systems Lab #9: ME 59700-19 Spring 2015 Professor Hansung Kimsuhayb_1988No ratings yet

- Suhib Makhlouf Assignment Chapter 8 Assignment QuestionDocument2 pagesSuhib Makhlouf Assignment Chapter 8 Assignment Questionsuhayb_1988No ratings yet

- LSP 132002 MG SolventSheet FINAL ForWebDocument1 pageLSP 132002 MG SolventSheet FINAL ForWebsuhayb_1988No ratings yet

- Assignment Chapter 8 - 20 Points Assignment Question: Note The Text Is The Best Source For This AssignmentDocument1 pageAssignment Chapter 8 - 20 Points Assignment Question: Note The Text Is The Best Source For This Assignmentsuhayb_1988No ratings yet

- Adsorption Exercises S2010Document2 pagesAdsorption Exercises S2010suhayb_1988No ratings yet

- Application For Employment ABC Wireless & Repair:: - NameDocument2 pagesApplication For Employment ABC Wireless & Repair:: - Namesuhayb_1988No ratings yet

- Freundlich: Powder AC - Acid Washed (4M) Sample WT (MG)Document2 pagesFreundlich: Powder AC - Acid Washed (4M) Sample WT (MG)suhayb_1988No ratings yet