Professional Documents

Culture Documents

For Example, Wearing Apparel, Furniture, Car or Scooter, TV, Refrigerator, Musical

For Example, Wearing Apparel, Furniture, Car or Scooter, TV, Refrigerator, Musical

Uploaded by

Joshua GibsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Example, Wearing Apparel, Furniture, Car or Scooter, TV, Refrigerator, Musical

For Example, Wearing Apparel, Furniture, Car or Scooter, TV, Refrigerator, Musical

Uploaded by

Joshua GibsonCopyright:

Available Formats

Capital Asset is defined to include property of any kind held by an assessee, whether connected with his business or profession

or not connected with his business or profession. It includes all kinds of property, movable or immovable, tangible or intangible, fixed or circulating. Thus, Land and building, plant and machinery, motorcar, furniture, ewellery, route permits, goodwill, tenancy rights, patents, trademarks, shares, debentures, securities, units, mutual funds, !ero coupon bonds etc. are capital assets.

Contents

" #xcluded from the definition of capital assets $ The most specific common definitions in use are as follows % &' tax definition versus broader economic definition ( 'ee also ) *eferences

Excluded from the definition of capital assets

". Any stock in trade, consumable stores, or raw materials held for the purpose of business or profession have been excluded from the definition or profession. $. Any movable property +excluding ewellery made out of gold, silver, precious stones, and drawing, paintings, sculptures, archeological collections etc., used for personal use by the assessee or any member +dependent, of assessee-s family is not treated as capital assets. For example, wearing apparel, furniture, car or scooter, T., refrigerator, musical instruments, gun, revolver, generator, etc. is the examples of personal effects. %. Agricultural land situated in rural area. (. /"0$1 gold bonds or 21 gold bonds "345, national defense gold bond "345, issued by the central government. ). 'pecial bearded bonds, "33" /. 6old deposit bonds issued under gold deposit scheme, "333.

The most specific common definitions in use are as follows

In financial economics, capital refers to any asset used to make money, as opposed to assets used for personal en oyment or consumption. This is an important distinction because two people can disagree sharply about the value of personal assets, one person might think a sports car is more valuable than a pickup truck, another person might have the opposite taste. 7ut if an asset is held for the purpose of making money, taste has nothing to do with it, only differences of opinion about how much money the asset will produce. 8ith the further assumption that people agree on the probability distribution of future cash flows, it is possible to have an ob ective Capital asset pricing model. #ven

without the assumption of agreement, it is possible to set rational limits on capital asset value.9": In governmental accounting, or with reference to public capital or infrastructure usually managed by government, a capital asset is defined as any asset used in operations with an initial useful life extending beyond one reporting period.9$: 6enerally, government managers have a ;stewardship; duty to maintain capital assets under their control. See International Public Sector Accounting Standards for details. See Triple bottom line for widely used public sector accounting methods in which natural capital and social capital are characterized not as intangibles or externalities but as actual capital assets. In some income tax systems +for example, in the &nited 'tates,, gains and losses from capital assets are treated differently than other income. 'ale of non<capital assets, such as inventory or stock of goods held for sale, generally is taxed in the same manner as other income. Capital assets generally include those assets outside the daily scope of business operations, such as investment or personal assets. The &nited 'tates system defines a capital asset by exclusion.9%: Capital assets include all assets except inventory of supplies or property held for sale +including subdivided real estate,, depreciable property used in a business, accounts or notes receivable, certain commodities derivatives and hedging items, and certain copyrights and similar property held by the creator of the property. The &nited =ingdom has an even broader definition.9(:

US tax definition versus broader economic definition

A well<known financial accounting textbook9): advises that the term be avoided except in tax accounting because it is used in so many different senses, not all of them well<defined. >or example it is often used as a synonym for fixed assets9/: or for investments in securities.9): ?owever this advice is @uestionable beyond the &' private context. 'everal public sector standards in global use, notably triple bottom line accounting as defined by ICL#I for world cities, re@uire that employees or the environment or something else be treated as a capital asset. In this context it means something managers have a responsibility to maintain, and to report changes in value as gains or losses.92: See human capital, natural capital, triple bottom line, human de elopment theory. Capital assets should not be confused with the capital a financial institution is re@uired to hold. This capital is computed from the right<hand side of the balance sheet while assets are found on the left<hand side.9): See !asel III for a summary of how such re"uirements are proposed to be calculated.

See also

Current asset

References

".

Jump up ^ #ugene >. >ama and Aerton ?. Ailler, The Theory of Finance, ?olt *inehart and 8inston +"32(,. $. Jump up ^ 6overnmental Accounting 'tandards 7oard 'tatement Bo. %(, !asic Financial Statements#and $anagement%s &iscussion and Analysis#for State and 'ocal (o ernments, paragraph "3. %.

4.

Jump up ^ $/ &'C "$$". Also see the discussion of capital gains and losses in I)S Publication **+. Jump up ^ 'ee ?A*C discussion of assets liable to capital gains tax. C Dump up toE a b c Clyde F. 'tickney and *oman L. 8eil, Financial Accounting, p. /$$. Jump up ^ Dohn Gwen #dward Clark, &ictionary of International Accounting Terms, p. 34 Jump up ^ Havid >. *obinson, ;?uman asset accounting;, 'ong )ange Planning, v. 2, i. ", >ebruary "32(, Fp. )4</5.

). /. 2.

CategoriesE Capital Asset >inancial economics

>inancial terminology Taxation Capital +economics,

You might also like

- Actg1 - Chapter 3Document37 pagesActg1 - Chapter 3Reynaleen Agta100% (1)

- Afs Term SheetDocument22 pagesAfs Term Sheetcutie_pixieNo ratings yet

- Chapter 11 - Answers To Concept QuestionsDocument9 pagesChapter 11 - Answers To Concept QuestionsMsKhan0078No ratings yet

- Asset: Financial Accounting Economic Value Ownership CashDocument5 pagesAsset: Financial Accounting Economic Value Ownership CashPhillip DominguezNo ratings yet

- Asset: Formal DefinitionDocument5 pagesAsset: Formal DefinitionAngelo AristizabalNo ratings yet

- Assets - Meaning and ClassificationDocument6 pagesAssets - Meaning and ClassificationJann Vic SalesNo ratings yet

- In Business and AccountingDocument6 pagesIn Business and AccountingHarish AroraNo ratings yet

- Accounting BasicDocument61 pagesAccounting BasicSwapna Zacharia CheripurathuNo ratings yet

- FinanceDocument21 pagesFinanceAyisha A. GillNo ratings yet

- AssetsDocument4 pagesAssetsCLLN FILESNo ratings yet

- Managing Financial Resources & DecisionsDocument23 pagesManaging Financial Resources & DecisionsShaji Viswanathan. Mcom, MBA (U.K)No ratings yet

- IAS-Cash Flow StatementDocument24 pagesIAS-Cash Flow Statementpks009No ratings yet

- Bunwin Residence: Is The Company Profitable??Document6 pagesBunwin Residence: Is The Company Profitable??Pum MineaNo ratings yet

- Balance Sheet - en - Text For TranslationDocument1 pageBalance Sheet - en - Text For TranslationТеа ДимитроваNo ratings yet

- Balance SheetDocument7 pagesBalance Sheetapi-27014089100% (2)

- Statements of Accounting Standards (AS 10) : Accounting For Fixed AssetsDocument6 pagesStatements of Accounting Standards (AS 10) : Accounting For Fixed AssetsSantoshca1984No ratings yet

- Introduction To Balance Sheet: Assets Liabilities Owner's (Stockholders') EquityDocument7 pagesIntroduction To Balance Sheet: Assets Liabilities Owner's (Stockholders') EquityChanti KumarNo ratings yet

- Pink GurlzDocument423 pagesPink Gurlzmygurlz1991No ratings yet

- The Marketing ConceptDocument13 pagesThe Marketing ConceptMadan CoolboyNo ratings yet

- Chapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductionDocument10 pagesChapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductiontemedebereNo ratings yet

- Fixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ADocument7 pagesFixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ARandal SchroederNo ratings yet

- Unit 5 Audit of Fixed AssetsDocument10 pagesUnit 5 Audit of Fixed Assetssolomon adamuNo ratings yet

- Assignment Guide Title PageDocument19 pagesAssignment Guide Title PageAli NANo ratings yet

- Research On PSUDocument17 pagesResearch On PSUDevendra BhagyawantNo ratings yet

- Business Awareness CT 9 PDFDocument11 pagesBusiness Awareness CT 9 PDFRitikaNo ratings yet

- @final Thesis@Document305 pages@final Thesis@vvpatelNo ratings yet

- Types of AssetsDocument2 pagesTypes of AssetsJustine Airra OndoyNo ratings yet

- 12 Prepare Financial ReportsDocument48 pages12 Prepare Financial Reportstigistdesalegn2021No ratings yet

- Capital FormationDocument8 pagesCapital FormationJohn Arul PrakashNo ratings yet

- Statement of Financial Position and Statement of Cash Flows - HandoutDocument8 pagesStatement of Financial Position and Statement of Cash Flows - HandoutdesyanggandaNo ratings yet

- Peter Goa - English Exercise Unit 4Document14 pagesPeter Goa - English Exercise Unit 4Ronaldo Stevent SitohangNo ratings yet

- What Is A Tangible Asset Comparison To Non-Tangible AssetsDocument7 pagesWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportNo ratings yet

- Investment: Investment Is The Commitment ofDocument5 pagesInvestment: Investment Is The Commitment ofHuy DuNo ratings yet

- Basic Accounting.Document3 pagesBasic Accounting.Sanjay MeenaNo ratings yet

- Myanmar Accounting Standard 7: Statement of Cash FlowsDocument18 pagesMyanmar Accounting Standard 7: Statement of Cash FlowsKyaw Htin WinNo ratings yet

- Definition Off Balance SheetDocument7 pagesDefinition Off Balance SheetdomomwambiNo ratings yet

- Assets and LiabilityDocument2 pagesAssets and LiabilityDheeraj KumarNo ratings yet

- Accounting AssignmentDocument7 pagesAccounting AssignmentRio Rosa BolanteNo ratings yet

- Corporate Finance Assignment - 1Document14 pagesCorporate Finance Assignment - 1nsmkarthickNo ratings yet

- Fra Notes Unit1&2Document21 pagesFra Notes Unit1&2mohdsahil2438No ratings yet

- Working Capital Management Unit - IVDocument54 pagesWorking Capital Management Unit - IVThanasekaran TharumanNo ratings yet

- Actuarial Society of India: ExaminationsDocument8 pagesActuarial Society of India: ExaminationsRewa ShankarNo ratings yet

- Accounting SystemDocument14 pagesAccounting SystemPooja MaldeNo ratings yet

- CH 05Document16 pagesCH 05Hanif MusyaffaNo ratings yet

- An Income Tax Is A Tax Levied On The Income of Individuals or Businesses (Corporations or Other LegalDocument4 pagesAn Income Tax Is A Tax Levied On The Income of Individuals or Businesses (Corporations or Other LegalJuan Carlos GabrielNo ratings yet

- Copfin ModuleDocument110 pagesCopfin ModuleLuckmore ChivandireNo ratings yet

- BBA 3rd Semister Finance C-1 Short NotesDocument5 pagesBBA 3rd Semister Finance C-1 Short NotesNahid HasanNo ratings yet

- Use in National Accounts Statistics: Capital Formation Is A Concept Used inDocument15 pagesUse in National Accounts Statistics: Capital Formation Is A Concept Used inMaraNagaSambaraniNo ratings yet

- Depreciation Is An Accounting Method of Allocating The Cost of A Tangible or Physical AssetDocument15 pagesDepreciation Is An Accounting Method of Allocating The Cost of A Tangible or Physical AssetReney RajuNo ratings yet

- Important Definitions As Per AsDocument35 pagesImportant Definitions As Per Askumarishu125No ratings yet

- Summative AssessmentDocument3 pagesSummative AssessmentXavar XanNo ratings yet

- 1975 To 1977, in Which The Figures inDocument27 pages1975 To 1977, in Which The Figures inJeremiah OjimaduNo ratings yet

- Chapter 4: General Principles of AccountingDocument4 pagesChapter 4: General Principles of AccountinglibraolrackNo ratings yet

- Paper 12: Financial Management and International FinanceDocument12 pagesPaper 12: Financial Management and International FinanceRajat PawanNo ratings yet

- InvestmentDocument19 pagesInvestmentvenu457No ratings yet

- Faa IDocument18 pagesFaa INishtha RathNo ratings yet

- L Intangibles GoodwillDocument6 pagesL Intangibles GoodwillsahnojNo ratings yet

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsFrom EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsNo ratings yet

- The Finace Master: What you Need to Know to Achieve Lasting Financial FreedomFrom EverandThe Finace Master: What you Need to Know to Achieve Lasting Financial FreedomNo ratings yet

- CH 11Document72 pagesCH 11Joshua GibsonNo ratings yet

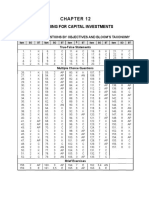

- CH 12Document55 pagesCH 12Joshua GibsonNo ratings yet

- Chapter 9 PDFDocument40 pagesChapter 9 PDFJoshua GibsonNo ratings yet

- CompexamsDocument28 pagesCompexamsJoshua GibsonNo ratings yet

- CH 10Document64 pagesCH 10Joshua Gibson100% (1)

- CH 08Document55 pagesCH 08Joshua GibsonNo ratings yet

- FinalexamDocument12 pagesFinalexamJoshua GibsonNo ratings yet

- CH 07Document63 pagesCH 07Ivhy Cruz Estrella100% (5)

- CH 06Document46 pagesCH 06Joshua Gibson100% (1)

- CH 02Document66 pagesCH 02Joshua GibsonNo ratings yet

- At 3Document8 pagesAt 3Joshua GibsonNo ratings yet

- CH 03Document67 pagesCH 03Joshua GibsonNo ratings yet

- At 7Document7 pagesAt 7Joshua GibsonNo ratings yet

- At 5Document9 pagesAt 5Joshua GibsonNo ratings yet

- How To Tell A Kidding FdsadasDocument1 pageHow To Tell A Kidding FdsadasJoshua GibsonNo ratings yet

- How To Tell A Kidding FdsadasDocument1 pageHow To Tell A Kidding FdsadasJoshua GibsonNo ratings yet

- At 2Document8 pagesAt 2Joshua GibsonNo ratings yet

- How To Tell A Kidding FdsadasDocument1 pageHow To Tell A Kidding FdsadasJoshua GibsonNo ratings yet

- How You Doin ManDocument1 pageHow You Doin ManJoshua GibsonNo ratings yet

- How You Doin ManDocument1 pageHow You Doin ManJoshua GibsonNo ratings yet

- How You Doin ManDocument1 pageHow You Doin ManJoshua GibsonNo ratings yet