Professional Documents

Culture Documents

Exam Sample1

Exam Sample1

Uploaded by

Ferdinand DaveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam Sample1

Exam Sample1

Uploaded by

Ferdinand DaveCopyright:

Available Formats

Sample Exam Questions Cost Terms, Concepts, and Classifications

Multiple Choice

16. C Easy The corporate controllers salary would be considered a(n): a. manufacturing cost. b. product cost. c. administrative cost. d. selling expense. The cost of fire insurance for a manufacturing plant is generally considered to be a: a. product cost. b. period cost. c. variable cost. d. all of the above. For a manufacturing company, which of the following is an example of a period rather than a product cost? a. Depreciation of factory equipment. b. Wages of salespersons. c. Wages of machine operators. d. Insurance on factory equipment. Which of the following would be considered a product cost for external financial reporting purposes? a. Cost of a warehouse used to store finished goods. b. Cost of guided public tours through the company's facilities. c. Cost of travel necessary to sell the manufactured product. d. Cost of sand spread on the factory floor to absorb oil from manufacturing machines. Which of the following would NOT be treated as a product cost for external financial reporting purposes? a. Depreciation on a factory building. b. Salaries of factory workers. c. Indirect labor in the factory. d. Advertising expenses. The salary of the president of a manufacturing company would be classified as which of the following? a. Product cost b. Period cost c. Manufacturing overhead d. Direct labor

17. A Medium

20. B Easy CPA adapted

21. D Medium

22. D Easy

24. B Easy

25. D Easy

Micro Computer Company has set up a toll-free telephone line for customer inquiries regarding computer hardware produced by the company. The cost of this toll-free line would be classified as which of the following? a. Product cost b. Manufacturing overhead c. Direct labor d. Period cost The wages of factory maintenance personnel would usually be considered to be: Indirect labor No Yes Yes No Manufacturing overhead Yes No Yes No

26. C Medium

a. b. c. d. 27. C Medium CPA adapted

Direct materials are a part of: Conversion cost Yes Yes No No Manufacturing cost Yes Yes Yes No Prime cost No Yes Yes No

a. b. c. d.

28. B Medium CPA adapted

Manufacturing overhead consists of: a. all manufacturing costs. b. all manufacturing costs, except direct materials and direct labor. c. indirect materials but not indirect labor. d. indirect labor but not indirect materials. Which of the following should NOT be included as part of manufacturing overhead at a company that makes office furniture? a. sheet steel in a file cabinet made by the company. b. manufacturing equipment depreciation. c. idle time for direct labor. d. taxes on a factory building.

29. A Medium

32. D Medium

Last month, when 10,000 units of a product were manufactured, the cost per unit was $60. At this level of activity, variable costs are 50% of total unit costs. If 10,500 units are manufactured next month and cost behavior patterns remain unchanged the: a. total variable cost will remain unchanged. b. fixed costs will increase in total. c. variable cost per unit will increase. d. total cost per unit will decrease. Variable cost: a. increases on a per unit basis as the number of units

33. B

Easy

produced increases. b. remains constant on a per unit basis as the number of units produced increases. c. remains the same in total as production increases. d. decreases on a per unit basis as the number of units produced increases. Within the relevant range, the difference between variable costs and fixed costs is: a. variable costs per unit fluctuate and fixed costs per unit remain constant. b. variable costs per unit are constant and fixed costs per unit fluctuate. c. both total variable costs and total fixed costs are constant. d. both total variable costs and total fixed costs fluctuate.

34. B Medium

35. A Medium

Which of the following statements regarding fixed costs is incorrect? a. Expressing fixed costs on a per unit basis usually is the best approach for decision making. b. Fixed costs expressed on a per unit basis will react inversely with changes in activity. c. Assumptions by accountants regarding the behavior of fixed costs rest heavily on the concept of the relevant range. d. Fixed costs frequently represent long-term investments in property, plant, and equipment. An opportunity cost is: a. the difference in total costs which results from selecting one alternative instead of another. b. the benefit forgone by selecting one alternative instead of another. c. a cost which may be saved by not adopting an alternative. d. a cost which may be shifted to the future with little or no effect on current operations. Conversion cost consists of which of the following? a. Manufacturing overhead cost. b. Direct materials and direct labor cost. c. Direct labor cost. d. Direct labor and manufacturing overhead cost. Prime cost consists of direct materials combined with: a. direct labor. b. manufacturing overhead. c. indirect materials. d. cost of goods manufactured.

36. B Easy

40. D Easy

41. A Easy

The following data (in thousands of dollars) have been taken from the accounting records of Karlist Corporation for the just completed year. Sales ................................... Raw materials inventory, beginning ...... Raw materials inventory, ending ......... Purchases of raw materials .............. Direct labor ............................ Manufacturing overhead .................. Administrative expenses ................. Selling expenses ........................ Work in process inventory, beginning .... Work in process inventory, ending ....... Finished goods inventory, beginning ..... Finished goods inventory, ending ........ $800 $ 60 $ 70 $180 $100 $190 $110 $150 $ 70 $ 80 $120 $160

Use these data to answer the following series of questions. 74. C Medium Refer To: 2-3 The cost of the raw materials used in production during the year (in thousands of dollars) was: a. $240. b. $190. c. $170. d. $250. The cost of goods manufactured (finished) for the year (in thousands of dollars) was: a. $450. b. $470. c. $530. d. $540. The cost of goods sold for the year (in thousands of dollars) was: a. $610. b. $410. c. $490. d. $570.

75. A Medium Refer To: 2-3

76. B Medium Refer To: 2-3

77. B Medium Refer To: 2-3

The net income for the year (in thousands of dollars) was: a. $390. b. $130. c. $70. d. $190.

Reference: 2-4 The following data pertain to Harriman Company's operations during July: July 1 Raw materials inventory ..... 0 Work in process inventory ... ? Finished goods inventory .... $12,000 July 31 $5,000 4,000 ?

Other data: Cost of goods manufactured ........ $105,000 Raw materials used ................ 40,000 Manufacturing overhead costs ...... 20,000 Direct labor costs ................ 39,000 Gross profit ...................... 100,000 Sales ............................. 210,000 78. A Hard Refer To: 2-4 79. C Hard Refer To: 2-4 The beginning work in process inventory was: a. $10,000. b. $14,000. c. $1,000. d. $4,000. The ending finished goods inventory was: a. $17,000. b. $12,000. c. $7,000. d. $2,000.

Reference: 2-5 Bergeron Inc. reported the following data for last year: Work in process inventory, beginning .. Work in process inventory, ending ..... Finished goods inventory, beginning ... Finished goods inventory, ending ...... Direct labor cost ..................... Direct materials cost ................. Manufacturing overhead cost ........... 80. B Easy Refer To: 2-5 The prime cost is: a. $900. b. $800. c. $500. d. $700. $100 $150 $180 $200 $300 $500 $400

81. A Easy Refer To: 2-5 82. D Medium Refer To: 2-5

The conversion cost is: a. $700. b. $800. c. $900. d. $500. The cost of goods manufactured is: a. $1,250. b. $1,180. c. $1,220. d. $1,150.

100. Medium

NOTE TO THE INSTRUCTOR: Questions 99, 100 and 101 are different versions of the same question. The following data (in thousands of dollars) have been taken from the accounting records of Larner Corporation for the just completed year. Sales ..................................... Purchases of raw materials ................ Direct labor .............................. Manufacturing overhead .................... Administrative expenses ................... Selling expenses .......................... Raw materials inventory, beginning ........ Raw materials inventory, ending ........... Work in process inventory, beginning ...... Work in process inventory, ending ......... Finished goods inventory, beginning ....... Finished goods inventory, ending .......... Required: a. Prepare a Schedule of Cost of Goods Manufactured in good form. b. Compute the Cost of Goods Sold. c. Using data from your answers above as needed, prepare an Income Statement in good form. $870 $110 $130 $200 $160 $140 $ 30 $ 60 $ 50 $ 10 $150 $140

Answer: a. Schedule of cost of goods manufactured Direct materials: Raw materials inventory, beginning ........ Add: Purchases of raw materials ........... Raw materials available for use ........... Deduct: Raw materials inventory, ending ... Raw materials used in production .......... Direct labor .............................. Manufacturing overhead .................... Total manufacturing cost ..................

$ 30 $110 $140 $ 60 $ 80 $130 $200 $410

Add: Work in process inventory, beginning . $ 50 $460 Deduct: Work in process inventory, ending . $ 10 Cost of goods manufactured ................ $450 b. Computation of cost of goods sold Finished goods inventory, beginning ......... Add: Cost of goods manufactured ............. Goods available for sale .................... Deduct: Finished goods inventory, ending .... Cost of goods sold .......................... c. Income statement Sales ....................................... Less: Cost of goods sold .................... Gross margin ................................ Less: Administrative expenses ............... Less: Selling expenses ...................... Net income .................................. $150 $450 $600 $140 $460

$870 $460 $410 $160 $140 $110

You might also like

- AAT Chapter ActivitiesDocument13 pagesAAT Chapter ActivitiesabushohagNo ratings yet

- Answer Key FPBDocument74 pagesAnswer Key FPBJoy Gutierrez100% (2)

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- Cost Acc Chapter 11Document10 pagesCost Acc Chapter 11ElleNo ratings yet

- P2Document18 pagesP2Robert Jayson UyNo ratings yet

- Inventory: COST OF PRODUCTIONDocument104 pagesInventory: COST OF PRODUCTIONHAFIZ MUHAMMAD UMAR FAROOQ RANANo ratings yet

- Preliminary Exam in Cost Accounting and ControlDocument5 pagesPreliminary Exam in Cost Accounting and ControlMohammadNo ratings yet

- Project CostingDocument10 pagesProject CostingDanish JamaliNo ratings yet

- Budgeting and Cost EstimationDocument24 pagesBudgeting and Cost Estimationafshan awanNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Chapter 10 SolMan Accounting For Special Transactions 1 Millan 2018Document20 pagesChapter 10 SolMan Accounting For Special Transactions 1 Millan 2018Alvin Jheii Sioco Alfonso0% (1)

- Seatwork # 1Document2 pagesSeatwork # 1Joyce Anne GarduqueNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- MAS Diagnostic ExamDocument10 pagesMAS Diagnostic ExamDanielNo ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- Edoc - Pub Problems Solving Masdocx PDFDocument6 pagesEdoc - Pub Problems Solving Masdocx PDFReznakNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- Liabilities BSA 5-2sDocument7 pagesLiabilities BSA 5-2sJustine GuilingNo ratings yet

- D7Document11 pagesD7neo14No ratings yet

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument39 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingAnggari SaputraNo ratings yet

- Accounting For Joint Arrangements Material 1Document5 pagesAccounting For Joint Arrangements Material 1Erika Mae BarizoNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingXienaNo ratings yet

- AFAR BOOKLET 2 AutoRecovered AutoRecoveredDocument222 pagesAFAR BOOKLET 2 AutoRecovered AutoRecoveredEmey CalbayNo ratings yet

- DocDocument3 pagesDocWansy Ferrer BallesterosNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- Sol Man Sec 6 SQ1 PDFDocument4 pagesSol Man Sec 6 SQ1 PDFHope Trinity EnriquezNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) LawDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

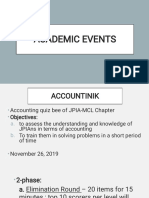

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- Audit Theory Case AnalysisDocument2 pagesAudit Theory Case AnalysisSheila Mary GregorioNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- The Joint Arrangement Provided For The Division of Gains and Losses Among ADocument1 pageThe Joint Arrangement Provided For The Division of Gains and Losses Among Aelsana philip100% (1)

- Abusama 1st Assignment UpdatedDocument5 pagesAbusama 1st Assignment UpdatedDonna Mae SingsonNo ratings yet

- Audit of Investments May 2028Document8 pagesAudit of Investments May 2028kmarisseeNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- C8JDocument4 pagesC8JTess De LeonNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Mock 2nd Eval - TOADocument7 pagesMock 2nd Eval - TOAPatrick Powell100% (1)

- Week17 2010 CorDocument20 pagesWeek17 2010 CormdafeshNo ratings yet

- Partnership Dissolution: National College of Business and ArtsDocument5 pagesPartnership Dissolution: National College of Business and ArtsKate Jezel SantoniaNo ratings yet

- Required: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToDocument2 pagesRequired: 1a. Assuming That The Company Has No Alternative Use For The Facilities Now Being Used ToErica AbegoniaNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Diagnostic Test - Audit TheoryDocument13 pagesDiagnostic Test - Audit TheoryYenelyn Apistar CambarijanNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- SpoilageDocument17 pagesSpoilageBhawin DondaNo ratings yet

- Framework of AccountingDocument11 pagesFramework of AccountingAngelica ManaoisNo ratings yet

- Overhead Costs Have Been Increasing Due To All of The Following EXCEPTDocument13 pagesOverhead Costs Have Been Increasing Due To All of The Following EXCEPTElla Mae TuratoNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Chapter 2 CasesDocument6 pagesChapter 2 CasesSameh Ahmed HassanNo ratings yet

- Cost 1 2Document3 pagesCost 1 2fekadegebretsadik478729No ratings yet

- Part 1: Introduction To Managerial AccountingDocument7 pagesPart 1: Introduction To Managerial AccountingJoemel F. RizardoNo ratings yet

- Managerial Accounting ConceptsDocument5 pagesManagerial Accounting ConceptsPia NietoNo ratings yet

- Cost Accounting Budgets Case BookDocument10 pagesCost Accounting Budgets Case Bookms23a036No ratings yet

- HW 2-33 & 2-36Document3 pagesHW 2-33 & 2-36Cheng ChengNo ratings yet

- Topic 4.2 - Process CostingDocument33 pagesTopic 4.2 - Process CostingTân NguyênNo ratings yet

- Absorption (Variable) Costing and Cost-Volume-Profit AnalysisDocument41 pagesAbsorption (Variable) Costing and Cost-Volume-Profit AnalysisPapsie PopsieNo ratings yet

- Short-Term Budgeting: (Problem 1)Document18 pagesShort-Term Budgeting: (Problem 1)princess bubblegumNo ratings yet

- Manual 16 Jun 2021 - Part 1Document6 pagesManual 16 Jun 2021 - Part 1Feni AlvitaNo ratings yet

- P1 Pilot Paper MA 2006 2Document28 pagesP1 Pilot Paper MA 2006 2mgsotesNo ratings yet

- B.E. (2003 Patt.)Document517 pagesB.E. (2003 Patt.)Aniket SankpalNo ratings yet

- BSBFIM501 Manage Budgets and Financial Plans Learner Instructions 1 (Plan Financial Management Approaches)Document8 pagesBSBFIM501 Manage Budgets and Financial Plans Learner Instructions 1 (Plan Financial Management Approaches)vipulclasses01 vipulclassNo ratings yet

- Fixed AssetsDocument77 pagesFixed AssetsRizkya Kusuma PutriNo ratings yet

- CA Final Costing Guideline Answers May 2015Document12 pagesCA Final Costing Guideline Answers May 2015jonnajon92-1No ratings yet

- Managerial Accounting: Sixteenth EditionDocument100 pagesManagerial Accounting: Sixteenth EditionAhmed El KhateebNo ratings yet

- BaenDocument8 pagesBaenBrian ChoiNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Solution To The Problem Set On "Treatment of Overheads"Document6 pagesSolution To The Problem Set On "Treatment of Overheads"Saloni MalhotraNo ratings yet

- Throughput COSTINGDocument11 pagesThroughput COSTINGpiyush_127100% (1)

- Rojas Bsa2-ADocument2 pagesRojas Bsa2-ARalph Josh RojasNo ratings yet

- MANACC Module 1 Assignment No. 1.1Document4 pagesMANACC Module 1 Assignment No. 1.1Allana GuintoNo ratings yet

- Conversion Processes and Controls: Chapter 11Document30 pagesConversion Processes and Controls: Chapter 11dinaNo ratings yet

- Standard Costing by Acca PDFDocument39 pagesStandard Costing by Acca PDFFahmi AbdullaNo ratings yet

- Variance Analysis With The Reasons of VariancesDocument19 pagesVariance Analysis With The Reasons of Variancesmohamed Suhuraab100% (1)

- Chap 7 Financial PlanDocument51 pagesChap 7 Financial PlanShiyamala SubramaniamNo ratings yet

- Anytime Fitness - Financials - Sec 83 MR Malik PDFDocument6 pagesAnytime Fitness - Financials - Sec 83 MR Malik PDFJasbir SehwagNo ratings yet

- Ma 23d Session14 Slides AfterDocument16 pagesMa 23d Session14 Slides AftermisalNo ratings yet