Professional Documents

Culture Documents

Joint operation profit and cash received calculation

Uploaded by

elsana philip100%(1)100% found this document useful (1 vote)

452 views1 pageOriginal Title

The joint arrangement provided for the division of gains and losses among A

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

452 views1 pageJoint operation profit and cash received calculation

Uploaded by

elsana philipCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

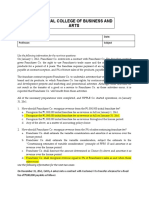

The joint arrangement provided for the division of gains and losses among A, B and C in the

ratio of 2:3:5. The joint operation is to close on December 31, 2008.

5. What is the joint operation profit?

a. (6,600) b. 6,600 c. 6,060 d. (6,060)

6. What is the amount of cash that A will receive on final settlement?

a. 9,280 b. 9,712 c. 8,500 d. 1,212

Sales 24,600

Cost of sales (16910) (8500+7K+200+1210)

Gross Profit 7690

Expenses 1090 (550+540)

Profit 6600

Joint Operation -A:

Merchandise contribution 8500

Share in profit 6600 x 20% 1320

Unsold inventory (540)

Cash to A 9280

Use the following information for the next two questions:

A and B agreed on a joint operation to purchase and sell car accessories. They agreed to

contribute P 25,000 each to be used in purchasing the merchandise, share equally in any gain or

loss. And record their joint operation transactions in their individual books. After one year, they

decided to terminate the joint operation, and data from their records were:

You might also like

- Accounting For Special Transaction C8 Prob 5Document2 pagesAccounting For Special Transaction C8 Prob 5skilled legilimenceNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Tips on Accounting for Troubled Debt Restructuring and BondsDocument35 pagesTips on Accounting for Troubled Debt Restructuring and BondsLexter Dave C EstoqueNo ratings yet

- OrDocument10 pagesOrasdf100% (1)

- Cash Received From Customers During The YearDocument5 pagesCash Received From Customers During The Yearelsana philipNo ratings yet

- Use The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsDocument4 pagesUse The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsRey Joyce Abuel0% (1)

- Arpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionDocument4 pagesArpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionLovely ArpiaNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Use The Following Information For The Next Four QuestionsDocument1 pageUse The Following Information For The Next Four QuestionsTine Vasiana DuermeNo ratings yet

- Partnership Dissolution: National College of Business and ArtsDocument5 pagesPartnership Dissolution: National College of Business and ArtsKate Jezel SantoniaNo ratings yet

- Name: Date: Professor: Section: Score: Assynchronous Activity-Final TermDocument14 pagesName: Date: Professor: Section: Score: Assynchronous Activity-Final TermkmarisseeNo ratings yet

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- Trade and Other Receivables Case StudiesDocument6 pagesTrade and Other Receivables Case StudiesJanine SarzaNo ratings yet

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- PDF Valle Quiz ABC CompressDocument6 pagesPDF Valle Quiz ABC CompressPotie RhymeszNo ratings yet

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- Accounting for Derivatives and Hedging Transactions (Part 3Document13 pagesAccounting for Derivatives and Hedging Transactions (Part 3Sheed ChiuNo ratings yet

- Assignment About Liquidation ValueDocument1 pageAssignment About Liquidation ValueNiezel MirandaNo ratings yet

- Ast - 3B - Quiz No. 1Document10 pagesAst - 3B - Quiz No. 1Renalyn Paras0% (1)

- Bachelor of Science in Accountancy Advanced Financial Accounting and Reporting Quiz Number 1: Home Office and Branch AccountingDocument5 pagesBachelor of Science in Accountancy Advanced Financial Accounting and Reporting Quiz Number 1: Home Office and Branch AccountingJoyce Mamoko0% (1)

- Partial Topics AccountingDocument51 pagesPartial Topics AccountingDzulija Talipan100% (1)

- 162 005Document1 page162 005Angelli LamiqueNo ratings yet

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- Answer Key Week 4Document10 pagesAnswer Key Week 4Chin FiguraNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Corp LiquiDocument15 pagesCorp Liquijikee11No ratings yet

- Chapter 8 - Teacher's Manual - Afar Part 1Document7 pagesChapter 8 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Acquiring IMMATURE: Estimating GoodwillDocument1 pageAcquiring IMMATURE: Estimating GoodwillRiselle Ann Sanchez50% (2)

- Revenue Recognition Multiple Choice QuestionsDocument9 pagesRevenue Recognition Multiple Choice Questionschowchow123No ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- Chapter 5 - Teacher's Manual - Afar Part 1Document15 pagesChapter 5 - Teacher's Manual - Afar Part 1Mayeth BotinNo ratings yet

- Sample ProblemsDocument3 pagesSample ProblemsGracias100% (1)

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Morsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting SystemDocument5 pagesMorsell Corporation Has Provided The Following Data From Its Activity-Based Costing Accounting Systemmohammad hejaziNo ratings yet

- Partnership Dissolution ProblemsDocument2 pagesPartnership Dissolution ProblemsAilene MendozaNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- 1Document35 pages1Rommel CruzNo ratings yet

- Government Inventory ProcessesDocument4 pagesGovernment Inventory ProcessesAlelie Joy dela CruzNo ratings yet

- Phinma - University of Iloilo Bam 006: Midterm Exam: Amount UncollectibleDocument4 pagesPhinma - University of Iloilo Bam 006: Midterm Exam: Amount Uncollectiblehoneyjoy salapantanNo ratings yet

- Acct. 162 - EPS, BVPS, DividendsDocument5 pagesAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNo ratings yet

- DBP V ArcillaDocument137 pagesDBP V ArcillajeysonregNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Quiz 2 Joint ArrangementsDocument4 pagesQuiz 2 Joint ArrangementsJane Gavino100% (2)

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Midterm Exam AST With AnswersDocument15 pagesMidterm Exam AST With AnswersJames CantorneNo ratings yet

- Final ExamDocument11 pagesFinal Examdar •No ratings yet

- Test Series - 1 - KeyDocument8 pagesTest Series - 1 - Keydakshparashar973No ratings yet

- Rental Income CalculationDocument8 pagesRental Income CalculationAliRazaSattarNo ratings yet

- Types of Joint ArrangementsDocument5 pagesTypes of Joint ArrangementsJean Ysrael Marquez100% (2)

- 12th Sample paper 6Document8 pages12th Sample paper 6Amit ChaudhryNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitieselsana philipNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument7 pagesUse The Following Information For The Next Two Questionselsana philipNo ratings yet

- Years Accounting 123Document7 pagesYears Accounting 123elsana philipNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- Tweak Corporation Determined The Value in Use of The Unit To Be P535Document6 pagesTweak Corporation Determined The Value in Use of The Unit To Be P535elsana philipNo ratings yet

- Costs of Market Research Activities 75Document3 pagesCosts of Market Research Activities 75elsana philipNo ratings yet

- Felicia Co Ae101 AccountingDocument4 pagesFelicia Co Ae101 Accountingelsana philipNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESelsana philipNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement Analysiselsana philipNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- Pra Acc Quizzer 2016Document5 pagesPra Acc Quizzer 2016Kim DavilloNo ratings yet

- Find Deferred Loss AmountDocument3 pagesFind Deferred Loss Amountelsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- When It Is Repayable On Demand and Form An Integral Part of An EntityDocument2 pagesWhen It Is Repayable On Demand and Form An Integral Part of An Entityelsana philipNo ratings yet

- Pra Acc Quizzer 2016Document5 pagesPra Acc Quizzer 2016Kim DavilloNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- Equipment sale effect on retained earningsDocument3 pagesEquipment sale effect on retained earningselsana philipNo ratings yet

- On March 31 Accounting 101732636556Document3 pagesOn March 31 Accounting 101732636556elsana philipNo ratings yet

- If The Company Sells 3Document2 pagesIf The Company Sells 3elsana philipNo ratings yet

- Determine cash and cash equivalentsDocument2 pagesDetermine cash and cash equivalentselsana philipNo ratings yet

- Illustration: Bonds Issued at Premium - With Transaction CostsDocument2 pagesIllustration: Bonds Issued at Premium - With Transaction Costselsana philipNo ratings yet

- The Immaterial Cost of The Leasehold Shall Be Amortized Over The LifeDocument3 pagesThe Immaterial Cost of The Leasehold Shall Be Amortized Over The Lifeelsana philipNo ratings yet

- Loan From BDO BankDocument2 pagesLoan From BDO Bankelsana philipNo ratings yet

- Insurance On Production EquipmentDocument2 pagesInsurance On Production Equipmentelsana philipNo ratings yet

- Practice Final Exam for AC 225 Managerial AccountingDocument1 pagePractice Final Exam for AC 225 Managerial AccountingMae CruzNo ratings yet

- Insurance On Production EquipmentDocument2 pagesInsurance On Production Equipmentelsana philipNo ratings yet

- Solution Auditng ProblemsDocument1 pageSolution Auditng Problemselsana philipNo ratings yet

- D. $0.75 Per Client-Visit $19,826 Per MonthDocument2 pagesD. $0.75 Per Client-Visit $19,826 Per Monthelsana philipNo ratings yet