Professional Documents

Culture Documents

Use The Following Information For The Next Four Questions

Uploaded by

Tine Vasiana DuermeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Use The Following Information For The Next Four Questions

Uploaded by

Tine Vasiana DuermeCopyright:

Available Formats

Activity 4.

Direction: Provide what is asked.

Use the following information for the next four questions:

On December 1, 20x1, ABC Co. enters into a silver futures contract to purchase 4,000 ounces of silver on February 1, 20x2 for ₱200

per ounce. The broker requires an initial margin deposit of ₱80,000. The quoted prices per ounce of silver are as follows:

Dec. 1, 20x1 Dec. 31, 20x1 Feb. 1, 20x2

200 190 185

1. The entries on December 1, 20x1 include

a. debit to “deposit with broker” for ₱80,000

b. credit to cash for ₱80,000

c. a and b

d. none

2. How much is the derivative asset (liability) as of December 31, 20x1?

a. 0 b. (34,668) c. (40,000) d. 40,000

3. How much is the total net effect of the derivative on the 20x1 and 20x2 profit or loss? Gain (loss)

a. (60,000) b. 60,000 c. (40,000) d. 40,000

4. How much is the net settlement on February 1, 20x2? – Receipt (payment)

a. 20,000 b. (20,000) c. (60,000) d. 60,000

Use the following information for the next seven questions:

ABC Co. is a commodity trader. On December 1, 20x1, ABC Co. carries in its inventory 400 troy ounces of gold valued at ₱4,800,000

(or ₱12,000 per troy ounce). ABC Co. measures its inventory of gold at fair value less costs to sell through profit or loss.

To protect the fair value of its inventory against a potential decline in prices, ABC Co. enters into a “short” futures contract on

December 1, 20x1 to sell 400 troy ounces of gold at ₱12,100 per troy ounce on February 1, 20x2 (the expected date of sale of the

inventory). The futures contract requires an initial margin deposit of ₱384,000.

We will assume that the fair values shown below already reflect costs to sell.

Dec. 1, 20x1 Dec. 31, 20x1 Feb. 1, 20x2

Spot price 12,000 12,250 11,800

Futures price 12,100 12,300 11,800

5. The entries on December 1, 20x1 include

a. debit to “deposit with broker” for ₱384,000

b. credit to cash for ₱384,000

c. a and b

d. none

6. How much is the adjustment to the inventory account on December 31, 20x1? Increase (decrease)

a. 100,000 b. (100,000) c. 80,000 d. 0

7. How much is the derivative asset (liability) as of December 31, 20x1?

a. (100,000) b. 100,000 c. (80,000) d. 80,000

8. How much is the gain (loss) on the futures contract on February 1, 20x2?

a. 0 b. (80,000) c. (200,000) d. 200,000

9. How much is the net settlement on February 1, 20x2? – Receipt (payment)

a. 120,000 b. (120,000) c. 504,000 d. 504,000

10. How much is the total net cash receipt (payment) on the two contracts?

a. 4,840,000 b. (4,840,000) c. (504,000) d. 504,000

“The heart of the discerning acquires knowledge, for the ears of the wise seek it out.”

(Proverbs 18:15)

You might also like

- Use The Following Information For The Next Seven Questions:: Activity 2.4Document2 pagesUse The Following Information For The Next Seven Questions:: Activity 2.4Tine Vasiana Duerme0% (1)

- Accounting for Derivatives and Hedging Transactions (Part 3Document13 pagesAccounting for Derivatives and Hedging Transactions (Part 3Sheed ChiuNo ratings yet

- Joint operation profit and cash received calculationDocument1 pageJoint operation profit and cash received calculationelsana philip100% (1)

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Cost To CostDocument1 pageCost To CostAnirban Roy ChowdhuryNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- Name: Date: Professor: Section: Score: Assynchronous Activity-Final TermDocument14 pagesName: Date: Professor: Section: Score: Assynchronous Activity-Final TermkmarisseeNo ratings yet

- Accounting 162 - Material 006: For The Next Few RequirementsDocument3 pagesAccounting 162 - Material 006: For The Next Few RequirementsAngelli LamiqueNo ratings yet

- HB Quiz 2020Document4 pagesHB Quiz 2020Allyssa Kassandra LucesNo ratings yet

- Revenue Recognition for Franchise AgreementsDocument15 pagesRevenue Recognition for Franchise AgreementsBobslaneLlenos0% (2)

- Insurance Contracts ChapterDocument10 pagesInsurance Contracts ChapterGloowwjNo ratings yet

- HB - Forex Midterm 2021Document5 pagesHB - Forex Midterm 2021Allyssa Kassandra LucesNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Home and Branch Part 1Document4 pagesHome and Branch Part 1Jessica Libunao100% (1)

- AP Solutions 2016Document13 pagesAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- D. All of ThemDocument6 pagesD. All of ThemRyan CapistranoNo ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- 07 Installment SalesDocument1 page07 Installment SalesGem Yiel33% (3)

- Trade and Other Receivables Case StudiesDocument6 pagesTrade and Other Receivables Case StudiesJanine SarzaNo ratings yet

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocument3 pagesExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.No ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- P2Document18 pagesP2Robert Jayson UyNo ratings yet

- Acquiring IMMATURE: Estimating GoodwillDocument1 pageAcquiring IMMATURE: Estimating GoodwillRiselle Ann Sanchez50% (2)

- MC Chapter 1Document5 pagesMC Chapter 1JiexelNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Bachelor of Science in Accountancy Advanced Financial Accounting and Reporting Quiz Number 1: Home Office and Branch AccountingDocument5 pagesBachelor of Science in Accountancy Advanced Financial Accounting and Reporting Quiz Number 1: Home Office and Branch AccountingJoyce Mamoko0% (1)

- Audit Risk Model and MaterialityDocument14 pagesAudit Risk Model and Materialityedrick LouiseNo ratings yet

- Accounting For Special Transaction C8 Prob 5Document2 pagesAccounting For Special Transaction C8 Prob 5skilled legilimenceNo ratings yet

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Sample Probles For Corpo Liquidation Part 2Document1 pageSample Probles For Corpo Liquidation Part 2Kezia GuevarraNo ratings yet

- Acct. 162 - EPS, BVPS, DividendsDocument5 pagesAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNo ratings yet

- Problem 1: Auditing and Assurance PrinciplesDocument3 pagesProblem 1: Auditing and Assurance PrinciplesMitch MinglanaNo ratings yet

- Audit of Investments - Equity Securities Supplementary ProblemsDocument2 pagesAudit of Investments - Equity Securities Supplementary ProblemsNIMOTHI LASE0% (1)

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Module 1 Home Office and Branch Accounting General ProceduresDocument4 pagesModule 1 Home Office and Branch Accounting General ProceduresDaenielle EspinozaNo ratings yet

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- AudTheo Salosagcol 2018ed Ansv1 PDFDocument13 pagesAudTheo Salosagcol 2018ed Ansv1 PDFDanica Gravito100% (1)

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Leases (PART I)Document28 pagesLeases (PART I)Carl Adrian Valdez100% (1)

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- Forfing Effect Case StudyDocument4 pagesForfing Effect Case StudyHarvey BalmesNo ratings yet

- FinAcc 1 Quiz 6Document10 pagesFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Activity 1 Home Office and Branch Accounting - General ProceduresDocument4 pagesActivity 1 Home Office and Branch Accounting - General ProceduresDaenielle EspinozaNo ratings yet

- Chapter 8 - Investment Property, Other Non-current AssetsDocument7 pagesChapter 8 - Investment Property, Other Non-current AssetsPamela Cruz100% (1)

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Foreign Exchange Rates and TransactionsDocument29 pagesForeign Exchange Rates and TransactionsYing LiuNo ratings yet

- 11 - Substantive Tests of Property, Plant and EquipmentDocument27 pages11 - Substantive Tests of Property, Plant and EquipmentArleneCastroNo ratings yet

- QUIZ C12 Acctg-Derivatives & Hedging2-OnLINEDocument3 pagesQUIZ C12 Acctg-Derivatives & Hedging2-OnLINECheesy MacNo ratings yet

- Effects of Changes in ForEx RatesDocument40 pagesEffects of Changes in ForEx RatesEnrique Paolo Mendoza80% (5)

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- AFAR - 10-Foreign Currency - Transaction and TranslationDocument5 pagesAFAR - 10-Foreign Currency - Transaction and TranslationDaniela AubreyNo ratings yet

- How to Design a Business PortfolioDocument4 pagesHow to Design a Business PortfolioTine Vasiana DuermeNo ratings yet

- Learning: Misamis University Wilnirose C. MalinaoDocument3 pagesLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNo ratings yet

- Learning: Misamis University Wilnirose C. MalinaoDocument4 pagesLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNo ratings yet

- Accounting procedures for partnership liquidationDocument4 pagesAccounting procedures for partnership liquidationTine Vasiana DuermeNo ratings yet

- Learning: Framework For DCF-Based Valuation Model Measure Discount Factor AssessmentDocument5 pagesLearning: Framework For DCF-Based Valuation Model Measure Discount Factor AssessmentTine Vasiana DuermeNo ratings yet

- The Next Two Items Are Based On The Following Information:: Activity 3.1.2Document1 pageThe Next Two Items Are Based On The Following Information:: Activity 3.1.2Tine Vasiana DuermeNo ratings yet

- Final 10 Google SheetsDocument2 pagesFinal 10 Google SheetsTine Vasiana DuermeNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Materials and MethodsDocument18 pagesMaterials and MethodsTine Vasiana DuermeNo ratings yet

- Use The Following Information For The Next Three Questions:: Activity 3.2Document2 pagesUse The Following Information For The Next Three Questions:: Activity 3.2Tine Vasiana DuermeNo ratings yet

- Nikki Villarta - Chart On COVID CasesDocument4 pagesNikki Villarta - Chart On COVID CasesTine Vasiana DuermeNo ratings yet

- Misamis University ISO 9001 Certified CollegeDocument4 pagesMisamis University ISO 9001 Certified CollegeTine Vasiana DuermeNo ratings yet

- Isamis Niversity: College of Computer StudiesDocument1 pageIsamis Niversity: College of Computer StudiesTine Vasiana DuermeNo ratings yet

- Viruses Corrected FormatDocument25 pagesViruses Corrected FormatTine Vasiana DuermeNo ratings yet

- Misamis University College of Computer Studies ISO CertificationDocument1 pageMisamis University College of Computer Studies ISO CertificationTine Vasiana DuermeNo ratings yet

- Picture SourceDocument1 pagePicture SourceTine Vasiana DuermeNo ratings yet

- North America Asia South America Europe Africa Oceania: ContinentsDocument4 pagesNorth America Asia South America Europe Africa Oceania: ContinentsTine Vasiana DuermeNo ratings yet

- Nikki Villarta - Rank FunctionDocument3 pagesNikki Villarta - Rank FunctionTine Vasiana DuermeNo ratings yet

- Robert Jansmit O. YapDocument1 pageRobert Jansmit O. YapTine Vasiana DuermeNo ratings yet

- Research Chapter 3Document9 pagesResearch Chapter 3Tine Vasiana DuermeNo ratings yet

- Nikki Villarta - Rank FunctionDocument3 pagesNikki Villarta - Rank FunctionTine Vasiana DuermeNo ratings yet

- Your Language Story: Reflecting on your language experiencesDocument1 pageYour Language Story: Reflecting on your language experiencesTine Vasiana DuermeNo ratings yet

- Assets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesDocument2 pagesAssets Carrying Amounts Fair Values Cash 10,000 10,000 Receivables, Net 400,000 280,000 Inventory LiabilitiesTine Vasiana DuermeNo ratings yet

- Basic Consolidation ProceduresDocument17 pagesBasic Consolidation ProceduresTine Vasiana DuermeNo ratings yet

- MU Exam Notes SummaryDocument5 pagesMU Exam Notes SummaryTine Vasiana DuermeNo ratings yet

- John Spencer L. Guangco Midterm Activity 2Document4 pagesJohn Spencer L. Guangco Midterm Activity 2Tine Vasiana DuermeNo ratings yet

- NIKKI DIANNE P. VILLARTA ReflectionDocument1 pageNIKKI DIANNE P. VILLARTA ReflectionTine Vasiana DuermeNo ratings yet

- Foreign Exchange and Balance of PaymentDocument10 pagesForeign Exchange and Balance of PaymentMohan Lal AgarwalNo ratings yet

- 2013 National Painting Cost Estimator: SampleDocument72 pages2013 National Painting Cost Estimator: Samplemithileshvnit85No ratings yet

- Interest Rate Swap GuideDocument15 pagesInterest Rate Swap GuideSandya SuraNo ratings yet

- Chapter 3 (Unit 1)Document21 pagesChapter 3 (Unit 1)GiriNo ratings yet

- Mr. Rohit Bajaj - 1 - Open AccessDocument38 pagesMr. Rohit Bajaj - 1 - Open Accessyatendra singhNo ratings yet

- National Income Estimation in Indian ContextDocument17 pagesNational Income Estimation in Indian ContextBHANU TYAGINo ratings yet

- Lipman Bottle Company Case Analysis Group1Document13 pagesLipman Bottle Company Case Analysis Group1Shubham Nigam100% (1)

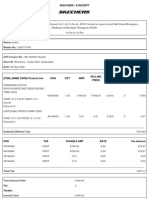

- Skechers Receipt 123413958916Document3 pagesSkechers Receipt 123413958916shirishamarneni77No ratings yet

- JD Sports Marketing MixDocument4 pagesJD Sports Marketing Mixapi-505775092No ratings yet

- Financial Merchandise Management: Retail Management: A Strategic ApproachDocument31 pagesFinancial Merchandise Management: Retail Management: A Strategic ApproachJohnny LewisNo ratings yet

- Binungey Ice CreamDocument6 pagesBinungey Ice CreamCassandra BorbonNo ratings yet

- Exam 2 ReviewDocument10 pagesExam 2 ReviewPresto CaresNo ratings yet

- Term Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisDocument10 pagesTerm Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisImranul GaniNo ratings yet

- Mgt232 Video Project SummaryDocument2 pagesMgt232 Video Project SummaryRahim PirachaNo ratings yet

- Cost Accounting Section-A: 3rd SemesterDocument2 pagesCost Accounting Section-A: 3rd SemesterMonika AggarwalNo ratings yet

- Pecchiari MatteoDocument79 pagesPecchiari Matteoitvmw04 itvmw04No ratings yet

- Micro Eco, Ch-7Document16 pagesMicro Eco, Ch-7Umma Tanila RemaNo ratings yet

- Tutorial 6 - Cost of EquitiesDocument1 pageTutorial 6 - Cost of EquitiesAmy LimnaNo ratings yet

- Chapter 6 8Document19 pagesChapter 6 8Rugie Dianne ColladoNo ratings yet

- Microeconomics Concepts and ElasticityDocument40 pagesMicroeconomics Concepts and ElasticityNguyễn Bá Tài AnhNo ratings yet

- Law of DemandDocument30 pagesLaw of DemandPâwàń ĞûpťãNo ratings yet

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대No ratings yet

- SAP - Cost Center Accounting PDFDocument3 pagesSAP - Cost Center Accounting PDFpavan8412No ratings yet

- IFM2 - Equity Valuation Model - Stock and DDMDocument42 pagesIFM2 - Equity Valuation Model - Stock and DDMCo londota2No ratings yet

- Fundamentals of Economics (Mh106) : By:-Dr. Millo Yasung Department of Management and Humanities NitapDocument16 pagesFundamentals of Economics (Mh106) : By:-Dr. Millo Yasung Department of Management and Humanities Nitapvishal kumarNo ratings yet

- Fin 520 NoteDocument10 pagesFin 520 NoteEmanuele OlivieriNo ratings yet

- Iem Unit1&2Document74 pagesIem Unit1&2shiva12mayNo ratings yet

- Pendants Plus Company CaseDocument4 pagesPendants Plus Company CaseShuo LuNo ratings yet

- Costing Pricing PDFDocument26 pagesCosting Pricing PDFNeeraj Kumar100% (1)

- CREDIT SPREAD DERIVATIVES EXPLAINEDDocument6 pagesCREDIT SPREAD DERIVATIVES EXPLAINEDtinotendacarltonNo ratings yet