Professional Documents

Culture Documents

Part 2 GL AR AP

Part 2 GL AR AP

Uploaded by

venkat62990 ratings0% found this document useful (0 votes)

17 views200 pagesGL AR AP Part 2

Original Title

Part_2_GL_AR_AP

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGL AR AP Part 2

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views200 pagesPart 2 GL AR AP

Part 2 GL AR AP

Uploaded by

venkat6299GL AR AP Part 2

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 200

SAP Partner Only

Use

Internal

ac200

Solution 18: Open Item Clearing

Task 1;

Answer the following question:

1. Name the two basic transactions that you can use to clear open items

Answet

+ Account clearing

+ Post with clearing

Task 2:

‘True or false?

1, Documents with open items cannot be archived because open items represent

incomplete transactions,

Answer: Truc

2. A clearing document must have at least two line items,

Ans

A clearing document may have no fine items.

3. “Posting with clearing” can be cartied out for several accounts

simmltaneously.

alse

Answer: Truc

The document must stay in the system until all open items are cleared. After

that the document can be arcaived.

4, The automatic clearing progrim cannot carry out automatic postings.

Answer: False

As of R/3 Release 4.0, the attomatic clearing program can carry out

‘automatic postings.

Continued on nest page

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Clearing Open items

Task 3:

Answer the following questions:

1

Clearing a credit memo with an open invoice is an example of account

clearing,

Answer: account clearing

‘The transaction “Accoun! Clearmng”1s one option for clearmmg open stems.

Posting a payment for an open invoice with a resulting zero balance is an

example of posting with clearing,

Answer: posting with clearing

The transaction “Post with Clearing” is the second option for clearing open

items and is carried out éuring entry of the incoming payment.

Task 4:

Camy out the exercise for “Account Clearing”

1

Post a customer invoice for 5,500 units local currency. When you enter the

customer invoice, change the proposed terms of payment key to "0001" (die

immediately). Use the tax code 10 (output tax (course) 10%). Then clear the

items with the credit memo that you created for the same amount and check

the lin items in the customer account before and after clearing.

£ Hint: All open iems have been selected for processing. There are

several ways of deactivating each item,

+ Doublectick on cach item’s amount (Gross)

+ Choose HEEB select All" (in the lower part of the screen).

‘Then choose |8.82m2.] "Deactivate Items" to deactivate

all items.

Doubleclick on the amounts of the individual items that you

‘want fo clear together,

+ Process additional business transactions by choosing the button

“Editing Options”

Continued on next page

‘© 2005 SAP AG. All rights reserved. 281 SS

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

ac200

Select the indicator “Selected Items Initially Inactive” so that

all items are deactivated the next time the business transaction

is processed.

£ ‘Hint: To clear the cash discount, enter the value 0

(zero) in the field “Cash Discount”.

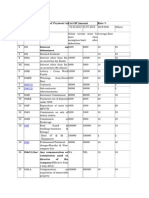

Customer Invoice

SAP Easy Access ment: Accounting —» Financtal Accounting —>

Customers + Documert Entry + Invoice

Field Name or Data Type Values

Basic Data

Customer ‘Your customer

Tavoice Date (Current date

Posting Date Current date

Amount 5500

Cumency Local currency

Calculate Tax v

Tax ID 10 (Output tax (course) 10%)

‘Terms of Payment

(0001

Items — Ist detail line

Document —» Simulate

GIL Account ‘Your instructor will give you

the revenue account.

DIC Credit

‘Amount in Document Currency 5500

Tax ID 10 (Qutput tax (course) 10%)

Check your document. Douibleclick on a line item to display or change

daa,

Choose "Post" to save ihe document, Document number:

Display the line ifems in your customer account:

Continued on nest page

Ey 282

‘©2005 SAP AG. All rights reserved

i

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Clearing Open items

SAP Easy Access menu: Aecounting > Financial Accounting >

Customers + Account ~> Display/Change Line Items

‘Field Name or Data Type Values.

GIL Account ‘Your customer

‘Company Code GR

Line Item Selection. (Choose “All Ttems

‘Choose “Execute to display all the values posted {0 your customer

account. Note that both the invoice for 10,000 units and the credit

‘memo are open items.

Clear the account,

SAP Easy Access men: Accounting — Financial Accounting —+

Customers Account —+ Clear

Field Name or Data Type ‘Values

“Account ‘Your customer

‘Company Code RHE

‘Choose the button “Fait Open Items,

£ ‘Hint: All open items have been selected for processing, There

are several Ways to deactivate each item, (except the clearing,

invoice for 10.000 and credit memo):

+ Doubleclick on cach item’s amount (Gross).

+ Choose IE »setect Atl" (in the lower part of the screen)

‘Then choose Lt #2#"= | "Deactivate tems" to deactivate

all items.

Doubleclick on the amounts of the individual items that

‘you want ro clear together.

+ Process additional business transactions by choosing the

buttor: “Editing Options”

Continued on next page

‘© 2005 SAP AG. All rights reserved. 283 Sa”

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

ac200

Select the indicator “Selected Items Initially Inactive” so

‘tat all items are deactivated the next time the business

‘wansaction is processed.

&P Hint: To clear the cash discount, enter the value

eto) in the field “Cash Discount”

Choose “Post to save the document, Document munber:

Display the tine items in your customer account:

SAP Easy Access menv: Accounting — Financial Accounting —>

Customers —+ Account —+ Display/Change Items

Field Name or Data Type Values

‘Account ‘Your customer

‘Company Code ‘RHE

Line Item Selection ‘Choose “All Trems”

Choose "Execute" to display all the costs posted to your customer

account. Note that the invoice for 10,000 units and the credit memo

are now cleared items.

Ey 284

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

8

Lesson: Clearing Open items

Lesson Summary

‘You should now be able to:

Explain the clearing process

Clear an account

Post with clearing

‘© 2005 SAP AG. All rights reserved. 285 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

ac200

Lesson: Incoming and Outgoing Payments

8

oe

Lesson Overview

his lesson explains how to post nuanual incoming and outgoing payments,

Lesson Objectives

Aficr completing this lesson, you will be able to:

+ Post incoming and outgoing payments

+ Reset clearing

Business Example

Customers pay open invoices taking advantage of cash discounts, The cash

discount is to be posted in the syst-m automaticaly.

ZS post wit

GY CLEARING

®& Document header

4. Payment header i

2. Bank data [B__ Process open items

3.Select openitems activate tems

2. Activate cash discount

G Post

1, Display overview

2.Post

Figure 123: The Manual Payment Process

A manual payment i a transaction that clears an open item, typically an invoice,

by manually assigning a clearing cocument

‘An incoming payment, typically wsed in Accounts Receivable, clears an open

debit amount.

An outgoing payment, typically used in Accounts Payable, clears an open credit

amount

Ey 286

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIed dV¥S 88M [eUse}zU]

Ajuo

Use SAP Partner Only

Internal

‘Ac200 Lesson: Incoming and Outgoing Payments

A manual payment is processed in three steps’

+ Data is entered in the document header.

+ Open items are selected to be cleared.

+ The transaction is saved.

Possible payment differences will be dealt with in the next lesson.

Figure 124: Document Header - Payment Header

‘The data entered in the document header is similar to the data entered when

‘posting invoices. The documeat header consists of three sections: The payment

header, the bank data, and the open item selection.

2008/02, (© 2005 SAP AG. All ights reserved,

287

4euzy4e8d dWS 88M J[eUsazUY

Ajuo

Use SAP Partner Only

Internal

Unit 5: Clearing

ac200

Enter the following information in the payment header section of the document

header:

+ Enter the document date. This isthe date on the physical document

+ The system proposes the docament type dependent on the transaction called

(Gee lesson “Default Values”),

+ Ifthe company code is not proposed, you have to enter it (see lesson “Default

Values”),

+ The period specifications inciude the posting date and the posting period,

‘The current date is defaulted as the posting date and the posting period is,

derived from the posting date.

+ The currency specifications inchude the currency code, the exchange rate

and the date for currency translation. Ifo exchange rate or translation

date is entered, the exchange rate from the exchange rate table on the posting

date is used.

+ Any references needed to identify the incoming payment may be entered in

the reference document nuraber, document header text. and clearing

text fields,

jrer0z)

05-2000] Been 5 |

ft

a

invoice Nav or Check Ne,

I

as

Figure 125: Document Header ~ Bank Data

Ey 288

(©2005 SAP AG. Allrighs reserved. 2005/02

4euz4ed dWS 88M J[eUsezUuY

Aiuo

Use SAP Partner Only

Internal

Lesson: Incoming and Outgoing Payments

Enter the following bank data in the next section of the document header:

+ The account is a general ledger account used for incoming or outgoing

payments,

+ The payment amount is the total payment amount,

+ The bank may charge bank charges for its services, and these are posted

automatically to a special expense account. With incoming payments, the

system adds the bank charges to the payment amount fo form the clearing

‘amount. With outgoing payments, it subtracts the bank charges from the

payment amount to determine the clearing amount.

+ The value date is the date used to evaluate the position in Cash Management,

It may be defaulted by the system (see lesson “Default Values”)

+ The text is an optional description of the item. Start the Hine with, “*" to

‘enable the text to be prin‘ed on correspondence. You can also work with text

‘templates - the user can sclect an entry from a lst of standard texts,

+ The assignment number is either created by the system or you can enter

it manually,

‘rocess Opn tems

(er

062000 Penad 2

Vd

_——

Figure 126: Document Header ~ Open Item Selection

‘© 2005 SAP AG. All rights reserved. 289 SS

4euz4ed dWS 88M J[eUsezUuY

Aiuo

Use SAP Partner Only

Internal

Unit 5: Clearing

ac200

Enter the following open item selection data in the next section of the document

header:

Account and account type: [n this area, “Account” refers to the account

‘number of the business partner and the account type for this account. The

account and account type are required to determine the account that contains

the open items.

Normal open ilems and/or special G/L. trausactiouy: You cau select noua

open items and/or special G/L transactions for processing.

Payment advice note number: You can use the number of a payment

advice note (either entered manually or created by the system) to select

‘the open items.

Other accounts: You can select other accounts in FI to process their open

items at the same time.

Additional selections: You can use additional sclection criteria defined in.

the configuration to select open items. You can use “Distribute by Age” or

“Automatic Search’ to speed up the selection process.

‘Amount Entered _1 000 000,

Assigned "1000 000-

Difference Posting

Not Assigned é

Figure 127: Process Open items

‘The next sercen lists all of the unassigned, open items. These could be payments,

debit or credit memos, or invoices, Depending on your settings al of the items

ccan be active or inactive.

‘The fist step in processing open items isto activate the required line items before

you can assign a payment.

Ey 290

(©2005 SAP AG. Allrighs reserved. 2005/02

4euz4ed dWS 88M J[eUsezUuY

Aijuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Incoming and Outgoing Payments

‘The amount entered is assigned to the appropriate line items and their cash

discount.

‘There are several options for activating or deactivating fine items:

+ Selection of editing options for open items: Select “Selected Item Initially

Inactive”.

+ Doubleclick on the amount

+ Selection from action menus and fnction keys: There are different menus

and keys available.

‘You can post the document if ‘he amount entered is the same as the amount

assigned.

‘The cash discount granted is determined by the terms of payment of the line item.

‘The cash discount is taken inte consideration for calculating the assigned amount

‘You can change the cash disceunt by overwriting the absolute cash discount of

by changing the cash discount percentage rate. It must not exceed the limits set

in the tolerances.

B® Display overview

© Simulate to review automatically

generated iteme

© Correct any mistekes

T° Post

Post wit

CLEARING

>)

‘You can then check the document you have entered.

‘Via Document —> Simulate you can display all of the items including those

created automatically

Ifthe debits and the credits agree, you can post the complete document.

you subsequently discover tut the document contains an error that has to be

corrected, reset the cleared items and then reverse the document, You then have to

re-enter the original posting correctly.

Figure 128: Posting the Payment

‘© 2005 SAP AG. All rights reserved. 291 Sr

JeuzIed dV¥S 88M [eUse}zU]

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

8

ac200

&> © Cash discounts expense or revenue

$ ‘© Cash discount clearing (net procedure)

© Tax adjustments

Tqanewas| © Exchange rate differences

2002 | 5000 © Bank charges

thas © Clearing for cross-company code

‘cam be ceares payenents:

© =Over- or underpayments within

tolerances

Figure 129; Automatic Postings for Clearing Open Items,

If necessary, the system carries out automatic postings during clearing, We have

already seen the configuration for most of these automatic postings in previous

lessons.

‘You can enter bank charges wien you enter the bank data; they are automatically

posted to the G/L account

In order to perform cross-company code payments you have to assign a

Clearing transaction (either “Incoming Payment” ot “Outgoing Payment”) to

‘the combination of paying compar code and the company code for which the

payment is being madz. Then, when yon celect apen items, apen items are

.

‘The treatment of over and underpayments is dealt with inthe lesson “Payment

Differences”

‘Open item account pen item account

‘2000 1) 5000 | ancset, 2000 | 5000

3000 (| 1000 1) | “tome. \ 3000 | 1000

© Line items cleared in error ‘clearing

: i @ semen

© Cancel clearing by resetting ew

clearing document and elesred reset,

items -

Figure 130: Resetting Clearing

‘Users can reset clearing for indivicual documents, When you reset clearing, the

Clearing data is removed from the items,

Ey 292

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIed dV¥S 88M [eUse}zU]

Ajuo

SAP Partner Only

Use

Internal

‘A200 incoming and Outgoing Payments

‘The changes are logged and cen be displayed in change documents. In Accounts

Receivable, the payment history and the credit limit are corrected, if applicable.

2008/02 ‘© 2005 SAP AG. All rights reserved. 293

JeuzIe@d dVS 88M JeUse;UI

Ajuo

ac200

Unit 5: Clearing

Internal

A1uo

Jauzied dv¥S eSN

Use SAP Partner Only

peusozuy

‘©2005 SAP AG. All rights reserved

Ey 204

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Incoming and Outgoing Payments

Exercise 19: Incoming and Outgoing

Payments

Exercise Objectives

After completing this exercise, you will be able to:

+ Post am incoming paymeat with cash discount

Business Example

‘Customers pay open invoices aking advantage of cash discounts.

Task:

‘Cany out the following exercise for posting with cleating.

1. Your have received a payment of 213,400 units of local currency fom your

customer to clear the open item of 220,000 units that you posted in the iesson

“Simple Documents in mySAP ERP Financials”. If you did not grant cash,

discount when you entered the invoice, enter 6,600 units cash discount

manually. Use the bank eccount supplied by your instructor.

‘© 2005 SAP AG. All rights reserved. 295 Sa”

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

acz00

Solution 19: Incoming and Outgoing

Payments

Task:

Camry out the following exercise for posting with clearing

‘Your have received a paymert ot 213.400 units of local currency trom your

caistomer to clear the open item of 220,000 units that you posted in the lesson.

“simple Documents in mySAP ERP Financials”. If you did not grant cash

discount when you entered the invoice, enter 6,600 imits cash discount

‘manually, Use the bank accoumt supplied by your instructor,

1

a) Incoming Payments

Application: Accounting > Financial Accounting — Customers

Document Entry —> Incoming Payments

Field Name or Data Type ‘Values

Document Header.

Document Date (Current date

Document Type Dz

‘Company Code ‘Your company code

Posting Date Current date

Cumrency Local currency

Bank Data

‘Account ‘Your instructor will give

you this information.

‘Amount 213 400

Value Date Current date

‘Open Item Selection

‘Account ‘Your customer

Choose the button “Edit Open Items".

Select the invoice for 220,000 currency units. If necessary, enter

cash discount for 6,600 units of currency.

If the value “Not Assigned is zero, you can:

Document —> Simulate

Continued on next page

Ey 296

‘©2005 SAP AG. All rights reserved

i

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Incoming and Outgoing Payments

Check your document, Doubleclick on a line item to display or

change data.

Choose “Post* to save the document. Document number:

=D Note: Youare now familiar wit two cleating options:

+ Account clearing: In the lesson “Clearmg Upen items

‘you ckared an open invoice with an open credit memo.

+ Posting with clearing: In this lesson you posted an

incoming payment from a customer against an open

invoice.

‘© 2005 SAP AG. All rights reserved. 297

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

8

Lesson Summary

‘You should now be able to:

Post incoming and outgoing payments

Reset clearing

ac200

Ey 298

‘©2005 SAP AG. All rights reserved

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Acz200

Lesson: Payment Differences

Lesson: Payment Differences

Lesson Ovet

‘This lesson describes ways of posting in the context of payment differences

we

Lesson Objectives

Afler completing this lesson, you will be able to:

+ Post payment differences

+ Describe tolerance groups and their role for posting payment differences

+ Post partial and residual payments

+ Create and use payment difference reason codes,

Business Example

‘Customers often pay invoices with deductions that sometimes exceed the tolerance

limits of the company.

les that define acceptable differences during posting

Tolerance group for employees

2. © Upper timits for hansactions

GIMP © Permitted payment differences

Tolerance group for G/L accounts

* c ‘© Permited payment difterences

yy >

Tolerance group for customarsivendors

‘© Default values for clearing transactions

Tolerances:

BBS cerned pmo cron

Egg « spectatns or posting vee toms om

© Tolerances for payment advice notes

Figure 131: Tolerance Groups

In Fl there are three types of tolerances: Employee tolerance groups. G/L. account

tolerance groups, and customer/vendor tolerance groups.

‘The employee tolerance group is used to control:

+ Upper limits for posting transactions (see lesson “Posting Authorizations”),

+ Pemnitted payment differences

‘© 2005 SAP AG. All rights reserved. 299 Sr

JeuzIed dV¥S 88M [eUse}zU]

Ajuo

SAP Partner Only

Use

Internal

ac200

‘The GL. account toleranice group is used to control:

+ Permitted payment differences (for example, for automatic clearing

procedures),

‘The customervendor tolerance gercups provide specifications for:

+ Clearing transactions

+ Permitted payment differences

+ Posting residual items from payment differences

+ Tolerances for payment advice notes

Configuration of tolerance groups

+ Tolerance groups for employees, for example:

= Accountant 1

= Accountant IT

— Accounting manager

+ Tolerance groups for customers'vendors, for examp!

= Good customers/vendors

= Not so good customersivendors

= Cash only customers/vendors

+ Tolerance groups for G/L. accounts, for example:

— Clearing accounts (extemal procurement)

= Clearing accounts (in-house production)

Define permitted payment differences using tolerances.

Assign the tolerance groups to

+ User master data

+ GIL account master records

+ Customerivendor master records

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Use SAP Partner Only

Internal

‘Acz200 Lesson: Payment Differences

‘You have to camry out two stefs to use tolerance groups:

+ Group definition

= The tolerance group is defined by a group key, company code, and a

currency code,

= The group Key is four character alphamueric key.

= The key"\__” (BLANK) is the standard tolerance group and is

required a5 the min:mum tolerance group.

+ Group assignment

— Employee tolerance groups may be assigned to employees.

= GIL account foleravce groups may be assigned to G/L account master

records

= Castomerrvendor tolerance groups may be assigned to a customer

or vendor master record.

= Ifno tolerances are assigned, the default tolerance group *

(blank) applies.

e Tolerance Group fr Employees

Figure 132: Permitted Payment Differences

‘The specifications for permitted payment differences can be found in both

types of tolerance groups. They control the automatic posting of cash discount

adjjustuseuts au unauthorized customer deductions.

2008/02 ‘© 2005 SAP AG. All rights reserved. 301 Sa”

4euUzIegd dVS ®SM JeusazUl

Aijuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

@

ac200

‘The system takes the entries in both groups into account during clearing. The

payment difference has to be within both tolerances to be handled automatically,

for example:

+ A payment difference has to be lower than 3,00 and 2.00 currency units to be

‘written off automatically as a cash discount adjustment.

+ A payment difference has tobe lower than 200,00 and 100.00 currency

units as well as lower than 2.5% aud 2.0% of xe ypeut ammount (o be wuitle

off automatically as an unauthorized deduction, The “lower” of the two

tolerances always applies: Fer an open amount of 1,000 currency units, that

‘would be an unauthorized customer deduction of 20 currency tnt; for

an open amount of 100,000 currency tnits that would be an tmauthorized

customer deduction of 100 currency units

‘The entries in the tolerance groups are always in local currency.

Invoice(s) £1000: 1000 | 1000

Incoming payment p96, 967 949

Cash discount bf 30030

Difference A fs 21

‘Cash discount: sz

Unauth, Customer deductions:

Eee ee

Figure 133: Payment Differences

‘A payment difference normally occurs during the clearing of an open item. The

difference is then compared to the tolerance groups of the employee and the

ccustomer'vendor and is handled accordingly.

+ Within tolerances

+ Automatically posted as either cash discount adjustment or unauthorized

deduction

+ Outside tolerances

+ Processed manually

Ey 302

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dV¥S 88M [eUse;U

Ajuo

Use SAP Partner Only

Internal

‘Ac200

Lesson: Payment Differences

Processing payment

differences

Figure 134: Processing Payment Differences

If the payment difference is immaterial, it may be processed automatically by

allowing the system to adjust the cash discount up to certain amounts or to write it

off toa special account. The limits to which a payment difference is considered

to be immaterial are defined ir tolerance groups. Within the tolerance group for

‘an employee, you can allow an adjustinent of the cash discount (within. defined

limits) so thatthe employee his the authorization to make the adjustment,

the payment difference is too high to be immaterial, it must be processed

‘manually: The payment may be posted as:

+ Partial payment

+ The payment difference may be posted as a residual item

+ The payment difference can be posted to an account assigned to a reason

code or written off by manually entering a new posting item.

+ Payment on account

‘© 2005 SAP AG. All rights reserved. 303 Sa”

4euzIegd dVS ®SNM JeuUsazUL

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

8

ac200

Customer/Vendor © Partial payment

= Partial

000° 5000 Payment _* ‘both items remain onthe account

Invoice reference

CustomeriVendor! © Residual tems

parley f= Toes of payment

Residual + From cleared item

9000) ito + New terms of payment

‘= New document with reference

to original document

CustomerlVendor| # Payment differences.

8000 | 50007

30007

artial and Residual Payments

If the payment difference is outside of the tolerances it has to be processed

‘manually. The user can:

+ Post the payment as a partial payment, where all the documents remain in

the account as open items

+ Post the payment difference as a residual item, whereby only the residual

item remains in the account and the original document and the payment are

cleared. A new document number is created with reference to the original

documents,

+ Post the payment difference 10 a different account as a difference posting

using reason codes and automatic determination.

+ Write off the difference (menual account assignment)

‘The customerivendor tolerance groups contain entries that control the residual

items. These specify:

+ Whether the ferms of payment of a residual item are the same as those of

the cleared item or whether the terms of payment are fixed

+ Whither cash discount is granted only partially and not for the whole

amount

+ Bysspecifying a dunning key, whether the residual item has @ maximum

ddunning level or is printed separately

Ifyou know the reason for a payment difference, you can enter a reason code.

Ey 304

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Use SAP Partner Only

Internal

‘Ac200

coal

CC eee nT

ee Tere Pay

cry Poy

Ceo

Cua coat)

COT

Ce)

Figure 136: Reason Codes

Reason codes are used to describe the reason for the payment difference. To

assign more than one reason code to a payment difference, click on “Distribute

Difference”.

Reason codes ean be assigned to:

+ Difference postings

+ Partial payments

+ Residual items

‘The reason code can be used 10 analyze and postprocess payment differences.

Additional optional functions are:

+ Control of the type of payment notice which is sent to the customer

+ Control the account winee a residual item is posted

+ Automatic posting of a residual item to a specified G/L account.

+ Exclusion of residual items from credit limit checks because they are disputed

‘© 2005 SAP AG. All rights reserved. 305 Sa”

4Jeuzyse@d dWS 88M J[eUsazUY

Aiuo

ac200

Unit 5: Clearing

Internal

A1uo

Jauzied dv¥S eSN

Use SAP Partner Only

peusozuy

‘©2005 SAP AG. All rights reserved

Ey 306

SAP Partner Only

Use

Internal

‘Acz200

Lesson: Payment Differences

Exercise 20: Payment Differences

Exercise Objectives

After completing this exercise, you will be able to:

Create a reason code for damaged goods

Post an incoming payment with cash discount and a reason code

Business Example

Customers generally pay open invoices taking advantage of cash discounts

Task:

Answer the following questions:

1

A cleats the invoice and the payment to create a

‘neW open Tem.

Fill n the blanks to complet the sentence.

A results in the open invoice and the

incoming payment remaining in the customer account as open items.

Fill nthe Blanks to complete the seruence

Customers are reducing theit payments as a result of damage to goods during

transport. You want to record these amounts. You decide to create a reason

code, “Goods damaged during transport, Z##” to write off this difference,

‘Your have received a payment of 250,000 units of local currency from your

customer and you mst fost this against the open item for 300,000 units

Your customer is requesting a price reduction for the remaining amount

since the goods were damaged in transit. Post the difference as a residual

item using the reason code that you created, Zit

‘© 2005 SAP AG. All rights reserved. 307 Sa”

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

ac200

Solution 20: Payment Differences

Task:

Answer the following questions:

1, A residual item clears the invoice and the payment to create a new open item,

Answer: residual item

A partial payment results in the open invoice and the incoming payment

‘remaining in the customer account as open items.

Answer: partial payment

Continued on next page

Ey 308

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Acz200

Lesson: Payment Differences

Customers are reducing their payments as a result of damage to goods during

transport. You want to record these amounts. You decide to create a reason

code, “Goods damaged during transport, Z##" to write off this difference.

8) IMG: Financial Accounting > Accounts Receivable and Accounts

Payable ~+ Business Transactions > Incoming Payment —> Incoming

Payment Global Setings + Overpayment/Underpayment -> Define

Reason Codes

‘Field Name or Data Type ‘Values

‘Company Code GR

Choose “Enters.

Edit > New Entries

Field Name or Data Type ‘Values

RCA Zit

Short Text ‘Damage in transit (for example)

‘GIL Account Long Text ‘Goods damaged in transit

c ‘(Charge of difference via separate

account)

Choose “Save“.

Define Accounts for Payment Differences

IMG: Financial Accounting —» Accounts Receivable and Accounts

Payable Accounting —> Business Transactions ~> Incoming Payment —>

‘Incoming Payment Global Setings —» Overpayment/Underpayment->

Define Accounts for Payment Differences

Choose Chart of Accounts “INT”.

Choose “Enter”.

‘Your have received a payment of 250,000 units of local currency from your

customer and you must fost this against the open item for 300.000 units.

‘Your customer is requesting a price reduction for the remaining amount

since the goods were damaged in transit. Post the difference as a residual

item using the reason code that you created, Zt

8) Tncoming payment with difference

SAP Easy Access menu: Accounting — Financial Accounting —>

Accounts Receivable + Document Entry —> Incoming Payments

Continued on next page

‘© 2005 SAP AG. All rights reserved. 309 Sa”

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Only

Use SAP Partner

Internal

Unit 5: Clearing

acz00

FieldName or Data Type | Values

Document Header

Document Date ‘Curent date

Company Code Your company code

Posting Date ‘Curent date

Currency Course currency

Bank Data

‘Account "Your house bank G/L account

“Amount 250 000)

Value Date Curent date

‘Open Ttem Selection

‘Account ‘Your customer

Choose the button “Process Open Items“.

In this exercise, clear the cash discount amounts by deleting them

or entering 0% and pressing “Finter

Create residual item:

Choose the tab page “Residual Items",

Enter the payment amount by entering the following values or

doubleclicking on the fleld “Residual Ttems*.

Field Name or Data Type ‘Values

Residual Item 50.000

RCA itt

Document —> Simulate

Check your document, Doubleclick on a line item to display or

change data,

‘Choose “Post” o save the document. Document number:

=P Note: You have just.

+ Created a write-off reason code

Continued on next page

Ey 310

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Ac200 Lesson: Payment Differences

* Posted an incoming payment with a difference

+ Created a residual item

+ Assigned the write-off reason code.

2008/02 ‘© 2005 SAP AG. All rights reserved. 311

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing

8

ac200

Lesson Summary

‘You should now be able to:

Post payment differences

Describe tolerance groups and their role for posting payment differences

Post partial and residual payments

Create and use payment differeuve reasou codes

Ey 312

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Acz200

Lesson: Exchange Rate Differences

@

Lesson Overview

Lesson Objectives

After completing this lesson, you will be able to:

+ Explain the system treatment of exchange rate differences

Business Example

‘Management is considering purchasing goods from a foreign country and would

like o be able to post any exchange rate differences.

Outgoing Payments Foreign Vendor

open

2.

Rate : 0.25 e

ER ere EER sore | (EM orc |

Kursdifferenzen

e--

Figure 137: Realized Exchange Rate Differences

‘When clearing open items in a foreign currency, exchange rate differences may

‘occur due to fluctuations in exchange rates.

‘The system posts these exchange rate differences automatically as realized gains

or losses,

‘The system posts the differences automatically to the revenuc/expense account for

exchange rate differences that you defined during configuration, This prevents

incomrect postings.

‘The realized difference is stored in the cleared line item.

Exchange rate differences are also posted when open items are valuated for the

financial statements, These exchange rate differences from valuation are posted to

‘another exchange rate difference account and to a financial statement adjustment

‘© 2005 SAP AG. All rights reserved. 313 Say

JeuzIe@d dV¥S 88M [eUse;U

Ajuo

Use SAP Partner Only

Internal

Unit 5: Clearing ac200

account. When clearing an open item that has already been valuated, the system.

reverses the balance sheet correction account and posts the remaining exchange

rate difference to the account for realized exchange rate differences.

‘Account Determination

‘Account Currency

8

I Qy,

160000

160000 USD

160000 DEM 10

Porro cinen

Tey ttt

Realized exchange rate difference |9gq020 Pam

ee eed Prat

Realized exchange rate difference | 280010 >=

eae Pat

Pon

ee cert)

Figure 138: Account Determination

All reconciliation accounts and all G/L accounts with open item transactions in

foreign currency must be assigned revenuie/expense accounts for realized losses

and gains,

One gainvloss account can be assigned:

+ Toall currencies and currency types

+ Per currencies and cumency type

+ Per currency

+ Per currency type

Ey 314 (©2005 SAP AG. All rights reserved. 7200502

4euzy4e8d dWS 88M J[eUsazUY

Aijuo

SAP Partner Only

Use

Internal

‘Acz200

Exercise 21: Exchange Rate Differences

Exercise Objectives

After completing this exercise, you will be able to:

+ Explain the basics of exchange rate differences

Business Example

Management is considering purchasing goods fiom a foreign country and would

like to be able to post any exchange rate differences.

Task 1:

‘True or False?

1. The mySAP ERP system generates the exchange rate differences

automatically,

Determine whether this stsement is rue or false.

co Te

5 False

2. GéL-avcoumts must be defined for exchange rate losses or gains.

Determine whether this savement is true or false

5 Tne

5 False

Task 2:

Answer the following question

1. List the number of ways the G/L account can be determined for exchange

rate differences,

‘© 2005 SAP AG. All rights reserved. 315 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 5: Clearing ‘ac200

Solution 21: Exchange Rate Differences

Task 1;

‘True or False?

1

‘The mySAP ERP system generates the exchange rate differences

automaticaly.

Answer: Truc

‘When clearing open items in a foreign currency, exchange rate differences

may occur due fo fluctuations in the exchange tate table. The system posts

these differences automatically as realized gnins or losses.

GIL accounts must be defined for exchange rate losses or gains.

Answer: True

The system posts the differences automatically to the revenme/expense

account. Therefore, you have to define the accounts during the configuration.

Task 2:

Answer the following question:

1

List the number of ways the G/T. account can be determined for exchange

rate differences,

Answer: A single G/L account can be used for all currencies and currency

types

+ Asingle G/L account can be used per currency and currency type.

+ A single G/L account can be used per currency.

+ Assingle G/L account can be used per currency type.

Ey 316

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Acz200

8

Lesson Summary

‘You should now be able to:

Explain the system teatraent of exchange rate differences

(© 2005 SAP AG. All ights reserved,

317

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit Summary

8

ac200

Unit Summary

‘You should now be able to:

+ Explain the clearing process

+ Clear an account

+ Post with clearing

+ Post incoming and outgoing payments

+ Reset clearing

+ Post payment differences

+ Describe tolerance groups and thei role for posting payment differences

+ Post partial and residual payments

+ Create and use payment difference reason codes

+ Explain the system treatment of exchange rate differences

Ey 318

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Internal Use SAP Partner Only

AjuQ 419U}1e8d dW¥S ESN Jeusazuy

Internal Use SAP Partner Only

AjuQ 419U}1e8d dW¥S ESN Jeusazuy

SAP Partner Only

Use

Internal

6

Cash Journal

Unit Overview

Unit Objectives

After completing this unit, you witl be able 10:

+ Create a cash journal ang assign it to a general ledger account

+ Explain business transaction categories

+ Create business transactions

+ Save and post business transactions in the cash journal

Unit Contents

Lesson: Cash Journal Conf guration ............

Exercise 22: Setting Up the Cash Journal .......

Lesson: Cash Journal Transaction

Exercise 23: Business Transactions in the Cash Journal 333

Exercise 24: Document Split. 337

Exercise 25: Posting to One-Time Accounts 344

‘© 2005 SAP AG. All rights reserved. 319 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal ‘Ac200

Lesson: Cash Journal Configuration

©

@

Lesson Overview

Lesson Objectives

After completing this lesson, you will be able to:

+ Create @ cash joumal and assign i toa general edger account

+ Explain business transaction categories

+ Create business transactions

Business Example

‘The accounting department requires special general ledger accounts to handle the

cash journal. You want to be able fo post to this account automatically.

We

Company Gose HARK

a ™

EUR Cash Journal 001 GBP Cash Journal 0003

USD cash Journal 0002

Figure 139: Cash Journal Assignment

‘The cash joumal is a tool for mansging cash in the ENJOY-Release 4.6. It

supports posting cash receipts and payments.

With this tool you can:

+ Create a separate cash journal For each currency

+ Post to customer. vendor. ané general ledger accounts

+ Rum several cash journals in each company code

+ Choose a random number for cash journal identification (a four-digit

alphanumeric key)

Ey 320

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

8

Lesson: Cash Journal Configuration

LJ tl

EUR cash Journal 0001 USD Cash Journs! 0002

EUR Petty Cash 100001 sD Petty Gash 100002

CRATEUAIIIY) cr acct document — iB)

document typest

‘Outgoing payments (2) GA)

Incoming payments (RA) (62)

Figure 140: Setting Up the Cash Journal

‘To set up a new cash joumal fer a company code, you have to enter the appropriate

‘values for the following ficlds:

The company code in which you want to use the cash journal

The four digit cash joumal identification and name

The G/L accounts to which you want to post the cash joumal business

transactions

The currency in which you want to run the cash journal

The document types for:

= GIL account postings

— Outgoing payments to vendors

— Incoming payments from vendors

= Outgoing payments to customers

— Incoming payments from customers

‘© 2005 SAP AG. All rights reserved. 321 Sy

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal ‘Ac200

8

cath Expense

u Expense (E)

Revenue

Ey ever ro

em Bank | cach teanefor trom

ga ‘cash Journal to bank (B)

—_ Cash transfer from

ere

ae AR customers-incomingloutgoing payment (D)

Big #8

a

Figure 14

o a By ets ettzelngincoming payment)

jusiness Transaction Types

‘Within the cash journal you proces different transactions that you have to set up

beforehand using business transaction categories. Below are standard business

‘transaction categories and their postings:

+ Expense (&)

+ Bxpense/Cash desk

+ Revenue (R)

+ Cash desk/Revenuc

+ Cash transfer:

+ From cash journal to bank (B)

+ Bank/Cash desk

+ From bank to cash joumal (©)

+ Cash desk/Bank

+ Accounts receivable (D)

+ Customer incoming payment Cash joumal/customer

+ Customer outgoing payment Customer/Cash journal

+ Accounts payable (K)

+ Vendor outgoing payment Veudor/Cash journal

+ Vendor incoming payment Cash joumal/Vendor

Ey 322

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

ob is

Lesson: Cash Journal Configuration

“HS be

* Cash Sale

‘company Code xxx Transactionnumber Revenue Account Tax Code

Figure 142: Creating Business Transactions.

‘You can define new business transactions for the cash journal in two places: In

‘the cash journal itself or in the Implementation Guide (IMG), When you give the

business transaction a name, you cant base it on the type of business transaction.

For example, for the business cransaction for creating postings to cash sales, you

‘could assign the name “Cash Sale”

‘To create a business transaction, make the following settings:

The company code in which the business transaction should be created

The type of business tramactiou (uote, You cumot uuske entures au Use Like

“G/L Account Number” Zor the cash journal business transactions D and K)

Specify tax codes for the business transactions E (Expense) and R (Revente)

For business transaction categories E, R. C, and B, you can set and indicator

to enable the gencral ledzer account for the business transaction to be

changed wien the document is entered. In this case, the general ledger

account is only a default value

For business transaction categories E and R, you can set and indicator to

enable the tax code for the business transaction to be changed when the

document is entered. If 10 tax code has been defined, you have to specify

one (if required for the aecount) when you create the document.

Once saved, the business transaction is assigned a number automatically.

Daring document entry, the business transaction can be called up by its

name or its number.

‘mySAP ERP Enterprise ‘eatures a new indicator that blocks the business

transaction for further postings,

‘© 2005 SAP AG. All rights reserved. 323 ay

JeuzIe@d dV¥S 88M [eUse;U

Ajuo

ac200

Unit 6: Cash Journal

Internal

A1uo

Jauzied dv¥S eSN

Use SAP Partner Only

peusozuy

‘©2005 SAP AG. All rights reserved

Ey 324

SAP Partner Only

Use

Internal

‘Acz200

Lesson: Cash Journal Configuration

Exercise 22: Setting Up the Cash Journal

Exercise Objectives

After completing this exercise, you will be able to:

+ Create a G/L account for the cash joumal

+ Set up your cash journal

Business Example

‘The accounting department requires special general ledger accounts for the cash,

joumal, Our department pays for some of the office supplies. for example, pens,

‘cash Cash expenses have to be saved locally and posted to the general ledger

account every day.

Task:

‘Carry out the Customizing for setting up a cash journal in your company code.

1. Create a GIL Account, 1002##, for the cash journal in your company code

Create your G/L account using the reference account 100000. Make sure that

the G/L account can only be posted to automatically and that the account

currency isthe same as the company code currency.

2. Create cash joumal 20##, tor your company code using the course currency.

Use document types “AB” for G/L account postings, for payments to/from,

vendors “KZ”, for payments to/from customers “DZ”. Name your cash

journal “Cash ##" and check if the number range 01 for your cash journal

documents is predefined,

‘© 2005 SAP AG. All rights reserved. 325 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal

acz00

Solution 22: Setting Up the Cash Journal

Task:

‘Carry out the Customizing for setting up a cash journal in your company code.

1, Create a G/T. Account, 10024#, forthe cash joumal in your company code

Create your G/L account using the reference secount 100000. Make sure that

the G/L account can only be posted to automatically and that the account

currency is the same as the company code currency.

a) Create a GIL account fer your cash joumal.

IMG: Financial Accourting > Bank Accounting —> Business

Transactions —> Cash Journal —+ Create G/L Account for Cash Journal

or: Application: Accounting > Financial Accounting ~» General

Ledger —» Master Records -» G/L Accounts —sIndividual Processing

= Centrally

Or transaction code: FS00

Field Name or Data Type Values

GIL Account 1002##

‘Company Code GRE

Select the “Create with Template” pushbutton.

Field Name or Data Type ‘Values

GIL Accounts 100 000

‘Company Code GR

Choose “Enters,

‘Tab page: “Type/Deseription*:

Field Name or Data Type ‘Values

Short Text Petty Cash #

GAL Account Long Text Petty cash for cash journal

‘Tab page “Create/Bank/Tnterest*

Continued on next page

Ey 326

‘©2005 SAP AG. All rights reserved

4euUzIegd dVS ®SM JeusazUl

Ajuo

SAP Partner Only

Use

Internal

‘Acz200 Lesson: Cash Journal Configuration

[Hieta Name or Data Type ‘Values

| Post Automatically Only Vv

Delete the Alternative account no. on tabpage “controlData™”.

Choose “Saves,

2. Create cash joumal 20##, for your company code using the course currency.

Use document types “AB” for G/T. account postings, for payments tovfrom

vendors “KZ”, for payments to/from customers “DZ”. Name your cash

Journal “Cash #" and check if the number range 01 for your cash journal

documents is predefined,

8) Create cash journal

IMG: Financial Accounting -» Bank Accounting —» Business

Transactions —» Cash Journal —+ Set Up Cash Journal

Select the “New Entries pushbutton and enter the following

information:

‘Field Name or Data Type

Company Code

Gah Journal Number

Account Number

Currency Local currency

Document Type: G/L Account Posting | AB

Document Type: Payment to Vendor KZ,

Document Type Fayment from Vendor [KZ

Document Type: Fayment from Customer | DZ.

Document Type: Payment to Customer for [DZ

GI Account Posting

‘Name Group ## Cash Journal

2o%H

‘Choose “Save”,

Determine whether the number range interval 01 has already been

predefined by the system,

IMG: Financial Accounting —> Bank Accounting ~> Business

Transactions —> Cash Journal + Define Number Range intervals for

Cash Journal Documents

Continued on next page

2008/02 ‘© 2005 SAP AG. All rights reserved. 327 Say

4euUzIegd dVS ®SM JeusazUl

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal

acz00

Field Name or Data Type Values

‘Company Code GRE

Choose “Display Intervals”.

Ifthe number range intervall 01 is not predifined:

(Choose “Change Intervals”

Choose “Insert Interval”

Field Name or Data Type. ‘Values:

Number on

From 1.000 000 000)

To 1.999 999 999,

Choose “Insert™.

Choose “Saves

Select “Enter“ to confirm the information message about

transporting number ranges.

Ey 328

‘©2005 SAP AG. All rights reserved 2005/02

4euUzIegd dVS ®SM JeusazUl

Ajuo

SAP Partner Only

Use

Internal

‘Acz200

8

Lesson: Cash Journal Configuration

Lesson Summary

‘You should now be able to:

Create a cash joumal an assign it to a general ledger account

Explain business transaction categories

Create business transactions

‘© 2005 SAP AG. All rights reserved. 329 Sy

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Use SAP Partner Only

Internal

Unit 6: Cash Journal ac200

Lesson:

8

@

Cash Journal Transaction

Lesson Overview

‘This lesson describes how to post business transactions in the cash journal.

Lesson Objectives

Aficr completing this lesson, you will be able to:

+ Save and post business transections in the cash journal

Business Example

‘Our department pays for some of the office supplies, for example, pens. cash.

Cash expenses have to be saved locally and have to be posted transferred to the

general ledger every day.

Balance display fr splayed period

orci ea

“ee

al paements

Sore tere

Business transactions

(Payments / Receipts/Checks)

Banko Journal

Figure 143: Posting Business Transactions in the Cash Journal (ENJOY)

The cash journal is one of the ENJOY business transactions that you can process on.

‘one screen: On this screen, you can enter, display, and change cash journal entries.

‘You can save cash journal entries locally in the cash journal subledger. and copy

ordelete them. The cash journal entries saved are posted to the general ledger, for

‘example, at the end of the working day.

‘You can also print the cash journal entries you have saved (receipts) as well as

the cash joumal entries posted in the time period displayed. The print forms are

selected in Customizing.

EX” 330

‘©2005 SAP AG. All rights reserved 2005/02

4euzJIegd dVS eSM J|eusazUl

Aijuo

Use SAP Partner Only

Internal

‘Ac200

Lesson: Cash Journal Transaction

The follow-on documents that are posted as a result of cash joumal entries are

displayed.

‘You can also copy and delete cash journal entries saved and display the deleted

cash joumal entries

From Release 4.6C, you can also enter checks in the cash journal,

ttem Tax

code

‘es document

3 Vs 2000

vt 000,

Figure 144: Cash Journal Document with Document Split,

ALA

(Cdocument

1 v6 1000 Document 4

2-vi 1000 Document 2

3 ve 2000 Document 3

poe tems

+ tom

Up to now, if cash joumal transaction contained several items with different tax:

codes and/or Controlling account assignments, a separate cash journal document

had to be created for each item. These cash joumal documents Were then used 10

‘create several Financial documents. In mySAP ERP Enterprise, you can enter

a cash journal document with a document split. In otler words, a cash joumal

‘document can contain several items with different tax codes and/or Controlling

‘account assignments. When the cash journal document is forwarded to Financial,

therefore, only one Financial document is created.

(© 2005 SAP AG. All ights reserved,

331

4euzIegd dVS ®SNM JeuUsazUL

Aijuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal ‘Ac200

Customer/vendor posting with master record

cash desk customer

Cash desk Vendor

Customer/vendor posting to one-time account

—oTA__

EE (6 window tor address data

oma

TEL wincow tor asaress ata

‘ash Journal Document with One-Time Account

Figure 14:

Before mySAP ERP Enterprise, customer and vendor postings could only be made

for customers and vendors with a master record. Now, postings can also be made

to one-time customer or vendor accounts. When you enter a one-time account,

dialog box is displayed for recording the address data

Ey 332 (©2005 SAP AG. All rights reserved. 7200502

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200 Lesson: Cash Journal Transaction

Exercise 23: Business Transactions in the

Cash Journal

Exercise Objectives

After completing this exercise, you will be able to:

+ Post an incoming paymeat

+ Control the balances calculated and displayed automatically

+ Check the follow-on documents

Business Example

‘The accounting department requires a special general ledger account to handle the

cash joumal. Our department pays for some of the office supplies, for example,

pens, cash. Cash expenses have to be saved locally and have to be posted to the

general ledger every day.

Task:

‘Use the fimetions of the cash joumal that you have created for the frst time.

1, Create a business transaction for purchasing office supplies for your

company code. To do this, nse the expense huisiness transaction, F, and the

office supply account, 476000 with the appropriate tax code for your country.

Create a “cash receipt” transaction, with business transaction category C,

to record cash transfers fom your bank account to the cash joumal. Use

GAL account 113100 as the bank account for the offSetting postings of G/L,

account postings.

2. Use the ENJOY single screen transaction where you can enter al the data

on one screen. Buy office supplies, worth 120 units local currency, and

create a cash document. Do not forget: Before you buy the office supplies

‘yom also need some money in your new cash journal. Transfer 1,000 tnits

Gocal currency) fiom the bank to the cash journal

Save your cash journal eatries locally in your cash journal subledger. Check

the balance display for displayed period. Post the saved cash journal entries

to the general ledger and check the follow-on documents,

2008/02 ‘© 2005 SAP AG. All rights reserved. 333 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal acz00

Solution 23: Business Transactions in the

Cash Journal

Task:

Use the fictions of the cash journal that you have created for the first time.

1. Create a business transaction for purchasing ottice supplies for your

company code. To do this, use the expense business transaction, F, and the

office supply account, 476000 with the appropriate tax code for your country.

Create a “cash receipt” transection, with business transaction category C,

to record cash transfers from your bank account to the cash joumal. Use

YL account 113100 as the bank account for the offSetting postings of G/L,

account postings

4) Create business transactions to use in your eash joumal

IMG: Finaneial Accourting > Bank Accounting ~> Business

Transactions + Cash Journal —» Create, Change, Delete Business

Transactions

Select the “New Entries pushbutton and enter the following

information:

Field Name or Data Type Values

Business Transaction for Expenses

‘Company Code GRE

Business Transaction Category E

GIL Account £76,000

Tax ID Listed on the data sheet

Transaction Name Office Supplies #8

Business Transaction for Cash

‘Company Code GR

Business Transaction Category c

GIL Account 113100

Transaction Name Bank to Cash Journal ##

Choose “Saves,

Continued on next page

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Cash Journal Transaction

‘Use the ENTOY single sereen transaction where you can enter all the data

om one screen. Buy office supplies, worth 120 units local currency. and

create a cash document. Do not forget: Before you buy the office supplies

‘you also need some money in your new cash journal. Transfer 1,000 units

ocal currency) from the bank to the cash jourmal

Continued on next page

‘© 2005 SAP AG. All rights reserved. 335 Say

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal

acz00

Save your cash joumal entries locally in your cash joumal subledger. Check

the balance display for displayed period. Post the saved cash journal entries

to the general ledger and check the follow-on documents

) Record business transactions in the cash joumal

Application: Accounting + Financial Accounting — Banks + Input

= Cash Journal

Field Name or Data Type Values

Company Code GR

Cash Journal 20%

Choose “Enters,

Record the cash transfer to the cash journal:

Select the “Cash Receipts tab and enter the following information

Field Name or Data Type __| Values

‘Transaction Name ‘Bank to Cash Journal ##

Amount 1,000 units local currency

Text ‘Transfer cash to cash journal

Choose “Save.

Record the expense to the cash journal (only for company codes

WITHOUT tax jurisdiction codes):

Select the “Cash Payments“ tab and enfer the following information

Field Name or Data Type _ | Values

Transaction Name Office Supplies ##

Amount 120 units local currency

Text Cash for office supplies

Choose “Saves.

‘To save your entries tothe subledger, select the “Post pushbutton.

‘To display the account documents, choose Goto — FI Follow-On

Documents

Ey 336

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Cash Journal Transaction

Exercise 24: Document Split

Exercise Objectives

After completing this exercise, you will be able to:

+ Use the document split fametion in the cash journal

Business Example

‘Our department wants to model the purchase of advertising articles from a major

software company as a business transaction in the cash joumal. A colleague is

to purchase the advertising artcles from the software maker’s sales stand while

he attends a training course at the company in a small town in California, We

iced to create a new transaction in our cash journal to reflect the purchase of

office supplies with the softwere maker's logo and flower arrangements with

the three initials of the group.

Task:

‘Cash Joumal Document with Document Split

1. Inyour company code, c-eate a business transaction for the (cash) purchase

of advertising articles. Create this business transaction as part of the business

transaction category for expenses, E. To do this. use the office supply

account 476000 with the appropriate tax code for your country. Note that the

scenario described above requires that you enter a further expense account

anda firther tax code,

2. Enfera business transaction for purchasing advertising articles with a value of

100 currency units. The transaction involves the purchase of office supplies,

and a flower arrangement (sce scenario). Use the business transaction yout

just created. Assign the ransaction to accounts 476000 (office supplies) and

47100 (advertising articles). Make sure you use different tax codes. First

save the business transaction in the cash journal. Then post the business

‘transaction in the general ledger and take a look atthe accounting document.

‘© 2005 SAP AG. All rights reserved. 337 Sa

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal ‘Ac200

Solution 24: Document Split

Task:

Cash Joumal Document with Document Split

1, Tn your company code, create a business transaction for the (cash) purchase

of advertising articles. Create this hnciness transaction as part af the hnsiness,

transaction category for expanses, E. To do this, use the office supply

account 476000 with the appropriate tax code for your country. Note thatthe

scenario described above requires that you enter a further expense account

anda further tax code,

a) Create the new business transaction in Customizing,

IMG: Financial Accouming —> Bank Accounting —> Business

‘Transactions — Cash Journal —> Create, Change, Delete Business

Transactions

Eat + New Entries

Field Name or Data Type Values

Company Code GR

Transaction Type E (Expense)

GIL Account 476000

Tax Code WN

Cash Journal Business Transaction _[ Advertising articles

‘Account Modifiable Select

Tax Code Select

Choose “Save”

2. Enter business transaction for purchasing advertising articles with a value of

100 currency units, ‘The transaction involves the purchase of office supplies

and a flower arrangement (see scenario). Use the business transaction you

just created, Assign the transaction to accounts 476000 (office supplies) and

‘477100 (advertising articles). Make sure you use different tax codes. First

save the business transaction in the cash journal. Then post the business

transaction inthe general ledgcr and take a look at the accounting document.

a) Enter the business transaction

Application: Accounting —» Financial Accounting Banks >

Ouagoings —> Cash Jownal

Continued on next page

Ey 338

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Ac200 Lesson: cash Journal Transaction

Field Name or Data Type Values

‘Company Code GRHF

Cash Journal 20%

‘Choose ENTER.

Choose the Cash Payments tab page.

Field Name or Data Type ‘Values

Business Transaction Cash purchase of advertising

articles

‘Amount 100

‘Choose the Split Cash Journal Document pushbutton,

Item 1

Field Name or Data Type ‘Values

Business Transaction Cash purchase of advertising

auticles

“Amount 30

“Tax Code WN

‘General Ledger 476000

Item 2

Field Name or Data Type Values

Business Transaction Cash purchase of advertising

articles

‘Amount 20

“Tax Code v2

General Ledger 47100

Choose the COPY pushbutton.

Choose the SAVE pushbutton

‘Choose the POST pushbutton

‘Sclect the item you just posted, click the FOLLOW-ON DOCUMENTS

pushbutton, and choose the accounting document.

2008/02 ‘© 2005 SAP AG. All rights reserved. 339 Say

4euUzIegd dVS ®SM JeusazUl

Ajuo

ac200

Unit 6: Cash Journal

Internal

A1uo

Jauzied dv¥S eSN

Use SAP Partner Only

peusozuy

‘©2005 SAP AG. All rights reserved

Ey 340

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Cash Journal Transaction

Exercise 25: Posting to One-Time

Accounts

Exercise Objectives

After completing this exercise, you will be able to:

+ Post cash joumal documents to one-time accounts

Business Example

‘Our customers enjoy the candy we provide in our reception area. To make sure

that we never run out, we constantly buy more stock at various weekly markets.

‘Our department wants to record a transaction in the cash journal for cash purchases

cof candy fom small suppliers as one-off business partners.

Task:

‘Create a one-time account and post a business transaction

1. Create an account for one-time vendors in your company code, Use vendor

1960 from company code 1000 as a template

2. Entera business transaction for a cash purchase of candy with a value of 50

currency unit. The transaction involves cream dalights of quality class A

from a traveling salesperson Mr. S. Ugar with an address in Sweet Street

11, Candytown (zip code 12345). Use an existing business transaction, First

save the business transaction in the cash journal. Then post the business

transaction and take a look at the accounting document,

‘© 2005 SAP AG. All rights reserved. 341 Sy

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal acz00

Solution 25: Posting to One-Time

Accounts

Task:

Create a one-time account and post a business transaction

1. Create an account for one-time vendors in your company code. Use vendor

1960 fiom company code 1000 as a template

a) Create your one-time vendor.

Application: Accounting + Financial Accounting —» Vendors —>

Master Records — Create

Field Name or Data Type ‘Values

Vendor 1960

‘Company Code GR

Reference

Field Name or Data Type Values

‘Vendor 1960

‘Company Code 1000

‘Accept the data from the template vendor and choose SAVE.

2. Enter a business transaction for a cash purchase of candy with a value of $0

currency units, The transaction involves cream delights of quality class A

from a traveling salesperson Mr. S. Ugar with an address in Sweet Street

Continued on next page

Ey 342

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Only

Use SAP Partner

Internal

Ac200 Lesson: cash Journal Transaction

11, Candytown (zip code 12345), Use an existing business transaction, First

save the business transaction in the cash journal. Then post the business

transaction and take a look at the accounting document.

a) Enter the cash payment for candy.

Application: Accounting > Financial Accounting —+ Banks —»

‘Outgoings —» Cash Journal

Field Name or Data Type ‘Values:

‘Company Code GR#

Cash Journal 20%

‘Choose ENTER.

Choose the Cash Payments tab page.

‘Field Name or Data Type. ‘Values

‘Business Transaction payment fo vendor

Amount 50.

Text Candy,

Vendor 1960,

‘Choose ENTER.

Enter the address 07 Mr. S. Ugar.

Field Name or Data Type Values

Title Mi

‘Name ‘Ss. Ugar

Street ‘Sweet Street 11

ZAP code RMS

cay Candyiown

‘Choose ENTER.

Choose the SAVE pushbutton

Choose the POST yushbutton

‘Choose the FOLLCW-ON DOCUMENTS pushbutton and select the

accounting document.

2008/02 ‘© 2005 SAP AG. All rights reserved. 343 Sy

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 6: Cash Journal

© Lesson Summary

You should now be able to:

Save and post business transections in the cash jourmal

ac200

Ey 344

‘©2005 SAP AG. All rights reserved

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

8

Unit Summary

‘You should now be able to:

+ Create cash joumal an¢ assign it to a general ledger account

+ Explain business transaction categories

+ Create business transactions

+ Save and post business ttansactions in the cash journal

Unit Summary

(© 2005 SAP AG. All ights reserved,

345

JeuzIe@d dVS 88M JeUse;UI

Ajuo

Internal Use SAP Partner Only

AjuQ 419U}1e8d dW¥S ESN Jeusazuy

Internal Use SAP Partner Only

AjuQ 419U}1e8d dW¥S ESN Jeusazuy

Ac200

Unit 6; Cash Journal

Internal

A1uo

Jauyied dvS

asn

Use SAP Partner Only

jeusajzuy

(© 2008 SAP AG. Al rights reserved.

346

2008/02

SAP Partner Only

Use

Internal

6

Logistics Integration

Unit Overview

Unit Objectives

After completing this

nit, you will be able to:

+ Describe the central mySAP ERP objects in Logisties

+ Describe how a basic procurement process is handled in mySAP ERP

+ Discuss the configuration of the account determination with the Purchasing

management project tearm

+ Describe how a basic sales process is handled in mySAP ERP

+ Discuss the configuration of the account determination with the sales project

team

Unit Contents

Lesson: Logistics - General ........... eoseeene 348

Exercise 26: Logistics - General... : 353

Lesson: Procurement Process... : ce 356

Exercise 27: Procurement Process ........... 381

Exercise 28: Purchase Order Processing..... 385

Exercise 29: Goods Receipt Processing ........ vee 391

Exercise 30: Invoice Verification. 397

Lesson: Sales Order Management Process, 403

Exercise 31: Sales Process. 423

‘© 2005 SAP AG. All rights reserved. 347 Sy

JeuzIe@d dVS 88M JeUse;UI

Ajuo

SAP Partner Only

Use

Internal

Unit 7: Logisties Integration ‘Ac200

Lesson: Logistics - General

8

@

Lesson Overview

Lesson Objectives

Aficr completing this lesson, you will be able to:

+ Deseribe the central mySAP ERP objects in Logistics

Business Example

‘The customer installs Sales Order Management and Purchasing Management in

the second phase of the implementation project and wants to check the integration

between Purchasing and Financials and Sales and Financials.

ial

Company code 1000

wih be

Plant 1000 Plant 2000 ‘Plant 3000 Plant 4000

Figure 146: Plants

‘The most important organizational unit in Logistics isthe plant.

A plant must always be assigned to exactly one company code.

Ey 348

‘©2005 SAP AG. All rights reserved 2005/02

JeuzIed dV¥S 88M [eUse}zU]

Ajuo

SAP Partner Only

Use

Internal

‘Ac200

Lesson: Logistics - General

Valuation Level

‘Company Code Level Plant Level

Material Stock |, || material stock Materia stock

Plant 10002000 Plant 1000, Plant 2000,

cere, |] | sell |

some se a

— ee

Valuation Areas = Plants

Figure 147: Valuation Levels -> Valuation Areas

‘The valuation level can either be at the level of the company code or the plant.

‘This setting is valid for the whole client. Once you have defined the valuation

level you can no longer change it. If it is absolutely necessary to subsequently