Professional Documents

Culture Documents

Guide To PE 12569785235

Guide To PE 12569785235

Uploaded by

Khurram ShahzadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide To PE 12569785235

Guide To PE 12569785235

Uploaded by

Khurram ShahzadCopyright:

Available Formats

001-02_Copyright

16/5/05

9:28 am

Page 1

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

003-04_Contents_2 pages

16/5/05

9:33 am

Page 3

Contents

Introduction

Kelly DePonte, Partner, Probitas Partners

25 Emerging managers: how to analyse

a first time fund

Kelly DePonte, Partner, Probitas Partners

Private equity fund manager due diligence and selection

Helen Steers, Partner, Pantheon Ventures Limited

Key points in the analysis of emerging managers Summary

Introduction The importance of private equity manager selection The challenges of private equity manager due diligence Private equity portfolio construction The typical due diligence process

31 Due diligence in emerging private equity markets

Ernest J.F. Lambers, AlpInvest Partners N.V.

15 Towards a standard private equity due diligence

questionnaire

Neil Rue, Principal, Pension Consulting Alliance, Inc.

Background A due diligence questionnaire is still essential Final thoughts

Introduction Investing in developing markets Key elements in the selection of private equity managers Past performance Strategy Team Terms and governance Concluding remarks

39 Mezzanine funds: risk, return and the equity mix

Dr. Matthias Unser, VCM Venture Capital Management GmbH

19 Track records: analysing unrealised returns

Peter Martenson, Former Director, Pacific Corporate Group LLC and Chris Hanrahan, Principal, Key Capital Corporation

Introduction Understand the GPs original investment thesis Evaluate the GPs value creation Understand valuation comparables Financial model of the portfolio Some final steps Conclusion

Overview of the mezzanine market Different strategies of mezzanine funds Risk and return of mezzanine investments Due diligence on mezzanine fund managers Conclusion and outlook

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

003-04_Contents_2 pages

16/5/05

9:33 am

Page 4

61 Legal due diligence: a Q&A session

Benjamin Aller, Partner, SJ Berwin, Craig Dauchy, Partner, Cooley Godward LLP, Robin Painter, Partner, Proskauer Rose LLP, Duncan Woollard, Assistant Solicitor, SJ Berwin

The panel Contributor biographies

Terms and conditions GP and portfolio company visits Use of questionnaires Analysing track record Due diligence on first time funds Sponsored funds

69 Benchmarking and performance measurement

Mark Weisdorf, Mark Weisdorf Associates Ltd. and Janet Rabovsky, Watson Wyatt & Company

DIRECTORY OF INVESTMENT 101 ADVISORS AND CONSULTANTS

Private equity the redux Having the right mindset Short-term performance measures: qualitative assessment of performance Longer term measures: quantitative performance measurement and benchmarks No one measure or benchmark is sufficient The requirement for a balanced scorecard

127 CONTRIBUTOR BIOGRAPHIES

133 APPENDIXES 134 Appendix One:

Private Equity Investors Association Recommended Due Diligence Questionnaire

77 Co-investment due diligence

Guido van Drunen, Kenneth Van Heel and David Julier, The Dow Employees Pension Plan

140 Appendix Two:

Pension Consulting Alliance, Inc. Due Diligence Questionnaire

157 Appendix Three:

Introduction Why establish a co-investment program? Issues to consider when developing a co-investment strategy Due diligence Conclusion

Private Equity International on fund investment due diligence

193 Appendix Four:

Private Equity Manager on fund investment due diligence

208 Appendix Five:

About Private Equity International

87 SURVEY 209 Appendix Six:

Due diligence and the Limited Partner

Private Equity International About Private Equity International Research Publications

Introduction Scope of investment activity Most important factors in due diligence

RESEARCH GUIDE

009-14_Pantheon_6 pages

16/5/05

9:33 am

Page 11

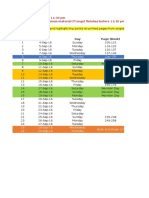

and the organisation and ensure that there are no obvious dealbreakers. If the investor is satisfied that the fund meets its preliminary criteria, full due diligence begins. People frequently ask how long a typical fund due diligence process takes. Unfortunately the answer is that the length of the due diligence phase varies wildly, since it depends upon the complexity of the fund, its geographic remit, the size of the managers organisation and the availability and quality of the information supplied by the manager. In addition, investors have varying levels of sophistication and knowledge, and often focus more on certain elements of the process than on others. In general, investors have to evaluate a basket of both quantitative and qualChart Three: Private Equity Fund Investment Decision-Making Flow Chart

itative factors, which can be grouped together under the following areas and assessed using the techniques described below.

People:

Assessment of the managers team, organisation, individuals experience, remuneration structure Multiple face-to-face meetings, including visits to the fund managers offices. Interviews with investment professionals, alone, and in groups, formally and informally. Organisational, ownership and remuneration analysis. Detailed reference checks with portfolio company management, other private equity professionals, bankers, accountants, lawyers, investors, and previous colleagues.

Process:

Private Equity Funds

Available in the Market

Industry Relationshps

Research

Intermediaries

Fund Relationship

Assessment of the managers deal sourcing, due diligence, monitoring and exit process Complete portfolio review. Assessment of the managers previous due diligence work, including checks on portfolio company files and monitoring systems. Interviews with portfolio company managers.

Philosophy and investment strategy:

11

Deal Sourcing Preliminary Analysis Does Not Fit Criteria Due Diligence Investment Committee Approval Negotiation and Legal Review Monitor and Oversight Exit and Distribution Management

Assessment of the consistency and suitability of the managers strategy, and its execution Understanding of the market within which the fund manager operates. Comparison of strategy and positioning with private equity managers targeting the same or similar markets (whether or not they are currently in the market with a new fund). Analysis of trends in previous portfolios of the fund manager to test for strategy drift (departure from a stated strategy). Evaluation of the managers ability to carry out the funds stated strategy.

Performance:

Commitment

Assessment of the managers track record, areas of value-add and repeatability

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

019-24_Track Records_6 pages

16/5/05

9:31 am

Page 20

both where the company is in reference to initial expectations and also the GPs projected exit method, exit valuation and projected timing. This provides a relatively unbiased assessment of whether the portfolio company is tracking on the original underwriting projections proposed by the GP. Incidentally, this data also should provide additional guidance regarding the appropriateness of the current carrying value. A prospective LP should attempt to place himself in the shoes of the GP in order to evaluate whether, at a macro level, the portfolio company presented a compelling investment opportunity. Investors should consider the characteristics of the business model that make the company an attractive investment, such as barriers to entry (e.g. brand/switching costs/scale economies) and potential substitutes, the nature and degree of competition in the companys markets and the companys respective positioning, the power of suppliers and buyers (e.g. the Wal*Mart factor) and the strength of the management team (including whether the management team is comprised of repeat, successful entrepreneurs). Additional considerations in the case of an LBO investment should include, among other factors: the companys ability to generate steady free cashflow; low capital expenditure requirements; financeability; consistent operating margins; and relative cyclicality. When evaluating a venture investment, one should additionally assess the market opportunity and whether competing VCs have financed companies in a similar space. The following questions illustrate the types of considerations that can facilitate an investors analysis of the initial investment thesis. Did the GP expect to grow the company organically, by acquisition, or a combination of both? If the GP projected top line (revenue) growth for the company, how realistic were these projections? What are the operating margins of comparable companies? If the leading company in the industry boasts operating margins of 30%, is it reasonable to expect the GP to achieve margins in excess of that benchmark? How did the GP plan to finance the companys growth, and was the company capitalised in a manner appropriate to the thesis? Several of these issues are discussed in more depth in Evaluate the portfolio

company value added of the GP below. Finally, in considering the GPs original investment thesis, one should remain cognisant of macroeconomic trends and cycles and how they, in turn, impact the IPO and merger and acquisition markets. These macro trends can dramatically affect company performance, exit valuations, and exit timing. In fact, there is such a high degree of correlation with macroeconomic trends that a rule of thumb has arisen, which states that on average, recession vintage years outperform for buyout funds, while nonrecession vintage years outperform for venture capital funds.

VC focus

Venture-backed companies carry some unique considerations relevant to assessing the original investment thesis. First, one must assess the pre- and post-money valuation at which the GP made the investment. One can, through Venture Economics or other databases, assess the reasonableness of that valuation relative to its peers. When a security software company is financed at a $50 million post-money valuation at its A round and is preproduct and pre-revenue, the robustness of the valuation may inhibit prospects for future out-performance because most venture realisations and exits average between $70 and $100 million while loss ratios of 50% are not uncommon. Second, one should also assess the cash burn rate and anticipated future cash needs of the company as well as the strength of its investing syndicate. This is necessary to assess future financing risk for the company and may provide insight as to the probability of an imminent writedown or writeoff. If a company has three months of cash left, has sought follow-on financing for a year, and has consistently missed its investment milestones, its prospects of attracting follow-on financing are limited certainly at its current valuation. Third, one must assess the status of the market that the start-up is targeting whether it develops as expected, or more slowly than expected, will impact the companys financing needs, runway, willingness of VCs to continue funding, size of the company and its ultimate success. Consider whether the market is crowded or out-of-favour in the context of a companys probable exit timing. If the company is maturing, the robustness of the exit environment via M&A and/or IPO for companies in its space is critical. Fourth and more generally, one needs to assess whether the company is hitting its milestones in product development, sales, management team build out, etc., as a failure to achieve these on plan will impact future valuations. Likewise, one should note whether the company has been able to attract strategic investment because the presence of strategic money may provide insight into the relative attractiveness of the market and commercialisation potential.

Evaluate the GPs value creation

An outgrowth of understanding the GPs initial investment thesis is discerning how the GP has added value since investment. Of course the type of value creation that is most important varies by the type of portfolio company investment and by the GPs original investment thesis. In general, investors need to ascertain the source(s) of value creation for a particular investment opportunity: operational improvements (leading to increased growth, profitability or both), debt paydown, and/or multiple expansion. However, some basic areas to focus on include the following: Increase/decrease of revenue and EBITDA improvement/deterioration of margins Increase/decrease in debt prudent/imprudent leverage Management team changes anticipated/un-planned management changes Strategic direction planned/unplanned changes in strategy such as expanding/contracting product lines, customers; marketing, etc. prudent development milestones

20

RESEARCH GUIDE

025_30 Emerging Manager_6 pages

16/5/05

9:46 am

Page 26

agers who have a demonstrated history of success as private equity investors. For fund managers, having individuals with significant attributable private equity track records as part of the team is crucial. Of course, a group that has a combination of private equity, operational, technical and investment banking skills is attractive, but the lack of a successful private equity track record including realisations makes an emerging manager much less credible. Even with some sort of track record in place, the most difficult issue to diligence is the team dynamic and its impact on stability. For true first-time funds where the team is coming together for the first time this is especially key. Any fund of institutional size roughly larger than $100 million or 100 million is difficult to manage with a single person. A team of three or more senior investors is usually preferred. If the team does not work well together if it in fact is not a cohesive team it can fracture and put the fund and investors at risk.

key in determining whether they still espouse the basic tenets of the team when they are not presenting as part of the group and that the corporate culture of the team is truly engrained in its senior members.

Previous working relationships within the team

Emerging managers: a definition

There is no one definition of an emerging manager. Different investors apply different criteria. However, the four classifications below broadly cover the sector: First time fund, first time investors In this case, a group of professionals looks to form an investment vehicle with a senior team that does not include a single individual with significant private equity experience. Fundraising for these groups is often very difficult; and often these groups actually fail to raise a fund. First time fund, experienced investor team In this case, a group of professionals who individually have extensive private equity experience, but have limited experience working together, form a fund. Groups like this would include the first funds of Fox Paine and Shasta Ventures. Team spinouts In this instance, a team of professionals who have worked together within a fund manager decide to spin out and form a separate firm. Examples include: Triton Partners spinning out from Doughty Hanson; Alta Partners, Alta Communications and Polaris all spinning out of Burr, Egan, Deleage; the recent creation of Diamond Castle by senior professionals from DLJ Merchant Banking; and the founding of Exponent by senior team members from 3i. First institutional fund Since the process of raising a first time fund is very difficult, many fund managers start the process differently by raising money on a deal-bydeal basis or creating a fund with significant support from government programs (such as the SBIC program in the US) or financial institution sponsors. These groups then approach the broader institutional market with a follow-on fund, but have at that point had a chance to prove their investment ability, their access to quality deal flow, and their strength as a cohesive team. Fund managers who started in this manner include Littlejohn & Company, W Capital and KRG.

26

Evaluating the team dynamic and potential team stability is an art rather than a science. It requires the experience of having performed due diligence on a large number of managers in the past. Key process items and areas of focus include:

Group and individual interviews

Besides interviews, of course, a review of previous working relationships amongst the team members is important. If the team is assembling for the first time, it is important to determine if theyve worked together before either on individual transactions while at other firms or even in other businesses before becoming involved in private equity. Personal social ties can also be important, though it must be noted that the tenor of those relationships is likely to be different from that in a high-pressure working environment. Last, it needs to be noted that even for team spinouts, drilling down in this area is important, especially if only a part of a group of investment professionals has left another organisation to form an emerging manager. Teams are not just collections of individuals, but rather a social grouping whose members play various roles dynamically interacting with other members of the group. When a subset of a group breaks off, the team dynamic can change dramatically sometimes for better, sometimes for worse.

Internal firm economics

There is no substitute for meeting with the team extensively in order to develop a feeling for how well they will work together. How they interact with each other while being questioned on their investment strategy, their investment process and their personal relationships is a key check on how well they have considered these issues internally before starting the fund marketing process. Importantly, time needs to be spent both in group meetings and on a one-on-one basis with senior team members. Group sessions are important not only for what is said but also for body language how they react to what the other is saying. This is important to help determine whether they agree on important issues, respect one another, and like one another all important factors in weathering difficult times. One-on-one sessions are also

The internal division of carried interest and ownership shares of the fund management company are always important in determining team stability, whether with an established or an emerging manager. A large disparity in the distribution of carry amongst senior investment professionals often leads to dissension and turnover and the structure of most private equity funds is not usually geared toward a single individual dominating the investment and company oversight process in a diverse portfolio of investments. Ownership positions in the management company not only drive certain economics, but also affect the ability of individuals to share in the direction of the firm, helping to build commitment to the team.

RESEARCH GUIDE

039-60_Mezzanine Funds_22 pages

16/5/05

1:00 pm

Page 42

accord and have already started to triage their portfolios. This has limited the availability of senior debt and boosted demand for mezzanine. Going forward the picture for independent mezzanine funds with a focus on small and medium sized companies is a good one, even if activity levels amongst the banks picks up. Sponsors often favour independents over banks for supplying mezzanine for a number of reasons. If a bank holds both senior and mezzanine debt on its balance sheet it will usually favour the senior if something goes wrong. Companies and sponsors therefore see banks as less flexible than independent mezzanine players and without the same interest in maintaining equity value. In a wind-down situation, a bank would rather liquidate the assets

instead of viewing the company as a going concern. Market dynamics are quite different, however, for large transactions. This end of the market has seen unforeseen inflows of capital from structured vehicles, hedge funds and other institutional investors recently. With pricing for mezzanine under severe pressure, it is very hard for independent mezzanine funds to maintain their previous position at the forefront of transactions.

Different strategies of mezzanine funds

There are six dimensions along which mezzanine fund managers can define their strategies:

Chart Three: Different strategic profiles in the US and Europe

Strategic Choices

42

Strategies in the Market

1 with warrants 2 sponsored

Equity orientation Background of transaction Size of investee companies

6 leveraged

3 large caps

Degree of independence Industry focus Fund structure Geographical focus Europe US

5 diversified 4 independent

RESEARCH GUIDE

039-60_Mezzanine Funds_22 pages

16/5/05

1:00 pm

Page 48

Chart Seven: Captive vs. independent funds

Distribution of deals in CEPRES independent PE captive bank/insurance captive 70.7% 18.7% 10.8%

20%

18.1% 16.1%

1.6 1.5 1.4 1.3 1.37 1.45 1.44

9% 8% 7% 6%

8.5%

15%

14.1%

7.2%

7.0%

48

Gross IRR Multiple Loss rate

One of the most important strategic choices of a mezzanine fund manager is the one between sponsored and non-sponsored transactions. While there are still many funds that follow both routes, it seems that fund managers are increasingly focusing on one or the other strategy as the market matures. Consequently, in Europe most fund managers still tend to do both sponsored and non-sponsored transactions, while in the US many fund managers started with the same approach a couple of years ago but now focus on one of these two strategies. Chart Six illustrates that, while they carry higher risk, non-sponsored transactions deliver higher returns. Not only are the loss rates for non-sponsored transactions higher than those for sponsored transactions (8.9 per cent vs. 7.3 per cent) but also the equity cushion is lower (28.3 per cent for non-sponsored deals

vs. 34.1 per cent for sponsored deals). Finally, the higher risk also stems from a higher percentage of invested capital that is invested in common or preferred stock (17.4 per cent for nonsponsored vs. 5.3 per cent for sponsored deals). What is the effect of being a captive fund on the risk and return of mezzanine transactions? Does getting the first look at a deal really produce higher returns? We distinguish between independent funds and funds that are affiliates of either a private equity firm or a bank or an insurance company. The results shown in Chart Seven are somewhat mixed. While independent funds achieve higher gross IRRs than captive funds their multiple is lower. The explanation for this embarrassing result is that captive funds invest a higher percentage in the equity (which typically is paid back only after several years with no current

RESEARCH GUIDE

039-60_Mezzanine Funds_22 pages

16/5/05

1:00 pm

Page 52

shift strategy and enter a market segment where it expects more favourable competitive conditions, the fund manager must be in a position to execute this new strategy successfully. For example, a mezzanine manager that focussed on sponsored deals in the past and now wants to do more nonsponsored deals needs access to new sources of deal flow. This requires that a new network of deal sources has to be built, as the manager can no longer rely on equity sponsors and banks as providers of attractive deals. Quality of deal flow Mezzanine funds generally compete not on the basis of price, but on the basis of relationships and the flexibility and reliability they can offer. Therefore, it is important to have established relationships with equity sponsors, banks and

financial intermediaries. Proprietary deal flow is relevant to avoid auctions in which pricing is highly competitive.

Management team

Quality of team For a mezzanine investor it is important to have both a creditors and an equity holders perspective on transactions. While the economic, financial and legal risks associated with leverage are of primary importance, there is also an interest in the upside potential of the company that has to be accurately assessed. Especially important is that the team members have worked in a relevant space. For example, for a midmarket mezzanine fund it is vital to have bankers that were active in mid-market lending, leveraged finance or M&A. For a non-sponsored fund a background in private equity is

Chart Ten: Proprietary rating system

Category

52

Investment Strategy

A Expected B Return Rating C D A B C D

Fund C

Return factors Leadership Consistency Quality of deal flow

Risk factors Deal flow sources Due diligence Covenants Monitoring and risk management Proportion of recaps Investor structure Continuity Carry split Performance attribution Team structure and succession plans Standard deviation Loss rate Contractual returns Leverage Equity risk

Fund A

Fund B

Fund D

Management Team

Team quality Commitment Value added

Expected Risk Rating

Track Record

IRR Multiple

RESEARCH GUIDE

069-76_Benchmarking_8 pages

16/5/05

9:39 am

Page 70

best determine how to measure its performance. This is especially true during the early years, when the J-curve seems to generate a drag on returns the short-term price for a longer-term illiquidity premium. As we will demonstrate, fiduciaries (boards, trustees, CIOs and portfolio managers alike) can be comfortable with the challenges associated with measuring the performance of a private equity portfolio, particularly in the early years, if performance is measured within the proper context.

life is the only true measure of the GPs performance, quantitative measures during the first five years, and arguably prior to the seventh or eighth year of a funds life, can be challenging. Of course, fiduciaries have a responsibility to monitor investment performance and oversee managers in the short term as well as the long term, and portfolio managers must have some basis for deciding whether to invest in a GPs subsequent private equity fund prior to the maturity of the current vehicle. Therefore, appropriate measurement tools need to be determined and utilised over both the short and longer term.

What are you trying to measure?

An important consideration prior to determining which performance measures should be utilised is what exactly is one trying to measure? Possibilities include: The performance of the private equity portfolio relative to one or more of: a targeted or required rate of return (nominal, real or risk-adjusted) public equity the universe of private equity funds the private equity portfolios of peer groups The performance of the GP relative to its stated investment thesis and objectives. The performance of the GP relative to its peer group (e.g. leveraged buyouts, venture capital, mezzanine debt, etc.). The performance of underlying portfolio companies. The skill of the investment team in selecting superior funds and GPs. The skill of the investment team in deciding to overweight or underweight certain styles, geographies, and strategies at various times during economic and capital market cycles. All of the above are useful things to measure and it is for fiduciaries to determine their relative importance and priority. Clarity with respect to what different measures of performance actually measure is also helpful in performing attribution analysis, i.e. assessing the various components of performance, outperformance and underperformance.

Having the right mindset

Private equity funds tend to involve commitments of up to 1012 years (and up to as much as 15 years for funds of funds). Such funds typically provide the investment manager (known as the general partner or GP) five to six years to find attractive investments (in private companies) in which to deploy the capital, and another five to six years to add value to portfolio companies so as to maximise their exit value. The result is that private equity funds have a typical weighted average life of between 7 and 8 years. For pension plans, endowments and foundations, the long-term nature of private equity investment is often a closer match to the duration of their liabilities and obligations than most other asset classes. Success in private equity is dependent on internal portfolio managers, private equity fund of funds, consultants, gatekeepers or advisors (collectively known as limited partners or LPs) selecting external managers (GPs) who can deliver superior returns. Given the wide dispersion of possible returns, and long investment time horizon, fiduciaries require a robust and extensive due diligence, assessment and selection process. Industry data illustrates that median returns for private equity funds, after costs, over ten year periods, are often below that of investing in public equity indices. Other studies have noted that top quartile managers have continued to deliver top quartile returns in other words, there is a persistency of success.2 Since cash return to investors over the 10 to 15 years of a funds

2

Short-term performance measures: qualitative assessment of performance

During the first five years of a private equity program, prior to material cash returns from exits and subsequent distributions, performance of the portfolio, individual GPs and investment teams must by necessity involve more qualitative assessment. The following outlines a number of criteria that can be monitored and included in an assessment of interim performance.

Investment thesis

70

Is the GP disciplined in staying within the original investment thesis and strategy, to the extent it remains relevant, and within the funds area of competence or competitive advantage (e.g. geographic, sectoral)? How informative and timely is the manager in communicating to investors with respect to the investment environment, emerging themes, and planned adjustments to strategy and tactics? Are the tactics employed by the GP responsive to changes in the economic and capital market environment, and given competitive and other dynamics in the industries in which the fund invests?

Pace of investment

What percentage of total capital committed to the fund has

Steve Kaplan and Antoinette Schoar, Private Equity Performance: Returns, Persistence and Capital Flows University of Chicago Graduate School of Business, June 11, 2003.

RESEARCH GUIDE

077-86_Co Investment_10 pages

16/5/05

9:47 am

Page 83

"Show me the money!" Cuba Gooding, Jr. in Jerry McGuire

trying to answer are whether or not the technology, product or service does what it is purported to do, and if not, why; and what will drive adoption of the product or service? In established companies, it is important to understand the market and competitive conditions driving the companys revenue and margin projections, and to identify risks associated with the operating plan. This may be a section of the due diligence process where an institution is more reliant on the GP, third-party consultant or industry expert. However, with some guidance, an institution should be able to clarify the companys value proposition and determine if its success is predicated on factors outside of the control of the company, such as the creation or development of another technology or market, or the establishment of an alliance with a complementary company.

Financials: records and projections

overall quality of those revenues. One must also be cognisant of the potential and propensity for a companys management and/or the sellers to use unrealistic revenue projections. It is prudent for a co-investment manager to discount these projections considering expected market conditions and managements track record of meeting stated revenue targets. Customer reference calls can be helpful in verifying future revenue ranges, though even these data points must be considered in context. Another financial issue that an institution must consider is how much capital has already been injected into the company and how much is expected to be raised. This issue is especially important when considering managements use of capital and their ability to meet business objectives. An institution may want to avoid companies that have consumed financial resources in excess of comparable companies at similar stages of growth. Within the realm of conducting due diligence on the financials of a proposed investment, particularly in non control co-investments, it is important for an institution to evaluate the companys capitalisation (CAP) table and determine the companys ownership structure on a fully-diluted basis. This will provide insight as to the investor base that has effective control over the company and its direction. In order to ensure alignment of interest, an institution should also carefully consider the management and employee ownership and option pool (contained within the CAP table). The appropriateness of issued options will be dependent on several factors, including the stage and type of company, quality of management, and managements ability to achieve business objectives. A typical allocation for management and employees is 10-20% depending on the stage of the company, not including founders shares. In certain types of transactions, investors may also require that management invest or maintain a certain level of ownership in the company.

Market and industry

Once the product/service and value of a company have been judged, those managing an institutions co-investment program will want to review the financial records and management projections of the portfolio company in an attempt to assess its fiscal health and the feasibility of achieving the value creation. The only thing we are sure about is that financial projections are rarely correct and often optimistic or inflated. Although GPs will typically have a companys financial statements audited by a third party, the institution must review and understand the financial statements of the company. This review will help the institution ascertain if company management is fiscally responsible and focused on the value-creating milestones and operating plan. One will also want to stress-test the financials of the projected operating plan. This would allow the institution to determine if the company would have the capacity to remain economically viable given an extended downside scenario, and the key sensitivities driving success. When reviewing a companys financial statements, special attention should be paid to historical and forecasted revenues. Those managing the co-investment program should have a good understanding of how the companys management imparts information regarding revenue and how that translates into the

83

Most likely prepared in parallel to the assessment of a companys value proposition and revenue projections, the managers of the co-investment program should conduct a study of the industry

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

087-100_Survey_14 pages

16/5/05

3:24 pm

Page 90

% of Respondents

levels of interest from limited partners. Mid-market funds are seen by investors to have a number of advantages over large buyout funds. Crucially, the mid-market is seen by many to be less efficient than the large buyout market. A comparative lack of auctioned deals not only means that prices are often lower, but also gives GPs managing mid-cap vehicles a better chance of securing proprietary deal flow. As such, they are seen to offer better returns prospects. While many of these arguments are valid, one can question whether investors faith in the mid-market sector is misplaced. The mid-market is an increasingly crowded space, with seemingly every other GP keen to ensure it is seen as a mid-market player. It is also becoming a much more efficient segment of the private equity market, with deals increasingly conducted by investment banks and other advisors via auctions. As such, the idea of proprietary deal flow may be something of a myth. This is particularly the case in mature markets like the US and United Kingdom, which have heavily competitive markets where auctions are commonplace. In such an environment pricing pressures may be as acute as in the larger buyout segment of the market. And of course, if every institutional investor is keen to invest in the mid-market, it stands to reason that not all can get into the top-performing funds. Less than 80% of respondents indicated that they invest in large buyout funds. It is likely that this lower percentage reflects concerns over whether such vehicles can be amongst the best performers in the industry, given the sheer size of the transactions they are undertaking and the fact they are operating in a highly competitive, structured and auction- and process-driven segment of the market. It may also reflect concerns over fee sizes, both management and transactional. Finally, the sheer size of such vehicles means access can become an issue for some investors, as a result of minimum commitment levels being pegged too high for them to reach. Unsurprisingly, it is North America where the largest proportion of limited partners are making fund commitments, with 96% of respondents stating that they invest in North American vehicles

(see Chart Five). Almost 85% of limited partners are also investing in Western European funds, with the same proportion also backing UK vehicles. This is a strong indication that Western European markets on the Continent have reached a substantial level of maturity. Other markets see less activity, with the most substantial being the Asia Pacific region. Fully half of all respondents state they have appetite for Asian Pacific private equity and venture capital funds, a reflection of the current strong interest in this part of the world. Many private equity houses view Japan and China in particular as interesting opportunities and this is clearly translating into LP interest in backing funds investing in the region. And interest will certainly have been boosted by the huge returns made by the Ripplewood-led syndicate from the listing of Japanese bank Shinsei, a transaction that has been described as amongst the most lucrative private equity deals of all time. 55% of limited partners report that they purchase fund interests on the secondary market (see Chart Six), while 47% indicate that they undertake direct investment in unquoted companies, either directly themselves or as co-investments alongside investee funds. The fact that more than half of investors are actively purchasing interests on the secondaries market (and presumably also selling interests as well) is a strong indicator of how much the institutional market has matured in recent years. Interest in secondary funds managed by the likes of Landmark Partners, Coller Capital and Greenpark Capital has been extremely strong in recent years. Furthermore, investors are now beginning to use the secondary markets to actively manage their private equity portfolios, focusing the number of GP relationships they have on a smaller number of better-performing managers and gaining exposure to earlier year vintage funds managed by such groups. This shows a level of understanding, sophistication and experience of private equity that one would not have expected from such a large proportion of the limited partner community but a few short years ago.

Chart Four: Types of private equity and venture capital funds invested in

100 90 80 70 60 50 40 30 20 10 0

M ark et Bu arl yo yS ut tag eV en G La tu ro re ter wt sta hC ge a pit Ve nt al ur eC ap i tal La rg eB uy ou t Se co nd ari Di e str s ess ed De bt M ezz an Fu in e nd of Fu nd s Re al Es t a In te fra str uc tu re Se e d/ E O th er

90

M id-

Chart Five: Geographical regions invested in

Other Emerging Markets Latin America Central & Eastern Europe Israel Asia Pacific Western Europe (excl. UK) United Kingdom North America 0 20 40 60 80 100

% of Respondents

RESEARCH GUIDE

087-100_Survey_14 pages

16/5/05

3:24 pm

Page 94

is generated. Investors may also be prepared to give way on terms if the GP in question is top tier. The most well established and best-performing managers are usually able to extract more favourable terms, due to their historical performance and the strong demand for their vehicles. A first time or emerging manager, by contrast, would likely find investors much more robust when it comes to negotiating terms. Terms must also be considered in aggregate rather than individually. As an example, an investor may be willing to agree to the non-existence of a keyman clause if the partnership agreement contains a robust no-fault divorce provision. At the end of the day, if an investor declines to commit to a fund due to terms, it is usually because of the terms and conditions of the vehicle as a whole, rather than because of any one clause. Nonetheless, some areas of the partnership agreement are given more weight by investors and are often the subject of intense negotiation between GP and LPs. And for some investors, certain terms will be sacrosanct, with either their absence (or presence in some cases), or the fact that they are not structured to the investors liking, enough to cause the institution to walk away. Three areas in particular can be seen as deal breakers: the lack of a clawback; the lack of keyman clauses; and the absence of a GP contribution to the fund (see Chart Ten). The following were also offered by investors as potentially deal-breaking issues in addition to those illustrated in Chart Ten: excessive transaction fee retention (one respondent indicated it had declined to invest in a fund due to this issue); excessive management fees; a failure to net transaction fee income off against management fee; cherry picking, or special treatment to particular LPs; transfer provisions; and overly restrictive FOIA-related terms, such that confidentiality clauses in the partnership agreement are overly binding. The latter is especially an issue for US public pension plan sponsors and possibly also for their counterparts across the Atlantic, now that the UK has its own Freedom of Information legislation (although it seems the effect of such legislation may be less pronounced in the UK than in the US). The main issue for investors seems to be the GP contribution, with more than 80% of respondents stating that a lack of same

could be a deal breaker. Investors are keen that GPs put skin in the game by committing their own capital to the funds they are seeking to raise. Low GP contribution levels are increasingly being seen as an important screening issue for investors. As well as serving to further align the interests of the management team at the GP with that of LPs, it is also an indication of confidence on the part of the GP as to its strategy and performance expectations. Most if not all investors would be extremely reluctant to commit to a vehicle if the GP wasnt prepared to put its money where its mouth is and risk its own capital. Furthermore, such commitment should be meaningful given the circumstances of the GP group in question. While 1% to 2% is often seen as a market standard for GP contribution levels, this amount might be excessive for a newly formed group raising its first fund. By contrast, for the executives at a GP on their fifth or sixth fund that have already made substantial sums from previous vehicles, such a figure might not represent much of a burden in terms of their personal net wealth.

Chart Ten: Deal breaking terms and conditions

No Hurdle No No-Fault Divorce Provisions Not Sharing Transaction Fee Income Deal-By-Deal Carried Interest No Claw Back Provision No Keyman Provisions No GP Contribution to the fund 0 10 20 30 40 50 60 70 80 90

% of Respondents

94

GP and portfolio company visits

Limited partners clearly see substantial value in visiting the GPs with which they are considering investing. Over 70% of respondents always visit the offices of GPs as part of their due diligence process. A further 20% often undertake such visits. A mere 8% and 1% respectively only rarely visit or never visit (see Chart Eleven). By visiting the office(s) of a GP, investors get to see the manager in its natural environment (as it were), allowing them to get a greater handle on how the GP interacts as a team; what the working dynamics are like and so on. In particular, it offers LPs a chance to meet with and interview junior members of the GPs team, an important consideration given the fact such individuals will rarely be part of a pitch given by the GP. Many investors put such store in the value of visiting with a GP at its office that they make multiple visits and/or endeavour to visit all the offices the manager maintains. Clearly there is no substitute for pressing the flesh and, for many investors in private equity funds, no visit means no investment.

Chart Eleven: Do you visit the offices of GPs as part of your due diligence process?

Rarely Visit 8% Never Visit 1%

Often Visit 20%

Always Visit 71%

RESEARCH GUIDE

101-126_Directory Section

16/5/05

9:56 am

Page 106

Bear Stearns Asset Management, Inc.

Address: Phone: Fax: Other office locations: Website: Email: Private Equity Division, 383 Madison Avenue, New York, NY 10179, United States of America +1 212 272 9062

www.bearstearns.com

Callan Associates Inc.

Address: Phone: Fax: Other office locations: Website: Email: 101 California Street, Suite 3500, San Francisco, CA 94111, United States of America +1 415 974 5060 +1 415 512 0524 Atlanta, Chicago, Denver, New Jersey www.callan.com dunleavy@callan.com

106

CAM Private Equity Consulting & Verwaltungs GmbH

Address: Phone: Fax: Other office locations: Website: Email: Zeppelinstr. 4-8, Cologne, D-50667, Germany +49 22 1937 0850 +49 22 1937 085 19 www.cam-pe.com

Cambridge Associates LLC

Address: Phone: Fax: Other office locations: Website: Email: 100 Summer Street, Boston, MA 02110-2112, United States of America +1 617 457 7500 +1 617 457 7501 London, Menlo Park, Singapore, Washington DC www.cambridgeassociates.com

RESEARCH GUIDE

133-139_App 1_PEIA Question

16/5/05

9:35 am

Page 134

Appendix One: Private Equity Investors Association Recommended Due Diligence Questionnaire

134

Private Equity Investors Association (PEIA) was formed in 2002 in order to promote the interests of institutional investors in private equity partnerships. It aims to achieve this by providing (1) a focal point for raising standards and promoting best practice, (2) a forum for communicating both nationally and internationally with general partners and other interested bodies, and (3) a means for exchanging knowledge, information and experience. Members are drawn from the world of investors in private equity and represent pension funds, charities, family offices and insurance companies. At present, the Association can claim to represent many of the leading independent private equity investors in the UK. As part of its programme to promote best practice, the PEIA formed a working party to develop a standardised questionnaire for limited partners to use in their due diligence process. It is hoped that it will be adopted by both limited and general partners and thereby improve the quality and quantity of the information presented in due diligence memoranda. It is recognised that the questionnaire does not cover all the needs of all limited partners and that some limited partners will request additional information. Please note that the PEIA recognises that this is the first publication of this questionnaire and is subject to change. If any interested parties have suggestions or recommendations then these will be carefully considered by the PEIA and may be incorporated in later versions. Any such comments should be made to Robert Baird, a director of the PEIA. He can be contacted on +44 (0) 1689 826837 or by e-mail at: robert@rsmbaird.ndo.co.uk.

PART I - Initial Due Diligence Material

1. General Fund Information

3. Fundraising and Corporate Governance

a. Full legal name and address of Fund. b. Legal and tax structure of Fund (diagram if available). c. Jurisdiction of Fund. d. Full legal name and address of General Partner/Manager. e. Primary Fund contact person and contact details (phone, fax and e-mail). f. Brief overview of history of organization including information on when and how founded, funds under management currently and an overview of all investing activities carried out by the firm.

2. Placement Agents

a. Target Fund size including maximum (hard cap) and minimum target sizes, together with minimum and maximum size of individual LP commitments. b. Total commitments received to date and, if available, the names, contact details and amount committed by each investor. c. Actual or anticipated first closing date. d. If applicable, details of investments made to date. e. Expected total number of closings and date of anticipated final closing. Details of provisions regarding the admission of additional investors after first closing. f. General Partners commitment to the Fund. g. Executive commitment to Fund. h. Describe the Funds policy for making distributions in cash or in specie and the method for calculating the carried interest for in specie distributions. Please state the prior history of in specie distributions. i. Describe the Funds policy regarding the reinvestment of previously distributed amounts. If permitted, describe the time constraints. j. Describe the Funds policy regarding the reinvestment of

a. Name all placement agents and advisors, including contact names, addresses, e-mail addresses, telephone and fax numbers. b. Describe the placement agreements, including compensation structure. Please indicate who will be responsible for payment of placement agent compensation, and how and when compensation will be paid. c. Nature of any affiliations between placement agent(s) and General Partner.

RESEARCH GUIDE

140-156_App 2_PCA Question

16/5/05

9:36 am

Page 142

3. Please discuss how interests will be aligned between the General and Limited Partners. 4. Please provide your pro forma annual budgets for the General Partner/management companies for all funds you currently manage (including the proposed new fund). Note the duration of the investment/commitment periods for each fund. 5. Please quantify the following financial information on the individual principals of the General Partner:

Also, please provide full details (or a copy of ) your planned distribution procedures. 9. For all principals involved with the Partnership, please complete the table titled Current Board Responsibilities on the next page. Include all Board responsibilities (e.g. portfolio company boards, public company boards, non-profit boards, other boards). 10. Please provide copies of all side letter agreements with any investors, including but not limited to all Limited Partners and General Partners.

Total Annual Expected Compensation From Other Sources Carried Interest Compensation If Fund Meets Objective (see Section 1, Ques. 1c)

Partners will not be liable for any issues beyond the term of the partnership? 15. Identify and discuss any actual or potential conflicts of interest with respect to the General Partner and professionals involved with the fund. 16. Please describe for cause and general termination rights proposed in the Limited Partnership agreement.

Initial Base Fee Initial Capital Base: Committed Capital Contributed Capital Other Capital Base (please describe) Fee Reversion Features New Asset Base when Commitment Period Terminates Sliding Fee Reduction over Time Other Features: Fee Scaled on Capital Raised Advisory Fee Offsets Other Features (please describe)

% Check one that applies

Principal Name

Expected Capital Contribution $2,500,000 $8,500,000 1,000,000 500,000 10,000,000

Carry Points

Total Annual Expected Compensation From This Fund

Check all that apply

Joe Smith Total All Principals Affiliate 1

5 17 2 1 20

142

Affiliate 2 Total Principals and Affiliates

Check all that apply

6. For each principal in the partnership, please complete the following carried interest schedule for all prior partnerships the individual has an interest in:

Principal or Affiliate Name Joe Smith Total All Principals and Affiliates Allocated Carried Interest $7,482,000 45,257,000

11. Under the proposed partnership agreement is the General Partner allowed to coinvest alongside the Limited Partners outside the Limited Partnership?

Amount of Allocated Carried Interest Distributed $1,243,000 $6,722,000 Amount of Allocated Carried Interest Vested $6,239,000 $38,535,000

Type of Distribution Return of LPs invested capitalin individual investment Return of LPs management fees associated with individual investment Return of LPs share of writedowns associated with other investments LPs Preferred return on capital invested in individual investment Return of LPs share of management fees associated with all partnership investments LPs preferred return on all of a Limited Partners contributed capital Other

Occur before Profit Sharing?

7. Please use the table to the top right to provide full details of your planned management fee structure. 8. Using the table to the bottom right please highlight what distributions take place before profit sharing (i.e., carried interest) takes place:

12. Please identify all principals and/or affiliates of the General Partner that will be coinvesting. 13. Will an advisory board give final approval to distributions? Who will be the members? 14. What steps have you taken to ensure that the Limited

RESEARCH GUIDE

140-156_App 2_PCA Question

16/5/05

9:36 am

Page 151

Schedule I Performance Summary for ABC Partnership, L.P.

A

Company Level Performance - Gross of Fees Fully Distributed Investments

K

Pre Carry Yr. Of First Investment XXXX Yr. Of Exit XXXX Contributed Capital* $ Distributed Capital $ Distr./Contr. Multiple x.xX Distributed Capital $

L

After Carry IRR % Distr./Contr. Multiple x.xX IRR %

Company A Company B Company C G Company D Company E Company F Company G Aggregate of Fully Distributed Investments Partially Distributed Investments

x.xX

x.xX

P F

Yr. Of First Investment Company H XXXX Company I Company J Company K Company L Company M Company N Company O Company P Company Q Company R Company S Company T Aggregate of Partially Distributed Investments S $ Contributed Capital $ Terminal Value Cash-On-Cash - Using Adjusted Terminal Values (ATV) Pre Carry Distributed Capital Distr./Contr. Multiple x.xX IRR % Distributed Capital $ After Carry Distr./Contr. Multiple x.xX IRR % Terminal Value $

Q

Using Unrealized Values (UV) Pre Carry IRR % After Carry IRR %

151

x.xX

x.xX

B

Total Fund Performance - Gross of Fees Management Fees (before advisory fee rebates) less: advisory fee rebates Net Management Fees Total Fund Performance - Net of Fees

$ $ $ $

x.xX

x.xX

T

$ $ x.xX % $ x.xX % % % %

Notes: If investment history is less than one year, then IRR is NM - Not Meaningful Show negative IRRs, do not insert alternative explanations or acronyms

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

157-192 App 3_PEInternational

16/5/05

9:36 am

Page 158

Chart Two: Ratio of distributed to contributed capital for venture fund quartile boundaries, as of June 2003

5 Top Quartile Median Bottom Quartile Breakeven

So far the argument has only taken into consideration venture funds. Does the same logic apply to all private equity funds? Data in Venture Economics for non-venture funds is relatively sparse, but whats there is suggestive. Chart 3 looks at how long it takes for top-quartile funds in aggregate to pay back contributed capital, for vintage years 1986-1996. This shows that top-quartile venture funds and top-quartile non-venture funds (buyouts, distressed, and so on) have surprisingly similar payback statistics. Out of 11 vintage years in this arbitrary sample, the non-venture top quartile paid back faster in four cases, the venture top quartile paid back faster in six cases, and there was one tie (4.25 years for aggregate top-quartile venture and non-venture funds formed in 1993). And it is worth bearing in mind that this sample period includes the extraordinary years for venture funds of 1995 and 1996. As a result, the results discussed above apply just as well to non-venture funds as to venture funds, and a diversified portfolio is more likely to give the best cashflow over time than a portfolio that concentrates on one sector alone. This analysis provides some guidance on how one might construct the best private equity portfolio, for both IRR and payback rate. First, pick strong managers of all kinds dont just concentrate on the strategies currently in fashion. Next, build a well-diversified portfolio of perhaps 15-25 funds from among these managers. Over the long term, we believe such a portfolio is the best bet, whether measured in terms of IRR or time to break even.

Barry Griffiths is a Vice President at Goldman Sachs and Head of

Chart Three: Breakdown times for top-quartile vintage-year aggregates, 1986-1996

Metric Mean time to breakeven Fastest time to breakeven Slowest time to breakeven Number of years faster

Source: Thomson Venture Economics

Venture 5.4 2.5 10.0 6.5

Non-venture 5.6 3.5 7.8 4.5

3

Multiple

0

1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000

158

Vintage Year

Source: Thomson Venture Economics

(Source: Thomson Venture Economics)

Why does this happen? As Chart 2 reveals, cash returns in the venture universe are right-skewed. That is to say, the best funds are farther above the median than the median is above the worst funds. As a result, the best funds in a portfolio speed up the return of capital more than the worst funds slow it down. This observation that a portfolio of funds will generally return capital faster than the median fund in the universe the portfolio is drawn from applies just as much to top-quartile venture funds as it does to the venture universe as a whole. Its easy to see that the top quartile has some funds that return capital very quickly, but no funds that return capital very slowly. In other words, the top quartile is itself right-skewed. Therefore a portfolio of top-quartile funds will usually return capital faster than the median top-quartile fund.

Quantitative Research for the Private Equity Group (PEG), which manages approximately $11 billion in capital commitments across primary partnership, co-investments, and secondary partnership investments. He can be reached at barry.griffiths@gs.com. This material is provided for educational purposes only. In the event any of the assumptions used in this material do not prove to be true, results are likely to vary substantially from those shown herein. Opinions expressed are current opinions as of the date appearing in this material only.

RESEARCH GUIDE

157-192 App 3_PEInternational

16/5/05

9:36 am

Page 172

Now, from an ex-ante perspective the expected return on the private equity investment depends on the expectation with respect to the benchmark return and the PME. Specifically, the expected returns can be written as follows:

Table 3: Pooled sample distribution of PE Funds PMEs

PME (MSCI Europe) VC Liquidated Funds Average Median 75th Percentile 25th Percentile Stdev value-weighed PME Sample I Average Median 75th Percentile 25th Percentile Stdev value-weighed PME 0.98% 0.75% 1.17% 0.40% 1.15% 0.94% 0.86% 1.24% 0.59% 0.51% 0.96% 0.82% 1.23% 0.51% 0.89% 1.04% 1.14% 1.06% 1.44% 0.66% 1.02% 1.24% 1.02% 1.43% 0.63% 0.59% 1.20% 1.03% 1.43% 0.66% 1.11% 1.27% 0.82% 0.68% 0.97% 0.33% 1.01% 0.90% 0.89% 1.24% -0.51% 0.53% 0.86% 0.80% 1.10% 0.42% 0.81% 0.94% 1.11% 0.81% 1.38% 0.54% 1.51% 1.07% 1.09% 1.37% 0.64% 0.60% 1.09% 0.99% 1.38% 0.58% 1.14% 1.21% BO TOTAL BME (JPM European Govt. Bond) VC BO TOTAL

Taking into account that y and x defines the standard deviation of the random variables x and y, the expectation of the yearly compounded rate of return is defined as follows:

172

Of course, one may not only be interested in making an assessment of the future return of investment strategy 1, but also in the riskiness implied by this strategy. This can be expressed in terms of variability of the final wealth generated by the investment strategy or, what is equivalent, in terms of the variance of the yearly rates of return. Under the assumption that x and y are identically and independently distributed (iid) it follows:

Sample II Average Median 75th Percentile 25th Percentile Stdev value-weighed PME 1.01% 0.76% 1.22% 0.44% 1.15% 1.06% 0.92% 1.35% 0.61% 0.70% 1.03% 0.88% 1.27% 0.55% 0.95% 1.16% 1.25% 0.99% 1.27% 0.60% 1.38% 1.06% 1.13% 1.42% 0.77% 0.74% 1.23% 1.07% 1.45% 0.66% 1.10% 1.30%

From this it follows that the variance of the periodic yearly returns is calculated as follows:

Finally, it should be noted that under this approach the correlation coefficient of the continuously compounded yearly returns of the private equity investment and the benchmark investment is defined as follows:

Now, if this approach is used for making an inference on the return characteristics of the private equity industry as a whole, it should be emphasised that the distributional parameters of the PME cannot be estimated on the basis of table 3. There, the distribution of the PME on the basis of all sample funds is reported, i.e. a pooled distribution. However, strategy 1 implies that an LP invests in all the funds available at a given point in time, i.e.

in all the funds with a given vintage year. Therefore, the relevant PME distribution of such a strategy has to be derived on the basis of all the vintage year portfolios available in our sample. Basically, this is the time-series distribution of the PME. In sample 1, 20 of these vintage year portfolios can be constructed leading to the results presented in table 4. As one would expect, it turns out that the PME volatility of several funds portfolios is lower than the PME volatility of the single funds. Moreover, it turns out that this time-series approach leads to considerably higher average PMEs. Now, the results of table 4 can be used for estimating the distri-

RESEARCH GUIDE

157-192 App 3_PEInternational

16/5/05

9:36 am

Page 179

Chart Two: Payback percentage per vintage year USA PAYBACK PERCENTAGE PER VINTAGE YEAR USA

100%

80%

Average Payback Period

For liquidated funds that did break even, what were the average and median payback periods? Table 1 shows that for buyout funds, the average payback period is approximately seven years, whereas venture funds took more than eight years on average, with European venture funds showing the longest payback period. Note that the average and the median payback period are very similar.

Is capital being returned faster?

Chart Three: Average payback period AVERAGE PAYBACK PERIOD

14 12 10 8 6 4 2

Payback Percentage

60%

40%

20%

US VC

0% 1983 1984 1985 1986

US BO

1987 1988 1989 1990 1991 1992 1993 1994

Size

It is important to consider how the payback characteristics described above might develop over various vintage years. In particular, can one observe trends in either the payback percentage or the payback period? In other words, is the industry paying back faster than it used to? In order to investigate the behavior of the payback characteristics over time, we analyse a larger sample of 1,057 funds in the dataset that were raised in the time period from 1983 to 1994. It should be noted that when we investigate payback characteristics of non-liquidated funds per vintage year, the results are naturally biased downwards: assuming that the funds in the dataset do not change, every fund that reaches break-even after December 2003 (the date of our data sample) will increase both the payback percentage (more funds pay back) and the average payback period (payback periods of funds reaching breakeven for any given vintage year are longer than the current average). We choose 1994 as a cut-off point to reduce the bias introduced through funds that are still active but have not yet reached break-even. Chart 2 shows that the payback percentage of US private equity funds has proven to be surprisingly stable across vintage years. Generally 75 to 80 percent of US buyout funds paid back all drawn capital with only the 1990, 1991 and 1994 vintages showing a failure rate over 40 percent. For US venture, one observes that approximately 70 to 75 percent of all funds paid back all drawn capital. These figures coincide with the average payback percentage of all liquidated funds (see Table 1).

US VC

0 1983 1984 1985

US BO

1986 1987 1988 1989 1990 1991 1992 1993 1994

Vintage Years

Payback percentages by vintage year for US funds raised between 1983 and 1994.

Average payback period per vintage year for US funds raised between 1983 and 1994.

Our analysis reveals that the payback percentage and period depend both on the regional focus and the investment stage of funds. Table 1 indicates that US buyout funds are the most successful in paying back drawn capital. Of all liquidated US buyout funds, 80 percent managed to return the full amount of capital drawn from investors. While US venture (77 percent) and Europe buyout (75 percent) show similar payback percentages, investors have to be especially careful when selecting European venture funds historically, 44 percent (24 of the 55 liquidated European venture funds in our sample) did not break even.

Payback characteristic Payback percentage Average payback period Median payback period US venture 77% 8.1 8.0 US buyout 80% 6.8 6.9 EU venture 56% 8.7 9.0 EU buyout 75% 7.1 7.1

Interestingly, while vintage 1993 and 1994 venture funds might still manage to pay back their drawn capital, many of these funds were apparently not able to benefit from the excellent exit environment of the late 1990s. A comparable study of European buyout and venture funds shows similar results. As already mentioned, the average payback period of the sample underestimates the final payback period for the vintages 1983 to 1994 (downward bias). Nevertheless, trends and cycles in the average payback period of private equity funds are clearly observable. Chart 3 illustrates what most investors realised when monitoring their portfolios; the 90s vintages paid back much faster than the 80s vintages. In contrast to the relatively stable payback percentages described above, the average US venture payback period has fallen from above eight years for vintages in the mid-eighties to approximately five years for the 1993 vintage year, as can be seen from Chart 3. Given the relative lack of venture capital exits during 2000-2003, we expect this trend to reverse for late 1990s vintage venture funds that did not benefit from the TMT bubble. Average payback periods for such funds should rise toward the

179

Table 1: Payback percentage and payback period of liquidated funds as of Q4 2003.

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

208_App 5_ About PEI

16/5/05

9:51 am

Page 208

Appendix Five: About Private Equity International

In November 2001 a management team bought out their business from major financial publishing group, Euromoney Institutional Investor PLC. This business was centred on private equity and venture capital, and included the website PrivateEquityOnline.com already one of the most heavily used private equity news sites around as well as plans for a major new magazine dedicated to the asset class. That magazine was launched in December 2001 and is called Private Equity International. Since then, that same group of managers plus a growing team of seasoned journalists and other publishing professionals, have been busy developing a range of publications and other media that are all centred on private equity and venture capital. The company now has offices in both London and New York and is able to track all aspects of the industry across all time zones. We are genuinely global in our approach. Today, the company offers the following publications and products: Private Equity International: the global magazine for private equity. One of the most widely read and recognised monthly magazine on private equity and venture capital. Written by one of the most highly regarded editorial teams with over thirty years combined experience of the industry. PEI delivers fresh news and insight on how the asset class is developing worldwide. Private Equity Manager: the first monthly journal written for those involved in running the modern private equity firm: CFOs, COOs, Heads of IR, Human Resources as well as the managing partners. Launched in June 2004, PEM delivers substantive commentary and guidance on all aspects of operational best practice for the private equity and venture firm.

208

PrivateEquityOnline.com: probably the best known website dedicated to private equity and venture capital. Launched in April 2000, its daily news coverage from around the world is now read by 40,000 registered users. Journalists in both London and New York are posting stories on PEO throughout the day on the people, the deals and the firms shaping the industry. Private Equity International conferences: in order to provide private equity professionals with a small number of focused events that make full use of the companys knowledge of the private equity industry, PEI is now hosting a series of conferences in Europe, North America and elsewhere. Our Private Equity COO & CFO meetings in both London and New York, for example, have already established a significant following. Private Equity International research publications: a growing series of market reports, research guides and directories are being written, edited and compiled by members of the team to provide in-depth information and analysis for various industry participants, including GPs, LPs, financiers and other advisers. These titles address the current absence in the market of in-depth products that cover the issues and trends shaping the asset class on a global basis. To find out more about any of these products just call either our London [+44 20 7566 5444] or New York [+1 212 645 1919] offices.

RESEARCH GUIDE

209-212_App 6 _ About PEI Books

16/5/05

9:52 am

Page 209

Appendix Six: About Private Equity International Research Publications

Private Equity Internationals research publications address the current absence in the market of in-depth products that cover the issues and trends shaping the asset class on a global basis. Leveraging its expert knowledge, along with its contacts and client base, Private Equity Internationals range of market reports, research guides and directories offer private equity professionals, investors in the asset class, the advisory community and others involved in private equity the quality, in-depth research, analysis and comment they need.

Market Reports

advisors, investors and others involved in the asset class. These practically orientated, comprehensive and detailed directories will profile investors in the asset class, advisors, service providers and private equity firms. The following research publications have already been published:

Placement Agents Market Report

Group, Paul Capital Partners, Pomona Capital, Probitas Partners, Schroder Ventures International Investment Trust, SJ Berwin, Standard & Poors and Vision Capital.

Private Equity Technology: Assessing the Alternatives

Cover specific topics of relevance to private equity in a concise and focused manner. These highly specialised and targeted reports are aimed at covering technical issues or particular areas of the private equity industry in an incisive manner, providing readers with a valuable primer on these issues.

Research Guides

The definitive guide to private equity placement agents, this 120-page Market Report combines in-depth editorial with a global directory of agents and the results from surveying both LPs and GPs about their views on the role and contribution of agents in the fundraising process. The book is filled with information and comment relevant to anyone involved with private equity funds and fundraising.

Routes to Liquidity

An assessment of technology solutions and how they apply to private equity firms. This 222-page Market Report covers the importance and risks of technology, how technology specifically applies to the modern private equity firm and includes a detailed analysis of the technology solutions currently available to private equity firms. The guide is supported by a survey of investors use of and attitudes towards technology, along with a unique directory of private equity technology providers and their products / services. This guide is essential reading for anyone involved in developing a private equity firms technology infrastructure.

The UK LBO Manual

209

Cover the broader issues, themes and trends that are helping to shape the development of the private equity asset class. Consisting of in-depth analysis and comment, along with the results of surveys into the attitudes and opinions of private equity professionals and investors, these research-rich, multi-contributor studies provide readers with some of the most authoritative and substantive comment available on private equity.

Directories

A detailed study of how liquidity is being brought to the asset class. This 224-page Research Guide includes contributions from leading players in the liquidity field, combining in-depth editorial with a global directory of secondary buyers and advisors, along with the results of a unique survey into the attitudes towards the secondary market of buyers, sellers and GPs. Contributors include Camelot Group, Campbell Lutyens, Capital Dynamics, Cogent Partners, Coller Capital, Debevoise & Plimpton, Deutsche Bank, Goldman Sachs, Greenpark Capital, Landmark Partners, Lexington Partners, LGT Capital Partners, London Business School, New York Private Placement Network, Pantheon Ventures, Partners

Private Equity International will also be publishing a range of directories for use as work tools by private equity professionals,

A practical guide to structuring private equity-backed buyouts in the United Kingdom. Written and researched by leading international law firm Ashurst, this is the first in a series of country-specific guides that address all aspects of private equity-backed buyouts. Topics covered include: the development of the UK buyout market; the structure of leveraged buyouts; documentation; taking equity; debt and security; taxation aspects of LBOs; the impact of EC and UK merger control and anti-trust rules; public to privates; structuring equity incentives for management; insolvency; and more. This 156-page report is an essential resource for all those involved in UK private equity buyouts.

THE GUIDE TO PRIVATE EQUITY FUND INVESTMENT DUE DILIGENCE

209-212_App 6 _ About PEI Books

16/5/05

9:52 am

Page 210

The Private Equity International Global Limited Partners Directory

The most comprehensive international guide to investors in private equity funds. This 990-page directory provides detailed, in-depth profiles of the private equity investment programs of over 870 institutional investors and advisors from around the globe. Built from the ground-up by a team of multi-lingual researchers, this directory is the most comprehensive, extensive and user friendly guide to current and active investors in the asset class available. An indispensable fundraising tool for those raising and marketing private equity and venture capital funds.

The Guide to Private Equity Fund Investment Due Diligence

into the dynamics and future of the fund of funds market undertaken with fund of funds managers, placement agents and LPs. Also contains the most comprehensive directory of fund of funds managers available, profiling more than 150 managers from around the globe, including contact details, investment remits and previous funds backed. This report is an essential purchase for anyone interested in understanding and raising capital from this increasingly important area of the private equity market. Contributors include Adams Street Partners, London Business School, Mowbray Capital LLP, OMelveny & Myers LLP, Partners Group, Probitas Partners, SCM Strategic Capital Management, Standard Life Investments (Private Equity) Ltd. If you have any queries about Private Equity Internationals current and forthcoming research publications please contact: Nick Gordon Head of Research Publications Private Equity International Second Floor Sycamore House Sycamore Street London EC1Y 0SG United Kingdom +44 (0)20 7566 5437 nick.g@investoraccess.com

210