Professional Documents

Culture Documents

Business Portfolio Analysis - Hofer Method: Ionescu Florin Tudor

Business Portfolio Analysis - Hofer Method: Ionescu Florin Tudor

Uploaded by

Priyanka Raj AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Portfolio Analysis - Hofer Method: Ionescu Florin Tudor

Business Portfolio Analysis - Hofer Method: Ionescu Florin Tudor

Uploaded by

Priyanka Raj AgrawalCopyright:

Available Formats

BUSINESS PORTFOLIO ANALYSIS HOFER METHOD

Ionescu Florin Tudor The Academy of Economic Studies, Marketing Faculty, Mihai Eminescu Str., Nr.13-15, District 1, Bucureti, E-mail: florinionescu@mk.ase.ro, Tel.: 0728.098.128 Cescu tefan Claudiu The Academy of Economic Studies, Marketing Faculty, Mihai Eminescu Str., Nr.13-15, District 1, Bucureti, E-mail: stefancaescu@mk.ase.ro, Tel.: 0746.013.031 Cruceru Anca Francisca The Academy of Economic Studies, Marketing Faculty, Mihai Eminescu Str., Nr.13-15, District 1, Bucureti, E-mail:ancacruceru1@gmail.com, Tel.: 0745.144.089 Abstract: The business portfolio analysis represents an analytical approach by means of which managers have the possibility to view the corporation as a set of strategic business units that must be managed in a profitable way. Also, by taking into account features specific to the area in which the company operates, by taking into account the competitive advantage and the modalities of earmarking financial resources thereof, the business portfolio analysis provides managers the opportunity to approach companies from a different point of view and to pay increased attention to all activities that need to be undertaken. The present paper aims at presenting from a conceptual standpoint the Hofer method of business portfolio analysis, its strategic consequences and the characteristic advantages and disadvantages. Moreover, the paper will emphasize the importance and part that the business portfolio analysis holds within a company. Key words: business portfolio, strategic business units, strategic planning A fundamental question that managers must answer each time is: In what direction must the company go? The strategy implemented by a company must be elaborated so that it considers all market opportunities and neutralizes current threats or foreseen threats. At the same time the company must value its strong points, by referring to the competition. On the basis of these features specific to an ideal strategy and by considering current options that companies may resort to, one may assert that the salient features of the strategy selection process are its difficulty and complexity. Over time, a series of methods have been created with a view to support the strategy assessment and selection process. Of these, the methods corresponding to business portfolio analysis stands out. The analysis methods of the business portfolio analysis are used in order to identify and examine the various strategic alternatives that must be approached at corporate level. The business portfolio planning offers three potential benefits. The first resides in the fact that it encourages the promotion of competitive analysis at the level of strategic business units, by means of comparative assessments thereof, resulting in a series of viable strategies focused on benefits yielded by corporate diversity. The second benefit supports the selective earmarking of financial resources by means of identification of strategic issues and by means of adoption of a standardized and objective negotiation process thereof. Thus, the force mix inside a company will be much better directed. The third benefit derives from the opinion of several experts who assert that this manner of approaching the business portfolio that focuses on a host of analysis methods that help reduce risks, increases concentration and involvement, as far as identification and implementation of strategies at corporate level is concerned. Correlated to visual approach that is based on a series of graphic representations, the business portfolio analysis corresponding to a company is consolidated by the comparative assessment procedure of market shares, rates of market increase, market attractiveness, competitive position and life cycle of products/markets, specific to each strategic business unit. This business portfolio analysis must become routine activity undertaken by the company, through its carrying out on a regular basis, so that decisions of earmarking of financial resources may be monitored, updated and modified with a view to accomplishing

913

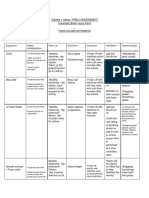

corporate objectives, correlated to the process of generation thereof carried out in an efficient way by each strategic business unit196. After identifying business portfolio strategies, the next step is taken; it involves the outlining of strategies specific to the level of strategic business units. The basic decisions, that involve the earmarking of corporate resources together with the general approach, by means of which a strategic business unit will be managed, does not complete the strategic analysis process and the selection of the viable strategic alternative. Consequently, each strategic business unit must examine and select a certain type of strategy that in the end should lead to the meeting of long-term strategic objectives197. A significant contribution in the field of strategic business portfolio analysis specific to a company belongs to Charles W. Hofer. Over time, he undertook a series of research studies showing that the stage of the life cycle of a product represents a factor that influences to a greater or smaller extent the success of a strategy. Also, he was unsatisfied with the G.E. method, developed by the McKinsey & Company consultancy company and by the General Electric company, which did not stated clearly the position of strategic business units which have recently penetrated the market and which presented a high development potential in the future. Consequently, he proposed a new assessment matrix of business portfolio of the company, organised into 15 quadrants. The specialty literature mentions in under the name of Hofer Matrix or "Product/Market Evolution Matrix and is quite similar to the Arthur D. Little matrix. Picture 1 displays the present matrix where strategic business units are graphically represented according to two basic indicators: competitive position on the market and the stage corresponding to the product/market evolution. As in the case of the other approaches, Hofer matrix implies the division of the company into strategic business units. The next step resides in assessing the competitive position of business units, by using techniques similar to those used by the McKinsey matrix. The position occupied by each strategic business unit is graphically represented by using the two axes of the matrix. Thus, on the vertical axis (Ox) the competitive position of strategic business units is set and on the vertical axis (Oy) the stage of the life cycle specific to the market where these operate is set. Further on, strategic business units are outlined, from a graphical point of view, under the form of circles. The size of each circle is proportional to the size of the market where the strategic business unit carries out its activity (measured on the basis of total income resulted on the mentioned markets), while the hatched areas, inside the circle, represent the market shares held by the strategic business units. The power of the Hofer matrix resides in the fact that it may outline the distribution of strategic business units during stages specific to life cycle of the market (industry). Similar to the McKinsey matrix, the present matrix offers the company the possibility to make a diagnosis regarding the portfolio, in order to establish if it exhibits a balanced or unbalanced structure. A balanced portfolio should be composed of strategic business units of the type corresponding to Stars and to Cash Cows and to a few Question Marks, which have recently penetrated the market or which are about to become Stars. Of course, in practice, most of the companies will have portfolios whole salient feature will be the unbalance.

Strategic consequences

The strategic consequences of this analysis focus on the various stages of life cycle when strategic business units are not covered. Thus, similar to the other methods of business portfolio analysis, the Hofer matrix also suggests that each position held by a strategic business unit indicates the selection of a strategic alternative198. According to picture 1, suggested strategies are as follows: Picture 1 Hofer Matrix

Armstrong, J. Scott; Brodie, Roderick J. - Effects of Portfolio Planning Methods on Decision Making: Experimental Results, International Journal of Research in Marketing, 11, 1994, 73-84, North-Holland, p. 2 197 Wensley, Robin - Making better decisions: The challenge of marketing strategy techniques - A comment on "Effects of portfolio planning methods on decision making: Experimental results" by Armstrong and Brodie, International Journal of Research in Marketing. Amsterdam: Jan 1994. Vol. 11, Iss. 1, p. 86 198 Byars, Lloyd L. - Strategic management: formulation and implementation: concepts and cases, 3rd Edition, Harper Collins, New York, 1991, p.133 914

196

A C B D

Source: Wheelen, Thomas L.; Hunger, J. David - Strategic management and business policy: concepts and cases, 10th Edition, Pearson/Prentice Hall, Upper Saddle River, 2006, p.304 1. Strategic business unit A seems to be a potential Star. It holds a large market share, it is in the stage of life cycle development and has a strong competitive position on the market. As such, unit A represents a potential candidate in the competition for corporate resource competition. 2. Unit B is very similar to unit A. Nevertheless, investments in unit B must take into account the fact that although it has a strong market position, its market share is quite small. Consequently, the cause for which market share has such a small value must be identified. Furthermore, a strategy that may contribute to the increase of market share must be developed, thus accounting for the future necessary investment. 3. Unit C has a small market share, its salient feature resides in the fact that it holds a competitively weak position and it entered a small market whose development is underway. A strategy that may increase the market share and develop the competitive position must be elaborated so that the future investments be accounted for. For the unit C a strategy residing in the elimination from the market must be applied, so that the investment for the first two units may be favourised. 4. Unit D is characterised by a strong competitive position on the market and it holds a large market share. In this case, it is recommended that investments be made with a view to maintaining the current position on the market. On the lung run, it will become a Cash Cow. 5. Unit E together with unit F are included into the Cash Cow category and they should be capitalized on because of great cash flows that they generate. 6. Unit G is included into the Dogs category and the management thereof is recommended, with a view to generating short-term cash flows in as much as it is possible. Nevertheless, on the long term the strategy of limitation or liquidation on the market must be selected. Taking into account that the structure of business portfolio varies from company to company and that they may take multiple forms of graphic expression, Hofer suggested that the majority of business portfolio strategies specific to companies represent variations of one of the three characteristic situations of an ideal portfolio199. The three situations specific to a portfolio having an ideal structure are as follows: Pearce, John A., II; Robinson, Richard B., Jr. - Strategic management: strategy formulation and implementation , 2nd Edition, Irwin , Homewood, 1985, p. 253 915

199

a) Developing portfolio b) Profitable portfolio c) Balanced portfolio Picture 2 exhibits the three ideal situations and by means thereof several distinct objectives are outlined, objectives that a company may set with a view to meeting them by means of strategic earmarking of financial resources.

Strengths and weaknesses of the Hofer method

The main strengths of the matrix resides in the fact that it provides an image regarding the manner of distribution of the businesses undertaken by a company during specific stages of a life cycle. The company may predict how the present portfolio will develop in the future and it may also act in real time in order to guarantee that his portfolio is in a balanced condition. Another advantage of the present matrix is that it manages to divert the managements attention from the corporate level and focus on potential strategies specific to the strategic business unit. According to specialty literature, the market life cycle represents one of the main factors that contribute to the adoption of strategic decisions at the level of the strategic business unit. Therefore, following the use of the Hofer matrix, the corporate management may identify strategic procedures that must be integrated and implemented at the level of strategic business units. Picture 2 Three ideal types of business portfolios

a) b) c) Source: Byars, Lloyd L. - Strategic management: formulation and implementation: concepts and cases, 3rd Edition, Harper Collins, New York, 1991, p.134 The disadvantage of the matrix resides in the fact that it does not focus on all the relevant factors that influence the level of attractiveness of a market. According to the McKinsey matrix, the present model illustrates as well the fact that the stage of the market life cycle is very important, but this element must not be deemed as being the only and the main influence factor of the level of market attractiveness. Therefore, there are other significant factors that may exert influence over the companys portfolio, without being dependent on the stage in which the market evolution is found. Taking into consideration the above mentioned, we must emphasize the fact that the restriction of the portfolio analysis to a single method, is not a very wise decision. Each method presents a series of advantages and disadvantages and each of them tries to offer, at one time, a diagnostic of the business portfolio specific to a company200. Haspeslagh, Philippe - Portfolio Planning: Uses and Limits, Harvard Business Review. Boston: Jan/Feb 1982. Vol. 60, Iss. 1; p. 60 916

200

The methods of analysis of the business portfolio facilitate the debate and outline of the competitive positions of the company and also contribute to the generation of a series of questions related to the way in which the allotment of its actual resources contribute to the achievement of success and vitality on long term. At the same time, these methods, besides the fact that they help the managers to control the allotment of resources and suggest realistic objectives for every strategic business unit, also offer the possibility to use the strategic units as indispensable resources in the process of achievement of the objectives established at a corporate level201. In conclusion, it is recommended the combined use of a large variety of methods of analysis of the business portfolio, by the managers from a corporate level, because, in this way they will understand much better the whole market mix included in the custody account analysis, the strategic position held by every strategic business unit, within a market, the performance potential of the portfolio as well as the financial aspects related to the process of allotment of resources, for the business units within the portfolio. It should also be mentioned that the methods of analysis of the business portfolio are not instruments, which offer accurate answers, in spite of the appearances created by the stage of analysis, in which the strategic business units are represented graphically and with austerity. Nevertheless, their main virtue is simplicity, since these underlie the need to further research.

Bibliography

1. Armstrong, J. Scott; Brodie, Roderick J. - Effects of Portfolio Planning Methods on Decision Making: Experimental Results, International Journal of Research in Marketing, 11, (1994), 73-84, North-Holland 2. Burdus, Eugen - Tratat de management, Editura Economica, Bucuresti, 2005 3. Byars, Lloyd L. - Strategic management: formulation and implementation: concepts and cases, 3rd Edition, Harper Collins, New York, 1991 4. Ciobanu, Ioan - Strategiile competitive ale firmei, Editura Polirom, Iasi, 2005 5. Haspeslagh, Philippe - Portfolio Planning: Uses and Limits, Harvard Business Review. Boston: Jan/Feb 1982. Vol. 60, Iss. 1 6. Pearce, John A., II; Robinson, Richard B., Jr. - Strategic management: strategy formulation and implementation , 2nd Edition, Irwin , Homewood, 1985 7. Pearce, John A., II; Robinson, Richard B., Jr. - Strategic management: formulation, implementation, and control, 10th Edition, McGraw-Hill/Irwin, Boston, 2007 8. Wheelen, Thomas L.; Hunger, J. David - Strategic management and business policy: concepts and cases, 10th Edition, Pearson/Prentice Hall, Upper Saddle River, 2006 9. Wilson, Richard Malcolm Sano; Gilligan, Colin - Strategic marketing management: planning, implementation and control, 3rd Edition, Elsevier Butterworth-Heinemann, Amsterdam, 2005 10. Wind, Yoram; Mahajan, Vijay; Swire, Donald J. - An Empirical Comparison of Standardized Portfolio Models, Journal of Marketing (pre-1986); Spring 1983; 47, 000002; ABI/INFORM Global 11. Wensley, Robin - Making better decisions: The challenge of marketing strategy techniques - A comment on "Effects of portfolio planning methods on decision making: Experimental results" by Armstrong and Brodie, International Journal of Research in Marketing. Amsterdam: Jan 1994. Vol. 11, Iss. 1

201

Wind, Yoram; Mahajan, Vijay; Swire, Donald J. - An Empirical Comparison of Standardized Portfolio Models, Journal of Marketing (pre-1986); Spring 1983; 47, 000002; ABI/INFORM Global, p. 98 917

You might also like

- SpectrumMath SampleBook Grade1.CompressedDocument16 pagesSpectrumMath SampleBook Grade1.CompressedPilar Morales de Rios67% (3)

- BMK1030Document66 pagesBMK1030Gilvan Junior80% (5)

- Mindmap Supply Chain Network Redesign Chainalytics 2020Document1 pageMindmap Supply Chain Network Redesign Chainalytics 2020Ngoc PhamNo ratings yet

- Tts Product CatalogDocument156 pagesTts Product Catalogchubby_hippoNo ratings yet

- Entrepreneurship Development A4Document44 pagesEntrepreneurship Development A4paroothiNo ratings yet

- BCG New Business Models For A New Global LandscapeDocument9 pagesBCG New Business Models For A New Global LandscapefdoaguayoNo ratings yet

- AIP Helicopter Routing MUMBAI JUHU.8062127Document11 pagesAIP Helicopter Routing MUMBAI JUHU.8062127vikalp1980No ratings yet

- A Progression Map For C Major PDFDocument1 pageA Progression Map For C Major PDFdavoNo ratings yet

- Birlasoft CaseA PDFDocument30 pagesBirlasoft CaseA PDFRitika SharmaNo ratings yet

- Business and Consumer EthicsDocument10 pagesBusiness and Consumer EthicsGary WongNo ratings yet

- Business AgilityDocument201 pagesBusiness AgilityTrinh NgoNo ratings yet

- Supply Chain Analysis A Handbook On The Interaction of Information, System and Optimization (International Series In... (Christopher S. Tang, Chung-Piaw Teo Etc.) (Z-Lib - Org) - 2Document287 pagesSupply Chain Analysis A Handbook On The Interaction of Information, System and Optimization (International Series In... (Christopher S. Tang, Chung-Piaw Teo Etc.) (Z-Lib - Org) - 2Tech SpacexNo ratings yet

- Marketing Automation: Practical Steps to More Effective Direct MarketingFrom EverandMarketing Automation: Practical Steps to More Effective Direct MarketingNo ratings yet

- Fergerson 2012Document115 pagesFergerson 2012posnirohaNo ratings yet

- Avoiding The Alignment Trap in ITDocument9 pagesAvoiding The Alignment Trap in ITSaptarshi RayNo ratings yet

- The State of Social: Facebook, Linkedin and DigitasDocument3 pagesThe State of Social: Facebook, Linkedin and DigitasericbrunettoNo ratings yet

- SCM ManualDocument106 pagesSCM ManualAlan Goodridge100% (4)

- Unit 4-Intro To Services MKTG - Price - Place - Jessy Nair - PESU - JN-MinorsDocument109 pagesUnit 4-Intro To Services MKTG - Price - Place - Jessy Nair - PESU - JN-MinorsJaya HarshitNo ratings yet

- Ai PDFDocument65 pagesAi PDFKhadri MohammedNo ratings yet

- Strategic AlliancesDocument15 pagesStrategic AlliancesAli AhmadNo ratings yet

- IRM Press,.Project Management For Modern Information Systems - The Effects of The Internet and ERP On Accounting. (2006.ISBN1591406935)Document433 pagesIRM Press,.Project Management For Modern Information Systems - The Effects of The Internet and ERP On Accounting. (2006.ISBN1591406935)juandaleNo ratings yet

- Bensaou Model-1 PDFDocument11 pagesBensaou Model-1 PDFBrendon NyaudeNo ratings yet

- LJ Institute of Management Studies (IMBA)Document5 pagesLJ Institute of Management Studies (IMBA)Hardik PatelNo ratings yet

- Beta POP - Data Science & Analytics Study MaterialDocument163 pagesBeta POP - Data Science & Analytics Study MaterialNiranjana MenonNo ratings yet

- Teaching Note: Case AbstractDocument6 pagesTeaching Note: Case AbstractOwel TalatalaNo ratings yet

- Stan Shih Acer Me Too Is Not My StyleDocument247 pagesStan Shih Acer Me Too Is Not My StylethoyibNo ratings yet

- Journal of Purchasing & Supply Management: Florence Crespin-Mazet, Emmanuelle DontenwillDocument11 pagesJournal of Purchasing & Supply Management: Florence Crespin-Mazet, Emmanuelle DontenwillEddiemtongaNo ratings yet

- Global Value ChainsDocument5 pagesGlobal Value ChainsAmrit KaurNo ratings yet

- Age of LogisticsDocument136 pagesAge of LogisticsManu JosephNo ratings yet

- Networking Strategies For Entrepreneurs: Balancing Cohesion and DiversityDocument32 pagesNetworking Strategies For Entrepreneurs: Balancing Cohesion and DiversityBangkit Rachmat HilcaNo ratings yet

- Informations Systems and Operations ManagementDocument9 pagesInformations Systems and Operations Managementprivilege1911No ratings yet

- Global Blood Monitoring & Cardiac Monitoring Devices Market Assessment & Forecast: 2015-2019Document15 pagesGlobal Blood Monitoring & Cardiac Monitoring Devices Market Assessment & Forecast: 2015-2019Re-Presen-TingNo ratings yet

- Financial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFDocument222 pagesFinancial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFAnonymous 94TBTBRksNo ratings yet

- New Product Development ProcessDocument12 pagesNew Product Development ProcessWan Zulkifli Wan IdrisNo ratings yet

- Digital Technology Enablers and Their Implications For Supply Chain ManagementDocument16 pagesDigital Technology Enablers and Their Implications For Supply Chain Management7dk6495zjgNo ratings yet

- User Needs - Plcor Dcor Scor Ccor - Hawley - 6-8-12 v1Document42 pagesUser Needs - Plcor Dcor Scor Ccor - Hawley - 6-8-12 v1Kariem DarwishNo ratings yet

- Advances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceDocument381 pagesAdvances in Banking Technology and Management Impacts of ICT and CRM Premier Reference SourceShilpakumari Sudhamani100% (1)

- Impacts of Ifpri'S "Priorities For Pro-Poor Public Investment" Global Research ProgramDocument72 pagesImpacts of Ifpri'S "Priorities For Pro-Poor Public Investment" Global Research ProgramKoert OosterhuisNo ratings yet

- Operations Management: William J. StevensonDocument31 pagesOperations Management: William J. StevensonbangiebangieNo ratings yet

- Simulation Integrated Design For LogisticsDocument262 pagesSimulation Integrated Design For LogisticsM.Maulana Iskandar ZulkarnainNo ratings yet

- Agile SC Strategy Agile Vs LeanDocument14 pagesAgile SC Strategy Agile Vs LeanChiara TrentinNo ratings yet

- BMGC Ch7Document3 pagesBMGC Ch7Fan YuqingNo ratings yet

- ClustersSegmentsPIPsOverview - 6 Feb 2013Document150 pagesClustersSegmentsPIPsOverview - 6 Feb 2013Conrad RodricksNo ratings yet

- Dells Just in Time Inventory Management SystemDocument19 pagesDells Just in Time Inventory Management SystemThu HươngNo ratings yet

- Weele 5th Ed - Chapter 03Document17 pagesWeele 5th Ed - Chapter 03Neha SharmaNo ratings yet

- Ecom GaryDocument26 pagesEcom GaryRaj Mohan100% (1)

- RetailingDocument122 pagesRetailingFalguni MathewsNo ratings yet

- International Business RESIT Summative Assessment BriefDocument12 pagesInternational Business RESIT Summative Assessment BriefSahibzada Abu Bakar GhayyurNo ratings yet

- Supply Chain Modeling Past, Present and Future PDFDocument19 pagesSupply Chain Modeling Past, Present and Future PDFEyüb Rahmi Aydın0% (1)

- MPS & MRPDocument41 pagesMPS & MRPdeliciousfood96No ratings yet

- The Concept of Information Overload: A Review of Literature From Organization Science, Accounting, Marketing, MIS, and Related DisciplinesDocument21 pagesThe Concept of Information Overload: A Review of Literature From Organization Science, Accounting, Marketing, MIS, and Related DisciplinesBima C. PratamaNo ratings yet

- CenturyLink Valuation ProjectDocument120 pagesCenturyLink Valuation ProjectJagr ThompkinsNo ratings yet

- Fortune Favors The PreparedDocument16 pagesFortune Favors The PreparedGreta Manrique GandolfoNo ratings yet

- FMS MITO NC NC054LD CompleteDocument47 pagesFMS MITO NC NC054LD CompleteShashi YadavNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- Forecasting Accuracy of Industrial Sales With Endogeneity in Firm-Level DataDocument11 pagesForecasting Accuracy of Industrial Sales With Endogeneity in Firm-Level DataInternational Journal of Business Marketing and ManagementNo ratings yet

- Buyer Supplier RelationshipDocument7 pagesBuyer Supplier RelationshipkisnacapriNo ratings yet

- Organising and Planning For LSCM FunctionsDocument13 pagesOrganising and Planning For LSCM FunctionsAnab ZaishaNo ratings yet

- Purchasing AssignmentDocument13 pagesPurchasing AssignmentLucas SalamNo ratings yet

- IELTS Reading Recent Actual Test 12 With AnswerDocument13 pagesIELTS Reading Recent Actual Test 12 With AnswerNhung NguyễnNo ratings yet

- Unit 1Document1 pageUnit 1Aya Chahboun el KannouaNo ratings yet

- Assignment 1 BadarDocument9 pagesAssignment 1 Badargaming0092No ratings yet

- Henri Fayol Principles of ManagementDocument17 pagesHenri Fayol Principles of Managementlalit sainiNo ratings yet

- G.R. No. 210669 - Hi-Lon Manufacturing, Inc. v. Commission On AuditDocument22 pagesG.R. No. 210669 - Hi-Lon Manufacturing, Inc. v. Commission On AuditMaying Dadula RaymundoNo ratings yet

- Workout Plan Tab and AlanaDocument9 pagesWorkout Plan Tab and Alanaapi-658308760No ratings yet

- 24 - Spectra IV SE IPDocument10 pages24 - Spectra IV SE IPJulio César Olmos MoraNo ratings yet

- Psychological Aspet of Values Education Module WAODocument16 pagesPsychological Aspet of Values Education Module WAOJessebel Loking SerencioNo ratings yet

- Toshiba V726B V727BDocument13 pagesToshiba V726B V727Bf17439100% (2)

- Cutting Data - Greenwood Tools LTDDocument3 pagesCutting Data - Greenwood Tools LTDJayakrishnaNo ratings yet

- 10 Years of Electrostatic QuestionsDocument6 pages10 Years of Electrostatic QuestionsBharti KakkarNo ratings yet

- Oracle® Database Security VPD FINEGRAINEDDocument442 pagesOracle® Database Security VPD FINEGRAINEDmaahjoorNo ratings yet

- Capital Budgeting - Decision Making Practices in PakistanDocument11 pagesCapital Budgeting - Decision Making Practices in Pakistanafridi65No ratings yet

- FDC Fan Drive Control - TI - Mar-2006Document38 pagesFDC Fan Drive Control - TI - Mar-2006Stelian CrisanNo ratings yet

- Answer: How Do You Indicate Pauses or Hesitation in Narration and Dialogue?Document7 pagesAnswer: How Do You Indicate Pauses or Hesitation in Narration and Dialogue?Disha TNo ratings yet

- Keti BerdzenishviliDocument2 pagesKeti BerdzenishviliKeti BerdzenishviliNo ratings yet

- Functions and Their GraphsDocument13 pagesFunctions and Their GraphsMaureen AkimoriNo ratings yet

- Biochemistry 9Th Edition Edition Shawn O Farrell Full ChapterDocument54 pagesBiochemistry 9Th Edition Edition Shawn O Farrell Full Chapterjesse.yardley161100% (4)

- Throttling Valves & Pump Corrosion IssuesDocument5 pagesThrottling Valves & Pump Corrosion IssuesNazira Abd RahmanNo ratings yet

- Bar Closing proceduresFB005Document2 pagesBar Closing proceduresFB005OfeliaNo ratings yet

- Fundamentals of Corporate Finance Canadian 3Rd Edition Berk Test Bank Full Chapter PDFDocument58 pagesFundamentals of Corporate Finance Canadian 3Rd Edition Berk Test Bank Full Chapter PDFRussellFischerqxcj100% (11)

- ChangelogDocument233 pagesChangelogJuancarlos MantillaNo ratings yet

- Jawaban Final Exam Database OracleDocument16 pagesJawaban Final Exam Database OracleNaomi Cindy Hermina TampubolonNo ratings yet

- The Return of The GolemsDocument6 pagesThe Return of The GolemsThavamNo ratings yet

- Pensky Marten Flash Point Apparatus PDFDocument4 pagesPensky Marten Flash Point Apparatus PDFngdthgyyttrNo ratings yet

- 300 Most Important PPSC MCS'sDocument18 pages300 Most Important PPSC MCS'ssami xainNo ratings yet