Professional Documents

Culture Documents

Income Tax Return File

Uploaded by

Muhammad Usman SaeedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Return File

Uploaded by

Muhammad Usman SaeedCopyright:

Available Formats

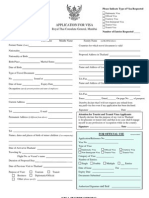

Government of Pakistan Federal Board of Revenue Taxpayer Registration Form

TRF-01

Token No. N

Current NTN Unit Trust Modarba

Sheet No.

of

Apply For

Category Company Individual AOP

New Registration (for Income Tax, Sales Tax, Federal Excise, I.T W/H Agent or S.T W.H Agent ) ST or FED Registration, who already have NTN Company Type Pvt. Ltd. NGO AOP Type => Non-Resident HUF Public Ltd. Society Firm Change in Particulars Small Company Any other (pl specify) Artificial Juridical Person Duplicate Certificate Trust

Body of persons formed under a foreign law

Status CNIC/PP No. Reg./ Inc. No. Name

Resident

Country of Non Resident

[for Individual only , Non-Residents to write Passport No.] [for Company & Registered AOP only]

5 6 7

Gender Birth/ Inc. Date

`

Male

Female

Name of Registered Person (Company, Individual or AOP Name)

Address

Registered Office Address for Company and Mailing/Business Address for Individual & AOP, for all correspondence

Office/Shop/House /Flat /Plot No

Street/ Lane/ Plaza/ Floor/ Village

Block/ Mohala/ Sector/ Road/ Post Office/ etc

Province

District

City/Tehsil

Area/Town

Activity Code

Registry

9 10

Principal Activity

Register for

Income Tax

Sales Tax

Federal Excise

Withholding agent for I/Tax

Withholding Agent for S/Tax

Revision

`

11

Representative/ Authorized Rep.

Rep. Type CNIC/ NTN Address

Representative u/s 172

Authorized Rep. u/s 223 Name

In Capacity as

Office/Shop/House /Flat /Plot No

Street/ Lane/ Plaza/ Floor/ Village

Block/ Mohala/ Sector/ Road/ Post Office/ etc

`

12

Province

District

City/Tehsil

Area/Town

Phone

Area Code Number

Mobile

Area Code Number

Fax

Area Code Number

13

E-Mail

Total Director/Shareholder/Partner

(e-Mail address for all correspondence)

14

Please provide information about top-10 Directors/Shareholders/Partners

Total Capital Action

(Add/ Remove)

Other Activities Director/Shareholder/Partner

15 Type NTN/CNIC/ Passport No.

Name of Director/Shareholder/Partner

Share Capital

Share %

16 17

All Other Shareholders/ Directors/Partners (in addition to 10) Action Activity Code Other Business Activities in addition to the Principal Activity given at Sr-9 above

(Add/ Close)

18 19 20

Total business/branches Bus/Br. Serial Bus/Br. Type

Provide details of all business/branches/outlets/etc., use additional copies of this form if needed Action Requested Add Change Close

Business/ Branch Name

HQ/Factory/Showroom/Godown/Sub Off./etc.

Address

Office/Shop/House /Flat /Plot No Street/ Lane/ Plaza/ Floor/ Village Block/ Mohala/ Sector/ Road/ Post Office/ etc

Business/ Branches

Province

District

City/Tehsil

Area/Town

21

Nature of Premises Possession

Owned Rented Others

Owner's CNIC/ NTN/ FTN Gas Connection installed Business/ Branch Start Date Yes No

Owner's Name Gas Consumer No. Business/ Branch Close Date, if applicable

22 23

Electricity Ref. No. Phone No.

Area Code Number

24

Total Bank Accounts Account Sr. A/C No. Bank Name

(NBP, MCB, UBL, Citi, etc.)

Provide details of all bank accounts, use additional copies of this form if needed Action Requested A/C Title City Account Start Date Branch Account Close Date , if close action is requested Add Change Close Type

Employer Bank Accounts

25 26 27 28

29 30 31

NTN/ FTN Address

Name City

Declaration

I, the undersigned solemnly declare that to the best of my knowledge and belief the information given above is correct and complete. It is further declared that any notice sent on the e-mail address or the address given in the registry portion will be accepted as legal notice served under the law.

32

__________________________

Date CNIC/ Passport No. Name of Applicant SIGNATURE

Government of Pakistan Federal Board of Revenue Taxpayer Registration Form

TRF-01 051 111-772-772

FILLING INSTRUCTIONS

1 Sheet No.

Usually only one sheet of this form is sufficient. However more sheets will be needed in case of more than 1-Businesses/Branches, more than 5-Business Activities or more than 1-Bank Accounts. For example, if 2-more sheets are attached then the first will have Sheet 1 of 3, and so on upto Sheet 3 of 3. If no sheet is attached, then write Sheet 1 of 1. This field is for official use. All the grey fields are for official use and should be left blank by the applicant. Tick () the relevant box. If the box for change in particulars is selected the current NTN should also be provided. Grey box is for check digit. If a person has already obtained NTN and now wants to apply for Sales Tax/ FED, he should tick () Apply for Sales Tax / FED Registration If application is issuance of Duplicate Certificate, then Current NTN should also be provided. Current Certificate should be surrendered

Application No. 2 Application Type

3 Category 4 Status 5 CNIC/ PP No. Gender 6 Reg./ Inc. No. Birth/ Inc. Date 7 Name 8 Address 9 Principal Activity

Check () the relevant box showing the Person Category as Company, AOP or Individual. If Category is selected as Company or AOP then one of the types of Company/AOP should also be checked (). Check the Status as Resident or Non-Resident . In case of Non-Resident the Country of Non-Resident Person should also be written. All Resident Individuals should write CNIC Number and Non-Resident Individuals should write Passport (PP) Number in this column. In case of Company and AOP this column should be left blank. Gender is required only for Individual, for Company and AOP it should be left blank In case of Company, write SECP incorporation number. In case of AOP write the registration number of AOP if available, otherwise leave it blank. Individual should write the Birth Date and Company/AOP should write the date of incorporation/formation Name of Registered Person. Individual should write the name as appearing in the CNIC/ Passport, Company should write the name as appearing in SECP and AOP should write the name as shown in the AOP Agreement. Company should write the address of Registered Office, Individual and AOP should write Business/Mailing Address. Principal Activity of the Person being registered should be written here, in case of multiple business activities the Principal Activity at the time of registration should be determined on the basis of major revenue generating business activity. Detailed list of Business Activities can be accessed from FBR's web site http://fbr.gov.pk or https://e.fbr.gov.pk. Individuals having only salary income should write Salary Income as Principal Activity. Professionals should specify their profession as Principal Activity or Other Activity as the case may be. Activity Code is for official use, applicant should leave it blank. Tick () the relevant boxes. All the relevant boxes should be checked. This is for official use, and should be left blank by the applicant. "Representative as defined u/s 172" or "Authorized Representative in case of Company not having Permanent Establishment in Pakistan, as defined u/s 223" of the Income Tax Ordinance 2001. Capacity in which Representative/ Authorized Representative is mentioned as defined u/s 172 or 223(2) of Income Tax Ord. 2001 Phone, Mobile and Fax number of the Legal Representative or Individual (in case of Self) should also be written. Fax number is optional. E-Mail address of the legal representative should be written here, which will be used to serve legal notices and correspondence Total Number of directors/shareholders/partners of the business. Total Capital of the business and shareholder wise share to be provided in case of Company. Particulars of all Partners should be provided for AOP Type of Identification: N=> NTN, C=> CNIC, P=> Passport Number, M=> CNIC number issued in Form-B by NADRA in case of Minors NTN/ CNIC of all the shareholders/ directors/ partners should be provided in this portion. More sheets should be added for more than 5. Name of Director/Shareholder/Partner. Capital share of owner in terms of capital amount, for Company only %age of share will be calculated by the system on the basis of share value provided in the capital column Others Share of owners in terms of capital amount Activity Code is for official use, applicant should leave it blank. Detailed list of Business Activities can be accessed from FBR's web at site http://fbr.gov.pk or http://e.fbr.gov.pk. Do not re-write the Principal Activity given at Sr9. Hence if there is no activity other than the Principal Activity, then this portion should be left blank. More activities can be added later through the Change Request as explained at Sr-2 above. Total Number of Businesses/ Branches, details of which should be provided in the following columns. Serial Number of the Business/ Branch. Separate sheets are required to provide information about each additional business/ branch including HQ Check () the relevant box as Add Business, Change Particulars or Close Business/ Branch Type of Business/ Branch such as Head Office, Sub-Office, Factory, Show Room, Godown, Sub Office, Outlet, etc Write name of the Business or Branch in accordance with the Business Branch Type selected Nature of Premises Possession as Owned, Rented or Others, along with CNIC/NTN/FTN and Name of the Owner should be written Electricity Consumer number of the connection installed at the business/ HQ/ branch premises Tick the relevant box, showing the gas connection installed at the premises If Gas connection is installed, then write here Gas Consumer number of the connection installed at the business/ branch premises Phone number with area code should be written for the Business/ Brach written at Sr. 20 Start Date of the Business/ Branch, date should be written in the format of DD-MM-YYYY. Closing Date of the Business/ Branch. This is applicable only when Close Business/ Branch is selected as Action Requested Total Number of Bank Accounts, details of which should be provided in the following columns Serial Number of the Bank Account. Separate sheets are required to provide information about each additional bank account Check () the relevant box as Add Account, Change Particulars or Close Account Bank Account No. as allotted by the bank Title of Account Check () the relevant box showing Account Type such as PLS or Current as the case may be. Write bank name in abbreviated form, e.g. MCB for Muslim Commercial Bank, NBP for National Bank of Pakistan, City Bank for City Bank Name of the City in which bank branch is located Name of the bank branch with branch Code Start Date of the bank Account, date should be written in the format of DD-MM-YYYY. Close Date of the bank Account, in case the account is closed. This is applicable only when Close Account is selected as Action Requested NTN/ FTN of the Employer, in case of applicant having Salary Income as Principal Activity. (FTN = Free Tax Numbers allotted to Govt. Departments) Name of Employer Address of Employer City of Employer's Head Office Declaration to be signed by the applicant or his/her authorized representative. Date of signing the application, in the format of DD-MM-YYYY. CNIC/Passport No. of the applicant. Applicant can be the Person him/her self or his/her authorized representative having written Authorization. Name of Applicant as appearing in the CNIC/Passport. Signatures of the applicant.

Registry

Activity Code 10 Register for Revision N 11 Rep. Type In Capacity as 12 Phone, Mobile, Fax 13 E-Mail 14 Total No. of Directors Total Capital 15 Type of Identification NTN/CNIC Name of Director Capital Share % 16 Others 17 Activity Code Business Activity

Other Activities Businesses/ Branches Bank Accounts Employer Declaration

Directors/ Partners

Representative/ /AuthRep

18 Total Business/branches 19 Business / Branch Sr. Action Requested 20 Business/Branch Type Business/ Branch Name 21 Nature of Premises 22 Electricity Reference No. Gas Connection installed Gas Consumer No. 23 Phone No. Business/Br. Start Date Business/Br. Close Date 24 Total Bank Accounts 25 Account Sr. Action Requested 26 A/C No. A/C Title Type 27 Bank Name City Branch 28 Start Date Close Date 29 NTN/ FTN Name 30 Address City 31 Declaration 32 Date CNIC/Passport No. Name of Applicant Signatures

Tax Registration Form can be submitted as follows: 1) Duly completed application form along with copies of required documents can be submitted at any of the (13) Regional Tax Offices or TFCs. 2) Online application can also be prepared by visiting the FBR website https://e.fbr.gov.pk. Online tutorial for assistance can also be downloaded. 3) NTN Certificate should be received in person at RTO by the applicant or his authorized representative, after one working day of successful telephonic verification. At the time of receiving the NTN Certificate, Original CNIC should be shown. If an authorized representative is to receive the NTN Certificate then Original Authority Letter and original CNIC of the authorized person should be shown at the RTO/ TFC Counter.

Application Modes

4) Request for Change in Particulars is also processed as described at Sr. 1-32 above. 5) For Request of Duplicate Certificate, complete particulars should be provided. Current Certificate should be surrendered, if available. If current certificate is lost, then an affidavit on Stamp Paper of Rs. 10 should be attached with the application. Attachments For all applications : Copy of the last paid Electricity Bill of the connection installed at the address given in the Registry Portion of the form (STR-1) For Individual 1) Copy of CNIC/ Passport For Company For AOP 01) RTO Karachi, Opposite Sindh Secretariat 02) RTO Lahore, Nabah Road 03) RTO Peshawar, Jamrud Road 04) RTO Quetta, Chaman Housing Scheme 1) Copy of CNIC of Applicant 1) Copy of CNIC of Applicant 2) Copy of SECP Incorporation Certificate 2) Copy of AOP Agreement, if applicable 3) Applications of all owners, if not already NTN holder 3) Applications of all Partners, if not already NTN holder 13) RTO Islamabad, Blue Area

RTO/ TFC

05) RTO Rawalpindi, Kachery Road 06) RTO Gujranwala, GT Road 07) RTO Sialkot, Kachary Road 08) RTO Faisalabad, New Civil Lines

09) RTO Hyderabad, Site Area 10) RTO Sukkur, Income Tax Building 11) RTO Multan, Shamsabad Colony

12) RTO Abbottabad, Main Mansehra Road

List of TFCs available at http://fbr.gov.pk

You might also like

- FBR - NTN Form PDFDocument2 pagesFBR - NTN Form PDFAdeel Bin Khalid100% (1)

- Deregistration Form (STR-3)Document1 pageDeregistration Form (STR-3)crazzyboy20090% (1)

- TRF 01Document2 pagesTRF 01Muhammad Faisal KhanNo ratings yet

- Current NTN (If Already Issued) : Federal Board of Revenue Taxpayer Registration Form (V-2)Document28 pagesCurrent NTN (If Already Issued) : Federal Board of Revenue Taxpayer Registration Form (V-2)khan brothers khan brotherNo ratings yet

- SST 01Document1 pageSST 01OSAMANo ratings yet

- 1903 January 2024 ENCS - FinalDocument4 pages1903 January 2024 ENCS - Finaljennylyneyoyo14No ratings yet

- Bir Form 1903 New VersionDocument4 pagesBir Form 1903 New Versionchato law officeNo ratings yet

- Application For Registration: Republic of The Philippines BIR Form NoDocument6 pagesApplication For Registration: Republic of The Philippines BIR Form Nomarlon anzanoNo ratings yet

- Bir Form 1903Document4 pagesBir Form 1903luizzasharraNo ratings yet

- Bir FormDocument4 pagesBir Formjennylyneyoyo14No ratings yet

- Application For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueDocument5 pagesApplication For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueSJC ITRNo ratings yet

- Application For Registration: (To Be Filled Up by BIR) DLNDocument2 pagesApplication For Registration: (To Be Filled Up by BIR) DLNRhu BurauenNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoDocument4 pagesApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form Nophoebemariealhambra1475No ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument2 pagesApplication For Registration: Kawanihan NG Rentas InternasAbs PangaderNo ratings yet

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- Osho 2Document3 pagesOsho 2assmexellenceNo ratings yet

- Annexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor Response RemarksDocument3 pagesAnnexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor Response RemarksChittaranjan PadhyNo ratings yet

- 1903 Jul 2021 ENCS - FinalDocument18 pages1903 Jul 2021 ENCS - FinalXDT - Business Unit 2No ratings yet

- BIR Form 1903Document2 pagesBIR Form 1903rafael soriaoNo ratings yet

- Stanbic Business Account Opening Form 2021Document4 pagesStanbic Business Account Opening Form 2021Edwin MhlabaNo ratings yet

- PFF002 EmployersDataForm V06Document2 pagesPFF002 EmployersDataForm V06hitme bensiNo ratings yet

- Formular 200 Anaf EngDocument14 pagesFormular 200 Anaf Enguzuneanu ralucaNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueBRF Services IncNo ratings yet

- Account Opening Form PDFDocument5 pagesAccount Opening Form PDFWildan FrianaNo ratings yet

- Common Application Form: - Lumpsum Investment - Systematic Investment Plan (SIP)Document3 pagesCommon Application Form: - Lumpsum Investment - Systematic Investment Plan (SIP)Naveen LimayeNo ratings yet

- A1-A2 - Business Customer InfoDocument2 pagesA1-A2 - Business Customer InfoSteve Lim100% (1)

- 1901 Jan 2018 ENCS V4 - 03.04.2019Document1 page1901 Jan 2018 ENCS V4 - 03.04.2019Andoy Domingo Carullo83% (6)

- Employer's Data Form (EDF, HQP-PFF-002, V03.2)Document2 pagesEmployer's Data Form (EDF, HQP-PFF-002, V03.2)Roniel Cedeño100% (5)

- Employer's Data Form (EDF, HQP-PFF-002, V03.2) PDFDocument2 pagesEmployer's Data Form (EDF, HQP-PFF-002, V03.2) PDFPamela Angelica Obaniana FisicoNo ratings yet

- 1901 Application For Registration (ENCS) 2000Document2 pages1901 Application For Registration (ENCS) 2000Kathyrn Ang-ZarateNo ratings yet

- Annexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseDocument13 pagesAnnexure - 1 Organisation and Tax Related Details: Sr. No Description Vendor ResponseMirza FaisalNo ratings yet

- PFF002 - Employer's Data Form - V04 - PDF PDFDocument2 pagesPFF002 - Employer's Data Form - V04 - PDF PDFarlyn100% (1)

- 1903 Jul 2021 ENCS - FinalDocument4 pages1903 Jul 2021 ENCS - FinalJah Zeiah RoblesNo ratings yet

- ICICI Prudential SMART FundDocument2 pagesICICI Prudential SMART FundDrashti Investments100% (1)

- Employers Data Form 2019Document2 pagesEmployers Data Form 2019Michelle Hernandez50% (2)

- Application For Registration: Date of Birth/Organization Date (In Case of Estate/Trust)Document3 pagesApplication For Registration: Date of Birth/Organization Date (In Case of Estate/Trust)MyPc ServicesNo ratings yet

- Application For Registration: Taxpayer Identification Number (TIN)Document4 pagesApplication For Registration: Taxpayer Identification Number (TIN)Vrix Ace MangilitNo ratings yet

- Cif Opg Form ENTITY Full Kyc Annexure 3Document1 pageCif Opg Form ENTITY Full Kyc Annexure 3Vibhu Sharma JoshiNo ratings yet

- BIR Form 1901Document4 pagesBIR Form 1901Kathleen Anne CabreraNo ratings yet

- For Self-Employed and Mixed Income Individuals, Estates and TrustsDocument2 pagesFor Self-Employed and Mixed Income Individuals, Estates and TrustsJeffrey TolentinoNo ratings yet

- 2023 KYBP Profile and Services (Latest Promo)Document14 pages2023 KYBP Profile and Services (Latest Promo)Kenny Diego ChenNo ratings yet

- Application For Registration: (Choose Only One. Mark The Appropriate Box, E.G. Professional OR Mixed Income Earner.)Document4 pagesApplication For Registration: (Choose Only One. Mark The Appropriate Box, E.G. Professional OR Mixed Income Earner.)Kris EllenNo ratings yet

- Application For Registration: For Self-Employed and Mixed Income Individuals, Estates and TrustsDocument2 pagesApplication For Registration: For Self-Employed and Mixed Income Individuals, Estates and TrustsMarson Andrei DapanasNo ratings yet

- BIR Form 1902 PDFDocument1 pageBIR Form 1902 PDFClarisse30No ratings yet

- BIR Form 1902Document1 pageBIR Form 1902Seuljjang Kang100% (1)

- 1902 (2008) 4Document1 page1902 (2008) 4Vanessa HaliliNo ratings yet

- 1901 Jan 2018 ENCS V4 - 03.04.2019Document7 pages1901 Jan 2018 ENCS V4 - 03.04.2019A1C Betiwan PAFNo ratings yet

- CANELO - CERILO - BIR 1901 FormDocument4 pagesCANELO - CERILO - BIR 1901 FormSam Sam OsmeniaNo ratings yet

- 5 - 1 - Annex D - LefcompanyDocument3 pages5 - 1 - Annex D - LefcompanyНебојша БабовићNo ratings yet

- NON Individual - KYCDocument2 pagesNON Individual - KYCdigitaltarun99No ratings yet

- Nevada Business Registration Form InstructionsDocument3 pagesNevada Business Registration Form InstructionstibymiaNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Every Nonprofit's Tax Guide: How to Keep Your Tax-Exempt Status & Avoid IRS ProblemsFrom EverandEvery Nonprofit's Tax Guide: How to Keep Your Tax-Exempt Status & Avoid IRS ProblemsNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- ACCA PakistanDocument1 pageACCA Pakistanzubairkhan_leoNo ratings yet

- Chapter One: Organizations and Organization TheoryDocument5 pagesChapter One: Organizations and Organization Theoryzubairkhan_leoNo ratings yet

- 09 WordDocument3 pages09 Wordzubairkhan_leoNo ratings yet

- 05 - Chapter 5 - Partnership AccountsDocument16 pages05 - Chapter 5 - Partnership Accountszubairkhan_leo100% (15)

- Visa Visit Tourism 17 ENGDocument4 pagesVisa Visit Tourism 17 ENGGreg Beranga Jeune PatronNo ratings yet

- Visa CanadaDocument6 pagesVisa CanadaChelsea ValdezNo ratings yet

- Https Portal2.Passportindia - Gov.in AppOnlineProject PDF AdvisoryDocument3 pagesHttps Portal2.Passportindia - Gov.in AppOnlineProject PDF AdvisoryBhargav GoudNo ratings yet

- Singapore Visa ChecklistDocument2 pagesSingapore Visa ChecklistRamakrishnanNo ratings yet

- Australia Visitor Visa Form - 1419 PDFDocument17 pagesAustralia Visitor Visa Form - 1419 PDFpunsums80% (5)

- Passport Application Form Government of INDIA, Ministry of External AffairsDocument1 pagePassport Application Form Government of INDIA, Ministry of External AffairsSamratNo ratings yet

- Digital Tachograph Workshop Card Appliation Guidance d778bDocument9 pagesDigital Tachograph Workshop Card Appliation Guidance d778bZak Charlesworth 웃No ratings yet

- UK Visas & Immigration: Personal InformationDocument3 pagesUK Visas & Immigration: Personal InformationОлег АнасьевNo ratings yet

- China Visa SampleDocument2 pagesChina Visa SampleBen mom bunNo ratings yet

- 157N PDFDocument5 pages157N PDFMinh NguyenNo ratings yet

- Delhi Airport: E-Visa Application FormDocument2 pagesDelhi Airport: E-Visa Application FormMuhammad Ridwan Talhah0% (1)

- ICCR Application Form 2017-2018Document12 pagesICCR Application Form 2017-2018Muhammed BashriNo ratings yet

- UntitledDocument78 pagesUntitledສາຍທອງ ມອດມອດNo ratings yet

- IDLK9393GE 45736300 UnlockedDocument3 pagesIDLK9393GE 45736300 UnlockedAli AbdullahNo ratings yet

- Passport ApplicationDocument3 pagesPassport ApplicationRagul ANo ratings yet

- Espionage Case Pune JudgementDocument46 pagesEspionage Case Pune JudgementSampath BulusuNo ratings yet

- Real Id Enhanced Standard: How To Apply For A New YorkDocument4 pagesReal Id Enhanced Standard: How To Apply For A New YorkRajaNo ratings yet

- 9A Visa Extension and ProceduresDocument4 pages9A Visa Extension and ProceduresColleen GuimbalNo ratings yet

- B8029556-LOPEZNOMAR MR-14062019-Ticket InvoicedDocument5 pagesB8029556-LOPEZNOMAR MR-14062019-Ticket InvoicedLopez Nordz AxelNo ratings yet

- Reconciliation LetterDocument2 pagesReconciliation Letteranees ur rehmanNo ratings yet

- Pasport Form DDNI06330312GO0330Document0 pagesPasport Form DDNI06330312GO0330Awdhesh Singh BhadoriyaNo ratings yet

- Airport Entry Pass (Aep) Application Form (Aepaf) : (D) (M) (Y) (D) (M) (Y)Document3 pagesAirport Entry Pass (Aep) Application Form (Aepaf) : (D) (M) (Y) (D) (M) (Y)Dharmendra0% (1)

- UK Visas & Immigration: Partially Completed ApplicationDocument10 pagesUK Visas & Immigration: Partially Completed ApplicationНатальяNo ratings yet

- NIDMS - Approval in Principle - Still Abroad - Regular V7.0 - 0303367A - 20230621 - 104131Document3 pagesNIDMS - Approval in Principle - Still Abroad - Regular V7.0 - 0303367A - 20230621 - 104131নাম জেনে কি লাভNo ratings yet

- Meeting The Criteria - Permanent Resident Visa - Immigration New ZealandDocument3 pagesMeeting The Criteria - Permanent Resident Visa - Immigration New ZealandNicholasFCheongNo ratings yet

- Covering LetterDocument3 pagesCovering LetterManwinder Singh GillNo ratings yet

- High Commission of The Republic of South Africa: Visitors VisaDocument5 pagesHigh Commission of The Republic of South Africa: Visitors VisaNayab Gull KhanNo ratings yet

- Indian Passport Surrender Certificate IssueDocument5 pagesIndian Passport Surrender Certificate IssueSRINIVASNo ratings yet

- Thai VisaDocument2 pagesThai VisaRosy VeigasNo ratings yet

- Naturalization As A Chinese National: Nationality Law of The People's Republic of ChinaDocument15 pagesNaturalization As A Chinese National: Nationality Law of The People's Republic of Chinalev albareceNo ratings yet