Professional Documents

Culture Documents

1089 3948 1 PB

Uploaded by

Iqbal Khan HaqaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1089 3948 1 PB

Uploaded by

Iqbal Khan HaqaniCopyright:

Available Formats

DBA Africa Management Review 2012, Vol 3 No 1 pp.

22-37

The Impact of Credit Risk Management on Financial Performance of Commercial Banks in Kenya

Ogilo Fredrick, PhD.1

This study analysed the impact of credit risk management on the financial performance of commercial banks and also attempted to establish if there exists any relationship between the credit risk management determinants by use of CAMEL indicators and financial performance of commercial banks in Kenya. A causal research design was undertaken in this study and this was facilitated by the use of secondary data which was obtained from the Central Bank of Kenya publications on banking sector survey. The study used multiple regression analysis in the analysis of data and the findings have been presented in the form of tables and regression equations. The study found out that there is a strong impact between the CAMEL components on the financial performance of commercial banks. The study also established that capital adequacy, asset quality, management efficiency and liquidity had weak relationship with financial performance (ROE) whereas earnings had a strong relationship with financial performance. This study concludes that CAMEL model can be used as a proxy for credit risk management. Key Words: Credit Risk, Management, Financial Performance, Commercial Banks, Kenya

Lecturer, School of Business, Department of Finance and Accounting, Mombasa Campus, University of Nairobi, Kenya 22 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Introduction Credit risk is defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. According to Chijoriga (1997) credit risk is the most expensive risk in financial institutions and its effect is more significant as compared to other risk as it directly threatens the solvency of financial institutions. The magnitude and level of loss caused by the credit risk as compared to other kind of risks is severe to cause high level of loan losses and even bank failure. While financial institutions have faced difficulties over the years for a multitude of reasons, the major cause of serious banking problems continues to be directly related to lax credit standards for borrowers and counterparties, poor portfolio risk management, or a lack of attention to changes in economic or other circumstances that can lead to a deterioration in the credit standing of a banks counterparties (Basel, 1999). Loans are the largest source of credit risk to commercial banks. However, other sources of credit risk exist throughout the activities of a bank, including in the banking book and in the trading book, and both on and off the balance sheet. Banks are increasingly facing credit risk (or counterparty risk) in various financial instruments other than loans, including acceptances, interbank transactions, trade financing, foreign exchange transactions, financial futures, swaps, bonds, equities, options, and in the extension of commitments and guarantees, and the settlement of transactions. The goal of credit risk management is to maximise a banks risk adjusted rate of return by 23 |

maintaining credit risk exposure within acceptable parameters. Banks need to manage the credit risk inherent to the entire portfolio as well as the risk in individual credits as transactions (Sinkey, 1992). Credit risk management should be at the centre of banks operations in order to maintain financial sustainability and reaching more clients. Despite these facts, over the years there has been increased number of significant bank problems in both, matured as well as emerging economies (Brownbridge and Harvey, 1998; Basel, 2004). Bank problems, mostly failures and financial distress have afflicted numerous banks, many of which have been closed down by the regulatory authorities (Brownbridge and Harvey, 1998). Among other factors, weakness in credit risk management has all along been cited as the main cause for bank problems (Richard et al., 2008 and Chijoriga, 1997). Since exposure to credit risk continues to be the leading source of problems in banks world-wide, banks and their supervisors should be able to draw useful lessons from past experiences. Banks should now have a keen awareness of the need to identify, measure, monitor and control credit risk as well as to determine that they hold adequate capital against these risks and that they are adequately compensated for risks incurred (Basel, 1999). Pazarbasioglu (1999) believes that the best warning signs of financial crises are proxies for the vulnerability of the banking and corporate sector. He adds that the most obvious indicators that can be used to predict banking crises are those that relate directly to the soundness of the banking

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

system. In the 1980's and early 1990's, several countries in developed, developing and transition economies experienced several banking crises requiring a major overhaul of their banking systems (IMF, 1998). As the banking sector continues to embrace innovations, the intensity and variety of risks that the players are exposed also continue to increase in tandem. To ensure that the growth in the banking sector does not jeopardize its stability, risk management is crucial. In view of this, the CBK carried out a risk management survey on the Kenyan banking sector in September 2004. The surveys objective was to determine the needs of the local banking sector with regard to risk management. The survey was necessitated by the drive to fully adopt Risk Based Supervision and to incorporate the international risk management best practices envisioned in the 25 Basel Core Principles for Effective Banking Supervision. The survey culminated in the issuance of the Risk Management Guidelines (RMGs) in 2005 and the adoption of the Risk Based Supervision approach of supervising financial institutions in 2005. In response to this, commercial banks embarked upon an upgrading of their risk management and control systems (CBK, 2005). In order to assess the adequacy and impact of the Risk Management Guidelines, 2005 on Kenyan banking institutions, CBK issued risk management survey 2010. The goal of the CBK risk management survey 2010 was to determine whether the RMGs issued in 2005 have had any impact on the institutions and as to whether the RMGs are adequate, as well as establishing the necessary amendments and/or additions that needed to be introduced to ensure that 24 |

the RMGs remained relevant, current and reflective of circumstances in the operating environment. Their finding was that generally the institutions revealed that the Risk Management Guidelines issued in 2005 had, for the majority of them; enhanced risk-awareness and riskmanagement at the institutions, increased the efficiency and effectiveness of risk management, helped reduce financial losses, led to the establishment of effective and better-resourced risk management functions, and enhanced the overall decision making processes in their institutions (CBK, 2010). Credit Risk Management Measurement Operating and financial ratios have long been used as tools for determining the condition and the performance of a firm. Modern early warning models for financial institutions gained popularity when Sinkey (1975) utilized discriminant analysis for identifying and distinguishing problem banks from sound banks and Altman (1977) examined the savings and loan industry. To anticipate banks financial deterioration, procedures have been developed to identify banks approaching financial distress. These procedures, though varying from country-to-country, are designed to generate financial soundness ratings and are commonly referred to as the CAMEL rating system (Gasbarro et al., 2002). In Kenya, the Central Bank also applies the CAMEL rating system to assess the soundness of financial institutions which is an acronym for Capital Adequacy, Asset Quality, Management Quality, Earnings and Liquidity (CBK, 2010). Numerous prior studies have examined the efficacy of CAMEL ratings and they generally

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

conclude that publicly available data combined with regulatory CAMEL ratings can identify and/or predict problem or failed banks (Gasbarro et al., 2002). Internal factors have been identified as the most important causes of troubled banks, commencing with Sinkey (1979) and most recently Hanc (1998). In particular, Sinkey points out that the internal factors causing bank failures are decisions over which the managers and directors of the bank have direct control. This study was guided by the following objectives: i. To analyse the impact of credit risk management on the financial performance of commercial banks in Kenya. ii. To establish if there exists a relationship between the credit risk management determinants and the performance of commercial banks in Kenya. METHODS This research problem was studied through the use of causal research design. The target population for this study constituted 42 commercial banks registered and operational as at 31st December, 2011 licensed to carry out banking business in Kenya under the Banking Act Cap. 488. A population census was applied in this study. However, commercial bank(s) which were not in operation for the entire 5 year period or under receivership were

dropped due to incompleteness of the records or missing data. This research used secondary data which was collected from the CBK publications on banking sector survey and the respective banks financial statements for the period of analysis 20062010. The data analysis method used was based on Pearson correlation analysis and a multiple regression model which took the form of: Y = 0+ 1X1 + 2X2 + 3X3 + 4X4 + 5X5 + Where: Y = Dependent variable X1, X2, X3, X4 and X5 = Independent variables 0 = Constant 1, 2, 3, 4, 5 = Regression coefficients or change included in Y by each X value = error term The dependent variable was the financial performance of the banks whereas the independent variables were the CAMEL components of Capital adequacy, Asset quality, Management efficiency, Earnings and Liquidity. RESULTS AND DISCUSSION Correlation Coefficient As a key assumption of regression model, the study sought to establish whether there was linearity between independent and dependent variables. The average values of the datasets were used for the five year period (2006 2010). The results are presented on table 4.1 below.

25 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

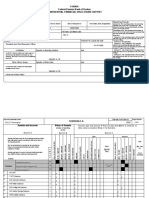

Table 1: Correlation Matrix ROE 1 C A M E L

Pearson Correlation Sig. (2-tailed) Average Capital Pearson Correlation -.250* Sig. (2-tailed) .035 Adequacy Average Asset Pearson Correlation -.324* Sig. (2-tailed) .041 Quality Pearson Correlation -.512** Average .001 Management Quality Sig. (2-tailed) Pearson Correlation .891** Average Earnings Sig. (2-tailed) .000 Pearson Correlation .362* Average Liquidity Sig. (2-tailed) .022 N 40 *. Correlation is significant at the 0.05 level (2-tailed). **. Correlation is significant at the 0.01 level (2-tailed). Average ROE

1 .398 .109 .108 .507 .155 .341 -.250 .119 40 1 .158 .331 -.115 .480 -.276 .085 40 1 -.415 .408 -.566 .540 40 1 .251 .118 40 1 40

Pearson correlation was used to analyse the correlations between the variables and financial performance. Table 1 reveals the correlation coefficients between the variables and financial performance. Table 1 shows that capital adequacy has a correlation coefficient of -0.25 at p=0.035 with financial performance. The correlation coefficient between asset quality and financial performance is (R=-

0.324) at p=0.041. Management quality also has correlation with financial performance given R values of -0.512 at p=0.001. A correlation was also established between earnings quality and ROE at 95% confidence levels with R values of 0.89 at p<0.001. A correlation was also observed between liquidity and financial performance of 0.362 at p=0.022.

Goodness of Fit Statistics

Table 1: Regression Model Goodness of Fit

Year 2006 2007 2008 2009 2010 R .912a .771a .949a .971a .929a R Squared 0.832 0.594 0.901 0.943 0.862 Adjusted R Std. Error of the DurbinSquared Estimate Watson 0.807 4.171811 2.077 0.534 6.601744 2.044 0.887 4.06234 1.756 0.935 3.173106 1.902 0.842 4.148072 1.763

Source: Research data

26 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

a. Predictors: (Constant), Liquidity, Management Quality, Earnings Quality (ROA), Capital Adequacy, Asset Quality b. Dependent Variable: ROE Table 2 illustrates that the strength of the relationship between financial performance and independent variables (liquidity, management quality, earnings quality (ROA), capital adequacy and asset quality). The correlations results depicted a linear relationship between the dependent and the independent variables aggregates with R having lowest values of 0.771 in 2007 and highest values of 0.971 in 2009. The determination coefficients, denoted by R2 had higher values of 0.912, 0.949, 0.971 and 0.929 in the years 2006, 2008, 2009 and 2010 respectively. The study also used Durbin Watson (DW) test to check that the residuals of the models were not auto correlated since independence of the residuals is one of the basic hypotheses of regression analysis. Being that the DW statistics were close to the prescribed value of 2.0 for residual independence, it can be noted that there was no autocorrelation. Multicollinearity Test The study conducted formal detectiontolerance or the variance inflation factor (VIF) for multicollinearity. For tolerance, value less than 0.1 suggest multicollinearity while values of VIF that exceed 10 are often regarded as indicating multicollinearity. The average data for the 5 year period was used.

Table 2:

Multicollinearity Test Tolerance .768 .752 .675 .987 .876 VIF 1.567 1.678 1.559 1.672 1.457

Capital Adequacy Asset Quality Management Quality Earnings Liquidity Source: Research data

Table 3 shows that the values of tolerance were greater than 0.1 and those of VIF were less than 10. This shows lack of multicollinearity among independent

variables. It, therefore, omitting variables with insignificant regression coefficients, would be in appropriate.

27 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Regression Analysis - 2006 4: Regression Coefficients - 2006

Unstandardized Coefficients B Std. Error 8.790 4.438 -.102 .079 -.282 .068 -28.709 56.970 4.326 8.403 .461 15.186 Standardized Coefficients Beta -.099 -.300 -.042 .738 .043 T Sig.

(Constant) Capital Adequacy Asset Quality Management Efficiency Earning Quality Liquidity

1.980 -1.292 -4.136 -.504 9.378 .553

.056 .205 .000 .618 .000 .584

Source: Research data The established regression equation for year 2006: ROE = 8.790 0.102*Capital Adequacy 0.282*Asset Quality 28.709*Management Quality + 4.326*Earnings + 8.403*Liquidity. Table 4 reveals the regression coefficients for the year 2006. Table 4.4 shows that holding capital adequacy; asset quality, management efficiency, earnings and liquidity constant financial performance will be 8.790. Capital adequacy, asset quality and management efficiency all had negative coefficients of -0.102, -0.282 and -28.709 respectively. Earnings quality had a positive coefficient of 4.326 and liquidity also had a positive coefficient of 8.403.

Regression Analysis - 2007 Table 5: Regression Coefficients 2007

Unstandardized Coefficients B Std. Error (Constant) Capital Adequacy Asset Quality Management Efficiency Earning Quality Liquidity 12.414 -.009 -.261 20.600 2.764 .796 3.767 .049 .093 98.166 .581 22.593 -.028 -.385 .029 .719 .005 Standardized Coefficients Beta t Sig.

3.295 -.178 -2.796 .210 4.755 .035

.002 .860 .008 .835 .000 .972

Source: Research data The established regression equation for year 2007: ROE = 12.414 0.009*Capital Adequacy 0.261*Asset Quality + 20.6*Management Quality + 2.764*Earnings + 0.796*Liquidity.

28 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Table 5 shows the regression coefficients for the year 2007. Table 5 reveals that holding independent variables constant (capital adequacy, asset quality, management efficiency, earnings and liquidity), financial performance will be Regression Analysis - 2008 Table 6: Regression Coefficients 2008

12.414. Capital adequacy had a negative coefficient of -0.009 and asset quality also had a negative coefficient of -0.261. Management efficiency, earnings quality and liquidity all had positive coefficients of 20.600, 2.764 and 0.796 respectively.

(Constant) Capital Adequacy Asset Quality Management Efficiency Earning Quality Liquidity

Unstandardized Coefficients B Std. Error 13.214 4.502 -21.850 5.955 -.119 .061 -88.597 5.473 -.684 53.635 .388 4.281

Standardized Coefficients Beta -.227 -.119 -.115 .868 -.011

Sig.

2.935 -3.669 -1.963 -1.652 14.094 -.160

.006 .001 .058 .108 .000 .874

Source: Research data The established regression equation for year 2008: ROE = 13.214 21.85*Capital Adequacy 0.119*Asset Quality 88.597*Management Quality + 5.473*Earnings 0.684*Liquidity. Table 6 depicts the regression coefficients for the year 2008. Table 6 illustrates that financial performance will be 13.214 if the with Capital adequacy, asset quality, independent variables (capital adequacy, management efficiency and liquidity asset quality, management efficiency, having negative coefficients of -21.850, earnings and liquidity) are held constant. 0.119, -88.597 and -0.684 respectively. All the independent variables had negative Earnings quality had a positive coefficient coefficients except for earnings quality of 5.473.

29 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Regression Analysis - 2009 Table 7: Regression Coefficients - 2009

Unstandardized Coefficients B Std. Error (Constant) Capital Adequacy Asset Quality Management Efficiency Earning Quality Liquidity 6.129 -.149 -.054 -46.856 6.316 4.983 1.799 .041 .073 36.700 .360 18.167 -.163 -.038 -.061 .941 .012 Standardized Coefficients Beta T Sig.

3.407 -3.582 -.744 -1.277 17.533 .274

.002 .001 .462 .210 .000 .786

Source: Research data The established regression equation for year 2009: ROE = 6.129 0.149*Capital Adequacy 0.054*Asset Quality 46.856* Management Quality + 6.316*Earnings + 4.983* Liquidity. Table 7 depicts the regression coefficients for the year 2009. Table 7 shows that holding capital adequacy, asset quality, management efficiency, earnings and liquidity constant financial performance will be 6.129. Capital adequacy, asset quality and management efficiency all had negative coefficients of -0.149, -0.054 and -46.856 respectively. Earnings quality had a coefficient of 6.316 and liquidity 4.983.

Regression Analysis - 2010 Table 8: Item Regression Coefficients - 2010

Unstandardized Coefficients B Std. Error 8.416 -16.913 -.079 -97.887 5.737 18.387 2.759 5.616 .103 57.032 .477 32.493 -.214 -.060 -.123 .894 .040 Standardized Coefficients Beta T Sig.

(Constant) Capital Adequacy Asset Quality Management Efficiency Earning Quality Liquidity

3.050 -3.011 -.766 -1.716 12.024 .566

.004 .005 .449 .095 .000 .575

Source: Research data The established regression equation: ROE = 8.416 16.913*Capital Adequacy 0.079*Asset Quality 97.887*Management Quality + 5.737*Earnings Quality + 18.387*Liquidity. P<0.001 30 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Table 8 shows the regression coefficients for the year 2010. Table 8 reveals that holding capital adequacy, asset quality, management efficiency, earnings and liquidity constant financial performance will be 8.416. Capital adequacy, asset quality and management efficiency all had negative coefficients of -16.913, -0.079 and -97.887 respectively. Earnings quality had a positive coefficient of 5.737 and liquidity also had a positive coefficient of 18.387. Impact of Credit Risk Management Determinants on the Financial Performance of Commercial Banks in Kenya The study found that there is a significant impact between the CAMEL components on the financial performance of commercial banks as depicted on Table 2 which shows the regression model of goodness fit for the respective years under study. From Table 2, the value for R2 is 0.832 in the year 2006, which means that CAMEL components explain 83.2 percent variations in the financial performance of banks. 2007 has the lowest value of R2 at 0.594 which means that CAMEL components explain 59.4 percent variations of the financial performance of banks. Similarly years 2008, 2009 and 2010 have R2 values of 0.901, 0.943 and 0.862 implying that CAMEL components explain 90.1 percent, 94.3 percent and 86.2 percent variations of financial performance of banks respectively. The CAMEL rating system can thus be used as a credit risk management indicator in the determination of financial performance of commercial banks.

Analysis from tables 4 to 8 shows the regression coefficients for the years 2006 to 2010 and it was established that the intercept value was positive ranging from the lowest value of 6.129 in 2009 to 13.214 in 2008. Table 4 depicts that a unit increase in capital adequacy will lead to a decrease in financial performance by 0.102, a unit increase in asset quality will lead to a decrease in financial performance by a factor of 0.282 and a unit increase in management efficiency will further lead to a 28.709 decrease in financial performance. Table 4 also implies that a unit increase in earnings quality of the company will cause a 4.326 increase in financial performance whereas a unit increase in liquidity will cause an 8.403 increase in financial performance. Table 5 depicts that a unit increase in capital adequacy will cause a 0.009 decrease in financial performance and a unit increase in asset quality will lead to a 0.261 decrease in financial performance. Table 4.5 also reveals that that a unit increase in management efficiency will lead to an increase in financial performance by a factor of 20.6 and a unit increase in earnings quality would cause a 2.764 increase in financial performance. Likewise a unit increase in liquidity would cause a 0.796 increase in financial performance. Analysis from Table 6 shows that a unit increase in capital adequacy would cause a 21.85 decrease in financial performance, asset quality causes a 0.119 decrease in financial performance and a unit increase in management quality will lead to a decrease in financial performance by 88.597. An increase in earnings quality

31 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

would lead to a 5.473 increase in financial performance and a negative increase of 0.684 in financial performance is obtained with unitary increase in liquidity. Table 7 reveals that a unit increase in capital adequacy will cause a 0.149 decrease in financial performance and a unit increase in asset quality will lead to a 0.054 decrease in financial performance. A unit increase in management efficiency will lead to a 46.856 decrease in financial performance and a unit increase in earnings quality will lead to a 6.316 increase in financial performance. Likewise a unit change in liquidity would cause a 4.983 positive change in financial performance. Table 8 depicts that a unit increase in capital adequacy will lead to a decrease in financial performance by 16.913, a unit increase in asset quality will lead to a decrease in financial performance by a factor of 0.079 and a unit increase in management efficiency will further lead to a 97.887 decrease in financial performance. Table 8 also implies that a unit increase in earnings quality of the company will cause a 5.737 increase in financial performance. While a unit increase in liquidity will cause an 18.387 increase in financial performance. Relationship between Credit Risk Management Determinants and Financial Performance Of Commercial Banks in Kenya Table 1 shows the correlation matrix of the CAMEL indicators to financial performance. From table 1, capital adequacy has values of R=-0.250 at p=0.035. This implies that capital adequacy has a weak relationship with 32 |

financial performance of commercial banks in Kenya. Asset quality had values of R=-0.324 at p=0.041 revealing that there also exists a weak relationship between asset quality and financial performance of commercial banks in Kenya. Management efficiency (R=-0.512, p=0.001) had an average relationship with financial performance. Earnings quality on the other hand, as per table 1, had a strong relationship with financial performance with the values being R=0.891 at p=0.045. Liquidity on the other hand had a weak relationship with financial performance (R=0.362; p=0.022).

Conclusion

The study established that credit risk management by use of CAMEL indicators has a strong impact on the financial performance of commercial banks in Kenya. This study therefore concludes that CAMEL model can be used as a proxy for credit risk management. The CAMEL indicators in this study had strong impact on the financial performance with the CAMEL components being able to explain variations of up to 94.3 percent in 2009 on financial performance of commercial banks. The study also established the relationship between credit risk management proxied by CAMEL indicators and financial performance of commercial banks in Kenya. The study concludes that capital adequacy, asset quality, management efficiency and liquidity have weak relationship with financial performance of banks in Kenya. Earnings have a strong relationship with financial performance.

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

This is because earnings as proxied by return on assets determine the ability of a bank to increase capital (through retained earnings), absorb loan losses, support the future growth of assets, and provide a return to investors. Thus, as each shilling invested in assets increases its revenues generation, the financial performance of banks increase. The study recommends that commercial banks should also try to keep their operational cost low as this negates their profits margin thus leading to low financial performance. This is depicted by the strong effect of earnings on financial performance. Commercial banks should also check their credit policy and practices. By this they would reduce loss on nonperforming loans which raises their expenses and consequent reduction in financial performance. The study suggests that a further study can be done on the impact of credit risk management by use of CAMEL indicators on the financial performance of other financial institutions like the micro finance institutions (MFIs) and SACCOs. This is to ascertain if the CAMEL model can be applied as a proxy for credit risk management on the other financial institutions in the Kenyan market. Further studies can also be undertaken on risk management practices followed by commercial banks in Kenya whereby the study will aim to investigate on the awareness about risk management practices within the banking sector. The study can comprise of data collected through both, primary as well as secondary sources with the purpose of using primary source data being to check the extent to which different risk management practices 33 |

have been followed by the commercial banks through the use of a questionnaires whereas, the objective to use secondary data will be to link the risk weighted Capital Adequacy Ratio (CAR) to the different financial indicators of the commercial banks that are used to measure the banks financial soundness. REFERENCES

Ahmad, N. H. (2003). Formation of Credit Risk, Price Effect of Regulatory Changes and the Path Linking Credit Risk and Total Risk. Ph.D Dissertation, University, Utara Malaysia. Ahmed, A. S. (1998). Bank Loan Loss provision: A Re-examination of Capital Management, Earnings Management and Signaling Effects. Syracuse University, Syracuse: 1-37. Allen, F., & Santomero, A. (1997). The theory of financial intermediation, Journal of Banking and Finance 21, 14611485. Al-Smadi, M. O. (2009). Factors Affecting Banks Credit Risk: Evidence from Jordan. Ph.D Dissertation, University Utara Malaysia, Malaysia. Al-Tamimi, H. (2002). Risk Management Practices: An Empirical Analysis of the UAE Commercial Banks, Finance India 16(3), 1045-1057. Altunbas, Y., Carbo, S., Gardener, E. P. M., & Molyneux, P. (2007). Examining the Relationships between Capital, Risk and Efficiency in European Banking, European Financial Management 13(1), 4970. Anderson, R. C., & Fraser, D. R. (2000). Corporate Control, Bank Risk Taking, and the Health of the Banking Industry, Journal of Banking and Finance 24, 1383-1398. Angbazo, L.A., Mei, J., & Saunders, A. (1998). Credit Spreads in the Market for Highly Leveraged Transaction Loans,

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Journal of Banking and Finance 22, 12491282. Angkinand, A., & Wihlborg, C. (2010). Deposit Insurance Coverage, ownership and Banks' Risk-Taking in Emerging Markets, Journal of International Money and Finance 29, 252-274. Basel. (1999). Principles for the Management of Credt Risk. Basel Committee on Banking Supervision, Basel. Basel II. (2004). Bank Failures in Modern Economies. Basel Committee on Banking Supervision, Basel. Bercoff, J. J., Giovanniz, J. & Grimardx, F. (2002). Argentina Banks, Credit Growth and the tequila Crisis. A Duration Analysis. Berger, A. N., & DeYoung, R. (1997). Problem Loans and Cost Efficiency in Commercial Banks, Journal of Banking and Finance 21, 849-870. Berger, A., & Udell, G. (1993). Securitization, Risk, and the Liquidity Problem in Banking, Structural Change in Banking. M. Klausner and L. White, Editors, Irwin Publishers, Illinois. Bessis, J. (2002). Risk Management in Banking. 2nd Ed. John Wiley, Chichester, England. Bhattacharya, B. & Sinha Roy, T. N. (2008). Macroeconomic Determinants of Asset Quality of Indian Public Sector Banks: A Recursive VAR Approach. The IUP Journal of Bank Management 1, 20-40. Bichsel, R., & Blum, J. (2004). The Relationship between Risk Banks: A Panel Study, Applied Financial Economics 8, 591-597. Brealey, R. A., & Myers, S. C. (2003). Financing and risk management. McGrawHill Professional

Brownbridge, M. & Harvey, N. (1998). Banking in Africa. James Currey Ltd, USA. Bryant, J. (1980). A Model of Reserves, Bank Runs and Deposit Insurance, Journal of Banking and Finance 4, 335344. Calomiris, C. W. & Kahn, C.M. (1991). The Role of Demandable Debt in Structuring Optimal Banking Arrangements, American Economic Review 81, 497513. Cannata, F., & Quagliariello, M. (2007). The Value of Market Information in Banking Supervision: Evidence from Italy, Journal of Financial Services Research 27(2), 139162. Cebeyonan, A. S., & Strahan, P. E. (2004). Risk Management, Capital Structure and Lending at Banks, Journal of Banking and Finance 28, 1943.

Central Bank of Kenya, (2005). Risk Management Survey for the Banking Sector. CBK, Nairobi. Central Bank of Kenya, (2010). Bank Supervision Annual Report. CBK, Nairobi. Central Bank of Kenya, (2010). Risk Management Survey for the Banking Sector. CBK, Nairobi. Chege, S. W. (2010). The Relationship between Credit Risk Management Practices and Financial Performance of Microfinance Institutions in Kenya. Unpublished MBA Dissertation, University of Nairobi, Nairobi. Chijoriga, M. M. (1997). Application of Credit Scoring and Financial Distress Prediction Models to Commercial Banks Lending: The Case of Tanzania. Ph.D Dissertation, Wirts Chaftsnnversitat Wien (WU), Vienna. Das, A., & Ghosh, S. (2007). Determinants of Credit Risk in Indian State-owned Banks: An Empirical Investigation. MPRA Paper

34 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

17301, University Library of Munich, Germany. Diamond, D. W. (1984). Financial Intermediation and Delegated Monitoring, Review of Financial Studies 51, 393414. Diamond, D. W., & Dybvig, P. H. (1983). Banking Theory, Deposit Insurance and Bank Regulation, Journal of Business 59, 5368. Diamond, D. W., & Rajan, R. G. (1998). Liquidity Risk, Liquidity Creation and Financial Fragility: A Theory of Banking, Mimeo, University of Chicago. Ellul, A., & Yerramilli, V. (2010). Stronger Risk Controls, Lower Risk: Evidence from U.S. Bank Holding Companies. Indiana University. Eng, L. L., & Nabar, S. (2007). Loan Loss Provisions by Banks in Hong Kong, Malaysia and Singapore, Journal of International Financial Management & Accounting 18(1), 1838. Fisher, K. P., Gueyie, J. P., & Ortiz, E. (2000). Risk-taking and Charter Value of Commercial Banks From the NAFTA Countries. Kuala Lumpur, Malaysia. Flannery, M. J. (1994). Debt Maturity and the Deadweight Cost of Leverage: Optimally Financing Banking Firms, American Economic Review 84, 320331. Frankfort-Nachmias, C., & Nachmias, D. (1992). Research Methods in the Social Sciences (4th ed.). New York: St. Martin's Press. Gasbarro, D., Sadguna I. M., & Zumwalt J. K. (2002). The Changing Relationship between CAMEL Ratings and Bank Soundness during the Indonesian Banking Crisis, Review of Quantitative Finance and Accounting 19: 247260. Gisemba, P. N. (2010). The Relationship between Credit Risk Management Practices and Financial Performance of SACCOs in

Kenya. Unpublished MBA Dissertation, University of Nairobi, Nairobi. Godlewski, C. (2005). Banks Default Risk and Regulatory Factors in Emerging Market Economies, Journal of Financial Transformation 15, 147-158. Gorton, G., & Pennacchi, G. (1990). Money Market Funds and Finance Companies: Are they the Banks of the Future? Structural Change in Banking, M. Klausner and L. White, eds. Homewood, Illinois: Irwin, 173214. Gurley, J., & Shaw, E. (1960). Money in a Theory of Finance, Washington D.C. Brookings. Hanc, G. (1998). Banking Crises of the 1980s and Early 1990s: Summary and Implications. FDIC Banking Review 11(1). Obtained from http://www.fdic.gov/bank/analytical/bankin g/1998spec/brspecial.pdf Hays, F. H., De Lurgio, S. A., & Gilbert, A. H. (2009). Efficiency Ratios and Community Bank Performance, Journal of Finance and Accountancy 1, 1-15 Hassan, M. K. (1993). Capital Market Tests of Risk Exposure of Loan Sales Activities of Large US Commercial Banks, Quarterly Journal of Business & Economics 32 (1), 27. Hunter, W. C., & Smith, S. D. (2002). Risk Management in the Global Economy: A Review Essay, Journal of Banking and Finance 26, 205-221. John, K., T. A. John, and L. W. Senbet (1991). "Risk-Shifting Incentives of Depository Institutions: A New Perspective on Federal Deposit Insurance Reform," Journal of Banzkiniga nzdF inianzce,1 5, 895-915. Kioko, K. T. (2008). A Survey of Credit Risk Management Techniques of Unsecured Bank Loans of Commercial Banks in Kenya. Unpublished MBA Dissertation, University of Nairobi, Nairobi.

35 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Konishi, M., & Yasuda, Y. (2004). Factors Affecting Bank Risk Taking: Evidence from Japan, Journal of Banking and Finance 28, 215-232. Laeven, L., & Levine, R. (2009). Bank Governance, Regulation and Risk Taking, Journal of Financial Economics 2, 259275. Madura, J. (2008). Financial Markets and Institutions, 10th edition, Cengage learning. Garcia-Marco, T., & Robles-Fernndez, M. D. (2008). "Risk-Taking Behaviour and Ownership in the Banking Industry: The Spanish Evidence, Journal of Economics and Business 60(4), 332-354. Goyal, S. P. (2010). CAMELS Framework Analysis of Top 5 Banks of India. Obtained from: http://www.scribd.com/doc/33598881/Perf ormance-Analysis-of-Top-5-Banks-inIndia-Hdfc-Sbi-Icici-Axis-Idbi-bySatishpgoyal. Millon, M., & Thakor, A. V. (1985). Moral Hazard and Information Sharing: A Model of Financial Intermediation Gathering Agencies, Journal of Finance 40, 1403 1422. Mugenda, O. & Mugenda, A. (2003). Research Methods: Quantitative & Qualitative Approaches. Africa Centre for Technology Studies, Kenya Mwirigi, P. K. (2006). An Assessment of Credit Risk Management Techniques Adopted by MFIs in Kenya. Unpublished MBA Dissertation. University of Nairobi, Nairobi. Ndwiga, J. M. (2010). Relationship between Credit Risk Management Practices and Financial Performance of Microfinance Institutions in Kenya. Unpublished MBA Dissertation. University of Nairobi, Nairobi.

Ngare, E. M. (2008). A Survey of Credit Risk Management Practices by Commercial Banks in Kenya. Unpublished MBA Dissertation, University of Nairobi, Nairobi. Obiero, D. (2002). The Banking Sector Regulatory Framework in Kenya. Its Adequacy in Reducing Bank Failures. Unpublished MBA Dissertation. University of Nairobi, Nairobi. Oldfield, G. S., & Santomero, A. M. (1997). The Place of Risk Management in Financial Institutions. The Wharton Financial Institutions Center 95-05-B. Retrieved from http://fic.wharton.upenn.edu/fic/papers/95 /9505.pdf. Pazarbasioglu, C. (1999). Determinants and Leading Indicators of Banking Crises: Further Evidence. George Allen & Unwin, London. Qi, J. (1998). Deposit Liquidity and Bank Monitoring, Journal of Financial Intermediation 7(2), 198218. Quagliariello, M. (2007). Banks Riskiness over the Business Cycle: A Panel Analysis on Italian Intermediaries. Applied Financial Economics, Taylor and Francis Journals 17(2), 119-138. Ramakrishnan, R. T. S., & Thakor, A. V. (1984). Information Reliability and a Theory of Financial Intermediation, Review of Economic Studies 51, 415432. Richard, E., Chijoriga, M., Kaijage, E., Peterson, C., & Bohman, H. (2008). Credit Risk Management System of a Commercial Bank in Tanzania, International Journal of Emerging Markets 3(3), 323 332. Salas, V., & Saurina, J. (2002). Credit Risk in Two Institutional Regimes: Spanish Commercial and Savings Banks, Journal of Financial Services Research 22 (3), 203 24.

36 |

DBA Africa Management Review 2012, Vol 3 No 1 pp. 22-37

Saunders, A., & Cornet, M. M. (2008). Financial Institutions Management. A Risk Management Approach (6th ed.): McGrawHill Irwin. Saunders, A., Strock, E., & Travlos, N. G. (1990). Ownership Structure, Deregulation and Bank Risk Taking, Journal of Finance 45, 643654. Scholtens, B., & van Wensveen, D. (2003). The Theory of Financial Intermediation: An Essay on What it Does (not) Explain, The European Money and Finance Forum SUERF, Vienna. Sinkey, J. F. (1975). A Multivariate Statistical Analysis of the Characteristics of Problem Banks, Journal of Finance 30(1), 21-36. Sinkey, J. F. (1979). Problem and Failed Institutions in the Commercial Banking Industry. Greenwich: JAI Press.

Sinkey, J. F. (1992). Commercial Bank Financial Management. Macmillan Perspective Publishing Company. Tandelilin, E., Kaaro, H., Mahadwartha, P. A & Supriyatna, K. (2007). Corporate Governance, Risk Management, and Bank Performance: Does Type of Ownership Matter? Final Report of an EADN Individual Research Grant Project. Wasankar, P. (2009). Industry Insight Selecting stocks from Banking. Wasankar Training Institute, India. Yong, H. H. A., Faff, R., & Chalmers, K. (2009). Derivative Activities and AsiaPacific Banks' Interest Rate and Exchange Rate Exposures Journal of International Financial Markets, Institutions, and Money 19(1), 1632.

37 |

You might also like

- 295-306 Vol 3 Issue 5 May 2014Document12 pages295-306 Vol 3 Issue 5 May 2014Anonymous ed8Y8fCxkSNo ratings yet

- The Impact of Credit Risk Management OnDocument7 pagesThe Impact of Credit Risk Management OnNirvana CélesteNo ratings yet

- 1 PBDocument8 pages1 PBGizachewNo ratings yet

- Capital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaDocument11 pagesCapital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Evaluation of Credit Risks Management and PerfoDocument27 pagesAn Evaluation of Credit Risks Management and PerfoOGUNBULE OPEYEMINo ratings yet

- 01 The Impact of Credit Risk Management On Financial Performance of Commercial BanksDocument7 pages01 The Impact of Credit Risk Management On Financial Performance of Commercial BanksmaslovNo ratings yet

- Effects of Credit Risk Management On Loan Performance in Kenyan Commercial BanksDocument13 pagesEffects of Credit Risk Management On Loan Performance in Kenyan Commercial BanksManpreet Kaur VirkNo ratings yet

- SSRN Id2938546Document16 pagesSSRN Id2938546Hesti PermatasariNo ratings yet

- Effect On The PerformanceDocument11 pagesEffect On The Performancehanna abadiNo ratings yet

- Assessment of Credit Risk Management System in Ethiopian BankingDocument13 pagesAssessment of Credit Risk Management System in Ethiopian Bankinginventionjournals100% (1)

- @@ Credit Risk Management On The Financial Performance of Banks in Kenya For The Period 2000 - 2006Document9 pages@@ Credit Risk Management On The Financial Performance of Banks in Kenya For The Period 2000 - 2006Rafiqul IslamNo ratings yet

- CHAPTER ON1.edited - EditedDocument5 pagesCHAPTER ON1.edited - EditedPelah Wowen DanielNo ratings yet

- Credit Risk Management and Effectiveness of CreditDocument12 pagesCredit Risk Management and Effectiveness of CreditEfthker Uddin RafiNo ratings yet

- Mahmud Rani FriendDocument25 pagesMahmud Rani FriendMOHAMMED ABDULMALIKNo ratings yet

- Credit Risk Management and The Performance of Deposit Money Banks in Nigeria: An Error Correction AnalysisDocument13 pagesCredit Risk Management and The Performance of Deposit Money Banks in Nigeria: An Error Correction AnalysisAnonymous ed8Y8fCxkSNo ratings yet

- Ae 75Document9 pagesAe 75BudhaNo ratings yet

- The Effect of Financial Risk Management On The FinDocument13 pagesThe Effect of Financial Risk Management On The FinmabroukNo ratings yet

- Impact of Credit Risk Management On Bank Performance of Nepalese Commercial BankDocument8 pagesImpact of Credit Risk Management On Bank Performance of Nepalese Commercial BankVivi OktaviaNo ratings yet

- Risk Management in Banks: The AHP WayDocument31 pagesRisk Management in Banks: The AHP WayAastha TandonNo ratings yet

- Credit Risk and Profitability of Deposit Money Banks in NigeriaDocument3 pagesCredit Risk and Profitability of Deposit Money Banks in NigeriaGodwinUddinNo ratings yet

- Banking RiskDocument26 pagesBanking RiskmkrmadNo ratings yet

- CREDIT RISK AND COMMERCIAL BANKS' PERFORMANCE IN NIGERIA: A PANEL Model APPROACHDocument8 pagesCREDIT RISK AND COMMERCIAL BANKS' PERFORMANCE IN NIGERIA: A PANEL Model APPROACHdarkniightNo ratings yet

- Synopsis Report: The Study of Risk Management in Banking SectorDocument7 pagesSynopsis Report: The Study of Risk Management in Banking SectorAadriti Upadhyay100% (1)

- Risk Management in Banks, The AHP Way - Diksha AroraDocument29 pagesRisk Management in Banks, The AHP Way - Diksha AroraDiksha Arora KathuriaNo ratings yet

- Credit RiskDocument12 pagesCredit RiskSamson NdhlovuNo ratings yet

- Relationship Between Risk Committee Existence and Financial Performance of Commercial Banks in KenyaDocument5 pagesRelationship Between Risk Committee Existence and Financial Performance of Commercial Banks in KenyaIJEMR JournalNo ratings yet

- MR ZulfaDocument14 pagesMR ZulfaHalim Pandu LatifahNo ratings yet

- Corporate Governance and Operational Risk Management of The Listed Deposit Money Banks (DMBS) in Nigeria: Conceptual FrameworkDocument14 pagesCorporate Governance and Operational Risk Management of The Listed Deposit Money Banks (DMBS) in Nigeria: Conceptual Frameworkiaset123No ratings yet

- Chen, K., & Pan, C. (2012) .Document17 pagesChen, K., & Pan, C. (2012) .Vita NataliaNo ratings yet

- Credit Risk and Commercial BanksDocument18 pagesCredit Risk and Commercial BanksOkoth WilliamNo ratings yet

- Effect of Credit Risk Management On The Performance of Commercial Banks in Nigeria 1 To 3Document57 pagesEffect of Credit Risk Management On The Performance of Commercial Banks in Nigeria 1 To 3MajestyNo ratings yet

- Managing Gap - A Case Study Approach To Asset-Liability Management of Banks PDFDocument11 pagesManaging Gap - A Case Study Approach To Asset-Liability Management of Banks PDFRohit SahniNo ratings yet

- Credit Risk ManagementDocument41 pagesCredit Risk Managementkijiba50% (2)

- VietnamDocument49 pagesVietnamShoikot BishwasNo ratings yet

- Risk Components and The Financial PerforDocument8 pagesRisk Components and The Financial PerforRasaq MojeedNo ratings yet

- Credit Risk Management in Banks ThesisDocument8 pagesCredit Risk Management in Banks Thesisafibaubdfmaebo100% (2)

- Finance SynopsisDocument14 pagesFinance SynopsisNageshwar SinghNo ratings yet

- Assignment ArticleDocument9 pagesAssignment Articlemastermind_asia9389No ratings yet

- Trung 2021Document36 pagesTrung 2021robbyNo ratings yet

- A Proposal On Credit Risk Management inDocument15 pagesA Proposal On Credit Risk Management inAiza MirNo ratings yet

- Thesis On Credit Risk Management in GhanaDocument4 pagesThesis On Credit Risk Management in Ghanafd0kyjpa100% (2)

- Admin1, 1102 Edt v1 303-319Document17 pagesAdmin1, 1102 Edt v1 303-319Jessica AnggiNo ratings yet

- Intro CRMDocument8 pagesIntro CRMMaryletIlagan100% (1)

- Impact of Risk Management On Profitability of BankDocument5 pagesImpact of Risk Management On Profitability of Bankankit chauhanNo ratings yet

- Credit Risk ModellingDocument28 pagesCredit Risk ModellingAnjali VermaNo ratings yet

- Research Paper On Credit Risk Management in BanksDocument7 pagesResearch Paper On Credit Risk Management in BanksafnhinzugpbcgwNo ratings yet

- The Influence of Credit Risk ManagementDocument26 pagesThe Influence of Credit Risk ManagementPia CallantaNo ratings yet

- Engineering Journal Determinants of Loan Quality: Evidence From The Tunisian Banking SectorDocument13 pagesEngineering Journal Determinants of Loan Quality: Evidence From The Tunisian Banking SectorEngineering JournalNo ratings yet

- Asset Quality As A Determinant of Commercial Banks Financial Performance in KenyaDocument12 pagesAsset Quality As A Determinant of Commercial Banks Financial Performance in KenyaAsegid GetachewNo ratings yet

- Thesis On Credit Risk Management in Commercial Banks of NepalDocument6 pagesThesis On Credit Risk Management in Commercial Banks of Nepalabbyjohnsonmanchester100% (2)

- Credit OperationsDocument4 pagesCredit OperationsGrace OpeketeNo ratings yet

- Credit Risk Management in Public and Private Sector BanksDocument6 pagesCredit Risk Management in Public and Private Sector Banksvk sarangdevotNo ratings yet

- Financial Risk, Capital Adequacy and Liquidity Performance of Deposit Money Banks in NigeriaDocument12 pagesFinancial Risk, Capital Adequacy and Liquidity Performance of Deposit Money Banks in NigeriaEditor IJTSRDNo ratings yet

- CB Case Study 1Document7 pagesCB Case Study 1raviraj969355No ratings yet

- Risk-Taking Behavior and Trend Analysis of The Ethiopian Banking Sector: An Observation of Selected BanksDocument9 pagesRisk-Taking Behavior and Trend Analysis of The Ethiopian Banking Sector: An Observation of Selected BanksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Operational RiskDocument6 pagesOperational Risksobi malikNo ratings yet

- Effect of Credit Risk Management On Financial Performance of Nepalese Commercial BanksDocument12 pagesEffect of Credit Risk Management On Financial Performance of Nepalese Commercial BanksSonam ShahNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet

- Hadith of The Day - 99 Names of Allah (SWT)Document18 pagesHadith of The Day - 99 Names of Allah (SWT)Hannan KüçükNo ratings yet

- The Relationship Between Capital Requirements and Bank BehaviorDocument34 pagesThe Relationship Between Capital Requirements and Bank BehaviorHannan KüçükNo ratings yet

- Pitanja Za Ispit Općeg ZnanjaDocument184 pagesPitanja Za Ispit Općeg ZnanjaRizlak100% (1)

- Bank CapitalDocument37 pagesBank CapitalHannan KüçükNo ratings yet

- Gupea 2077 19299 1Document55 pagesGupea 2077 19299 1Hannan KüçükNo ratings yet

- Https Doc 14 BK Apps Viewer - GoogleusercontentDocument14 pagesHttps Doc 14 BK Apps Viewer - GoogleusercontentHannan KüçükNo ratings yet

- Goodness of Fit FariasDocument15 pagesGoodness of Fit FariasHannan KüçükNo ratings yet

- Municipal Bond Boom in Hungary: Focusing On The Analysis of Local Financial ManagementDocument21 pagesMunicipal Bond Boom in Hungary: Focusing On The Analysis of Local Financial ManagementHannan KüçükNo ratings yet

- Measuring Inequality: Using The Lorenz Curve and Gini CoefficientDocument4 pagesMeasuring Inequality: Using The Lorenz Curve and Gini CoefficientHannan KüçükNo ratings yet

- Chap 019Document11 pagesChap 019Hannan KüçükNo ratings yet

- The 2012 Overture:: An Overview of Municipal BondsDocument14 pagesThe 2012 Overture:: An Overview of Municipal BondsHannan KüçükNo ratings yet

- Banks or Bonds? Building A Municipal Credit Market: George E. Peterson Senior Fellow The Urban Institute Washington, DCDocument18 pagesBanks or Bonds? Building A Municipal Credit Market: George E. Peterson Senior Fellow The Urban Institute Washington, DCHannan KüçükNo ratings yet

- Assessment of Local Economic Development Capacities According To Business-Friendly Scheme in Case of Tešanj'S MunicipalityDocument4 pagesAssessment of Local Economic Development Capacities According To Business-Friendly Scheme in Case of Tešanj'S MunicipalityHannan KüçükNo ratings yet

- The Issue of Municipal Bonds, A Challenge For The Romanian Local Public AdministrationsDocument9 pagesThe Issue of Municipal Bonds, A Challenge For The Romanian Local Public AdministrationsHannan KüçükNo ratings yet

- Rating Agencies - General Issues and Potential Solutions: Ana-Maria MinescuDocument6 pagesRating Agencies - General Issues and Potential Solutions: Ana-Maria MinescuHannan KüçükNo ratings yet

- SSRN Id267273Document29 pagesSSRN Id267273Hannan KüçükNo ratings yet

- The Role of Credit Rating Agencies in The Establishment of CapitalDocument20 pagesThe Role of Credit Rating Agencies in The Establishment of CapitalHannan KüçükNo ratings yet

- Pantaleon Vs American Express InternationalDocument1 pagePantaleon Vs American Express InternationalNicole Marie Abella CortesNo ratings yet

- What Is MoneyDocument9 pagesWhat Is Moneymariya0% (1)

- Intercompany Inventory Transactions: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocument22 pagesIntercompany Inventory Transactions: Mcgraw-Hill/Irwin © 2008 The Mcgraw-Hill Companies, Inc. All Rights ReservedFarhan Osman ahmedNo ratings yet

- General AnnuityDocument15 pagesGeneral AnnuityJORENCE PHILIPP ENCARNACIONNo ratings yet

- Compound IntrestDocument5 pagesCompound Intrestvenkata sureshNo ratings yet

- Dwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFDocument36 pagesDwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFpetrorichelle501100% (15)

- Account PayableDocument6 pagesAccount PayablenaysarNo ratings yet

- Vinod Kumar Gupta Mini Project MBA 2nd SemesterDocument95 pagesVinod Kumar Gupta Mini Project MBA 2nd SemesterVinod GuptaNo ratings yet

- Rosengren's 2020 Trades and HoldingsDocument7 pagesRosengren's 2020 Trades and HoldingsCNBC.comNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- Service-Journal-Tony GoDocument9 pagesService-Journal-Tony GoJasmine Acta100% (1)

- Sbi - Google SearchDocument3 pagesSbi - Google SearchsubgNo ratings yet

- Govt. Securities Market in India: Presentation OnDocument19 pagesGovt. Securities Market in India: Presentation OnHitesh PandeyNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Boe FS 2019Document169 pagesBoe FS 2019Qorxmaz AydınlıNo ratings yet

- Analisis Perbandingan Kinerja Keuangan Pada PT Kalbe Farma TBK Dan Kimia Farma TBK PERIODE 2014 - 2016Document18 pagesAnalisis Perbandingan Kinerja Keuangan Pada PT Kalbe Farma TBK Dan Kimia Farma TBK PERIODE 2014 - 2016BAngelina Christy WalangitanNo ratings yet

- Annual Report - Norinchukin BankDocument180 pagesAnnual Report - Norinchukin BankSenthil KumaranNo ratings yet

- JhgfdsaDocument2 pagesJhgfdsaRic John Naquila CabilanNo ratings yet

- Answer Key Quiz 1Document8 pagesAnswer Key Quiz 1Shaira Mae ManalastasNo ratings yet

- Chapter Two PDFDocument6 pagesChapter Two PDFKate PereiraNo ratings yet

- FAR610 - Test 1-Apr2018-Q PDFDocument3 pagesFAR610 - Test 1-Apr2018-Q PDFIman NadhirahNo ratings yet

- Getting Started With GST Unit 2 8 Mark QuestionsDocument2 pagesGetting Started With GST Unit 2 8 Mark Questionsmanoharchary157No ratings yet

- Introduction To Financial Management (History, Nature and Significance of Finance)Document41 pagesIntroduction To Financial Management (History, Nature and Significance of Finance)Ronan PermejoNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- Lesson Plan - Basic Documents and Transactions Related To Bank DepositsDocument5 pagesLesson Plan - Basic Documents and Transactions Related To Bank DepositsBrenda Sebandal100% (3)

- Dwnload Full Fundamentals of Advanced Accounting 7th Edition Hoyle Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Advanced Accounting 7th Edition Hoyle Solutions Manual PDFjacobriceiv100% (4)

- Reflection Paper 1Document2 pagesReflection Paper 1Dela Peña, Rey Igino K.No ratings yet

- 19 Ways To Find Fast Cash, More Savings - NerdWalletDocument10 pages19 Ways To Find Fast Cash, More Savings - NerdWalletGeorgios MoulkasNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument31 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementRonak ChhabriaNo ratings yet

- ACC 503: Chapter 10 - Exercise 1Document8 pagesACC 503: Chapter 10 - Exercise 1BaderNo ratings yet