Professional Documents

Culture Documents

N13 IPCC Tax Guideline Answers Web

Uploaded by

George MooneyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

N13 IPCC Tax Guideline Answers Web

Uploaded by

George MooneyCopyright:

Available Formats

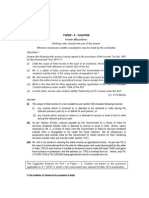

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.1

Gurukripas Guideline Answers to Nov 2013 Exam Questions

CA Inter (IPC) Income Tax, Service Tax and VAT

Question No.1 is compulsory (4 X 5 = 20 Marks).

Answer any five questions from the remaining six questions (16 X 5 = 80 Marks). [Internal Choice in Qn.7(b)]

Working Notes should form part of the answer.

Wherever necessary, suitable assumptions should be made and stated clearly by way of a Note.

Note: All questions pertaining to the Income Tax in Nov 2013 Question Paper relate to Assessment Year 20132014.

However, in this Guideline Answers, they have been solved for the Assessment Year 20142015,

which is relevant for May 2014 and Nov 2014 Exams.

Question 1 (a): Computation of Total Income (10 Marks)

The following is the Profit and Loss Account of Mr. Aditya, aged 58 years, a resident, for the year ended 31.03.2014:

Particulars Particulars

Rent 60,000 Gross Profit 1,85,000

Repair of Car 3,000 Gift of Cash froma Friend (received on 15.09.2013) 25,000

Wealth Tax 5,000 Sale of Car 17,000

Medical Expenses 4,500 Interest on IncomeTax refund 3,000

Salary 18,000

Depreciation on Car 3,000

Advance IncomeTax 1,500

Net Profit 1,35,000

Total 2,30,000 Total 2,30,000

Other information:

1. Aditya bought a Car during the year for 20,000. He charged depreciation @ 15%on the value of the Car. The above Car

was sold during the year for 17,000. The use of the car was 3/4

th

for business and 1/4

th

for personal use.

2. Medical Expenses were incurred for the treatment of Nikita, his wife.

3. Salary had been paid on account of Car Driver.

4. Rent includes Arrears of Rent fromApril 2013 to October 2013 @ 5,000 p.m. paid in cash on 01.11.2013.

5. Mr. Aditya had also let out a House Property at a monthly rent of 25,000. The annual letting value is considered to be

2,50,000. The Municipal Taxes are 6,000, out of which 3,000 are paid by the Tenant and 3,000 are yet to be paid

by Mr. Aditya. Interest on Loan taken for the House Property is 20,000.

6. Mr. Adityas Minor Daughter received 75,000 fromStage Acting. Interest on Company Deposits of Mr. Adityas daughter

(Deposit was made out of Income fromStage Acting) was 10,000.

7. Aditya incurred an expense of 50,000 on the medical treatment of his dependent son, who has disability of more than 80%.

8. Aditya had taken a Loan during the year 20132014 for the education of his son, who is pursuing B.Com. in Delhi

University. Interest paid on the same during the year was 10,000.

Compute the Total Income of Mr. Aditya for the Assessment Year 20142015.

Solution: Note: Application of various provisions of law above have been illustrated in Chapter 6, 14 and 27.

Assessee: Mr. Aditya Previous Year: 20132014 Assessment Year: 20142015

Computation of Total Income

Particulars

1. Income from House Property (Refer Working Note 1) 1,90,000

2. Profits and Gains of Business or Profession (Refer Working Note 2) 1,44,250

3. Capital Gains on Sale of Car (Sale Value 17,000 less Cost of Acquisition 20,000) (3,000)

4. Income from Other Sources (Refer Working Note 3) 11,500

Gross Total Income 3,42,750

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.2

Particulars

Less: Deductions under Chapter VIA

U/s 80DD Expenses on Medical Treatment of Son (Severe Disability) 1,00,000

U/s 80E Interest on Education Loan 10,000 (1,10,000)

Total Income 2,32,750

Working Note 1: Computation of Income from House Property (Let out Property)

Particulars

Gross Annual Value (25000 x 12) 3,00,000

Less: Municipal Taxes paid (No deduction as actual payment not made by Assessee.

Amount paid byTenant is not allowable as deduction.)

NIL

Net Annual Value 3,00,000

Less: Deductions u/s 24 30%of NAV ( 3,00,000 30%) 90,000

Interest on Borrowed Capital 20,000 (1,10,000)

I ncome from House Property 1,90,000

Working Note 2: Computation of Profits and Gains of Business or Profession

Particulars Deduct Add

Net Profit as per Profit & Loss Account given 1,35,000

Add / Less:

Gift from Friend considered separately 25,000

Sale of Car considered separately 17,000

Interest on Income Tax Refund considered separately 3,000

Arrears of Rent paid in Cash, disallowed u/s 40A(3) (Apr to Oct = 7 5,000 pm) 35,000

Repairs of Car 1/4

th

not allowed being personal use = 1/4

th

of 3,000 750

Wealth Tax, not allowable u/s 40(a)(iia) 5,000

Medical Expenses incurred for Spouse, being personal expenses disallowed 4,500

Car Driver Salary 1/4

th

of Car Driver Salary not allowed being used for personal use 4,500

Depreciation on Car considered separately 3,000

Advance Income Tax, not allowable u/s 40(a)(ii) 1,500

SubTotal of Adjustments 45,000 54,250 + 9,250

Profits and Gains from Business or Profession 1,44,250

Working Note 3: Computation of Income from Other Sources

Particulars

1. Interest on Income Tax Refund 3,000

2. Cash Gift from Friend (not taxable since amount is less than 50,000) Nil

3. Income earned by Minor Daughter from Stage Acting (i.e. by exercise of Skill, Talent, etc.), is

assessable only in her hands, and not clubbed in the Parents hands. However, Interest on

Bank Deposit shall be included, i.e. clubbed in Parents hands u/s 64(1A)

10,000

Less: Exemption u/s 10(32) (1,500) 8,500

Income from Other Sources 11,500

Question 1 (b): Service Tax Value of Taxable Service and Service Tax Payable (5 Marks)

Professionals Ltd is engaged in providing services which became taxable with effect from1

st

July 2013. Compute the Service

Tax payable by Professionals Ltd on the following amounts (exclusive of Service Tax) received for the month of March 2014:

Particulars

Services performed before such service became taxable (Invoice issued on 28

th

June 2013) 5,00,000

Services by way of renting of Residential Dwelling for use as Residence 1,50,000

Free Services rendered to the friends of Directors 20,000

Advance Received for services to be rendered in July 2014 5,00,000

Other Receipts 12,00,000

Rate of Service Tax is 12%Education Cess is 2%Secondary &Higher Education Cess is 1%.

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.3

Solution: Similar to Q.No.30, Page 24.33 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.30, Page 24.18 Padhukas Revision Guide for Taxation CA I PCC / I nter

Computation of Service Tax Payable by Professionals Ltd

Particulars

Services performed before such service became taxable (Note 1) Nil

Services by way of renting of Residential Dwelling for use as Residence (Note 2) Nil

Free Services rendered to the Friends of Directors (Note 3) Nil

Advance Received for the services to be rendered in J uly 2013 (Note 4) 5,00,000

Other Receipts 12,00,000

Total 17,00,000

Service Tax @ 12% 2,04,000

Add: Education Cess @ 2% 4,080

Add: Secondary and Higher Education Cess @ 1% 2,040

Service Tax Payable 2,10,120

Notes:

1. Under Rule 5, no Service Tax is payable for the value of services, which is attributable to services provided during the

period when such services were not taxable even if the amount is realized after such services have become taxable.

2. Services by way of renting of residential dwelling for use as residence are included in the Negative List of Services.

Hence, they are not subject to service tax.

3. Service Tax is not leviable in case of Free Services, since no consideration is involved.

4. Advance Received for the services to be rendered in J uly 2014, is liable for Service Tax.

5. It is assumed that Service Tax is collected on all Invoices, irrespective of Basic Exemption.

Question 1 (c): Computation of VAT Liability (5 Marks)

Compute Net VAT Liability of Sachin fromthe following information:

Particulars

RawMaterials fromForeign Market (includes Duty paid on Imports @ 20%) 1,20,000

RawMaterials purchased fromlocal market

Cost of RawMaterial 2,50,000

Add: Excise Duty @ 12% 30,000

2,80,000

Add: VAT @ 4% 11,200 2,91,200

RawMaterials purchased fromNeighbouring State (includes CST @ 2%) 51,000

Storage and Transportation Cost 9,000

Manufacturing Expenses 30,000

Sachin sold goods to Madan, and earned profit @ 12%on the Cost of Production. VAT Rate on Sale of such goods is 4%. There

is no Opening or Closing Stock.

Solution:

Similar to I llustration in Page 26.23 Padhukas Students Referencer on I ncome Tax, Service Tax and VAT

Also refer Page No.26.29, Q.No.18 Padhukas Revision Guide for Taxation CA I PCC / I nter [N 10 Qn]

Dealer: Sachin Computation of Net VAT Liability

Particulars

Raw Materials from Foreign Market 1,20,000

Raw Material from Local Market (Cost of Raw Material including Excise Duty) 2,80,000

Raw Materials purchased from Neighbouring State 51,000

Storage and Transportation Cost 9,000

Manufacturing Expenses 30,000

Cost of Production 4,90,000

Add: Profit Margin at 12% 58,800

Sale Value 5,48,800

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.4

Particulars

VAT on Sale Value at 4% 21,952

Less: VAT Credit Available on Local Purchases (given) (11,200)

Net VAT Liability 10,752

Question 2 (a): Income fromHouse Property (8 Marks)

Mr. Krishna owns a Residential House in Delhi. The House is having two identical units. First Unit of the House is self

occupied by Mr. Krishna, and another unit is rented for 12,000 p.m. The rented unit was vacant for three months during the

year. The particulars of the house for the previous year 20132014 are as under:

Standard Rent 2,20,000 p.a.

Municipal Valuation 2,44,000 p.a.

Fair Rent 2,35,000 p.a.

Municipal Tax paid by Mr. Krishna 12%of the Municipal Valuation

Light and Water Charges 800 p.m.

Interest on Borrowed Capital 2,000 p.m.

Insurance Charges 3,500 p.m.

Painting Expenses 16,000 p.a.

Compute Income fromHouse Property of Mr. Krishna, for the Assessment Year 20142015.

Solution:

Similar to I llustration in Page 5.12 Padhukas Students Referencer on I ncome Tax, Service Tax and VAT

Also refer Page No.5.18, Q.No.5 Padhukas Revision Guide for Taxation CA I PCC / I nter [N 08 Qn]

Assessee: Mr. Krishna Previous Year: 20132014 Assessment Year: 20142015

Computation of I ncome from House Property

Particulars 1

st

Unit () 2

nd

Unit ()

Nature of House Property Self Occupied Let Out

Annual Value u/s 23(1)(a) / (b) (See Notes 1 & 2) NIL 1,08,000

Less: Municipal Taxes paid ( 2,44,000 12% 50%) NIL (14,640)

Net Annual Value NIL 93,360

Less: Deduction u/s 24

30% of NAV ( 93,360 30%)

Interest on Borrowed Capital ( 1,000 p.m. 12 months) each for 2 units

NIL

(12,000)

(28,008)

(12,000)

I ncome from House Property (12,000) 53,352

Taxable I ncome from House Property (after intersource adjustment) 41,352

Notes:

1. Annual Value of 2

nd

Unit is determined as under: Since it is identical units, both the House Properties occupy equal

floor space. [For Municipal Value & Tax Apportionment.] [So, 50% of each amount is considered in computations.]

(a) Higher of Municipal Value ( 1,22,000) or Fair Rent ( 1,17,500), i.e. 1,22,000.

(b) Lower of 1,22,000 (as per (a) above) or Standard Rent ( 1,10,000) , i.e. 1,10,000.

(c) Actual Rent Receivable for the whole year of 1,44,000 (12,000 12) and the Standard Rent of 1,10,000 which

ever is higher is the Annual Value.

(d) However, the annual value shall be the Actual Rent received for let out period, if it is lower owing to vacancy.

Hence, Annual Value is 1,08,000 ( 12,000 9).

2. Annual Value of 1

st

Unit: Since the House Property is self occupied by the Assessee, the Annual Value of the property

is taken as NIL.

3. Setoff of Losses: Loss from one House Property can be set off against Income from another Property, u/s 70.

4. Light and Water Charges, Insurance Charges and Painting Expenses are not allowable as deduction u/s 24.

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.5

Question 2 (b): Service Tax Excess Service Tax, use of Single Challan, etc. (4 Marks)

(i) What will be the obligation of the Service Provider, in respect of excess Service Tax collected fromthe Recipient under the

Service Tax law?

(ii) Can a Multiple Service Provider use a single challan for payment of Service Tax for various services rendered by it?

Solution: Refer following pages of Padhukas Students Referencer on Income Tax, Service Tax and VAT

Qn Reference Answer

(i)

Page 24.30, Para 24.3.6

Point 1

Excess Collection [Sec.73A]: Assessee who has collected an amount in excess of

the amount required to be collected under Service Tax Law, should deposit such

amount with the Government. If not paid, the Central Excise Officer (CEO) shall serve

a show cause notice and after giving the Assessee a reasonable opportunity of being

heard, determine the amount payable by / refundable to him.

(ii)

Page 24.2, Para 24.1.1,

Point 5(b)

A Multiple Service Provider can either use single GAR 7 Challan for making payment in

respect of all services, or separate challans for each services rendered.

Question 2 (c): VAT Credit utilization against VAT &CST Payable (4 Marks)

Mayank, a Dealer, furnished the following details for the month of January 2014:

Inputs purchased within the State 1,00,000

Finished Goods sold within the State 2,00,000

Goods sold in the course of interState trade 1,00,000

Capital Goods procured during the month 1,00,000

VAT paid on Capital Goods 12.5%

Input VAT Rate 12.5%

Output VAT Rate 4%

Central Sales Tax Rate 2%

Compute the Total Tax Liability under the State VAT Law.

Note: The Capital Goods are not goods included in the Negative List. Input Tax Credit on Capital Goods is available in full in

the year of purchase.

Solution: Similar to Q.No.42, Page 26.38 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.42, Page 26.19 Padhukas Revision Guide for Taxation CA I PCC / I nter

Computation of the Tax Liability for the month of J anuary 2014

Particulars

1. Output VAT = Output Sold in the month (within the State) 4% = 2,00,000 4% 8,000

2. Input VAT Credit (including Capital Goods) ( 2,00,000 12.5%) = ( 12,500 + 12,500) 25,000

3. Excess VAT Credit carried forward (1 2) 17,000

4. CST for InterState Sale = 1,00,000 2% 2,000

5. Balance VAT Credit carried forward to subsequent period (4 5) 15,000

6. State VAT Payable ( 8,000 25,000), sufficient Credit is available. Hence, VAT Payable = Nil

7. CST Payable ( 2,000 17,000), sufficient VAT Credit is available. Hence, CST Payable = Nil

Note: It is assumed that the respective State provides for Claim of Credit against CST Payable on InterState Sales.

Question 3 (a): Computation of Salary Income 8 Marks

Fromthe following details, find out the Salary chargeable to tax of Mr. Anand for the Assessment Year 20142015:

Mr. Anand is a regular employee of Malpani Ltd in Mumbai. He was appointed on 01032013 in the scale of 25,0002,500

35,000. He is paid dearness Allowance (which forms part of Salary for Retirement Benefits) @ 15%of Basic Pay, and Bonus

equivalent to one and a half months Basic Pay as at the end of the year. He contributes 18%of his Salary (Basic Pay plus

Dearness Allowance) towards Recognized Provident Fund and the Company contributes the same amount.

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.6

He is provided free housing facility which has been taken on Rent by the Company at 15,000 per month. He is also provided

with following facilities:

(i) The Company reimbursed the medical treatment bill of 40,000 of his daughter, who is dependent on him.

(ii) The monthly salary of 2,000 of a housekeeper is reimbursed by the Company.

(iii) He is getting Telephone Allowance @ 1,000 per month.

(iv) A Gift Voucher of 4,700 was given on the occasion of his marriage anniversary.

(v) The Company pays Medical Insurance Premiumto effect an insurance on the health of Mr. Anand 12,000.

(vi) Motor Car running and maintenance charged fully paid by Employer of 36,600. (The Motor Car is owned and driven by

Mr. Anand. The engine cubic capacity is below1.60 litres. The Motor Car is used for both official and personal purpose by

the Employee.)

(vii) Value of Free Lunch provided during office hours is 2,200.

Solution: Similar to Q.No.38, Page 4.57 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.38, Page 4.27 Padhukas Revision Guide for Taxation CA IPCC / I nter (N 10 Qn)

Assessee: Mr. Anand Previous Year: 20132014 Assessment Year: 20142015

Computation of Income under the Head Salaries

Particulars

Basic Salary ( 25,000 11) + ( 27,500 1) 3,02,500

Dearness Allowance ( 3,02,500 15%) 45,375

Bonus ( 27,500 x 1.5) 41,250

Employers Contribution to Provident Fund in excess of 12% [( 3,02,500 + 45,375) (18% 12%)] 20,873

Rent Free Unfurnished Accommodation [See Note below] 60,169

Medical Treatment of Daughter dependent on the Assessee ( 40,000 15,000) 25,000

Medical Insurance Premium on self (Not Taxable being paid by Employer) Nil

House Keepers Salary reimbursed ( 2,000 12) 24,000

Gift Voucher (Below 5,000. Hence not Taxable) NIL

Telephone Allowance = ( 1,000 12) 12,000

Motor Car = Amount incurred by Employer less 1,800 pm = [36,600 (1,800 x 12)] 15,000

Value of Free Lunch Provided Fully Exempt (Assumed not exceeding 50 per meal) Nil

Gross Salary 5,46,167

Less: Deduction u/s 16 NIL

Income under the head Salaries 5,46,167

Note: Valuation of Rent Free Unfurnished Accommodation

Particulars

I . Computation of Salary for Valuation of Accommodation Facilities

Basic + DA + Bonus + Telephone Allowance ( 3,02,500+ 45,375 + 41,250 + 12,000) 4,01,125

II. Computation of Taxable Value of Unfurnished Accommodation

Rent paid by Employer or 15% of Salary, whichever is lower = 1,80,000 or 15% of 4,01,125 60,169

Less: Rent recovered from employee Nil

Taxable Value of Unfurnished Accomodation 60,169

Question 3 (b): Service Tax First ST Return Enclosures (4 Marks)

List out the documents to be submitted along with the first Service Tax Return.

Solution: Refer Page 25.5, Para 25.2.1 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.6, Page 25.4 Padhukas Revision Guide for Taxation CA IPCC / I nter (N 09 Qn)

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.7

Question 3 (c): VAT Composition Scheme 4 Marks

What happens to VAT Chain when a Seller opts for Composition Scheme? Who are not eligible for Composition Scheme under

the VAT regime? Discuss briefly.

Solution: Refer Page 26.25, Para 26.8 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.19, Page 26.10 Padhukas Revision Guide for Taxation CA I PCC / I nter (M 10 Qn)

Question 4 (a): Capital Gains Value adopted by Stamp Valuation Authority, Land vs Building LT / ST, etc. 4 Marks

Mr. Vaibhav sold a house, held as a Capital Asset, to his friend Mr. Dhanush on 1

st

December 2013, for a consideration of

25,00,000. The SubRegistrar refused to register the document for the said value, as according to him, Stamp Duty

Valuation based on State Government Guidelines was 45,00,0000. Mr. Vaibhav preferred an appeal to the Revenue

Divisional Officer, who fixed the value of the House as 35,00,000 ( 22,00,000 for Land and the balance for Building

portion). The differential Stamp Duty was paid, accepting the said value determined. Mr. Viabhav had purchased the Land

on 1

st

June 2006, for 5,19,000 and completed the construction of the House on 1

st

October 2011, for 14,00,000.

Cost Inflation Indices may be taken as 519 for the Financial Year 20062007, 785 for the Financial Year 20112012 and 939 for

the Financial Year 20132014.

Briefly discuss the tax implications in the hands of Mr. Vaibhav for the Assessment Year 20142015 and compute the Capital

Gains chargeable to tax.

Solution: Similar to Q.No.24, Page 7.62 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.24, Page 7.23 Padhukas Revision Guide for Taxation CA IPCC / I nter (M 10 Qn)

Assessee: Mr. Vaibhav Previous Year: 20132014 Assessment Year: 20142015

Computation of Capital Gains

Particulars Land () Bldg ()

Sale Consideration (Note 1) 22,00,000 13,00,000

Less: Expenses on transfer

Net Consideration 22,00,000 13,00,000

Less: Cost of Acquisition / Indexed Cost of Acquisition (COA / ICA) (Note 2)

Land LTCA Indexed Cost of Acqn = ( 5,19,000

519

939

) (Refer Note 2)

(9,39,000)

Building STCA So, Cost of Acquisition (14,00,000)

Capital Gain/ (Loss) 12,61,000 (1,00,000)

Nature of Capital Gain / Loss LTCG STCL

Notes:

1. Sale Consideration: Value fixed in appeal, i.e. 35,00,000 ( 22,00,000 for Land and 13,00,000 for Building) shall be

taken as Sale Consideration.

2. Nature of Asset: Capital Gain arising out of Land will be LTCG (if Holding Period is > 36 months). Capital Gain arising out of

superstructure will be STCG. (if Holding Period is < 36 months). [C.R.Subramanian 242 ITR 342 (Kar.),

Dr.D.L.Ramachandra Rao 236 ITR 51 (Mad.) and Vimal Chand Golecha 201 ITR 442 (Raj.)]

Asset Purchase/ Construction completed Date Sale Date Period of Holding Nature of Asset

Land 01.06.2007 01.12.2013 > 36 Months LTCA

Building 01.10.2011 01.12.2013 < 36 Months STCA

3. STCL can be set off against LTCG u/s 70. So, LTCG of 11,61,000 ( 12,61,000 1,00,000) is taxable at 20%.

Question 4 (b): Taxability of Certain Receipts 4 Marks

State with brief reasoning whether the following receipts are chargeable to IncomeTax or are exempt (if chargeable, the

amount taxable is to be mentioned) for the Assessment Year 20142015. Computation is NOT required.

Nature of Receipts

(i) Interest on Enhanced Compensation received in 12032014 for acquisition of Urban Land, of which 40%

relates to the earlier year.

96,000

(ii) Rent Received for letting out Agricultural Land for a movie shooting 72,000

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.8

Solution: For Previous Year: 20132014 Assessment Year: 20142015

I tem and Taxability Taxable Amount () Reference

1. Interest on Enhanced Compensation received in

the currxent year is taxable under the head

Income from Other Sources.

2. However u/s 57, 50% of deduction is available

on such enhanced compensation received.

48,000

Padhukas Students Referencer on

Income Tax, Service Tax & VAT

Page 8.2, Para 8.1.1, I tem 18, and

Page 8.3, Para 8.1.2, I tem 6.

Rent Received for letting out Agricultural Land for

a movie shooting is fully taxable, as it is not

considered as Agricultural Income.

72,000 Padhukas Students Referencer on

Income Tax, Service Tax & VAT

Page 13.2, Para 13.1.2

Question 4 (c): Service Tax Advance Received Service not rendered Amount Refunded Effect 4 Marks

Mr. Suresh Karthik, a Service Provider, received an Advance of 3 Lakhs fromMr. Dinesh Raina on 12042013. Even when the

Advance was received, there was some doubt as to whether any service will be rendered. No services were rendered to

Mr.Dinesh Raina, and ultimately on 12032014, Mr. Suresh Karthik refunded the amount to him. Mr. Suresh Karthik wants to

knowwhether

(i) Any Service Tax is payable when the advance was received, and

(ii) He can make selfadjustment of Service Tax while remitting Service Tax due for the quarter ended 31032014.

Solution: See following pages of Padhukas Students Referencer on Income Tax, Service Tax & VAT

Qn Reference Answer

(i)

Page 20.10, Para 20.3.10

Point 2

Service Tax is payable on amounts received as Advance, i.e. received for services

agreed to be provided.

(ii)

Page 24.28, Para 24.3.3,

Rule 6(3) / 6(4A)

SelfAdjustment can be done only in the subsequent month / quarter.

Question 4 (d): VAT Basics 2 +2 =4 Marks

(i) What are the items aggregated in the Addition Method to calculate the VAT payable? When is this method mainly used?

(ii) Is any threshold exemption limits fixed for Dealers to obtain VAT Registration, as per the White Paper? If yes, why is the

same provided?

Solution: See following pages of Padhukas Students Referencer on Income Tax, Service Tax & VAT

Qn Reference Answer

(i) Page 26.8, Para 26.3.1

All the Factor Payments including Profits, are added to arrive at the Total Value

Addition. This method is mainly used with Income Variant of VAT.

(ii) Page 26.32, Para 26.13

Threshold Exemption Limits are fixed to provide relief to Small Dealers. Small Dealers

with Gross Annual Turnover not exceeding 5 Lakhs will not be liable to pay VAT, but

State can extend upto 10 Lakhs.

Question 5 (a): Sec.10(48) of Income Tax Act 4 Marks

Briefly explain the exemption available under Section 10(48) of the IncomeTax Act, 1961 in respect of Income received by

certain Foreign Companies fromSale of Crude Oil.

Solution: See Page 3.6, Para 3.2.5 Padhukas Students Referencer on I ncome Tax, Service Tax & VAT

Any Income received in India in Indian Currency by a Foreign Company on account of sale of Crude Oil, or (w.e.f

01.04.2014, any other goods or rendering of services), as notified by Central Government in this behalf, to any

person is exempt, based on following conditions

1. Such Income is received in India by the Foreign Company, pursuant to an agreement or arrangement entered into by

Central Government or approved by Central Government.

2. Having regard to the national interest, the Foreign Company and the agreement or arrangement are notified by the

Central Government in this behalf. (Note: National Iranian Oil Company is notified vide Notfn No.22/2012 dt 14.6.2012)

3. The Foreign Company is not engaged in any activity in India, other than the receipt of such income.

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.9

Question 5 (b): Power Sector WDV Option Depreciation and Additional Depreciation 4 Marks

Mr. Abhimanyu is engaged in the business of generation and distribution of electric power. He always opts to claim

depreciation on Written Down Value for IncomeTax purposes. Fromthe following details, compute the Depreciation allowable

as per the provisions of the IncomeTax Act, 1961 for the Assessment Year 20142015:

Particulars in Lakhs

(i) Opening WDV of Block (15%Rate) 42

(ii) NewMachinery purchased on 12102013 10

(iii) Machinery imported fromColombo on 12042013. This Machine has been used only in Colombo earlier and

the Assessee is the first user in India.

9

(iv) NewComputer installed in Generation Wing of the unit on 15072013 2

Solution: Similar to Q.No.27, Page 6.92 Padhukas Students Referencer on Income Tax, Service Tax & VAT

Also refer Q.No.27, Page 6.22 Padhukas Revision Guide for Taxation CA IPCC / I nter

Assessee: Mr. Abhimanyu Previous Year: 20132014 Assessment Year: 20142015

Computation of Depreciation allowable u/ s 32 (in )

Particulars Block I (15%) Block I I (60%)

Opening WDV as on 01.04.2013 42,00,000

Add: Additions made during the year

Second hand Machinery (Imported from Colombo) (12.04.2013) 9,00,000

New Machinery (12.10.2013) 10,00,000

New Computer Installation (15.07.2013) 2,00,000

Value of Block before charging Depreciation 61,00,000 2,00,000

Less: Depreciation for the year

Normal Depreciation (for entire year) (42,00,000+9,00,00)

15% = 7,65,000

2,00,000 60%

= 1,20,000

On New Plant and M/c put to use for less than 180 days at 50% 10,00,000 15%

50% = 75,000

Additional Depreciation on New Machinery

(restricted to 50% being less than 180 days of use)

10,00,000 20%

50% = 1,00,000

Total Depreciation Allowable u/ s 32 9,40,000 1,20,000

Closing WDV on 31.03.2014 51,60,000 80,000

Notes:

(a) Additional Depreciation is not allowed in respect of Second Hand Machinery, even if Assessee is the first user in India.

(b) No Additional Depreciation is allowed in respect of Assets other than Plant & Machinery. Hence, New Computer

Installation is not considered as Eligible Asset for the purpose of Additional Depreciation.

Question 5 (c) : Service Tax Value of Taxable Services and ST Payable 4 Marks

Mr. Visvakshena, who has been regularly assessed to Service Tax for the past four years, with taxable Service Tax Receipts of

21 Lakhs in the earlier financial year, furnishes the following details for the quarter ended 31032014:

Nature of Receipts Amount ( Lakhs)

Accounting Services rendered to Charitable Trusts 26

Selling Time Slots for T.V. Advertisements 32

Selling Time Slots for Advertisements in Newspapers 24

Compute the Value of Taxable Services and the Total Service Tax Payable by him.

Is he required to efile his Service Tax Return for the halfyear ended on 31032014?

Solution: See Page 21.5, Para 21.1.8 Padhukas Students Referencer on Income Tax, Service Tax & VAT

See Page 25.7, Para 25.2.3, Point 2 Padhukas Students Referencer on I ncome Tax, Service Tax & VAT

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.10

Computation of Value of Taxable Services for the quarter ended 31.03.2014

Nature of Receipts Taxability Lakhs

Accounting Services rendered to Charitable Trusts Yes (No specific exemption given) 26.00

Selling Time Slots for T.V. Advertisements Yes [Not covered u/s 66D(g)] 32.00

Selling Time Slots for Advertisements in Newspapers No. Covered by Negative List Sec.66D(g)

Total Value of Taxable Service 58.00

Service Tax Payable at 12.36% (including EC & SHEC) 7.17

W.e.f. 01.10.2011, all Assessees have to file returns electronically. [Notification No 43/ 2011ST, dt 25.08.2011]

Question 5 (d): VAT Fill up the Blanks for the following items in the context of VAT. 4 Marks

Qn Question

Answer Reference

(i) The most commonly used method for computing VAT is the

Method.

I nvoice Method. Page 26.8, Para 26.3.2

(ii) The most widely used variant amongst the various ones is

the Variant.

Consumption Variant. Page 26.6, Para 26.2.3

(iii) When a Dealer opts for Composition Scheme, the VAT Chain

(continues / gets broken).

Gets broken. Page 26.25, Para 26.8

(iv) amongst the following is not an applicable VAT

rate : 0, 1, 8 and 12.5.

8% Page 26.4, Para 26.1.4

Question 6 (a) 8 Marks

Compute the Total Income of Mr. Krishna for the Assessment Year 20142015 fromthe following particulars:

Particulars

Income fromBusiness before adjusting the following items 1,75,000

(a) Business Loss brought forward fromAssessment Year 20122013 70,000

(b) Current Depreciation 40,000

(c) Unabsorbed Depreciation of earlier year 1,55,000

Income fromHouse Property (Gross Annual Value) 4,32,000

Municipal Taxes paid 32,000

Mr. Krishna sold a Plot at Noida on 12

th

September 2013 for a consideration of 6,40,000, which had been

purchased by himon 20

th

December 2010 at a cost of 4,10,000.

LongTermCapital Loss on Sale of Shares sold through Recognized Stock Exchange (STT paid) 75,000

LongTermCapital Gain on Sale of Debentures 60,000

Dividend on Shares held as StockinTrade 22,000

Dividend froma Company carrying on agri business 10,000

During the previous year 20132014, Mr. Krishna has repaid 1,67,000 towards Housing Loan froma Scheduled Bank. Out

of 1,67,000, 97,000 was towards Payment of Interest and rest towards Principal Payments. Cost Inflation Indices are as

under Financial Year 20102011: 711, Financial Year 20132014: 939.

Solution:

Similar to I llustration in Page 10.17 Padhukas Students Referencer on I ncome Tax, Service Tax and VAT

Also refer Page No.10.18, Q.No.10 Padhukas Revision Guide for Taxation CA I PCC / I nter

Assessee: Mr. Krishna Previous Year: 20132014 Assessment Year: 20142015

Computation of Total Income

Particulars

Income from House Property (assumed Let Out)

Gross Annual Value 4,32,000

Less: Municipal Taxes paid ( 2,44,000 12% 50%) 32,000

Net Annual Value 4,00,000

Less: Deduction u/s 24: 30% of NAV ( 4,00,000 30%) (1,20,000)

Interest on Borrowed Capital (97,000) (2,17,000)

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.11

Particulars

I ncome from House Property 1,83,000

Profits and Gains of Business or Profession

Income from Business 1,75,000

Less: Setoff of the following:

Current Year Depreciation (40,000)

Unabsorbed Business Loss (Brought Forward from AY 20122013) (70,000)

Unabsorbed Depreciation of earlier year 1,55,000 (restricted to balance

Business Income) i.e. 1,75,000 40,000 70,000

(65,000) NI L

Balance Unabsorbed Depreciation for other Head Adjustments = 90,000

Capital Gains:

A. Long Term Capital Gain on Sale of Debentures 60,000

Long Term Capital Loss on Sale of Shares (Long Term Capital Gain on Sale of

Listed Securities, STT paid is fully exempt from tax. Hence, any Loss arising

from such Sale cannot be setoff.)

Nil

Total of above 60,000

Less: Unabsorbed Depreciation 90,000 available for set off, restricted to (60,000)

Long Term Capital Gains Nil

B. Short Term Capital Gain on Sale of Plot (Holding Period < 36 months)

Sale Consideration 6,40,000 less Cost of Acquisition 4,10,000 2,30,000

Less: Unabsorbed Depreciation 90,000 60,000 used against LTCG (Balance

setoff against Short Term Capital Gains)]

(30,000) 2,00,000

I ncome from Other Sources:

Dividend on Shares held as StockinTrade 22,000

Dividend from a Company carrying on agricultural activities 10,000 32,000

Less: Exemption u/s 10(34) (32,000) NI L

Gross Total Income 3,83,000

Less: Deduction under Chapter VIA:

U/s 80C Repayment of Housing Loan Principal ( 1,67,000 97,000) (70,000)

Total Income 3,13,000

Question 6 (b): Service Tax Meaning of Terms 4 Marks

In the context of chargeability of service tax, what are the implications of the termprovided or agreed to be provided?

Solution: See Page 20.10, Para 20.3.10 Padhukas Students Referencer on I ncome Tax, Service Tax & VAT

Question 6 (c): VAT Ineligible for ITC 4 Marks

List the purchases which are not eligible for Input Tax Credit under VAT Legislation.

Solution: Refer Page 26.14, Para 26.4.1, Point 6

Padhukas Students Referencer on Income Tax, Service Tax & VAT

Question 7 (a): Assessee as per Income Tax Act 4 Marks

Define the termAssessee as per the IncomeTax Act, 1961.

Solution: Refer Page 1.15, Para 1.8.1, Padhukas Students Referencer on Income Tax, Service Tax & VAT

Question 7 (b): EITHER Option Sec.10AA Exemption 4 Marks

Mr. Pranya is running two Industrial Undertakings, one in a SEZ (Unit A) and another in a DTA (Unit B). The brief details for the

year ended 31.03.2013 are as under: (amounts in Lakhs)

Gurukripas Guideline Answers for Nov 2013 CA Inter (IPC) Income Tax, Service Tax and VAT

Nov 2013.12

Particulars Unit A Unit B

Domestic Turnover 10 100

Export Turnover 120 Nil

Gross Profit 20 10

Less: Expenses and Depreciation 07 06

Profits derived fromthe Units 13 04

The Brought Forward Business Loss pertaining to Assessment Year 20112012 for Unit B is 3.2 Lakhs. Briefly compute the

Business Income of the Assessee.

Solution:

Similar to I llustration in Page 3.23 Padhukas Students Referencer on I ncome Tax, Service Tax and VAT

Also refer Page No.3.13, Q.No.2 Padhukas Revision Guide for Taxation CA I PCC / I nter [M 11 Qn]

Assessee: Mr. Pranay Previous Year: 20132014 Assessment Year: 20142015

Computation of Business Income ( In Lakhs)

Particulars A B

Profits derived from the Units 13.00 4.00

Less: Exemption u/s 10AA

Turnover Total

Turnover Export

g Undertakin the of Business of Profit = 13.00

10 + 120

120

(12.00)

Taxable Profits 1.00 4.00

Less: Brought Forward Business Loss (3.20)

Business Income 1.00 0.80

Note: It is assumed that the above Financial Year falls within the first 5year period commencing from the year of

manufacture or production of articles / things, or provision of services, by Unit A.

Question 7 (b): OR Option Conditions to be satisfied by Charitable Trust 4 Marks

What are the conditions to be fulfilled by a Charitable Trust u/s 12A for applicability of exemption provisions contained in

Sections 11 and 12 of the IncomeTax Act, 1961?

Solution: Refer Page 16.3, Para 16.2.1, Padhukas Students Referencer on Income Tax, Service Tax & VAT

Question 7 (c) : Service Tax Consideration not wholly in money 4 Marks

Describe briefly the manner of determination of value for service tax purposes, when consideration is not wholly/partly

consisting of money.

Solution: Refer Page 22.5, Para 22.2.1, Padhukas Students Referencer on Income Tax, Service Tax & VAT

If Consideration partly in cash and partly in nonmonetary form, Value of Taxable service is such value which

together with the Service Tax is the consideration. [i.e. consideration shall be deemed as inclusive of service tax.].

Consideration shall include any amount that is payable for the taxable services provided or to be provided.

Question 7 (d): VAT Deficiencies of VAT 4 Marks

What are the deficiencies of VAT System?

[

Solution: Refer Page 26.35, Para 26.14.2, Padhukas Students Referencer on Income Tax, Service Tax & VAT

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Module 04 Income Tax Compliance RevisedDocument25 pagesModule 04 Income Tax Compliance RevisedSly BlueNo ratings yet

- Deductions From Gross IncomeDocument30 pagesDeductions From Gross IncomeKatherine Ederosas50% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Taxation 2013 NovDocument25 pagesTaxation 2013 NovAshok 'Maelk' RajpurohitNo ratings yet

- (With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusDocument25 pages(With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusTushar BhattacharyyaNo ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDocument16 pagesGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakNo ratings yet

- Service Tax and Vat Problems By-BharathDocument3 pagesService Tax and Vat Problems By-BharathrajdeeppawarNo ratings yet

- Suggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Document13 pagesSuggested Answer For Ipce May 2013 Taxation: by CA Parasuram Iyer Contact: 9028518367Parasuram IyerNo ratings yet

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargNo ratings yet

- Examples On Taxable Services A To L (Chapter 59)Document6 pagesExamples On Taxable Services A To L (Chapter 59)kapilchandanNo ratings yet

- F6PKN 2012 Dec A PDFDocument13 pagesF6PKN 2012 Dec A PDFabby bendarasNo ratings yet

- 51043bos40756 cp4 PDFDocument27 pages51043bos40756 cp4 PDFraghuraman1511No ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- M 14 Final Financial Reporting Guideline AnswersDocument16 pagesM 14 Final Financial Reporting Guideline Answersmj192No ratings yet

- Sample Assessment Questions: Formative Activity: / Summative AssessmentDocument15 pagesSample Assessment Questions: Formative Activity: / Summative AssessmentEli_Hux50% (2)

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekeraNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Long Test For Final Examination in Conceptual Framewor... (BSA 2-1 STA. MARIA: 1ST SEM AY 2020-2021)Document26 pagesLong Test For Final Examination in Conceptual Framewor... (BSA 2-1 STA. MARIA: 1ST SEM AY 2020-2021)Mia CruzNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaP VenkatesanNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- F6 (MYS) Specimen Qs Dec 2015Document22 pagesF6 (MYS) Specimen Qs Dec 2015rayyan darwishNo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- 54595bos43759 p4 PDFDocument33 pages54595bos43759 p4 PDFakkkNo ratings yet

- Statutory Income Assessable Income Chargeable IncomeDocument4 pagesStatutory Income Assessable Income Chargeable IncomeKelvin Lim Wei LiangNo ratings yet

- Ipc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamDocument8 pagesIpc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamAnuj Harshwardhan SharmaNo ratings yet

- 9mys 2010 Dec A PDFDocument7 pages9mys 2010 Dec A PDFGabriel SimNo ratings yet

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282No ratings yet

- CA IPCC ExamDocument9 pagesCA IPCC ExamTushar BhattacharyyaNo ratings yet

- Acca Tx-Mys 2019 JuneDocument14 pagesAcca Tx-Mys 2019 JuneChoo LeeNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Document8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuNo ratings yet

- TAX MGT PPT 1Document28 pagesTAX MGT PPT 1Rahul DesaiNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- 10-Practical Questions of Individuals (78-113)Document38 pages10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- Work Shop On InterestDocument25 pagesWork Shop On InterestmukeshNo ratings yet

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasNo ratings yet

- Commercial and Industrial ActivitiesDocument15 pagesCommercial and Industrial ActivitiesMR BeastNo ratings yet

- Income Tax May23 Free ResourcesDocument29 pagesIncome Tax May23 Free ResourcesPurna PatelNo ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- Annual ReportDocument43 pagesAnnual ReportShuchita AgarwalNo ratings yet

- Leve 2 Coc ExamDocument45 pagesLeve 2 Coc Exameferem92% (38)

- CA IPCC Inter Income Tax Revision - Kalpesh Classes PDFDocument61 pagesCA IPCC Inter Income Tax Revision - Kalpesh Classes PDFnagababuNo ratings yet

- CA IPCC Inter Income Tax Revision - Kalpesh Classes PDFDocument61 pagesCA IPCC Inter Income Tax Revision - Kalpesh Classes PDFSandra MaloosNo ratings yet

- Old Question Practice2Document3 pagesOld Question Practice2Anuska JayswalNo ratings yet

- Balance Sheet:: Profit and Loss AccountDocument6 pagesBalance Sheet:: Profit and Loss AccountAhmed JavaidNo ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet

- P6mys 2016 Jun QDocument15 pagesP6mys 2016 Jun QAtiqah DalikNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet