Professional Documents

Culture Documents

Acc 3013 - Fwa Revision Questions

Uploaded by

falnuaimi001Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 3013 - Fwa Revision Questions

Uploaded by

falnuaimi001Copyright:

Available Formats

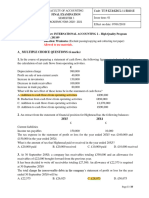

Faculty-wide Assessment (FWA)

ONLINE ASSESSMENT

Division Business Duration 120 minutes

Program Bachelor of Accounting

Course ACC 3013 Taxation

Instructions to Students

You should have:

This question paper:

Tax tables containing applicable tax rates and allowances: 7 pages

Academic Honesty Statement

In accordance with HCT policy LP201- Academic Honesty

• Students are required to refrain from all forms of academic dishonesty as defined

and explained in HCT procedures and directions from HCT personnel.

• A student found guilty of having committed acts of academic dishonesty may be

subject to one or more of the disciplinary measures as outlined in Article 33 of the

Student and Academic Regulations.

إفادة األمانة األكاديمية

األمانة األكاديميةLP201 - وفًقا لسياسة كليات التقنية العليا

كما هو مبّين وموضح في السياسات واإلجراءات،• ُيطلب من الطلبة االمتناع عن كافة أشكال سوء األمانة األكاديمية

. والتوجيهات الصادرة من موظفي الكليات،الخاصة بكليات التقنية العليا

• في حالة ارتكاب الطالب أي شكل من أشكال سوء األمانة األكاديمية سوف يتعرض الى واحد أو أكثر من التدابير

. من األنظمة األكاديمية33 التأديبية على النحو المبين في المادة

Signature: _____________________________________________

Student Name: _______________________________________________________

Student HCT ID: _______________________________________________________

Section No. ONE TWO Total %

Marks Allocated 20 80 100 100

Marks Obtained

SAMPLE FWA EXAM

SECTION ONE: MULTIPLE CHOICE (20 possible marks)

1. Most of the taxes in UK are _________.

A. direct taxes

B. indirect taxes

C. indirectly collected by the government

D. flat-rate taxes

2. Which of the following refers to past legal decisions written by the courts in the course

of deciding cases?

A. acts of Parliament

B. statutory Instruments

C. HMRC publications

D. case law

3. Which of the following is a case of tax evasion?

A. contributions to tax-free individual savings accounts (ISAs)

B. donating larger amounts to approved charities

C. making contributions to personal pension plans in excess of available allowances

D. none of the above

4. Vicky is visiting UK once every year since 2010 but has not been a UK resident in any of

the preceding tax years. In 2019, he arrives in the UK on 6 April and wishes to spend

maximum days but would not like to become UK resident for the tax year 2019/20. If

Vicky has no any UK ties, how long should he stay?

A. less than 46 days

B. less than 16 days

C. less than 90 days

D. less than 183 days

SAMPLE FWA EXAM

5. Rizwan makes a chargeable gain of £21,900 during the tax year 2019/20. This gain does

not qualify for entrepreneur’s relief. What is the amount of taxable gain for Rizwan for

the tax year 2019/20?

A. £21,900

B. £10,050

C. £10,200

D. £11,700

6. The latest filing date for a personal paper return for the tax year 2019/20 where notice

to file tax return issued by HM Revenue & Customs on 15 May 2020 is__________.

A. 15 May 2020

B. 31 October 2020

C. 31 December 2020

D. 31 January 2020

7. Which of the following is not likely to be used as a badge of trade?

A. length of ownership of goods

B. age of the taxpayer

C. intentions of the taxpayer

D. frequency of transactions

8. Hill View Limited published accounts for the year ended 31 March 2020 in April 2020

and filed tax return for the financial year 2019 in November 2020. If no any compliance

check enquiry related to FY 2019 is pending or expected, Hill View Limited must keep the

records up to__________.

A. 31 March 2026

B. 31 March 2021

C. 30 November 2026

D. 31 December 2020

SAMPLE FWA EXAM

9. Unless advised otherwise by HM Revenue & Customs, a VAT registered trader must keep

records for inspection for_________.

A. 6 years

B. 1 year

C. 3 years

D. 4 years

10. JP Mehra, a VAT registered trader, purchased a motor car in July 2019 for £20,000

excluding VAT. He could not recover VAT paid because the car is not wholly used for

business purposes. JP Mehra subsequently sold the car in February 2020 for £18,000

excluding any VAT. What is the output tax payable on this sale?

A. £3,600

B. £2,000

C. £4,000

D. £0

END OF SECTION ONE

SAMPLE FWA EXAM

SECTION TWO: CONSTRUCTED RESPONSE QUESTIONS (80 possible marks)

11. Perry works for Mahr Ltd. He also owns and runs a small trading business as a sole

trader. Following information relates to the tax year 2019/20:

£

Employment income (before deduction of PAYE tax) 75,000

Trading income (taxable) 33,500

Dividends 6,250

Building society interest 2,200

Qualifying interest paid 1,000

Contribution to personal pension plan (net) 6,500

Mahr Ltd. has deducted £28,000 PAYE tax from payments made to Perry. Perry has donated

£3,600 in gift aid to an approved local charity during the tax year 2019/20.

Required:

Assess the income tax liability of Perry for the tax year 2019/20.

SAMPLE FWA EXAM

11. Agha is a sole trader who has been in business for many years preparing accounts to 5

April each year. His recent results have been as follows:

Year ended 5 April 2019 profit £19,500

Year ended 5 April 2020 loss 31,900

Agha received dividend income of £6,300 and £4,900 in 2018/19 and 2019/20

respectively. Agha has no other income in 2019/20.

Required:

Assess taxable income for 2018/19 & 2019/20, and determine the amount of trading

loss to carry forward to the tax year 2020/21, if Agha wishes to claim loss relief against

general income of the current and preceding year (quickest claim).

(6 marks)

SAMPLE FWA EXAM

13. Peter and Noreen are running a partnership business since 2014 and prepare accounts

to 31 March each year. For the year ended 31 March 2020, taxable trading profits are

£90,000. Peter is allocated an annual salary of £10,000 and the remaining profits are

then shared between Peter and Noreen in the ratio of 1:2. However, on 31 May 2019

they agreed to new terms that allow annual salaries of £10,000 to each partner and

equal share of remaining profit or loss.

Required:

Assess taxable profits of each partner assuming none of the partners has any other

during the tax year 2019/20. (8 marks)

SAMPLE FWA EXAM

14. In February 2011, Patricia made a lifetime chargeable transfer of £229,000. On 10

January 2020, she makes a gift of £430,000 to a trust. The trustees agree to pay the

inheritance tax due.

Required:

Assess inheritance tax liability of the trustees (donee) on the gift made in January 2020.

(8 marks)

SAMPLE FWA EXAM

15. Ravi Ryan Ltd manufactures chemicals for use in textile industries. Ravi Ryan Ltd is a UK

resident company and prepares accounts to 31 March every year. The company’s

statement of profit or loss for the year ended 31 March 2020 is as follows:

Notes £ £

Gross profit 1,222,000

Other income

Dividends income 1 30,000

Profit on sale of business premises 2 54,800

Property rental income 3 15,000

Bank interest 4 18,320

118,120

Expenses

Impaired debt (all trade) 8,500

Depreciation 191,600

Professional fees 5 42,000

Repairs and renewals 6 128,000

Other expenses 7 72,000

(442,100)

Interest payable 8 (41,900)

Profit before taxation 856,120

Notes:

1) Dividends income of £30,000 was received from a UK company.

2) Profit on sale of business premises

SAMPLE FWA EXAM

Business premises were sold on 15 October 2019 for £590,000. The chargeable gain

on sale has been computed to £49,800.

3) Property rental income was received during the year in respect of a commercial

property held as an investment and is let out to an unconnected company. Rental

amount received covers the rental period from 1 April 2019 to 31 March 2020.

4) Bank interest received

The bank interest is the amount accrued to 31 March 2020 on deposits not held for

trading purposes.

5) Professional fees are as follows:

Legal fees in connection with the issue of loan notes (N.8) £9,700

Legal fees in connection with fine for breach of health and safety rules 2,100

Accountancy and audit fee 15,400

Legal fees in connection with the issue of share capital 14,800

42,000

6) Repairs and Renewals

Repairs and renewals includes £90,700 for constructing an extension to the

company’s manufacturing premises and £37,300 for repainting interior of the

company’s headquarter.

7) Other expenses

Other expenses include:

Charitable donation to a qualifying local charity £8,000

Entertaining customers 3,200

8) Interest payable

A note was issued on 1 August 2019, proceeds of which was used for trading

purposes. Interest amount given in the profit statement was paid on 31 March 2020

and is the amount accrued to that date.

9) Capital allowances on plant and machinery

The tax written down value of main pool at 1 April 2019 was £1,118,750.

In the year to 31 March 2019, following assets were purchased:

1 June 2019 Machinery £130,000

SAMPLE FWA EXAM

12 November 2019 Van 17,500

Company disposed of plant on 15 December 2019 for £12,000 (original cost

£16,000).

Required:

a. Assess Ravi Ryan’s tax adjusted trading profits for the year ended 31 March 2020.

Start with the profit before taxation of £856,120 and list all of the items in the

statement of profit and loss indicating by the use of a zero (0) any items that do not

require adjustment. Assume that the company claims maximum available capital

allowances. (16 marks)

b. Assess Ravi Ryan Ltd’s taxable total profits for the year ended 31 March 2020.

(5

marks)

c. Assess the corporation tax liability of Ravi Ryan for the year ended 31 March 2020.

(2

marks)

SAMPLE FWA EXAM

16. Hariby Ltd has provided the following information for the quarter to 31 March 2020:

1) Sales consisted of £45,000 standard rated sales and £15,000 zero rated sales.

2) Purchases of trade goods were all standard rated and totaled £31,000.

3) Standard rated expenses were £7,600, including £350 for entertaining UK customers.

4) Goods costing £250 were taken out of inventory for private use. The replacement

cost of goods was £300.

5) A photocopier (for use in office) costing £6,400 was purchased.

All figures exclude VAT.

Required:

Assess the VAT liability of Hairby Ltd for the quarter ended 31 March 2020.

(15 marks)

SAMPLE FWA EXAM

You might also like

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Question. Chapter 4. Trading ProfitDocument6 pagesQuestion. Chapter 4. Trading ProfitTâm TốngNo ratings yet

- Progress Test 1: Principle of TaxationDocument12 pagesProgress Test 1: Principle of TaxationĐỗ ĐạtNo ratings yet

- ICAEW - Tax - Mini Test 3 - STDDocument6 pagesICAEW - Tax - Mini Test 3 - STDlinhdinhphuong02No ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- Template - QE - BLT For Incoming 4th YrDocument12 pagesTemplate - QE - BLT For Incoming 4th YrJykx SiaoNo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Acct 470 Pre Quiz Chapter 4,5,9-12Document28 pagesAcct 470 Pre Quiz Chapter 4,5,9-12karissa.jqasm.0No ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- F2 Financial Accounting April 2019Document24 pagesF2 Financial Accounting April 2019Saddam HusseinNo ratings yet

- F2 Tax August 2020 - 1Document24 pagesF2 Tax August 2020 - 1paul sagudaNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Financial AccountingDocument20 pagesFinancial AccountingVarun SoniNo ratings yet

- Tax3226N 3247N October 2024 AssignmentDocument10 pagesTax3226N 3247N October 2024 AssignmentKeaTumi Bokang LeagoNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- P6-Corporation TaxDocument16 pagesP6-Corporation TaxAnonymous rePT5rCrNo ratings yet

- Final - Unit - 10 - Financial Accounting - TrangDocument5 pagesFinal - Unit - 10 - Financial Accounting - TrangKevin PhạmNo ratings yet

- FAR Vol 2 Chapter 16 18Document14 pagesFAR Vol 2 Chapter 16 18Allen Fey De Jesus100% (1)

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Income From Business and ProfessionDocument14 pagesIncome From Business and Professionimdadul haqueNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PaperssedikingNo ratings yet

- Income Tax Trading Losses - July 2023Document3 pagesIncome Tax Trading Losses - July 2023maharajabby81No ratings yet

- Test 1 TaxDocument16 pagesTest 1 TaxZyrelle Delgado0% (1)

- TX UK June 2023 Examiner's Report - FinalDocument19 pagesTX UK June 2023 Examiner's Report - FinalMUHAMMAD KAMRANNo ratings yet

- Clouie Jid Malino TLA 6.2Document9 pagesClouie Jid Malino TLA 6.2Raynon AbasNo ratings yet

- BT NLKTDocument3 pagesBT NLKTTâm NguyễnNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- Taxation Management and PlanningDocument10 pagesTaxation Management and PlanningJoel EdauNo ratings yet

- Income Tax On Partnerships - QuestionsDocument9 pagesIncome Tax On Partnerships - QuestionsJembrain CanubasNo ratings yet

- TAX Preweek Lecture (B42) - December 2021 CPALEDocument16 pagesTAX Preweek Lecture (B42) - December 2021 CPALEkdltcalderon102No ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- TaxDocument3 pagesTaxLet it beNo ratings yet

- Tax Accounting Set ADocument4 pagesTax Accounting Set AGopti EmmanuelNo ratings yet

- Exam - Midterm - Answers - 17 March 2022Document10 pagesExam - Midterm - Answers - 17 March 2022elodie Helme GuizonNo ratings yet

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Tax-1-Solutions Bsa Quiz - Theories W AnsDocument6 pagesTax-1-Solutions Bsa Quiz - Theories W AnsCyrss BaldemosNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Ca Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Document5 pagesCa Inter, Group I Class Test 5. Test - DT Topic - . PGBP Date-TIME: 1:30 Hours MARKS:40 Total No - of Questions: 7 Total No - of Pages: 00Shrestha GuptaNo ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Document22 pagesDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeNo ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Quiz 1 IntaxDocument5 pagesQuiz 1 IntaxTOMAS, JACKY LOU C.No ratings yet

- Icag Past QuestionDocument5 pagesIcag Past QuestionAdam AliuNo ratings yet

- Far CeggDocument17 pagesFar CeggMaurice AgbayaniNo ratings yet

- AnswerDocument8 pagesAnswerJericho PedragosaNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- ACC 3013 - FWA - Revision - 202110Document14 pagesACC 3013 - FWA - Revision - 202110falnuaimi001No ratings yet

- ACC 3003 - ReviewDocument22 pagesACC 3003 - Reviewfalnuaimi001No ratings yet

- ACC 3013 Taxation RevisionDocument4 pagesACC 3013 Taxation Revisionfalnuaimi001No ratings yet

- ACC 3003 - Final Exam Revision - SolutionDocument22 pagesACC 3003 - Final Exam Revision - Solutionfalnuaimi001No ratings yet

- ACC 3003-Key Revision For Test 1Document7 pagesACC 3003-Key Revision For Test 1falnuaimi001No ratings yet

- ACC 3003 - Final Exam RevisionDocument19 pagesACC 3003 - Final Exam Revisionfalnuaimi001100% (1)

- ACC 2103 FWA Revision - V2 - Q Then KEY - 201810-DIFDocument23 pagesACC 2103 FWA Revision - V2 - Q Then KEY - 201810-DIFfalnuaimi001No ratings yet

- ACC 2103 - FWA1 - 201910 - Answer KeyDocument10 pagesACC 2103 - FWA1 - 201910 - Answer Keyfalnuaimi001No ratings yet

- ACC 3003-Revision For Test 1Document7 pagesACC 3003-Revision For Test 1falnuaimi001No ratings yet

- ACC 2103 Practise QuestionsDocument7 pagesACC 2103 Practise Questionsfalnuaimi001No ratings yet

- ACC 3003 Case 4Document1 pageACC 3003 Case 4falnuaimi001No ratings yet

- Acc 2103 FWARDocument8 pagesAcc 2103 FWARfalnuaimi001No ratings yet

- Radhu's Recipes - 230310 - 180152 PDFDocument123 pagesRadhu's Recipes - 230310 - 180152 PDFl1a2v3 C4No ratings yet

- Industrial RobotDocument32 pagesIndustrial RobotelkhawadNo ratings yet

- Line-And-Staff Organizations - Examples, Advantages, Manager, Type, Company, Disadvantages, BusinessDocument4 pagesLine-And-Staff Organizations - Examples, Advantages, Manager, Type, Company, Disadvantages, BusinessSangram PradhanNo ratings yet

- The Progress Report of The Mumbai-Ahmedabad High Speed Railway ProjectDocument4 pagesThe Progress Report of The Mumbai-Ahmedabad High Speed Railway ProjectJorge MariaNo ratings yet

- Finalizing The Accounting ProcessDocument2 pagesFinalizing The Accounting ProcessMilagro Del ValleNo ratings yet

- Peter A. Levine - Waking The Tiger - Healing Trauma - The Innate Capacity To Transform Overwhelming Experiences - 1997 - OCRDocument193 pagesPeter A. Levine - Waking The Tiger - Healing Trauma - The Innate Capacity To Transform Overwhelming Experiences - 1997 - OCRNeelakanta Kalla96% (55)

- Ernst Bloch Principle of Hope PDFDocument2 pagesErnst Bloch Principle of Hope PDFAdamNo ratings yet

- 4194-Article Text-11162-1-10-20190903Document6 pages4194-Article Text-11162-1-10-20190903Akhsana SantosoNo ratings yet

- Fold N Slide Hardware BrochureDocument52 pagesFold N Slide Hardware Brochurecavgsi16vNo ratings yet

- Strategy Implementation, Evaluation and ControlDocument6 pagesStrategy Implementation, Evaluation and Controlbonny MishNo ratings yet

- Citing SourcesDocument37 pagesCiting Sourcesasquared29No ratings yet

- Srijana BahadurDocument13 pagesSrijana Bahadurkhadija khanNo ratings yet

- PC-1 FORM Revised 2005 Government of Pakistan Planning Commission Pc-1 Form (Social SECTORS)Document18 pagesPC-1 FORM Revised 2005 Government of Pakistan Planning Commission Pc-1 Form (Social SECTORS)Muhammad IlyasNo ratings yet

- Cynara FoliumDocument37 pagesCynara Foliumshuvvro dhaNo ratings yet

- Customer Experience For DummiesDocument51 pagesCustomer Experience For DummiesAlejandroNo ratings yet

- Agitated Thin Film Dryer ClaculationDocument12 pagesAgitated Thin Film Dryer ClaculationakaashNo ratings yet

- Your Electricity Bill at A Glance: Total Due 198.32Document2 pagesYour Electricity Bill at A Glance: Total Due 198.32rodrigo batistaNo ratings yet

- Analog Devices - LVDT Signal Conditioner AD598Document16 pagesAnalog Devices - LVDT Signal Conditioner AD598maguschNo ratings yet

- 01 IKSP and Environmental MovementsDocument12 pages01 IKSP and Environmental MovementsGlister Diadem DolleraNo ratings yet

- Abrar AwolDocument153 pagesAbrar AwolErmias Assaminew AlmazNo ratings yet

- V Upashama PrakaranamDocument488 pagesV Upashama PrakaranamantiX LinuxNo ratings yet

- Strategic ManagementDocument91 pagesStrategic ManagementAniket DEORENo ratings yet

- Explanation Teks: How To Keep The Body HealthyDocument4 pagesExplanation Teks: How To Keep The Body HealthyremybonjarNo ratings yet

- Advanced Concepts of GD&TDocument3 pagesAdvanced Concepts of GD&TPalani Trainer33% (3)

- NN IP Guidebook To Alternative CreditDocument140 pagesNN IP Guidebook To Alternative CreditBernardNo ratings yet

- Unidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFDocument24 pagesUnidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFpedropruebaNo ratings yet

- Unit 2Document42 pagesUnit 2Kalaiselvan PunniyamoorthyNo ratings yet

- Forces and MotionDocument22 pagesForces and MotiongamahimeNo ratings yet

- ExcaDrill 45A DF560L DatasheetDocument2 pagesExcaDrill 45A DF560L DatasheetИгорь ИвановNo ratings yet

- L807268EDocument1 pageL807268EsjsshipNo ratings yet