Professional Documents

Culture Documents

Quantitative Analysis: CFA Level - I

Quantitative Analysis: CFA Level - I

Uploaded by

Ashish JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quantitative Analysis: CFA Level - I

Quantitative Analysis: CFA Level - I

Uploaded by

Ashish JainCopyright:

Available Formats

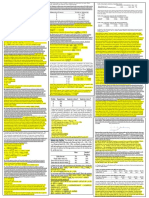

Means Variance & Std.

Deviation

Geometric mean: Calculating

investment returns over multiple

period or to measure compound

Average of squared deviations from mean.

Population variance

( )

N

X X

N

i

i

=

=

1

2

2

Arithmetic mean: =

N

i

i

N

X

1

Quantitative Analysis

Time Value of

Money

Descriptive

Statistics

Probability

Distributions

Technical Analysis Hypothesis Testing Probability Sampling

Pristine CFA Level - I

period or to measure compound

growth rates

RG = [(1+R

1

)*..*(I+R

N

)]

1/N

-1

Sample variance

Standard deviation:

N

1

1

2

2

=

=

n

X X

s

N

i

i

Q. ABC was inc. on Jan 1, 2004. Its expected

annual default rate of 10%. Assume a

constant quarterly default rate. What is the

probability that ABC will not have defaulted

by April 1, 2004?

Ans. P(No Default Year) = P(No def all

Quarters)

= (1-PDQ

1

)*(1-PDQ

2

)*(1-PDQ

3

) * (1-PDQ

4

)

PDQ

1

=PDQ

2

=PDQ

3

=PDQ

4

=PDQ

P(No Def Year) = (1-PDQ)

4

P(No Def Quarter) = (0.9)

4

= 97.4%

Harmonic mean =

N

i i

X

1

1

Variance = s or

Calculate the standard deviation of following

data set:

Data Set A: 10,20,30,40,50

Data Set B: 10,20,70,120,130

Q. Amit has invested $300 in Security A, which has a mean return of 15% and standard deviation of

Quantitative Analysis

Time Value of

Money

Descriptive

Statistics

Probability

Distributions

Technical Analysis Hypothesis Testing Probability Sampling

Expected Return /

Std. Deviation

Correlation & Covariance

Correlation = Corr(R

i

, R

j

) = Cov(R

i

, R

j

) / (R

i

)*(R

j

)

Expected return, Variance of 2-stock portfolio:

E(Rp) = w

A

E(R

A

) + w

B

E(R

B

)

VaR(R

p

) =w

A

2

2

(R

A

)+ w

B

2

2

(R

B

) +2w

A

w

B

(R

A

) (R

B

)(R

A,

, R

B

)

Expected Return E(X)=P(x

1

)x

1

+P(x

2

)x

2

+.+P(x

n

)x

n

Probabilistic variance:

2

(x)=

=P(x

1

)[x

1

-E(X)]

2

+P(x

2

)[x

2

-E(X)]

2

+.+P(x

n

)[x

n

-E(X)]

2

2

)] ( )[ ( X E x x P

i i

Pristine CFA Level - I

Q. Amit has invested $300 in Security A, which has a mean return of 15% and standard deviation of

0.4. He has also invested $700 in security B, which has a mean return of 7% and variance of 9%. If

the correlation between A and B is 0.4, What is his overall expectation and Standard deviation of

portfolio?

Return = 9.4%, Std Deviation = 7.8%

Return = 9.4%, Std Deviation = 24%

Return = 9.4%, Std Deviation = 28%

Ans.

The correct answer is Return = 9.4%, Std Deviation = 24%

B) Cov(A, w) - 2w(1 w) - (1 w

2

B

2 2

A

2

+ +

Calculate the correlation between the following data set:

Data Set A: 10,20,30,40,50

Data Set B: 10,20,70,120,130

Quantitative Analysis

Time Value of

Money

Descriptive

Statistics

Probability

Distributions

Technical Analysis Hypothesis Testing Probability Sampling

Dispersion relative to mean

of a distribution; CV=/ ( is

std dev.)

Coefficient of

Variation

Sharpe Ratio

Nominal Scale: Observations classified with no order.

e.g. Participating Cars assigned numbers from 1 to 10 in the car race

Ordinal Scale: Observations classified with a particular ranking out of defined

set of rankings.

Measurement Scales

Measures excess return per unit of risk.

Sharpe ratio =

Roys safety- First ratio:

p

f p r r

et t p r r arg

Pristine CFA Level - I

Q. If the threshold return is higher than the

risk-free rate, what will be the relationship

b/w Roys safety-first ratio (SF) and Sharpes

ratio?

Denominator (Sharpe) = Denominator (SF)

R

target

> Rf

R Rf > R - R

target

Sharpe > SF

Ans. R Rf > R - R

target

set of rankings.

e.g. Driver assigned a pole position according to their performance in heats

Interval Scale: Observations classified with relative ranking. Its an ordinal scale

with the constant difference between the scale values.

e.g. Average temperature of different circuits.

Ratio Scale: Its an interval scale with a constant ratio of the scale values. True

Zero point exists in the ratio scale.

e.g. Average speed of the cars during the competition.

Which of the following type of scale is used when interest rates on Treasury

bill is mentioned for 60 years?

A. Ordinal scale

B. Interval scale

C. Ratio scale

Ans. Ratio Scale

Expect 2 questions form Measurement Scales

Roys safety- First ratio:

Sharpe Ratio uses risk free rate, Roys Ratio

uses Min. hurdle rate

For both ratios, larger is better.

p

r r

Quantitative Analysis

Time Value of

Money

Descriptive

Statistics

Probability

Distributions

Technical Analysis Hypothesis Testing Probability Sampling

Definition & Properties

Empirical probability: derived fromhistorical data

Priori probability: derived by formal reasoning

Subjective probability: derived by personal judgment

Sum Rule and Bayes Theorem

P(B)= P(AB)+ P(A

c

B)

= P(BA)*P(A) + P(BA

c

)*P(A

c

)

P(A|B)=P(BA)*P(A) / [P(BA)*P(A)

+P(BA

c

)*P(A

c

)]

Pristine CFA Level - I

P(A) = no. of fav. Events / Total possible events

0 < P(A) <1, P(A

c

)=1-P(A)

P(AUB)=P(A)+P(B)-P(AB)

If A,B Mutually exclusive:

P(AUB)=P(A)+P(B)

P(AB)= P(AB)/P(B)

P(AB)=P(AB)P(B)

If A,B Independent:

P(AB)=P(A)P(B)

Q. The subsidiary will default if the parent defaults, but the

parent will not necessarily default if the subsidiary defaults.

Calculate Prob. of a subsidiary & parent both defaulting.

Parent has a PD = 0.5%subsidiary has PD of .9%

Ans. P(PS) = P(S/P)*P(P)

= 1*0.5%

= 0.5%

You might also like

- Notice of Appeal NAPOLCOMDocument3 pagesNotice of Appeal NAPOLCOMJhoey Castillo Bueno75% (4)

- CRE GlossaryDocument128 pagesCRE GlossaryWong Shu Yang100% (1)

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- The Astrology of I Ching - Sherrill-ChuDocument461 pagesThe Astrology of I Ching - Sherrill-Chuale94% (16)

- Chapter 6 Pilbeam Finance and Financial Markets 4th EditionDocument64 pagesChapter 6 Pilbeam Finance and Financial Markets 4th EditionJay100% (1)

- Introduction To Hedge Funds 2018 enDocument20 pagesIntroduction To Hedge Funds 2018 enVeera PandianNo ratings yet

- Clo Manager Size RankingsDocument75 pagesClo Manager Size Rankingskiza66No ratings yet

- Finance 261 - Cheat SheetDocument2 pagesFinance 261 - Cheat SheetstevenNo ratings yet

- Review of Basic Bond ValuationDocument6 pagesReview of Basic Bond ValuationLawrence Geoffrey AbrahamNo ratings yet

- SS 01 Quiz 2 PDFDocument60 pagesSS 01 Quiz 2 PDFYellow CarterNo ratings yet

- CH - 15 Financial Management: Core ConceptsDocument35 pagesCH - 15 Financial Management: Core ConceptsLolaNo ratings yet

- ADCCAC Arbitration RulesDocument32 pagesADCCAC Arbitration RulesbsiddiqiNo ratings yet

- Chapter 6 Unit Test TrigDocument6 pagesChapter 6 Unit Test TrigAnanya Sharma - Lincoln Alexander SS (2132)No ratings yet

- Mind Map Cfa Exam Prep 2017 1Document86 pagesMind Map Cfa Exam Prep 2017 1ashwingrgNo ratings yet

- Excel and Exceed Basel-IIDocument20 pagesExcel and Exceed Basel-IIHaris AliNo ratings yet

- CSC Preparation GuideDocument88 pagesCSC Preparation GuideFahim Ahmed0% (1)

- Coombs Clyde HDocument21 pagesCoombs Clyde HAlinde CostarNo ratings yet

- Video Series CFA FRMDocument10 pagesVideo Series CFA FRMShivgan JoshiNo ratings yet

- Practical Guide For Integrated Financial PlanningDocument80 pagesPractical Guide For Integrated Financial Planningnaresh sNo ratings yet

- Morning Session Q&ADocument50 pagesMorning Session Q&AGANESH MENONNo ratings yet

- 2020 - 11 - The Future of Fixed Income Technology - CelentDocument26 pages2020 - 11 - The Future of Fixed Income Technology - CelentProduct PoshanNo ratings yet

- Asset Management Careers Guide 2009Document126 pagesAsset Management Careers Guide 2009Garrett SmithNo ratings yet

- SEC Presentation On Accredited InvestorsDocument12 pagesSEC Presentation On Accredited InvestorsCrowdfundInsiderNo ratings yet

- WK 5 BF Tutorial Qns and Solns PDFDocument6 pagesWK 5 BF Tutorial Qns and Solns PDFIlko KacarskiNo ratings yet

- Bond Market Interest Rates: Bonds CurriculumDocument4 pagesBond Market Interest Rates: Bonds Curriculumits_different17No ratings yet

- WM Wealth Management BasicsDocument30 pagesWM Wealth Management BasicsAnshu SinghNo ratings yet

- CH 06Document13 pagesCH 06Efrén BarretoNo ratings yet

- Burgundy Elite Wealth Manager PDFDocument12 pagesBurgundy Elite Wealth Manager PDFRajeev P TibarewalNo ratings yet

- Chartered Market Technician (CMT) Program: Level 1 - Spring 2010Document4 pagesChartered Market Technician (CMT) Program: Level 1 - Spring 2010Foru FormeNo ratings yet

- Midterm II SampleDocument4 pagesMidterm II SamplejamesNo ratings yet

- Case Scenarios For Taxation Exams ACCT 3050 by RC (2020)Document5 pagesCase Scenarios For Taxation Exams ACCT 3050 by RC (2020)TashaNo ratings yet

- PWC Mutual Fund Regulatory Services Brochure PDFDocument31 pagesPWC Mutual Fund Regulatory Services Brochure PDFramaraajunNo ratings yet

- Risk ManagementDocument63 pagesRisk ManagementAmit Gupta100% (1)

- Maricris G. Alagar BA-101 Finance IIDocument5 pagesMaricris G. Alagar BA-101 Finance IIMharykhriz AlagarNo ratings yet

- 2012 06 CFA L1 100forecast PDFDocument444 pages2012 06 CFA L1 100forecast PDFNyll Gabrylle GasconNo ratings yet

- CAIA Prerequisite Diagnostic Review BOctober07Document30 pagesCAIA Prerequisite Diagnostic Review BOctober07minsusung9368100% (1)

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- Lisette Lopez: ContactDocument1 pageLisette Lopez: ContactLisette LopezNo ratings yet

- WetFeet I-Banking Overview PDFDocument3 pagesWetFeet I-Banking Overview PDFNaman AgarwalNo ratings yet

- Everything You Need To Know About BondsDocument9 pagesEverything You Need To Know About BondszhengyiilpavNo ratings yet

- Lecture 4 - Equity ValuationDocument45 pagesLecture 4 - Equity Valuationchenzhi fanNo ratings yet

- Derivatives CFA Level 1Document75 pagesDerivatives CFA Level 1Rodrigo Vázquez Vela Hernández100% (1)

- Crash Course Company ValuationDocument23 pagesCrash Course Company ValuationMSA-ACCA100% (2)

- Intro To AMDocument70 pagesIntro To AMzongweiterngNo ratings yet

- Bionic Turtle FRM Practice Questions P1.T3. Financial Markets and Products Chapter 3. Fund ManagementDocument9 pagesBionic Turtle FRM Practice Questions P1.T3. Financial Markets and Products Chapter 3. Fund ManagementChristian Rey Magtibay100% (1)

- Credit Risk S1Document33 pagesCredit Risk S1tanmaymehta24No ratings yet

- Credit Management 7th Semester Final Examination Study ManualDocument145 pagesCredit Management 7th Semester Final Examination Study ManualMohammad Asad MahmudNo ratings yet

- e 51 F 8 F 8 B 4 A 32 Ea 4Document159 pagese 51 F 8 F 8 B 4 A 32 Ea 4Shawn Kou100% (5)

- Business Economics ICFAIDocument20 pagesBusiness Economics ICFAIDaniel VincentNo ratings yet

- DSP Black Rock Final Without Winner PageDocument56 pagesDSP Black Rock Final Without Winner PageSoumalya GhoshNo ratings yet

- Intro Practice Book Sample FPDocument35 pagesIntro Practice Book Sample FPnaresh2011No ratings yet

- Fixed Income - Zell Education 2024Document184 pagesFixed Income - Zell Education 2024harshNo ratings yet

- Ta CN TCNH - Unit 2 - Time Value of MoneyDocument19 pagesTa CN TCNH - Unit 2 - Time Value of MoneyPhương NhiNo ratings yet

- CFP Self StudyDocument24 pagesCFP Self StudyEkansh DewanNo ratings yet

- Bond and Equity ValuationDocument18 pagesBond and Equity Valuationclassmate0% (1)

- Topic 55 Binomial Trees - Answers PDFDocument12 pagesTopic 55 Binomial Trees - Answers PDFSoumava PalNo ratings yet

- The Unofficial Guide To Investment Banking Issued by Contents OvervDocument36 pagesThe Unofficial Guide To Investment Banking Issued by Contents OvervEgon Dragon100% (1)

- The Trade Lifecycle1Document4 pagesThe Trade Lifecycle1Simon BrownNo ratings yet

- Alibaba Prospectus PDFDocument442 pagesAlibaba Prospectus PDFSiau Shuang50% (2)

- Global Aml CFT CPF and Kyc Policy 2022Document52 pagesGlobal Aml CFT CPF and Kyc Policy 2022tylor32No ratings yet

- Studymaster PitchbookDocument17 pagesStudymaster Pitchbookapi-241338805No ratings yet

- Investment Banking Career GuideDocument90 pagesInvestment Banking Career Guidebachmuse95No ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)

- Gödel's Incompleteness TheoremsDocument6 pagesGödel's Incompleteness TheoremsLucianoNo ratings yet

- 2º Nb-A - Progress Test Review 1-6Document16 pages2º Nb-A - Progress Test Review 1-6Adrienn JeruskaNo ratings yet

- Week 8 ActivityDocument4 pagesWeek 8 ActivityEmmanuel SindolNo ratings yet

- Blocki 2007Document5 pagesBlocki 2007Abdellah LAHDILINo ratings yet

- Xen'drik Expedition To Tomb of AnnihilationDocument7 pagesXen'drik Expedition To Tomb of AnnihilationkalicjawaczykNo ratings yet

- PCR Types and Its ApplicationsDocument68 pagesPCR Types and Its ApplicationsShefali Pawar100% (1)

- Supporting Information Emergency MedicineDocument3 pagesSupporting Information Emergency MedicineHaider Ahmad KamilNo ratings yet

- LO1 Understand Virtual and Augmented Reality and How They May Be UsedDocument3 pagesLO1 Understand Virtual and Augmented Reality and How They May Be UsedtjhadawayschoolworkNo ratings yet

- Sentence Based WritingDocument3 pagesSentence Based WritingNari WulandariNo ratings yet

- 107年國營事業 (台電、中油…) - 共同科目 (國文、英文) PDFDocument4 pages107年國營事業 (台電、中油…) - 共同科目 (國文、英文) PDF林倉舒No ratings yet

- Content AnalysisDocument20 pagesContent AnalysisAlexander RomeroNo ratings yet

- Generalized Anxiety DisorderDocument17 pagesGeneralized Anxiety DisorderFathima MohammedNo ratings yet

- ComDocument294 pagesComAMAN SAXENANo ratings yet

- Venous Thromboembolism and Obstetric Anaesthesia TOTW 207 2010Document9 pagesVenous Thromboembolism and Obstetric Anaesthesia TOTW 207 2010Juan Ramón González MasisNo ratings yet

- L6 Online Modern AfricaDocument20 pagesL6 Online Modern AfricaGabriel tettehNo ratings yet

- Blue Rabbit - Dracula The VampireDocument9 pagesBlue Rabbit - Dracula The VampireAracelly MeraNo ratings yet

- Autodesk® Simulation Multiphysics: Course Length: 2 DaysDocument6 pagesAutodesk® Simulation Multiphysics: Course Length: 2 DaysLUISALBERTO06011985No ratings yet

- English Language - Syllabus - Grade 11Document63 pagesEnglish Language - Syllabus - Grade 11EApp And AgreementNo ratings yet

- Stylus StudyDocument2 pagesStylus Studyapi-549307910No ratings yet

- Yessup Compulsory Grammar ExaminationDocument18 pagesYessup Compulsory Grammar ExaminationShoun TrrNo ratings yet

- Template For Request To Additional Shs Program OfferingDocument7 pagesTemplate For Request To Additional Shs Program OfferingJerome BelangoNo ratings yet

- Clean Edge RazorDocument14 pagesClean Edge RazorOyedele AjagbeNo ratings yet

- Senior High School Student Permanent Record: Republic of The Philippines Department of EducationDocument3 pagesSenior High School Student Permanent Record: Republic of The Philippines Department of EducationfretzNo ratings yet

- Intro Pad 101Document43 pagesIntro Pad 101Kemisetso Sadie MosiiwaNo ratings yet

- B. Philippine Airlines Inc. vs. CADocument15 pagesB. Philippine Airlines Inc. vs. CAKaloi GarciaNo ratings yet

- Task ManagementDocument11 pagesTask Managementnaveedskhan100% (1)