Professional Documents

Culture Documents

Lecture2 - Balance Sheet Analysis - To Be Printed

Uploaded by

Dani Alexandra0 ratings0% found this document useful (0 votes)

5 views27 pagescdsasc

Original Title

Lecture2_Balance Sheet Analysis_to Be Printed

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcdsasc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views27 pagesLecture2 - Balance Sheet Analysis - To Be Printed

Uploaded by

Dani Alexandracdsasc

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 27

Balance Sheet Analysis

Balance Sheet Analysis

The balance sheet is a snapshot of the firms

assets and liabilities at a given point in time

Assets are listed in order of liquidity

Ease of conversion to cash

Without significant loss of value

Balance Sheet Identity

Assets = Liabilities + Stockholders Equity

Balance Sheet Analysis

To remember. . .

Basic equations

Assets = Debt + Equity

Assets minus debts = equity

Assets - equity = debt

The Balance-Sheet Model

of the Firm

Current Assets

Fixed Assets

1 Tangible

2 Intangible

Shareholders

Equity

Current

Liabilities

Long-Term

Debt

Investment

decision

The Capital Budgeting Decision

Financing

decision

Working

capital

management

There is a

financial

equilibrium

between

resources and

their uses?

Net

Working

Capital

Shareholders

Equity

Current

Liabilities

Current Assets

Fixed Assets

1 Tangible

2 Intangible

Long-Term

Debt

Balance Sheet Structure

Current Assets

cash, marketable securities, inventory,

accounts receivable

Long-Term Assets

equipment, buildings, land

Which earn higher rates of return?

Which help avoid risk of illiquidity?

Balance Sheet Structure

Current Assets

cash, marketable securities, inventory,

accounts receivable

Long-Term Assets

equipment, buildings, land

Risk-Return Trade-off:

Current assets earn low returns, but help reduce

the risk of illiquidity.

Balance Sheet Structure

Current Liabilities

short-term notes, accrued expenses,

accounts payable

Long-Term Debt and Equity

bonds, preferred stock, common stock

Which are more expensive for the firm?

Which help avoid risk of illiquidity?

Balance Sheet Structure

Current Liabilities

short-term notes, accrued expenses,

accounts payable

Long-Term Debt and Equity

bonds, preferred stock, common stock

Risk-Return Trade-off:

Current liabilities are less expensive, but

increase the risk of illiquidity.

Balance Sheet Structure

Balance Sheet

Current Assets Current Liabilities

Fixed Assets Long-Term Debt

Preferred Stock

Common Stock

To illustrate, lets finance all current assets

with current liabilities, and finance all

fixed assets with long-term financing.

Balance Sheet

Current Assets CurrentLiabilities

Fixed Assets Long-Term Debt

Preferred Stock

Common Stock

Suppose we use long-term financing to

finance some of our current assets.

This strategy would be less risky, but more

expensive!

Balance Sheet

Current Assets Current Liabilities

Fixed Assets

Long-Term Debt

Preferred Stock

Common Stock

Suppose we use current liabilities to finance

some of our fixed assets.

This strategy would be less expensive, but

more risky!

Permanent Assets (those held > 1 year)

should be financed with permanent and

spontaneous sources of financing

Temporary Assets (those held < 1 year)

should be financed with temporary sources

of financing

The hedging principle

Two Basic Questions:

1. What is the appropriate level for

current assets, both in total and by

specific accounts?

2. How should current assets be

financed?

Balance Sheet Structure

The Requirement for Current

Assets Financing depends on:

Seasonal Variations

Business Cycles

Expansion of the companys

activity

Permanent current assets

TIME

D

O

L

L

A

R

A

M

O

U

N

T

Temporary current assets

Current Assets

Current Assets

Permanent Current Assets

Current asset balances that do not change

due to seasonal or economic conditions--

even at the trough of a firms business cycle

Permanent Current Assets

Temporary Current Assets

Current assets that fluctuate with seasonal

or economic variations in a firms business

Current Assets

Temporary Current Assets

Alternative Current Asset

Financing Policies

Moderate Match the maturity of the

assets with the maturity of the financing.

Aggressive Use short-term financing to

finance permanent assets.

Conservative Use permanent capital for

permanent assets and temporary assets.

Maturity Matching, or

Self-Liquidating Approach

A financing policy that matches asset

and liability maturities

This would be considered a moderate

current asset financing policy

Alternative Current Asset

Financing Policies

Hedging (or Maturity

Matching) Approach

A method of financing where each asset would be offset with a financing

instrument of the same approximate maturity.

TIME

D

O

L

L

A

R

A

M

O

U

N

T

Long-term financing

Fixed assets

Current assets*

Short-term financing**

Conservative Approach

A policy where all of the fixed assets,

all of the permanent current assets, and

some of the temporary current assets of

a firm are financed with long-term

capital

Alternative Current Asset

Financing Policies

Risks vs. Costs Trade-Off

(Conservative Approach)

Firm can reduce risks associated with short-term borrowing by using a

larger proportion of long-term financing.

TIME

D

O

L

L

A

R

A

M

O

U

N

T

Long-term financing

Fixed assets

Current assets

Short-term financing

Aggressive Approach

A policy where all of the fixed assets of

a firm are financed with long-term capital,

but some of the firms permanent current

assets are financed with short-term non-

spontaneous sources of funds

Alternative Current Asset

Financing Policies

Firm increases risks associated with short-term borrowing by using a

larger proportion of short-term financing.

TIME

D

O

L

L

A

R

A

M

O

U

N

T

Long-term financing

Fixed assets

Current assets

Short-term financing

Risks vs. Costs Trade-Off

(Aggressive Approach)

Summary of Short- vs.

Long-Term Financing

Financing

Maturity

Asset

Maturity

SHORT-TERM LONG-TERM

Low

Risk-Profitability

Moderate

Risk-Profitability

Moderate

Risk-Profitability

High

Risk-Profitability

SHORT-TERM

(Temporary)

LONG-TERM

(Permanent)

Quick Quiz

What is the balance-sheet equation?

What is the difference between Romanian Form and Anglo-Saxon Form of the

balance sheet?

Which things should be kept in mind when looking at a balance sheet?

Which is the most important piece of information we have to look for in a

balance sheet, as stockholders (creditors, or other stakeholders)?

How should current assets be financed?

Which are the implications of financing short term assets by long term

resources?

Which are the implications of financing long term assets by short term

resources?

Conservative or Aggressive Financing Policy? Which one are you inclined to

use? Why?

How do you see the situation of an en-detail trading company, which has a

negative net working capital?

QuickGrow is in an expanding market, and its sales are increasing by 25

percent per year. Would you expect its net working capital to be increasing or

decreasing?

Why do you think one would need market values in the financial analysis of the

balance sheet?

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- RCMP Corruption in Policing Causes and ConsequencesDocument40 pagesRCMP Corruption in Policing Causes and ConsequencesPaisley RaeNo ratings yet

- Decision Matrix Selection MatrixDocument2 pagesDecision Matrix Selection MatrixEng Muhammad MarzoukNo ratings yet

- What's Behind Microsoft & Skype Acquisition?Document18 pagesWhat's Behind Microsoft & Skype Acquisition?Piotr BartenbachNo ratings yet

- Compound Financial InstrumentsDocument3 pagesCompound Financial InstrumentsJm atlavs100% (1)

- Week 3 Statement of Financial PositionDocument22 pagesWeek 3 Statement of Financial PositionKushal KhatiwadaNo ratings yet

- Happiness Is A Habit-eBookDocument93 pagesHappiness Is A Habit-eBookDani AlexandraNo ratings yet

- The Nature of The FirmDocument2 pagesThe Nature of The FirmDani Alexandra100% (6)

- Dwnload Full Fundamentals of Corporate Finance 12th Edition Ross Solutions Manual PDFDocument35 pagesDwnload Full Fundamentals of Corporate Finance 12th Edition Ross Solutions Manual PDFpuddyshaunta100% (11)

- 1 s2.0 S1138489117300171 MainDocument12 pages1 s2.0 S1138489117300171 MainDani AlexandraNo ratings yet

- 23 FullDocument13 pages23 FullDani AlexandraNo ratings yet

- Contagious Currency CrisesDocument50 pagesContagious Currency CrisesDani AlexandraNo ratings yet

- Developing Rest's Model To Examine The Relationship Between Ethical Accounting Education and International Education Standard 4 (IES 4) PrinciplesDocument10 pagesDeveloping Rest's Model To Examine The Relationship Between Ethical Accounting Education and International Education Standard 4 (IES 4) PrinciplesDani AlexandraNo ratings yet

- Examining Personal Values and Ethical Behaviour between Accounting and Non-Accounting StudentsDocument24 pagesExamining Personal Values and Ethical Behaviour between Accounting and Non-Accounting StudentsDani AlexandraNo ratings yet

- W 20526Document70 pagesW 20526Dani AlexandraNo ratings yet

- Report WritingDocument17 pagesReport WritingEdwin Wong50% (2)

- The Economics of Currency Crises and Contagion: An IntroductionDocument14 pagesThe Economics of Currency Crises and Contagion: An Introductionabdulla_nafiz_1No ratings yet

- Cohesion3 Summary enDocument18 pagesCohesion3 Summary enDani AlexandraNo ratings yet

- Shrikhande International Finance Fall 2010 Problem Set 1: NswerDocument7 pagesShrikhande International Finance Fall 2010 Problem Set 1: NswerHwa Tee HaiNo ratings yet

- Guideline For The Final Project - 2014Document2 pagesGuideline For The Final Project - 2014Dani AlexandraNo ratings yet

- Income Statement Analysis ExplainedDocument23 pagesIncome Statement Analysis ExplainedDani AlexandraNo ratings yet

- Formular Inscriere Casting@DiamondagencyDocument1 pageFormular Inscriere Casting@DiamondagencyDani AlexandraNo ratings yet

- The Sectoral Structures in Romania, Its Regions and The EU Countries - Key Features of Economic and Social CohesionDocument10 pagesThe Sectoral Structures in Romania, Its Regions and The EU Countries - Key Features of Economic and Social CohesionDani AlexandraNo ratings yet

- AhnerDocument10 pagesAhnerDani AlexandraNo ratings yet

- 3 Globalizatioan and EquityDocument17 pages3 Globalizatioan and EquityKiran ReddyNo ratings yet

- Formular Inscriere Casting@DiamondagencyDocument1 pageFormular Inscriere Casting@DiamondagencyDani AlexandraNo ratings yet

- Globalization Evolution 1830-PresentDocument8 pagesGlobalization Evolution 1830-PresentDani AlexandraNo ratings yet

- Distinction Between Business Cycles and Business Fluctuations (C2-C5)Document24 pagesDistinction Between Business Cycles and Business Fluctuations (C2-C5)Dani AlexandraNo ratings yet

- Emerging Markets Financial Crisis and Recovery: Curelea Elena-Alexandra, Group 933Document3 pagesEmerging Markets Financial Crisis and Recovery: Curelea Elena-Alexandra, Group 933Dani AlexandraNo ratings yet

- Building IndiaDocument64 pagesBuilding IndiaEric KazmaierNo ratings yet

- Report WritingDocument17 pagesReport WritingEdwin Wong50% (2)

- Measures of Variability and Normal DistributionDocument11 pagesMeasures of Variability and Normal DistributionDani AlexandraNo ratings yet

- Curelea Alexandra StarbucksDocument3 pagesCurelea Alexandra StarbucksDani AlexandraNo ratings yet

- Unit 2 P 2Document1 pageUnit 2 P 2Dani AlexandraNo ratings yet

- GigOptix (GIG) Needham Conference Version 1.14.14 FINALDocument21 pagesGigOptix (GIG) Needham Conference Version 1.14.14 FINALJonathan OdomNo ratings yet

- (Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANDocument8 pages(Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANLê Cung NhưNo ratings yet

- 11 Self Declaration Re. Undertaking in Difficulty v.1.0Document2 pages11 Self Declaration Re. Undertaking in Difficulty v.1.0Alina BojincaNo ratings yet

- UPAR2018Document252 pagesUPAR2018sajetha sezliyanNo ratings yet

- (A) Reproduce The Retained Earnings Account For 2012. Solution: Retained Earnings AccountDocument5 pages(A) Reproduce The Retained Earnings Account For 2012. Solution: Retained Earnings AccountQasim KhanNo ratings yet

- Chapter 15 Coverage of Learning ObjectivesDocument37 pagesChapter 15 Coverage of Learning ObjectivesPiyal Hossain50% (2)

- Solved The Following Data Pertain To Three Divisions of Nevada Aggregates IncDocument1 pageSolved The Following Data Pertain To Three Divisions of Nevada Aggregates IncM Bilal SaleemNo ratings yet

- IFRS 13-Eng PDFDocument71 pagesIFRS 13-Eng PDFNhhư QuỳnhhNo ratings yet

- Accrual vs Cash Basis AccountingDocument43 pagesAccrual vs Cash Basis AccountingOmar HosnyNo ratings yet

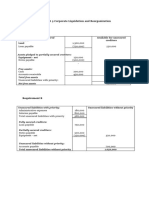

- CHAPTER 5 Corporate Liquidation and Reorganization Problem 5 Requirement ADocument6 pagesCHAPTER 5 Corporate Liquidation and Reorganization Problem 5 Requirement AArtisanNo ratings yet

- Accy 517 Syllabus (Fall 2015)Document6 pagesAccy 517 Syllabus (Fall 2015)VerguishoNo ratings yet

- Project Profile On The Establishment of Leather Goods Producing PlantDocument27 pagesProject Profile On The Establishment of Leather Goods Producing Planthussen seid100% (1)

- Financial Accounting ManualDocument91 pagesFinancial Accounting ManualCristina RodriguezNo ratings yet

- Annual Report 2021 Zurich Life Insurance Company LTDDocument22 pagesAnnual Report 2021 Zurich Life Insurance Company LTDArun KumarNo ratings yet

- Partnerships Liquidation: Advanced Accounting, Fifth EditionDocument33 pagesPartnerships Liquidation: Advanced Accounting, Fifth Editionhasan jabrNo ratings yet

- HTA - 708 Revenue ManagementDocument4 pagesHTA - 708 Revenue ManagementRachel HennessyNo ratings yet

- Ayesha Steel Ratio Analysis Current Quick Working Capital Profitability Return Assets Equity EPS Margin Inventory Assets Receivable Debts Equity TIE Capitalization Value Added EVADocument5 pagesAyesha Steel Ratio Analysis Current Quick Working Capital Profitability Return Assets Equity EPS Margin Inventory Assets Receivable Debts Equity TIE Capitalization Value Added EVAMuhammad AwaisNo ratings yet

- Enseval-Putera-Megatrading Billingual 31 Des 2016 Released-SecuredDocument113 pagesEnseval-Putera-Megatrading Billingual 31 Des 2016 Released-SecuredAnto KristianNo ratings yet

- Accounting Ratios Chapter Notes - Accountancy Class 12 - Commerce PDF DownloadDocument20 pagesAccounting Ratios Chapter Notes - Accountancy Class 12 - Commerce PDF DownloadNubic IndiaNo ratings yet

- KGAR21 Financial ReviewDocument8 pagesKGAR21 Financial ReviewJhanvi JaiswalNo ratings yet

- Accounting Principles and Financial Statements ExplainedDocument23 pagesAccounting Principles and Financial Statements ExplainedAnonymous LC5kFdtcNo ratings yet

- Jurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta VidadaDocument18 pagesJurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta Vidadasyafrizal rizalNo ratings yet

- Strategic Business Management Syllabus and GridsDocument24 pagesStrategic Business Management Syllabus and GridsHamza AliNo ratings yet

- Thesis On Impact of Capital Structure On ProfitabilityDocument5 pagesThesis On Impact of Capital Structure On Profitabilityfjf1y2rz100% (1)

- Responsibility Acctg Transfer Pricing GP Analysis PDFDocument21 pagesResponsibility Acctg Transfer Pricing GP Analysis PDFma quenaNo ratings yet

- Week 5 - ch17Document61 pagesWeek 5 - ch17bafsvideo4No ratings yet