Professional Documents

Culture Documents

Wind in Power Annual Statistics 2012

Wind in Power Annual Statistics 2012

Uploaded by

Mircea Draghia0 ratings0% found this document useful (0 votes)

13 views14 pagesStatistici energie eoliana

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentStatistici energie eoliana

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views14 pagesWind in Power Annual Statistics 2012

Wind in Power Annual Statistics 2012

Uploaded by

Mircea DraghiaStatistici energie eoliana

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

1

THE EUROPEAN WIND ENERGY ASSOCIATION

Wind in power

2012 European statistics

February 2013

2

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

Contents

Executive summary

..............................................................................

3

2012 annual installations

......................................................................

5

Wind power capacity installations

.................................................

5

Power capacity installations

.........................................................

6

Renewable power installations

.....................................................

7

Trends and cumulative installations

........................................................

7

Renewable power installations

.....................................................

7

Net changes in EU installed power capacity 2000-2012

................

8

Total installed power capacity

.......................................................

8

A closer look at wind power installations

................................................

9

Total installed power capacity

.......................................................

9

National breakdown of wind power installations

.............................

9

Onshore and offshore annual markets

..........................................

10

Cumulative wind power installations

.............................................

10

Estimated wind energy production

................................................

11

Wind power targets

..............................................................................

12

Contributors

Justin Wilkes (Policy Director, EWEA)

Jacopo Moccia (Head of Policy Analysis, EWEA)

Data sources

Platts PowerVision, January 2013

EWEA, wind energy data and ocean energy data

EPIA, solar PV data

ESTELA, CSP data

Special thanks to:

IGWindkraft (AT) - EDORA and VWEA (BE) - APEE and BGWEA (BG) - Suisse Eole (CH) CWEA (CY) - CSVE (CZ), BWE and VDMA

(DE) DWIA (DK) Tuulenergia (EE) HWEA (EL) AEE (ES) - IWEA (IE) Suomen Tuulivoimayhdistys ry and Technology indus-

tries of Finland (FI) Ademe (FR) Energy Institute Hrvoje Pozar (HR) MSZET and MSZIT (HU) - ANEV (IT) LWPA (LT) Ministre

de lconomie et du commerce extrieur (LU) Baltic Wind Park (LV) - NWEA (NL) NorWEA (NO) TREB (TK) PWEA (PL) -

APREN (PT) Svenskvindenergi (SE) - UWEA (UA) RenewableUK (UK).

Photo cover: Wolfram Bradac

3

THE EUROPEAN WIND ENERGY ASSOCIATION

2012 annual installations

11,895 MW of wind power capacity (worth between 12.8bn and 17.2bn) was installed in the EU

during 2012.

The National Renewable Energy Action Plans forecast a net increase in 2012 of 11,360 MW, 328 MW

less than the actual net annual increase of 11,688 MW.

EU wind power installations for 2012 do not show the signifcantly negative impact of market, regu-

latory and political uncertainty sweeping across Europe since the beginning of 2011. The turbines

installed during 2012 were generally permitted, fnanced and ordered prior to the crisis feeding through

to a destabilisation of legislative frameworks for wind energy. The stress being felt in many markets

across Europe throughout the wind industrys value chain should become apparent in a reduced level

of installations in 2013, possibly continuing well into 2014.

Wind power accounted for 26.5% of total 2012 power capacity installations.

Renewable power installations accounted for 70% of new installations during 2012: 31.3 GW of a total

44.9 GW of new power capacity, down 4% on 2011.

Trends and cumulative installations

The EUs total installed power capacity increased by 29.2 GW net to 931.9 GW, with wind power

increasing by 11.7 GW and reaching a share of total installed generation capacity of 11.4%, up from

10.5% the previous year.

The 106 GW of installed wind power capacity is 1.6 GW (1.5%) below the installed capacity outlined in

the 27 National Renewable Energy Action Plans (NREAPs) of 107.6 GW. Onshore there are 101 GW of

installed capacity instead of 101.7 GW foreseen by the NREAPs (-1%). Offshore there are 4,993 MW of

installed capacity instead of 5,829 foreseen by the NREAPs (-14%).

Since 2000, 27.7% of new capacity installed has been wind power, 51.2% renewables and 91.2%

renewables and gas combined.

The EU power sector continues its move away from fuel oil, coal and nuclear, with each technology

continuing to decommission more than it installs.

Wind power installations

Annual installations of wind power have increased steadily over the last 12 years, from 3.2 GW in

2000 to 11.9 GW in 2012, a compound annual growth rate of over 11.6%.

A total of 106 GW is now installed in the European Union, an increase in installed cumulative capacity

of 12.6% compared to the previous year.

Germany remains the EU country with the largest installed capacity followed by Spain, the UK and Italy.

15 Member States have more than 1 GW of installed capacity, including two newer Member States,

Poland and Romania.

There was generalised growth in wind energy installations across Europe, although it is expected that

a number of large markets, such as Italy and Spain, and certain previously fast growing emerging

markets, such as Bulgaria, may slow down signifcantly over the coming years.

Offshore saw a record growth in 2012, and the trend is expected to continue in 2013 and 2014.

The wind power capacity installed by the end of 2012 would, in a normal wind year, produce 231 TWh

of electricity, enough to cover 7% of the EUs electricity consumption up from 6.3% the year before.

Wind power targets

Overall the EU is lagging by 1.6 GW (-1.5%) behind its 27 National Renewable energy Action Plan

forecasts.

Eighteen Member States are falling behind on their wind power capacity trajectories, most notably

Slovakia, Greece, Czech Republic, Hungary, France and Portugal.

Nine Member States are above their trajectory.

Compared to EWEAs 2009 forecast, onshore installations are 3 GW above expectations (+3%).

Offshore installations are below EWEAs expectations by 307 MW (-6%).

Executive summary

4

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

PORTUGAL

4,525

SPAIN

22,796

FRANCE

7,564

UNITED

KINGDOM

8,445

IRELAND

1,738

BELGIUM

1,375

NETHERLANDS

2,391

LUXEMBOURG*

45

GERMANY

31,308

POLAND

2,497

DENMARK

4,162

SWEDEN

3,745

FINLAND

288

ESTONIA

269

LATVIA 68

LITHUANIA* 225

ITALY

8,144

AUSTRIA

1,378

CZECH

REPUBLIC

260

SLOVAKIA 3

HUNGARY

329

SLOVENIA

0

ROMANIA

1,905

BULGARIA

684

GREECE

1,749

MALTA

0

RUSSIA*

15

NORWAY

703

UKRAINE

276

SWITZERLAND

50

CROATIA

180

TURKEY

2,312

CYPRUS

147

FAROE ISLANDS*

4

* Provisional data or estimate.

** Former Yugoslav Republic of Macedonia

Note: due to previous year adjustments, 207 MW of project de-commissioning, re-powering and

rounding of fgures, the total 2012 end-of-year cumulative capacity is not exactly equivalent to

the sum of the 2011 end-of-year total plus the 2012 additions.

Installed 2011 End 2011 Installed 2012 End 2012

Candidate Countries (MW)

Croatia 52 131 48 180

FYROM** 0 0 0 0

Serbia 0 0 0 0

Turkey 477 1,806 506 2,312

Total 529 1,937 554 2,492

EFTA (MW)

Iceland 0 0 0 0

Liechtenstein 0 0 0 0

Norway 99 537 166 703

Switzerland 3 46 4 50

Total 88 583 170 753

Other (MW)

Faroe Islands* 0 4 0 4

Ukraine 66 151 125 276

Russia* 0 15 0 15

Total 66 171 125 296

Total Europe 10,361 97,043 12,744 109,581

Installed

2011

End

2011

Installed

2012

End

2012

EU Capacity (MW)

Austria 73 1084 296 1,378

Belgium 191 1,078 297 1,375

Bulgaria 28 516 168 684

Cyprus 52 134 13 147

Czech Republic 2 217 44 260

Denmark 211 3,956 217 4,162

Estonia 35 184 86 269

Finland 2 199 89 288

France 830 6,807 757 7,564

Germany 2,100 29,071 2,415 31,308

Greece 316 1,634 117 1,749

Hungary 34 329 0 329

Ireland 208 1,614 125 1,738

Italy 1,090 6,878 1,273 8,144

Latvia 17 48 21 68

Lithuania* 16 179 46 225

Luxembourg* 1 45 0 45

Malta 0 0 0 0

Netherlands 59 2,272 119 2,391

Poland 436 1,616 880 2,497

Portugal 341 4,379 145 4,525

Romania 520 982 923 1,905

Slovakia 0 3 0 3

Slovenia 0 0 0 0

Spain 1,050 21,674 1,122 22,796

Sweden 754 2,899 846 3,745

United Kingdom 1,298 6,556 1,897 8,445

Total EU-27 9,664 94,352 11,895 106,040

Total EU-15 8,524 90,145 9,714 99,652

Total EU-12 1,140 4,207 2,181 6,388

Wind power installed in Europe by end of

2012 (cumulative)

European Union: 106,040 MW

Candidate Countries: 2,492 MW

EFTA: 753 MW

Total Europe: 109,581 MW

FYROM**

0

5

THE EUROPEAN WIND ENERGY ASSOCIATION

2012 annual installations

Wind power capacity installations

During 2012, 12,744 MW of wind power was installed

across Europe, of which 11,895 MW was in the

European Union.

Of the 11,895 MW installed in the EU, 10,729 MW

was onshore and 1,166 MW offshore. Investment in

EU wind farms was between 12.8bn and 17.2bn.

Onshore wind farms attracted 9.4bn to 12.5bn,

while offshore wind farms accounted for 3.4bn to

4.7bn.

In terms of annual installations, Germany was the

largest market in 2012, installing 2,415 MW of new

capacity, 80 MW of which (3.3%) offshore. The UK

came in second with 1,897 MW, 854 MW of which

(45%) offshore, followed by Italy with 1,273 MW, Spain

(1,122 MW), Romania (923 MW), Poland (880 MW),

Sweden (845 MW) and France (757 MW).

Among the emerging markets of Central and Eastern

Europe, Romania and Poland both had record years -

both installing around 7.5% of the EUs total annual

capacity. Both markets are now consistently in the top

ten in the EU for annual installations.

It is also important to note the amount of installations

in the UK, Italy and Sweden. These three markets

represent respectively 16%, 11% and 7% of total EU

installations in 2012.

Offshore accounted for 10% of total EU wind power

installations in 2012, one percentage point more than

in 2011.

FIGURE 1.1 EU MEMBER STATE MARKET SHARES FOR NEW

CAPACITY INSTALLED DURING 2012 IN MW. TOTAL 11,566 MW

Installed 2011 End 2011 Installed 2012 End 2012

Candidate Countries (MW)

Croatia 52 131 48 180

FYROM** 0 0 0 0

Serbia 0 0 0 0

Turkey 477 1,806 506 2,312

Total 529 1,937 554 2,492

EFTA (MW)

Iceland 0 0 0 0

Liechtenstein 0 0 0 0

Norway 99 537 166 703

Switzerland 3 46 4 50

Total 88 583 170 753

Other (MW)

Faroe Islands* 0 4 0 4

Ukraine 66 151 125 276

Russia* 0 15 0 15

Total 66 171 125 296

Total Europe 10,361 97,043 12,744 109,581

P

h

o

t

o

:

S

i

e

m

e

n

s

A

G

E

n

e

r

g

y

S

e

c

t

o

r

Romania

923

8%

Poland

880

7%

Sweden

846

7%

France

757

6%

Belgium

297

3%

Austria

296

3%

Germany

2,415

20 %

UK

1,897

16%

Italy

1,273

11%

Spain

1,122

9%

Other

1,189

10%

6

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

Power capacity installations

Wind power accounted for 26.5% of new installations

in 2012, the second biggest share after solar PV

(37%) and before gas (23%).

Solar PV installed 16 GW (37% of total capacity),

followed by wind with 11.9 GW (26.5%), and gas with

10.5 GW (23%).

No other technologies compare to wind, PV and gas

in terms of new installations. Coal installed 3 GW (7%

of total installations), biomass 1.3 GW (3%), CSP 833

MW (2%), hydro 424 MW (1%), waste 50 MW, Nuclear

22 MW, fuel oil 7 MW, ocean technologies 6 MW

(1)

and

geothermal 5 MW.

FIGURE 1.3 NEW INSTALLED POWER CAPACITY AND DECOMMISSIONED POWER CAPACITY IN MW

FIGURE 1.2 SHARE OF NEW POWER CAPACITY INSTALLATIONS

IN EU. TOTAL 44,601 MW

Gas

10,535

23%

Coal

3,065

7%

PV

16,750

37%

Wind

11,895

27%

Biomass

1,338

3%

Hydro

424

1%

Wave

and Tidal

6

0%

Geothermal

5

0%

CSP

833

2%

Nuclear

22

0%

Fuel oil

7

0%

Waste

50

0%

16,750

11,895

10,535

3,065

1,338

424

50 22 5

833

7 6

0

-207

-5,495 -5,441

-43

-158

0 0

-1,205

-3,204

-6,000

1,000

4,000

9,000

14,000

19000

PV Wind Gas Coal Biomass Hydro Waste Nuclear CSP Fuel oil

Wave

and Tidal

New Decommissioned

Geo-

thermal

0 0

Overall, during 2012, 44.9 GW of new power gener-

ating capacity was installed in the EU, 1.7 GW less

than in 2011, which was a record year for new power

capacity installations.

During 2012, 5.5 GW of gas capacity was decommis-

sioned, as were 5.4 GW of coal, 3.2 GW of fuel oil and

1.2 GW of nuclear capacity.

After two years of installing more capacity than it

decommissioned, coal power installations reduced by

almost 2.4 GW in 2012.

(1)

Provisional data.

7

THE EUROPEAN WIND ENERGY ASSOCIATION

FIGURE 2.1 INSTALLED POWER GENERATING CAPACITY PER YEAR IN MW AND RES SHARE (%)

In 2000, new renewable power capacity installations

totalled a mere 3.5 GW. Since 2010, annual renew-

able capacity additions have been between 24.5 GW

and 33.7 GW, seven to eight times higher than at the

turn of the century.

The share of renewables in total new power capacity

additions has also grown. In 2000, the 3.5 GW

Renewable power capacity installations

Trends & cumulative installations

represented 20.7% of new power capacity instal-

lations, increasing to 31.3 GW representing 70% in

2012.

353 GW of new power capacity has been installed

in the EU since 2000. Of this, almost 28% has been

wind power, 51% renewables and 91% renewables and

gas combined.

In 2012, a total of 31 GW of renewable power capacity

was installed. Almost 70% of all new installed capacity

in the EU was renewable. It was, furthermore, the ffth

year running that over 55% of all new power capacity

in the EU was renewable.

Renewable power capacity installations

FIGURE 1.4 2012 SHARE OF NEW RENEWABLE POWER

CAPACITY INSTALLATIONS IN MW. TOTAL 30,968 MW

PV

16,750

54%

Wind

11,895

38%

Biomass

1,338

4%

CSP

833

3%

Hydro

424

1%

Waste

50

0%

Wave and Tidal

6

0%

Geothermal

5

0%

5000

10000

15000

20000

25000

30000

35000

40000

45000

50000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

R

E

S

(

7

0

%

)

Peat

Fuel oil Nuclear

Coal Gas

CSP

Waste Biomass

Geothermal Hydro

PV Wind

8

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

Total installed power capacity

Wind powers share of total installed power capacity

has increased fve-fold since 2000; from 2.2% in 2000

to 11.4% in 2012. Over the same period, renewable

FIGURE 2.3 EU POWER MIX 2000 FIGURE 2.4 EU POWER MIX 2012

FIGURE 2.2 NET ELECTRICITY GENERATING INSTALLATIONS IN THE EU 2000-2012 (GW)

The net growth since 2000 of gas power (121 GW),

wind (96.7 GW) and solar PV (69 GW) was at the

expense of fuel oil (down 17.4 GW), nuclear (down 14.7

GW) and coal (down 12.7 GW). The other renewable

technologies (hydro, biomass, waste, CSP, geothermal

and ocean energies) have also been increasing their

installed capacity over the past decade, albeit more

slowly than wind and solar PV.

Net changes in EU installed power capacity 2000-2012

The EUs power sector continues to move away from

fuel oil, coal and nuclear while increasing its total

installed generating capacity with gas, wind, solar PV

and other renewables.

8

THE EUROPEAN WIND ENERGY ASSOCIATION

121

97

69

4 4

2 2

0 0 0

-13

-15

-17

20

20

40

60

80

100

140

Gas Wind PV Biomass Hydro Waste CSP Peat Wave

and Tidal

Coal Nuclear Fuel oil Geo-

thermal

120

Hydro

110,066

19%

Wind

12,887

2%

Biomass

2,790

1%

Peat

1,868

0%

Geothermal

1,360

0%

Ocean

248

0%

PV

125

0%

Coal

159,482

28%

Nuclear

128,471

22%

Gas

89,801

16%

Fuel oil

66,518

12%

Hydro

126,354

14%

Wind

106,041

11%

PV

68,990

7%

Biomass

7,315

1%

Waste

3,854

0%

CSP

1,890

0%

Geothermal

1,487

0%

Ocean

260

0%

Coal

227,877

25%

Gas

214,993

23%

Nuclear

120,261

13%

Fuel oil

50,548

6%

Peat

2,030

0%

capacity increased by 51% from 22.5% of total power

capacity in 2000 to 33.9% in 2012.

9

THE EUROPEAN WIND ENERGY ASSOCIATION

Total installed power capacity

Annual wind power installations in the EU have

increased steadily over the past 12 years from 3.2

GW in 2000 to 11.9 GW in 2012, a compound annual

growth rate of over 11%.

National breakdown of wind power installations

In 2000, the annual wind power installations of the

three pioneering countries Denmark, Germany and

Spain represented 85% of all EU wind capacity addi-

tions. In 2012, this share had decreased to 32%.

Moreover, in 2000, the countries that make up, today,

the 12 newer EU Member States

(2)

had no wind energy;

in 2012, they represented 18% of the EUs total market.

A closer look at wind power installations

FIGURE 3.2 DENMARK, GERMANY AND SPAINS SHARE OF EU WIND POWER MARKET (GW)

FIGURE 3.1 ANNUAL WIND POWER INSTALLATIONS IN EU (GW)

3.2

4.4

5.9

5.5

5.8

6.5

7.2

9

8.5

10.3

9.8

9.7

11.9

2

4

6

8

10

12

14

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

2.7

3.6

3.4

3.8

0.5

2.8

5

6

0

0

1.5

2.2

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2000 2005 2010 2012

NMS Other EU Pioneers

(2)

Bulgaria, Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, Slovakia and Slovenia.

10

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

Cumulative wind power installations

A total of 106 GW is now installed in the European Union,

a growth of 12.6% on the previous year and similar to

the growth recorded in 2011. Germany remains the EU

country with the largest installed capacity, followed by

Spain, Italy, the UK and France. Ten other EU countries

have over 1 GW of installed capacity: Austria, Belgium,

Denmark, Greece, Ireland, The Netherlands, Poland,

Portugal, Romania and Sweden

Onshore and offshore annual markets

2012 was a record year for offshore installations, with 1,166 MW of new capacity grid connected. Offshore wind

power installations represent 10% of the annual EU wind energy market, up from 9% in 2011.

FIGURE 3.3 ANNUAL ONSHORE AND OFFSHORE INSTALLATIONS (MW)

10

THE EUROPEAN WIND ENERGY ASSOCIATION

4,377

5,743

5,186

5,749

6,454

7,086

8,648

8,109

9,695

8,964

8,790

10,729

51

170

276

90

90

93

318

373

575

883

874

1,166

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Offshore Onshore

FIGURE 3.4 CUMULATIVE WIND POWER INSTALLATIONS IN THE

EU (GW)

12.9

17.3

23.1

28.5

34.4

40.8

48

56.7

65

75.2

85

94.4

106

20

40

60

80

100

120

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

11

THE EUROPEAN WIND ENERGY ASSOCIATION

FIGURE 3.5 EU MEMBER STATE MARKET SHARES FOR TOTAL

INSTALLED CAPACITY. TOTAL 106 GW

Germany (31.3 GW) and Spain (22.8 GW) have the

largest cumulative installed wind energy capacity

in Europe. Together they represent 52% of total EU

capacity. The UK, Italy and France follow with, respec-

tively, 8.4 GW (8% of total EU capacity), 8.1 GW (8%)

and 7.6 GW (7%). Amongst the newer Member States,

Poland, with 2.5 GW of cumulative capacity, is now in

the top 10, in front of the Netherlands, and Romania is

eleventh with 1.9 GW (1.8%).

Estimated wind energy production

The wind capacity installed at end 2012 will, in a normal

wind year, produce 231 TWh of electricity, representing

7% of the EUs gross fnal consumption

(3)

.

According to this methodology Denmark remains the

country with the highest penetration of wind power in

electricity consumption (27.1%), followed by Portugal

(16.8%), Spain (16.3%), Ireland (12.7%) and Germany

(10.8%). Of the newer Member States, Romania has

the highest wind energy penetration (6.9%).

FIGURE 3.6 WIND POWER SHARE OF TOTAL ELECTRICITY CONSUMPTION IN EU (7%) AND IN MEMBER STATES

(3)

According to the latest gures from Eurostat, gross electricity consumption in the EU was 3,349 TWh in 2010.

Germany

31

30%

Spain

23

22%

UK

8

8%

Italy

8

8%

France

8

7%

Portugal

5

4%

Denmark

4

4%

Sweden

4

3%

Poland

2

2%

Netherlands

2

2%

Others

10

10%

0%

0%

0%

1%

1%

1%

2%

2%

3%

3%

4%

4%

4%

4%

4%

5%

5%

6%

6%

6%

6%

7%

7%

11%

13%

16%

17%

27%

5% 10% 15% 20% 25% 30%

Denmark

Portugal

Spain

Ireland

Germany

EU

Romania

UK

Estonia

Greece

Cyprus

Sweden

Italy

Netherlands

Lithuania

Austria

Bulgaria

Belgium

Poland

France

Latvia

Hungary

Luxembourg

Czech Republic

Finland

Slovakia

Slovenia

Malta

12

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

Note: wind energy penetration levels are calculated

using average capacity factors onshore and offshore

and Eurostat electricity consumption gures (2010).

Consequently, Figure 3.6 indicates approximate share of

consumption met by the installed wind energy capacity

at end 2012. The Figure does not represent real wind

energy production and electricity consumption data over

a calendar year. Consequently real national gures for

any given year can vary. For example, according to the

Portuguese TSO (REN), wind energy met over 19% of

total consumption during 2012.

FIGURE 3.7 WIND POWER SHARE OF TOTAL ELECTRICITY CONSUMPTION IN CROATIA, NORWAY, SWITZERLAND, TURKEY

12

THE EUROPEAN WIND ENERGY ASSOCIATION

0.2%

1.1%

2%

2.3%

0.5% 1% 1.5% 2% 2.5%

Turkey

Croatia

Norway

Switzerland

Despite the growth of annual wind energy installations

in 2012 and cumulative capacity reaching 106 GW,

wind energy deployment is lagging behind the objec-

tives the EU Member States set themselves in their

National Renewable Energy Action Plans (NREAPs)

(4)

. Comparison with the NREAPs does not take

into account any subsequent changes to targets.

Interestingly, installations in 2012 were higher than

EWEAs expectations.

Wind power targets

In 2009, the EWEA published a growth scenario

(5)

that

expected cumulative capacity in the EU to be 103 GW

at the end of 2012. However, EWEAs scenario reaches

230 GW of installed wind energy capacity in 2020,

whereas the sum of the Member States NREAPs

is 213 GW. The latter suggests that whereas EWEA

took a gradual approach with annual installations

increasing slowly at the beginning and more rapidly

towards 2020, the Member States, on the whole,

front-loaded their trajectories.

(4)

Foreseen by Directive 2009/28/EC of 23 April 2009 on the promotion of the use of energy from renewable sources.

(5)

Pure Power, wind energy targets for 2020 and 2030 a report by the European Wind Energy Association.

13

THE EUROPEAN WIND ENERGY ASSOCIATION

TABLE 4.1 WIND POWER CAPACITY TARGETS, NATIONAL RENEWABLE ENERGY ACTION PLANS AND REAL (MW)

Onshore 2012 Offshore 2012 Total 2012

Difference 2012

NREAP Real NREAP Real NREAP Real Onshore Offshore Total

Austria 1,435 1,378 0 0 1,435 1,378 -57 0 -57 -4%

Belgium 720 996 503 380 1,223 1,375 276 -124 152 12.5%

Bulgaria 451 684 0 0 451 684 233 0 233 51.7%

Cyprus 114 147 0 0 114 147 33 0 33 28.9%

Czech Rep 343 260 0 0 343 260 -83 0 -83 -24.2%

Denmark 2,985 3,241 856 921 3,841 4,162 256 65 321 8.4%

Estonia 311 269 0 0 311 269 - 42 0 -42 -13.5%

Finland 380 262 0 26 380 288 -118 26 -92 -24.2%

France 7,598 7,564 667 0 8,265 7,564 -34 -667 -701 -8.5%

Germany 30,566 31,027 792 280 31,358 31,307 461 -512 -51 -0.2%

Greece 2,521 1,749 0 0 2,521 1,749 -772 0 -772 -30.6%

Hungary 445 329 0 0 445 329 -116 0 - 116 -26.1%

Ireland 2,334 1,713 36 25 2,370 1,738 -621 -11 -632 -26.7%

Italy 7,040 8,144 0 0 7,040 8,144 1,104 0 1,104 15.7%

Latvia 49 68 0 0 49 68 19 0 19 38.8%

Lithuania 250 225 0 0 250 225 -25 0 -25 -10%

Luxembourg 54 45 0 0 54 45 -9 0 -9 -16.7%

Malta 2 0 0 0 2 0 -2 0 -2 -100%

Netherlands 2,727 2,144 228 247 2,955 2,391 -583 19 -564 -19.1%

Poland 2,010 2,497 0 0 2,010 2,497 487 0 487 24.2%

Portugal 5,600 4,523 0 2 5,600 4,525 -1,077 2 - 1,075 -19.2%

Romania 1,850 1,905 0 0 1,850 1,905 55 0 55 3%

Slovakia 150 3 0 0 150 3 -147 0 -147 -98%

Slovenia 2 0 0 0 2 0 -2 0 - 2 -100%

Spain 23,555 22,796 0 0 23,555 22,796 -707 0 -707 -3.2%

Sweden 2,311 3,582 97 164 2,408 3,745 1,269 67 1,336 55.6%

UK 5,970 5,497 2,650 2,948 8,620 8,445 -473 298 - 175 -2%

EU-27 101,773 101,048 5,829 4,993 107,602 106,041 -725 -836 -1,561 -1.5%

EWEA

2009 EU

98,000 5,300 103,300

Difference

EWEA 2009

and real

3,048 -307 2,741

14

WIND IN POWER: 2012 EUROPEAN STATISTICS

THE EUROPEAN WIND ENERGY ASSOCIATION

14

THE EUROPEAN WIND ENERGY ASSOCIATION

FIGURE 4.1 WIND POWER CAPACITY TARGETS (NREAPS AND EWEA 2009) AND REAL (MW)

101.8

98

101

5.8

5.3

5

92

94

96

98

100

102

104

106

108

110

NREAPs EWEA 2009 Real

Offshore Onshore

Eighteen Member States are falling behind their wind

power capacity trajectories. Of these, the furthest

behind are Slovakia (-147 MW, -98%), Greece (-772

MW, -30.6%), Czech Republic (-83 MW, -24.2%),

Hungary (-116 MW, -26.1%), Portugal (-1,075 MW,

-19%) and France (-701 MW, -8.5%). The nine other

Member States are, on the other hand, above their

trajectory. Sweden is the most noteworthy with 1,336

MW more than forecast (+55%).

The EU overall is lagging by almost 1.6 GW (-1.5%).

Table 4.1 also highlights that it is in offshore where

there is the biggest discrepancy between the NREAPs

and real installations. The Member States are trailing

by 836 MW, -14%.

Compared to EWEAs 2009 forecast, on the other

hand, onshore installations have increased faster than

expected (+3,048 MW or +3%). However, offshore

installations are below expectations by 307 MW or -6%.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Applied Statistics and Probability For EngineersDocument31 pagesApplied Statistics and Probability For EngineersDinah Jane Martinez50% (2)

- 01A - The Nature of Energy PDFDocument10 pages01A - The Nature of Energy PDFMuhammad Zida Idhum MNo ratings yet

- Chapter 2 Industry AnalysisDocument3 pagesChapter 2 Industry AnalysisApril Ann CapatiNo ratings yet

- Repeal The Casino Deal Sept 5 FilingDocument31 pagesRepeal The Casino Deal Sept 5 FilingMassLiveNo ratings yet

- 5 Minute Scalping SystemDocument10 pages5 Minute Scalping SystemEko Gatot IriantoNo ratings yet

- MarketingDocument33 pagesMarketingFranita AchmadNo ratings yet

- Ujjala 2022Document62 pagesUjjala 2022Akshay Kumar PrajapatiNo ratings yet

- Self Help Africa-Introductory NewsletterDocument2 pagesSelf Help Africa-Introductory NewsletterGeorge Jacob100% (2)

- Abba P LernerDocument5 pagesAbba P LernerKana Rizki Dara MutiaNo ratings yet

- IELTS Writing Task 1 Combined Graphs Line Graph and Table 1Document6 pagesIELTS Writing Task 1 Combined Graphs Line Graph and Table 1Sugeng RiadiNo ratings yet

- Managerial Economics: By-Swarnim DobwalDocument17 pagesManagerial Economics: By-Swarnim DobwalSwarnim DobwalNo ratings yet

- Issue Essay 1Document5 pagesIssue Essay 1api-489917923No ratings yet

- PEST and SWOT Analysis of MICE Industry in SingaporeDocument5 pagesPEST and SWOT Analysis of MICE Industry in SingaporeMukesh RanaNo ratings yet

- Cottrell, S. P., & Cutumisu, N. (2007), SustainableDocument4 pagesCottrell, S. P., & Cutumisu, N. (2007), SustainableRogelineNo ratings yet

- EY Building The Bank of 2030 and BeyondDocument44 pagesEY Building The Bank of 2030 and BeyondmonamohamadniaNo ratings yet

- Kerala Apartment Ownership ActDocument10 pagesKerala Apartment Ownership Actunni1962No ratings yet

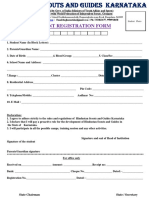

- Student Registration Form: Hsg/KarDocument1 pageStudent Registration Form: Hsg/KarLakshmiPrasad SNo ratings yet

- Abhisarika Sex Education Magazine Nov 2015Document40 pagesAbhisarika Sex Education Magazine Nov 2015Dr. DVR Poosha100% (4)

- Fin 440 - Assignment 2Document2 pagesFin 440 - Assignment 2Rabia AliNo ratings yet

- 20% Development Fund Utilization Report FY 2021Document2 pages20% Development Fund Utilization Report FY 2021edvince mickael bagunas sinonNo ratings yet

- Bills 23 Jan 2021Document3 pagesBills 23 Jan 2021Justine RhodesNo ratings yet

- DeflationDocument4 pagesDeflationan rajammaniNo ratings yet

- Tourism Investment ILoilo-GuimarasDocument71 pagesTourism Investment ILoilo-GuimarasMa Geobelyn LopezNo ratings yet

- The Story of Ma Yun (Jack Ma)Document11 pagesThe Story of Ma Yun (Jack Ma)Tanuj SharmaNo ratings yet

- Bibliography - Affordable Housing in IndiaDocument2 pagesBibliography - Affordable Housing in IndiaArul PaulNo ratings yet

- Nelogica Bolsa CMEDocument16 pagesNelogica Bolsa CMERobertoMaltaNo ratings yet

- CRMDocument41 pagesCRMjeebala100% (1)

- Lcasean Midterms Part 1Document5 pagesLcasean Midterms Part 1Sid Damien TanNo ratings yet

- East Timor Road Map, Upgrading Dili - Baucau RoadDocument140 pagesEast Timor Road Map, Upgrading Dili - Baucau RoadJhonny SarmentoNo ratings yet

- AnnexureDocument3 pagesAnnexurekalanidhieeeNo ratings yet