Professional Documents

Culture Documents

Strategy Guide

Strategy Guide

Uploaded by

QuanMaster0 ratings0% found this document useful (0 votes)

10 views4 pagesstrat filler

Original Title

52601594 Strategy Guide

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentstrat filler

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesStrategy Guide

Strategy Guide

Uploaded by

QuanMasterstrat filler

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

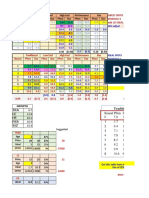

1. Take all types of loans in the initial rounds.

These loans should be used in the initial rounds to fund

your R&D and automation.

2. Release products in all segments such that they form a diagonal on the perceptual maps of high tech

and low tech products. Ideally, one product should be launched each year till year 5

3. High tech products launched initially would slowly move to low tech segments. Keep launching newer

ones in high tech

4. Production automation gradual increase to 10. This is very important to increase contribution

margins which are very helpful in later rounds

5. Target 100% awareness and keep spending on marketing till you reach this stage. The spending could

follow this

Round when the product is launched 1700

Subsequent rounds till awareness reaches 100% - 2500

After awareness reaches 100% - 1400 to maintain dominance

Target 100% accessibility and keep spending on sales till you reach this stage. The spending could follow

this

Round when the product is launched 2500

Subsequent rounds till awareness reaches 100% 3000

After acessibility reaches 100% - 2000 to maintain 100%

6. 1000-1200 is the maximum market share for a product in a competitive market.

7. Sales forecast can be determined by taking the total of potentials for each segment of your product

8. No dividends should be given in any rounds

9. Whenever cash available, buy back the shares. This would increase your share price significantly

10. At each round, keep an eye on Balanced score card proforma. Your target in each round can be

Rounds 1-3 : 40+

Rounds 4-6: 70+

Rounds 7-8: 85+

first move advantage by: BORROWING FIRST, LAUNCHING NEW PRODUCT FIRST, PROMOTION first.

why he did all of those?? THIS IS BECAUSE THE FIRST MOVER CAN CAPTURE THE BIGGEST MARKET

SHARE !!!!! when you just on your feet by having adequate market share, even a mediocre CEO can do

JUST

1. If you are being graded on specific areas, become an expert in that area. (ie If you are being

graded on Return on Assets or Leverage learn those equations and look at what impacts those

numbers).

2. When creating a strategy, dont look at where we are now and how to get through the next

round. If your school is running 8 rounds, look at where you want to be at the end of 8 rounds.

Then map out how to get there. Its the same when you go to college. You choose a major (this

what I want to get a degree in) and then a path is developed for you to follow.

3. An ideal strategy. Everyone wants to know which market segments are the best ones to go into

and win!! If all teams decided to go into the Low, Traditional and High end then the

Performance and Size segments are not being taken care of. The teams that are in the Low,

Traditional and High End will be in a blood bath. Some teams that try to divide themselves

between all market segments have a harder time all of their resources are divided across 5

market segments. If a team has 2 products in one market segment, they can increase their

accessibility (run by the sales budget amounts). Remember, you can manufacture up to 8

products.

4. After printing the Courier which everyone gets the same one print out the financial reports

for your company. This will show Confidential information about your companys products.

Make sure that each product is bringing in enough money (the contribution margin) to cover the

fixed costs of that product line.

It's pretty easy to score within the top 99% of teams. Just borrow as much debt and issue as much

common stock as you can in the early rounds. The key of course is to pick a strategy and stick with it. Be

low cost or be a differentiator, it's tough to be both. Going the low cost route is usually the easiest, but

make sure you invest heavily in automation in order to squeeze out as much savings as possible. Even if

you don't go low cost it's beneficial to have high automation.

Putting multiple products in a market segment is a good idea, the more you can spread out your

marketing and sales cost the better. Rule of thumb is that you need at least 2 products in any segment

that you seriously want to compete in.

The big money makers are Low Cost and the average or normal segment, forgot what it is called. Hardly

anyone tries to compete in the Size and Performance segments, so you can have it all to yourself if

you're lucky. Unfortunately, the profit margins in both of those segments are razor thin, so you won't

make as much money as in the other market segments.

To win capsim, you must keep releasing products continuously. Utilize all that you can get in loans for

your research and development, especially for new technologies.

Promotional budget to increase awareness. The aim is to reach 100% awareness in the shortest

period of time. For the first product which is already in the market, YR1 spend $1700 and YR2

spend $2500, subsequent spending is $1400 to maintain 100% awareness. For new product, on

the year that it is going to be launched (eg. Mar 09), make the spending on YR09 $3000 (this

will come out in your statement as $3250), YR10 which is the year after will required $3000 as

well and subsequent spending is $1400 to maintain 100%.

Sales budget to increase accessibility. Its very hard to come out with a proper formula on how

this works as it takes into consideration all products in an existing market. My suggestion is,

don't be stingy. Spend $3000 on each product until accessibility reach 100% then tune down to

$2000. Yearly!

Next, its our product. What kind of specification and how many and which market?

Launch 5 products. 1 product each year. All product will target the low tech market but will also

cater for the high tech market. MTBF will set to highest point for low tech requirement, if I

remember correctly is 21000. To get the yearly specific product positioning, you have to get the

fine cut line for both high tech and low tech in YR8 which is the final year. Your 5 products

should be spread out and resting on the low tech fine cut line which is in the high tech region.

After you have decided the positioning for all 5 products, you can calculate backward for each

products as you already know how much the low tech market move each year. Performance

increase by 0.5 units every year and size decrease by 0.5 units every year just in case. Work

backwards!

When you want to launch a new product, the positioning of the product should be for the year the

product will be ready to be sold in the market. In our strategy, it will take 2 years to upgrade your

product (due to automation 10, I will explain later). Therefore, you must upgrade your product

when it is around 2 years old. Takes 2 years to upgrade, by the time it finished upgrade, it will be

4 years old. For an upgraded product, age will be divided by 2, and your product will go back to

2 years old, and you upgrade it again. This will in fact put your product in the optimum age

range, 2-4 years old and 3 years old being the best. When you are upgrading, its very hard to

position the product exactly as you wish, but give and take, make sure the product comes out in

within 2 years, not 2.1 years or 2.2 years!

You have your product, and you need to produce it and sell!

My experience tells me that in a competitive market, you cannot sell more than 1000 units for

each product. Our strategy will utilize 100% overtime as it saves us the overhead cost. We will

buy 500 units capacity for each product. Automation will be set to 10 which will gives us the

lowest possible labor cost which is variable cost. This will give us the maximum margin.

In order to know how many units to produce each round, you need to do sales forecast. The

easiest way to do the forecast is by looking at the last few pages of your statement. There will be

a page that shows all the product in the market, the actual and potential number of units sold in

units and percentage. The potential percentage should be used as a forecast for your product, use

the percentage number and get the unit number from the following year's market size. Do it for

both low tech and high tech and add together, that will be the number of units you will be

producing, repeat for each product. If your product just enter into the market like Mar 09, you

can put in maximum possible production in YR09.

Now, to buy all that capacity, to buy all that automation, to pay for all that marketing and new

product research. You need money!

In the beginning, no matter what is the source, be it stock issue, short term loan, long term loan,

emergency loan, they are all good! Money is important at all cost! So, go all out in financing in

the beginning.

Here's a system loophole. To maximize short term loan borrowings, you need to set your unit

sales forecast in the marketing tab for each product to 1 unit. It will affect the numbers shown

there, a lot of reds, but don't bother about it. Then go to your financing tab and get the largest

possible amount of short term loan.

You should never pay dividend. After your company start making positive cash flow (not

profit!), and you have sufficient cash flow to pay for your investments, you should start buying

back all your stocks. Share buy back will make your stock price shoot up faster and higher than

getting an erection. If you still have excess money from your share buy back, pay back as much

long term loan as possible, as they carry fix interests which are high. Issue new long term loan at

a lower interests rate. Reducing your short term loan will be on the last priority.

There are some debates that I have been thrown into:

1. Marketing expenses is too high.

MPS is a marketing subject, I have yet to encounter a marketer who would ask his boss to reduce

the company's marketing budget when every marketer out there is fighting for more money to

spend on marketing. The amount of money spent is like buying an insurance that guarantee all

your products to be sold out, so that you don't need to carry all the dead load on inventory cost.

2. Automation 10 incur high depreciation and slow down product upgrade.

Depreciation is not a cash flow, it is just an accounting number. Depreciation expense lets you

pay less tax. The super high margin provided by automation 10 brings in more revenue than

depreciation expense in numerical terms. You are dealing in a low tech product market, it creates

a synergy with your product upgrade as it takes two years exactly and you can keep your product

in optimum position and age. Plus, you can make do with super crazy price war selling below

your competitors' cost price.

3. No point borrow short term loan as you have to pay back in 1 year.

Have you ever swiped a HSBC Credit Card, when the statement comes, transfer the balance to

your Citibank Credit Card, when the next statement comes, transfer the balance to Maybank

Credit Card? At the end of the day, you only pay the interest and not the balance. If you are a

finance major, you will have learned of the 3 month loan which you roll over every time it

expires. Its the same thing with short term loan, you don't need to pay back at all. Just keep

rolling over.

4. Stocking out is not really a good idea.

Its a good enough idea for me. I carry 0 inventory cost and I am happy I have sold out all my

products as planned.

That's all. Good luck and all the best!

You might also like

- Capsim Predict v9Document11 pagesCapsim Predict v9ABHISHEK100% (2)

- Capsim StrategyDocument2 pagesCapsim Strategyhtshot2350% (2)

- Dos and Donts in MarkstratDocument5 pagesDos and Donts in MarkstratEliana RusuNo ratings yet

- Risk V9a Sample PaperDocument39 pagesRisk V9a Sample PaperRaj KumarNo ratings yet

- CAPSIM DecisionDocument4 pagesCAPSIM DecisionJenniferNo ratings yet

- 20181104044546compxm Practice Board Query QuestionsDocument5 pages20181104044546compxm Practice Board Query QuestionsrockingjoeNo ratings yet

- 04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Document76 pages04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Vidhi Sharma0% (1)

- Sample Strategic Plan 2Document5 pagesSample Strategic Plan 2ibrahimaktan100% (1)

- Capsim Expert GuideDocument61 pagesCapsim Expert Guideniroson88% (8)

- Final Project Strategic Management and PolicyDocument10 pagesFinal Project Strategic Management and PolicyBushra ImranNo ratings yet

- Digby Corp 2021 Annual ReportDocument13 pagesDigby Corp 2021 Annual ReportwerfsdfsseNo ratings yet

- Flyht Case SolutionDocument2 pagesFlyht Case SolutionkarthikawarrierNo ratings yet

- Case 3: Rockboro Machine Tools Corporation Executive SummaryDocument1 pageCase 3: Rockboro Machine Tools Corporation Executive SummaryMaricel GuarinoNo ratings yet

- Team Chester BADocument16 pagesTeam Chester BAsebast107No ratings yet

- BCG Case Interview HackedDocument9 pagesBCG Case Interview HackedRohit Singh100% (1)

- Capsim Tips and TricksDocument4 pagesCapsim Tips and TricksAlyNo ratings yet

- CompXM Study GuideDocument1 pageCompXM Study GuidePrashant KapoorNo ratings yet

- Andrews AnalysisDocument11 pagesAndrews Analysisapi-334753705No ratings yet

- Capsim Business Simulation - Key Learnings - FinalDocument26 pagesCapsim Business Simulation - Key Learnings - Finalvin100% (2)

- CAPSIM Full Strategy ExcelDocument19 pagesCAPSIM Full Strategy ExcelSiddharth Modi100% (1)

- Capstone Simulation: Strategy For Your CompanyDocument17 pagesCapstone Simulation: Strategy For Your Companyadivitya100% (6)

- Nike Case AnalysisDocument11 pagesNike Case AnalysisastrdppNo ratings yet

- Bitter Competiton HBR Case AnalysisDocument10 pagesBitter Competiton HBR Case Analysissrikanthiitb100% (2)

- Capsim Report - Digby TeamDocument17 pagesCapsim Report - Digby Teamparamjit badyal100% (1)

- Rich Vs King Case Analysis - Group CDocument6 pagesRich Vs King Case Analysis - Group Csinhatal_gdgwiNo ratings yet

- Topic: Report of Aima Bizlab Module Leader-Dr. Vinod Lakhwani Submitted byDocument23 pagesTopic: Report of Aima Bizlab Module Leader-Dr. Vinod Lakhwani Submitted byBhakti PatelNo ratings yet

- CHAPTER 12 Capital Budgeting - Principles and TechniquesDocument119 pagesCHAPTER 12 Capital Budgeting - Principles and TechniquesMatessa AnneNo ratings yet

- Brand ExtensionDocument2 pagesBrand ExtensionUtkarsh MaheshwariNo ratings yet

- Chapter 4 Test Bank PDFDocument23 pagesChapter 4 Test Bank PDFCharmaine Cruz100% (4)

- Notes CapsimDocument6 pagesNotes CapsimElinorWang0% (1)

- Good Info CapsimDocument11 pagesGood Info Capsimmstephens1No ratings yet

- RTS Company AndrewsDocument26 pagesRTS Company Andrewsasia0312No ratings yet

- Capstone Industry - 602 Team AndrewsDocument17 pagesCapstone Industry - 602 Team AndrewsPeshwa BajiraoNo ratings yet

- CapSim Demonstration - Student NotesDocument7 pagesCapSim Demonstration - Student NotesKarthik HegdeNo ratings yet

- How To Win at Capsim and CompXM - Learn To WinDocument5 pagesHow To Win at Capsim and CompXM - Learn To WinAlka DubeyNo ratings yet

- Capsim Success MeasuresDocument10 pagesCapsim Success MeasuresalyrNo ratings yet

- Comp-Xm® Inquirer WordDocument37 pagesComp-Xm® Inquirer WordAnonymous TAV9RvNo ratings yet

- Comp XM Examination GuideDocument15 pagesComp XM Examination Guidesarathusha100% (1)

- Management Games Andrews Industry 24Document9 pagesManagement Games Andrews Industry 24Rahul ChauhanNo ratings yet

- Basic Capsim StrategiesDocument8 pagesBasic Capsim StrategiesRachel YoungNo ratings yet

- CAPSIMDocument4 pagesCAPSIMJie ChengNo ratings yet

- Capsim FinalDocument24 pagesCapsim FinalTanvi Mudhale100% (1)

- Capstone Simulation Final Evaluation PresentationDocument15 pagesCapstone Simulation Final Evaluation PresentationwerfsdfsseNo ratings yet

- CompXmGuide (Summary)Document1 pageCompXmGuide (Summary)Jai PhookanNo ratings yet

- Comp-XM Examination GuideDocument15 pagesComp-XM Examination GuideJacquesMeyer100% (2)

- BS Digby ReportDocument12 pagesBS Digby ReportAlok PathakNo ratings yet

- Lesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument5 pagesLesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case Studiesthetpainghein one0% (1)

- Dominion Motors LTDDocument5 pagesDominion Motors LTDutkarshdave100% (1)

- Capstone StrategiesDocument13 pagesCapstone Strategiesrns116No ratings yet

- Quality Analytics SimulationDocument2 pagesQuality Analytics SimulationNehir AltıparmakNo ratings yet

- OB Group AssignmentDocument3 pagesOB Group AssignmentAshish SandapuNo ratings yet

- Global Supply Chain Management SimulationDocument9 pagesGlobal Supply Chain Management SimulationJawadNo ratings yet

- Markstrat Rubicon Bravo PresentationDocument25 pagesMarkstrat Rubicon Bravo PresentationDebadatta RathaNo ratings yet

- CAPSIM Capstone Strategy 2016Document21 pagesCAPSIM Capstone Strategy 2016Khanh MaiNo ratings yet

- Capstone 5 Year StrategyDocument11 pagesCapstone 5 Year Strategyberetta92f100% (2)

- Strategic Management g9 Elon Musk BetsDocument5 pagesStrategic Management g9 Elon Musk BetsJaya Neelanshi SethNo ratings yet

- HP CompaqDocument34 pagesHP CompaqJeevandra SivarajahNo ratings yet

- GE's Two-Decade: Transformation: Jack Welch's LeadershipDocument2 pagesGE's Two-Decade: Transformation: Jack Welch's LeadershipkimNo ratings yet

- Capstone Situation AnalysisDocument5 pagesCapstone Situation AnalysisHerbert Ascencio0% (1)

- Corporate Management Guide PDFDocument139 pagesCorporate Management Guide PDFSafaljot SinghNo ratings yet

- Why It Is Important To Learn About Product Life CycleDocument42 pagesWhy It Is Important To Learn About Product Life CycleYogendra SinghNo ratings yet

- Home Security EquipmentDocument5 pagesHome Security EquipmentNidhi KaushikNo ratings yet

- Capsimstrategy Blogspot Com AuDocument5 pagesCapsimstrategy Blogspot Com AuCahyo EdiNo ratings yet

- Dos and Donts in MarkstratDocument7 pagesDos and Donts in MarkstratSundaramNo ratings yet

- Chapter 07, 08, 09 Non Current AssetsDocument8 pagesChapter 07, 08, 09 Non Current Assetsali_sattar15No ratings yet

- Mahindra Sustainability Report 2013-14Document175 pagesMahindra Sustainability Report 2013-14Angela LopezNo ratings yet

- CHAPTER 6 Muhammad Adi Teo Andri IrmawanDocument3 pagesCHAPTER 6 Muhammad Adi Teo Andri IrmawanMuhammad AditeoNo ratings yet

- Kryss-Mark-Francisco Module 4 and 5 IOMDocument24 pagesKryss-Mark-Francisco Module 4 and 5 IOMChellemark FranciscoNo ratings yet

- Chapter 7 Short Term FinancingDocument41 pagesChapter 7 Short Term Financingzatty kimNo ratings yet

- PDFDocument559 pagesPDFComedy WorldNo ratings yet

- Assembly & Fabrication of Walking Tiller Tractor PlantDocument24 pagesAssembly & Fabrication of Walking Tiller Tractor PlantThomas M100% (4)

- Risk and Insurance: Biyani's Think TankDocument122 pagesRisk and Insurance: Biyani's Think TankFaiz Ur RehmanNo ratings yet

- Business and Finance Course SyllabusDocument3 pagesBusiness and Finance Course Syllabusvicente leanzaNo ratings yet

- International Economics - Intertemporal Trade and Current Account BalanceDocument17 pagesInternational Economics - Intertemporal Trade and Current Account BalanceMaxime KirpachNo ratings yet

- EatikDocument29 pagesEatikCler SntsNo ratings yet

- Pure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECDocument25 pagesPure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECBob ReeceNo ratings yet

- Fundraising Best Practices: 2020 EditionDocument23 pagesFundraising Best Practices: 2020 EditionFounder InstituteNo ratings yet

- The TRAIN Law and The Poor Antonio P. Contreras: BY ON JANUARY 30, 201Document7 pagesThe TRAIN Law and The Poor Antonio P. Contreras: BY ON JANUARY 30, 201Jellah Lorezo AbreganaNo ratings yet

- YVCDocument2 pagesYVCnetterinder0% (1)

- International Journal of Bank Marketing: Article InformationDocument32 pagesInternational Journal of Bank Marketing: Article Informationrohil qureshiNo ratings yet

- Absorption and Marginal CostingDocument58 pagesAbsorption and Marginal CostingtokyadaluNo ratings yet

- TF WorkDocument11 pagesTF WorkMay Jutamanee LeangvichajalearnNo ratings yet

- Project Report 1Document87 pagesProject Report 1Sonu MishraNo ratings yet

- Turner Vs Lorenzo ShippingDocument3 pagesTurner Vs Lorenzo ShippingWhere Did Macky GallegoNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet

- Staff Emails Part 13 PDFDocument183 pagesStaff Emails Part 13 PDFRecordTrac - City of OaklandNo ratings yet

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationNo ratings yet

- Narra Nickel Mining Vs RedmontDocument1 pageNarra Nickel Mining Vs RedmontAnnKhoLugasan100% (1)

- 3.3.6 Multinational CorporationsDocument32 pages3.3.6 Multinational CorporationsAli AhmedNo ratings yet