Professional Documents

Culture Documents

Honest Money - Biblical Principles of Money and Banking

Honest Money - Biblical Principles of Money and Banking

Uploaded by

gypsylanternCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Honest Money - Biblical Principles of Money and Banking

Honest Money - Biblical Principles of Money and Banking

Uploaded by

gypsylanternCopyright:

Available Formats

HONEST

MONEY

I

.

Other books by C@-y North

Marx% Rel&ion flll?euolution, 1968

An I ntroduction to hristian Economics, 1973

~

Unconditional Surqder, 1981

Successfid I nvesting in an Age of Envy, 1981

The Dominion Covenant: Genesz3, 1982

Government By Emerge.qv, 1983

Th Last Train Out, 1983

Backward, Christian Soldiers?, 1984

75 Bible Questions Your I nstructors

Pray Mu Wont Ask, 1984

Coined Freedom: Gold in the Age of

the Bureaucrats, 1984

Moses and Pharaoh, 1985

Negatwnds, 1985

The Sinai Strategy, 1986

Unholy Sirits: Occultism and

New Age Humanism, 1986

Conspira~: A Btblwal View, 1986

Merit the Earth, 1986

F&hting Chance, 1986 [wi th Arthur Robi nson]

Books Edi ted by Gary North

Foundationsof Chrzitian SchoZursh$, 1976

Tactics of Chrzltian Resistance, 1983

The Theology of Christiun Resistance, 1983

*

HONEST

MONEY

The Bi bl i cal Bl uepri nt

for Money and Banki ng

Gary North

DOMI NI ON PRESS G FT. WORTH, TEXAS

THOMAS NELSON, I NC. G NASHVI LLE, TENNESSEE

Copyri ght 01986 by Gary North

Al l ri ghts reserved. Wri tten permi ssi on must be secured fi -om the

publ i sher to use or reproduce any part of thi s book, except for

bri ef quotati ons i n cri ti cal revi ews or arti cl es.

Co-publ i shed by Domi ni on Press, Ft. Worth, Tkxas, and Thomas

Nel son, I nc., Nabhvi l l e, Tennessee.

Printed in tb .Unitid States of America

Unl ess othemvi se noted, al l Scri pture quotati ons are from the

New Ki ng James Versi on of the Bi bl e, copyri ghted 1984 by

Thomas Nel son, I nc., Nashvi l l e, Tennessee.

Li brary of Congress Catal og Card Number 86-050796

I

I

I SBN 0-930462-15-7

I

i

Thk book i s dedi cated to

John Maul di n

who has assured me, as my di rector of marketi ng,

that thi s book wi l l make me a pi l e of money . . . honest!

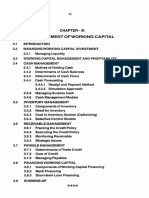

TABLE OF CONTENTS

Part I : BLUEPRI NTS ,

I ntroducti on . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...3

I

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

TheVal ue ofMoney . . . . . . . . . . . . . . . . . . . . . . . ...7

The Ori gi nsofMoney . . . . . . . . . . . . . . . . . . . . . . . 19

Mai ntai ni ngHonestMoney . . . . . . . . . . . . . . . . ...29

Debasi ng the Currency . . . . . . . . . . . . . . . . . . . . ...39

The Contagi on of I nfl ati on . . . . . . . . . . . . . . . . ...49

When the State Monopol i zes Money . . . . . . . . ...59

Bi bl i cal Banki ng . . . . . . . . . . . . . . . . . . . . . . . . . . ...70

Fracti onal Reserve Banki ng . . . . . . . . . . . . . . . . ...80 .

Protecti ngLi censedCounterfei ters . . . . . . . . . . ...91

A Bi bl i cal Monetary System . . . . . . . . . . . . . . . ...103.

Concl usi on . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...113

Part I I : RECONSTRUCTI ON

11. A Program of Monetary Reform . . . . . . . . ...123

12. The Pol i ti cs of Money . . . . . . . . . . . . . . . . . . . . ...132

13. The ReformofDebt . . . . . . . . . . . . . . . . . . . . . ...142

Bi bl i ography . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...153

Scri pture I ndex. . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . 155

Subject I ndex . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...157

What Are Biblical Bl uepri nts?.. . . . . . . . . . . . . . . . . . ...161

vi i

Part I

BLUEPRINTS

We began by stati ng that the i ssue wi th respect to gol d i s an

i ssue more central l y wi th respect to God. I s there an ul ti mate and

absol ute order, and does Gods soverei gn l aw establ i sh an i nescap-

abl e order wi th respect to every sphere, so that transgressi on of

that l aw bri ngs soci al penal ti es and decay? Or i s humani sm true,

and the onl y val ue i s man and hi s desi res, ~ hi s pl easure i n con-

sumpti on, di spl ay, and expressi on? The monetary cri si s refl ects a

cul tural cri si s.

Those opposi g wel fare economi cs must of necessi ty have a

1 sound monetary p, l i cy. But a sound monetary pol i cy rests i n the

framework of abs@te l aw, i n the basi c premi se of the soverei gn

and absol ute Godl whose l aw-order governs al l real i ty. Wi thout

thi s fai th, the conservati ves economi cs l acks the consi stency of the

stati sts. The monetary pol i ci es of soci al i sm refl ect, after al l , a

consi stent fai th i n the ul ti macy and soverei gnty of man and mans

abi l i ty to create hi s own l aw, money, and worl d at wi l l . Here as

el sewhere the questi on i s si mpl y thi s: who i s God? I f the Lord be

God, then fol l ow Hi m. But i f Bad be god, then Baal must be fbl -

I owed. Not wi thout si gni fi cance, the U. S. coi nage, from the days

of the Ci vi l War, bore the i mpri nt, I n God We Trust.

R. J. Rushdoony*

* Rushdoony, Polihcs of Guiit and P@ (Fai rfax, VA: Thobum Press [1970]

1978), pp. 241-42.

I NTRODUCTI ON

Thi s i s a book on money, a subject that has defi ed anal ysi s by

professi onal economi sts for as l ong as there have been professi onal

economi sts. At the same ti me, i t i s a topi c for whi ch the most i l l -

i nformed peopl e thi nk they have the answers. Very often the most

i l l -i nformed peopl e are professi onal economi sts.

I wi l l gi ve you an exampl e. I n the fal l of 1985, I suggested to a

research assi stant to a U. S. Congressman that he conduct a qui ck

study of the Mexi can peso. I thought that the sharp i ncrease i n

cash Ameri can money i n ci rcul ati on, 1982-85, mi ght be expl ai ned

by Mexi can nati onal s substi tuti ng dol l ars for pesos i n Mexi co. At

the t@e that he began hi s i nvesti gati on, the peso was sel l i ng for

about 250 per do~ar. I suggested that he ask a staff economi st at

the Federal Reserve System, our nati ons central bank, i f he

thought that Mexi cans were hoardi ng cash dol l ars. I suspected

that Mexi can ci ti zens were usi ng the U.S. dol l ar as a substi tut,

for the col l apsi ng peso.

He phoned back a few days l ater. Two staff economi sts, one oi

whom was a speci al i st i n the Mexi can economy, had tol d hi m that

i t was qui te unl i kel y that Mexi cans were hoardi ng dol l ars,

because Mexi cans coul d take cash dol l ars to thei r l ocal bank, ex-

change thei r dol l ars for pesos, and the bank woul d pay them i n-

terest i n pesos.

Wi thi n one week, the peso fel l to 500 to the dol l ar. Thus, any-

one who had fol l owed the advi ce ~f the expert economi sts had l ost

hal f of hi s capi tal . On the other hand, those who had bought cash

dol l ars wi th thei r pesos and never went near a bank had doubl ed

thei r money (pesos). I n short, a l ot of i l l i terate Mexi can peasants

3

4 Honest Money

know more about practi cal economi cs i n an i nfl ati onary economy

than Federal Rese&e economi sts know. Somehow, thi s di scovery

di d not surpri se m~.

A few months I qter, a report on the apparent di sappearance of

Ameri can cash appeared i n the newspapers. I t sai d that Federal

Reserve economi sts now thi nk that peopl e i n forei gn countri es are

usi ng Ameri can bi l l s i nstead of thei r depreci ati ng nati onal curren-

ci es. So much for the consi stent vi ews of economi sts. They just

dont agree on much of anythi ng, except the need to keep econ-

omi sts on the payrol l . ,

The Cri si s We Face

There i s a debt cri si s i n the maki ng. I t i s i nternati onal . Every

i ndustri al nati on on earth faces a cri si s that coul d dwarf the cri si s

of the 1930s. The banks of the worl d have done the bi ddkg of the

pol i ti ci ans, and they have l oaned hundreds of bi l l i ons of dol l ars .

and other currenci es to the l ess devel oped countri es (LDCS).

The p+i ti ci ans wanted them to do thi s because the voters were

ti red of sendi ng government forei gn ai d to these backward soci al -

i st di ctatorshi ps and tri bal despoti sms. Begi nni ng i n the 1970s,

the bankers sent the deposi tors money by the hundreds of bi l l i ons

of dol l ars.

The resul t i n ei ther case i s the same: the money i s gone. The

despots bought what they wanted, and squi rrel ed away hundreds

of mi l l i ons or even bi l l i ons i n Swi ss banks. (I n earl y 1986, the

Swi ss government froze the bank accounts of deposed Phi l i ppi ne

Presi dent Marcos when i t was rumored that he was about to pul l

%k money out of Swi ss banks.) The governments bui l t ci ti es (the

cl assi c exampl e i s Brasi l i a) and power pl ants and steel mi l l s

none of whi ch produces a profi t. The money was spent, the pyra-

mi ds were bui l t, and now the Wests banks are si tti ng on top of a

mountai n of I OUs that are never goi ng to be pai d off, at l east not

wi th money that i s worth anythi ng.

Thi s means that you and I are si tti ng on top of those I OUs,

for i t was our economi c futures that the i di ot banker q gave away.

But i ts parti al l y our faul t; we trusted them, year by year.

I

1

I ntroduction 5

There are no sol uti ons. The l oans are sour. There wi l l be a

defaul t. The practi cal forecasti ng questi ons we need to get

answered are these: How soon wi l l the defaul t come? What ki nd

of defaul t wi l l i t be?

Thi s book asks a di fferent questi on: What vi ol ati ons of the

pri nci pl es of the Bi bl e di d the West commi t that l ed us i nto thi s

mess? I t al so asks thi s questi on: What shoul d we bui l d on the

rui ns of the present system after the col l apse?

Bi bl i cal Al ternati ves

There are Bi bl i cal al ternati ves. I f we had adopted them 500

years ago, or 100 years ago, or even 50 years ago, we woul d not be

faci ng the monetary cri si s that we now face. But we di dnt adopt

them, so we are faci ng i t.

Professi onal economi sts do not take the Bi bl es answers seri -

ousl y. They wi l l not take thi s book seri ousl y. But we have l i stened

to professi onal economi sts for 200 years, and what do we have to

show for i t? Where have they set forth a si mpl e, pri nci pl ed, cl ear

program for l ong-term economi c stabi l i ty? Where have they come

to any agreement on what ought to be done? Nowhere. Where

there are fi ve economi sts, there wi l l be at l east si x opi ni ons.

Professi onal theol ogi ans who bel i eve i n the B~bl e as the i nfal l i -

bl e Word of God al so have not taken the Bi bl es answers seri ousl y.

They are not used to thi nki ng of the Bi bl e as a book that offers

soci al , pol i ti cal , and economi c bl uepri nts. They have not con-

cerned themsel ves wi th broad soci al questi ons-for over a century.

Why, then, do I thi nk I know the thi ngs the Bi bl e says we

must da, when the athei sti c economi sts and l ets-not-get-i nvol ved-

i n-soci al -i ssues theol ogi ans are agreed that the Bi bl e doesnt offer

us any speci fi c bl uepri nts? Because I take the Ol d Testament seri -

ousl y. The economi sts and the l ets-just-preach-Jesus theol ogi ans

dont.

When the cri ses hi t and they are goi ng to hi t Chri sti ans

need to be i n posi ti ons of l eadershi p, ready wi th accurate answers

about how and why the cri ses hi t, and what the Bi bl e says needs

to be done to recover from them, and to keep these cri ses from hi t-

/

6 Honest Mong

ti ng us agai n. Thi s means that Chri sti ans need to understand the

Bi bl es bl uepri nts for every area of l i fe. One of these areas i s

monetary pol i cy.

The pri nci pl es of honest money are not di ffi cul t to l earn. I m-

pl ementi ng them, on the other hand, wi l l i nvol ve consi derabl e

soci al cost, but nothi ng compared to what the West wi l l go

through i f we Chri sti ans dont do the work, and the ci vi l govern-

ment doesnt begi n to enforce Gods l aw. I f we fai l to reconstruct

the present banki ng system because everyone refuses to pay

whatever soci al costs are necessary to do i t, we wi l l eventual l y pay

far hi gher costs anyway. Chr@i ans shoul d be prepared to fol l ow

Jesus warni ng about counti ng the costs:

For whi ch of you, i ntendi ng to bui l d a tower, does not si t down

fi rst and count the cost, whether he has enough to fi ni sh i t l est,

after he has l ai d the foundati on, and i s not abl e to fi ni sh i t, al l who

see hl m begi n to mock hi m, sayi ng, Thi s man began to bui l d and

was not abl e to fi ni sh (Luke 14:28-29).

1

THE V_UE OF MONEY

So when the money fai l ed i n the l and of Egypt and i n the l and

of Canaan, al l the Egypti ans came to Joseph and sai d, Gi ve us

bread, tfor why shoul d we di e i n your presence? For the money has

fai l ed (Genesi s 47.15).

Dani el Defoe wrote a novel i n 1719 about a man whose shi p

sank, and who ,wound up on a deserted i sl and for 28 years. I t was

cal l ed Robinson Crusoe. Economi sts l ove to use Robi nson Crusoe as

thei r exampl e when they begi n an i ntroductory textbook on eco-

nomi cs. Why? Because he was al one i ni ti al l y. We can then tal k

about scarci ty and i ts economi c effects i n a worl d wi thout a money

economy. Why di dnt Crusoes economy have money? Because i t

was a worl d wi thout exchange (trade) and the di vi si on of l abor.

Crusoe faced a hosti l e worl d. How was he goi ng to overcome

scarci ty? He needed food, cl othi ng, and shel ter. Fortunatel y for

hi m, he was abl e to get a l ot of hi s tool s from the shi p; i f he hadnt,

he woul dnt have survi ved even 28 days.

The reason why economi sts use Robi nson as an exampl e i s

that they dont have to begi n wi th the ddl i cul t probl ems of the

di vi si on of l abor and vol untary trade. Onl y when the economi st ,

has expl ai ned basi c producti on, savi ng, and the al l ocati on of ti me

and capi tal does he i ntroduce Fri day, the nati ve partner. That was

Defoes strategy, too.

The textbook Crusoe i ni ti al l y has to deci de what hi s hi ghest

pri ori ti es are. What i s hi s order of preferences? I s i t fresh water,

food, shel ter, or cl othi ng? What need does he attempt to sati sfy

fi rst? The whol e poi nt of the i l l ustrati on i s to show that i n a worl d

7

8 Hontwt Along

of l i mi ted resources, a person has to make deci si ons about how to

achi eve hi s goal s. He cant achi eve al l of them at the same ti me.

He has to deci de what he needs to dofi rst, second, and so on,

down to a hundred and thi rty-fi fth or more-and then he has to

compare thi s l i st wi th hi s avai l abl e resources, i ncl udi ng hi s per-

sonzd ski l l s and ti me.

One day he may pi ck berri es. But they dont l ast forever,and

besi des, he wants somethi ng el se to eat. He can cl i mb a tree and

pi ck coconuts, or he can spend several hours to make a sort of

poki ng sti ck that he can use to knock down frui t or coconuts from

trees. But the ti me he spends l ocati ng a sui tabl e sti ck cant be used

to cl i mb trees and get food di rectl y. The poi nt i s that he has to gi ve

up i ncome (food) i n order to get the ti me to produce or di scover

capi tal (the sti +).

He may want to go fi shi ng. That means he needs a fi shi ng

pol e, some l i ne, a hook, and maybe some bai t. Or.he needs a net.

But unl ess he fi nds i t as a free gi ft (the shi ps warehouse), he has to

make i t. He cant become too fancy, or el se he wi l l di e of mal nutri -

ti on before he fi ni shes the project.

(

Decisions on Board

Say that he has a pi l e of goods to take from the shi p. He has

put together a crude and i nsecure raft that he can use to fl oat

some goods back to shore. The shi p i s sl owl y si nki ng, so he has

l i mi ted ti me. A storm i s comi ng up over the hori zon. He cant

grab everythi ng. What does he take? What ~ i s most val uabl e to ,

hi m? Obvi ousl y, he makes hi s deci si on i n terms of what he thi nks

he wi l l need on the i sl and. He tri es to esti mate what tool s wi l l be

most val uabl e, gi ven hi s new envi ronment.

The val ue of a tool as far as he i s concerned has nothi ng to do

wi th the money i t cost ori gi nal l y. He mi ght be abl e to pi ck up a

sophi sti cated cl ock, or an expensi ve musi cal i nstrument, but he

probabl y wont. He woul d probabl y sel ect some i nexpensi ve

kni ves, a mi rror (for si gnal i ng a passi ng shi p), a barrel (for col -

l ecti ng rai n water), and a dozen other si mpl e tool s that coul d

mean the di fference between l i fe and death.

I

I %e l%lue of Mong 9

I n short, val ue i s subjecti ve. The economi st uses fancy l an-

guage and says that Crusoe imputes val ue to scarce resources. He

deci des what i t i s he wants to accompl i sh, and then he eval uates

the val ue to hi m personal l y of each tool . I n other words, the val ue

of the tool i s compl etel y dependent on the val ue of the toolt expectedfu-

ture outut. He mental l y cal cul ates the future, val ue of the expected

future output of each tool , and then he makes judgments about the

i mportance of any gi ven tool i n produci ng thi s output. Then he

cal cul ates how much ti me he has unti l the shi p si nks, how much

wei ght each tool contri butes, how l arge hi s raft i s, and how

choppy the water i s. He sel ects hi s pi l e of tool s and other goods ac-

cordi ngl y.

I n other words; he doesnt l ook to the past i n order to eval uate

the val ue to hi m of any i tem; he l ooks to the future. The past i s

gone. No matter what the goods cost ori gi nal l y, they are val uabl e

now onl y i n terms of what i ncome (i ncl udi ng psychi c i ncome) they

are expected to produce i n the future. Whatever they cost i n the

past i s gone forever. Bygones are bygones. The economi st cal l s

thi s the doctri ne of sunk costs. I n the case of Crusoes shi p, thats

exactl y what they are about to become: sunk. Thats why he has to

act fast i n order to avoi d l osi ng everythi ng.

There are objecti ve condi ti ons on the i sl and, and the vari ous

tool s are al so objecti ve, but everythi ng i s evaluated subjective~ by

Crusoe. He asks the questi on, What val ue i s thi s i tem to me?

Hi s assessment i s the sol e determi ni ng factor of what each i tem i s

worth. He may make mi stakes. He may re-ewduate (re-i mpute)

every i tems val ue l ater, when he better understands hi s condi ti ons

on the i sl and. He may l ater wi sh that he had pi cked up some other

i tem i nstead. The poi nt i s, i ts hi s deci si on and hi s eval uati on that

count. Because he i s al l al one, he and he al one determi nes what

everythi ng i s worth. He doesnt ask, How much money di d thi s

i tem cost i n the past? He asks i nstead, What goods and benefi ts

wi l l i t produce for me i n the future? Then he makes hi s choi ces.

He allocates the scarce means of producti on. He al l ocates some to

the raft and the rest he l eaves on the si nki ng shi p. He l oads hi s ,

top-pri ori ty i tems onto hi s raft, and fl oats i t back to shore.

10 Honest Mong

The Functi on of Money

W~t has money got to do wi th al l thi s? Absol utel y nothi ng.

Crusoe doesnt use money. He si mpl y makes mental esti mati ons

of the val ue of anythi ng i n terms of what he thi nks i t wi l l produce

for hi + i n the future. I f whatever an i tem wi l l produce i snt worth

very ml ueh to hi m i n the future, i t wont be worth very much today.

~.

He! doesnt ask hi msel f, .1 wonder how much money al l thi s

cost before i t was l oaded onto the shi p? Unl ess he expects to be

rescued shortl y, thereby enabl i ng hi m to resel l the i tem, he

woul dnt bother wi th such a questi on. What does he care how

much money any i tem cost i n the past? Al l that matters i s what

actual servi ces (non-money i ncome) i t wi l l produce for hi m i n the

future.

Assume that he has real l y l i ttl e hope of bei ng rescued. -The

shi p i s si nki ng. Hi s raft i s al most ,si nki ng bel ow the water. The

storm i s comi ng. He has to get back to shore fast. As he i s about to

cl i mb off the shi p and onto the raft, he remembers that the captai n

of the shi p was rumored to own a chest ful l of gol d coi ns. Woul d

Crusoe run back to the captai ns room to try to fi nd thi s chest?

Even i f he had epough ti me, and even i f he real l y knew where i t

was, woul d he drag i t to the edge of the shi p and try to l oad i t onto

the raft? Woul d he toss the tool s i nto the ocean to make way for a

chest of gol d coi ns? Obvi ousl y not.

But money i s weal th, i snt i t? Gol d i s money. Why woul dnt he

sacri fi ce some i nexpensi ve kni ves and barrel s i n order to i ncrease

hi s weal th (money)? The answer i s si mpl e: i n a one-person envi -

ronment, money cannot exist. I t serves no purpose. Crusoe knows

that gol d i s heavy. I t di spl aces tool s. I t si nks rafts. I ts not onl y

usel ess; i ts a l i abi l i ty.

The val ue of money i s determi ned by what those who val ue i t

expect that i t wi l l do for them i n the future. A l onel y man on a

deserted i sl and cant thi nk of much that money wi l l do for hi m i n

the future. I f he remai ns al one for the rest of hi s l i fe, there i s noth-

i ng that money can do for hi m at al l .

So the val ue of money i n thi s exampl e i s zero.

Th Value of Momy 11 ~

Joseph i n Egypt

Now l ets take a real hi stori cal exampl e, the fami ne era i n

- Egypt. Joseph had warned the Pharaoh of the fami ne to come,

and for i i ev~n years, the Pharaohs agents had col l ected one-fi fth of

the harvest and had stored i t i n granari es. Then the fami ne hi t.

The crops fai l ed. The peopl e of nearby Canaan al so suffered. No

one had enough food.

And Joseph gathered up al l the money that was found i n the

l and of Egypt and i n the l and of Canaan, for the grai n whi ch they

bought; and Joseph brought the money i nto Phar aZWs house. So

when the money fai l ed i n the l and of Egypt and i n the l and of Ca- .

naan, al l the Egypti ans came to Joseph and sai d, Gi ve us bread,

for why shoul d we di e i n your presence? For the money has fai l ed

(Genesi s 47:14-15).

What di d they mean, the money has fai l ed? They meant

si mpl y that compared to the value of lz~e-gwing grain, the money was

worth nothi ng. Why woul d a man faci ng starvati on want to gi ve

up hi s remai ni ng suppl y of grai n i n order to get some money?

What good woul d the money do hi m? He wanted l i fe, not money,

and grai n offered l i fe.

Because the money fai l ed, i t had fal l en to al most zero val ue.

Thus, i n order to buy food, the peopl e had been forced to spend

al l of thei r money. Now they were wi thout food or money.

Then Joseph sai d, Gi ve your l i vestock, and I wi l l gi ve you

bread for your l i vestock, i f the money i s gone. So they brought

thei r l i vestock to Joseph, and Joseph gave them bread i n exchange

for the horses, the fl ocks, the cattl e of the herds, and for the don-

keys. Thus he fed them wi th bread i n exchange for al l thei r l i ve-

stock that year. (Genesi s 47:16-17).

Were the Egypti ans fool i sh? After al l , al l those cattl e and

horses were useful . But ani mal s eat grai n. The grai n was too val -

uabl e duri ng a farni ne to feed to ani mal s. Al l that the ani mal s

were worth was whatever they woul d bri ng as food, arm m Egypt,

the meat woul dnt l ast l ong. Dead ani mal s i n a desert country

dont remai n val uabl e very l ong. Why not trade ani mal s for grai n,

12 -- Honest Money

whi ch survi ves the heat?

The onl y reason the Pharaoh had ~y use for the ani mal s and

money i s that he knew he had enough food to suryi ve the fami ne.

He I &ew that i t woul d eventual l y end. Thus, he woul d be the

owner of al l the weal th of Egypt at the end of the fami ne. For hi m,

the exchange was a good deal , but onl y because he had the foods

and the army to defend i t, and he al so possessed what he bel i eved

to be accurate knowl edge concerni ng when the fami ne woul d end.

Joseph had i ol d hi m i t woul d l ast seven years.

Because he had a surpl us of grai n beyond mere survi val , and ,

because he had i nsi de i nformati on about the durati on ,of the

fami ne, money and ani mal s were val uabl e to the Pharaoh, even

though they were not val uabl e to the peopl e. Thus, a vol untary

. exchange became profi tabl e for both si des. The Pharaoh gaye up

grai n for goods that woul d agai n become very val uabl e i n the

future. The Egypti ans gave up goods worth very l i ttl e to them i n

the pres?nt i n order to get absol utel y vi tal present goods. Each

si de gave up somethi ng l ess val uabl e i n exchange for somethi ng

more val uabl e. Each si de i mproved i ts economi c posi ti on. Each

si de therefore gai ned i n the transacti on.

Noti ce here that we are not deal i ng wi th any so-cal l ed equal -

i ty of exchange. Thi s theory says that peopl e exchange goods

onl y when the goods are of equal val ue. I t i s true that i n the mar-

ketpl ace, they may be of equal @i ce, but they are not of equal

val ue i n the mi nds of the traders. What we are al ways deal i ng

wi th i n the case of vol untary exchange i s ineguzzlz~ of exchange.

One person wants to possess what the other person has more than

he wants to keep what he al ready has. Because each person eval -

uates what the other has as more val uabl e, a vol untary exchange

takes pl ace:

Egypts money fai l ed. I n fact, grai n became the newform of mong,

al though the Bi bl e doesnt say thi s expl i ci tl y. What i t says i s that

everyone was wi l l i ng to trade whatever he had of former val ue i n

order to buy food. But i f some i tem i s what everyone wants, then

we can say that i ts the true money.

.,, ,

The Kilue ofMoney 13

The Properti es of Money

Why woul d grai n have served as money? Because i t had the

fi ve essenti al characteri sti cs that al l forms of money must have:

1.

2.

3.

4.

5.

Di vi si bi l i ty

Portabi l i ty

Durabi l i ty

Recogni zabi l i ty

Scarci ty (hi gh val ue i n rel ati on to vol ume and wei ght)

Normal l y, grai n doesnt functi on as money. Why not? Because

of characteri sti c number fi ve. A parti cul ar cup of grai n doesnt

possess hi gh val ue, at l east not i n compari son to a cup of

di amonds or a cup of gol d coi ns. The buyer thi nks to hi msel f,

Theres l ots more where that came from. Normal l y, hes correct;

there i s a l ot more grai n where that came from.. But not duri ng a

fami ne.

Why di vi si bi l i ty? Because you need to count thi ngs. Fi ve

ounces of thi s for a brand-new that. Onl y three ounces for a used

that. ~ Both the buyer and the sel l er need to be abl e to make a trans-

acti on. The sel l er of the used that may want to go out and buy

three other used thats i n order to stay i n the that busi ness, so

he needs some way to, di vi de up the i ncome from the i ni ti al sal e.

Thi s means di vi si bi l i ty: ounces, number of zeroes on a pi ece of

paper , or whatever . -

Portabi l i ty i s obvi ous. I t i snt an absol ute requi rement. I have

-

read that the South Paci fi c i sl and cul ture of Yap uses gi ant stone

doughnuts as money. They are too l arge to move. But they area

si gn of weal th, and peopl e are wi l l i ng to gi ve goods and servi ces to

buy them. Actual l y what are exchanged are ownershi p certi fi cates ,

of some ki nd. Normal l y, however, we prefer somethi ng a bi t

smal l er than gi ant stone doughnuts. When we go to the market,

we want to carry money wi th us. I f i t cant be carri ed easi l y, i t

probabl y wont functi on as money.

Durabi l i ty i s i mportant, too: I f your preferred money uni t

wears out fast or rotsj you have to keep repl aci ng i t. That means

troubl e. A barrel ~ of fresh fi sh i n a worl d wi thout refri gerati on

14 Honest Money

wont serve as money. But there are excepti ons to the durabi l i ty

rul e. Ci garettes arent durabl e the way that metal i s, but ci garet-

tes have functi oned as money i n every known modern warti me

pri son camp. Thei r hi gh val ue per uni t of wei ght and vol ume

overcomes the l ow durabi l i ty factor. Al so, they stay scarce: peopl e

keep smoki ng thei r capi tal .

Recogni zabi l i ty i s cruci al i f youre goi ng to persuade anyone

to trade wi th you. I f he doesnt see that i ts good, ol d, fami l i ar

money, he wont ri sk gi vi ng up ownershi p of whatever i t i s that

youre tryi ng to buy. I f i t takes a l ong ti me for hi m to i nvesti gate

whether or not i ts real l y money, i t eats i nto everyones val uabl e

ti me. I nvesti gati ons arent free of charge, ei ther. So the costs ofex-

change go up. Peopl e woul d rather deal wi th a more fami l i ar

money. I ts cheaper, faster, and safer.

So what we say i s that any object that possesses these fi ve char-

acteri sti cs to one degree or another has the potenti al of servi ng a

soci ety as money. Some very odd i tems have served as money hi s-

tori cal l y: sea shel l s, bear cl aws, sal t, cattl e, pi eces of paper wi th

pol i ti ci ans faces on them, and even women. (The probl em wi th

women i s the di vi si bi l i ty factor: hal f a woman i s worse than no

woman at al l .)

Money as a Soci al Product

We have al ready seen that Robi nson Crusoe has no need of

money on hi s i sl and. From there we went to anci ent Egypt, and

we found that soci ety di d i ni ti al l y need money, but when a fami ne

struck, the ol der forms of money fai l ed, no l onger servi ng as

money. Maybe grai n took over as the new money. Or maybe

nothi ng repl aced money.

These exampl es shoul d gi ve us some prel i mi nary i deas about

what money i s, and how i t works. I t i s used i n exchange. Because

Robi nson Crusoe i s al l al one, he has no use for money. He doesnt

i ntend to make any vol untary exchanges. Si mi l ad y, i n a soci ety

that i s just barel y survi vi ng, and al most everyone i s a farmer,

there wi l l be no reason for money to exi st. Nobody buys and sel l s

for money any more. To trade away grai n i s to trade away l i fe.

Z3e l%lue ofMong 15

They al l hang onto every bi t of food they grow, and nobody trades

- very much. They may barter goods and servi ces di rectl y, but they

no l onger trade by means of money. Thi s i ndi cates a very l ow

amount of trade. So wi despread trade ceases. When thi s happens,

money fai l s . I t di es. I t no l onger serves soci ety, so i t fal l s i nto ,di s-

use unti l the cri si s i s over.

I f peopl e dont trade, they cant speci al i ze i n producti on. I n

the case of Egypt, what had been a ri ch nati on became poo~ The

Pharaoh was ri ch, and the peopl e of Egypt survi ved, but at very

hi gh cost: the l oss of thei r freedom. They sol d themsel ves i nto a

form of sl avery i n order to buy food, for they sol d thei r l and and

thei r chi l drens i nheri tance to Pharaoh (Genesi s 47:19-23). Thats

poverty wi th a vengeance. But they survi ved the fami ne. They

bought thei r l i ves.

Why does money exi st? Because i t serves peopl e wel l . I f they

want to i ncrease thei r personal weal th by gi vi ng up l ess val uabl e

i tems (to. them) i n order to buy more val uabl e i tems (to them),

they need tradi ng partners. I f I have onl y cattl e to sel l , and the per-

son I want to sel l to doesnt want cattl e, but wants an axe, I have to

go fi nd someone who wi l l trade an axe for my cattl e, and then I

have to try to fi nd the person who wants the axe. I hope and pray

he hasnt bought an axe from someone el se i n the meanti me.

But where theres a wi l l , theres a way. Where there i s a need

i n soci ety, men have an i ncenti ve to fi nd a way to fi l l the need. As

peopl e trade wi th one another, they vol untady begi n to search out

uni versal l y desi red i tems i n order to hol d for a rai ny day. They

sel l thei r surpl us goods or servi ces for thi s uni versal l y sought-after

good. Why? Because they make the assumpti on that peopl e wi l l

want thi s good tomorrow and next week, too. So i f they store up a

quanti ty of thi s good, they wi l l be abl e to fi nd peopl e who wi l l be

wi l l i ng to sel l them al l sorts of goods and servi ces l ater on. I n fact,

the owner of thi s good wi l l be abl e to change hi s mi nd next week

about what he wants to buy, and he wi l l sti l l be abl e to buy i t.

I n short, and most i mportant, nzon~ zs the most marketabl e com-

modi~ in a particular society. That i s the best defi ni ti on of money that

economi sts have been abl e to come up wi th. I n Egypt, when the

16 Honest Mong

ol der form of money was no l onger marketabl e, the Bi bl e says that

the money fai l ed. Fai l ed money i s the same as unmarketabl e

money. But there i s no such thi ng as unmarketabl e money. I f i ts

unmarketabl e, then no one wants i t. I f no one wants i t, i ts no

l onger money.

Money al l ows us to change our mi nds i nexpensi vel y. I t al l ows

us to make mi stakes about what we need or want, and we can sti l l

recover. Money broadens the number of peopl e who wi l l be wi l l -

i ng to sel l us what we want. The more peopl e who want money,

the more peopl e I wi l l be abl e to deal wi th.

/

Furthermore, money makes i t possi bl e for peopl e to establ i sh

common pri ces for most goods and servi ces. I dont have to com-

pute how many axes wi l l buy how many shoes, and then compare

shoes wi th cattl e, and sheep wi th axes, and on and on. Al l I need

to do i s to check the newspaper and see al l the thi ngs I can buy

wi th money. So we al l make better deci si ons because we can cal cu-

l ate more effecti vel y. Wi thout money, we can achi eve onl y a

pri mi ti ve economy, because cal cul ati ng the pri ce of anythi ng, l et

al one everythi ng, ti ecomes too di ffi cul t. I n fact, we can defi ne the

word pri mi ti ve as, a soci ety wi thout a devel oped money system.

Money i ncr easds the di vi si on of l abor. I t i ncreases our opti ons

of buyi ng and sel l i ng. I t therefore i ncreases our weal th and our

freedom of acti on. I t promotes economi c growth. And most i nter-

esti ng of al l , to achi eve al l thi s, the State* doesnt need to produce

i t. I t i s a product of i ndi vi dual economi c acti on, not government

l egi sl ati on. ,

Summar y

Robi nson Crusoe di dnt need money (except perhaps after

I ?ri day showed up) because he had no one to trade wi th. He had

to make hi s cal cul ~i ons of val ue di rectl y. 1 want thi s most of al l ,

thi s over here second, that over there thi rd: and so fofi . He cal -

G I capi tal i ze the word State when referri ng to cwi l government i n general . I

dont cap~tahze I t when I am referri ng to a Umted States pohtwd Juri schcti on

cal l ed a state.

I

1.

The Uzlue ofMonV 17

cul ated i n terms of fi rst, second, thi rd, etc., not by ten uni ts,

seven uni ts, fi ve uni ts, etc. He had no uni ts i n hi s head, so he

coul dnt use them to make compari sons.

I n Egypt, the money fai l ed because everyone wanted the same

thi ng, grai n, and nobody was wi l l i ng to gi ve up any grai n except

the Pharaoh. Trade ei ther ceased or sl owed down drasti cal l y.

Money ceased to serve as a means of trade. The fami ne made

peopl e poor, and as trade was reduced, they became even poorer.

The di vi si on of l abor col l apsed. Thi s means that the speci al i zati on

of producti on col l apsed. ~

Money i s a soci al phenomenon. I t comes i nto exi stence

because i ndi vi dual s begi n to recogni ze that certai n common ob-

jects i n soci ety are uni versal l y sought after. Peopl e then sel l thei r

goods and servi ces i n order to obtai n thi s sought-after good. They

store up thi s commodi ty because they expect others to sel l them

what they need i n the future. As i n the case of Robi nson Crusoe

on board the shi p, peopl e want to own whatever wi l l provi de them

wi th i ncome (goods and servi ces) i n the future. Peopl e make deci -

si ons concerni ng the present and the future. The past i s gone for-

ever. Money offers peopl e the wi dest number of opti ons i n the

future, so they sel l thei r goods and servi ces i n order to buy money

i n the present.

The pri nci pl es governi ng the val ue of money are these:

1. Economi c acti on begi ns wi th an ordered set of wants (fi rst,

second, thi rd, etc.).

2. A worl d of scarci ty doesnt permi t us to achi eve al l of our

desi res at the same ti me.

3. To i ncrease output, we need capi tal (tool s).

4. We have to sacri fi ce present i ncome i n order to obtai n

capi tal .

5. The val ue of the tool to each person i s dependent on the ex-

pected val ue (to hi m) of the future output of the tool .

6. Val ue i s i mputed by a person to goods and servi ces; i t i s

therefore subjecti ve.

7. Past costs are economi cal l y i rrel evant; present and future

i ncome are al l that matter.

18 Honest Money

1

8. ti e must a!l ocate our scar ce r esour ces r ati onal l y i n or der to

achi eve our goal 1.

4

9. Money d snt exi st i f youre al l al one.

10. Money i s a soci al phenomenon.

11. The val ue i of money i snt constant (for exampl e, duri ng a

fami ne). ~

12. There i s no equal i ty of exchange.

13. Moneys fi ~e characteri sti cs are di vi si bi l i ty, portabi l i ty, dur-

abdi ty, recogni zabi l i ty, and scarci ty.

14. Money i s {he most marketabl e good.

15. Money i ncreases our opti ons.

16. Money al l ows us to r ecover mor~ ea.dy when we have made

economi c er r or s.

17. Money i ncreases the di vi si on of l abor.

18. Money therefore i ncreases our producti vi ty.

19. Money i ncreases our freedom.

20. Money makes possi bl e a hi ghl y devel oped economi c cal cu-

l ati on.

21. The State doesnt need to create i t i n order for i t to exi st.

.

2

THE ORI GI NS OF MONEY

And the gol d of that l and [Havi l ah] i s good. Bdel l i um and the

onyx stone are there (Genesi s 2:12).

I n the second chapter of the Book of Genesi s, God, speaki ng

through Moses, saw fi t to menti on thi s aspect of the l and of

Havi l ah. I t was a pl ace where val uabl e mi neral s were present.

One of these mi neral s was gol d.

We cannot l egi ti matel y bui l d a case for a gol d standard from

thi s verse. We coul d as easi l y bui l d a case for the onyx standard,

or a bdel l i um standard (whatever i t was: possi bl y a whi te

mi neral ). What we can argue i s that Moses knew that peopl e

woul d recogni ze the i mportance of the l and of Havi l ah because

they woul d recogni ze the val ue of these mi neral s. One of these

mi neral s was gol d.

Why do I stress gol d? Hi stori cal l y, gol d has served men as the

l ongest-l i ved form of money on record. Si l ver, too, has been a

popul ar money metal , but gol d i s hi stori cal l y ki ng of the money

metal s. There i s no doubt that Moses expected peopl e to recog-

ni ze the val ue of gol d. We read hi s words 3,500 years l ater, and we

recogni ze the i mportance of the l and of Havi l ah. I f we coul d

l ocate i t on a map, there woul d be as wi l d a gol d rush today as

there woul d have been i n Moses day. No one thi nks to hi msel f, I

wonder what gol d was?

Money: Past, Present, and Future

You may remember from the previ ous chapter that money

appears i n a soci ety when i ndi vi dual s begi n to recogni ze that a

parti cul ar commodi ty i s becomi ng wi del y accepted i n exchange.

19

20 Horwst MongJ

Peopl e want to be abl e to buy what they want tomorrow or next

week or next year. They arent real l y sure whi ch economi c goods

wi l l be i n demand then, so they seek out one good whi ch wi l l

probabl y be i n heavy demand. They can buy uni ts of thi s good

now, put them away, and then buy what other goods or servi ces

they want l ater on. I n short, money i s the most marketabl e com-

modi ty. I t i s marketabl e because peopl e expect i t to be ua(uable in

the~ture.

Thi s i snt too di i i i cul t to understand. But i t rai ses a probl em.

The uni t we cal I money i s val uabl e today. We have to sel l goods or

servi ces i n order to buy i t. I n other words, money has al ready es-

tabl i shed i tsel f as the common uni t of economi c cal cul ati on. My

l abor i s worth a tenth of a uni t per hour. A brai n surgeons l abor i s

worth a ful l uni t. A new car i s worth ten uni ts. Money has ex-

change val ue today. I f i t di dnt, i t woul dnt be money. We have al l

l earned about moneys val ue i n our dai l y ai l ai rs. We are fami l i ar

wi th i t.

How do we know what i ts worth today? We know what i t was

worth yesterday. We have a hi stori cal record for i ts purchasi ng

power. I f we di dnt know anythi ng about moneys val ue i n the

past, we woul d not accept i t as a uni t of account today. I f i t has no

hi story, why shoul d anyone expect i t to have a future? But i f peo-

pl e dont expect i t to have a future, i t cant serve as money.

So here i s the key questi on: How di d money ori gi nate? I f i t

has to have a hi story i n order to have present val ue, how di d i t

come i nto exi stence i n the fi rst pl ace? Are we confronti ng a

chi cken-and-egg probl em?

Thi s was the i ntel l ectual probl em faced by one of the greatest

economi sts of al l ti me, Ludwi g von Mi ses, an Austri an schol ar. I n

hi s book, The Z%eoty ofA40n~ and Credit (1912), he offered a sol uti on

to thi s i mportant questi on. Money, he argued, came i nto exi s-

tence because i n earl i er ti mes, i t was val ued for other properti es.

He thought that gol d was probabl y one of the earl i est forms of I

money not a uni que observati on, certai nl y. Before i t functi oned

.

as money, i t must have served other purposes. Perhaps i t was used

as jewel ry. Possi bl y i t was used as ornamentati on. We know that

The Oti gi ns of Mong 21

many rel i gi ons have used gol d as part of thei r ornaments. I t i s

shi ni ng, l ovel y to l ook at, and wi del y recogni zed.

Gold in the Bible ,

Anyone fami l i ar wi th the Bi bl e woul d recogni ze the accuracy .

of Mi ses theory. Abrahams servant gave Rebekah gi fts i n order

to l ure her i nto marri age wi th I saac. These gi fts i ncl uded jewel ry

made of si l ver and gol d (Genesi s 24:53). When the I srael i tes fl ed

Egypt, they were tol d by God to col l ect spoi l s as repayment for

thei r l ong ensl avement: jewel s of gol d and si l ver (Exodus 3:22).

God warned the I srael i tes not to make gods of gol d or si l ver to

worshi p (Exodus 20: 23), i ndi cati ng that thi s was a common form

of i dol atry i n pagan l ands. But hi s tabernacl e was to be fi l l ed wi th

gol d ornaments (Exodus 25, 26, 28, 37, 39). So was the templ e

(1 Ki ngs 6,7:48-51, 10). As a possi bl e (though not concl usi ve) argu-

ment, we can compare the shi ni ng bri l l i ance of gol d wi th the gl ory

cl oud of God (Ezeki el 1:4). I t i s not surpri si ng that men adopted

gol d i n rel i gi ous worshi p, and then i n ornamentati on and jewel ry.

Gol d has the fi ve characteri sti cs of money: di vi si bi l i ty, dura-

bi l i ty, transportabi l i ty, recogni zabi l i ty, and scarci ty (i n rel ati on to

wei ght and vol ume). I t i s uni quel y di vi si bl e. I t can be cut wi th an

i ron or steel kni fe i n i ts pure form. I t can be hammered i ncredi bl y

fi ne. I t i s uni quel y durabl e; onl y an aci d, aqua regi a, destroys i t.

I t i s easi l y transported and easi l y hi dden. I t i s i nstantl y recogni z-

abl e. As for i ts scarci ty, throughout hi story i t has been exceed-

i ngl y scarce i n rel ati on to other metal s. Men have searched for i t

for as l ong as we have records.

We can understand how i t was that gol d came i nto common

use as a form of money. Peopl e recogni zed i ts beauty, and i ts cl ose

connecti on wi th the gods. Men who are made i n Gods i mage un-

derstandabl y desi re to col l ect gol d for themsel ves. I f God wants

gol d i n hi s pl aces of worshi p, why shoul dnt peopl e want gol d to

adorn themsel ves?

God descri bed Hi s l ove of I srael by descri bi ng fi gurati vel y

what He had done for Hi s peopl e. Li ke a bri de, I srael had been ~

gi ven ornaments, bracel ets, chai ns around her neck, a jewel i n

22 Honest A40ng ~

her forehead and earri ngs. Thus you were adorned wi th gol d and

si l ver, and your cl othi ng was of fi ne l i nen, si l k, and embroi dered .

cl oth. You ate pastry of fi ne fl our, honey, and oi l . ,~ou were ex-

ceedi ngl y beauti ful , and succeeded to royal ty (Ezeki el 16:13).

The Most Marketabk Commodity

Gol d has been the most marketabl e commodi ty fur tl i ousands

of years. A sel l er of gol d has not had to stand i n the streets despe?-

atel y beggi ng peopl e to consi der bu yi ng hi s gol d. I f anythi ng, he

has needed bodyguards to keep peopl e from steal i ng hi s gol d.

Understand from the begi nni ng that the State was not neces-

sari l y a part of the devel opment of gol d and si l ver as money.

There i s nothi ng i n the Bi bl e that i ndi cates that gol d and si l ver

became money metal s because Abraham, Moses, Davi d, or any ~

other pol i ti cal l eader announced one afternoon: From now on,

gol d i s money! The State onl y affi rmed what the market had cre-

ated. I t col l ected taxes i n gol d and si l ver. I t thereby acknowl edged

the val ue whi ch market forces had i mputed to gol d and si l ver. But

the State di dnt create money.

Noti ce al so that i f Mi ses argument i s correct concerni ng the

devel opment of money, the ori gi nal money uni ts must have been

commodi ty-based. I f the uni t of account (for exampl e, gol d) must

have come i nto popul ar use because of i ts past val ue, at some

poi nt we must concl ude that i t was val uabl e as a commodi ty for

some benefi t that i t brought besi des servi ng as the most market-

abl e commodi ty: money. Money had to start somewhere. I t had

to ori gi nate someti me. Before i t was money, i t must have been a

commodi ty.

I n short, money was not ori gi nal l y a pi ece of paper wi th a pol i -

ti ci ans pi cture on i t.

Money and Taxes

There i s no doubt that the State can strongl y i nfl uence the

conti nuati on of one or more metal s as an acceptabl e uni t of

money. Al l the State has to do i s to announce: From now on,

everyone wi l l be requi red to pay hi s taxes i n a parti cul ar uni t of

The Or@ns ofMonq 23

account . After al l , taxes are an expense. There i s no escape from

death and taxes. (But, fortunatel y, the death rate doesnt go up

every ti me Congress meets.) The &ate has power. I f i t says that

peopl e must pay thei r taxes i n a parti cul ar uni t of account, there

wi l l be strong i ncenti ves for peopl e to store up thi s form of money.

Sti l l , the State doesnt have an absol utel y free hand i n sel ect-

i ng thi s uni t of account. I f i t i mposes on peopl e a l egal obl i gati on

to pay what the peopl e cannot actual l y gai n access to, there wi l l be

no revenues. I n the Mi ddl e Ages, for exampl e, there were no gol d

coi ns i n ci rcul ati on i n Western Europe unti l the mi d-1200s. There ~

was no way that a ki ng or emperor coul d compel peopl e to pay

gol d i n the year 1100 or 900, because hi s subjects coul dnt get any

gol d. They had nothi ng val ued by the East (Byzanti um, the East-

ern Roman Empi re) that coul d be exchanged for gol d.

The Bi bl e i s cl ear: taxes to the State were pai d both i n ki nd

(a ti the of actual agri cul tural producti on: 1 Samuel 8:14-15) and

i n cash, meani ng si l ver. A head tax was requi red when the na-

ti on was numbered i mmedi atel y before a mi l i tary confl i ct (Ex-

odus 30:12-14) the onl y ti me that i t was.l awful for the State to

conduct a census, as Ki ng Davi d l ater l earned (2 Samuel 24:1-17).

Sol omon col l ected 666 tal ents of gol d (1 Ki ngs 10:14), presumabl y

from taxes, gi fts from other nati ons, and from the sal e of any agri -

cul tural produce he col l ected. (We arent tol d where he got thi s

huge quanti ty of gol d.)

Tri bute i n si l ver and gol d was pai d to a mi l i tari l y vi ctori ous

State. There were i nci dents when I srael had to pay such tri bute

(2 Ki ngs 15:19; 23:33) and al so when forei gn nati ons pai d tri bute

to I srael (2 Chroni cl es 27:5).

The State al so hi red mi l i tary forces wi th gol d (2 Chroni cl es

25:6). Thus, taxes came i nto the treasury i n the form of si l ver and

gol d, but then expendi tures by the State came back out i n the

same form. There i s no doubt that thi s process made si l ver and

gol d the fami l i ar forms of money i n the anci ent Near East. There

are pl enty of exampl es i n anci ent records from other Near East

soci eti es that they asked for tri bute i n gol d and si l ver. I t was the

common currency of the anci ent worl d.

24 HonestMong

What must be ful l y understood i s that there were no coi ns i n

thi s era. Coi ns di dnt appear i n the wori d unti l about 600 years

before Chri st. Thi s woul d have been about the ti me that}Judah

fel l to the i nvadi ng Babyl oni ans, qui te l ate i n Hebrew hi story. So

there was no system of State money wi th the monarchs pi cture or

other symbol s on the metal bars, or i f there was, no exampl es of

such marki ngs have survi ved. I t i s reasonabl y I certai n that the

State di d not manufacture the,metal l i c bars i n anci ent I srael .

Thi s means that the State di d not ori gi nate money. A theoreti -

cal model (bl uepri nt) for the ori gi n of money doesnt need to i n-

cl ude any reference to the State. The States deci si on about what

to tax cl earl y had an i nfl uence on the ki nd of money peopl e ac-

cepted, but that deci si on was ti ed to the exi sti ng ki nd of money

that was al ready bei ng used by the peopl e. I n short, I f i t ai nt be-

i ng used, you cant tax i t .

Thi s i s very i mportant to understand from the begi nni ng.

There are many economi sts who rel y heavi l y on the i dea that the

State was the source of money ori gi nal l y, and that whatever the

State desi gnates as money h money. Thi s expl anati on i s Bi bl i cal l y

i ncorrect, hi stori cal l y i ncorrect, and l ogi cal l y i ncorrect. Money i s

the product of i ndi vi dual s who make deci si ons to buy,and sel l . I f

i ndi vi dual s refuse to use what the State desi gnates as money, i t

i snt money: I f the State refuses to use what the market has desi g-

nated as money, i t cant col l ect taxes or buy peopl es servi ces and

goods. The State can i nfl uence the val ue of a parti cul ar ki nd of

money, or the popul ari ty of that money, for the State i s a bi g

buyer and sel l er of goods and servi ces. But the State cannot

autonomousl y create money and i mpose i t on the market i f mar-

ket parti ci pants dont want to use i t.

No Commi ttee Needed

I

I t i s di ffi cul t for many peopl e to understand that the free

market operates rati onal l y, even though there i s no commi ttee of

expert pl anners or pol i ti ci ans to tel l the market what to produce.

Peopl e fi nd i t di ffi cul t to bel i eve that Gods worl d i s a worl d i n

whi ch i ndi vi dual peopl e, responsi bl e before God and thei r fel l ow

The Origins of Monqv 25

men, go about thei r dai l y busi ness, maki ng deci si ons, pl anni ng

for the future, and focusi ng thei r attenti on on thei r own personal

and fami l y needs, and out of al l thi s hustl i ng and bustl i ng, push-

i ng and shovi ng, comes the most producti ve economy i n the hi s-

tory of man.

Chri sti ans can bel i eve that the worl d i s orderl y because i t was

created by God. The Bi bl e teaches that God i s soverei gn, but men

are ful l y responsi bl e for thei r acti ons. As they i nteract wi th one ,

another, they l earn thi ngs. They fi nd out what the y must offer to

other peopl e i n order to buy what they want. They al so,fi nd out

what other peopl e are wi l l i ng and abl e to offer them for the thi ngs

that they presentl y own. Market competi ti on i s a form of exchang-

ing information. Free market acti vi ty can be descri bed as a Process of

t$kcovery.

We dont need a commi ttee to tel l us what we need to do to

sati sfy other buyers. I n fact, a commi ttee cannot possi bl y know al l

the thi ngs that we know as i ndi vi dual s, taken as a group. What

we l earn we can put to profi tabl e use l ater on.

Thi s spread of knowl edge i s made much easi er by the exi st-

ence of an agreed-upon currency uni t. I dont mean that we al l sat

down and agreed to use i t. I mean that peopl e l earned that other

peopl e wi l l usual l y accept a parti cul ar currency i n exchange for .

goods and servi ces. As thi s l earni ng process conti nues, certai n

currency uni ts become fami l i ar. I ts al ways easi er for us to deal

wi th each other i f the rul es of the game are known i n advance.

~ The currency uni t i s the most i mportant si ngl e source of i nformati on

concerni ng the state of the actual condi ti ons of suppl y and demand.

Who deci des whi ch currency uni t i s acceptabl e? Ori gi nal l y,

the peopl e di d who entered i nto agreements wi th each other about

buyi ng and sel l i ng. They l earned what was good for them, and

the rest of us have conti nued to l earn. A currency uni t becomes

fami l i ar. We get i nto the habi t of cal cul ati ng the pri ce of every-

thi ng i n terms of thi s fami l i ar uni t. I t saves us ti me and effort

when we can mental l y esti mate: Lets see, I can buy three of

these, but onl y two of those, or fi ve of yours; or ei ght of hers.

Whi ch do I want more?

26 Honest Mong

Do you want a commi ttee to set pri ces? Do you thi nk a com-

mi ttee can si t down and deci de what everythi ng shoul d cost i n

rel ati on to everythi ng el se? Wi l l a commi ttee be an i ntel l i gent,

rel i abl e economi c representati ve of al l of us? Most of us know the

\

answer most of the ti me: no.

Why then woul d a commi ttee do such a terri fi c job i n deci di ng

how much money to create or destroy? I f the commi ttee cant set

pri ces, why shoul d i t be al l owed to control the suppl y of money i n

whi ch al l pri ces are quoted? Why shoul d we trust a commi ttee i n

money cjuesti ons when the commi ttee di dnt i nvent money, and

when the commi ttee cant know enough to tel l al l of us what we

rea/ Ly need or shoul d rdy pay?

H&es another questi on. How do we know that the commi ttee

wi l l act onl y i n behal f of us ci ti zens? How can we be sure that the

commi ttee wont start fool i ng

-

around wi th the money suppl y i n

or der to feather i ts own economi c nest? Monopol i es are al ways

dangerous. Why shoul d some government commi ttee have a l egal

monopol y over money? No commi ttee i nvented money. No com-

mi ttee showed the rest of us how to use money. Why shoul d any

commi ttee possess absol ute control over money, now that the rest

of us have deci ded on what ki nd of money we want?

Summar y

Money i s a very i mportant soci al i nsti tuti on. I t was no more

i nvented by a government than l anguage was. Ti -ue, the govern-

ment can i nfl uence money i n the same way that i t can i nfl uence

l anguage, but i t i s not the source of moneys ori gi ns. I t cannot i m-

pose i ts monetary deci si ons on the publ i c unl ess peopl e deci de

that the government i s doi ng the ri ght thi ng. I f peopl e change

thei r mi nds l ater on, they can change the government or vol un-

tari l y, transacti on by transacti on, change over to a new form of

money.

Hi stori cal l y, peopl e have vol untari l y sel ected gol d as the com-

mon medi um of exchange. Si l ver has al so been wi del y acceptabl e,

al l over the worl d. No government l egi sl ated thi s; peopl e si mpl y

came to use these two metal s i n thei r economi c transacti ons.

l?ze Otigins ofMoney 27

Why do peopl e sel ect a parti cul ar form of money? Because

they l earn from experi ence that other peopl e usuul ~ accept thi s

monetary uni t i n exchange. We can make better predi cti ons and

pl ans about the future when we di scover that other peopl e gener-

al l y have accepted a certai n currency uni t i n the past. What peo-

pl e habi tual l y do they tend to keep on doi ng. They have a ri ght to

change thei r mi nds, but i ts easi er not to, at l east most of the ti me.

Thus, money al l ows us to gai n access i n the future to the goods

and servi ces we thi nk we wi l l want, or even to new ones that we

havent thought about yet.

Thus, hi stori cal l y i t was the free market whi ch determi ned

what was acceptabl e to peopl e for thei r economi c acti vi ti es. I t

happened to be gol d and si l ver, but other commodi ti es have some-

ti mes been used wi del y. The poi nt i s, peopl e uohmtanJI sel ected

what they wanted to use as money. They di d not need a commi t-

tee to make thi s deci si on for them.

The pri nci pl es of the ori gi ns of money are therefore these:

1. The Bi bl e doesnt say that peopl e shoul d be requi red to use

gol d and si l ver as money.

2. The Bi bl e does i ndi cate that peopl e i n Bi bl i cal ti mes came to

use gol d and si l ver as money.

3. Money wi l l be sel ected because peopl e expect others to use

i t i n the futur e.

4. To establ i sh what money i s worth today, we need i nforma-

ti on about what i t was worth yesterday.

5. Tr aci ng thk pri nci pl e backward, we concl ude that the money

commodxty must have been used for somethi ng el se ori gi nal l y.

6. Gol d and sal ver were used as jewel ry and ornaments.

7. The beauty of gol d and si l ver probabl y had somethi ng to do

wi th thei r popul ari ty.

8. The symbol i c shi ni ng of gol d may have been connected i n

peopl es mi nds wi th Gods gl ory.

9. The metal l urgi cal properti es of gol d make i t hi ghl y sui tabl e

as money (the fi ve characteri sti cs).

10. Money i s the most marketabl e commodi ty.

11. The State can i nfl uence the conti nued us; of a monetary

uni t by taxi ng and spendi ng m terms of that uni t.

28

HhnestMoney

12. Some economi sts argue that money i s what the State says i t

i s.

13. The Bi bl i cal evi dence poi nts to the concl usi on that money i s

what the market says i t i s.

14. A commi ttee di dnt ori gi nate money.

15. A commi ttee i snt needed to mai ntai n money.

16. A monopol y over money i s a dangerous grant of power by

the State.

3

MAI NTAI NI NG HONEST MONEY

You shal l do no i njusti ce i n judgment, i n measurement of

l ength, wei ght, or vol ume. You shal l have just bal ances, just

wei ghts, a just ephah, and a just bi n: I am the Lord your God, who

brought you out of the l and of Egypt (Levi ti cus 19:35-36).

I t% not necessary to get i nto a debate over just exactl y what

uni ts of measurement an ephah and a bi n were. The poi nt i s

cl ear enough: once defi ned, they coul d not be changed by i ndi vi d-

ual s i n the marketpl ace.

Who defi ned them? *hat i snt sai d. Not the Hebrew ci vi l gov-

ernment, i n al l l i kel i hood, because i t was bei ng set up at the ti me

the l aw was announced. Li ke the wi despread use of gol d and

si l ver, certai n wei ghts and measures had al so come i nto wi de-

spread use on a vol untary basi s. The i mportant thi ng was not that

the ci vi l government make i ts defi ni ti ons sci enti fi c; the i mpor-

tant thi ng was for the ci vi l government to enforce a consutent

standar d.

I t shoul d be noted that God i mmedi atel y provi des the reason

for thi s commandment: He i s the One who brought them out of

Egypti an bondage. He i s the Lord, the soverei gn master of the

uni verse. He i s the del i verer of I srael . To avoi d bei ng pl aced i n ~

bondage once agai n, they had to di sci pl i ne themsel ves. Fi rst, they

had to di sci pl i ne themsel ves by means of honest wei ghts and

measures. -Second, they had to di sci pl i ne themsel ves by means of ~

Gods comprehensi ve moral l aw.

We cannot do wi thout di sci pl i ne. I t i s never a questi on of di s-

/

ci pl i ne or no di sci pl i ne. I t i s al ways a questi on of uhe di sci pl i ne.

29

.

30 Honest Mong

Wi l l we be di sci pl i ned by oursel ves, as i ndi vi dual s under Gods

l aw? Wi l l we be di sci pl i ned by God di rectl y (for exampl e, when

He sends a pl ague on us, as He di d several ti mes i n the Ol d T~ta-

ment)? Or wi l l we be di sci pl i ned by the State? I n our day, State

tyranny i s the most common al ternati ve to sel f-di sci pl i ne.

Wi thout sel f-di sci pl i ne under Gods reveal ed l aws, there can

be no freedom. Fal se wei ghts and measures l ead to unri ghteous-

ness. Peopl e who sel l i tems to the publ i c must be sure that they

avoi d gi vi ng l ess than what i s expected reveal ed on the scal es

through tamperi ng wi th the physi cal standards. I n short, tamper-

i ng wi th the soci etys physical standards is a si gn that men have

al ready tampered wi th the soci etys moral standards.

Market Scal es

When a person i n Ol d Testament ti mes (i ndeed, up unti l rel -

ati vel y modern ti mes) went to market i n order to buy somethi ng,

he brought wi th hi m somethi ng val uabl e to exchange. I n barter

soci eti es, he woul d bri ng some home-grown or home-made i tem

for sal e. He woul d try to exchange i t for some&e el ses home-

grown i tem, or manufactured i tem.

I f a man brought somethi ng that woul d requi re wei ghi ng (for

exampl e, a sheep) and wanted to trade i t for some other i tem that

requi red wei ghi ng (for exampl e, a sack of wheat), the questi on of

accurate scal es was l ess i mportant. I f somethi ng was underwei ghed 1

for the sel l eq i t was equal l y underwei ghed for the buyer. (Re-

member, both parti es are buyers and sel l ers si mul taneousl y: one

buys wheat and sel l s a sheep, whi l e the other buys a sheep and

sel l s wheat.) Di shonest wei ghts woul d be those i n whi ch the pro-

fessi onal sel l erthe man who coul d afford the scal es tampered

wi th the wei ghts i n one hal f of the transacti on. Tamperi ng i n hal f

the transacti on probabl y i snt easy.

-

When peopl e started bri ngi ng metal s to market i n order to

buy consumer goods, i t became easi er for sel l ers to use di shonest

scal es. The metal bar or i tem woul d normaI l y be measured i n

smal l uni ts of wei ght (ounces), or even smal l er (grams), i n the

case of gol d. But the i tem bei ng sol d for money woul d, i f sol d by

Mak.aning Honest Money .

31

wei ght, probabl y requi re much heavi er uni ts (>ounds). The

man wi th the scal es coul d cheat the buyer by l i ghteni ng up the

money metal scal e, whi l e maki ng heavi er the product scal e.

Thus, once money metal s came i nto wi despread use, as they

woul d i n an advanci ng, hi gh di vi si on of l abor economy, the op-

portuni ti es to commi t fraud i ncreased drasti cal l y.

The SeUer5 Advantage

The sel l er i n the marketpl ace normal l y has an advantage over

the buyers. He understands hi s trade, especi al l y scal es. I t i s easi er

for the professi onal sel l er to tamper wi th the scal es than i t i s for

the buyer to tamper wi th the coi ns. Thi s i s not a uni versal rul e,

:

however. Coi n cl i ppi ng i s an anci ent practi ce. Peopl e woul d shave

a bi t of the gol d off the ri m. Thi s i s why coi ns have those l i ttl e

ri dges around them: to reduce theft (a l egacy of the days when

coi ns were made of val uabl e metal s). I have heard that the

Chi nese i mmi grants i n Cal i forni a i n the gol d rush days woul d

pl ace several gol d coi ns i n a smal l sack and have ol d peopl e or

young chi l dren i n the fami l y shake the sack, unti l gol d fl akes

woul d rub o~. Then they woul d col l ect the dust from the sack.

There i s another odd exampl e from Uni ted States hi story. I n

the l ate 1800s, duri ng the wi l d west era, a famous crooked cat-

tl eman named Dan Drew herded hi s cattl e for days wi thout al l ow-

i ng them access to water. Then, just before he sol d them, he

woul d l et them dri nk thei r fi l l . He woul d then take them to the

stockyards and sel l them. Thi s became known as wateri ng the

stock. The same term was l ater appl i ed to a si mi l ar i mmoral prac-

ti ce by corporati ons. Corporate offi cers woul d pri nt up huge

quanti ti es of ownershi p certi fi cates (stock) and sel l them whenever

some outsi de group woul d try to take over the company by buyi ng

up 5170 of the outstandi ng shares. The buyers wound up wi th

shares of depreci ated val ue watered down stock.

On the whol e, though, the professi onal produce sel l er wi th the

scal es i s more l i kel y to cheat than the sel l er of goods. I t i s he who i s

normal~ the focus of attenti on by the ci vi l government. On the other

hand, i t i s easi est to check hi m, for he operates i n a publ i c pl ace.

32 Honest Mong

Perhaps even more i mportant, the sel l er of produce has com-

peti tors. Buyers catch on when they are bei ng cheated, i f they

have access to a ri val . The competi tors have an economi c i ncen-

ti ve to warn the buyers, or warn the ci vi l government, about the

fraud at any parti cul ar shop. Thus, market competition tends to

pressure produce sel l ers to stay honest, at l east wi thi n the gener-,

al l y accepted permi ssi bl e range of the free market.

Scales of J ustice

God l i nks the ownershi p of scal es wi th Hi s own soverei gnty.

The man who owns the scal es i s a judge. God judges men i n terms

of moral standards. He i s a Judge wi th the scal es of justi ce. When

the evi l Babyl oni an ki ng Bel shazzar was havi ng hi s great feast, i n

the mi dst of a mi l i tary si ege by the Medo-Persi ans, the hand of

God wrote the famous words on the wal l : MENE, MENE,

TEKEL, UPHARSI N. The ki ng cal l ed Dani el to transl ate, and

Dani el di d so: MENE: God has numbered your ki ngdom, and

fi ni shed i t; TEKEL: You have been wei ghed i n the bal ances, and

found wanti ng (Dani el 5:25-27).

We@ed in the balance: this i s symbol i c of Gods fi nal judgment.

Therefore, the man who control s the scal es of ci vi l justi ce i s a

judge. So i s the man who control s the actual wei ghts and meas-

ures i n the marketpl ace.

I f a man mi suses hi s posi ti on and cheats peopl e, he i s thereby

testi fyi ng fal sel y to the character of God. He i s sayi ng, i n effect,

that God cares nothi ng for justi ce, that He ti ps the bal ance, that

He cheats manki nd for Hi s own ends. This is precise~ what Satan

_ implies about God% role a-s J tige. I t i s fal se wi tness agai nst God.

Thus, God warns men that they must use honest wei ghts and

measures, for He i s the soverei gn God who del i vered them out of

bondage. He i mpl i es that He has the power to deliver them back into

bondage i f they cheat i n thi s very speci al area of economi cs.

-Honest Metal Money

What was money i n anci ent I srael i n the days before the

Babyl oni an capti vi ty? I t woul d have been any i tem that peopl e

vol untari l y accepted i n exchange for goods and servi ces. The onl y

!.

Maintaining Honest Money 33

monetary uni ts i denti fi ed i n the Bi bl e rel ati ng to money were the

shekel and the tal ent. These were units of ukight. I n pri nci pl e,

though the Bi bl e doesnt speci fy thi s, they, were al so uni ts of fi ne-

ness. (Fi neness refers to the percentage of pure gol d or si l ver i n

the total wei ght of the coi n.) We concl ude thi s because of the fact

that base (cheaper) metal s can be mel ted i n when ~e smel ter i s

pouri ng the metal i nto the mol ds. Wei ght was not enough; there

had to be a parti cul ar fi neness.

Years ago, when I was a boy, I vi si ted Juarez, Mexi co wi th my

fami l y. I saw an ol d woman si tti ng i n front of a stal l i n a l arge

market. Someone handed her a coi n. She stuck the coi n i nto her

mouth and bi t i t. I coul dnt fi gure i t out. My mother tol d me i t

was her way of testi ng the coi n. I f i t wasnt soft enough for her

teeth to l eave a mark, i t wasnt the proper wei ght of the preci ous

metal .

An i ngot or coi n of a speci fi c si ze, assumi ng i ts wel l known, i s

known by sel l ers to wei gh a certai n amount. By measuri ng the i n-

got or coi n, and then by wei ghi ng i t, the expert can determi ne

whether i ts of the standard fi neness (the proper mi xture of a base

metal for hardness and a preci ous metal for val ue). I own a si m-

pl e, i nexpensi ve set of wei ghts and measures that measure the

more common gol d coi ns.

The wei ghts and measures for the i ngot of gol d or si l ver i s the

professi onal sel l ers defense agai nst fraud. The scal es for produce

are the buyers protecti on agai nst fraud.

The Bi bl e l ays down the rul e of honest wei ghts and measures.

- To tamper wi th the scal es i s a moral evi l . I t i s theft through fraud.

Someone trusts the sel l er, and the sel l er mi suses thi s trust. I t i s

easi er to cheat a trusti ng person because the l atter i snt watchi ng

every move of the sel l er. Thus, tamperi ng wi th the scal es i s a ma-

jor si n. When sel l ers get away wi th i t because the authori ti es l ook

the other way, honest, trusti ng peopl e l ose, whi l e crooked deal ers

wi n. Thi s reverses Gods standards for domi ni on, namel y, domi n-

i on by ethi cal behavi or. Furthermore, i t reduces the effi ci ency of

the market, for buyers have to devote extra ti me and troubl e i n

testi ng sel l ers. God wi l l not tol erate such behavi or i ndefi ni tel y.

34 Honest Mong

One reason why gol d and si l ver came i nto wi despread use i n

the anci ent worl d was that they coul d be tested by sel l ers of goods

and servi ces. Today, a sel l er of goods (buyer of money) can use

si mpl e tool s, i f necessary, to determi ne the rel i abi l i ty of a parti cu-

l ar i ngot or coi n. He coul d test the i ngots i n the anci ent worl d,

too, usi ng si mi l ar si mpl e tool s. Because gol d and si l ver were rec-

ogni zed. and because standards of shape and wei ght made i t pos-

si bl e for peopl e to test the ful l wei ght (preci ous metal content) of

the i ngots, these two metal s coul d more easi l y functi on as the

most marketabl e commodi ti es i n soci ety.

Honest money i s. easy to defi ne i n the context of a pure

preci ous-metal s i ngot or coi n economy. An i ngot or coi n contai ns

a speci fi c quanti ty of gol d or si l ver of a known fi neness. I n the case

of the famous U.S. doubl e eagl e, the $20 gol d pi ece, the coi n

wei ghed 1.075 troy ounces (the standard uni t for measuri ng gol d),

wi th .967 ounces of pure gol d and the rest copper, for hardness.

For greatest ease of use, an i ngot woul d be stamped wi th some

fami l i ar mark or company, so that the user woul d know that smel -

ter or fi rm stands behi nd the honesty of the wei ghts and measures.

The coi n or i ngot i n a l i terate soci ety woul d announce i ts wei ght

and fi neness of the metal (such as one ounce, .999 fi ne). Perhaps

the tradi ti onal names of nati onal cumenci es mi ght be retai ned on

the coi ns dol l aq yen, peso, etc. but to reduce confusi on to

a mi ni mum, i t woul d be better to have no name attached. I t

woul d si mpl y be a one-ounce gol d coi n. Wi th or wi thout a

fami l i ar name, the coi n when ori gi nal l y produced woul d contai n

exactl y what i t says concerni ng the preci ous metal .

To tamper wi th ei ther the wei ght or the fi neness of the coi n

woul d be l i ke pouri ng water i nto the ground meat at the-super-

market. I t woul d be fraudul ent: the attempt to get somethi ng for

nothi ng.

Honest Paper Money

Coi ns and i ngots are heavy and bul ky. I t shoul d be obvi ous

why peopl e prefer paper money. I t fi ts i nto a wal l et or purse. I ts

fl at. I ts easi l y recogni zabl e. Paper can be pri nted to represent any

number of currency uni ts: 1, 5, 10, 20, 50, 100, and so forth.

Maintaining Honest Money 35

The key word i s represent. The paper money, to remai n honest,

must be i ssued by the money-i ssuer on a stri ct one-to-one basi s. I f

i t announces that i t represents a one-ounce gol d coi n, .999 pure,

then the i ssuer must have that one-ounce coi n i n reserve, ready to

be redeemed by anyone who wal ks i n and presents the pi ece of

paper .

To i ssue. a pi ece of paper that serves as an I OU for preci ous ,

metal s wi thout havi ng 1007o of the promi sed metal i n reserve i s

fraudul ent. I t i s theft. I t i s a form of tamperi ng wi th wei ghts and

measures.

How woul d such a system work? The coi n owner mi ght

deposi t hi s coi ns at a warehouse. He wants hi s coi ns kept safel y.,

He pays a fee for the safekeepi ng, the same way we rent safety

deposi t boxes at our bank. The warehouse i ssues a recei pt. Si nce

the recei pt promi ses to pay the bearer a speci i l c amount of coi ns,