Professional Documents

Culture Documents

Summary of Net Inflow of Foreign Investment in Pakistan

Summary of Net Inflow of Foreign Investment in Pakistan

Uploaded by

Kamran Ali0 ratings0% found this document useful (0 votes)

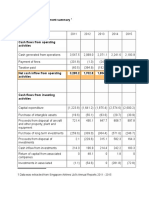

2 views1 pageThis document summarizes foreign investment inflows and outflows in Pakistan from FY09 to FY14. It shows that in FY14, total net foreign inflows decreased by $43 million (5.2%) compared to the previous fiscal year, totaling $782.6 million. Private foreign investment decreased by $109 million (13.2%) while direct investment increased by $39 million (6.1%). Portfolio investment decreased significantly by $148 million (74.6%) mainly due to a $36 million decrease in equity securities and $112 million decrease in debt securities.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes foreign investment inflows and outflows in Pakistan from FY09 to FY14. It shows that in FY14, total net foreign inflows decreased by $43 million (5.2%) compared to the previous fiscal year, totaling $782.6 million. Private foreign investment decreased by $109 million (13.2%) while direct investment increased by $39 million (6.1%). Portfolio investment decreased significantly by $148 million (74.6%) mainly due to a $36 million decrease in equity securities and $112 million decrease in debt securities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageSummary of Net Inflow of Foreign Investment in Pakistan

Summary of Net Inflow of Foreign Investment in Pakistan

Uploaded by

Kamran AliThis document summarizes foreign investment inflows and outflows in Pakistan from FY09 to FY14. It shows that in FY14, total net foreign inflows decreased by $43 million (5.2%) compared to the previous fiscal year, totaling $782.6 million. Private foreign investment decreased by $109 million (13.2%) while direct investment increased by $39 million (6.1%). Portfolio investment decreased significantly by $148 million (74.6%) mainly due to a $36 million decrease in equity securities and $112 million decrease in debt securities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Summary of Net Inflow of Foreign Investment in Pakistan

FY09 FY10 FY11 FY12 FY13

(R)

2013

(R)

2014

(P)

FY13

(R)

FY14

(P)

Absolute %age

Foreign Private Investment 3,209.5 2,738.7 1,999.3 760.6 1,576.0 145.6 59.9 829.7 720.2 (109.5) (13.2)

Direct Investment 3,719.9 2,150.8 1,634.7 820.6 1,456.5 116.8 63.5 631.0 669.8 38.8 6.1

Inflow

4,479.4 3,184.3 2,269.6 2,099.1 2,665.3 185.5 162.0 1,604.1 1,424.5 (179.6) (11.2)

Outflow

759.5 1,033.5 634.8 1,278.4 1,208.9 68.7 98.5 973.1 754.7 (218.4) (22.4)

of which Privatization Proceeds

Portfolio Investment (510.4) 587.9 364.6 (60.0) 119.6 28.8 (3.6) 198.7 50.4 (148.3) (74.6)

Equity Securities (409.8) 600.9 364.6 (60.0) 119.6 28.8 (3.6) 198.7 162.6 (36.1) (18.2)

Debt Securities (100.6) (13.0) (112.2) (112.2) -

Convertible Bonds of Pace Pakistan - (13.0)

International bonds of PMCL (100.6) -

(112.2) (112.2) -

Foreign Public Investment (544.1) (652.4) (20.1) (52.8) 4.6 (0.1) (1.8) (3.8) 62.5 66.3 1,752.6

Portfolio Investment (544.1) (652.4) (20.1) (52.8) 4.6 (0.1) (1.8) (3.8) 62.5 66.3 1,752.6

Equity Securities

Debt Securities * (544.1) (652.4) (20.1) (52.8) 4.6 (0.1) (1.8) (3.8) 62.5 66.3 1,752.6

2,665.4 2,086.3 1,979.2 707.8 1,580.6 145.5 58.1 825.9 782.6 (43.3) (5.2)

Source: State Bank of Pakistan.

(P): Provisional

* Net sale/Purchase of Special US$ bonds, Eurobonds, FEBC, DBC, Tbills and PIBs

(R) : Revised

Contact Person Mr. Zarar Askari,Sr.Joint Director

Phone: 021-32453630, 32453679, 99221112

Email: zarar.askari@sbp.org.pk

Feedback: http://www.sbp.org.pk/stats/survey/

Total

Million US$

March July-March Change over July-March FY13

You might also like

- Custom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Document37 pagesCustom Redevelopment Model - Built From Scratch For Mixed Use Retail, Office, Multifamily.Jonathan D SmithNo ratings yet

- FPP1x Country CaseDocument87 pagesFPP1x Country CasesamskritaNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- Schwab Jan2023 SMART SupplementDocument1 pageSchwab Jan2023 SMART SupplementManish SinghNo ratings yet

- Schwab Dec2022 SMART SupplementDocument1 pageSchwab Dec2022 SMART SupplementJames GarciaNo ratings yet

- National Income and Other AgregatesDocument5 pagesNational Income and Other Agregatesluka rekhviashviliNo ratings yet

- Net in Flow SummaryDocument1 pageNet in Flow Summarysherman ullahNo ratings yet

- Efrs 2014-2018 Amsa. Ratios-Final-2Document60 pagesEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- Table A4: Tanzania's Balance of Payments: Balance On Goods ServicesDocument1 pageTable A4: Tanzania's Balance of Payments: Balance On Goods ServicessabbealexNo ratings yet

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryNo ratings yet

- LatinFocus Consensus Forecast - November 2023 (Argentina)Document1 pageLatinFocus Consensus Forecast - November 2023 (Argentina)Phileas FoggNo ratings yet

- Monthly Economic Report July 06Document11 pagesMonthly Economic Report July 06iedh_nagNo ratings yet

- 14-10 Years HighlightsDocument1 page14-10 Years HighlightsJigar PatelNo ratings yet

- Netinflow SummaryDocument1 pageNetinflow SummarySana SaeedNo ratings yet

- Moderna Inc DCF ValuationDocument4 pagesModerna Inc DCF ValuationFabianNo ratings yet

- Share ValueDocument1 pageShare ValuechronoskatNo ratings yet

- Tata Motors FM - Chintan HasnaniDocument26 pagesTata Motors FM - Chintan Hasnanianser lalNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliNo ratings yet

- Financial ReportDocument140 pagesFinancial ReportAlberto AsinNo ratings yet

- Bharti Airtel: Concerns Due To Currency VolatilityDocument7 pagesBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNo ratings yet

- 1Q23 Supporting SpreadsheetDocument22 pages1Q23 Supporting SpreadsheetJamilly PaivaNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- UBL Annual Report 2018-94Document1 pageUBL Annual Report 2018-94IFRS LabNo ratings yet

- TVS Motor 4Q FY 2013Document13 pagesTVS Motor 4Q FY 2013Angel BrokingNo ratings yet

- Household Balance Sheet Q2 2009Document6 pagesHousehold Balance Sheet Q2 2009DvNetNo ratings yet

- Caso 2 Excel 1Document8 pagesCaso 2 Excel 1Carolina NunezNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19MeeroButtNo ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- Currency Management: 2. Developments in Currency in CirculationDocument7 pagesCurrency Management: 2. Developments in Currency in CirculationRöhit NigamNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Economic IndicatorsDocument2 pagesEconomic IndicatorsmkpatidarNo ratings yet

- 5-Money and CreditDocument8 pages5-Money and CreditAhsan Ali MemonNo ratings yet

- NAG FijiDocument20 pagesNAG Fijiwilliamlord8No ratings yet

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1No ratings yet

- Supplement Du Pont 1983Document13 pagesSupplement Du Pont 1983Eesha KNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- Financial ModelDocument38 pagesFinancial ModelufareezNo ratings yet

- Balance Sheet of Households FEDz1r-5Document6 pagesBalance Sheet of Households FEDz1r-5a.b.saffariNo ratings yet

- Foreign Direct Investment (FDI) & ExportDocument9 pagesForeign Direct Investment (FDI) & ExportSibghaNo ratings yet

- Insights EdelMFDocument81 pagesInsights EdelMFSindhuja AvinashNo ratings yet

- Identifiable Gold Demand (Tonnes) : % CH 2009 Vs 2008 % CH Q4'09 Vs Q4'08Document1 pageIdentifiable Gold Demand (Tonnes) : % CH 2009 Vs 2008 % CH Q4'09 Vs Q4'08api-27018542No ratings yet

- 2021 Con Quarter01 CFDocument2 pages2021 Con Quarter01 CFMohammadNo ratings yet

- HMC DCF ValuationDocument31 pagesHMC DCF Valuationyadhu krishnaNo ratings yet

- Bank - Model Commerzbank 1Document10 pagesBank - Model Commerzbank 1Khryss Anne Miñon MendezNo ratings yet

- BOP SummaryDocument1 pageBOP SummarysamirnajeebNo ratings yet

- Table 6.1 National Savings Schemes (Net Investment)Document2 pagesTable 6.1 National Savings Schemes (Net Investment)sidraNo ratings yet

- 6 PesDocument2 pages6 PessidraNo ratings yet

- IEM 221 eDocument4 pagesIEM 221 eMc AndrésNo ratings yet

- 02 EnglishDocument7 pages02 EnglishMalaz.A.S MohamedNo ratings yet

- Jan FileDocument1 pageJan FileAshwin GophanNo ratings yet

- Discounted Cash Flow Analysis - Steel Dynamics Inc. (Unlevered DCF)Document4 pagesDiscounted Cash Flow Analysis - Steel Dynamics Inc. (Unlevered DCF)Moni DahalNo ratings yet

- Tugas Pertemuan 10 - Sopianti (1730611006)Document12 pagesTugas Pertemuan 10 - Sopianti (1730611006)sopiantiNo ratings yet

- Portefeuille MINDEODocument2 pagesPortefeuille MINDEOwendk396No ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23acharya.arpan08No ratings yet

- Asian Paints Financial ModelDocument15 pagesAsian Paints Financial ModelDeepak NechlaniNo ratings yet

- Advertisement Faculty Staff 2018 FinalDocument3 pagesAdvertisement Faculty Staff 2018 FinalKamran AliNo ratings yet

- Content Weightages University of Chitral Chitral Khyber PakhtunkhwaDocument5 pagesContent Weightages University of Chitral Chitral Khyber PakhtunkhwaKamran AliNo ratings yet

- FATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Document3 pagesFATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Kamran AliNo ratings yet

- Fair Combined Ad No.06-2017 PDFDocument32 pagesFair Combined Ad No.06-2017 PDFKamran AliNo ratings yet

- Content Weightages Khyber Pakhtunkhwa Revenue Authority (KPRA)Document3 pagesContent Weightages Khyber Pakhtunkhwa Revenue Authority (KPRA)Kamran AliNo ratings yet

- New Doc 2017-06-02Document6 pagesNew Doc 2017-06-02Kamran AliNo ratings yet

- Khyber Pakhtunkhwa Revenue AuthorityDocument1 pageKhyber Pakhtunkhwa Revenue AuthorityKamran AliNo ratings yet

- Khyber Pakhtunkhwa Public Service Commission: Communication and Works DepartmentDocument8 pagesKhyber Pakhtunkhwa Public Service Commission: Communication and Works DepartmentKamran AliNo ratings yet

- Khyber Pakhtunkhwa Revenue Authority (KPRA) : Weekly Collection of Sales Tax On ServicesDocument2 pagesKhyber Pakhtunkhwa Revenue Authority (KPRA) : Weekly Collection of Sales Tax On ServicesKamran AliNo ratings yet

- Branchwise Report 11-4-2017Document1 pageBranchwise Report 11-4-2017Kamran AliNo ratings yet

- Collection ReportDocument1 pageCollection ReportKamran AliNo ratings yet

- FATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Document3 pagesFATA University, FR Kohat: Application Form FOR Employment in Bps 1-16Kamran AliNo ratings yet

- Content Weightages For Pakhtunkhwa Highways AuthorityDocument2 pagesContent Weightages For Pakhtunkhwa Highways AuthorityKamran AliNo ratings yet

- Agricultural Credit-Meaning, Definition, Need and ClassificationDocument4 pagesAgricultural Credit-Meaning, Definition, Need and ClassificationKamran AliNo ratings yet

- The Determinants of Industrialization in Developing Countries, 1960-2005Document26 pagesThe Determinants of Industrialization in Developing Countries, 1960-2005Kamran AliNo ratings yet

- Draftingofficial 120918113417 Phpapp01Document23 pagesDraftingofficial 120918113417 Phpapp01Kamran AliNo ratings yet