Professional Documents

Culture Documents

Schwab Jan2023 SMART Supplement

Uploaded by

Manish SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schwab Jan2023 SMART Supplement

Uploaded by

Manish SinghCopyright:

Available Formats

The Charles Schwab Corporation Supplemental Monthly Client Metrics For January 2023

2022 2023

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan

Clients' Daily Average Trades (DATs) (in thousands) 6,881 6,389 6,471 6,330 6,477 5,881 5,228 5,598 5,720 5,601 5,393 5,172 5,822

Number of Trading Days 20.0 19.0 23.0 20.0 21.0 21.0 20.0 23.0 21.0 21.0 20.5 21.0 20.0

Select Assets in Client Accounts (in billions, at month end)

Bank Deposit Account (BDA) Balances:

Insured Deposit Account (IDA) Balances 144.1 143.3 143.5 140.5 144.4 144.3 141.5 134.2 133.8 128.0 123.9 122.6 119.5

Third-party BDA Balances(1) 11.3 11.3 11.3 11.3 11.3 11.3 11.3 8.9 5.8 4.8 3.9 4.0 -

Total BDA Balances 155.4 154.6 154.8 151.8 155.7 155.6 152.8 143.1 139.6 132.8 127.8 126.6 119.5

Money Market Funds:

Proprietary Purchased Money Market Funds 120.7 119.9 118.8 116.1 123.6 135.4 150.4 171.9 190.5 213.2 231.5 258.5 285.7

Proprietary Sweep Money Market Funds 24.1 24.2 24.3 23.9 23.8 23.8 22.9 21.6 20.6 20.1 19.5 20.4 19.4

Third-party Money Market Funds 13.0 12.4 12.3 11.7 10.6 9.3 4.0 3.8 3.6 3.4 3.3 3.2 3.1

Total Money Market Funds 157.8 156.5 155.4 151.7 158.0 168.5 177.3 197.3 214.7 236.7 254.3 282.1 308.2

Mutual Fund and Exchange-Traded Fund

Net Buys (Sells) (in millions of dollars)(2)

Equities:

Large Capitalization Stock 1,803 2,854 6,642 (1,596) 3,217 (22) 3,602 5,380 (35) 2,461 2,130 206 264

Small / Mid Capitalization Stock (1,220) 744 2,014 (967) 380 (114) 246 1,692 (892) 1,171 816 (420) 882

International 4,019 3,177 2,218 748 131 799 1,515 1,514 (477) (55) 321 (305) 4,785

Specialized 2,782 2,596 3,303 1,029 (1,839) (2,249) 226 1,879 (1,258) 407 510 (1,318) 1,305

Total Equities 7,384 9,371 14,177 (786) 1,889 (1,586) 5,589 10,465 (2,662) 3,984 3,777 (1,837) 7,236

Hybrid (367) (478) (497) (529) (1,718) (1,054) (2,041) (783) (938) (1,380) (2,052) (1,595) (433)

Bonds:

Taxable Bond 2,500 (859) (5,589) (3,659) (3,820) (4,629) 275 (309) (3,416) (5,065) (3,124) (1,798) 4,380

Tax-Free Bond (696) (1,114) (2,262) (3,274) (2,301) (1,002) 454 168 (2,385) (2,153) (597) (1,462) 1,266

Total Bonds 1,804 (1,973) (7,851) (6,933) (6,121) (5,631) 729 (141) (5,801) (7,218) (3,721) (3,260) 5,646

(1) In January 2023, the company ended its arrangements with the other third-party banks.

(2) Represents the principal value of client mutual fund and ETF transactions handled by Schwab, including transactions in proprietary mutual funds and ETFs. Includes institutional funds available only

to Investment Managers. Excludes money market fund transactions.

**The information in this spreadsheet is being provided for informational purposes and is subject to additions, deletions, and other changes. The company may choose to update or restate the

information as appropriate.

You might also like

- Schwab Dec2022 SMART SupplementDocument1 pageSchwab Dec2022 SMART SupplementJames GarciaNo ratings yet

- Bank - Model Commerzbank 1Document10 pagesBank - Model Commerzbank 1Khryss Anne Miñon MendezNo ratings yet

- Tata Motors FM - Chintan HasnaniDocument26 pagesTata Motors FM - Chintan Hasnanianser lalNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- Paramount Student SpreadsheetDocument12 pagesParamount Student Spreadsheetanshu sinhaNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Efrs 2014-2018 Amsa. Ratios-Final-2Document60 pagesEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- NIKE Inc Ten Year Financial History FY19Document1 pageNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosNo ratings yet

- Super Gloves 2Document6 pagesSuper Gloves 2anon_149445490No ratings yet

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Document62 pagesConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNo ratings yet

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờNo ratings yet

- Corporate Finance, Funds Statament, Agency Problem 52Document52 pagesCorporate Finance, Funds Statament, Agency Problem 52ashdhaNo ratings yet

- New Earth Mining Inc.Document20 pagesNew Earth Mining Inc.Asif Rahman100% (1)

- Chapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Document59 pagesChapter III - Developments in Commercial Banking: (Amount in Rs. Crore)Modi SinghNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- Moderna Inc DCF ValuationDocument4 pagesModerna Inc DCF ValuationFabianNo ratings yet

- IEM 221 eDocument4 pagesIEM 221 eMc AndrésNo ratings yet

- Spyder Case Intro: See Templates On Blackboard For WACC and DCF OutputDocument11 pagesSpyder Case Intro: See Templates On Blackboard For WACC and DCF Outputrock sinhaNo ratings yet

- AMTEXDocument87 pagesAMTEXBilal Ahmed KhanNo ratings yet

- Household Balance Sheet Q2 2009Document6 pagesHousehold Balance Sheet Q2 2009DvNetNo ratings yet

- Stryker Corporation: Capital BudgetingDocument8 pagesStryker Corporation: Capital Budgetinggaurav sahuNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- Caso 2 Excel 1Document8 pagesCaso 2 Excel 1Carolina NunezNo ratings yet

- 14-10 Years HighlightsDocument1 page14-10 Years HighlightsJigar PatelNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocument5 pagesHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossNo ratings yet

- Swedish Match 9 212 017Document6 pagesSwedish Match 9 212 017Karan AggarwalNo ratings yet

- Ceres Gardening Company Submission TemplateDocument5 pagesCeres Gardening Company Submission TemplateShubham MishraNo ratings yet

- 3 PDFDocument2 pages3 PDFJannine Gamuza EstilloroNo ratings yet

- Complete P&L Statement TemplateDocument4 pagesComplete P&L Statement TemplateGolamMostafaNo ratings yet

- Financial Data Year 2019-20Document9 pagesFinancial Data Year 2019-20Sabarna ChakrabortyNo ratings yet

- BOP SummaryDocument1 pageBOP SummarysamirnajeebNo ratings yet

- Financial ReportDocument140 pagesFinancial ReportAlberto AsinNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Letchoose Farm Corporation Financial Highlights (Insert FS)Document31 pagesLetchoose Farm Corporation Financial Highlights (Insert FS)Cking CunananNo ratings yet

- 02 EnglishDocument7 pages02 EnglishMalaz.A.S MohamedNo ratings yet

- 12 Month Cash Flow Statement Template v.1.1Document1 page12 Month Cash Flow Statement Template v.1.1BOBANSO KIOKONo ratings yet

- 4019 XLS EngDocument4 pages4019 XLS EngAnonymous 1997No ratings yet

- PT Proiect BatranceaDocument33 pagesPT Proiect Batranceapentaxoptios40No ratings yet

- Macro For The Market and Funding Liquidity Stress TestsDocument40 pagesMacro For The Market and Funding Liquidity Stress Testsbing mirandaNo ratings yet

- Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetDocument4 pagesTaiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetHarry KilNo ratings yet

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocument4 pagesPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDocument3 pagesMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- NicaraguaDocument2 pagesNicaraguaulianedelkova6No ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- Calaveras ExhibitsDocument16 pagesCalaveras ExhibitsLucasNo ratings yet

- Love Verma Ceres Gardening SubmissionDocument8 pagesLove Verma Ceres Gardening Submissionlove vermaNo ratings yet

- Avenue SuperDocument19 pagesAvenue Superanuda29102001No ratings yet

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Document6 pagesChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNo ratings yet

- Balance Sheet of Households FEDz1r-5Document6 pagesBalance Sheet of Households FEDz1r-5a.b.saffariNo ratings yet

- MR D.I.Y.: OutperformDocument9 pagesMR D.I.Y.: OutperformZhi_Ming_Cheah_8136No ratings yet

- Deduction PDFDocument207 pagesDeduction PDFdeepluthra6No ratings yet

- Q: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetsDocument4 pagesQ: No: 45 (KAPLAN) Hapsburg Consolidated Statement of Financial Position: - Non - Current AssetszarimanufacturingNo ratings yet

- Perniagaan IzyanDocument5 pagesPerniagaan IzyanZikri KiNo ratings yet

- 14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Document26 pages14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Love FreddyNo ratings yet

- How Unethical Practices Almost Destroyed WorldcomDocument16 pagesHow Unethical Practices Almost Destroyed WorldcomtodkarvijayNo ratings yet

- Apoorva Goel Chaitanya Jain Madhurima Kar Preetam S Roy Priyanka Panwar Yogesh RajDocument14 pagesApoorva Goel Chaitanya Jain Madhurima Kar Preetam S Roy Priyanka Panwar Yogesh Rajvarndrit kumarNo ratings yet

- Module 2 - Asset Based Valuation For Going Concern Opportunities Part 1Document2 pagesModule 2 - Asset Based Valuation For Going Concern Opportunities Part 1Marlou AbejuelaNo ratings yet

- ENG-UU 40-2007 Perseroan Terbatas (ABNR)Document129 pagesENG-UU 40-2007 Perseroan Terbatas (ABNR)Kartika Budianti Lestari100% (9)

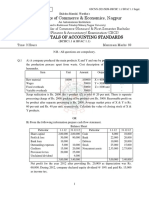

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- KPMG Ind As Illustrattive Financial Statements 2019Document217 pagesKPMG Ind As Illustrattive Financial Statements 2019Utsav HiraniNo ratings yet

- 19.1 Banks FMP 2Document17 pages19.1 Banks FMP 2Javneet KaurNo ratings yet

- Business Ethics and Social ResponsibilityDocument39 pagesBusiness Ethics and Social ResponsibilityMalathi Meenakshi SundaramNo ratings yet

- Unsecured Bond: Why Issue Unsecured Bonds?Document2 pagesUnsecured Bond: Why Issue Unsecured Bonds?aeman hassan100% (1)

- Finance Practice File 1 With SolutionsDocument18 pagesFinance Practice File 1 With Solutionsdscgool1232100% (2)

- Consolidated Financial Statements - 5. CFS (Subsidiaries)Document56 pagesConsolidated Financial Statements - 5. CFS (Subsidiaries)shubhamNo ratings yet

- (Reyes) Portal of Installment LiquidationDocument16 pages(Reyes) Portal of Installment LiquidationChe NelynNo ratings yet

- TheoriesDocument13 pagesTheoriesZee RoeNo ratings yet

- FUNACC3Document4 pagesFUNACC3por wansNo ratings yet

- Ebook PDF Company Law Perspectives 3e PDFDocument41 pagesEbook PDF Company Law Perspectives 3e PDFrubin.smith411100% (31)

- FM-Dividend PolicyDocument9 pagesFM-Dividend PolicyMaxine SantosNo ratings yet

- Accounting NotesDocument9 pagesAccounting NotesJerusha ENo ratings yet

- (FM02) - Chapter 7 The Valuation of Ordinary SharesDocument12 pages(FM02) - Chapter 7 The Valuation of Ordinary SharesKenneth John TomasNo ratings yet

- Session 10 Finance Formula Cheat SheetDocument16 pagesSession 10 Finance Formula Cheat Sheetpayal mittalNo ratings yet

- Annual Report 2020Document405 pagesAnnual Report 2020Abu Hamzah NomaanNo ratings yet

- Business Organizations Law OutlineDocument65 pagesBusiness Organizations Law OutlineNas YasinNo ratings yet

- Definition and Attributes of A CorporationDocument6 pagesDefinition and Attributes of A Corporationkeith105No ratings yet

- Chapter 3 Financial Statements, Cash Flow, TaxesDocument30 pagesChapter 3 Financial Statements, Cash Flow, Taxeslil pluieNo ratings yet

- Single Entry Bookkeeping NotesDocument1 pageSingle Entry Bookkeeping NotesInday MiraNo ratings yet

- 2019 Audited Financial Statements - Diamond Quest Marketing CorporationDocument4 pages2019 Audited Financial Statements - Diamond Quest Marketing CorporationJan Gavin GoNo ratings yet