Professional Documents

Culture Documents

Performance AGlance

Uploaded by

Harshal SawaleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance AGlance

Uploaded by

Harshal SawaleCopyright:

Available Formats

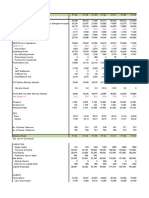

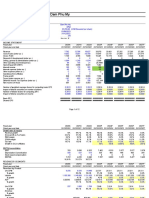

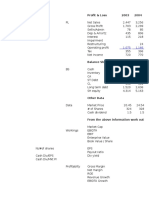

10 YEARS’ FINANCIAL HIGHLIGHTS

` Crore

Year ended March 31, 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Income from Operations 3,135 3,980 4,596 4,687 5,733 6,024 5,936 6,333 7,334 7,315 8,048

EBITDA 418 484 626 748 870 1,051 1,159 1,138 1,326 1,469 1,591

Profit before Interest & Tax (PBIT) 369 444 577 729 845 1,050 1,166 1,133 1,298 1,453 1,546

Profit before Tax (PBT) 376 400 552 695 822 1,029 1,149 1,117 1,257 1,374 1,523

Net Profit attributable to 286 317 396 485 573 711 799 814 926 1,043 1,162

Owners of the Company

Cash Profits (Profit after Current Tax + 405 397 491 592 668 873 947 922 1,057 1,167 1,327

Depreciation + Amortisation)

Economic Value Added 180 204 227 332 419 558 610 550 589 704 845

Goodwill on consolidation 398 395 396 254 489 497 479 486 503 538 613

Net Fixed Assets 458 502 1,422 638 590 620 616 801 842 916 1,023

Investments 89 296 152 311 284 513 608 543 450 733 854

Net Current Assets 607 532 674 671 749 655 846 1,105 1,420 1,094 1,034

Net Non Current Assets 130 205 251 213 163 35 41 (82) (68) (63) (20)

Deferred Tax Asset (Net) 30 22 - - - 65 10 20 202 159 186

Total Capital Employed 1,712 1,953 2,894 2,086 2,274 2,386 2,600 2,873 3,349 3,377 3,690

Equity Share Capital 61 61 64 64 65 129 129 129 129 129 129

Reserves 854 1,082 1,917 1,296 1,760 1,888 2,197 2,394 2,846 2,894 3,111

Net Worth 915 1,143 1,982 1,361 1,825 2,017 2,326 2,523 2,975 3,023 3,240

Minority interest 22 25 35 36 14 14 13 12 12 13 18

Borrowed Funds 774 785 872 680 428 331 239 309 349 335 348

Deferred Tax Liability - - 6 10 8 23 22 29 13 6 84

Total Funds Employed 1,712 1,953 2,894 2,086 2,274 2,386 2,600 2,873 3,349 3,377 3,690

EBITDA Margin (%) 13.3 12.2 13.6 16.0 15.2 17.5 19.5 18.0 18.1 20.1 19.8

Profit before Tax to Turnover (%) 12.0 10.1 12.0 14.8 14.3 17.1 19.4 17.6 17.1 18.8 18.9

Profit after Tax to Turnover (%) 9.1 8.0 8.6 10.4 10.0 11.8 13.5 12.9 12.6 14.3 14.4

Return on Net Worth (%) 36.5 30.8 25.3 30.1 36.0 37.0 36.8 33.5 33.7 34.8 37.1

(PAT / Average Net Worth $)

Return on Capital Employed 26.1 24.3 23.8 30.4 38.7 45.1 46.8 41.3 42.0 42.4 44.6

(PBIT / Average Total Capital Employed @)

Net Cash Flow from Operations per share

(`) (Refer Cash Flow Statement) 4.0 6.5 6.7 10.2 10.3 6.5 5.0 4.0 8.2 9.4 16.0

Earning per Share (EPS) (`) 4.7 5.2 6.1 7.5 8.9 5.5 6.2 6.3 7.2 8.1 9.0

(PAT / No. of Equity Shares)

Economic Value Added per share (`) 2.9 3.3 3.5 5.1 6.5 4.3 4.7 4.3 4.6 5.5 6.5

Dividend per share (`) 0.7 0.7 1.0 3.5 2.5 3.4 3.5 4.3 4.8 6.8 6.8

Debt / Equity 0.8 0.7 0.4 0.5 0.2 0.2 0.1 0.1 0.1 0.1 0.1

Book Value per share (`) 14.9 18.6 30.7 21.1 28.3 15.6 18.0 19.5 23.0 23.4 25.1

(Net Worth / No. of Equity Shares)

Sales to Average Capital Employed @ 2.2 2.2 1.9 2.0 2.6 2.6 2.4 2.3 2.4 2.2 2.3

Sales to Average Net Working Capital # 5.3 7.0 7.6 6.6 8.1 8.6 7.9 6.5 5.8 5.8 7.6

@ Average Capital Employed = (Opening Capital Employed + Closing Capital Employed)/2

$ Average Net Worth = (Opening Net Worth + Closing Net Worth)/2

# Average Net Working Capital = (Opening Net Current Assets + Closing Net Current Assets)/2

Note 1: FY14 onwards, financials will not include Kaya as it has been demerged from Marico Group effective April 1,2013.

Note 2: FY16 onwards, per share numbers are calculated on the post bonus number of shares

Note 3: FY16 onwards, financials are as per IND - AS and hence not comparable with earlier years.

Note 4: FY19, FY20 and FY21 Net Profit excludes the impact of one-offs and extraordinary items.

Note 5: P&L for FY19, FY20 and FY21 and Balance Sheet for FY19, FY20 and FY21 are as per Ind-AS 116 and hence not comparable

with earlier years.

You might also like

- Swedish Match 9 212 017Document6 pagesSwedish Match 9 212 017Karan AggarwalNo ratings yet

- Apple Model - FinalDocument32 pagesApple Model - FinalDang TrangNo ratings yet

- Moore Hunt - Illuminating The Borders. of Northern French and Flemish Manuscripts PDFDocument264 pagesMoore Hunt - Illuminating The Borders. of Northern French and Flemish Manuscripts PDFpablo puche100% (2)

- Finding Buyers Leather Footwear - Italy2Document5 pagesFinding Buyers Leather Footwear - Italy2Rohit KhareNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Bluest EyeDocument10 pagesThe Bluest EyeBethany0% (2)

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- A Cancer in The Army Identifying and Removing Toxic LeadersDocument47 pagesA Cancer in The Army Identifying and Removing Toxic LeadersFirebrand38No ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- Financial InfoDocument4 pagesFinancial InfoPawan SinghNo ratings yet

- MAR001-1 ExemplarDocument9 pagesMAR001-1 ExemplarAeman SohailNo ratings yet

- English5 - q1 - Mod1 - Filling Out Forms Accurately - v3.1 PDFDocument22 pagesEnglish5 - q1 - Mod1 - Filling Out Forms Accurately - v3.1 PDFje santos50% (4)

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenNo ratings yet

- Restructuring at Neiman Marcus Group (A) Bankruptcy ValuationDocument66 pagesRestructuring at Neiman Marcus Group (A) Bankruptcy ValuationShaikh Saifullah KhalidNo ratings yet

- Persistent KPIT - Merger ModelDocument86 pagesPersistent KPIT - Merger ModelAnurag JainNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- We Are Not Above Nature, We Are A Part of NatureDocument216 pagesWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNo ratings yet

- Additional Information Adidas Ar20Document9 pagesAdditional Information Adidas Ar20LT COL VIKRAM SINGH EPGDIB 2021-22No ratings yet

- Financial Ratios of Home Depot and Lowe'sDocument30 pagesFinancial Ratios of Home Depot and Lowe'sM UmarNo ratings yet

- FSA AssignmentDocument4 pagesFSA AssignmentDharmil OzaNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Almarai's Quality and GrowthDocument128 pagesAlmarai's Quality and GrowthHassen AbidiNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Performance at A GlanceDocument4 pagesPerformance at A GlanceabhikakuNo ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- NIKE Inc Ten Year Financial History FY19Document1 pageNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosNo ratings yet

- 10-Year Consolidated Financial Statements Summary (2001-2010Document12 pages10-Year Consolidated Financial Statements Summary (2001-2010anshu sinhaNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- Bcel 2019Document1 pageBcel 2019Dương NguyễnNo ratings yet

- Part-2 Cash Flow Apex Footwear Limited Growth RateDocument11 pagesPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630No ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Period Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares OutstandingDocument4 pagesPeriod Ended 2/1/2020 2/2/2019 2/3/2018: Diluted Shares Outstandingso_levictorNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocument5 pagesHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossNo ratings yet

- AnalysisDocument20 pagesAnalysisSAHEB SAHANo ratings yet

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Document172 pagesPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDocument7 pagesBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniNo ratings yet

- IFRS Financial Statements and Operating Metrics for FY09-FY19Document19 pagesIFRS Financial Statements and Operating Metrics for FY09-FY19Ketan JajuNo ratings yet

- EVA ExampleDocument27 pagesEVA Examplewelcome2jungleNo ratings yet

- Alk Bird1Document5 pagesAlk Bird1evel streetNo ratings yet

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Document62 pagesConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNo ratings yet

- Supreme Annual Report 2019Document148 pagesSupreme Annual Report 2019adoniscalNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- TJX Forecast ChangesDocument13 pagesTJX Forecast ChangesAnonymous 8ooQmMoNs1No ratings yet

- Análisis de Estados Financieros de Starbucks (SBUXDocument7 pagesAnálisis de Estados Financieros de Starbucks (SBUXjosolcebNo ratings yet

- Financial Summary Model Answer v03Document1 pageFinancial Summary Model Answer v03Ayesha RehmanNo ratings yet

- KPIT Cummins: TemplateDocument15 pagesKPIT Cummins: Templatekajal malhotraNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- KPIT Cummins Infosystems Ltd. Income Statement and Balance Sheet AnalysisDocument22 pagesKPIT Cummins Infosystems Ltd. Income Statement and Balance Sheet AnalysisArun C PNo ratings yet

- Newfield QuestionDocument8 pagesNewfield QuestionFaizan YousufNo ratings yet

- Historical Financials and Forecast with Key MetricsDocument3 pagesHistorical Financials and Forecast with Key MetricsPragathi T NNo ratings yet

- Financial Statement: Statement of Cash FlowsDocument6 pagesFinancial Statement: Statement of Cash FlowsdanyalNo ratings yet

- $R4UFVSNDocument3 pages$R4UFVSNGrace StylesNo ratings yet

- 31-March-2020Document8 pages31-March-2020lojanbabunNo ratings yet

- HortDocument3 pagesHortHarshal SawaleNo ratings yet

- Seedprodnpostharvesttech InsoybeanDocument6 pagesSeedprodnpostharvesttech InsoybeanHarshal SawaleNo ratings yet

- MC DonaldsDocument2 pagesMC DonaldsHarshal SawaleNo ratings yet

- Groups and Types of GroupsDocument18 pagesGroups and Types of GroupsHarshal SawaleNo ratings yet

- Business AnalyticsDocument10 pagesBusiness AnalyticsHarshal SawaleNo ratings yet

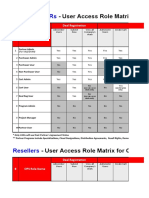

- Vads & Dvars: - User Access Role Matrix For OPSDocument10 pagesVads & Dvars: - User Access Role Matrix For OPSHandi BiryaniNo ratings yet

- Solved Table 2 5 Shows Bushels of Wheat and Yards of ClothDocument1 pageSolved Table 2 5 Shows Bushels of Wheat and Yards of ClothM Bilal SaleemNo ratings yet

- Case Study - Generative AI Applications in Key IndustriesDocument2 pagesCase Study - Generative AI Applications in Key Industriessujankumar2308No ratings yet

- Eng PDFDocument14 pagesEng PDFbrm1shubhaNo ratings yet

- Chap 4 E-Commerce, M-Commerce and Emerging Technology Part 2 PDFDocument324 pagesChap 4 E-Commerce, M-Commerce and Emerging Technology Part 2 PDFPraveen KumarNo ratings yet

- IIPDocument47 pagesIIParnabb_16No ratings yet

- The Usages of Kinship Address Forms Amongst Non Kin in Mandarin Chinese: The Extension of Family SolidarityDocument30 pagesThe Usages of Kinship Address Forms Amongst Non Kin in Mandarin Chinese: The Extension of Family SolidarityRichardNo ratings yet

- Shiela V. SiarDocument35 pagesShiela V. SiarCrimson BirdNo ratings yet

- Metaphysical Foundation of Sri Aurobindo's EpistemologyDocument25 pagesMetaphysical Foundation of Sri Aurobindo's EpistemologyParul ThackerNo ratings yet

- A Short Guide To Environmental Protection and Sustainable DevelopmentDocument24 pagesA Short Guide To Environmental Protection and Sustainable DevelopmentSweet tripathiNo ratings yet

- Test Bank Interpersonal Relationships 7th Edition Boggs Arnold DownloadDocument10 pagesTest Bank Interpersonal Relationships 7th Edition Boggs Arnold Downloadadrienneturnerkpqowgcymz100% (15)

- Public auction property saleDocument1 pagePublic auction property salechek86351No ratings yet

- Successful Telco Revenue Assurance: Rob MattisonDocument4 pagesSuccessful Telco Revenue Assurance: Rob Mattisonashish_dewan_bit909No ratings yet

- Mount ST Mary's CollegeDocument9 pagesMount ST Mary's CollegeIvan GutierrezNo ratings yet

- Forensic Accounting and Fraud Control in Nigeria: A Critical ReviewDocument10 pagesForensic Accounting and Fraud Control in Nigeria: A Critical ReviewKunleNo ratings yet

- Drinking Poison KnowinglyDocument6 pagesDrinking Poison KnowinglySanjeev NambalateNo ratings yet

- David Redman InterviewDocument2 pagesDavid Redman InterviewSue Fenton at F Words Journalism & CopywritingNo ratings yet

- General Rules - APA FormattingDocument3 pagesGeneral Rules - APA FormattingSYafikFikkNo ratings yet

- Chapter IDocument18 pagesChapter IHarold Marzan FonacierNo ratings yet

- Market StructuresDocument5 pagesMarket StructuresProfessor Tarun DasNo ratings yet

- Finance 5Document3 pagesFinance 5Jheannie Jenly Mia SabulberoNo ratings yet

- EVS Complete Notes PDFDocument148 pagesEVS Complete Notes PDFrevantrajkpdh2002No ratings yet

- PDF - 6 - 2852 COMMERCE-w-2022Document13 pagesPDF - 6 - 2852 COMMERCE-w-2022Anurag DwivediNo ratings yet

- Accounting for Foreign Currency TransactionsDocument32 pagesAccounting for Foreign Currency TransactionsMisganaw DebasNo ratings yet