Professional Documents

Culture Documents

Balance Sheet Ratios

Balance Sheet Ratios

Uploaded by

bidyuttezu0 ratings0% found this document useful (0 votes)

11 views2 pagesRATIOS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRATIOS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesBalance Sheet Ratios

Balance Sheet Ratios

Uploaded by

bidyuttezuRATIOS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

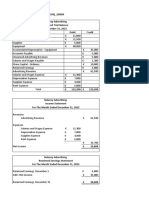

Balance Sheet Ratios

Ratio How to Calculate What it Means In Dollars and Cents

Current Current Assets Measures solvency: The number of dollars in Current

Current Liabilities Assets for every $1 in Current Lialilites.

For example: a Current Ratio of 1.76 means that for

every $1 of Current Liabilities, the company has $1.76 in

Current Assets with which to pay them.

Quick Cash + Accounts Receivable Measures liquidity: The number of dollars in Cash and

Current Liabilities Accounts Receivable for each $1 in Current Liabilities.

For example: a Quick Ratio of 1.14 means that for

every $1 of Current Liabilities, the company has $1.14

in Cash and Accounts Receivable with which to pay

them.

Debt-to-Worth Total Liabilities Measures financial risk: The number of dollars of Debt

Net Worth owed for every $1 in Net Worth.

For example: a Debt-to-Worth ratio of 1.05 means that

for every $1 of Net Worth that the owners have invested,

the company owes $1.05 of Debt to its creditors.

Income Statement Ratios

Gross Margin Gross Profit Measures profitability at the Gross Profit level: The number

Sales of dollars of Gross Margin produced for every $1 of Sales.

For example: a Gross Margin Ratio of 34.4% means that

for every $1 of Sales, the company produces 34.4 cents

of Gross Profit.

Net Margin Net Profit Before Tax Measures profitability at the Net Profit level: The number of

Sales dollars of Net Profit produced for every $1 of Sales.

For example: a Net Margin Ratio of 2.9% means that for

every $1 of Sales, the company produces 2.9 cents of

Net Profit.

Overall Efficiency Ratios

Sales-To-Assets Sales Measures the efficiency of Total Assets in generating

Total Assets sales: The number of dollars in Sales produced for every

$1 invested in Total Assets.

For example: a Sales-To-Asset Ratio of 2.35 means that

for every $1 invested in Total Assets, the company

generates $2.35 in Sales.

Return On Net Profit Before Tax Measures the efficiency of Total Assets in generating Net

Assets Total Assets Profit: The number of dollars in Net Profit produced for

every $1 invested in Total Assets.

For example: a Return on Assets Ratio of 7.1% means

that for every $1 invested in Assets, the company is

generating 7.1 cents in Net Profit Before Tax.

Return On Net Profit Before Tax Measures the efficiency of Net Worth in generating Net

Investment Net Worth Profit: The number of dollars in Net Profit produced for

every $1 invested in Net Worth.

For example: a Return on Investment Ratio of 16.1%

means that for every $1 invested in Net Worth, the

company is generating 16.1 cents in Net Profit Before

Tax.

Specific Efficiency Ratios

Inventory Cost of Goods Sold Measures the rate at which Inventory is being used on an

Turnover Inventory annual basis.

For example: an Inventory Turnover Ratio of 9.81 means

that the average dollar volume of Inventory is used up

almost ten times during the fiscal year.

Inventory 360 Converts the Inventory Turnover ratio into an average "days

Turn-Days Inventory Turnover inventory on hand" figure.

For example: a Inventory Turn-Days Ratio of 37 means

that the company keeps an average of thirty-seven days

of Inventory on hand throughout the year.

Accounts Sales Measures the rate at which Accounts Receivable are being

Receivable Accounts Receivable collected on an annual basis.

Turnover For example: an Accounts Receivable Turnover Ratio of

8.00 means that the average dollar volume of Accounts

Recievalbe are collected eight times during the year.

Average 360 Converts the Accounts Receivable Turnover ratio into the

Collection A/RTurnover average number of days the company must wait for its

Period Accounts Receivable to be paid.

For example: an Accounts Receivable Turnover ratio of

45 means that it takes the company 45 days on average

to collect its receivables.

Accounts Cost of Goods Sold Measures the rate at which Accounts Payable are being

Payable Accounts Payable paid on an annual basis.

Turnover For example: an Accounts Payable Turnover ratio of

12.04 means that the average dollar volume of Accounts

Payable are paid about twelve times during the year.

Average 360 Converts the Accounts Payable Turnover ratio into the

Payment Accounts Payable Turnover average number of days that a company takes to pay its

Period Accounts Payable.

For example: an Accounts Payable Turnover ratio of 30

means that it takes the company 30 days on average to

pay its bills.

You might also like

- Financial Ratio Analysis: List of Financial RatiosDocument3 pagesFinancial Ratio Analysis: List of Financial RatiosshahbazsiddikieNo ratings yet

- Financial Analysis and Reporting (FM 222) : 1 Semester, School Year 2022-2023Document60 pagesFinancial Analysis and Reporting (FM 222) : 1 Semester, School Year 2022-2023Lai Alvarez100% (1)

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Balance Sheet RatiosDocument3 pagesBalance Sheet RatiosMohit Sunil Anju MehtaNo ratings yet

- Module 1 - Business Transaction and Their Analysis Part 1Document12 pagesModule 1 - Business Transaction and Their Analysis Part 11BSA5-ABM Espiritu, CharlesNo ratings yet

- Papat All SubjectsDocument104 pagesPapat All SubjectsChester Jericho RamosNo ratings yet

- List of Financial RatiosDocument3 pagesList of Financial RatiosHyacinth ApitNo ratings yet

- Accounting Ratio For CHP 4Document5 pagesAccounting Ratio For CHP 4HtetThinzarNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Bab 5 Statement of Financial Position and Statement of Cash Flows (Autosaved)Document99 pagesBab 5 Statement of Financial Position and Statement of Cash Flows (Autosaved)Maha Sarkowi SiranNo ratings yet

- Financial Ratios Are Useful Indicators of A Firm's Performance and FinancialDocument5 pagesFinancial Ratios Are Useful Indicators of A Firm's Performance and FinancialSef Getizo CadoNo ratings yet

- Financial Ratio Summary SheetDocument1 pageFinancial Ratio Summary SheetKeith Tomasson100% (1)

- Financial RatiosDocument7 pagesFinancial RatiosarungarNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Question P8-1A: Cafu SADocument29 pagesQuestion P8-1A: Cafu SAMashari Saputra100% (1)

- Introduction To Ratio Analysis (Autosaved)Document16 pagesIntroduction To Ratio Analysis (Autosaved)umarrizwan208No ratings yet

- Ratios IBMIDocument17 pagesRatios IBMIhaz002No ratings yet

- C) Management Efficiency RatiosDocument3 pagesC) Management Efficiency RatiosJessa Mae CacNo ratings yet

- Quick and Dirty Interpretation of RatiosDocument4 pagesQuick and Dirty Interpretation of RatiosGauravNo ratings yet

- Financial Ratios InterpretationsDocument6 pagesFinancial Ratios InterpretationsValven AnacioNo ratings yet

- Financial Ratio AnalysisDocument80 pagesFinancial Ratio AnalysisAppleCorpuzDelaRosaNo ratings yet

- Turnover Ratio Formula Excel TemplateDocument7 pagesTurnover Ratio Formula Excel TemplateMustafa Ricky Pramana SeNo ratings yet

- Financial Statements Analysis and Financial ModelsDocument15 pagesFinancial Statements Analysis and Financial ModelsBẢO NGUYỄN HUYNo ratings yet

- ASSETSDocument3 pagesASSETSJaily Jessica CerdeñaNo ratings yet

- ABMDocument5 pagesABMAli HasanieNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisZeshan MustafaNo ratings yet

- Financial AnalysisDocument6 pagesFinancial AnalysisHoward CromwellNo ratings yet

- RatiosDocument2 pagesRatiospvbatheNo ratings yet

- Tutorial 2 AnswerDocument10 pagesTutorial 2 AnswerSyuhaidah Binti Aziz ZudinNo ratings yet

- Chapter 14 - Financial Statement AnalysisDocument40 pagesChapter 14 - Financial Statement Analysisphamngocmai1912No ratings yet

- Price-To-Earnings Ratio Earnings Shares P/EDocument5 pagesPrice-To-Earnings Ratio Earnings Shares P/EVarun JainNo ratings yet

- Buffet BooksDocument3 pagesBuffet BooksyoloNo ratings yet

- What Are Financial Ratios?: Uses and Users of Financial Ratio AnalysisDocument5 pagesWhat Are Financial Ratios?: Uses and Users of Financial Ratio AnalysisGultayaz khanNo ratings yet

- Financial Management Slides 2.3Document10 pagesFinancial Management Slides 2.3honathapyarNo ratings yet

- General Accounting PrinciplesDocument20 pagesGeneral Accounting PrinciplesUmaNo ratings yet

- "How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/IrwinDocument41 pages"How Well Am I Doing?" Financial Statement Analysis: Mcgraw-Hill/Irwinrayjoshua12No ratings yet

- Far 3Document9 pagesFar 3Sonu NayakNo ratings yet

- Financial Ratio FormulaDocument4 pagesFinancial Ratio Formulathaonp3No ratings yet

- Lecture 10 Create Financial PlanDocument42 pagesLecture 10 Create Financial Planmoizlaghari71No ratings yet

- RatiosDocument1 pageRatiosHussain AhmedNo ratings yet

- Commonly Used Ratios I. LiquidityDocument7 pagesCommonly Used Ratios I. LiquidityJohn Lexter GravinesNo ratings yet

- What Are Financial Ratios?Document3 pagesWhat Are Financial Ratios?Ryzza Yvonne MedalleNo ratings yet

- Quiz 1 SBADocument6 pagesQuiz 1 SBATeresa AlbertoNo ratings yet

- Ratios and Their Meanings. Leverage RatioDocument3 pagesRatios and Their Meanings. Leverage RatioNaitik JainNo ratings yet

- Financial RatiosDocument5 pagesFinancial Ratiosarrowphoto8161343rejelynNo ratings yet

- AE 24 Lesson 2-3Document4 pagesAE 24 Lesson 2-3Keahlyn BoticarioNo ratings yet

- DemoDocument3 pagesDemoJayesh KukretiNo ratings yet

- Financial Ratios - ReadingsDocument5 pagesFinancial Ratios - Readingsdeborah remigioNo ratings yet

- Gross Profit Operating Revenue CogsDocument11 pagesGross Profit Operating Revenue CogskyoNo ratings yet

- Short-Term Solvency or Liquidity Ratios: Current RatioDocument18 pagesShort-Term Solvency or Liquidity Ratios: Current RatioSachini Dinushika KankanamgeNo ratings yet

- Du-Pont Analysis: Learning ObjectivesDocument11 pagesDu-Pont Analysis: Learning ObjectivesBabulalNo ratings yet

- Stocks & More: What Is The Difference Between Par and No Par Value Stock?Document8 pagesStocks & More: What Is The Difference Between Par and No Par Value Stock?Bato RockNo ratings yet

- Financial Ratios Are Grouped Into The Following CategoriesDocument6 pagesFinancial Ratios Are Grouped Into The Following CategoriesReginald ValenciaNo ratings yet

- Engineering Economics Lect 5Document38 pagesEngineering Economics Lect 5Furqan ChaudhryNo ratings yet

- Fatema NusratDocument10 pagesFatema NusratFatema NusratNo ratings yet

- Financial Ratios - Complete List and Guide To All Financial RatiosDocument6 pagesFinancial Ratios - Complete List and Guide To All Financial Ratiosayush_37100% (1)

- Financial RatiosDocument6 pagesFinancial RatiosToan BuiNo ratings yet

- Minus Sales Returns, Discounts, and Allowances) Minus Cost of SalesDocument7 pagesMinus Sales Returns, Discounts, and Allowances) Minus Cost of Salesclothing shoptalkNo ratings yet

- Financial Statement Analysis: Prepared By: Abdulelah FararjehDocument25 pagesFinancial Statement Analysis: Prepared By: Abdulelah FararjehAbdalelah Frarjeh100% (1)

- Financial Ratio Analysis - Question 1: How Liquid Is The Firm?Document10 pagesFinancial Ratio Analysis - Question 1: How Liquid Is The Firm?Amit KumarNo ratings yet

- Liquidity RatiosDocument4 pagesLiquidity RatiosBeyoung GamefightNo ratings yet

- Business Studies Notes - Finance RatiosDocument4 pagesBusiness Studies Notes - Finance RatiosCassidy LauguicoNo ratings yet

- Debt 2Document2 pagesDebt 2misganabbbbbbbbbbNo ratings yet

- Malinab Aira Bsba FM 2-2 Activity 4 The Basic Financial StatementsDocument10 pagesMalinab Aira Bsba FM 2-2 Activity 4 The Basic Financial StatementsAira MalinabNo ratings yet

- Financial Statement AnalysisDocument57 pagesFinancial Statement AnalysisYogesh PawarNo ratings yet

- (TR DR) (TR CR)Document33 pages(TR DR) (TR CR)sanddyhs2uNo ratings yet

- Overview IAS 16 - PPEDocument7 pagesOverview IAS 16 - PPEjustjade100% (1)

- Bus 5112 - Written Assignment Polly Pet Food Finacial StatementDocument5 pagesBus 5112 - Written Assignment Polly Pet Food Finacial Statementmynalawal100% (2)

- Financial Accounting ACC500Document48 pagesFinancial Accounting ACC500Jabnon NonjabNo ratings yet

- Accounting Cycle Explained 8-Step Process TipaltiDocument1 pageAccounting Cycle Explained 8-Step Process TipaltiNarender RasanooriNo ratings yet

- Operating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageOperating (Revenue) Expenses & Losses Brief Description:: Suresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Comptes Consolidés 31 Décembre 2022 vENGDocument143 pagesComptes Consolidés 31 Décembre 2022 vENGUmar MasaudNo ratings yet

- Statement of Cash FlowsDocument38 pagesStatement of Cash FlowsSpidey ModeNo ratings yet

- Devina Yulia 20221539 2EB09 AKM TM#3Document3 pagesDevina Yulia 20221539 2EB09 AKM TM#3rully movizarNo ratings yet

- Wa0000 PDFDocument12 pagesWa0000 PDFsipheleleNo ratings yet

- STTP - Icmd 2009 (B01)Document4 pagesSTTP - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Accounting 12 Week 10 & 11Document33 pagesAccounting 12 Week 10 & 11cecilia capiliNo ratings yet

- Ind AS 16 (PPE)Document20 pagesInd AS 16 (PPE)Eric GonsalvesNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Darma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceDocument9 pagesDarma Solusi Period 31 October 2015: NO Account Title Unadjusted Trial BalanceAlma SiwiNo ratings yet

- Additional Consolidation Reporting Issues: Mcgraw-Hill/IrwinDocument40 pagesAdditional Consolidation Reporting Issues: Mcgraw-Hill/IrwinRizki ApriyansyahNo ratings yet

- Tess Pascual Shoes Worksheet For The Month Ended Feb. 29, 2020Document10 pagesTess Pascual Shoes Worksheet For The Month Ended Feb. 29, 2020Sofia Gwen VenturaNo ratings yet

- ACCT1111 Chapter 2 LectureDocument61 pagesACCT1111 Chapter 2 LectureWky Jim100% (1)

- Chapter 12 Akun Keuangan TugasDocument1 pageChapter 12 Akun Keuangan Tugassegeri kecNo ratings yet

- Return On Invested Capital: Disaggregation of Profit MarginDocument8 pagesReturn On Invested Capital: Disaggregation of Profit MarginmohihsanNo ratings yet

- Shriram Life 2016-17Document2 pagesShriram Life 2016-17Javeed GurramkondaNo ratings yet

- FYBCOM Account Semester IIDocument154 pagesFYBCOM Account Semester IIRishi LalNo ratings yet

- Rectification of Errors Notes - CA Anand Bhangariya - StepFly (Nixu160521)Document9 pagesRectification of Errors Notes - CA Anand Bhangariya - StepFly (Nixu160521)kalyanikamineniNo ratings yet