Professional Documents

Culture Documents

Bureau of Internal Revenue: Revenue Memorandum Order No. 10-2013

Uploaded by

Alta Garcia0 ratings0% found this document useful (0 votes)

7 views8 pages,

Original Title

RMO 10-2013

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views8 pagesBureau of Internal Revenue: Revenue Memorandum Order No. 10-2013

Uploaded by

Alta Garcia,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

1

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

April 17, 2013

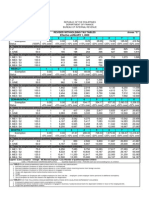

REVENUE MEMORANDUM ORDER NO. 10-2013

SUBJECT: Revised Guidelines and Procedures in the Issuance and

Enforcement of Subpoenas Duces Tecum and the Prosecution of

Cases for Non-Compliance Therewith

TO : All Internal Revenue Officers and Others Concerned

I. BACKGROUND

Section 5 of the National Internal Revenue Code of 1997 (NIRC), as

amended, vests the Commissioner of Internal Revenue with authority to obtain

information, summon and examine, as well as take testimony of persons in

ascertaining the correctness of any return or in determining the liability of any

person for any internal revenue tax, or in collecting any such liability, or simply in

evaluating tax compliance.

This Order is issued to further delineate and update the procedure for the

issuance and enforcement of Subpoenas Duces Tecum (SDTs) to ensure full

implementation of Sections 5, 14, 266 and related provisions of the NIRC, as

amended.

II. FORM

BIR Form No. 0713 shall be used in the SDTs to be issued. Every SDT to

be issued shall have a serial number in accordance with paragraph "III.3.9"

hereof. A sample copy of BIR Form No. 0713 is hereto attached as Annex "A".

III. GUIDELINES AND PROCEDURES

3.1 This Order shall cover the following persons/entities enumerated

under Section 5 of the NIRC, as amended, to wit:

a. Person liable for tax or required to file a return or any officer or

employee of such person, or any person having possession,

2

custody, or care of the books of accounts and other accounting

records containing entries relating to the business of the person

liable for tax;

b. Any person other than the person whose internal revenue tax

liability is subject to audit or investigation, or from any office or

officer of the national and local governments, government

agencies and instrumentalities, including the Bangko Sentral ng

Pilipinas and government-owned or controlled corporations

(GOCCs);

3.2 The Head of the Revenue District Office/Large Taxpayers Audit

Division/Large Taxpayers District Office/National Investigation

Division/Special Investigation Division concerned or any other

officer duly delegated by the Commissioner (e.g., Head of the Letter

Notice Task Force) shall make a written notice to any of the persons

enumerated above to provide information or the pertinent books of

accounts, accounting records and particular or specific documents.

The duplicate copy of this written notice, duly

acknowledged/received by the persons being served or their

authorized representatives shall form part of the docket of the case.

3.3 In case the information or records requested are not furnished

within the period prescribed in the written notice, or when the

information or records submitted are incomplete, the concerned

revenue officer conducting a verification or investigation (covered

by a Memorandum Order, Mission Order, Letter of Authority, Tax

Verification Notice or Letter Notice) shall request for the issuance

of SDT through a Memorandum Report, stating therein the relevant

facts, specifying the particular documents or records not made

available to him and the taxpayer liable or the third party/office

concerned.

3.4 The issuance of SDT shall be requested from the following:

a. Assistant Commissioner, Enforcement and Advocacy Service,

through the Prosecution Division for the National Office;

b. Assistant Commissioner, Large Taxpayers Service, through the

Prosecution Division for taxpayers under the jurisdiction of the

Large Taxpayers Service, including LTDOs;

3

c. Revenue Regional Directors, through the Legal Divisions for

the Regional Offices;

d. Any other officer duly delegated by the Commissioner.

The records of the case shall be attached to the

Memorandum Report.

3.5 The Prosecution Division at the National Office, the Legal Divisions

at the Regional Offices, or any other officer duly delegated by the

Commissioner, as the case may be, shall evaluate the request

within two (2) working days from receipt, and on the basis thereof,

undertake either of the following courses of action:

a. Return the case to its origin for further documentation or action;

b. Prepare the corresponding SDT in three copies for signature of

the Assistant Commissioner, Enforcement and Advocacy

Service; Assistant Commissioner, Large Taxpayers Service;

Revenue Regional Director; or any other officer duly delegated

by the Commissioner, as the case may be, the distribution of

which shall be as follows:

Original - to be served to the taxpayer

Duplicate - attached to the docket of the case

Triplicate - action lawyer file

3.6 In case the request for issuance of SDT is found to be meritorious,

the SDT shall be issued to the person liable for tax or required to

file a return, or should the information or records be in the

possession of a third party or office, then in that partys name,

requiring the concerned person to appear and submit before the

signatory of the SDT the mandated information/documents at an

appointed time, date and place.

The time to be indicated in the SDT shall be during regular

business hours or from eight oclock in the morning and five oclock

in the afternoon during the work week, excluding holidays. The

venue shall be in the BIR office of the signatory of the SDT.

a. In case of corporations, partnerships or associations, the SDT

shall be issued to the partner, president, general manager,

4

branch manager, treasurer, registered officer-in-charge,

employee/s or other persons responsible for the custody of the

books of accounts and other accounting records mandated to

be submitted or information mandated to be provided.

To ascertain the names of the incumbent of the aforesaid

positions, the concerned revenue officers may access, among

others, the latest General Information Sheet filed by the

corporation with the Securities and Exchange Commission.

b. If the concerned party is the national and local government,

government agencies and instrumentalities, including the

Bangko Sentral ng Pilipinas and government-owned or

controlled corporations (GOCCs), the SDT shall be issued to the

head of such office, agency, instrumentality, political subdivision

or GOCC. If the head shall comply through a representative, the

latter shall present the SDT, written authorization letter from the

head, and sufficient proof of identification.

3.7 The date of issuance of the SDT shall be the date when it was

officially signed.

3.8 The compliance date for the submission of books of accounts and

other accounting records shall be set on the fourteenth (14

th

) day

from date of issuance of the SDT.

3.9 The Prosecution Division at the National Office, the Legal Divisions

at the Regional Offices, or any other officer duly delegated by the

Commissioner, as the case may be, shall provide a corresponding

serial number for each SDT issued, to be placed on the upper right

portion of the SDT. The following format shall be used:

(Office Code - Year of Issuance - Series Number,

which shall begin from 01 for the first SDT, to be

followed by the corresponding digit in numerical order

for subsequent SDTs issued.)

The Office Codes prescribed under existing issuances shall be

followed.

3.10 The service of the SDT shall be effected by the revenue officers

assigned to investigate the case. However, such service may be

5

made by any other internal revenue officer authorized for the

purpose.

3.11 The Assistant Commissioner, Enforcement and Advocacy Service;

Assistant Commissioner, Large Taxpayers Service; Revenue

Regional Director; or any other office duly delegated by the

Commissioner, as the case may be, shall transmit the signed SDT

to the requesting office which shall effect its service in accordance

with the Rules provided hereunder.

3.12 The duly issued SDT shall be served within three (3) working days

from receipt by the concerned revenue officers.

3.13 The SDT shall be served through personal service by delivering

personally a copy of the SDT to the party at his registered or known

address or wherever he may be found. A known address shall

mean a place other than the registered address where business

activities of the party are conducted or his place of residence.

a. In case personal service is not practicable, the SDT shall be

served by substituted service or by mail.

b. Substituted service can be resorted to when the party is not

present at the registered or known address under the following

circumstances:

i. The SDT may be left at the partys registered address, with

his clerk or with a person having charge thereof.

ii. If the known address is a place where business activities of

the party are conducted, the SDT may be left with his clerk

or with a person having charge thereof.

iii. If the known address is the place of residence, substituted

service can be made by leaving the copy with a person of

legal age residing therein.

iv. If no person is found in the partys registered or known

address, the revenue officers concerned shall bring a

barangay official and two (2) disinterested witnesses to the

address so that they may personally observe and attest to

such absence. The SDT shall then be given to said barangay

official. Such facts shall be contained in the bottom portion

of the SDT, as well as the names, official position and

signatures of the witnesses.

6

v. Should the party be found at his registered or known address

or any other place but refuse to receive the SDT, the revenue

officers concerned shall bring a barangay official and two (2)

disinterested witnesses in the presence of the party so that

they may personally observe and attest to such act of

refusal. The SDT shall then be given to said barangay

official. Such facts shall be contained in the bottom portion

of the SDT, as well as the names, official position and

signatures of the witnesses.

vi. Disinterested witnesses refers to persons of legal age

other than employees of the Bureau of Internal Revenue.

c. Service by mail is done by sending a copy of the SDT by

registered mail to the registered or known address of the party

with instruction to the Postmaster to return the mail to the sender

after ten (10) days, if undelivered. A copy of the SDT may also

be sent through reputable professional courier service. If no

registry or reputable professional courier service is available in

the locality of the addressee, service may be done by ordinary

mail.

3.14 The server shall accomplish the bottom portion of the SDT. He shall

also make a written report under oath before a Notary Public or any

person authorized to administer oath under Section 14 of the NIRC,

as amended, setting forth the manner, place and date of service,

the name of the person/barangay official/professional courier

service company who received the same and such other relevant

information. The registry receipt issued by the post office or the

official receipt issued by the professional courier company

containing sufficiently identifiable details of the transaction shall

constitute sufficient proof of mailing and shall be attached to the

case docket.

3.15 The Head of the Office which issued the SDT shall maintain a record

of the date of personal service or service by mail, identifying therein

in adequate detail, the mode of service of the summons.

7

IV. ENFORCEMENT OF THE SDT

4.1 The concerned revenue officers are required to be present during

the appointed time, date and place set for the presentation of the

books of accounts and other accounting records in order to check

if the records presented are the complete records being required as

stated in the SDT. Non-compliance therewith shall subject violators

to administrative liability.

4.2 Upon verification by the concerned revenue officers that the records

presented are substantially complete, the documents presented

shall be consolidated with the records of the case and shall be

referred back to the appropriate office for continuation of the

investigation. The concerned revenue officer shall submit a written

report to the issuing office that the documents/records indicated in

the SDT have been submitted or that there was either no

submission or that the documents presented were so incomplete.

4.3 In case there is no submission or incomplete presentation of the

required books of accounts and other accounting records, the

action lawyer assigned to the case shall request the concerned

revenue officers for a conference. This shall be scheduled on the

fifth (5

th

) working day from the date set for compliance with the SDT.

The revenue officers shall work jointly with the action lawyer in

documenting/gathering evidence/s for the criminal prosecution of

the individual who disobeyed the SDT.

4.4 Payment of the administrative penalty shall not excuse the

taxpayer/person summoned from complying with the SDT.

V. INSTITUTION OF CRIMINAL ACTION FOR FAILURE TO OBEY SDT

5.1 Within seven (7) working days from conference mentioned in

Paragraph IV.4.3 above, the action lawyer shall prepare a Letter-

Complaint addressed to the Office of the Prosecutor,

recommending the criminal prosecution of the individual taxpayer

or third party; or the responsible officer/s or partner/s (in case the

taxpayer or third party is a corporation, partnership, association,

or office); who disobeyed the SDT for violation of Section 266

(Failure to Obey Summons) of the NIRC, as amended, together

with the Complaint-Affidavit and its supporting evidentiary

documents, properly marked. If the taxpayer concerned is a

corporation, an association or a general co-partnership, the

sanctions mandated under Section 256 (Penal Liabilities of

8

Corporations) of the NIRC, as amended, shall likewise be imposed

and invoked in the filing of a criminal case. The Letter-Complaint,

together with the Complaint-Affidavit and its attachments, shall then

be routed to the appropriate office/s for review and signature of the

concerned revenue official/s.

5.2 In the preparation of the Complaint-Affidavit, the revenue officers,

as the persons who have personal knowledge of the non-

compliance with the SDT shall be the complainants.

5.3 In the preparation of the Letter-Complaint to the Office of the

Prosecutor, the Regional Director for SDTs issued by the Revenue

Regions and the Deputy Commissioner for Legal and Inspection

Group for SDTs issued by the Enforcement and Advocacy Service

and the Large Taxpayers Service, shall be the signatories in

consonance with Revenue Delegated Authority Order No. 2-2007.

5.4 Upon return of the duly signed Letter-Complaint, together with the

Complaint- Affidavit and its attachments to the originating office, it

shall then be immediately filed with the Office of the Prosecutor that

has jurisdiction over the case.

VI. NON-WITHDRAWAL OF CASES

The person summoned shall be accorded full notice and opportunity to

comply with the SDT as detailed herein. Once the Complaint-Affidavit has been

filed for violation of Section 266 (Failure to Obey Summons) of the NIRC, as

amended, no prosecuting officer of the Bureau shall cause the withdrawal or

dismissal of the case, notwithstanding the subsequent submission of documents

indicated in the SDT.

VII. REPEALING CLAUSE

All issuances and/or portions thereof inconsistent with this Order are

hereby revoked, modified or amended accordingly.

VIII. EFFECTIVITY

This Order shall take effect immediately.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

You might also like

- RMO No 8-2014Document3 pagesRMO No 8-2014Kwini RojanoNo ratings yet

- MOA With FormatDocument3 pagesMOA With FormatkdescallarNo ratings yet

- Food and Beverage Vending Machine Agreement For RFPDocument30 pagesFood and Beverage Vending Machine Agreement For RFPKhai MohamadNo ratings yet

- RMC No. 77-2021Document38 pagesRMC No. 77-2021Mike Ferdinand SantosNo ratings yet

- Contract of LEASE-Palm Heights May 2019Document8 pagesContract of LEASE-Palm Heights May 2019Mario Rizon Jr.No ratings yet

- Answer FerdinelDocument3 pagesAnswer FerdinelLewidref Manaloto100% (1)

- Independent Contractor AgreementDocument7 pagesIndependent Contractor AgreementMariel YanogacioNo ratings yet

- Spa EditedDocument2 pagesSpa EditedOlezardo Jose UyNo ratings yet

- DENR Department OrderDocument1 pageDENR Department OrderElannie AvilesNo ratings yet

- Article 12 - Probate of A Will Executed AbroadDocument2 pagesArticle 12 - Probate of A Will Executed AbroadEan PaladanNo ratings yet

- Auditor Affidavit - EDITEDDocument4 pagesAuditor Affidavit - EDITEDdaryl canozaNo ratings yet

- Affidavit of Warranty (Motor Vehicle)Document1 pageAffidavit of Warranty (Motor Vehicle)goodtechpro3245No ratings yet

- Land Titles and Deeds Summary Part2Document4 pagesLand Titles and Deeds Summary Part2Chesza MarieNo ratings yet

- Compromise AgreementDocument27 pagesCompromise AgreementALONA MEDALIA CADIZ-GABEJANNo ratings yet

- Subscription Service Agreement - MCMDocument15 pagesSubscription Service Agreement - MCMJhoana Parica FranciscoNo ratings yet

- Unlawful Detainer DECISION May16Document4 pagesUnlawful Detainer DECISION May16Lzl BastesNo ratings yet

- (RACCO) New Petition Checklist As of 10.07.2022Document1 page(RACCO) New Petition Checklist As of 10.07.2022ANGEL JOY RABAGONo ratings yet

- Consti 2 ReviewerDocument8 pagesConsti 2 ReviewerJet GarciaNo ratings yet

- Affidavit of Consent: Address), Philippines, Having Been Duly Sworn in Accordance With Law, HerebyDocument1 pageAffidavit of Consent: Address), Philippines, Having Been Duly Sworn in Accordance With Law, HerebyMark Joseph M CastroNo ratings yet

- Motion To Revive Case: Metc/Mtcc/Mtc/Mctc Case No. RTC For Court Use OnlyDocument3 pagesMotion To Revive Case: Metc/Mtcc/Mtc/Mctc Case No. RTC For Court Use OnlyAndro DayaoNo ratings yet

- Week 1 Tax 2 ProvisionsDocument11 pagesWeek 1 Tax 2 ProvisionsJCapskyNo ratings yet

- 2011 Revised Rules of Procedure - HLURBDocument15 pages2011 Revised Rules of Procedure - HLURBLyrr ehcNo ratings yet

- LAB-rev Position Paper Set 1-ADocument6 pagesLAB-rev Position Paper Set 1-ACayen Cervancia CabiguenNo ratings yet

- Heirs of Susana Vs CADocument12 pagesHeirs of Susana Vs CAQuennie Jane SaplagioNo ratings yet

- BIR Ruling 63-2018Document6 pagesBIR Ruling 63-2018Glory PerezNo ratings yet

- Adoption Requirements ChecklistDocument2 pagesAdoption Requirements ChecklistnoelluzungNo ratings yet

- Formal Offer of ExhibitDocument3 pagesFormal Offer of ExhibitPer PerNo ratings yet

- Retainer ProposalDocument2 pagesRetainer Proposalangeli abellanaNo ratings yet

- Chap 9Document13 pagesChap 9D Del SalNo ratings yet

- Affidavit of Undertaking - BCSDocument1 pageAffidavit of Undertaking - BCSMARICHU MALINDOGNo ratings yet

- AEGIS 2015 - Photoshoot PrimerDocument20 pagesAEGIS 2015 - Photoshoot Primerina17_eaglerNo ratings yet

- Certificate of AuthenticationDocument1 pageCertificate of AuthenticationPing SantillanNo ratings yet

- Legal Services AgreementDocument3 pagesLegal Services AgreementAbid Shah JillaniNo ratings yet

- PRE-TRIAL BriefDocument4 pagesPRE-TRIAL BriefValiant Aragon DayagbilNo ratings yet

- Aw - Theft Is Closely Related To The Crime of EstafaDocument2 pagesAw - Theft Is Closely Related To The Crime of EstafaNardz AndananNo ratings yet

- PhilHealth Circ2017-0003Document6 pagesPhilHealth Circ2017-0003Toche DoceNo ratings yet

- Bail TranscriptDocument13 pagesBail TranscriptavrilleNo ratings yet

- Notice of DeathDocument2 pagesNotice of DeathJane Carl De JesusNo ratings yet

- Pretrial BriedDocument3 pagesPretrial BriedPj TignimanNo ratings yet

- Security Rmc39 07Document2 pagesSecurity Rmc39 07Printet08No ratings yet

- Hlurb-Br 871 2011 Rules of ProcedureDocument31 pagesHlurb-Br 871 2011 Rules of ProcedureTata Hitokiri0% (1)

- Complaint MamertoDocument7 pagesComplaint MamertogiovanniNo ratings yet

- Legal Opinion On Naturalization FinalDocument4 pagesLegal Opinion On Naturalization FinalKitem Kadatuan Jr.No ratings yet

- Value Added TaxDocument38 pagesValue Added TaxAhmad AbduljalilNo ratings yet

- Moa Doj OmbDocument2 pagesMoa Doj OmbDesai Sarvida100% (1)

- Authority To SellDocument1 pageAuthority To SellAprilRoxaneBadilloBarroNo ratings yet

- Compromise - Separation Properties (Template)Document9 pagesCompromise - Separation Properties (Template)Paul Jomar AlcudiaNo ratings yet

- 2015 BIR Withholding Tax TableDocument1 page2015 BIR Withholding Tax TableJonasAblangNo ratings yet

- Regional Trial Court: Rosena and Juan, Civil Case No. 03-CvDocument3 pagesRegional Trial Court: Rosena and Juan, Civil Case No. 03-CvDrewz BarNo ratings yet

- MR BacDocument1 pageMR BacB-an JavelosaNo ratings yet

- RA10389-Recognizance Act of 2012-Internal GuidelinesDocument8 pagesRA10389-Recognizance Act of 2012-Internal Guidelinesmira_cieleNo ratings yet

- MT DivanDocument10 pagesMT DivanKarl Kristjan MoroNo ratings yet

- ObliCon Cases Fortuitous EventDocument41 pagesObliCon Cases Fortuitous EventReyzen Paul Unite MendiolaNo ratings yet

- Revenue Memorandum Order No. 37-94: March 25, 1994Document8 pagesRevenue Memorandum Order No. 37-94: March 25, 1994Rufino Gerard Moreno IIINo ratings yet

- Globe Telecom Inc.: Mutual Confidentiality and Non-Disclosure AgreementDocument3 pagesGlobe Telecom Inc.: Mutual Confidentiality and Non-Disclosure AgreementJaypee PimentelNo ratings yet

- Crime Free Lease AddendumDocument1 pageCrime Free Lease AddendumjmtmanagementNo ratings yet

- War crimes and crimes against humanity in the Rome Statute of the International Criminal CourtFrom EverandWar crimes and crimes against humanity in the Rome Statute of the International Criminal CourtNo ratings yet

- Rules Subpoena Duces TecumDocument3 pagesRules Subpoena Duces TecumCaroline Claire BaricNo ratings yet

- Vitug vs. CA FullDocument6 pagesVitug vs. CA FullJoanna MandapNo ratings yet

- Smart Communications, Inc. vs. Astorga - G.R. No. 148132Document14 pagesSmart Communications, Inc. vs. Astorga - G.R. No. 148132Joanna MandapNo ratings yet

- RR No. 30-02Document1 pageRR No. 30-02Joanna MandapNo ratings yet

- Ra 10021Document5 pagesRa 10021Joanna MandapNo ratings yet

- Revenue Regulation 2-99Document5 pagesRevenue Regulation 2-99Joanna MandapNo ratings yet

- 1.in The Matter of James Joseph HammDocument12 pages1.in The Matter of James Joseph HammJoanna Mandap100% (1)

- Sched 1st Sem 2013-2014Document1 pageSched 1st Sem 2013-2014Joanna MandapNo ratings yet

- CIR v. TMX SalesDocument7 pagesCIR v. TMX SalesJoanna MandapNo ratings yet

- 09-3243-RTJ DQ of JudgeDocument7 pages09-3243-RTJ DQ of JudgeJoanna MandapNo ratings yet

- Hotels in TuscanyDocument1 pageHotels in TuscanyJoanna MandapNo ratings yet

- Expansion of The Coverage of The Rules On Electronic EvidenceDocument1 pageExpansion of The Coverage of The Rules On Electronic EvidenceJoanna MandapNo ratings yet

- Weather Forecast in Tokyo For Oct 28Document1 pageWeather Forecast in Tokyo For Oct 28Joanna MandapNo ratings yet

- Pichel Vs Alonzo DigestDocument2 pagesPichel Vs Alonzo DigestJoanna MandapNo ratings yet

- Solemnities of WillsDocument15 pagesSolemnities of WillsJoanna MandapNo ratings yet

- 66.eurotech Industrial Technologies, Inc. v. Cuizon, 521 SCRA 584Document12 pages66.eurotech Industrial Technologies, Inc. v. Cuizon, 521 SCRA 584bentley CobyNo ratings yet

- Informative Speech, DISS. by Tine.Document2 pagesInformative Speech, DISS. by Tine.Tine DeguzmanNo ratings yet

- Provisional State Merit ListDocument101 pagesProvisional State Merit Listimran khanNo ratings yet

- Chapter 1 - Accounting For Business CombinationsDocument6 pagesChapter 1 - Accounting For Business CombinationsLyaNo ratings yet

- A. Unlawful Detention or ImprisonmentDocument2 pagesA. Unlawful Detention or ImprisonmentzurianimNo ratings yet

- CCA Recommendation ReportDocument7 pagesCCA Recommendation ReportWVXU News100% (1)

- Transaction Details Report PDFDocument25 pagesTransaction Details Report PDFShakhir MohunNo ratings yet

- National Values BookletDocument9 pagesNational Values BookletWanjikũRevolution KenyaNo ratings yet

- ScanDocument3 pagesScanJesus Alberto Jimenez VasquezNo ratings yet

- Supreme Court: Republic of The Philippines ManilaDocument2 pagesSupreme Court: Republic of The Philippines ManilaJopan SJNo ratings yet

- RefugeDocument101 pagesRefugesusanooo001No ratings yet

- Gov 2Document23 pagesGov 2faker321No ratings yet

- Mobilization and Empowerment of Marginalized Women in South AsiaDocument32 pagesMobilization and Empowerment of Marginalized Women in South AsiaaalsNo ratings yet

- Texas Certificate of TitleDocument2 pagesTexas Certificate of TitleArq Isaac TriujequeNo ratings yet

- Smart Governance E-Governance and Citizen ServicesDocument30 pagesSmart Governance E-Governance and Citizen ServicesAnkita SinhaNo ratings yet

- Administeration of Hazrat Umar Radi-Allahu-AnhuDocument8 pagesAdministeration of Hazrat Umar Radi-Allahu-AnhuRizwanaNo ratings yet

- Best High-Yield Savings AccountsDocument8 pagesBest High-Yield Savings AccountsCristian StoicaNo ratings yet

- Taxation 11 Attempts Compilation M24 - UnlockedDocument710 pagesTaxation 11 Attempts Compilation M24 - Unlockedthakursumit851No ratings yet

- Nigerian Star Rema Brings Out Patoranking During Nairobi Concert To Fans' SurpriseDocument1 pageNigerian Star Rema Brings Out Patoranking During Nairobi Concert To Fans' SurpriseKai MyriamNo ratings yet

- Tawheed Vol1 Basis of Islam and Its Essential PillarsDocument31 pagesTawheed Vol1 Basis of Islam and Its Essential PillarsWahidNo ratings yet

- Varottil UDocument447 pagesVarottil UpriyaNo ratings yet

- LifestoryDocument3 pagesLifestoryNats MagbalonNo ratings yet

- Ra092018 - Let (Catarman-Sec - Physical Science) PDFDocument2 pagesRa092018 - Let (Catarman-Sec - Physical Science) PDFPhilBoardResultsNo ratings yet

- Teme Lucrari de Licenta in Lb. Engleza 2014-2015Document2 pagesTeme Lucrari de Licenta in Lb. Engleza 2014-2015cociorvanmiriamNo ratings yet

- How Democratic Was Jacksonian Democracy?Document3 pagesHow Democratic Was Jacksonian Democracy?Butovski JovanNo ratings yet

- Guideline FOR Conducting Bird Protection Test ON Transformer Tank Cover PlatesDocument6 pagesGuideline FOR Conducting Bird Protection Test ON Transformer Tank Cover PlatesMohammedAhmadOsamaNo ratings yet

- Acceptance Letter ICCIASH-2023Document1 pageAcceptance Letter ICCIASH-2023SaumyaAcharyaNo ratings yet

- Baby Deed of Land Recording - SSNotary 1Document2 pagesBaby Deed of Land Recording - SSNotary 1LaLa Banks100% (1)

- BirlaDocument2 pagesBirlaviresh shindeNo ratings yet

- 1 Government of The Philippines V AburalDocument3 pages1 Government of The Philippines V AburalColee StiflerNo ratings yet