Professional Documents

Culture Documents

Life Cycle of A Trade: Training Academy

Life Cycle of A Trade: Training Academy

Uploaded by

Rana PrathapOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Cycle of A Trade: Training Academy

Life Cycle of A Trade: Training Academy

Uploaded by

Rana PrathapCopyright:

Available Formats

Life Cycle of a Trade

Training

Academy

Page 2

Introduction

Facilitator

Self

Course Outline

Break Timings

15 mins Forenoon

45 mins Lunch

15 mins Afternoon

Exectations

Page 3

Expectations

Static data

How trade is booked

Settlement and before settlement

Trade booking and settlement

Impact of incorrect settlement

Pre-matcing before a settlement

Entire life of a trade

!ront office " middle office

How trade is entered and ow it is booked

Page 4

#at is your Idea of

Life Cycle of a trade $$

Section %ne

Te &arket Participants

Page 6

Te &arket Participants - !acilitators

Brokers

!ealers

"n#estment Banks

Stock Exchanges

Agents

Securities Tra$ing Organisations

Custo$ians

Clearing Banks

%egulators

Page 7

Te &arket Participants - In'estors

"nstitutional "n#estors

&utual Fun$s '(nit Trusts)

*ension Fun$s

"nsurance Comanies

+e$ge Fun$s

Charities

"n$i#i$ual "n#estors

Page 8

Te &arketplace

Securities

Trading

House

Excanges

",-ESTO%S

"

,

-

E

S

T

O

%

S

",-ESTO%S

A.E,TS

A.E,TS

A

.

E

,

T

S

ISS(E)S

ISS(E)S

Securities

Securities

Page 9

&arkets " Stock Excanges

* &arket is an en'ironment in wic securities are

bougt and sold+ Central to some market places is te

Stock Excange+

Tra$es execute$ o#er an Exchange are execute$ /On0

Exchange1 or /Exchange Tra$e$1

Other tra$es execute$ o#er the telehone are /OTC1 'O#er

the Counter) or ,on0Exchange Tra$e$

Each securities market has an associate$ an$

recognisa2le lace to effect settlement

E3g3 French .o#ernment Bon$s tra$e$ on the *aris Bourse settle in

Euroclear

Page 10

Stock Excanges

%egion Countr4 Financial

Centre

Stock Exchange

Euroe (5 Lon$on Lon$on Stock Exchange 'LSE)

Lon$on &etal Exchange

Lon$on "nternational Financial Futures 6 Otions Exchange

'L"FFE)

.erman4 Frankfurt !eutsche Bourse

Sain &a$ri$ Bolsa $e &a$ri$

Asia *acificChina +ong 5ong Stock Exchange of +ong 5ong

+ong 5ong Futures Exchange

China Shen7hen

Shanghai

Shen7hen Stock Exchange

Shanghai Stock Exchange

8aan Tok4o Tok4o Stock Exchange

Tok4o "nternational Financial Futures Exchange 'T"FFE)

Singaore Singaore Stock Exchange of Singaore

Singaore "nternational &onetar4 Exchange 'S"&E9)

Australia S4$ne4 Australian Stock Exchange 'AS9)

America (SA ,e: ;ork

Chicago

,e: ;ork Stock Exchange ',;SE)

Chicago Stock Exchange

Page 11

%ter &arket Participants

Saleseole

!ata *ro#i$ers

%egistrars

Couon *a4ing Agents

Tra$e &atching Ser#ices

Settlement "nstruction Communication &echanisms

Page 12

&arket Participants - Issuers

%rganisations occasionally need to raise cas,capital to expand

teir businesses by-

Selling art o:nershi issuing shares or e<uit4

Borro:ing cash from in#estors issuing $e2t in the form of 2on$s

T4e of "ssuer Examle

Cororations -o$afone '(5)

So#ereign Entities 5ing$om of !enmark

Local .o#ernments Cit4 of Lon$on

.o#ernment Agencies Fe$eral ,ational &ortgage Association

Suranational Organisations "nternational Bank for %econstruction 6

!e#eloment '=orl$ Bank "B%!)

Page 13

#ere does .eutsce /ank fit$

.eutsce co'ers multiple functions-

Broker

!ealer

Fun$>Asset &anager

"n#estment Bank

"ssuer

.lo2al Custo$ian

%etail Bank

Page 14

So far Co'ered

I+ &arket Participants

Section Two

Static .ata

Page 16

#at is Static .ata$

Static .ata is te common term to describe te store of

information used to determine te appropriate actions

re0uired for successful processing of eac trade+

!or Example-

Tra$ing Entities

Tra$ing Books :ithin each entit4

Counterarties

"nstruments

Currencies

*rices

Page 17

Sources of Static .ata

=here ossi2le? financial institutions tr4 an$ create a core

of /.ol$en Source1 static $ata to a#oi$ $ata conflicts in

inter0$een$ent s4stems

Comanies secialise in gathering an$ $istri2uting

financial $ata to institutions #ia@

Electronic File Fee$s

"nternet

Through on site terminals3

Page 18

Security .ata Pro'iders or .ata 1endors

%euters

Bloom2erg

Telekurs

%olfe 6 ,olan

S="FT

!TCC

Alert !irect>O&.EO

Stan$ar$ an$ *oors

Euroclear

=allstreet

S"AC

,SCC

Page 19

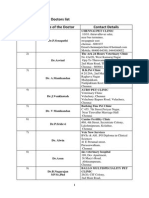

Counterparty Static .ata

,ame? A$$ress 6 Contact !etails

Authori7e$ Cre$it Limits

%elate$ Comanies

Stan$ar$ Settlement "nstructions

!ate of account set u

T4e of "nstitution

!ocumentation signe$

Tax Status

%egistere$ %eresentati#e

Confirmation !etails

Fax? Telex? Electronic Tra$e Confirmation? S="FT? Email

Page 20

Instrument Static .ata

T4e of instrument

E<uit4? Bon$? =arrant? !eri#ati#e? Commo$it4

"ssue

Short ,ame? Long ,ame? Si7e? !enomination? "ssuer

Couon !ates

Couon %ate? *a4ment Characteristics 0 AB>ACB? A>ACB etc

Alternati#e>External %eferences?

"S",? Common Co$e? %"C? Duick Co$e? Cusi etc

Exchange

Currenc4

&aturit4 !ate

Factors

Page 21

&aintaining Static .ata

Incorrect static data causes many processing errors-

!ela4e$ Confirmations

(nmatche$ Transactions

Settlement Failure

"ncorrect Fee calculations

"ncorrect *rofit 6 Loss Calculation

*oor %eorting '%egulator4 6 risk imact)

"ncrease$ cost er transaction $ue to re$uce$ ST*

Incorrect static data leads to reduced ser'ice and

dissatisfied customers+

Page 22

Static .ata Summary

Ba$ Static !ata results in re$uce$ ser#ice le#els to clients

$ue to rocessing hol$0us an$ ossi2le tra$e failure

Ba$ Static !ata imacts oerational risk an$ increases the

cost er tra$e rocesse$

Ba$ Static !ata contri2utes to oor internal 6 external

reorting imacting risk 6 reutation

Static !ata :ill continue to 2e an imortant $een$enc4

on the efficient rocessing of tra$es eseciall4 as the tra$e

lifec4cle :in$o: 2ecomes smaller

ST*TIC .*T*

&ust 2e oulate$ correctl4 :ithin all of the rele#ant s4stems3

&ust 2e o2taine$ from a cre$i2le source as timel4 as ossi2le3

Page 23

So far Co'ered

I+ &arket Participants

II+ Static .ata

Section Tree

Trade Execution " Trades Processing

Page 25

Straigt Troug Processing

S

t

r

a

i

g

t

T

r

o

u

g

P

r

o

c

e

s

s

i

n

g

2

S

T

P

3

Tra$e Execution

Tra$e "nstruction

Tra$e Confirmation>Affirmation>&atching

Tra$e *rocessing

Tra$e -ali$ation

Tra$e Cature

Tra$e Settlement

"nstruction>Agent &atching

Fails 6 Fail &anagement

Tra$e Enrichment

*

o

s

i

t

i

o

n

>

"

n

#

e

n

t

o

r

4

m

a

n

a

g

e

m

e

n

t

C

o

r

o

r

a

t

e

A

c

t

i

o

n

s

T

r

a

$

e

>

*

o

s

i

t

i

o

n

A

c

c

o

u

n

t

i

n

g

S

e

c

u

r

i

t

i

e

s

L

e

n

$

i

n

g

6

B

o

r

r

o

:

i

n

g

C

a

s

h

F

u

n

$

i

n

g

%

e

c

o

n

c

i

l

i

a

t

i

o

n

s

Page 26

#at is a Trade$

A legal contract 2et:een t:o EcounterartiesF3 A seller an$

a 2u4er3

The SELLER must $eli#er the commo$it4 he has sol$ to

the 2u4er3

The BUYER must a4 the agree$ urchase rice on the

agree$ #alue $ate3

Page 27

Te !ront %ffice

Tra$ing

Sales

Broking

Cororate Finance

%eo !esk

Page 28

#y Trade$

Seculate

*rofit from rice mo#e or increase in #alue of the asset3

Accumulate

Benefit from $i#i$en$ on shares an$ interest on 2on$s3

+e$ging@

To seculate an$ accumulate3

To re$uce risk3

Page 29

Trade Execution

Trade execution tends to operate in one of tree ways

were sellers and buyers execute trades-

Tra$ing Floor

Tra$itional metho$ of tra$ing face to face on the tra$ing floor of a

Stock Exchange3

Comuterise$ Exchanges

Esta2lishe$ in the (5 as art of the Big Bang in 1GHC3 This term

alie$ to the li2erali7ation of the Lon$on Stock Exchange 'LSE)

:hen Tra$ing :as automate$3

Telehone

Page 30

Trade Execution

!urtermore Trades can be-

Duote !ri#en

&arket &akers <uote rices #ia comuterise$ screens sho:ing the

le#el at :hich the4 are reare$ to 2u4 an$ sell :ith the intention of

attracting 2usiness3

,AS!AD '(S) SEAD '(5)

Or$er !ri#en

Or$ers from sellers are matche$ :ith 2u4ersF or$ers electronicall43

9etra '.erman4) SETS '(5) SEATS 'Australia)

Electronic Communications ,et:orks 'EC,)

EC,Fs oerate on an electronic 2asis onl43

Euro0&TS Brokertec Archielago

Page 31

Trade Capture

)egardless of te trade execution,origin4 all trades must be

recorded formally by te market participant+

To u$ate a tra$ing osition for a secific securit4 :ithin a tra$ing

2ook

To u$ate a#erage rice of the current tra$ing osition to ena2le the

tra$er to calculate tra$ing rofit or loss

To allo: tra$e $etail to 2e sent through to the Back Office for tra$e

rocessing an$ settlement

As art of &arket 6 %egulator4 %eorting re<uirements

To facilitate risk management

Traders use complex trading systems to facilitate trading " position

management4 trade processing is usually done 'ia /ack %ffice

processing systems+

Page 32

!ront %ffice Trade .etail

Tra$ing Book

Tra$e !ate

!eal Time

-alue !ate

Oeration 'e3g3 Bu4>Sell? Len$>Borro:? "n>Out)

Duantit4

"nstrument>Securit4

*rice

Counterart4

Page 33

Trade 1alidation

Tra$e #ali$ation occurs to check if the tra$e information recei#e$ in

the Back office s4stems correson$s :ith the Front Office recor$3

Tra$e #ali$ation inclu$es the checking of constituent static $ata

information@

Examles inclu$e@

"s the securit4 recognise$ on the s4stemI

"s the Counterart4 account recognise$I

"s the Tra$er allo:e$ to tra$e on the tra$ing 2ookI

"s the tra$ing 2ook #ali$ to tra$e securit4 xI

"s the #alue $ate a #ali$ settlement $ate in the location of settlementI

Are the securities restricte$I

*ll detected errors must be in'estigated and corrected+

Page 34

Trade Enricment

Tra$e enrichment exists to a$$ secific tra$e $ata to the

2asic tra$e $etail to allo: $o:nstream rocessing3

This $ata is not usuall4 hel$ in Front Office Tra$ing

s4stems3

This $ata can 2e a$$e$ manuall4 ho:e#er in the ST*

en#ironment the aim is to $eri#e this automaticall43

Examles inclu$e@

Calculation of cash #alues3

%egulator4 %eorting re<uire$3

Tra$e Confirmation re<uirements3

Selection of custo$ian $etails3

Selection of Settlement "nstructions an$ communication metho$3

Page 35

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Trades Processing

Section !our

Trade Confirmation

Page 37

Trade Confirmation,*greement

Tra$e Confirmation>Affirmation is an imortant rocess

re<uire$ to re$uce the risk of the traders P&L3

(ntil the counterart4 ackno:le$ges the tra$e $etail the

effect on the rice or <uantit4 of the tra$e is su2Ject to

change? imacting the tra$ers 2ook3

Tra$e agreement can 2e achie#e$ through@

Sen$ing tra$e confirmations to the counterart43

%ecei#ing tra$e confirmations from the counterart43

Tra$e or Contract &atching3

Tra$e Affirmation3

Page 38

Trade &atcing

Trade &atcing generally applies to mandatory

electronic matcing of trade details+

Both arties are re<uire$ to inut $etails to a central

matching facilit43

&atching results 'i3e3 matche$? unmatche$) are ro#i$e$

24 the tra$e matching facilit4 to 2oth arties3

Examles inclu$e@

Omgeo Central Tra$e &anager 'CT&)3

T%A9 '"nternationall4 tra$e$ $e2t 6 securities)3

!eositor4 Trust 6 Clearing Cororation '!TCC)

,ational Securities Clearing CororationFs Tra$e &atching Ser#ice3

',SCC)

Page 39

Trade *ffirmation

Trade *ffirmation relates to te electronic matcing of trade details

typically between securities institutions and Institutional clients+

Tra$e $etails are inut 24 the securities house an$ sent to a tra$e

affirmation facilit43

The Tra$e affirmation central hu2 sen$s on the message3

The institutional client agrees 'affirms) or $isagrees an$ the resonse

is sent 2ack to the securities house3

Both arties must su2scri2e to the ser#ice3

Examles inclu$e@

OmgeoFs Oas4s .lo2al s4stem3

F"9 '.lo2al)

Oas4s !omestic 0 '(S)

!TC "! '"nstitutional !eli#er4) '(S)

Page 40

Summary

/asic Principles

The longer a tra$eFs $etail remains unchecke$ after tra$e

$ate? the greater the risk of rice mo#ement an$ *6L

imact3

Tra$e confirmation>matching messages shoul$ 2e issue$

as soon as ossi2le after tra$e #ali$ation3

Timel4 an$ accurate confirmation generation is a maJor

client ser#ice consi$eration3

*romt actioning of all confirmation $iscreancies re$uces

tra$e risk3

Page 41

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

Section !i'e

Trade Instruction

Page 43

Settlement Instructions

Settlement Instructions are used to communicate te

mo'ement of securities and cas to te custodian+

Tra$e Agreement confirms the commercia detais of the

tra$e3

Settlement "nstructions in$icate the commercia detais of

the tra$e A,! the ocatio! an$ acco"!t detais for the

cash an$ securit4 mo#ements3 'Settlement !etails)3

Page 44

Instruction Content

Settlement Instructions tell te custodian,*gent to carry

out precise commands suc as-

The <uantit4 of securities to 2e recei#e$ or $eli#ere$3

The net settlement #alue to 2e ai$ or recei#e$3

From :hom securities :ill 2e recei#e$3

To :hom a4ment must 2e ma$e3

From :hom a4ment :ill 2e recei#e$3

To :hom securities must 2e $eli#ere$3

On :hich $ate to carr4 out these instructions3

Page 45

Instruction Communication &etods

S+#+I+!+T+

C%EST

!TC

Euroclear

Clearstream

Agent Banks

Custo$ians

Proprietary &essaging

C%EST

!TC

Eucli$ 'for Euroclear)

Ce$com 'for Clearstream)

Page 46

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

Section Six

Instruction,*gent &atcing

Page 48

#y do we matc instructions$

To reduce settlement risk by-

"ncreasing the chances of tra$e settlement on #alue $ate

%esol#ing $ifferences 2et:een tra$es an$ counterarties

Ena2ling accurate fun$ing of cash in nostro accounts

&anaging stock in#entor4 in $eositories

Page 49

&atcing at Te Settlement *gent

%nce Instructions a'e been recei'ed at te Custodian4

te next lifecycle steps include-

"nstruction &atching

Custo$ian attemt to match the instruction to the counterart4

instruction3

Status ($ate

Attachment of the current status of the instruction3

'matche$>unmatche$>unkno:n)3

(nmatche$ %esolution

"n#estigation an$ resolution of non0matching instructions3

Tra$e Settlement

($ating the current status :ithin the securities tra$ing

organisationFs 2ooks an$ recor$s3

Page 50

Instructions &atcing- Example

Securities

Trading

House

Counterparty

Securities

House

Counterart4

CS! or "CS!

"nstruction

Comarison

5

6

6

7

7

8

Status Status

Settlement

"nstruction

Settlement

"nstruction

Status

&atche$ or

(nmatche$

Status

&atche$ or

(nmatche$

1 "nstructions sent in 24 Securities +ouse an$ Counterart43

K "nstruction matching occurs3

A Status is recor$e$3

4 "nstruction Status '&atche$>(nmatche$) is sent 2ack to 2oth arties3

Page 51

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

Section Se'en

Trade Settlement

Page 53

Settlement Terminology

Trade settlement is te act of excanging securities and

cas between buyer and seller+

#a"e $ate > %o!tract"a Setteme!t $ate3

&ct"a Setteme!t

-alue !ate an$ Settlement !ate :ill 2e the same in the

maJorit4 of tra$e settlement cases3

A ercentage of tra$es fail to settle on #alue $ate an$ :ill

settle on another $ate referre$ to as the actual settlement

$ate3

Page 54

Settlement Considerations

How to ensure trade settlement

Ensure the seller hol$s the re<uire$ le#el of securities at

the correct custo$ian3

Some securities can settle at more than one location3

Ensure the urchaser has sufficient cash to make the

a4ment3

The urchaser ma4 aggregate 2alances o#er a num2er of accounts?

the total amount must co#er the amount re<uire$3 'Fun$ing)3

The urchaser ma4 ha#e a cre$it agreement :ith the custo$ian :ho

:ill co#er the cash shortfall3 'Secure$ cre$it line>O#er$raft)3

The urchaser ma4 ha#e a collateral agreement :here24 collateral

is hel$ in the account to offset an4 non return of fun$s3 '&argin)

Page 55

Types of Settlement

Full Settlement

*artial Settlement

Securities Onl4

Cash Onl4

Cross Currenc4 Settlement

,et Settlement

Page 56

Summary

Timely settlement of trades is an important part of te

Trade Lifecycle wit implications across te following

areas-

"n#entor4 &anagement

Cash &anagement

Settlement %isk

Cost &anagement

Firm %eutation

Page 57

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

Section Eigt

Position,In'entory &anagement

Page 59

In'entory &anagement

&anagement of te stock olding is an integral part of

trade settlement-

"n#entor4 &anagement ensures@

The correct amount of securities '!omi!a( are a#aila2le

At the correct location 'de)ot(*

At the correct time 'o! +a"e date(*

Page 60

&etods of In'entory &anagement

If securities are una'ailable we can consider te

following-

"nternal Book Transfer3

Borro: securities from another firm account same $eot3

%ealignment3

Borro: securities from another firm account $ifferent $eot3

Stock Borro: Loan Tra$e3

Borro: the securities from the market3

Auto2orro:3

Borro: the securities from the custo$ian>central $eositor43

Execute a %eurchase Agreement '%eo)

!o nothing an$ let the tra$e fail3

Page 61

In'entory " !unding &anagement

Transmit Settlement "nstruction

&atch Settlement "nstruction at Custo$ian

Settle at Custo$ian

Securities

Choices

Cas

Choices

.o 9oting Lend )epo .o 9oting

/orrow 'ia

)epo

/orrow

(nsecured

*uto/orrow

Page 62

*utomated Lending " /orrowing

Ser'ice pro'ided by large Custodians and Central

Security .epositories-

Borro:ers

Borro: re<uire$ securities automaticall43

Borro: certain t4es of securit4 automaticall4 i3e3 Sanish Bon$s3

Borro: uon re<uest3

Sometimes use$ as a last resort $ue to the cost3

Len$ers

Len$ all securities automaticall43

Len$ certain t4es of securit4 automaticall43

Len$ uon re<uest3

Page 63

How do Trades " Positions get updated$

Automate$ ($ates

"nstruction statuses are sent in 24 the custo$ian 'full4 settle$?

artiall4 settle$? faile$ etc)3

The Securities Tra$ing +ouse automaticall4 loa$s this information

into the settlements s4stems3

The s4stem attemts to locate the rele#ant tra$e in its internal 2ooks

an$ recor$s3

Once foun$ it recor$s the status u$ate against the transaction3

"t :ill also automaticall4 u$ate the rele#ant securit4 ositions an$

2alances reflecting the $eli#er4 or receits3

&anual ($ates

"n some cases it ma4 2e necessar4 to settle tra$e manuall4 an$ a

settlements secialist ma4 manuall4 recor$ the u$ate against the

tra$e recor$3

Page 64

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

Section 9ine

!ails " !ail &anagement

Page 66

!ailing Trades and teir Impact

A faile$ tra$e is an4 securities transaction that $oes not

settle on #alue $ate3

The 2u4er an$ seller are imacte$ 24 settlement failure@

(na2le to use the cash to fun$ other securit4 urchases3

(na2le to len$ on mone4 markets an$ earn cre$it interest on cash3

(na2le to a4 off existing o#er$raft>$e2t3

(na2le to use securities re<uire$ for an on:ar$ $eli#er4 causing a

2reak in the chain3

%isk imact $ue to mo#ement in the market causing a change in the

#alue of securities3 'mark to market)

Page 67

#y Trades !ail

"nstructions not recei#e$ 24 custo$ian

"nstructions remain unmatche$ on #alue $ate

"nsufficient cash? collateral? cre$it line

"nsufficient securities

Page 68

Te Importance of &anaging !ails

Fails ,i ha#e cash imlications

"nterest claims on fails to recei#e3

"nterest exense on fails to $eli#er3

Fails make the reconciliation of cororate actions $ifficult

:hich can lea$ to material losses

%egulator4 "mact 0 "n some markets fines are imose$ for

late tra$e settlement

Australia Fines are imose$ $ail4 from #alue $ate to settlement

$ate for tra$es execute$ on the Australian Stock Exchange3

(50 Fines are imose$ 24 C%EST from a mem2erFs failure to

achie#e re0$efine$ settlement targets3

Page 69

Interest Claims

An i!terest caim is comensation from the failing art4 to

for the loss of cash interest or use of securities3

Faile$ tra$es are monitore$ to $etermine the reason for failure an$

ena2le the interest claim to 2e execute$ against the counterart43

Some marketlaces 'e3g3 "S&A) ha#e minimum claima2le interest

recommen$ations an$ $ea$lines 24 :hich claims must 2e issue$3

Back Office Settlements a$$ immense #alue 24 acti#el4 monitoring

instruction statuses an$ heling to accuratel4 fun$ cash shortfalls or

short ositions3

"n some Securities Tra$ing +ouses? if the Firm Tra$er is at fault then

the cost of the fail can 2e $irectl4 attri2ute$ to their 2ook? imacting

their *6L3

Page 70

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

I:+ !ails " !ail &anagement

Section Ten

)econciliations

Page 72

#at are )econciliations

%econciliations exist to check the accurac4 of the firms

2ooks an$ recor$s@

"nternall4 2et:een s4stems an$ $eartments

Externall4 :here securities an$ cash are hel$3

A %econciliation Break is a $iscreanc4 2et:een one

recor$ an$ another

All 2reaks shoul$ 2e in#estigate$? accounte$ for an$

correcte$ to ensure continue$ integrit4

Automation of reconciliation reorting facilitates timel4

in#estigation an$ resolution of 2reaks on a $ail4 2asis

Page 73

#y do we monitor reconciliations$

%egulator4

&anaging %isk

Cororate Actions

T4es of %econciliations

*osition %econciliations

Tra$e %econciliations

S4stem %econciliations

Page 74

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

I:+ !ails " !ail &anagement

:+ )econciliations

Section Ele'en

Clearing and Custody

Page 76

Types of Custodian 6

Term !escrition Examle

Custo$ian An organisation that hol$s securities an$

cash on its clientsF 2ehalf an$ ma4 effect

tra$e settlement on its clientsF 2ehalf3

!eutsche Bank !omestic

Custo$4 Ser#ices

.lo2al Custo$ian As er custo$ian? 2ut has a net:ork of

local 'or su20custo$ians) that hol$

securities an$ cash an$ effect tra$e

settlement on 2ehalf of the glo2al

custo$ian3

State Street

Citigrou

Bo,;

*ari2as

Local Custo$ian A custo$ian that oerates :ithin a secific

financial centre3

Cre$it L4onnais *aris

Banco Esirito Santo

Lis2oa

Su20Custo$ian A custo$ian :ithin a .lo2al Custo$ianFs

net:ork of custo$ians3

Citi2ank &ilan

Citi2ank &a$ri$

Page 77

Types of Custodian 5

Term !escrition Examles

Central Securities

!eositor4 'CS!)3

,ational Central

Securities !eositor4

',CS!)

An organisation that hol$ securities?

normall4 in 2ook entr4 formL usuall4 the

lace of settlement? effecte$ through 2ook

transfer3

A CS! that han$les $omestic securities of

the countr4 in :hich it is locate$3

!TC '(SA)

C%EST '(5 6 Eire)

8AS!EC '8*;)

CCASS '+5)

"nternational Central

Securities !eositor4

'"CS!)

A CS! that han$les $omestic an$

international securities3

Onl4 t:o organisations are recognise$ as

"C!SFs3

Euroclear 'Brussels)

Clearstream

'Luxem2ourg)

Settlement Agent An organisation that effects the exchange

of securities an$ cash on 2ehalf of its

clientsL resultant securities an$ cash

2alances ma4 or ma4 not 2e hel$3

Citi2ank &ilan

Citi2ank &a$ri$

Page 78

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

I:+ !ails " !ail &anagement

:+ )econciliations

:I+ Clearing " Custody

Page 79

#at is a Corporate *ction$

*ny action by an Issuer wic may affect te in'estor-

The $istri2ution of 2enefits to existing sharehol$ers or

2on$hol$ers

Couon *a4ments

Cash !i#i$en$s

Stock !i#i$en$s

A change in the structure of an existing securit4

Stock Slit

Bonus Shares

A notification that ma4 or ma4 not re<uire a resonse from

the securities o:ner

Annual &eeting

-oting %ights

Section Twel'e

Trade " Position *ccounting

Page 81

Controlling

Te accounting group witin te bank is responsible for

correctly recording and monitoring all of te financial

transactions occurring witin te Securities Trading

House-

.eutsce /ank Controllers include-

Legal Entit4 Controller 'LEC)

%esonsi2le for !B Comanies3

Business Area Controller 'BAC)

%esonsi2le for ro$uct lines an$ the Business3

Central Functions %isk Controlling

%esonsi2le for &anaging %isk across the all $i#isions centrall43

Page 82

Controlling )esponsibilities

&onitor Stock>Securit4 *ositions

&onitor Cash Balances

Track Firm Books an$ %ecor$s

Create .oo$ *rocesses

Create Controls

%econcile Tra$e !ata

%econcile Cash Flo:

%econcile all 8ournal acti#it4

Page 83

Example Control )eports

%econciliations

*rofit an$ Loss Statement '*6L)

Balance Sheet %eorting 'BS)

Bu4 an$ +ol$ %eorting 'B6+)

&anagement "nformation %eorting '&"S)

Cre$it %isk %eorting 'C%ES)

Page 84

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

I:+ !ails " !ail &anagement

:+ )econciliations

:I+ Clearing " Custody

:II+ Trade " Position

*ccounting

Section Tirteen

)egulatory " Compliance

)esponsibilities

Page 86

)egulators

)egulatory autorities exist witin te securities

industry to ensure-

All 2usiness un$ertaken :ithin the marketlace is $one in

the roer manner

To rotect in#estors :ho are articiants :ithin the

marketlace

.uar$ the reutation an$ integrit4 of the marketlace

&onitor acti#it4 :hich fails outsi$e of normal 2usiness

tra$ing ractice

Page 87

)egulator )esponsibilities

Assessing suita2ilit4 of securities tra$ing houses to

articiate :ithin the market lace3

&onitor the 2usiness un$ertaken 24 securities tra$ing

houses? in#estment a$#isors 6 fun$ managers3

Enforcement of la:s an$ ossi2le rosecution of securit4

la: #iolators3

Page 88

!inancial )egulatory *utorities

Countr4 %egulator4 Authorit4

Australia Australian Securities 6 "n#estments Commission

*ru$ential %egulator4 Authorit4

Bahamas Bahamas Central Bank

France Commission $es Oerations $e Bourse

Ban<ue $e France

+ong 5ong Securities 6 Futures Commission

&onetar4 Authorit4

8aan Financial Suer#isor4 Agenc4

Financial %econstruction Commission

Singaore &onetar4 Authorit4 of Singaore

(5 Financial Ser#ices Authorit4 'FSA)

(SA Securities 6 Exchange Commission 'SEC)

(S Commo$it4 Futures Tra$ing Commission

,ational Futures Association

Page 89

)eporting &etods

* number of metods exist dependent on ow te local

)egulator re0uires reporting to be effected

Automatic for:ar$ing of tra$e $etails 24 a comuterise$

exchange re<uiring no a$$itional reorting

Automate$ message transmission 24 the mem2er for

confirmation>matching>instruction uroses art of :hich is

use$ to satisf4 transaction reorting re<uirements

File fee$s ro$uce$ from Front Office>Back

Office>Controlling s4stems an$ sent $irect to %egulator

Page 90

Compliance

Compliance is te /ank;s internal regulator+

)esponsibilities include-

Ensuring comliance to rules of aroriate financial

regulator4 2o$4

+an$ling confi$ential information

Ensure that ersonnel are a$e<uatel4 an$ roerl4

license$ to oerate in the marketlace

&anaging anti0mone4 laun$ering regulations

&onitoring Emlo4ee *ersonal Tra$ing

Page 91

So far Co'ered

I+ &arket Participants

II+ Static .ata

III+ Trade Execution " Processing

I1+ Trade Confirmation

1+ Trade Instruction

1I+ Instruction , *gent &atcing

1II+ Trade Settlement

1III+ Position , In'entory &anagement

I:+ !ails " !ail &anagement

:+ )econciliations

:I+ Clearing " Custody

:II+ Trade " Position

*ccounting

:III+ )egulatory "

Compliance

Section !ourteen

Conclusions

Page 93

Conclusions

%e$uce Settlement C4cles

"ncrease Straight Through *rocessing for tra$es

"ncrease use of central Counterarties

"ncrease use of /.ol$en Source1 static $ata

Acti#e management of collateral

&inimise %isk

&inimise Oerational Cost

Offer increase$ ser#ice to clients

&anage increasing #olumes

&aximise internal efficienc4

Section !ifteen

)eferences

Page 95

)ecommended )eading

&ichael Simmons

Securities Oerations A .ui$e to Tra$e 6 *osition &anagement

Stehen -al$e7

An "ntro$uction to =estern Financial &arkets

!a#i$ !ase4

An "ntro$uction to E<uit4 &arkets

&oora$ Chou$hr4

An "ntro$uction to %eo &arkets

%o2ert +u$sen

Treasur4 &anagement

Financial Engineering

The +an$2ook of E<uit4 !eri#ati#es

Oxfor$ aer2acks

!ictionar4 of Finance 6 Banking

Page 96

Industry #ebsites

htt@>>:::3crestco3co3uk> C%EST

htt@>>:::3$tcc3com> !eositor4 Trust 6 Clearing Cororation

htt@>>:::3euroclear3com> Euroclear

htt@>>:::3Jas$a<3co3J>in$exMen3Js 8aanese Securities !eositor4 Centre

htt@>>:::3isma3org>home3html "nternational Securities &arket Associations

htt@>>:::32ankofenglan$3co3uk>Links>setframe3html Bank of Englan$

htt@>>:::3fsa3go#3uk> Financial Ser#ices Authorit4

htt@>>:::3sec3go#> Securities Exchange Commission

htt@>>:::3nas$a<3com> ,ational Association of Securities !ealers

Automate$ Duotations3

htt@>>:::3amex3com> American Stock Exchange

htt@>>:::3lon$onstockexchange3com>Lon$on Stock Exchange

htt@>>:::3lchclearnet3com> Lon$on Clearing +ouse

htt@>>:::3liffe3com> "nternational Financial Futures 6 Otions

Exchange

Page 97

Industry #ebsites

htt@>>:::3iosco3org>iosco3html "nternational Organ Securities Commission

htt@>>:::3ima3org3uk> "nternational *rimar4 &arket Association

htt@>>:::3is$a3org>in$ex3html "nternational S:as 6 !eri#ati#es Association

htt@>>:::3isla3co3uk> "nternational Securities Len$ing Association

htt@>>:::3isma3com>home3html "nternational Securities &arket Association

htt@>>:::3li2a3org3uk> Lon$on "n#estment Bank Association

htt@>>:::3lsta3org> Loan S4n$ic Tra$ing Association

htt@>>:::3sia3com> Securities "n$ustr4 Association

htt@>>:::3securities0institute3org3uk Securities "nstitute

htt@>>$sace3$ial3iex3com>Jhalse4> Comliance Exchange

htt@>>:::3:orl$0exchanges3org> Fe$eration of Exchanges

htt@>>:::3triotima3com>tri> OTC !eri#ati#es termination ser#ice

htt@>>:::3finan70a$ressen3$e>=E0fin0regulator43html

Financial %egulator4 Authorities

Page 98

Industry #ebsites

htt@>>:::3exchange0han$2ook3co3uk>Exchange +an$2ook

htt@>>:::3in#estor:or$s3com> .lossar4

htt@>>:::3stforum3com> ST* Forum

htt@>>:::3stinfo3com> ST* "nfo

htt@>>:::3afonline3org> Association for Financial *rofessionals

htt@>>:::3calers3ca3go#>in$ex3JsI2cN>in#estments>straightthrough3xml

-irtual &atching (tilities '-&(s)L

htt@>>:::3omgeo3com> O&.EO

htt@>>:::3sungar$3com> Sungar$ S4stems

You might also like

- Flying Buffalo - Grimtooths Traps Too PDFDocument98 pagesFlying Buffalo - Grimtooths Traps Too PDFВячеслав100% (1)

- A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansFrom EverandA Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansRating: 5 out of 5 stars5/5 (1)

- Clearing Und Collateral PDFDocument37 pagesClearing Und Collateral PDFPauline Tykochinsky100% (2)

- Murex Training at Analyst360Document13 pagesMurex Training at Analyst360AnalystNo ratings yet

- OTC Trade Life CycleDocument157 pagesOTC Trade Life CycleMilt0577No ratings yet

- Common Derivative ProductsDocument71 pagesCommon Derivative Productsapi-19952066100% (2)

- Trade Life CycleDocument313 pagesTrade Life Cyclekulbhushan.baghel100% (2)

- Securities Trade Life CycleDocument28 pagesSecurities Trade Life CycleUmesh Bansode100% (4)

- A Study On Murex-AparnaDocument11 pagesA Study On Murex-AparnaG.v. Aparna50% (2)

- Trading and Settlement OverviewDocument21 pagesTrading and Settlement Overviewprabjyotkaur100% (2)

- Asset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectFrom EverandAsset-backed Securitization and the Financial Crisis: The Product and Market Functions of Asset-backed Securitization: Retrospect and ProspectNo ratings yet

- Income TaxDocument59 pagesIncome TaxRicha Bansal100% (4)

- Insider's Guide to Fixed Income Securities & MarketsFrom EverandInsider's Guide to Fixed Income Securities & MarketsRating: 5 out of 5 stars5/5 (1)

- Collateral Management GuideDocument20 pagesCollateral Management Guidereggie1010100% (3)

- Notice of Board Meeting: DHRAI Officers Attn: All Dhrai Board of TrusteeDocument1 pageNotice of Board Meeting: DHRAI Officers Attn: All Dhrai Board of TrusteePG and Sons IncNo ratings yet

- Life Cycle of A Trade: Training AcademyDocument98 pagesLife Cycle of A Trade: Training Academymox222No ratings yet

- (Lehman Brothers) Introduction To Asset Swaps, PDFDocument12 pages(Lehman Brothers) Introduction To Asset Swaps, PDFexplore651100% (1)

- European Fixed Income Markets: Money, Bond, and Interest Rate DerivativesFrom EverandEuropean Fixed Income Markets: Money, Bond, and Interest Rate DerivativesJonathan A. BattenNo ratings yet

- The Prime Brokerage Business PDFDocument20 pagesThe Prime Brokerage Business PDFmart2xipeco0% (1)

- Trading Front, Middle, Back OfficeDocument2 pagesTrading Front, Middle, Back OfficeAnkit Johari100% (1)

- Philip Green: Project Manager and Senior Business AnalystDocument5 pagesPhilip Green: Project Manager and Senior Business AnalystPhilip GreenNo ratings yet

- Life Cycle of A Trade: Training AcademyDocument98 pagesLife Cycle of A Trade: Training AcademyPavan Patil75% (4)

- Strategies of Banks and Other Financial Institutions: Theories and CasesFrom EverandStrategies of Banks and Other Financial Institutions: Theories and CasesNo ratings yet

- Derivatives and Trade Life CycleDocument19 pagesDerivatives and Trade Life Cyclepriyanka parakh80% (5)

- Murex Know HowDocument16 pagesMurex Know HowG.v. Aparna86% (7)

- The Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementFrom EverandThe Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementNo ratings yet

- Murex Services FactsheetDocument16 pagesMurex Services Factsheetmeetniranjan14100% (1)

- Calypso's Front Office: - Tools For TradingDocument11 pagesCalypso's Front Office: - Tools For TradingJames BestNo ratings yet

- Murex Services FactsheetDocument16 pagesMurex Services FactsheetG.v. Aparna100% (1)

- Chennai Veterinary Doctors ListDocument7 pagesChennai Veterinary Doctors Listsrinivasa777100% (1)

- OTC Derivatives ModuleDocument7 pagesOTC Derivatives ModulehareshNo ratings yet

- Unit 3.2 - Material HandlingDocument23 pagesUnit 3.2 - Material Handlinglamao123No ratings yet

- Introduction To Securities Trade LifecycleDocument8 pagesIntroduction To Securities Trade LifecycleSandra PhilipNo ratings yet

- Summit Versus Calypso - The Big FightDocument4 pagesSummit Versus Calypso - The Big Fightsosn100% (2)

- SS&C GlobeOp - FA ModuleDocument34 pagesSS&C GlobeOp - FA ModuleAnil Dube100% (1)

- Equity Security Trade Life CycleDocument9 pagesEquity Security Trade Life Cyclepshu25100% (2)

- MurexDocument5 pagesMurexKumarReddyNo ratings yet

- Calypso Business Analyst - Case Study - Fortis InvestmentsDocument3 pagesCalypso Business Analyst - Case Study - Fortis InvestmentsPhilip Green100% (1)

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- Trade Life Cycle EventsDocument5 pagesTrade Life Cycle Eventsvyassv100% (1)

- MX ML Exchange Tasks InstallationDocument8 pagesMX ML Exchange Tasks InstallationIanDolan75% (4)

- Dev GuideDocument195 pagesDev GuideArun Singh100% (2)

- Trade Life CycleDocument2 pagesTrade Life CycleYuvaraj Yr50% (2)

- Know About Calypso's Capital Market SolutionsDocument2 pagesKnow About Calypso's Capital Market SolutionsCalypso TechnologyNo ratings yet

- Derivatives in a Day: Everything you need to master the mathematics powering derivativesFrom EverandDerivatives in a Day: Everything you need to master the mathematics powering derivativesNo ratings yet

- Murex Modelling Services: An IntroductionDocument11 pagesMurex Modelling Services: An IntroductionpurushottamNo ratings yet

- Trade Initiation Stage Trade Execution Stage Trade Capture Stage Trade EnrichmentDocument5 pagesTrade Initiation Stage Trade Execution Stage Trade Capture Stage Trade EnrichmentNitish JhaNo ratings yet

- Murex FRTB 0916Document33 pagesMurex FRTB 0916sasankgogineni100% (3)

- Calypso TrainingDocument143 pagesCalypso TrainingDamon Yuan100% (1)

- Trade Life Cycle/Securities Trade Life Cycle: PRO VersionDocument7 pagesTrade Life Cycle/Securities Trade Life Cycle: PRO VersionPrasannaNo ratings yet

- MXML ARAA 0.2 PDFDocument47 pagesMXML ARAA 0.2 PDFIanDolan0% (1)

- MX 3.1 Pre-Post Trade WorkflowsDocument67 pagesMX 3.1 Pre-Post Trade Workflows王晓斌100% (3)

- Trade Life Cycle - The Process of Buying & SellingDocument10 pagesTrade Life Cycle - The Process of Buying & Sellingamitabhsinghania100% (1)

- Calypso Front Office SyllabusDocument3 pagesCalypso Front Office SyllabusJames Best100% (2)

- Schumann Etudes TreatiseDocument84 pagesSchumann Etudes TreatiseMarina SimeonovaNo ratings yet

- Business Analyst - MurexDocument2 pagesBusiness Analyst - MurexBogdan Dobrie100% (1)

- Derivative Instruments: A Guide to Theory and PracticeFrom EverandDerivative Instruments: A Guide to Theory and PracticeRating: 5 out of 5 stars5/5 (1)

- Model Test Paper 1Document3 pagesModel Test Paper 1Aman bansalNo ratings yet

- An Outline of The Method of Bhakti YogaDocument7 pagesAn Outline of The Method of Bhakti YogaNessuno NessunoNo ratings yet

- Delimitation CommissionDocument3 pagesDelimitation CommissionNavraj Singh SahiNo ratings yet

- Vision 2050 Pomegranate NRC, Sholapur PDFDocument40 pagesVision 2050 Pomegranate NRC, Sholapur PDFRaghavendra Gunnaiah0% (1)

- By Jamal Nasir 092-042-03004205754Document88 pagesBy Jamal Nasir 092-042-03004205754jgNo ratings yet

- BSC (Hons) Computer Science With Network Security: School of Innovative Technologies and EngineeringDocument13 pagesBSC (Hons) Computer Science With Network Security: School of Innovative Technologies and EngineeringHarryNo ratings yet

- Grade-3 Final PDFDocument30 pagesGrade-3 Final PDFJuvy Ann PalaginogNo ratings yet

- CTI Program FlyerDocument1 pageCTI Program Flyeramol awateNo ratings yet

- (PC) Weaver v. California Correctional Institution Confinement Shu - Document No. 3Document2 pages(PC) Weaver v. California Correctional Institution Confinement Shu - Document No. 3Justia.comNo ratings yet

- Running Dictation & Pronunciation WorksheetsDocument3 pagesRunning Dictation & Pronunciation WorksheetsDiana RenkeNo ratings yet

- Subject:: Social Science (For Mid-Term Exams.)Document2 pagesSubject:: Social Science (For Mid-Term Exams.)SKULL XT GAMINGNo ratings yet

- Bài Tập Chapter 3Document7 pagesBài Tập Chapter 3Huỳnh Ngọc Bảo TrânNo ratings yet

- Department of Education: Panggulayan Elementary School State of The School Address (Sosa) S.Y. 2020-2021Document3 pagesDepartment of Education: Panggulayan Elementary School State of The School Address (Sosa) S.Y. 2020-2021ROSE AMOR M. LACAYNo ratings yet

- As You Like IttDocument9 pagesAs You Like IttdanahansttNo ratings yet

- Protecting The Marine EnvironmentDocument13 pagesProtecting The Marine EnvironmentCirilo Aguadera Lagnason Jr.No ratings yet

- Simon Vs Human Rights CommissionDocument16 pagesSimon Vs Human Rights Commissionvj hernandezNo ratings yet

- Manual EAGLEDocument248 pagesManual EAGLEapi-3837584100% (2)

- Dakota Okhanpi IndexDocument61 pagesDakota Okhanpi IndexDawi Ironlegs100% (1)

- Solvent Cements For Poly (Vinyl Chloride) (PVC) Plastic Piping SystemsDocument5 pagesSolvent Cements For Poly (Vinyl Chloride) (PVC) Plastic Piping SystemsDavid SolisNo ratings yet

- House Viewing ChecklistDocument4 pagesHouse Viewing ChecklistGeorge CNo ratings yet

- Vsphere Esxi 703 Installation Setup GuideDocument238 pagesVsphere Esxi 703 Installation Setup GuideErdem EnustNo ratings yet

- OMC 140 Installation Manual v1.18Document68 pagesOMC 140 Installation Manual v1.18Joshua SissonNo ratings yet

- Pre Admission Math Assessment SampleDocument11 pagesPre Admission Math Assessment SamplePriscilla AddoNo ratings yet

- Properties of Cardiac MuscleDocument5 pagesProperties of Cardiac Musclekiedd_04100% (4)