Professional Documents

Culture Documents

Income Tax Calculation Statement For The Year 2001-2002

Uploaded by

elango1280 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

9-ITCS 02-03

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageIncome Tax Calculation Statement For The Year 2001-2002

Uploaded by

elango128Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

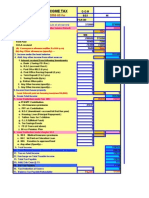

INCOME TAX CALCULATION STATEMENT FOR THE YEAR 2001-2002

1 .Name :

2 .Designation . :

3 .Total Salary Income. :

(Pay+DA+HRA+SPL.Pay+P.P+IR+MA)..

4 .Less HRA Exempted Under Sec.10(13A) :

a) Actual HRA Received :

b) Actual rent paid in excess of 10% of salary :

(Pay+D.A) (ie actual rent paid minus10%of salary)

c) 40% of Salary in A class city :

d) HRA Exempted whichever is least :

5 .Salary Income 3 – 4 :

6 Standard Deduction of Salary(item5)1/3 subject to :

The maximum of Rs30,000/=upto1.5 lakh

More nthan 1.5to3Lakh Rs 25000

a) Professional Tax paid :

7 .Gross Total income 5-6(Nearest Ten Rs) :

Gujrath fund…………… :

8 .If physically handicapped or totally blind deduction of :

Rs.20000/= /US 80U,80D/88D..

9 . Total Income 7-8 :

10Tax total income 1996 -97 :

Rs.1 to 50000……..nil :

Rs.50001to 60000……10% :

Rs60001 to150000…..20% :

Rs15001&above……..30%

Total Tax……………….. :

: Less rebate@20%upto 1.5 lakh

Less rebate@15%above 1.5 lakh

11.Less Rebate at 20% of the following items :

(Rounded off nearest rupee)

GPF Subscription :

FBF

SBF ;

PLI/LIC Premium :

NSC, Accrued interest

Housing loan principle Max Rs 10,000 :

Total :

12.Tax Arrived :

13So far I.T Deducted :

14..Balance I.T Deducted :

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Ca Inter Full Book 2Document32 pagesCa Inter Full Book 2Amar SharmaNo ratings yet

- Income Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)Document5 pagesIncome Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)gdmurugan2k7No ratings yet

- Computation of Total Income & Tax LiabilityDocument5 pagesComputation of Total Income & Tax LiabilityMehtab MalikNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetpalkwahNo ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Previous Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Document4 pagesPrevious Year April To June July To March 2016-17 Nil 15000 2017-18 15000 16500 2018-19 16500 18000 2019-20 18000 19500Sumit PattanaikNo ratings yet

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- CTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceDocument12 pagesCTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceNamita BhattNo ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeDocument4 pagesIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- Income Tax 2020-21 SolvedDocument61 pagesIncome Tax 2020-21 SolvedSyed QasimNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Complete Book P4 UDCDocument145 pagesComplete Book P4 UDCshubham0% (1)

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- 3 ADocument3 pages3 ATris EatonNo ratings yet

- DT Simplified Part IDocument79 pagesDT Simplified Part IPradeep MohantyNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- Paper 4Document16 pagesPaper 4Kali KhannaNo ratings yet

- Income TaxDocument79 pagesIncome TaxRaj HanumanteNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Income Tax Calculation MemoDocument3 pagesIncome Tax Calculation Memoajeetpoly100% (3)

- Chapter-1 Basic Concepts PDFDocument11 pagesChapter-1 Basic Concepts PDFBrinda RNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- RC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeDocument7 pagesRC Nirc, Ra, Nra-Etb Nra-Netb: Taxpayer Tax Base Source of Taxable IncomeGwyneth GloriaNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- Student Handout - Income Tax (Part 2) - 1Document4 pagesStudent Handout - Income Tax (Part 2) - 1debNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Summary of SalaryDocument6 pagesSummary of SalaryRahul GhosaleNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- It Compliance 2019 20Document8 pagesIt Compliance 2019 20Giri SukumarNo ratings yet

- Tax Liab. of Ind.Document13 pagesTax Liab. of Ind.Arun SwamiNo ratings yet

- Income From SalaryDocument6 pagesIncome From SalaryMuhammad FaisalNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Corporate TaxDocument48 pagesCorporate TaxNidzSinghNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- Ibps - Cwe - Clerks - VDocument2 pagesIbps - Cwe - Clerks - VJeganNo ratings yet

- New Course Solutions May 2019Document18 pagesNew Course Solutions May 2019Kali KhannaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- 9certificate 02-03Document1 page9certificate 02-03elango128No ratings yet

- 8certificate 01-02Document1 page8certificate 01-02elango128No ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- 6certificate99 00Document1 page6certificate99 00elango128No ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- 7certificate 00-01Document1 page7certificate 00-01elango128No ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- 5certificate98 99Document1 page5certificate98 99elango128No ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- 4certificate97 98Document1 page4certificate97 98elango128No ratings yet