Professional Documents

Culture Documents

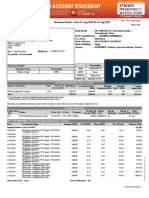

Deposit Amount Date of Issue Rate of Interest (P.a.) Maturity Date Maturity Amount

Uploaded by

dpk00 ratings0% found this document useful (0 votes)

48 views1 pageThis document is a term deposit receipt for Ganga Prasad showing details of a fixed deposit of INR 100,000 with an interest rate of 8.5% per annum maturing on September 10, 2014 with the maturity amount of INR 106,420.35. The deposit was made on December 14, 2013 for a period of 0 months and 270 days at the Lucknow branch. Ganga Prasad is the sole account holder and Pratibha Pant is listed as the nominee. The document also provides information about requirements to furnish a Permanent Account Number to claim tax benefits and notes that interest earned on NRO accounts is taxable under Section 195 of the Income Tax Act.

Original Description:

Original Title

300710391048

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a term deposit receipt for Ganga Prasad showing details of a fixed deposit of INR 100,000 with an interest rate of 8.5% per annum maturing on September 10, 2014 with the maturity amount of INR 106,420.35. The deposit was made on December 14, 2013 for a period of 0 months and 270 days at the Lucknow branch. Ganga Prasad is the sole account holder and Pratibha Pant is listed as the nominee. The document also provides information about requirements to furnish a Permanent Account Number to claim tax benefits and notes that interest earned on NRO accounts is taxable under Section 195 of the Income Tax Act.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views1 pageDeposit Amount Date of Issue Rate of Interest (P.a.) Maturity Date Maturity Amount

Uploaded by

dpk0This document is a term deposit receipt for Ganga Prasad showing details of a fixed deposit of INR 100,000 with an interest rate of 8.5% per annum maturing on September 10, 2014 with the maturity amount of INR 106,420.35. The deposit was made on December 14, 2013 for a period of 0 months and 270 days at the Lucknow branch. Ganga Prasad is the sole account holder and Pratibha Pant is listed as the nominee. The document also provides information about requirements to furnish a Permanent Account Number to claim tax benefits and notes that interest earned on NRO accounts is taxable under Section 195 of the Income Tax Act.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

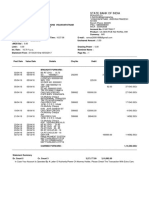

GANGA PRASAD FD No : 300710391048

A-15 KURMANCHAL NAGAR PO RSM NAGAR Customer No : 10159045

Branch Name : LUCKNOW

Period of Deposit : 0 Month(s) 270 Day(s)

LUCKNOW, UTTAR PRADESH Deposit Type : TERM DEPOSIT - DOMESTIC (REINVESTMENT)

Pincode : 226016

Nominee : Y Account Holder(S) : GANGA PRASAD

Lien : N Joint Account Holder 1 : PRATIBHA PANT

Joint Account Holder 2 : N/A

Deposit Amount Date of Issue Rate of Interest (p.a.) Maturity Date Maturity Amount

INR 100000.00 14-12-2013 8.50% 10-09-2014 INR 106420.35

Deposit amount (in words) :

Interest payment frequency :

Indian Rupee One Hundred Thousand Only

Quarterly Compounded

*Maturity amount is subject to change in case of TDS/part withdrawal.

*This is a valid computer generated advice and does not require a stamp/signature.

*Please ignore this advice if you have redeemed or renewed this deposit on or after the maturity date as mentioned.

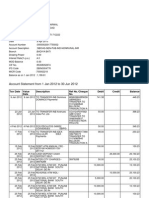

Requirement to furnish Permanent Account Number (applicable to Domestic & NRO Accounts)

1. Under newly inserted section 206AA of the Income Tax Act, 1961, w.e.f. 1st April 2012, non-furnishing of PAN to deductor ( i.e to bank)

would result in deduction of TDS at higher rate of 20%.

2. Declaration in 15G/15H under section 197A for non deduction of TDS shall be invalid if it does not contain PAN and bank shall proceed

with deduction of TDS at higher rate as mentioned above.

In view of above amendments it would be in the best interest of the customers to furnish the photocopy of the PAN card (if not submitted

earlier) to the branch where the account is maintained.

1. NRO deposit holders cannot claim DTAA benefit if PAN is not provided. Tax will be deducted at 30.90% for non PAN customers inspite

of TRC submission.

Non-Resident Deposits

- Every rupee earned as interest on NRO deposits is taxable under Sec. 195 of Income Tax Act. There is no threshold limit.

- Interest earned on NRE / FCNR deposits is exempted under Sec. 10 of Income Tax Act.

Resident Customers

Non-Resident Customers

You might also like

- Rate of Interest (% P.a.)Document2 pagesRate of Interest (% P.a.)MeeNo ratings yet

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDocument2 pagesAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- HDFC YsDocument2 pagesHDFC YsAkshat ShahNo ratings yet

- Acctstmt HDocument3 pagesAcctstmt Hmaakabhawan26No ratings yet

- FD ReceiptDocument2 pagesFD ReceiptRaghavendra KumarNo ratings yet

- Icici Bank: METRO BRANCH (13398)Document1 pageIcici Bank: METRO BRANCH (13398)Mayank chauhan100% (1)

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceShivam SinghNo ratings yet

- ReceiptDocument2 pagesReceiptAjinder Pal Singh ChawlaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceAster D SilvaNo ratings yet

- IDfC FD CertificateDocument3 pagesIDfC FD Certificatenisha bhardwaj100% (1)

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicekunal singhNo ratings yet

- E-Fixed Deposit Account ReceiptDocument1 pageE-Fixed Deposit Account ReceiptEsther DregoNo ratings yet

- Sbi Fix Deposit Slip PDFDocument1 pageSbi Fix Deposit Slip PDFAbdullah siddikiNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceTuhin ChakrabortyNo ratings yet

- Customer Name: Customer Number Debit Account Number: Scheme: Mode of Operation Maturity InstructionDocument1 pageCustomer Name: Customer Number Debit Account Number: Scheme: Mode of Operation Maturity InstructionSurya Goud0% (1)

- Hishu FD PDFDocument1 pageHishu FD PDFFresher NoobNo ratings yet

- Ramayana VishavrukshamDocument2 pagesRamayana VishavrukshamSRIDHAR allhari0% (1)

- SSG TAX SAVING FD PDFDocument1 pageSSG TAX SAVING FD PDFamirunnbegamNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicemozo dingdongNo ratings yet

- Yes Bank Interest CertificateDocument1 pageYes Bank Interest CertificateSourabh PunshiNo ratings yet

- StatementOfAccount 225476905 Jan06 133048 PDFDocument7 pagesStatementOfAccount 225476905 Jan06 133048 PDFmannarmannanNo ratings yet

- 12154560Document3 pages12154560anuradhaNo ratings yet

- Axis May-16 PDFDocument23 pagesAxis May-16 PDFAnonymous akFYwVpNo ratings yet

- CUBDepositOpeningReceipt 500707170039434Document1 pageCUBDepositOpeningReceipt 500707170039434Ganesh GaneNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGagan Sales Agencies SunamNo ratings yet

- Ad31296951 06052021095104Document1 pageAd31296951 06052021095104MayankNo ratings yet

- Yes Bank FD Harjinder KaurDocument1 pageYes Bank FD Harjinder KaurTanvi DhingraNo ratings yet

- Snehal Kadam 1Document3 pagesSnehal Kadam 1341 - C Saurabh RaneNo ratings yet

- Ad30047683 28032020011700 PDFDocument1 pageAd30047683 28032020011700 PDFKaran SharmaNo ratings yet

- FD Acknowledgement SlipDocument1 pageFD Acknowledgement SlipSwapnil kadamNo ratings yet

- NEERALDocument4 pagesNEERALSimran MehraNo ratings yet

- 1563270990991Document11 pages1563270990991JohnNo ratings yet

- CA Networth CertificateDocument3 pagesCA Networth CertificateRavimegaNo ratings yet

- Acctstmt DDocument4 pagesAcctstmt Dmaakabhawan26No ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaacscomcparandaNo ratings yet

- Gmail - PSG PDFDocument1 pageGmail - PSG PDFJehangir Allam100% (2)

- Account Statement From 1 Jan 2017 To 31 Dec 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 1 Jan 2017 To 31 Dec 2017: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaKalpa RNo ratings yet

- Acct Statement - XX7579 - 03112023Document19 pagesAcct Statement - XX7579 - 03112023Ashish Singh bhandari100% (1)

- 27 02 2018 - 01 04 2019 PDFDocument4 pages27 02 2018 - 01 04 2019 PDFsuresh KumarNo ratings yet

- Acct Statement - XX4279 - 19082023Document27 pagesAcct Statement - XX4279 - 19082023mohitNo ratings yet

- Dayana FD HDFCDocument1 pageDayana FD HDFCchrisj 99No ratings yet

- 02 HDFC Bank-May-18Document5 pages02 HDFC Bank-May-18Shubham SinghNo ratings yet

- Statement of Account: L246G SBI Gold Fund - Regular Plan - Growth NAV As On 14/10/2015: 8.8804Document4 pagesStatement of Account: L246G SBI Gold Fund - Regular Plan - Growth NAV As On 14/10/2015: 8.8804hari sharmaNo ratings yet

- Ca ReportDocument8 pagesCa ReportHarjot SinghNo ratings yet

- Bank DetailsDocument11 pagesBank DetailsANANDA MAITYNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHunterNo ratings yet

- Acct Statement XX2797 07022023Document9 pagesAcct Statement XX2797 07022023bogili srinuNo ratings yet

- IDFC FIRST Bank Statement As of 06 MAY 2019 PDFDocument1 pageIDFC FIRST Bank Statement As of 06 MAY 2019 PDFEkta BaroniaNo ratings yet

- NETWOERTHSDocument3 pagesNETWOERTHSVIJAY PAREEKNo ratings yet

- Ref - No.3084556-15788995-5: Date As On CRN No. Home Branch AddressDocument4 pagesRef - No.3084556-15788995-5: Date As On CRN No. Home Branch AddressDarren Joseph VivekNo ratings yet

- Folio No. 9075 4601 351: Account SummaryDocument2 pagesFolio No. 9075 4601 351: Account SummaryspeedenquiryNo ratings yet

- 01 04 2016 - 18 03 2017 PDFDocument3 pages01 04 2016 - 18 03 2017 PDFRamsai ChigurupatiNo ratings yet

- S 0 Uy BVWQC LKS7 BZ 3Document15 pagesS 0 Uy BVWQC LKS7 BZ 3Insta LoginNo ratings yet

- 6A. HDFC Sept2018 EStatementDocument9 pages6A. HDFC Sept2018 EStatementNanu PatelNo ratings yet

- Account Statement From 1 Jan 2012 To 30 Jun 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2012 To 30 Jun 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRavi AgarwalNo ratings yet

- Iw08206615 05012014061637Document2 pagesIw08206615 05012014061637prabhatkumarsuryaNo ratings yet

- Iw01220137 25022012025852Document1 pageIw01220137 25022012025852ishanarya00761No ratings yet

- Fdreceipt2022 10 12 09 45 43Document3 pagesFdreceipt2022 10 12 09 45 43Murali YNo ratings yet