Professional Documents

Culture Documents

Uttara Bank Limited

Uploaded by

Hasan Imam FaisalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Uttara Bank Limited

Uploaded by

Hasan Imam FaisalCopyright:

Available Formats

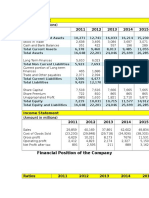

UTTARA BANK LIMITED

Highlights on the overall activities of the Bank for the year ended 2012 and 2011

Sl. Particulars

2012

2011

Change in

No.

Taka

Taka

Paid-up-Capital

3,306,449,088

2,875,173,120

15

Total Capital (Teir -I+II)

9,300,594,902

9,117,416,771

Capital surplus/(Deficit)

1,781,934,902

2,251,816,771

-21

Total Assets

123,790,627,973

97,417,927,797

27

Total Deposits

93,658,586,510

72,152,375,394

30

Total Loans & Advances

61,328,563,493

54,010,287,476

14

Total Contingent Liabilities

12,005,317,556

9,860,040,453

22

Advance/ Deposit Ratio

0.65:1

0.75:1

12

Percentage of Classified

Loans against total Loans &

Advances

8.39%

5.22%

61

10

Profit after tax & provision

1,236,356,336

1,650,339,616

-25

11

Amount of classified loan

during current year

3,393,000,000

814,914,000

316

12

Provision kept against

classified loans

1,803,533,437

1,091,983,437

13

Provision surplus /(deficit)

62,648,745

29,533,837

112

14

Cost of Fund (%)

7.23%

6.32%

14

15

Interest earning Assets

98,677,618,328

79,811,603,347

24

25,113,009,645

17,606,324,450

8.85%

9.63%

1.00%

1.69%

-41

3,716,097,423

2,204,265,402

69

-25

16

17

Non-interest earning

Assets

Return on Investment

(ROI) %

65

43

-8

18

Return on Assets (ROA)%

19

Income from Investment

20

Earning per Share

3.74

4.99

21

Consolidated Earning per

Share (SPS)

3.76

5.01

22

Market value per share

38.10

77.80

-51

23

Price Earning Ratio (Times)

10.19

15.59

-35

24

Net Assets value per share

29.63

29.13

-25

You might also like

- Japanese Investors in BangladeshDocument1 pageJapanese Investors in BangladeshHasan Imam Faisal100% (2)

- Pran RFL ReportDocument17 pagesPran RFL ReportAnita Khan33% (3)

- Financials at A GlanceDocument2 pagesFinancials at A GlanceAmol MahajanNo ratings yet

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocument23 pagesFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNo ratings yet

- Praktikum FinancialDocument22 pagesPraktikum Financiallisa amaliaNo ratings yet

- SM Report G3Document29 pagesSM Report G3SriSaraswathyNo ratings yet

- Competitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankDocument2 pagesCompetitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankAnum CharaniaNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Vertical Analysis PDFDocument12 pagesVertical Analysis PDFAbdul Rehman SafdarNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- Performance HighlightsDocument2 pagesPerformance HighlightsPushpendra KumarNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisShaheena SarfrazNo ratings yet

- WBC 5yr SummaryDocument2 pagesWBC 5yr SummaryPaskalis GlabadanidisNo ratings yet

- Financial StatementDocument115 pagesFinancial Statementammar123No ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- 2011/12 Budget To Actuals: Ministry of Finance Fiscal Data 2012Document2 pages2011/12 Budget To Actuals: Ministry of Finance Fiscal Data 2012patburchall6278No ratings yet

- Kingsbury AR - 2012 PDFDocument52 pagesKingsbury AR - 2012 PDFSanath FernandoNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Square Textiles Limited Balance Sheet 2009Document5 pagesSquare Textiles Limited Balance Sheet 2009jeeji126No ratings yet

- Financial Position of The Engro FoodsDocument2 pagesFinancial Position of The Engro FoodsJaveriarehanNo ratings yet

- Exchequer Final Statement March 2012Document5 pagesExchequer Final Statement March 2012Politics.ieNo ratings yet

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsQ.M.S Advisors LLCNo ratings yet

- Balance Sheet ExtractDocument1 pageBalance Sheet ExtractjoamonsachinNo ratings yet

- Research Paper On Working Capital Management Made by Satyam KumarDocument3 pagesResearch Paper On Working Capital Management Made by Satyam Kumarsatyam skNo ratings yet

- ANNUAL REPORT 2012 - 2013: Balance Sheet As at 31St March, 2013Document2 pagesANNUAL REPORT 2012 - 2013: Balance Sheet As at 31St March, 2013Sandeep SoniNo ratings yet

- Balance Sheet of Engro FoodsDocument20 pagesBalance Sheet of Engro FoodsMuhib NoharioNo ratings yet

- Company Financial StatementsDocument3 pagesCompany Financial StatementsNarasimha Jammigumpula0% (1)

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- LBP 2013 executive summaryDocument3 pagesLBP 2013 executive summaryDenise Angel SonNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Balance SheetDocument1 pageBalance SheetBharat AroraNo ratings yet

- Quarterly Acc 3rd 2011 12Document10 pagesQuarterly Acc 3rd 2011 12Asif Al AminNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- 01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012Document25 pages01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012saifulcrislNo ratings yet

- Shell Pakistan: Total Non Current Assets Current AssetsDocument17 pagesShell Pakistan: Total Non Current Assets Current AssetsshamzanNo ratings yet

- Analysis & InterpretationDocument34 pagesAnalysis & InterpretationArunKumarNo ratings yet

- 4.JBSL AccountsDocument8 pages4.JBSL AccountsArman Hossain WarsiNo ratings yet

- Gul AhmedDocument4 pagesGul AhmedDanialRizviNo ratings yet

- Introduction to Mercantile Bank LtdDocument5 pagesIntroduction to Mercantile Bank LtdJonaed Ashek Md. RobinNo ratings yet

- Life InsuranceDocument8 pagesLife InsuranceKKNo ratings yet

- Financial Report - ShyamDocument14 pagesFinancial Report - ShyamYaswanth MaripiNo ratings yet

- Department of Public Works and Highways Executive Summary 2022Document14 pagesDepartment of Public Works and Highways Executive Summary 2022Stacy VeuNo ratings yet

- Balance Sheet Analysis 2013-2012Document2 pagesBalance Sheet Analysis 2013-2012Syed Nabeel Hassan JafferyNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- 03-LBP2015 Executive Summary PDFDocument7 pages03-LBP2015 Executive Summary PDFFrens PanlarocheNo ratings yet

- Half Yearly Report 2010Document12 pagesHalf Yearly Report 2010tans69No ratings yet

- Six Years Financial SummaryDocument133 pagesSix Years Financial Summarywaqas_haider_1No ratings yet

- Chapter 1. Exhibits y AnexosDocument15 pagesChapter 1. Exhibits y AnexoswcornierNo ratings yet

- It Dic 13 Eng - NDocument11 pagesIt Dic 13 Eng - NcoccobillerNo ratings yet

- FinancialResult 30062012Document3 pagesFinancialResult 30062012Raghu NathNo ratings yet

- Eastern Bank: A Leading Private Bank in BangladeshDocument15 pagesEastern Bank: A Leading Private Bank in Bangladeshm_ihamNo ratings yet

- Procredit Alb 2019Document62 pagesProcredit Alb 2019Thomas SzutsNo ratings yet

- CIB balance sheet items 2010-2009Document1 pageCIB balance sheet items 2010-2009Khalid Al SanabaniNo ratings yet

- Financial Statement Analysis of HDFC BankDocument58 pagesFinancial Statement Analysis of HDFC BankArup SarkarNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- AB Bank key financial highlights 2013-2011Document1 pageAB Bank key financial highlights 2013-2011SikdarMohammadImrulHossainNo ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- Bangladesh Economic OverviewDocument7 pagesBangladesh Economic OverviewHasan Imam FaisalNo ratings yet

- Managing Talent ReportDocument37 pagesManaging Talent ReportHasan Imam FaisalNo ratings yet

- Join The Project Endeavor To Adapt Climate ChangeDocument1 pageJoin The Project Endeavor To Adapt Climate ChangeHasan Imam FaisalNo ratings yet

- Nascenia LimitedDocument4 pagesNascenia LimitedHasan Imam FaisalNo ratings yet

- GSK ReportDocument60 pagesGSK ReportHasan Imam FaisalNo ratings yet

- Acct 303 Chapter 17Document47 pagesAcct 303 Chapter 17Shannon KingNo ratings yet

- List of Insurance Companies in BangladeshDocument4 pagesList of Insurance Companies in BangladeshHasan Imam FaisalNo ratings yet

- Survey On A Business FarmDocument4 pagesSurvey On A Business FarmHasan Imam FaisalNo ratings yet