Professional Documents

Culture Documents

Risks To Consider When Purchasing Technology Based IP For Securitization

Uploaded by

Harpott GhantaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risks To Consider When Purchasing Technology Based IP For Securitization

Uploaded by

Harpott GhantaCopyright:

Available Formats

Risks to Consider When

Purchasing Technology-Based

IP for Securitization

DAN ROMAN, MICHAEL SARLITTO, AND ASLAM MUKHTIAR

DAN ROMAN

is vice president and general

manager at SummitPoint

Management in Chicago,

IL.

droman@suminitpoint

management, com

MI C HAEL S AR LI T T O

is president at SummitPoint

Management in Chicago,

IL.

msarli(to@summitpoint

management, com

AS LAM MUKHT I AR

is an independent consul-

tant in Minnetonka, MN.

a$lam@mukhtiar.cam

T

his article focuses on risks associated

with technology-based intellectual

property ("IP"). We provide trans-

action evaluators and originators

with a working list of risk-influenced items to

consider when reviewing opportunities

involving the purchase of IP for securitization,

specifically in cases where the source of the

asset's value is derived from commercialization,

re-commercialization, and assertion. It is

intended to assist practitioners identify and assess

these risks, make better-informed investment

decisions, and achieve their transaction goals.

Risk can be anything that threatens or

limits the ability ofa transaction to achieve its

intended goals or objectives. Risk manage-

ment, therefore, is the process of logically and

systematically contemplating all possible unde-

sirable outcomes before they occur, quanti-

fying and pricing their effects, and establishing

procedures to recognize, avoid, minimize,

and/or cope with these or other outcomes and

their eventual impacts. Three fundamental

activities are associated with transactional risk

management efforts: assessment, pricing, and

control.

1. Risk assessment is the process of identi-

fying modes of failure and their proba-

bility of occurrence.

2. Risk pricing builds upon this output to

model the range of outcomes, their inter-

actions, and potential economic impact

so as to ensure that the transaction is

valued correctly and that risk is offset

through deal structuring or other means.

3. Risk control employs the first two activ-

ities to develop a combination of tech-

niques and strategies designed to monitor,

manage, and mitigate risks over time.

In general, large-scale transactions (as

measured by value) tend to require more

detailed risk planning due to the number and

complexity of risks typically involved and the

financial impact of undesirable outcomes. As

a result, larger transactions will also include

the development and analysis of alternative

strategies and evaluation criteria. The ranking

of risks and development of mitigation strate-

gies in larger transactions often will demand

greater sophistication in quantifying and qual-

ifying the probability of occurrence and/or

evaluation of impact. This article is not

intended to provide an exhaustive list of risks

and assessment criteria that a transaction team

may observe. If exhaustive lists were possible,

the modes of failure in transactions would be

finite.

A RISK CHECKLIST

FOR PRACTITIONERS

A simplified framework of transaction

underperformance and failure, or what can go

wrong, has three risk components:

WINTER 2007 THEJOUKNAL OF STRUCTUIU-D FINANCE 6 1

1. Amount. It costs more and/or it yields less.

2. Volatility. The inflows are dispersed.

3. Duration. The inflows take longer to materialize, or

the outflows happen earlier than planned.

To operationalize this basic framework of what can

go wrong with a transaction, one must think o( ways

things can go wrongthis leads to categorizing risks. Cat-

egorization is most useful in unearthing specific risk fac-

tors that otherwise may not have been contemplated. It

leads a transaction team to ask pertinent questions, iden-

tify relevant phenomena and parameters (that may need

to be quantified), and examine unarticulated assumptions.

There are many market, commodity, financial, busi-

ness, and asset-specific transactional risks for practitioners

to consider when purchasing technology-based IP for

securitization (see Exhibit 1). However, a review of past

transaction experience yields the following categories of

risk as most significant:

Macroeconomic and demand risk

Technology risk

Collateral risk

Illiquidity risk

Credit risk

Structural risk

It should be noted that risk categories are never mutually

exclusive. As just one example, technology risks can

quickly morph into structural risks, which can just as

easily become a source of credit risk.

MACROECONOMIC AND DEMAND RISK

Dominant Impact: Commercialization

and Re-commercialization

This category refers to the range of factors within

the broader economy and the market segment(s) served

that could affect underlying demand for the products that

derive from the IP in question. It is best to address the risks

in this category by first understanding the nature of the

IP itself, what it does, for whom, and how. Such an analysis

helps define the elasticity and scope of demand for the

products derived from the IP. Topics that should be inves-

tigated include:

What problem does this IP solve? Why does that

problem exist?

What would cause this problem to increase either

in frequency or in impact?

Is the problem systemic and pervasive (e.g. when

data is transposed manually the error rate is usually

3% to 4%)?

Or, is it specific to a certain segment ofthe economy

(e.g. high-pressure industrial hoses have a tendency

to rupture within 12 diameters of a reducer

joint)?

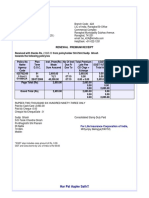

E X H I B I T 1

General Transactional Risk Factors

Market or

Commodity Risk

Price Risk

Basis Risk

Volume Risk

Correlation Risk

Index Risk

Liquidity Risk

Financial Risk

Currency Risk

Credit Risk

Interest Rate Risk

Capital Markets Risk

Business or Asset Risks

Freight or Transportation Risk

Emissions Risk

Weather Risk

Quality Risk

Imbalance Risk

Line Loss Risk

Tariff Risk

Project Completion Risk

Regulatory Risk

Political Risk

Technology Risk

Environmental Risk

Model Risk

Contract Risk

Equipment and Operations Risk

Key Person Risk

Moral Hazard

Reputation Risk

62 RISKS TO CONSIDER WHEN PURCHASING TECHNOLOOY-HASED IP FOR SECURITIZATION WINTER 2007

What types of products and market segments does

this IP serve today?

What types of products and market segments could

this IP serve in future?

What are the average price points of the products

derived from this IP?

What portion of the demand for products derived

from this IP could be considered inelastic or non-

discretionary?

What are the implications for demand for products

derived from this IP if long-term interest rates

rise/fall by 1%? The trade-weighted value of the

dollar rises/falls by 10%? Economic growth slows/

quickens by 1 %? Economic growth is negative? Real

per capita incomes (in the geographies served)

increases/declines by ]%? Energy prices rise/fall by

10%? 25%?

What is the geographic breakdown of revenues asso-

ciated with the products derived from this IP?

How many licensees does this IP have? How many

do you expect to have in three years? What is the

financial profile ofa licensee (this may also be a

credit risk)?

List the types of supply-chain disruptions that could

interrupt the production ofthe items derived from

this IP. In general, the greater the number and dis-

persal of manufacturing locations that can produce

these types of products (and their materials and com-

ponents), the lower the likelihood ofa supply chain

disruption.

Do public health and safety considerations impact

the sale of derived products? For example, IP related

to food processing technology can be affected by

health events and outbreaks that subsequently lead

to embargoes on food trade.

Does this IP affect issues of defense or national secu-

rity? What is the likelihood that sales ofthe derived

products would be restricted due to political deci-

sions (i.e. export restrictions)?

TECHNOLOGY RISK

Dominant Impact: Commercialization

and Re-commercialization

Secondary Impact: Assertion

Technology risks refer to the broad range of com-

petitive factors that could erode, shorten, or make more

volatile the expected revenue stream or its profitability.

In general, technology risks come in one of two types:

superior technologies (threats you can see coming) and

unrelated technologies (threats you may not have had

reason to consider). Unrelated technologies usually cause

more damage by way of both timing and scope. Consid-

eration should be given to the following topics:

How many competing technologies exist versus the

IP in question? Is there a monopoly? A duopoly?

What are these competing technologies?

How long has this competitive landscape been in

place? What would cause it to change? Are there

recent entrants or exits?

List the strengths and weaknesses of each ofthe com-

peting technologies. Know that a major source of

risk is when competitive offerings are better than,

but not as cheap as, the item produced using your

IP. This usually creates incentives for enabling tech-

nologies to commercialize the competing IP at lower

price points.

Under what macroeconomic conditions would a

competitor's weakness become a non-issue (list all

conditions without regard for likelihood)? For

example, if the price of oil climbs to 1-1/2 times its

current price, certain oil exploration technologies

become significantly more competitive. In general,

then, it is useful to analyze and model the marginal

conditions and inflection points within any com-

petitive structure.

Under what technological conditions would a com-

petitor's weakness become a non-issue (list all con-

ditions without regard for likelihood)? For example,

if the latency conditions in a memory circuit can

be made to drop below a pre-defined threshold, cer-

tain possibilities emerge within memory manage-

ment that can alter the competitive profile of IP

dealing with firmware. In this example, one notices

that competing technologies are not other pieces of

software but rather an unrelated advance in semi-

conductor manufacturing that leads to a different

way of constructing a memory circuit, which in

turn can nullify one's competitive advantage.

What factors and/or market segments drive demand

for all the products using your IP? What factors

and/or market segments drive demand for all the

products using competing technology or public

domain methods? Are these identical factors and

WINTER 2007 THE JOURNAL OI- STRUCTUKED FINANCE 6 3

market segments? If not, does the competitive IP

have a segment where it has an inherent advantage?

If that segment were to expand rapidly would it

generate enough volume to lower the costs of (and

enhance the competitiveness of) the competing tech-

nology?

Which, if any, competing technologies have a weak

competitive position because they are "orphan"

technologies owned by underperforming compa-

nies or residing in marginal or non-core subsidiaries

of larger organizations? Would that competing tech-

nology be more valuable and more of a business

threat if it changed hands? If so, describe how.

COLLATERAL RISK

Dominant Impact: Assertion

and Commercialization

Collateral risk refers to those types of situations and

events that damage the asset or preclude enforcement of

the rights of the owner of the asset. Collateral risk may

best be understood through a familiar banking analogy:

mortgage lenders lend consumers money to buy homes

only after thoroughly assessing the borrower's capacity to

make regular monthly payments over a period of time.

However, the value ofthe underlying asset (i.e. the home)

is also important and remains a secondary source of repay-

mentthrough foreclosure and subsequent resale. In order

to minimize collateral risk, mortgage lenders require a

home inspection, title insurance, and proof of home-

owners' insurance for at least the value ofthe loan.

While collateral risk can take many forms, for the

purposes of technology-based IP, prior transaction expe-

rience suggests that the focus be on theft, ongoing liti-

gation, or unclear ownership. Topics worthy of evaluation

include:

Who owns the IP and for how long have they

owned it? How did they come to acquire it?

Has the ownership ever been contested? How was

that matter resolved?

Are there any cross-licensing agreements in place

related to this IP?

Are there any contingent claims or prohibitions on

this IP?

Quantify the remaining protected and productive

life of this IP

Does this IP currently generate revenues? Is that

revenue stream available to you?

Is this IP easily reverse-engineered?

Are there knock-off products or processes currently

in use that mimic this IP?

What is the estimated ongoing lost (diverted) rev-

enue attributed to "mimic" IP? Has it been

growing?

Is there any brand risk associated with the products

derived from this IP? For example, if this IP is used

to make certain pharmaceutical compounds (process

patents) for companies that are the subject of class-

action litigation (i.e. Bausch & Lomb) then revenue

streams could be impacted by the damage to the

end-use brand even if the IP owned had no direct

contribution to the issue under litigation.

ILLIQUIDITY RISK

Dominant Impact: Assertion,

Commercialization,

and Re-commercialization

IP is one ofthe more illiquid asset classes due to the

difficulty in valuation and the risks related to the enforce-

ment of rights. Illiquidity risk is usually measured by bid-

ask spreads, transaction costs, and the time taken to

complete a transaction. In the case of IP, however, esti-

lnating illiquidity is as much art as science and the esti-

mate itself would likely be very different from the actual

experienced illiquidity if and when the time comes to

sell. However, there are several relevant factors to consider

in estimating illiquidity:

Is it a high-dollar-bundle of IP? The higher the

dollar value ofthe IP bundle, the greater the poten-

tial liquidity, up to a point. This is because the largely

fixed costs of valuation and transaction structuring

and documentation can be spread over a larger trans-

action base and thus justify interest and investment

by more parties.

Is it hard to evaluate? The simpler the transaction,

the greater the liquidity.

Do you need specialized skills to manage the IP on

an ongoing basis?

Would a bank or senior lender finance more than

half the transaction? If so, the liquidity would be

enhanced.

64 RISKS TO CONSIDER WHEN 1'URCHASING TECHNOLOGY-HASED IP FOK. SECURITIZATION WINTER 2007

CREDIT RISK

Dominant Impact: Assertion and

Commercialization

Credit risk refers to tlie probability that monies owed

are not paid because the debtor is unable or unwilling to

pay. The typical situation within credit risk is that the

greater the exposure (i.e. the greater the monies owed)

the greater the chance of default and consequently the

"expected loss" increases in a non-linear fashion. In the

context of financing the purchase of IP, that construct is

happily limited since higher exposures usually coincide

with scenarios wherein the sales ofthe underlying IP have

been robust. While it may be relatively unlikely that a

party would default on an arrangement and lose rights to

the very IP that has been the source of its success, credit

risks are very real in all business transactions. Important

topics to consider include:

If the contemplated transaction is anything less than

an arms-length true sale, then is any portion ofthe

revenue stream contingent on the credit standing of

the oiw/erof the IP (some business arrangements are

structured in a way that specifies loss of investment-

grade credit rating as an event of default)?

Who or what entity(ies) is(are) expected to be the

source of the revenue stream? What is the break-

down in expected revenues? Are the revenues con-

centrated in one or two customers?

What is the credit standing and profile of the var-

ious customers? Do they have any significant near-

term debt maturities?

If they were to pay you a healthy royalty/license

payment (i.e. if things go well) what portion of their

cost structure would that outflow represent?

Do they have a history of contesting IP payments?

Under what circumstances?

Would their credit profile be enhanced by the

growth in the end-use of your IP (the answer to this

question is usually "yes" but, if they purchased your

IP as a partial hedge, it could be "no")?

How is their long-term debt rated (match the dura-

tion of their debt to the weighted average life of

your IP)?

Are they contractually bound to send you the rev-

enue stream under all circumstances or do you have

to demonstrate "performance" (howsoever defined)

prior to being paid?

Do you receive the monies directly or through an

intermediary? If there is an intermediary involved

(not an escrow) you will need to assess the conjoint

probability of default.

Recall that unlike the ordinary case of business credit risk,

there is no option of shutting off "supply" until the cus-

tomer pays his invoice. To prevent the licensee from gain-

fully using your IP in the interim, owners will have to

expend time and money and rely on legal protections that

can be slow and uncertain and exacerbated, especially

when outside ofthe United States.

STRUCTURAL RISK

Deal structuring permits modeling and sensitivity

testing and so forms the basis for evaluating all risk vari-

ables and other inputs (i.e. market growth assumptions,

elasticity of demand). As a result, the structure ofa trans-

action typically reflects the combination of all risks and

inputs. While a deal structure is designed to mitigate risks,

it usually introduces new risks by virtue of its construc-

tion. Relevant topics of investigation include:

Describe the form and details of the structure of

cost and revenue agreements related to the IP. Trans-

late the term sheet into diagrams that show the struc-

tural risk factors.

Identify such items as: term of the arrangement;

periodicity of payment; principal mode of the

arrangement (i.e. royalty, license fee); base fees, min-

imum usage amounts (i.e. take or pay), and floors;

units of measurement that drive the royalty or fee

arrangements; geographic or market segment exclu-

sivity and conditions under which those may be

rescinded (include items such as true-up payments);

re-selling agreements and prohibitions; and condi-

tions of breach and cures.

If the following items apply, be sure to document

all details and scenarios: catch-up arrangements or

use-it-or-lose-it arrangements; thresholds, step-func-

tions, and waterfalls; swaps, spreads, collars, options,

contingent options, escalators, and indices; contin-

gent payments and receipts; pass-throughs and indi-

rect revenue arrangements.

WINTER 2007 THBJOURNAL 01= STRUCTURED FINANCE 6 5

EFFECTIVE MONITORING OF RISK FACTORS

As the technological, legal, economic, and business

environments of intellectual property are constantly

changing, today's practitioners must constantly monitor

and analyze risks, their impacts, and the progress of any

relevant mitigation/control efforts. Inadequate control

not only impairs value, but can also trigger loss of confi-

dence and disruptperhaps permanentlyaccess to the

bank financing/capital markets and/or deal flow. The fol-

lowing questions contain items that should be considered

throughout a deal's life cycle to ensure a focus on risk

identification and management:

Is there a regular status review and update of key

risks to assure they are under control?

Has a list of key risks been disseminated to the appro-

priate people within the organization?

Is there progress in mitigating each risk as planned?

For any risk exceeding defined trigger values, has a

contingency plan been implemented? How will any

contingency plans affect the transaction timeline?

Has the transaction team been reviewing the deal for

other risks that may have appeared?

Has the process to accept additional risks from trans-

action team members and outside stakeholders been

followed?

CONCLUSION

While each underperforming transaction does so in

its own unique way, there are broad categories of ways in

which transactions fail. A checklist can help identify and

quantify the specific risk elements within categories so

that they can be understood and priced. More impor-

tantly, a checklist can stimulate additional questions and

highlight interconnections that would not be otherwise

visible.

To extract the full benefit of the information

obtained during the course ofa deal life cycle, practitioners

ought to capture the data derived through the checklist

within a customizable and dynamic model that can eval-

uate the risk and return profile ofthe contemplated trans-

action under a wide range of scenarios. Such a model

would be critical to transaction financing, pricing, and

structuring as well as long-term risk management and

control.

To order reprints of this article, please contact Dewey Palniieri at

dpalmieri@iijournah.com or 212-224-3675

66 RISKS TO CONSIDER WHEN PURCHASING TECHNOLOGY-BASED IP FOR SHCURITIZATION

WINTER 2007

You might also like

- Aspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LDocument9 pagesAspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LHarpott Ghanta20% (5)

- Chap 3Document4 pagesChap 3Kios Kita86% (7)

- Dlak Submission CBK Amendment Bill 2020 05Document5 pagesDlak Submission CBK Amendment Bill 2020 05api-466447436No ratings yet

- Risk ManagementDocument10 pagesRisk ManagementRUPESH GOELNo ratings yet

- Telecommunications 2012-01-01Document28 pagesTelecommunications 2012-01-01STEVENo ratings yet

- Erm ReviewerDocument7 pagesErm ReviewerAron AbastillasNo ratings yet

- Assignment - Zia SCFDocument8 pagesAssignment - Zia SCFWandere LusteNo ratings yet

- Form of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListDocument4 pagesForm of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListKeanne ArmstrongNo ratings yet

- Study Notes Algorithmic Trading Briefing NoteDocument16 pagesStudy Notes Algorithmic Trading Briefing NoteProf EducationNo ratings yet

- MPinedo OperationalRisksDocument111 pagesMPinedo OperationalRiskssbabelliNo ratings yet

- Experiment-8: Identify, Control and Mitigate Risks To The Project (RMMM)Document7 pagesExperiment-8: Identify, Control and Mitigate Risks To The Project (RMMM)Man UtdNo ratings yet

- Risk Analysis & Assessment in Nigerian Banks IIDocument16 pagesRisk Analysis & Assessment in Nigerian Banks IIShowman4100% (1)

- OpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Document5 pagesOpAudCh03 CBET 01 501E Toralde, Ma - Kristine E.Kristine Esplana ToraldeNo ratings yet

- CH - 7 Project Risk ManagemtnDocument20 pagesCH - 7 Project Risk Managemtnamit_idea1No ratings yet

- PPLE - Assignment 2Document6 pagesPPLE - Assignment 2Sumit DasNo ratings yet

- Review and Revision: Anthony Asher 2015Document21 pagesReview and Revision: Anthony Asher 2015BobNo ratings yet

- Business Ethics Governance & Risk - A - STDocument11 pagesBusiness Ethics Governance & Risk - A - STDivyansh Singh100% (1)

- Strategic Management Concepts and Cases 1st Edition Dyer Solutions ManualDocument25 pagesStrategic Management Concepts and Cases 1st Edition Dyer Solutions ManualKaylaVasquezjoqfn100% (42)

- Technology IntelliegenceDocument2 pagesTechnology IntelliegenceguniporgaNo ratings yet

- Lo 1Document10 pagesLo 1TefeNo ratings yet

- June 2011Document19 pagesJune 2011Murugesh Kasivel EnjoyNo ratings yet

- Enterprise-Wide Risk Is Now A Widely Used Term in The Financial Services and Energy IndustriesDocument4 pagesEnterprise-Wide Risk Is Now A Widely Used Term in The Financial Services and Energy IndustriesRagav SathyamoorthyNo ratings yet

- Process Safety Management System-PaperDocument11 pagesProcess Safety Management System-PaperV. Balasubramaniam100% (2)

- Outsourcing v4 2Document45 pagesOutsourcing v4 2contactneelNo ratings yet

- Risk-Academys Guide On Compliance RiskDocument21 pagesRisk-Academys Guide On Compliance RiskPablo Cuevas CalvettiNo ratings yet

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNo ratings yet

- Untitled 1Document4 pagesUntitled 1Marry Shane BetonioNo ratings yet

- 6learning Outcome 6Document19 pages6learning Outcome 6Indu MathyNo ratings yet

- A Risk Management StandardDocument17 pagesA Risk Management StandardRishabh JainNo ratings yet

- Risk Management Process - What Are The 5 StepsDocument6 pagesRisk Management Process - What Are The 5 StepsJaveed A. KhanNo ratings yet

- OpaudCh03-502E-Regunayan, M PDocument5 pagesOpaudCh03-502E-Regunayan, M PMarco RegunayanNo ratings yet

- Strategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementFrom EverandStrategy, Value and Risk: Industry Dynamics and Advanced Financial ManagementNo ratings yet

- Creating An Effective Aml Audit / Review ProgramDocument20 pagesCreating An Effective Aml Audit / Review ProgramEmin SaftarovNo ratings yet

- Unit - 1 - Part - BDocument43 pagesUnit - 1 - Part - BUmar Badamasi IbrahimNo ratings yet

- AMLReportDocument33 pagesAMLReportprabu2125No ratings yet

- Module 5 Directed StudiesDocument28 pagesModule 5 Directed StudiesDeontray MaloneNo ratings yet

- Thompson Et Al Week 5 Reading Chapter 3Document30 pagesThompson Et Al Week 5 Reading Chapter 3ghamdi74100% (1)

- Chapter 11 - Risk ManagementDocument13 pagesChapter 11 - Risk Managementamazon.rem33No ratings yet

- Operational Risk by J L King PDFDocument6 pagesOperational Risk by J L King PDFGhazala QuraishyNo ratings yet

- Risk ManagementDocument8 pagesRisk ManagementĐức Thạch NguyễnNo ratings yet

- Mitigating Procurement Risk 091205Document7 pagesMitigating Procurement Risk 091205Yudish Deerpaul100% (1)

- Strategic Management Concepts and Cases 1st Edition Dyer Solutions ManualDocument36 pagesStrategic Management Concepts and Cases 1st Edition Dyer Solutions Manualinwardslength41xm100% (22)

- Sa Jan13 p3 Strategy1Document12 pagesSa Jan13 p3 Strategy1Eileen LimNo ratings yet

- Risk in International BusinessDocument37 pagesRisk in International BusinessNeetu Kumari 1 8 3 1 8No ratings yet

- Managing Risk in BusinessDocument3 pagesManaging Risk in BusinesstkurasaNo ratings yet

- Operational Risk Dissertation TopicsDocument7 pagesOperational Risk Dissertation TopicsWriteMyPaperOneDaySingapore100% (1)

- Strategic Management - Lesson 3Document49 pagesStrategic Management - Lesson 3Cristine MayNo ratings yet

- Material Six Steps To Secure Global Supply ChainsDocument23 pagesMaterial Six Steps To Secure Global Supply ChainsborisbarborisNo ratings yet

- The Strategic Planning ProcessDocument39 pagesThe Strategic Planning Processakash0chattoorNo ratings yet

- Environmental Business Scanning ToolsDocument17 pagesEnvironmental Business Scanning Toolsramadhanamos620No ratings yet

- After Studying The Fourth Session Topic On Exports and Reviewing The Additional MaterialDocument6 pagesAfter Studying The Fourth Session Topic On Exports and Reviewing The Additional Materialanishafebrianti16No ratings yet

- Perceptions of Peril: Evaluating Risk Management in Supply ChainsDocument10 pagesPerceptions of Peril: Evaluating Risk Management in Supply ChainsM QasimNo ratings yet

- Capitulo 8 - Supply Chain Management RiskDocument11 pagesCapitulo 8 - Supply Chain Management Riskanna ortizNo ratings yet

- 1 Risk ManagementDocument5 pages1 Risk ManagementKibegwa MoriaNo ratings yet

- Chapter - 01Document23 pagesChapter - 01Talimur RahmanNo ratings yet

- 2012 01 24 Larry Clinton Economics of Security Presentation at Opal Event in DCDocument36 pages2012 01 24 Larry Clinton Economics of Security Presentation at Opal Event in DCisallianceNo ratings yet

- SMMDocument7 pagesSMMSenor84No ratings yet

- Self-Assessment of GAC RisksDocument36 pagesSelf-Assessment of GAC RisksMarijaNo ratings yet

- Mie 480 Exam 2 Study GuideDocument2 pagesMie 480 Exam 2 Study GuideArturo Rojas-HolmquistNo ratings yet

- Module 5Document31 pagesModule 5Francisco Cuello100% (3)

- Module 11Document4 pagesModule 11AstxilNo ratings yet

- Re Wan Soon Construction Pte LTD (2005) 3 SLR 375 (2005) SGHC 102Document6 pagesRe Wan Soon Construction Pte LTD (2005) 3 SLR 375 (2005) SGHC 102Harpott GhantaNo ratings yet

- HSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Document34 pagesHSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Harpott GhantaNo ratings yet

- StateBarRequest - Feb 2015 & July 2015Document1 pageStateBarRequest - Feb 2015 & July 2015Harpott GhantaNo ratings yet

- G2 - List of Videos On AdvocacyDocument1 pageG2 - List of Videos On AdvocacyHarpott GhantaNo ratings yet

- Ny All LocationsDocument1 pageNy All LocationsHarpott GhantaNo ratings yet

- Andenas On European Company LawDocument74 pagesAndenas On European Company LawHarpott GhantaNo ratings yet

- The Ultimate Bar Exam Preparation Resource GuideDocument18 pagesThe Ultimate Bar Exam Preparation Resource GuidejohnkyleNo ratings yet

- NYS Bar Exam Online Application InstructionsDocument4 pagesNYS Bar Exam Online Application InstructionsHarpott GhantaNo ratings yet

- Act of Congress Establishing The Treasury DepartmentDocument1 pageAct of Congress Establishing The Treasury DepartmentHarpott GhantaNo ratings yet

- Chapter 4Document70 pagesChapter 4Harpott GhantaNo ratings yet

- Ds141sum eDocument2 pagesDs141sum eHarpott GhantaNo ratings yet

- AIG Travel Insurance Customer Care and Complaints Contact ListDocument4 pagesAIG Travel Insurance Customer Care and Complaints Contact ListIvory PlatypusNo ratings yet

- Bajaj AllianceDocument94 pagesBajaj AllianceAnish SainiNo ratings yet

- PLI-CP - PLI Insurance PlansDocument4 pagesPLI-CP - PLI Insurance PlansSubho SinghNo ratings yet

- Presentasi Asuransi FinalDocument64 pagesPresentasi Asuransi FinalMs. PotatoNo ratings yet

- CSC VLE Insurance Exam Questions and Answers NewDocument3 pagesCSC VLE Insurance Exam Questions and Answers NewWamo100% (2)

- Lecture 3 Risk Aversion and Capital AllocationDocument36 pagesLecture 3 Risk Aversion and Capital AllocationNguyễn Phương ThảoNo ratings yet

- Insurance Regulatory and Development Authority of India (IRDA of India)Document11 pagesInsurance Regulatory and Development Authority of India (IRDA of India)KRUPALI RAIYANINo ratings yet

- Max Life Smart - Wealth - Plan - Prospectus - WebDocument27 pagesMax Life Smart - Wealth - Plan - Prospectus - Webmantoo kumarNo ratings yet

- Chapter 24Document18 pagesChapter 24kennyNo ratings yet

- Wonderworld Co34Document14 pagesWonderworld Co34Sariah MohamedNo ratings yet

- ApkaiDocument20 pagesApkaiAhmadNo ratings yet

- PrmPayRcpt 75421275Document1 pagePrmPayRcpt 75421275Karan GuptaNo ratings yet

- ResumeDocument4 pagesResumeapi-3826517No ratings yet

- Assignment and Quiz FinMar Module 2Document2 pagesAssignment and Quiz FinMar Module 2Angelica IlaganNo ratings yet

- Ebook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFDocument41 pagesEbook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFjennifer.browne345100% (34)

- Slides Set1Document119 pagesSlides Set1Iqra JawedNo ratings yet

- ch.4 0Document25 pagesch.4 0solid9283No ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!MRINMOY BAIRAGYANo ratings yet

- AFRM Brochure MinDocument11 pagesAFRM Brochure MinVish JainNo ratings yet

- Security Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanDocument48 pagesSecurity Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanSHIVPRATAP SINGH TOMARNo ratings yet

- MGMT3076 U4v1 - 20180319Document11 pagesMGMT3076 U4v1 - 20180319Noelia Mc DonaldNo ratings yet

- Cource Out Line Risk Final AAUDocument4 pagesCource Out Line Risk Final AAUEbsa AdemeNo ratings yet

- 44 - Arturo Valenzuela Vs CADocument1 page44 - Arturo Valenzuela Vs CAperlitainocencioNo ratings yet

- Assignment No: 02: Name: Irhaa HussainDocument19 pagesAssignment No: 02: Name: Irhaa HussainSaira KhanNo ratings yet

- Expected & Unexpected LossDocument5 pagesExpected & Unexpected LossAdil AnwarNo ratings yet

- Century Royale Brochure Ver 05 (1) - 7-7Document1 pageCentury Royale Brochure Ver 05 (1) - 7-7arunsm1611No ratings yet

- Free Download Investments 12Th Edition Zvi Bodie Full Chapter PDFDocument51 pagesFree Download Investments 12Th Edition Zvi Bodie Full Chapter PDFcharles.stevens161100% (17)

- Certificate of Insurance: Insured DetailsDocument1 pageCertificate of Insurance: Insured DetailsReinardus RakkitasilaNo ratings yet

- Jurnal Bahaya PestisidaDocument8 pagesJurnal Bahaya PestisidaAde margusNo ratings yet