Professional Documents

Culture Documents

Case Study

Case Study

Uploaded by

Vaibhav Badgi0 ratings0% found this document useful (0 votes)

8 views9 pageskfa

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentkfa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views9 pagesCase Study

Case Study

Uploaded by

Vaibhav Badgikfa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 84

THE KING WITHOUT FISHES...!!!

[CASE ON CRISIS OF KINGFISHER AIRLINES]

Prof. Bhavik M. Panchasara

Marwadi Education Foundations Group of Institutions, RajKot, bhavikpanchasara@gmail.com

ABSTRACT

Indian Aviation Industry is one of the fastest growing markets in the world. But nowadays it is in the news due to

different reason. And that is the failure of one of the leading aviation player - Kingfisher Airlines. The airline has

been facing financial issues for many years. Till December 2011; Kingfisher Airlines had the second largest share

in India's domestic air travel market. However due to the severe financial crisis faced by the airline, it has the fifth

largest market share currently. Even the company have no funds to pay the salaries to the employees and is facing

several other issues like fuel dues; aircraft lease rental dues, service tax dues and bank arrears. This case outlines

the financial turmoil of the Kingfisher in detail.

Keywords: Aviation industry, Kingfisher Airlines, financial turmoil, financial issues, crisis and debt restructuring

INTRODUCTION:

Kingfisher Airlines is an airline group based in India.

Its head office is The Qube in Andheri (East),

Mumbai; and Registered Office in UB City,

Bangalore. Kingfisher Airlines was established in

2003. It is owned by the Bengaluru based United

Breweries Group. Kingfisher Airlines, through its

parent company United Breweries Group, has a 50%

stake in low-cost carrier Kingfisher Red. The airline

started commercial operations in 9 May 2005 with a

fleet of four new Airbus A320-200s operating a flight

from Mumbai to Delhi. It started its international

operations on 3 September 2008 by connecting

Bengaluru with London.

The airline has been facing financial issues for many

years. Till December 2011; Kingfisher Airlines had

the second largest share in India's domestic air travel

market. However due to the severe financial crisis

faced by the airline, it has the fifth largest market

share currently, only above Go Air. Kingfisher

Airlines is one of the only seven airlines awarded 5-

star rating by Skytrax along with Cathay Pacific,

Qatar Airways, Asiana Airlines, Malaysia Airlines,

Singapore Airlines, and Hainan Airlines. Kingfisher

operates 250 daily flights with regional and long-haul

international services. In May 2009, Kingfisher

Airlines carried more than 1 million passengers,

giving it the highest market share among airlines in

India. Kingfisher also owns the Skytrax award for

India's best airline of the year 2011.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 85

STARTING OF THE CRISES:

Ever since the airline commenced operations in 2005,

the company is reporting the losses. But the situation

became more horrible after acquiring the Air Deccan

in 2007. After acquiring the Air Deccan, the company

suffered a loss of over Rs. 1,000 crore for three

executive years. By early 2012, the airline

accumulated the losses of over Rs. 7,000 crore with

half of its fleet grounded and several members of its

staff going on strike. Following table 1 highlights

losses of the company since inception:

Table 1: Net Reported Losses and debts since inception (Rs. In Crores)

Year Mar-11 Mar-10 Mar-09 Mar-08 Jun-07 Jun-06 Mar-05

Loss -1027.4 -1646.22 -1608.83 -188.14 -419.58 -340.55 -16.79

Secured Loans 5,184.53 4,842.43 2,622.52 592.38 716.71 448.16 159.42

Unsecured Loans 1,872.55 3,080.17 3,043.04 342.00 200.00 3.50 125.06

DEBT RESTRUCTURING:

In the situation of loss and tough financial

condition, the company went for more loans. Table 1

shows the portion of secured and unsecured loans

taken by the company. Due to heavy burden of debt

and interest, in November 2010, the company

adopted the way of debt restructuring and under that

total 18 leading lenders, those have landed total Rs.

8,000 crores, agreed to cut interest rates and convert

part of loans to equity. As per the contract, lenders

have converted Rs. 650 crores debt into preference

shares which will be converted into equity when the

company lists the on the Luxembourg Stock

Exchange by selling global depositary receipts

(GDR). Shares will be converted into ordinary equity

at the price at which the GDRs are sold to investors.

Besides the 1,400 crore debt which will be

converted into preference shares, another 800 crore

debt has been converted into redeemable shares for

12 years. Due to debt restructuring, the company able

to down the average interest rate to 11% and to save

Rs. 500 crores every year in interest cost.

CRISIS TILL CONTINUE:

Debt restructuring also couldnt change the

game. By restructuring, company had reduced the

interest charges by Rs. 500 crores every year, but due

to the high leverage condition and increase in cost,

the company started to face the liquidity problem.

The company had no funds in hand and it created the

following payment problems.

DELAYED SALARY:

Kingfisher Airline has staff strength of 6,000

and spends 58 crore on salaries a month. According

to the first quarter financial results, it has 173.66

crore under the employees cost head, which has

increased from 163.40 crore during the same

quarter last year. Kingfisher Airlines delayed salaries

of its employees in August 2011, and for four months

in succession from October 2011 to January 2012.

Kingfisher also defaulted on paying the Tax

Deducted at Source from the employee income to the

tax department.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 85

STARTING OF THE CRISES:

Ever since the airline commenced operations in 2005,

the company is reporting the losses. But the situation

became more horrible after acquiring the Air Deccan

in 2007. After acquiring the Air Deccan, the company

suffered a loss of over Rs. 1,000 crore for three

executive years. By early 2012, the airline

accumulated the losses of over Rs. 7,000 crore with

half of its fleet grounded and several members of its

staff going on strike. Following table 1 highlights

losses of the company since inception:

Table 1: Net Reported Losses and debts since inception (Rs. In Crores)

Year Mar-11 Mar-10 Mar-09 Mar-08 Jun-07 Jun-06 Mar-05

Loss -1027.4 -1646.22 -1608.83 -188.14 -419.58 -340.55 -16.79

Secured Loans 5,184.53 4,842.43 2,622.52 592.38 716.71 448.16 159.42

Unsecured Loans 1,872.55 3,080.17 3,043.04 342.00 200.00 3.50 125.06

DEBT RESTRUCTURING:

In the situation of loss and tough financial

condition, the company went for more loans. Table 1

shows the portion of secured and unsecured loans

taken by the company. Due to heavy burden of debt

and interest, in November 2010, the company

adopted the way of debt restructuring and under that

total 18 leading lenders, those have landed total Rs.

8,000 crores, agreed to cut interest rates and convert

part of loans to equity. As per the contract, lenders

have converted Rs. 650 crores debt into preference

shares which will be converted into equity when the

company lists the on the Luxembourg Stock

Exchange by selling global depositary receipts

(GDR). Shares will be converted into ordinary equity

at the price at which the GDRs are sold to investors.

Besides the 1,400 crore debt which will be

converted into preference shares, another 800 crore

debt has been converted into redeemable shares for

12 years. Due to debt restructuring, the company able

to down the average interest rate to 11% and to save

Rs. 500 crores every year in interest cost.

CRISIS TILL CONTINUE:

Debt restructuring also couldnt change the

game. By restructuring, company had reduced the

interest charges by Rs. 500 crores every year, but due

to the high leverage condition and increase in cost,

the company started to face the liquidity problem.

The company had no funds in hand and it created the

following payment problems.

DELAYED SALARY:

Kingfisher Airline has staff strength of 6,000

and spends 58 crore on salaries a month. According

to the first quarter financial results, it has 173.66

crore under the employees cost head, which has

increased from 163.40 crore during the same

quarter last year. Kingfisher Airlines delayed salaries

of its employees in August 2011, and for four months

in succession from October 2011 to January 2012.

Kingfisher also defaulted on paying the Tax

Deducted at Source from the employee income to the

tax department.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 85

STARTING OF THE CRISES:

Ever since the airline commenced operations in 2005,

the company is reporting the losses. But the situation

became more horrible after acquiring the Air Deccan

in 2007. After acquiring the Air Deccan, the company

suffered a loss of over Rs. 1,000 crore for three

executive years. By early 2012, the airline

accumulated the losses of over Rs. 7,000 crore with

half of its fleet grounded and several members of its

staff going on strike. Following table 1 highlights

losses of the company since inception:

Table 1: Net Reported Losses and debts since inception (Rs. In Crores)

Year Mar-11 Mar-10 Mar-09 Mar-08 Jun-07 Jun-06 Mar-05

Loss -1027.4 -1646.22 -1608.83 -188.14 -419.58 -340.55 -16.79

Secured Loans 5,184.53 4,842.43 2,622.52 592.38 716.71 448.16 159.42

Unsecured Loans 1,872.55 3,080.17 3,043.04 342.00 200.00 3.50 125.06

DEBT RESTRUCTURING:

In the situation of loss and tough financial

condition, the company went for more loans. Table 1

shows the portion of secured and unsecured loans

taken by the company. Due to heavy burden of debt

and interest, in November 2010, the company

adopted the way of debt restructuring and under that

total 18 leading lenders, those have landed total Rs.

8,000 crores, agreed to cut interest rates and convert

part of loans to equity. As per the contract, lenders

have converted Rs. 650 crores debt into preference

shares which will be converted into equity when the

company lists the on the Luxembourg Stock

Exchange by selling global depositary receipts

(GDR). Shares will be converted into ordinary equity

at the price at which the GDRs are sold to investors.

Besides the 1,400 crore debt which will be

converted into preference shares, another 800 crore

debt has been converted into redeemable shares for

12 years. Due to debt restructuring, the company able

to down the average interest rate to 11% and to save

Rs. 500 crores every year in interest cost.

CRISIS TILL CONTINUE:

Debt restructuring also couldnt change the

game. By restructuring, company had reduced the

interest charges by Rs. 500 crores every year, but due

to the high leverage condition and increase in cost,

the company started to face the liquidity problem.

The company had no funds in hand and it created the

following payment problems.

DELAYED SALARY:

Kingfisher Airline has staff strength of 6,000

and spends 58 crore on salaries a month. According

to the first quarter financial results, it has 173.66

crore under the employees cost head, which has

increased from 163.40 crore during the same

quarter last year. Kingfisher Airlines delayed salaries

of its employees in August 2011, and for four months

in succession from October 2011 to January 2012.

Kingfisher also defaulted on paying the Tax

Deducted at Source from the employee income to the

tax department.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 87

FUEL DUES:

In the past several years, Kingfisher airlines

had trouble paying their fuel bills. Due non-payment,

several Kingfisher's vendors had filed winding up

petition with the High Court. As on Nov 2011,

winding up petition of seven creditors was pending

before the Bangalore High Court. In the past

Lufthansa Technik & Bharat Petroleum Corporation

Limited (BPCL) had also filed winding up petition

against Kingfisher Airlines. Here are some cases:

HPCL: In Jul 2011, Hindustan Petroleum

Corporation Limited (HPCL) stopped the fuel

(ATF) supplies for about two hours to Kingfisher

airlines owing to the non-payment of dues.

Situation was later resolved.

BPCL: Bharat Petroleum Corporation in 2009

had filed a case against Kingfisher airlines for

non-payment of dues. High court in an order said

that the entire amount 245 crore had to be paid

by Nov 2010 and the airline paid it in

instalments.

AIRCRAFT LEASE RENTAL DUES:

Since 2008, it has been reported that

Kingfisher Airlines has been unable to pay the

aircraft lease rentals on time. Due to that, the

Kingfisher Airlines has grounded 15 out of 66 aircraft

in its fleet as it was unable to meet the maintenance

and overhaul expenses. Here are the some major

issues with:

GECAS: In Nov 2008, GE Commercial Aviation

Services threatened to repossess 04 leased planes

in lieu of default. Kingfisher Airlines initially

denied that it missed the payments. GECAS had

filed a complaint with DGCA saying Kingfisher

had defaulted on rentals for four A320 aircraft,

and sought repossession of the planes. In Jan

2009, The Karnataka High Court rejected

petition by Kingfisher Airlines to restrain

GECAS from taking any step to deregister and

repossess the 04 aircraft in dispute. As a result,

Kingfisher had to return the A320 aircraft to

GECAS.

DVB: In Jul 2010, DVB Aviation Finance Asia

Ltd (a lessor from Singapore), sued Kingfisher

Airlines for lease rental default. Case was filed in

a UK court on Jul 16, 2010 after Kingfisher did

not pay for three month lease rental for A320

aircraft it leased from DVB.

AAI REPORTS:

Kingfisher received a notice from the

Airports Authority of India on February 2012

regarding accumulated dues of 255.06 crore. The

airline was operating on a cash and carry basis for the

last six months, with daily payments amounting to

0.8 crore.

SERVICE TAX:

On 9 December 2011, S.K. Goel, chairman,

Central Board of Excise and Customs (CBEC)

announced that CBEC is considering legal action

against Kingfisher for not paying service tax. As on

10th Jan 2012, Kingfisher Airlines has service tax

arrears of 70 crore. The Ministry of Finance has

given a concession to Kingfisher and instructed them

to pay the dues by 31st Mar 2012. In Jan 2012,

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 88

Kingfisher paid 20 crore towards its dues for

December 2011 and part of the arrears.

BANK ARREARS:

Kingfisher Airlines had not paid some

bankers (Lenders) as per the Debt Recast Package

(DRP) with lending banks. Till the end of Dec 2011,

the arrears were estimated to be 260 crore to 280

crore. Lenders hence had told Kingfisher Airlines to

clear its dues before they can release any more money

sought by the Airline. Ravi Nedungadi, chief

financial officer of UB Group however said that the

arrears were 180 crore. State Bank of India (SBI) on

5th Jan 2012 declared Kingfisher Airlines a NPA.

SBI is largest creditor and the leader of the

consortium of banks in the DRP (Debt Recast

Package) and has an exposure of 1,457.78 crore.

Thus, by Feb 2012, Kingfisher has been declared

NPA by following banks:

State Bank of India

Bank of Baroda

Punjab National Bank

IDBI

Central bank of India

Bank of India

Corporation Bank

THE CRISIS CONTINUE:

During late February, 2012, Kingfisher

Airlines started to sink into a fresh crisis. Several

flights were cancelled and aircraft were grounded.

The airline shut down most international short-haul

operations and also temporarily closed bookings. Out

of the 64 aircraft, only 22 were known to be

operational by February 20. With this, Kingfisher's

market share clearly dropped to 11.3%. The

cancellation of the flights was accompanied by a

13.5% drop in the stocks of the company on 20

February 2012. The CEO of the airlines, Sanjay

Agarwal was summoned by the Directorate General

of Civil Aviation to explain the disruptions of the

operations.

The State Bank of India, which is the lead

lender to Kingfisher airlines said that they would not

consider giving any more loans to Kingfisher unless

and until it comes up with a new equity by itself.

Political activists also claimed that bailing or helping

a private airline would lead to problems within the

Government. By February 27, Kingfisher operated

only above 150 out of its 400 flights and only 28

aircraft were functional. Reuters reported that if

Kingfisher were to shutdown, it would be the biggest

failure in the History of Indian Aviation. It was

announced that the direct flights to the smaller

airports of Jaipur, Thiruvananthapuram, Nagpur and

also to Hyderabad's Rajiv Gandhi International

Airport were all shut down and only one/two-stop

flights from its main hubs of Delhi and Mumbai

would operate.

In response to a situation as bad as

bankruptcy, Vijay Mallya announced that he had

organized funds to pay all the employees' overdue

salaries. With bank accounts frozen and huge debts

due, it is unknown so as from where he arranged the

money. But he apologized to his workers and said

that he would pay them immediately. By this time,

kingfisher had accumulated losses of 444 crore

during the third quarter of the fiscal year 2011-12.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 88

Kingfisher paid 20 crore towards its dues for

December 2011 and part of the arrears.

BANK ARREARS:

Kingfisher Airlines had not paid some

bankers (Lenders) as per the Debt Recast Package

(DRP) with lending banks. Till the end of Dec 2011,

the arrears were estimated to be 260 crore to 280

crore. Lenders hence had told Kingfisher Airlines to

clear its dues before they can release any more money

sought by the Airline. Ravi Nedungadi, chief

financial officer of UB Group however said that the

arrears were 180 crore. State Bank of India (SBI) on

5th Jan 2012 declared Kingfisher Airlines a NPA.

SBI is largest creditor and the leader of the

consortium of banks in the DRP (Debt Recast

Package) and has an exposure of 1,457.78 crore.

Thus, by Feb 2012, Kingfisher has been declared

NPA by following banks:

State Bank of India

Bank of Baroda

Punjab National Bank

IDBI

Central bank of India

Bank of India

Corporation Bank

THE CRISIS CONTINUE:

During late February, 2012, Kingfisher

Airlines started to sink into a fresh crisis. Several

flights were cancelled and aircraft were grounded.

The airline shut down most international short-haul

operations and also temporarily closed bookings. Out

of the 64 aircraft, only 22 were known to be

operational by February 20. With this, Kingfisher's

market share clearly dropped to 11.3%. The

cancellation of the flights was accompanied by a

13.5% drop in the stocks of the company on 20

February 2012. The CEO of the airlines, Sanjay

Agarwal was summoned by the Directorate General

of Civil Aviation to explain the disruptions of the

operations.

The State Bank of India, which is the lead

lender to Kingfisher airlines said that they would not

consider giving any more loans to Kingfisher unless

and until it comes up with a new equity by itself.

Political activists also claimed that bailing or helping

a private airline would lead to problems within the

Government. By February 27, Kingfisher operated

only above 150 out of its 400 flights and only 28

aircraft were functional. Reuters reported that if

Kingfisher were to shutdown, it would be the biggest

failure in the History of Indian Aviation. It was

announced that the direct flights to the smaller

airports of Jaipur, Thiruvananthapuram, Nagpur and

also to Hyderabad's Rajiv Gandhi International

Airport were all shut down and only one/two-stop

flights from its main hubs of Delhi and Mumbai

would operate.

In response to a situation as bad as

bankruptcy, Vijay Mallya announced that he had

organized funds to pay all the employees' overdue

salaries. With bank accounts frozen and huge debts

due, it is unknown so as from where he arranged the

money. But he apologized to his workers and said

that he would pay them immediately. By this time,

kingfisher had accumulated losses of 444 crore

during the third quarter of the fiscal year 2011-12.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 88

Kingfisher paid 20 crore towards its dues for

December 2011 and part of the arrears.

BANK ARREARS:

Kingfisher Airlines had not paid some

bankers (Lenders) as per the Debt Recast Package

(DRP) with lending banks. Till the end of Dec 2011,

the arrears were estimated to be 260 crore to 280

crore. Lenders hence had told Kingfisher Airlines to

clear its dues before they can release any more money

sought by the Airline. Ravi Nedungadi, chief

financial officer of UB Group however said that the

arrears were 180 crore. State Bank of India (SBI) on

5th Jan 2012 declared Kingfisher Airlines a NPA.

SBI is largest creditor and the leader of the

consortium of banks in the DRP (Debt Recast

Package) and has an exposure of 1,457.78 crore.

Thus, by Feb 2012, Kingfisher has been declared

NPA by following banks:

State Bank of India

Bank of Baroda

Punjab National Bank

IDBI

Central bank of India

Bank of India

Corporation Bank

THE CRISIS CONTINUE:

During late February, 2012, Kingfisher

Airlines started to sink into a fresh crisis. Several

flights were cancelled and aircraft were grounded.

The airline shut down most international short-haul

operations and also temporarily closed bookings. Out

of the 64 aircraft, only 22 were known to be

operational by February 20. With this, Kingfisher's

market share clearly dropped to 11.3%. The

cancellation of the flights was accompanied by a

13.5% drop in the stocks of the company on 20

February 2012. The CEO of the airlines, Sanjay

Agarwal was summoned by the Directorate General

of Civil Aviation to explain the disruptions of the

operations.

The State Bank of India, which is the lead

lender to Kingfisher airlines said that they would not

consider giving any more loans to Kingfisher unless

and until it comes up with a new equity by itself.

Political activists also claimed that bailing or helping

a private airline would lead to problems within the

Government. By February 27, Kingfisher operated

only above 150 out of its 400 flights and only 28

aircraft were functional. Reuters reported that if

Kingfisher were to shutdown, it would be the biggest

failure in the History of Indian Aviation. It was

announced that the direct flights to the smaller

airports of Jaipur, Thiruvananthapuram, Nagpur and

also to Hyderabad's Rajiv Gandhi International

Airport were all shut down and only one/two-stop

flights from its main hubs of Delhi and Mumbai

would operate.

In response to a situation as bad as

bankruptcy, Vijay Mallya announced that he had

organized funds to pay all the employees' overdue

salaries. With bank accounts frozen and huge debts

due, it is unknown so as from where he arranged the

money. But he apologized to his workers and said

that he would pay them immediately. By this time,

kingfisher had accumulated losses of 444 crore

during the third quarter of the fiscal year 2011-12.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 89

FROZEN BANK ACCOUNTS:

On March 3, 2012, The Central Board of

Excise & Customs of India froze many more

Kingfisher accounts as it was unable to pay all the

dues as per schedule. Kingfisher was meant to pay

1 crore per working day. Aviation minister Ajit Singh

warned the airline about the temporary suspension of

the license until the crisis was sorted out. He

announced that the rest of the airline's fleet would be

grounded and all flights cancelled until the crisis

came to an end. This would be only one step from

permanently closing the airline.

IATA SUSPENSION:

On March 7, 2012 IATA suspended ticket

sales of Kingfisher airlines citing non-payment of

dues as the primary reason, and they said that sales

services will only be restored once Kingfisher settles

ICH (IATA Clearing House) account. IATA also

immediately directed all travel agents to stop booking

tickets for Kingfisher. This would affect Kingfisher's

business by around 30%. Kingfisher claimed that

frozen bank accounts was the main cause of being

unable to pay the IATA, and the airline started

making alternate arrangements for the sale of tickets.

Soon it became difficult for the airline to follow the

much smaller schedule that it earlier released as even

more pilots began to go on strike.

UNCERTAINTY AHEAD:

After analysing the entire scenario, there are

strong possibilities of more difficult situation in the

last month of fiscal year 2011-12. The company is in

dilemma of finding help, but from where?

Government has refused for bailing and all the

lenders and bankers have no more trust. The

employees are also not able to tolerate the salary

crisis and the slipping market share leads the more

difficulties.

Promoter Vijay Malya has to decide the way

ahead. Whether is it possible to save the company?

There are very few alternatives. As per the previous

news, Etihad Airways was interested in investing in

Kingfisher by providing equity in exchange for a

stake in the airline. Also involved in the talks was the

International Airlines Group, owner of British flag

carrier British Airways and Spanish flag carrier

Iberia. But the question is the permission by

Government. So at present there is very tough

situation for Vijay Malya and for the company. Will

new fiscal year bring any solution for the company?

Lets wait and watch.

QUESTION FOR DISCUSSION:

1. Is the Problem of Kingfisher Airlines Industry

Specific or Company Specific?

2. What is the Impact of High Level of Debt on the

operating performance of company?

3. Should Government bailout Kingfisher Airlines?

4. According to you, what are the possible ways for

the company to overcome this situation?

TEACHING NOTES

1. The purpose of the case is to make the students

aware about the situation of financial crisis in

any organisation.

2. The issues involved in the case are about the

financial turmoil and its effects on the business

and market share of the company.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 89

FROZEN BANK ACCOUNTS:

On March 3, 2012, The Central Board of

Excise & Customs of India froze many more

Kingfisher accounts as it was unable to pay all the

dues as per schedule. Kingfisher was meant to pay

1 crore per working day. Aviation minister Ajit Singh

warned the airline about the temporary suspension of

the license until the crisis was sorted out. He

announced that the rest of the airline's fleet would be

grounded and all flights cancelled until the crisis

came to an end. This would be only one step from

permanently closing the airline.

IATA SUSPENSION:

On March 7, 2012 IATA suspended ticket

sales of Kingfisher airlines citing non-payment of

dues as the primary reason, and they said that sales

services will only be restored once Kingfisher settles

ICH (IATA Clearing House) account. IATA also

immediately directed all travel agents to stop booking

tickets for Kingfisher. This would affect Kingfisher's

business by around 30%. Kingfisher claimed that

frozen bank accounts was the main cause of being

unable to pay the IATA, and the airline started

making alternate arrangements for the sale of tickets.

Soon it became difficult for the airline to follow the

much smaller schedule that it earlier released as even

more pilots began to go on strike.

UNCERTAINTY AHEAD:

After analysing the entire scenario, there are

strong possibilities of more difficult situation in the

last month of fiscal year 2011-12. The company is in

dilemma of finding help, but from where?

Government has refused for bailing and all the

lenders and bankers have no more trust. The

employees are also not able to tolerate the salary

crisis and the slipping market share leads the more

difficulties.

Promoter Vijay Malya has to decide the way

ahead. Whether is it possible to save the company?

There are very few alternatives. As per the previous

news, Etihad Airways was interested in investing in

Kingfisher by providing equity in exchange for a

stake in the airline. Also involved in the talks was the

International Airlines Group, owner of British flag

carrier British Airways and Spanish flag carrier

Iberia. But the question is the permission by

Government. So at present there is very tough

situation for Vijay Malya and for the company. Will

new fiscal year bring any solution for the company?

Lets wait and watch.

QUESTION FOR DISCUSSION:

1. Is the Problem of Kingfisher Airlines Industry

Specific or Company Specific?

2. What is the Impact of High Level of Debt on the

operating performance of company?

3. Should Government bailout Kingfisher Airlines?

4. According to you, what are the possible ways for

the company to overcome this situation?

TEACHING NOTES

1. The purpose of the case is to make the students

aware about the situation of financial crisis in

any organisation.

2. The issues involved in the case are about the

financial turmoil and its effects on the business

and market share of the company.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 89

FROZEN BANK ACCOUNTS:

On March 3, 2012, The Central Board of

Excise & Customs of India froze many more

Kingfisher accounts as it was unable to pay all the

dues as per schedule. Kingfisher was meant to pay

1 crore per working day. Aviation minister Ajit Singh

warned the airline about the temporary suspension of

the license until the crisis was sorted out. He

announced that the rest of the airline's fleet would be

grounded and all flights cancelled until the crisis

came to an end. This would be only one step from

permanently closing the airline.

IATA SUSPENSION:

On March 7, 2012 IATA suspended ticket

sales of Kingfisher airlines citing non-payment of

dues as the primary reason, and they said that sales

services will only be restored once Kingfisher settles

ICH (IATA Clearing House) account. IATA also

immediately directed all travel agents to stop booking

tickets for Kingfisher. This would affect Kingfisher's

business by around 30%. Kingfisher claimed that

frozen bank accounts was the main cause of being

unable to pay the IATA, and the airline started

making alternate arrangements for the sale of tickets.

Soon it became difficult for the airline to follow the

much smaller schedule that it earlier released as even

more pilots began to go on strike.

UNCERTAINTY AHEAD:

After analysing the entire scenario, there are

strong possibilities of more difficult situation in the

last month of fiscal year 2011-12. The company is in

dilemma of finding help, but from where?

Government has refused for bailing and all the

lenders and bankers have no more trust. The

employees are also not able to tolerate the salary

crisis and the slipping market share leads the more

difficulties.

Promoter Vijay Malya has to decide the way

ahead. Whether is it possible to save the company?

There are very few alternatives. As per the previous

news, Etihad Airways was interested in investing in

Kingfisher by providing equity in exchange for a

stake in the airline. Also involved in the talks was the

International Airlines Group, owner of British flag

carrier British Airways and Spanish flag carrier

Iberia. But the question is the permission by

Government. So at present there is very tough

situation for Vijay Malya and for the company. Will

new fiscal year bring any solution for the company?

Lets wait and watch.

QUESTION FOR DISCUSSION:

1. Is the Problem of Kingfisher Airlines Industry

Specific or Company Specific?

2. What is the Impact of High Level of Debt on the

operating performance of company?

3. Should Government bailout Kingfisher Airlines?

4. According to you, what are the possible ways for

the company to overcome this situation?

TEACHING NOTES

1. The purpose of the case is to make the students

aware about the situation of financial crisis in

any organisation.

2. The issues involved in the case are about the

financial turmoil and its effects on the business

and market share of the company.

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 90

3. The case would be first given for individual

reading for 15 min and then for 15 min the case

can be discussed in groups of 4-5 students.

4. The case can be taught along with the concepts

like ways to overcome the crisis and surviving

strategies required to save the organisation

keeping in mind the possible different options

available.

5. The students can come prepared with topics of

prevailing crisis in Indian aviation industry and

other factors related to the aviation industry in

detail.

6. Cross reference can be made taking into account

the strategies used by the local, national and

international players to capture the slipping

market of the falling organisation.

REFERENCES:

http://www.flykingfisher.com/media-

center/press-releases/kingfisher-airlines-

announcement.aspx

http://in.finance.yahoo.com/news/kingfisher-

airlines-q3-loss-widens-033419822.html

http://timesofindia.indiatimes.com/india/Kingfi

sher.../12258986.cms

http://articles.economictimes.indiatimes.com/2

011-12-08/news/30490358_1_pilots-industrial-

action-kingfisher airlines

http://profit.ndtv.com/News/Article/aai-warns-

kingfisher-airlines-to-settle-dues-297284

http://articles.economictimes.indiatimes.com/2

010-09-26/news/27585421_1_cash-and-carry-

mode-bpcl-s

chairman-kingfisher-airlines

http://timesofindia.indiatimes.com/business/india-

business/Kingfisher-may-have-to-weather-pilot-

storm-next/articleshow/12214372.cms

Annexure 1: Market share of Kingfisher Airlines as on January 2012 in the domestic Aviation

Airline/Company % Share

Jet Airways (Including Jet Lite) 28.8%

Indigo 20.8%

Air India 17.1%

Spice Jet 16.3%

Kingfisher 11.3%

Go Air 5.8%

Source: http://in.finance.yahoo.com/news/kingfisher-airlines-q3-loss-widens-033419822.html

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 85

Annexure 2: Price Movement and Performance Charts of Kingfisher Airlines

Annexure 3: Index Comparison and Ownership Pattern of Kingfisher Airlines

Source:http://www.bseindia.com/bseplus/StockReach/AdvanceStockReach.aspx?scripcode=532747

Annexure 4: Comparative Balance Sheet of Kingfisher Airlines [Rs. In crores]

Sources Of Funds Mar '11 Mar '10 Mar '09 Mar '08 Jun '07 Jun '06 Mar05

Total Share Capital 1,050.88 362.91 362.91 135.80 135.47 98.18 16.20

Equity Share Capital 497.78 265.91 265.91 135.80 135.47 98.18 16.20

Share Appl. Money 2.95 7.48 8.11 10.09 0.00 0.00 0.00

Pref. Share Capital 553.10 97.00 97.00 0.00 0.00 0.00 0.00

Reserves -4,005.02 -4,268.84 -2,496.36 52.99 249.23 125.95 -2.54

Net worth -2,951.19 -3,898.45 -2,125.34 198.88 384.70 224.13 13.66

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 86

Secured Loans 5,184.53 4,842.43 2,622.52 592.38 716.71 448.16 159.42

Unsecured Loans 1,872.55 3,080.17 3,043.04 342.00 200.00 3.50 125.06

Total Debt 7,057.08 7,922.60 5,665.56 934.38 916.71 451.66 284.48

Total Liabilities 4,105.89 4,024.15 3,540.22 1,133.26 1,301.41 657.79 298.14

Application Of Funds

Gross Block 2,254.26 2,048.14 1,891.80 322.33 340.77 247.33 55.25

Less: Accum. Dep. 682.37 493.62 316.29 43.55 33.74 16.40 4.52

Net Block 1,571.89 1,554.52 1,575.51 278.78 307.03 230.93 50.73

Capital WIP 673.35 980.61 1,630.95 346.25 357.62 286.53 153.09

Investments 0.05 0.05 0.05 0.00 0.41 0.41 0.45

Inventories 187.65 164.88 147.25 48.64 61.62 57.26 36.40

Sundry Debtors 440.53 322.49 229.84 27.16 35.24 13.06 8.27

Cash & Bank Bal. 88.18 50.91 49.41 5.84 422.05 181.17 47.08

Total CA 716.36 538.28 426.50 81.64 518.91 251.49 91.75

Loans & Adv. 5,380.19 4,604.31 3,640.42 832.49 149.77 232.03 47.28

FDs 164.18 155.56 122.45 274.29 395.00 75.31 35.85

CA, Loans & Adv. 6,260.73 5,298.15 4,189.37 1,188.42 1,063.68 558.83 174.88

Current Liabilities 4,463.86 3,908.03 3,814.63 687.31 449.15 434.05 108.77

Provisions 62.11 46.77 45.55 9.52 6.94 5.93 1.07

Total CL & Prov. 4,525.97 3,954.80 3,860.18 696.83 456.09 439.98 109.84

Net Current Assets 1,734.76 1,343.35 329.19 491.59 607.59 118.85 65.04

Misc. Expenses 125.84 145.64 4.51 16.64 28.75 39.08 28.83

Total Assets 4,105.89 4,024.17 3,540.21 1,133.26 1,301.40 675.80 298.14

Source:http://www.moneycontrol.com/financials/kingfisherairlines/balancesheet/KA02#KA02

Annexure 5: Comparative P&L A/c of Kingfisher Airlines [Rs. In crores]

Income Mar '11 Mar '10 Mar '09 Mar '08 Jun '07 Jun06 Mar05

Net Sales 6,233.38 5,067.92 5,269.17 1,456.28 1,800.21 1285.42 305.55

Other Income 81.58 -333.30 598.90 113.62 342.10 59.64 14.73

Total Income 6,314.96 4,734.62 5,868.07 1,569.90 2,142.31 1345.06 320.28

Expenditure

Raw Materials 56.69 40.89 51.19 43.79 45.94 36.73 5.77

Power & Fuel Cost 2,274.03 1,802.99 2,602.62 889.30 979.50 625.45 92.98

Employee Cost 680.54 689.38 825.42 244.96 247.72 163.04 31.76

Other Manu. Exp. 1,192.80 1,108.82 1,112.85 408.21 617.56 425.48 104.78

Sell. & Admn Exp. 997.34 996.85 1,062.74 180.39 146.78 114.38 29.13

EISSN 2277-4955

BAUDDHIK VOLUME 3, NO.-1, JAN-APRIL-2012 87

Misc. Exp. 87.94 108.58 167.55 14.81 25.11 33.78 9.85

Total Expenses 5,289.34 4,747.51 5,822.37 1,781.46 2,062.61 1398.86 274.27

PBDIT 1,025.62 -12.89 45.70 -211.56 79.70 -53.80 46.01

Interest 2,340.32 2,245.59 2,029.33 434.44 466.05 250.72 55.33

PBDT -1,314.70 -2,258.48 -1,983.63 -646.00 -386.35 -304.52 -9.32

Depreciation 203.02 162.80 133.20 18.28 17.67 13.34 3.06

Other Written Off 38.01 54.49 38.39 18.31 26.25 18.94 5.73

Profit Before Tax -1,555.73 -2,475.77 -2,155.22 -682.59 -430.27 -336.80 -18.11

Extra-ordinary items 72.99 31.28 0.00 -0.97 14.09 0.00 -2.74

Tax -455.35 -700.00 -546.38 -494.45 3.40 3.75 -1.32

Reported Net Profit -1,027.40 -1,647.22 -1,608.83 -188.14 -419.58 -340.55 -16.79

Per share data (annualised)

Shares in issue (lakhs) 4,977.79 2,659.09 2,659.09 1,357.99 1,354.70 981.82 31.06

EPS (Rs) -20.64 -61.95 -60.50 -13.85 -30.97 -34.69 -54.05

Equity Dividend (%) 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Book Value (Rs) -70.46 -150.54 -83.88 13.90 28.40 22.83 43.96

Source: http://www.moneycontrol.com/financials/kingfisherairlines/profit-loss/KA02#KA02

You might also like

- DIY Homemade Moonshine, Whisky, Rum, and Other Distilled Spirits The Complete Guidebook To Making Your Own Liquor, Safely And... (Richard Armstrong)Document113 pagesDIY Homemade Moonshine, Whisky, Rum, and Other Distilled Spirits The Complete Guidebook To Making Your Own Liquor, Safely And... (Richard Armstrong)Nivaldo JoséNo ratings yet

- T 176Document9 pagesT 176ashkansoheylNo ratings yet

- Class 8 - Maths - Understanding Quadrilaterals PDFDocument32 pagesClass 8 - Maths - Understanding Quadrilaterals PDFAnand MekalaNo ratings yet

- Fuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersFrom EverandFuel Hedging and Risk Management: Strategies for Airlines, Shippers and Other ConsumersNo ratings yet

- A Case Study On Kingfisher AirlinesDocument23 pagesA Case Study On Kingfisher AirlinesLokeshwar Pawar100% (2)

- Study The Correlation of Clinker Quality, Reside, PSD On The Performance of Portland CementDocument12 pagesStudy The Correlation of Clinker Quality, Reside, PSD On The Performance of Portland CementIAEME PublicationNo ratings yet

- Stress Corrosion Cracking PDFDocument48 pagesStress Corrosion Cracking PDFPako RosasNo ratings yet

- Location: Method Statement TitleDocument32 pagesLocation: Method Statement TitleShanuNo ratings yet

- Failure of Kingfisher AirlinesDocument29 pagesFailure of Kingfisher AirlinesKunal AgarwalNo ratings yet

- Kingfisher Airline Fall Case StudyDocument14 pagesKingfisher Airline Fall Case Studycbhawsar100% (1)

- Business Development Strategy for the Upstream Oil and Gas IndustryFrom EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryRating: 5 out of 5 stars5/5 (1)

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- The Kingfisher CrisisDocument9 pagesThe Kingfisher CrisisSagar ParikhNo ratings yet

- Crisis and Debt Restructuring at Kingfisher AirlinesDocument5 pagesCrisis and Debt Restructuring at Kingfisher AirlinesAnk's SinghNo ratings yet

- Case Study KingfisherDocument7 pagesCase Study KingfisherAdison Growar SatyeNo ratings yet

- Kingfisher AirlineDocument13 pagesKingfisher AirlineAbhishek BansalNo ratings yet

- The King Without Fishes... !!!Document15 pagesThe King Without Fishes... !!!NishantMalhotraNo ratings yet

- Strategy Formulation - Kingfisher AirlinesDocument18 pagesStrategy Formulation - Kingfisher AirlinesJapkirat OberaiNo ratings yet

- Key WordsDocument13 pagesKey WordsNaMan SeThiNo ratings yet

- Debt Recast: Kingfisher Airlines Is An Airline Group Based inDocument8 pagesDebt Recast: Kingfisher Airlines Is An Airline Group Based invk1991No ratings yet

- BRM Group 3 (r1)Document12 pagesBRM Group 3 (r1)Bhavika VohraNo ratings yet

- KingfisherDocument18 pagesKingfisherpavitra_15_jadhavNo ratings yet

- Kingfisher Airlines Crisis: Presented By: Abhinandan Farhan Rajesh RaviDocument29 pagesKingfisher Airlines Crisis: Presented By: Abhinandan Farhan Rajesh RaviAbhichhajer100% (1)

- Kingfisher Airlines: Iata Icao CallsignDocument9 pagesKingfisher Airlines: Iata Icao CallsignPruthvi AdaniNo ratings yet

- Bengaluru United Breweries Group Airbus A320-200s Mumbai Delhi Bengaluru London Andheri Mumbai UB City Bengaluru Vile Parle (East) Vijay MallyaDocument2 pagesBengaluru United Breweries Group Airbus A320-200s Mumbai Delhi Bengaluru London Andheri Mumbai UB City Bengaluru Vile Parle (East) Vijay MallyaRobin PalanNo ratings yet

- Kingfisher ProjectDocument19 pagesKingfisher ProjectMohit Modi67% (3)

- A Case Study On Kingfisher Airlines CrisesDocument7 pagesA Case Study On Kingfisher Airlines CrisesManish Singh100% (2)

- Presentation of Kingfisher Airlines-1Document17 pagesPresentation of Kingfisher Airlines-1Tharun RNo ratings yet

- Financial Management Project Proposal: Group 10: India Jet Airways SpicejetDocument1 pageFinancial Management Project Proposal: Group 10: India Jet Airways SpicejetVivek AnandanNo ratings yet

- Kingfisher Rise and FallDocument10 pagesKingfisher Rise and FallRaaz sthaNo ratings yet

- Kingfisher Airlines Performance Post 2005 and Reasons Behind ItDocument2 pagesKingfisher Airlines Performance Post 2005 and Reasons Behind ItDhruv ChatterjeeNo ratings yet

- Kingifisher Airlines - A SummaryDocument6 pagesKingifisher Airlines - A SummaryCritlord Here100% (1)

- The Downfall of The King of Good Times'Document11 pagesThe Downfall of The King of Good Times'Golam Mehbub SifatNo ratings yet

- Kingfisher JourneyDocument15 pagesKingfisher JourneySuresh SenNo ratings yet

- HR Kingfisher Crisis CaseDocument20 pagesHR Kingfisher Crisis CaseNikita MaskaraNo ratings yet

- Kingfisher Scam in IndiaDocument5 pagesKingfisher Scam in IndiaGurudas Gaonkar100% (1)

- Kingfisher Airlines CaseDocument8 pagesKingfisher Airlines CasePrayag MaheshwariNo ratings yet

- Case Study:Kingfisher Airlines Financial CrisisDocument8 pagesCase Study:Kingfisher Airlines Financial CrisisGurpreet SinghNo ratings yet

- Yash Verma MBA - CMF13: DelhiDocument3 pagesYash Verma MBA - CMF13: DelhiYash VermaNo ratings yet

- Casestudy On Kingfisher AirlinesDocument5 pagesCasestudy On Kingfisher Airlinesbette_ruffles60% (10)

- On Kingfisher AirwaysDocument22 pagesOn Kingfisher AirwaysPratik Sukhani100% (5)

- Assignment Om Athul RDocument6 pagesAssignment Om Athul RAthul RNo ratings yet

- Turn Around Strategy of Air IndiaDocument33 pagesTurn Around Strategy of Air IndiaUvesh MevawalaNo ratings yet

- Air India Expects To Cut Losses by 75 PCT in FY11Document18 pagesAir India Expects To Cut Losses by 75 PCT in FY11Rakshit BapnaNo ratings yet

- Mallya CaseDocument9 pagesMallya CaseKaran BhansaliNo ratings yet

- Indigo Vs Kingfisher FinalDocument5 pagesIndigo Vs Kingfisher FinalVishakha GopinathNo ratings yet

- Critical Literature Review - Kingfisher AirlinesDocument6 pagesCritical Literature Review - Kingfisher AirlinesSeemaKapoorNo ratings yet

- Case 1-Intro To Corp FinDocument6 pagesCase 1-Intro To Corp FinShashi RanjanNo ratings yet

- Kingfisher AirlinesDocument3 pagesKingfisher AirlinesswaroopceNo ratings yet

- KingfisherDocument10 pagesKingfisherNabeel AhmedNo ratings yet

- Execution King FisherDocument5 pagesExecution King Fishervishrut_sharma_pgp13No ratings yet

- Kingfisher AirlinesDocument23 pagesKingfisher AirlinesShubham TiwariNo ratings yet

- Kingfisher Air To Raise $356 Million in Share Sales: BloombergDocument7 pagesKingfisher Air To Raise $356 Million in Share Sales: BloombergSanjib GuptaNo ratings yet

- Business EthicsDocument14 pagesBusiness EthicsRishav RajNo ratings yet

- Group 15Document40 pagesGroup 15CA Snehil PeriwalNo ratings yet

- Dr. Jeffamma and TeamDocument14 pagesDr. Jeffamma and TeamGreeshma SharathNo ratings yet

- Orion 2015 CaseDocument4 pagesOrion 2015 CaseAlphonse Raj DavidNo ratings yet

- A Project On Kingfisher AirlinesDocument13 pagesA Project On Kingfisher AirlinesSnehal KambleNo ratings yet

- Kingfisher AirlinesDocument13 pagesKingfisher AirlinesBilal SheniNo ratings yet

- Rise and Fall If Kingfisher AirlinesDocument5 pagesRise and Fall If Kingfisher AirlinesRam KrishnaNo ratings yet

- Kingfisher Airlines and Issues: Submitted by Shivani Singh 4 1 1 1 0 4 3 0 4 3Document6 pagesKingfisher Airlines and Issues: Submitted by Shivani Singh 4 1 1 1 0 4 3 0 4 3Avinash TripathiNo ratings yet

- From The Rising To The Sinking !!!: Jet AirwaysDocument6 pagesFrom The Rising To The Sinking !!!: Jet AirwaysSwikriti KhannaNo ratings yet

- Final Case StudyDocument29 pagesFinal Case StudySri Ram SuradaNo ratings yet

- Failure Story of Kingfisher Airlines: Strategic Management AssignmentDocument6 pagesFailure Story of Kingfisher Airlines: Strategic Management AssignmentAsif. MahamudNo ratings yet

- Ticket PricesDocument80 pagesTicket PricesGiuseppe Raimondo Vittorio BaudoNo ratings yet

- Dallas Music Shop Zagreb CD LagerDocument174 pagesDallas Music Shop Zagreb CD Lagervjeran rukavinaNo ratings yet

- Long Quiz in Physical Science Grade 11Document2 pagesLong Quiz in Physical Science Grade 11Kelly Ann PanganibanNo ratings yet

- Car HUD - Windscreen Display For Speed & Compass - Arduino Project HubDocument31 pagesCar HUD - Windscreen Display For Speed & Compass - Arduino Project HubPhops FrealNo ratings yet

- Grade VII ScienceDocument20 pagesGrade VII ScienceSunny BbaNo ratings yet

- Gawad Sa Manlilikha NG BayanDocument20 pagesGawad Sa Manlilikha NG Bayanmontefalcothea147No ratings yet

- OSHA/AWS/ANSI Shade Selector For WeldingDocument1 pageOSHA/AWS/ANSI Shade Selector For WeldingShabas Lukkumanil HakkimNo ratings yet

- Köppen Climate Classification PDFDocument21 pagesKöppen Climate Classification PDFJohann S M MendezNo ratings yet

- Report On Bharti Airtel Limited: Institute of Marketing and ManagementDocument26 pagesReport On Bharti Airtel Limited: Institute of Marketing and Managementsimply_cooolNo ratings yet

- DIN EN 12390 - 2 StandedDocument9 pagesDIN EN 12390 - 2 StandedSampath MuthunayakeNo ratings yet

- 2007 Intl PDFDocument496 pages2007 Intl PDFargaNo ratings yet

- TriumphDocument15 pagesTriumph1zmajNo ratings yet

- VMQ PDFDocument78 pagesVMQ PDFoleg-spbNo ratings yet

- 2.performance and Operating Characterstics of IC EngineDocument60 pages2.performance and Operating Characterstics of IC EngineSiraj MohammedNo ratings yet

- US3082461 Brisaci PatentDocument4 pagesUS3082461 Brisaci PatentMarko DjekicNo ratings yet

- X2R ATOWEB B NRI 003 01 - ATO - Webinar - SlidesDocument67 pagesX2R ATOWEB B NRI 003 01 - ATO - Webinar - SlidesBrik MalekNo ratings yet

- Re VistasDocument1,236 pagesRe VistasDego MorenoNo ratings yet

- Deutz Fahr Tractor Agrotron 265 After 81013001 Parts CatalogDocument22 pagesDeutz Fahr Tractor Agrotron 265 After 81013001 Parts Catalogcindybennettmd040595jbw100% (126)

- Desk Sputter Coater - DSR1Document3 pagesDesk Sputter Coater - DSR1mohamadazareshNo ratings yet

- Aluminium Foil AB - 711 S/S: Cool - Comfort - Energy SavingDocument2 pagesAluminium Foil AB - 711 S/S: Cool - Comfort - Energy SavingcandraNo ratings yet

- The Method of The Siddhas 5 Walking The Dog PDF FreeDocument25 pagesThe Method of The Siddhas 5 Walking The Dog PDF FreeDesiré Angelica GANo ratings yet

- Chocolate AnalysisDocument15 pagesChocolate AnalysissbdcmailNo ratings yet

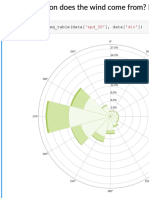

- Predicting The Wind: Data Science in Wind Resource AssessmentDocument61 pagesPredicting The Wind: Data Science in Wind Resource AssessmentFlorian RoscheckNo ratings yet

- List of NBFCDocument188 pagesList of NBFCDevansh Sanghvi (QubeHealth)No ratings yet