Professional Documents

Culture Documents

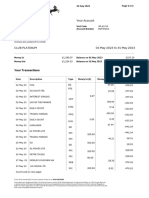

Tax Assignment

Uploaded by

gesalmariearnozaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Assignment

Uploaded by

gesalmariearnozaCopyright:

Available Formats

1 TAXATION; NATURE; NON-DELEGATION OF POWER, EXCEPTION. The power of t!

t"o# "$

# e$$e#t"% #& "#here#t ttr"'(te of $o)ere"*#t+, 'e%o#*"#* $ ,tter of r"*ht to e)er+

"#&epe#&e#t *o)er#,e#t, w"tho(t 'e"#* e!pre$$%+ -o#ferre& '+ the peop%e. It "$ power tht

"$ p(re%+ %e*"$%t")e #& wh"-h the -e#tr% %e*"$%t")e 'o&+ -##ot &e%e*te e"ther to the

e!e-(t")e or .(&"-"% &eprt,e#t of *o)er#,e#t w"tho(t "#fr"#*"#* (po# the theor+ of

$eprt"o# of power$. !!! /G.R. No. L-01112. Fe'r(r+ 34, 1542, PEP6I-COLA 7OTTLING

CO8PAN9 OF T:E P:ILIPPINE6, INC., p%"#t";-ppe%%#t, )$. 8UNICIPALIT9 OF TANAUAN,

LE9TE, T:E 8UNICIPAL 8A9OR, ET AL<.

3.

Power of T!t"o#= I#here#t "# 6o)ere"*# 6tte /3>>0<

Wh+ "$ the power to t! -o#$"&ere& "#here#t "# $o)ere"*#

6tte? /@A<

6UGGE6TED AN6WER=

It "$ -o#$"&ere& "#here#t "# $o)ere"*# 6tte 'e-($e "t "$

#e-e$$r+ ttr"'(te of $o)ere"*#t+. W"tho(t th"$ power #o

$o)ere"*# 6tte -# e!"$t or e#&(re. The power to t! pro-ee&$ (po#

the theor+ tht the e!"$te#-e of *o)er#,e#t "$ #e-e$$"t+ #& th"$

power "$ # e$$e#t"% #& "#here#t ttr"'(te of $o)ere"*#t+, 'e%o#*"#* $

,tter of r"*ht to e)er+ "#&epe#&e#t $tte or *o)er#,e#t. No

$o)ere"*# $tte -# -o#t"#(e to e!"$t w"tho(t the ,e#$ to

p+ "t$ e!pe#$e$; #& tht for tho$e ,e#$, "t h$ the r"*ht

to -o,pe% %% -"t"Be#$ #& propert+ w"th"# "t$ %","t$ to

-o#tr"'(te, he#-e, the e,er*e#-e

0. Power of T!t"o#= Le*%"t+; Lo-% Go)Ct T!t"o# /3>>0<

8+ Co#*re$$, (#&er the 15D4 Co#$t"t(t"o#, 'o%"$h the

power to t! of %o-% *o)er#,e#t$? /@A<

6UGGE6TED AN6WER=

No. Co#*re$$ -##ot 'o%"$h wht "$ e!pre$$%+ *r#te& '+

the f(#&,e#t% %w. The o#%+ (thor"t+ -o#ferre& to

Co#*re$$ "$ to pro)"&e the *("&e%"#e$ #& %","tt"o#$ o# the

%o-% *o)er#,e#tE$ e!er-"$e of the power to t! /6e-. 1, Art.

X, 15D4 Co#$t"t(t"o#<.

@. D"$-($$ the ,e#"#* #& ",p%"-t"o#$ of the fo%%ow"#* $tte,e#t$= F T!e$ re the

%"fe'%oo& of *o)er#,e#t #& the"r pro,pt #& -ert"# )"%'"%"t+ "$ # ",per"o($ #ee&.G

/1551<

T!e$ re the %"fe'%oo& of the *o)er#,e#t. W"tho(t t!e$, the *o)er#,e#t -# #e"ther e!"$t

#or e#&(re. The e!er-"$e of t!"#* power &er")e$ "t$ $o(r-e fro, the )er+ e!"$te#-e of the

6tte who$e $o-"% -o#tr-t w"th "t$ -"t"Be#$ o'%"*e$ "t to pro,ote p('%"- "#tere$t #& the

-o,,o# *oo& / G.R. No. 12>412. 8r-h 5, 3>1>, C:A87ER OF REAL E6TATE AND 7UILDER6E

A66OCIATION6, INC., pet"t"o#er, )$. T:E :ON. EXECUTIHE 6ECRETAR9 AL7ERTO RO8ULO,

T:E :ON. ACTING 6ECRETAR9 OF FINANCE IUANITA D. A8ATONG, #& T:E :ON.

CO88I66IONER OF INTERNAL REHENUE GUILLER8O PARA9NO, IR., re$po#&e#t$<.

1.

Power of T!t"o#= L","tt"o#$; Power to De$tro+ /3>>><

I($t"-e :o%,e$ o#-e $"&= The power to t! "$ #ot the power to

&e$tro+ wh"%e th"$ Co(rt /the 6(pre,e Co(rt< $"t$.J De$-r"'e the

power to t! #& "t$ %","tt"o#$. /1A<

6UGGE6TED AN6WER=

The power to t! "$ # "#here#t power of the $o)ere"*#

wh"-h "$ e!er-"$e& thro(*h the %e*"$%t(re, to ",po$e

'(r&e#$ (po# $('.e-t$ #& o'.e-t$ w"th"# "t$ I(r"$&"-t"o#

for the p(rpo$e of r"$"#* re)e#(e$ to -rr+ o(t the

%e*"t",te o'.e-t$ of *o)er#,e#t. The (#&er%+"#* '$"$ for

"t$ e!er-"$e "$ *o)er#,e#t% #e-e$$"t+ for w"tho(t "t #o

*o)er#,e#t -# e!"$t #or e#&(re. A--or&"#*%+, "t h$ the

'ro&e$t $-ope of %% the power$ of *o)er#,e#t 'e-($e "#

the '$e#-e of %","tt"o#$, "t "$ -o#$"&ere& $ (#%","te&,

p%e#r+, -o,prehe#$")e #& $(pre,e. The two %","tt"o#$

o# the power of t!t"o# re the "#here#t #& -o#$t"t(t"o#%

%","tt"o#$ wh"-h re "#te#&e& to pre)e#t '($e o# the

e!er-"$e of the otherw"$e p%e#r+ #& (#%","te& power. It "$

the Co(rtE$ ro%e to $ee to "t tht the e!er-"$e of the power

&oe$ #ot tr#$*re$$ the$e %","tt"o#$.

4. Power of T!t"o#= L","tt"o#$= P$$"#* of Re)e#(e 7"%%$

/1554<

The :o($e of Repre$e#tt")e$ "#tro&(-e& :7 4>>> wh"-h

e#)"$"o#e& to %e)+ t! o# )r"o($ tr#$-t"o#$. After the

'"%% w$ ppro)e& '+ the :o($e, the '"%% w$ $e#t to the

6e#te $ $o reK("re& '+ the Co#$t"t(t"o#. I# the (pper

ho($e, "#$te& of &e%"'ert"o# o# the :o($e 7"%%, the

6e#te "#tro&(-e& 67 D>>> wh"-h w$ "t$ ow# )er$"o# of

the $,e t!. The 6e#te &e%"'erte& o# th"$ 6e#te 7"%% #&

ppro)e& the $,e. The :o($e 7"%% #& the 6e#te 7"%%

were the# -o#$o%"&te& "# the 7"-,er% Co,,"ttee.

E)e#t(%%+, the -o#$o%"&te& '"%% w$ ppro)e& #& $e#t to

the Pre$"&e#t who $"*#e& the $,e. The pr")te $e-tor$

;e-te& '+ the #ew %w K(e$t"o#e& the )%"&"t+ of the

e#-t,e#t o# the *ro(#& tht the -o#$t"t(t"o#% pro)"$"o#

reK("r"#* tht %% re)e#(e '"%%$ $ho(%& or"*"#te fro, the

:o($e of Repre$e#tt")e$ h& 'ee# )"o%te&. Re$o%)e the

"$$(e.

6UGGE6TED AN6WER=

There "$ #o )"o%t"o# of the -o#$t"t(t"o#% reK("re,e#t tht

%% re)e#(e '"%%$ $ho(%& or"*"#te fro, the :o($e of

Repre$e#tt")e$. Wht "$ proh"'"te& "$ for the 6e#te to

e#-t re)e#(e ,e$(re$ o# "t$ ow# w"tho(t '"%% or"*"#t"#*

fro, the :o($e. 7(t o#-e the re)e#(e '"%% w$ p$$e& '+ the

:o($e #& $e#t to the 6e#te, the %tter -# p$$ "t$ ow#

)er$"o# o# the $,e $('.e-t ,tter -o#$o##t w"th the

%tterE$ power to propo$e or -o#-(r w"th ,e#&,e#t$. Th"$

fo%%ow$ fro, the -o-eK(%"t+ of the two -h,'er$ of

Co#*re$$ /To%e#t"#o ). 6e-retr+ of F"##-e, GR No.

111@11, O-t. 0>, 1551<.

11.

I#here#t L","tt"o#$ o# the power to t!

. The reK("re,e#t tht the %e)+ of t! ,($t 'e for p('%"- p(rpo$e

C$e=

EN 7ANC

LG.R. No. L-1>@>1. De-e,'er 35, 152>.M

WENCE6LAO PA6CUAL, "# h"$ oN-"% -p-"t+ $ Pro)"#-"% Go)er#or of R"B%, pet"t"o#er-

ppe%%#t, )$. T:E 6ECRETAR9 OF PU7LIC WORO6 AND CO88UNICATION6, ET AL.,

re$po#&e#t$-ppe%%ee$.

A$$t. F"$-% No%" 8. Corte$ #& Io$e P. 6#to$ for ppe%%#t.

A$$t. 6o%"-"tor Ge#er% Io$e G. 7(t"$t #& 6o%"-"tor A.A. Torre$ for ppe%%ee.

69LLA7U6

1. CON6TITUTIONAL LAW; LEGI6LATIHE POWER6; APPROPRIATION OF PU7LIC REHENUE6

ONL9 FOR PU7LIC PURPO6E6; W:AT DETER8INE6 HALIDIT9 OF A PU7LIC EXPENDITURE. JIt

"$ *e#er% r(%e tht the %e*"$%t(re "$ w"tho(t power to ppropr"te p('%"- re)e#(e$ for

#+th"#* '(t p('%"- p(rpo$e. . . . It "$ the e$$e#t"% -hr-ter of the &"re-t o'.e-t of the

e!pe#&"t(re wh"-h ,($t &eter,"#e "t$ )%"&"t+ $ .($t"f+"#* t! #& #ot the ,*#"t(&e of

the "#tere$t$ to 'e ;e-te& #or the &e*ree to wh"-h the *e#er% &)#t*e of the

-o,,(#"t+, #& th($ the p('%"- we%fre, ,+ 'e (%t",te%+ 'e#ePte& '+ the"r pro,ot"o#.

I#-"&e#t% &)#t*e to the p('%"- or to the $tte, wh"-h re$(%t$ fro, the pro,ot"o# of

pr")te "#tere$t$, #& the pro$per"t+ of pr")te e#terpr"$e$ or '($"#e$$, &oe$ #ot .($t"f+ the"r

"& '+ the ($e of p('%"- ,o#e+.J /30 R. L. C. pp. 05D-@1><.

3. ID.; ID.; ID.; UNDERL9ING REA6ON FOR T:E RULE. Ge#er%%+, (#&er the e!pre$$ or

",p%"e& pro)"$"o#$ of the -o#$t"t(t"o#, p('%"- f(#&$ ,+ 'e ($e& o#%+ for p('%"- p(rpo$e.

The r"*ht of the %e*"$%t(re to ppropr"te p('%"- f(#&$ "$ -orre%t")e w"th "t$ r"*ht to t!, #&,

(#&er -o#$t"t(t"o#% pro)"$"o#$ *"#$t t!t"o# e!-ept for p('%"- p(rpo$e$ #& proh"'"t"#*

the -o%%e-t"o# of t! for o#e p(rpo$e #& the &e)ot"o# thereof to #other p(rpo$e, #o

ppropr"te of $tte f(#&$ -# 'e ,&e for other th# p('%"- p(rpo$e. /D1 C.I.6. p. 11@4

The power to t! -# 'e re$orte& to o#%+ for -o#$t"t(t"o#%%+ )%"& p('%"- p(rpo$e. 7+ the

$,e toQe#, t!e$ ,+ #ot 'e %e)"e& for p(re%+ pr")te p(rpo$e$, for '("%&"#* (p of pr")te

fort(#e$, or for the re&re$$ of pr")te wro#*$. The+ -##ot 'e %e)"e& for the ",pro)e,e#t of

pr")te propert+, or for the 'e#ePt, #& pro,ot"o# of pr")te e#terpr"$e$, e!-ept where the

"& "$ "#-"&e#t to the p('%"- 'e#ePt. It "$ we%%-$ett%e& pr"#-"p%e of -o#$t"t(t"o#% %w tht #o

*e#er% t! -# 'e %e)"e& e!-ept for the p(rpo$e of r"$"#* ,o#e+ wh"-h "$ to 'e e!pe#&e&

for p('%"- ($e. F(#&$ -##ot 'e e!-te& (#&er the *("$e of t!t"o# to pro,ote p(rpo$e

tht "$ #ot of p('%"- "#tere$t. W"tho(t $(-h %","tt"o#, the power to t! -o(%& 'e e!er-"$e& or

e,p%o+e& $ # (thor"t+ to &e$tro+ the e-o#o,+ of the peop%e. A t!, howe)er, "$ #ot he%&

)o"& o# the *ro(#& of w#t of p('%"- "#tere$t (#%e$$ the w#t of $(-h "#tere$t "$ -%er. /41

A,. I(r. pp. 041-043<

T:IRD DIHI6ION

LG.R. No. 122>>2. 8r-h 1@, 3>>D.M

PLANTER6 PRODUCT6, INC., pet"t"o#er, )$. FERTIP:IL CORPORATION, re$po#&e#t.

D E C I 6 I O N

'. Proh"'"t"o# *"#$t the &e%e*t"o# of %e*"$%t")e power;

Ge#er% r(%e= No#-&e%e*t"o#

TAXATION; NATURE; NON-DELEGATION OF POWER, EXCEPTION. The power of t!t"o# "$

# e$$e#t"% #& "#here#t ttr"'(te of $o)ere"*#t+, 'e%o#*"#* $ ,tter of r"*ht to e)er+

"#&epe#&e#t *o)er#,e#t, w"tho(t 'e"#* e!pre$$%+ -o#ferre& '+ the peop%e. It "$ power tht

"$ p(re%+ %e*"$%t")e #& wh"-h the -e#tr% %e*"$%t")e 'o&+ -##ot &e%e*te e"ther to the

e!e-(t")e or .(&"-"% &eprt,e#t of *o)er#,e#t w"tho(t "#fr"#*"#* (po# the theor+ of

$eprt"o# of power$. The e!-ept"o#, howe)er, %"e$ "# the -$e of ,(#"-"p% -orport"o#$, to

wh"-h, $"& theor+ &oe$ #ot pp%+. Le*"$%t")e power$ ,+ 'e &e%e*te& to %o-%

*o)er#,e#t$ "# re$pe-t of ,tter$ of %o-% -o#-er#. Th"$ "$ $#-t"o#e& '+ ",,e,or"%. 7+

#e-e$$r+ ",p%"-t"o#, the %e*"$%t")e power to -rete po%"t"-% -orport"o#$ for p(rpo$e of

%o-% $e%f-*o)er#,e#t -rr"e$ w"th "t the power to -o#fer o# $(-h %o-% *o)er#,e#t *e#-"e$

the power to t! /G.R. No. L-01112. Fe'r(r+ 34, 1542, PEP6I-COLA 7OTTLING CO8PAN9 OF

T:E P:ILIPPINE6, INC., p%"#t";-ppe%%#t, )$. 8UNICIPALIT9 OF TANAUAN, LE9TE, T:E

8UNICIPAL 8A9OR, ET AL<.

-. I#ter#t"o#% -o,"t+, (#&er wh"-h the propert+ of fore"*# 6tte ,+ #ot 'e t!e& '+

#other;

&. Terr"tor"%"t+, wh"-h reK("re$ tht the per$o# or propert+ t!e& ,($t 'e $('.e-t to the

.(r"$&"-t"o# of the t!"#* 6tte;

E!,p%e$ "f - #& & fro, 3>1> 'r K(e$t"o# #& #$wer

I#here#t L","tt"o#$ of Terr"tor"%"t+ #& I#ter#t"o#% Co,"t+

8+ the Ph"%"pp"#e *o)er#,e#t reK("re t! w"thho%&"#* o# the $%r"e$ of F"%"p"#o e,p%o+ee$

worQ"#* "# the A,er"-#

E,'$$+ "# the Ph"%"pp"#e$?

No, 'e-($e th"$ w"%% )"o%te the pr"#-"p%e of "#ter#t"o#% -o,"t+. If the Ph"%"pp"#e

*o)er#,e#t wo(%& ",po$e

the reK("re,e#t of t! w"thho%&"#* o# the $%r"e$ of F"%"p"#o e,p%o+ee$ worQ"#* "# the

A,er"-# E,'$$+ "# the

Ph"%"pp"#e$, th"$ wo(%& "# e;e-t reK("re tht the A,er"-# *o)er#,e#t 'e -o#$t"t(te& $ the

w"thho%&"#* *e#t of

the Ph"%"pp"#e *o)er#,e#t "#$ofr $ the t!e$ o# the $%r"e$ of the F"%"p"#o e,p%o+ee$ re

-o#-er#e&. Th"$ "$

o')"o($%+ )"o%t")e of the "#here#t %","tt"o# tht t!t"o# "$ $('.e-t to the pr"#-"p%e of

"#ter#t"o#% -o,"t+

8+ the Ph"%"pp"#e *o)er#,e#t reK("re t! w"thho%&"#* o# the "#tere$t "#-o,e er#e& '+

re$"&e#t -"t"Be# fro, '#Q &epo$"t 'ro&?

No, 'e-($e th"$ w"%% )"o%te the pr"#-"p%e of terr"tor"%"t+. Wh"%e "t "$ tr(e tht the "#tere$t

"#-o,e "$ $('.e-t to

"#-o,e t! here "# the Ph"%"pp"#e$ -o#$"&er"#* tht the $,e w$ er#e& '+ re$"&e#t

-"t"Be#, $t"%%, the $,e

-o(%& #ot 'e the $('.e-t of t! w"thho%&"#*. Th"$ "$ 'e-($e "f the Ph"%"pp"#e *o)er#,e#t

wo(%& ",po$e the

reK("re,e#t of t! w"thho%&"#* o# the "#tere$t "#-o,e er#e& '+ re$"&e#t -"t"Be# fro,

'#Q &epo$"t 'ro&,

th"$ wo(%& "# e;e-t reK("re tht the fore"*# '#Q 'e -o#$t"t(te& $ the w"thho%&"#* *e#t of

the Ph"%"pp"#e

*o)er#,e#t. Th"$ "$ o')"o($%+ )"o%t")e of the "#here#t %","tt"o# tht t!t"o# "$ $('.e-t to

the pr"#-"p%e of

terr"tor"%"t+ 'e-($e fore"*# t!p+er wh"-h "$ o(t$"&e the terr"tor"% .(r"$&"-t"o# of the

-o(#tr+ wo(%& the# 'e

$('.e-te& to o(r t! %w$.

e. E!e,pt"o# of *o)er#,e#t% *e#-"e$ / perfor,"#* *o)er#,e#t% f(#-t"o#$< fro,

t!t"o# /'(t there "$ #o proh"'"t"o# *"#$t the *o)er#,e#t t!"#* "t$e%f<;

13

8r" 6(erte, F"%"p"#o -"t"Be#, p(r-h$e& %ot "# 8Qt" C"t+ "# 15D> t

pr"-e of P1 ,"%%"o#. 6"& propert+ h$ 'ee# %e$e& to 8A6 Corport"o#, &o,e$t"-

-orport"o# e#**e& "# ,#(f-t(r"#* pper pro&(-t$, ow#e& 55A '+ 8r" 6(erte. I#

O-to'er 3>>4, EIP Corport"o#, re% e$tte &e)e%oper, e!pre$$e& "t$ &e$"re to

'(+ the 8Qt" propert+ t "t$ f"r ,rQet )%(e P0>> ,"%%"o#, p+'%e $ fo%%ow$

= /< P2> ,"%%"o# &ow# p+,e#t; #& /'< '%#-e, p+'%e eK(%%+ "# twe#t+ fo(r

/3@< ,o#th%+ -o#$e-(t")e "#$t%%,e#t$. Upo# the &)"-e of t! %w+er, 8r"

6(erte e!-h#*e& her 8Qt" propert+ for $hre$ of $to-Q of 8A6 Corport"o#. A 7IR

r(%"#*, -o#Pr,"#* the t!-free e!-h#*e of propert+ for $hre$ of $to-Q, w$

$e-(re& fro, the 7IR Nt"o#% ON-e #& Cert"P-te A(thor"B"#* Re*"$trt"o#

w$ "$$(e& '+ the Re)e#(e D"$tr"-t ON-er /RDO< where the propert+ w$ %o-te&.

6('$eK(e#t%+, $he $o%& her e#t"re $to-Q ho%&"#*$ "# 8A6 Corport"o# to EIP

Corport"o# for P0>> ,"%%"o#. I# )"ew of the t! &)"-e, 8r" 6(erte p"& o#%+

the -p"t% *"#$ t! of P35,D51,>>> / P1>>,>>> ! 1A p%($ P35D,5>>,>> ! 1>A <,

"#$te& of the -orporte "#-o,e t! of P1>@,21>,>> / 01A o# P355 ,"%%"o# *"# fro,

$%e of re% propert+ <. After e)%(t"#* the -p"t% *"#$ t! p+,e#t, the RDO

wrote %etter to 8r" 6(erte, 6%t"#* tht $he -o,,"te& t! e)$"o#.

I$ the -o#te#t"o# of the RDO te#'%e? Or w$ "t t! )o"&#-e tht 8r" 6(erte

h& re$orte& to? E!p%"#. / 2A <

A%ter#t")e #$wer

No. The e!-h#*e of the re% $tte propert+ for the $hre$ of $to-Q$ "$ -o#$"&ere& $

%e*"t",te t! )o"&#-e $-he,e / 6e-t"o# @> LC3'M NIRC<. The $%e of the $hre$ of $to-Q$

of &o,e$t"- -orport"o#, wh"-h "$ -p"t% $$et, "$ $('.e-t to P#% t! of 1 A o# the Pr$t

1>>, >>> pe$o$ #& 1> A o# the ,o(#t "# e!-e$$ of 1>>,>>> / 6e-t"o# 3@ L-M NIRC<.

10. Wht "$ the #t(re of the t!"#* power of the pro)"#-e$, ,(#"-"p%"t"e$ #& -"t"e$? :ow

w"%% the %o-% *o)er#,e#t (#"t$ 'e '%e to e!er-"$e the"r t!"#* power$?

The t!"#* power of %o-% *o)er#,e#t$ "$ #ot # "#here#t power '(t o#e &e%e*te& (#&er

the Ph"%"pp"#e Co#$t"t(t"o#.

ARTICLE X

Lo-% Go)er#,e#t

6ECTION 1. E-h %o-% *o)er#,e#t (#"t $h%% h)e the power to -rete "t$ ow# $o(r-e$ of

re)e#(e$ #& to %e)+ t!e$, fee$, #& -hr*e$ $('.e-t to $(-h *("&e%"#e$ #& %","tt"o#$ $

the Co#*re$$ ,+ pro)"&e, -o#$"$te#t w"th the '$"- po%"-+ of %o-% (to#o,+. 6(-h t!e$,

fee$, #& -hr*e$ $h%% --r(e e!-%($")e%+ to the %o-% *o)er#,e#t$.

Lo-% *o)er#,e#t (#"t$ e!er-"$e the"r power$ thro(*h the e#-t,e#t of or&"##-e$ / 1551

Lo-% Go)er#,e#t Co&e, 7ooQ II, Chpter 1, 6e-. 103<.

1@

Basic Stages or Aspects of Taxation (2006)

E#(,erte the 0 $t*e$ or $pe-t$ of t!t"o#. E!p%"#

e-h. /1A<

SUGGESTE A!S"ER#

The $pe-t$ of t!t"o# re=

/1< LEH9ING the -t of the %e*"$%t(re "#

-hoo$"#* the per$o#$, propert"e$, r"*ht$ or pr")"%e*e$ to 'e

$('.e-te& to t!t"o#.

/3< A66E668ENT #& COLLECTION Th"$ "$

the -t of e!e-(t"#* the %w thro(*h the &,"#"$trt")e

*e#-"e$ of *o)er#,e#t.

/0< PA98ENT the -t of the t!p+er "# $ett%"#*

h"$ t! o'%"*t"o#$.

11

irect Tax $s% In&irect Tax ('(())

D"$t"#*("$h &"re-t fro, # "#&"re-t t!.

SUGGESTE A!S"ER#

A DIRECT TAX "$ o#e "# wh"-h the t!p+er who p+$

the t! "$ &"re-t%+ %"'%e therefor, tht "$, the '(r&e# of

p+"#* the t! f%%$ &"re-t%+ o# the per$o# p+"#* the t!.

A# INDIRECT TAX "$ o#e p"& '+ per$o# who "$ #ot

&"re-t%+ %"'%e therefor, #& who ,+ therefore $h"ft or p$$

o# the t! to #other per$o# or e#t"t+, wh"-h (%t",te%+

$$(,e$ the t! '(r&e#. (*ace&a $% *acaraig+ '(, SCRA

,,')

irect Tax $s% In&irect Tax (2000)

A,o#* the t!e$ ",po$e& '+ the 7(re( of I#ter#%

Re)e#(e re "#-o,e t!, e$tte #& &o#orE$ t!, )%(e-&&e&

t!, e!-"$e t!, other per-e#t*e t!e$, #& &o-(,e#tr+

$t,p t!. C%$$"f+ the$e t!e$ "#to &"re-t #& "#&"re-t t!e$,

#& &";ere#t"te &"re-t fro, I#&"re-t t!e$. /1A<

SUGGESTE A!S"ER#

I#-o,e t!, e$tte #& &o#orE$ t! re -o#$"&ere& $ &"re-t

t!e$. O# the other h#&, )%(e-&&e& t!, e!-"$e t!, other

per-e#t*e t!e$, #& &o-(,e#tr+ $t,p t! re "#&"re-t

t!e$.

DIRECT TAXE6 re &e,#&e& fro, the )er+ per$o#

who, $ "#te#&e&, $ho(%& p+ the t! wh"-h he -##ot $h"ft

to #other; wh"%e # INDIRECT TAX "$ &e,#&e& "# the

Pr$t "#$t#-e fro, o#e per$o# w"th the e!pe-tt"o# tht he

-# $h"ft the '(r&e# to $o,eo#e

irect Tax $s% In&irect Tax (200')

D"$t"#*("$h &"re-t t!e$ fro, "#&"re-t t!e$, #& *")e #

e!,p%e for e-h o#e. /3A<

SUGGESTE A!S"ER#

DIRECT TAXE6 re t!e$ where"# 'oth the "#-"&e#-e /or

%"'"%"t+ for the p+,e#t of the t!< $ we%% $ the ",p-t or

'(r&e# of the t! f%%$ o# the $,e per$o#. A#

e!,p%e of th"$ t! "$ "#-o,e t! where the per$o# $('.e-t

to t! -##ot $h"ft the '(r&e# of the t! to #other per$o#.

INDIRECT TAXE6, o# the other h#&, re t!e$ where"#

the "#-"&e#-e of or the %"'"%"t+ for the p+,e#t of the t!

f%%$ o# o#e per$o# '(t the '(r&e# thereof -# 'e $h"fte& or

p$$e& o# to #other per$o#. E!,p%e of th"$ t! "$ the

)%(e-&&e& t!.

ALTER!ATI-E A!S"ER#

A &"re-t t! "$ t! wh"-h "$ &e,#&e& fro, the per$o#

who %$o $ho(%&er$ the '(r&e# of the t!. E!,p%e=

-orporte #& "#&")"&(% "#-o,e t!.

A# "#&"re-t t! "$ t! wh"-h "$ &e,#&e& fro, o#e per$o#

"# the e!pe-tt"o# #& "#te#t"o# tht he $h%% "#&e,#"f+

h",$e%f t the e!pe#$e of #other, #& the '(r&e# P#%%+

re$t"#* o# the (%t",te p(r-h$er or -o#$(,er. E!,p%e=

)%(e &&e& t!.

irect Tax $s% In&irect Tax (2006)

D"$t"#*("$h J&"re-t t!e$J fro, J"#&"re-t t!e$.J G")e

e!,p%e$. /1A<

SUGGESTE A!S"ER#

DIRECT TAXE6 re &e,#&e& fro, the )er+ per$o# who

$ho(%& p+ the t! #& wh"-h he -# #ot $h"ft to #other.

A# INDIRECT TAX "$ &e,#&e& fro, o#e per$o# w"th

the e!pe-tt"o# tht he -# $h"ft the '(r&e# to $o,eo#e

e%$e, #ot $ t! '(t $ prt of the p(r-h$e pr"-e.

E!,p%e$ of &"re-t t!e$ re the "#-o,e t!, the e$tte t!

#& the &o#orE$ t!. E!,p%e$ of "#&"re-t t!e$ re the

)%(e-&&e& t!, the per-e#t*e t! #& the e!-"$e t! o#

e!-"$e'%e rt"-%e$.

12

Exe.ptions/ C0arita12e Instit3tions (2006)

The Co#$t"t(t"o# pro)"&e$ J-hr"t'%e "#$t"t(t"o#$, -h(r-he$,

per$o#*e$ or -o#)e#t$ pp(rte##t thereto, ,o$K(e$, #&

#o#-proPt -e,eter"e$ #& %% %#&$, '("%&"#*$, #&

",pro)e,e#t$ -t(%%+ &"re-t%+ #& e!-%($")e%+ ($e& for

re%"*"o($, -hr"t'%e or e&(-t"o#% p(rpo$e$ $h%% 'e e!e,pt

fro, t!t"o#.J Th"$ pro)"$"o# e!e,pt$ -hr"t'%e

"#$t"t(t"o#$ #& re%"*"o($ "#$t"t(t"o#$ fro, wht Q"#& of

t!e$? Choo$e the 'e$t #$wer. E!p%"#. /1A<

fro, %% Q"#&$ of t!e$, ".e., "#-o,e, HAT,

-($to,$ &(t"e$, %o-% t!e$ #& re% propert+ t!

fro, %o-% t! o#%+

fro, )%(e-&&e& t!

fro, re% propert+ t! o#%+

fro, -p"t% *"#$ t! o#%+

SUGGESTE A!S"ER#

The pro)"$"o# e!e,pt"o#$ -hr"t'%e "#$t"t(t"o#$ #&

re%"*"o($ "#$t"t(t"o#$ fro, /&< REAL PROPERT9 TAXE6

o#%+. The e!e,pt"o# "$ o#%+ for t!e$ $$e$$e& $ propert+

t!e$, $ &"$t"#*("$he& fro, e!-"$e t!e$ (CIR $% CA+ CTA 4

5*CA+ G%R% !o% '2)0)6+ 7cto1er ')+ '((8/

L2a&oc $% Co..issioner of Interna2 Re$en3e+ L9'(20'+ :3ne

'6+'(6;)%

',

Exc23sion 4 Inc23sion/ Gross Receipts (2006)

Co#*re$$ e#-t$ %w ",po$"#* 1A t! o# *ro$$ re-e"pt$

of -o,,o# -rr"er$. The %w &oe$ #ot &eP#e the ter,

J*ro$$ re-e"pt$.J E!pre$$ Tr#$port, I#-., '($ -o,p#+

p%+"#* the 8#"%-7*("o ro(te, h$ t",e &epo$"t$ w"th A7C

7#Q. I# 3>>1, E!pre$$ Tr#$port er#e& P1 8"%%"o#

"#tere$t, fter &e&(-t"#* the 3>A P#% w"thho%&"#* t! fro,

"t$ t",e &epo$"t$ w"th the '#Q. The 7IR w#t$ to -o%%e-t

1A *ro$$ re-e"pt$ t! o# the "#tere$t "#-o,e of E!pre$$

Tr#$port w"tho(t &e&(-t"#* the 3>A P#% w"thho%&"#* t!.

I$ the 7IR -orre-t? E!p%"#. /1A<

ALTER!ATI-E A!S"ER#

9e$. The ter, JGro$$ Re-e"pt$J "$ 'ro& e#o(*h to "#-%(&e "#-o,e

-o#$tr(-t")e%+ re-e")e& '+ the t!p+er. The ,o(#t w"thhe%& "$

p"& to the *o)er#,e#t o# "t$ 'eh%f, "# $t"$f-t"o# of w"thho%&"#*

t!e$. The f-t tht "t &"& #ot -t(%%+ re-e")e the ,o(#t &oe$ #ot

%ter the f-t tht "t "$ re,"tte& "# $t"$f-t"o# of "t$ t! o'%"*t"o#$.

6"#-e the "#-o,e w"thhe%& "$ # "#-o,e ow#e& '+ E!pre$$

Tr#$port, the $,e for,$ prt of "t$ *ro$$ re-e"pt$ (CIR $%

So2i&1an< Corp%+ G%R% !o% ')8'('+ !o$e.1er 2;+ 2006)%

3>. If the t!p+er h$ t! %"'"%"t+, #& he h$ -%", *"#$t the *o)er#,e#t, -# the$e

'e $('.e-t to -o,pe#$t"o#?

A#$wer=

T:IRD DIHI6ION

LG.R. No. 1314>@. A(*($t 3D, 155D.M

P:ILEX 8INING CORPORATION, pet"t"o#er, )$. CO88I66IONER OF INTERNAL REHENUE,

COURT OF APPEAL6, #& T:E COURT OF TAX APPEAL6, re$po#&e#t$.

69LLA7U6

1.

CIHIL LAW; EXTINGUI6:8ENT OF O7LIGATION6; CO8PEN6ATION; TAXE6 CANNOT 7E

6U7IECT TO LEGAL CO8PEN6ATION. I# $e)er% "#$t#-e$ pr"or to the "#$t#t -$e, we

h)e %re&+ ,&e the pro#o(#-e,e#t tht t!e$ -##ot 'e $('.e-t to -o,pe#$t"o# for

the $",p%e re$o# tht the *o)er#,e#t #& the t!p+er re #ot -re&"tor$ #& &e'tor$ of

e-h other. There "$ ,ter"% &"$t"#-t"o# 'etwee# t! #& &e't. De't$ re &(e to the

Go)er#,e#t "# "t$ -orporte -p-"t+, wh"%e t!e$ re &(e to the Go)er#,e#t "# "t$

$o)ere"*# -p-"t+. We P#& #o -o*e#t re$o# to &e)"te fro, the fore,e#t"o#e&

&"$t"#-t"o#. Pre$-"#&"#* fro, th"$ pre,"$e, "# Fr#-" )$. I#ter,e&"te Appe%%te Co(rt, we

-te*or"-%%+ he%& tht t!e$ -##ot 'e $('.e-t to $et-o; or -o,pe#$t"o#, th($= JWe h)e

-o#$"$te#t%+ r(%e& tht there -# 'e #o o;-$ett"#* of t!e$ *"#$t the -%",$ tht the

t!p+er ,+ h)e *"#$t the *o)er#,e#t. A per$o# -##ot ref($e to p+ t! o# the

*ro(#& tht the *o)er#,e#t owe$ h", # ,o(#t eK(% to or *reter th# the t! 'e"#*

-o%%e-te&. The -o%%e-t"o# of t! -##ot w"t the re$(%t$ of %w$("t *"#$t the

*o)er#,e#t.J The r(%"#* "# Fr#-" h$ 'ee# pp%"e& to the $('$eK(e#t -$e of C%te!

Ph"%"pp"#e$, I#-. )$. Co,,"$$"o# o# A(&"t, wh"-h re"terte& tht= J. . . t!p+er ,+ #ot

o;$et t!e$ &(e fro, the -%",$ tht he ,+ h)e *"#$t the *o)er#,e#t. T!e$ -##ot 'e

the $('.e-t of -o,pe#$t"o# 'e-($e the *o)er#,e#t #& t!p+er re #ot ,(t(%%+

-re&"tor$ #& &e'tor$ of e-h other #& -%", for t!e$ "$ #ot $(-h &e't, &e,#&,

-o#tr-t or .(&*,e#t $ "$ %%owe& to 'e $et-o;.J F(rther, Ph"%e!E$ re%"#-e o# o(r ho%&"#* "#

Co,,"$$"o#er of I#ter#% Re)e#(e )$. Ito*o#-6(+o- 8"#e$, I#-., where"# we r(%e& tht

pe#&"#* ref(#& ,+ 'e $et o; *"#$t # e!"$t"#* t! %"'"%"t+ e)e# tho(*h the ref(#& h$

#ot +et 'ee# ppro)e& '+ the Co,,"$$"o#er, "$ #o %o#*er w"tho(t #+ $(pport "# $tt(tor+

%w. It "$ ",port#t to #ote tht the pre,"$e of o(r r(%"#* "# the fore,e#t"o#e& -$e w$

#-hore& o# 6e-t"o# 11/&< of the Nt"o#% Re)e#(e Co&e of 1505. :owe)er, whe# the

Nt"o#% I#ter#% Re)e#(e Co&e of 1544 w$ e#-te&, the $,e pro)"$"o# (po# wh"-h the

Ito*o#-6(+o- pro#o(#-e,e#t w$ '$e& w$ o,"tte&. A--or&"#*%+, the &o-tr"#e e#(#-"te&

"# Ito*o#-6(+o- -##ot 'e "#)oQe& '+ Ph"%e!. D-IT:E

3. TAXATION; NATIONAL INTERNAL REHENUE CODE; A TAXPA9ER CANNOT REFU6E TO

PA9 :I6 TAXE6 W:EN T:E9 FALL DUE 6I8PL9 7ECAU6E :E :A6 A CLAI8 AGAIN6T T:E

GOHERN8ENT OR T:AT T:E COLLECTION OF T:E TAX I6 CONTINGENT ON T:E RE6ULT OF

T:E LAW6UIT IT FILED AGAIN6T T:E GOHERN8ENT. We f"% to $ee the %o*"- of Ph"%e!E$

-%", for th"$ "$ # o(tr"*ht &"$re*r& of the '$"- pr"#-"p%e "# t! %w tht t!e$ re the

%"fe'%oo& of the *o)er#,e#t #& $o $ho(%& 'e -o%%e-te& w"tho(t (##e-e$$r+ h"#&r#-e.

E)"&e#t%+, to -o(#te##-e Ph"%e!E$ wh",$"-% re$o# wo(%& re#&er "#e;e-t")e o(r t!

-o%%e-t"o# $+$te,. Too $",p%"$t"-, "t P#&$ #o $(pport "# %w or "# .(r"$pr(&e#-e. To 'e $(re, we

-##ot %%ow Ph"%e! to ref($e the p+,e#t of "t$ t! %"'"%"t"e$ o# the *ro(#& tht "t h$

pe#&"#* t! -%", for ref(#& or -re&"t *"#$t the *o)er#,e#t wh"-h h$ #ot +et 'ee#

*r#te&. It ,($t 'e #ote& tht &"$t"#*("$h"#* fet(re of t! "$ tht "t "$ -o,p(%$or+ rther

th# ,tter of 'r*"#. :e#-e, t! &oe$ #ot &epe#& (po# the -o#$e#t of the t!p+er. If

#+ t!p+er -# &efer the p+,e#t of t!e$ '+ r"$"#* the &efe#$e tht "t $t"%% h$

pe#&"#* -%", for ref(#& or -re&"t, th"$ wo(%& &)er$e%+ ;e-t the *o)er#,e#t re)e#(e

$+$te,. A t!p+er -##ot ref($e to p+ h"$ t!e$ whe# the+ f%% &(e $",p%+ 'e-($e he h$

-%", *"#$t the *o)er#,e#t or tht the -o%%e-t"o# of the t! "$ -o#t"#*e#t o# the re$(%t of

the %w$("t "t P%e& *"#$t the *o)er#,e#t. 8oreo)er, Ph"%e!E$ theor+ tht wo(%&

(to,t"-%%+ pp%+ "t$ HAT "#p(t -re&"tRref(#& *"#$t "t$ t! %"'"%"t"e$ -# e$"%+ *")e r"$e to

-o#f($"o# #& '($e, &epr")"#* the *o)er#,e#t of (thor"t+ o)er the ,##er '+ wh"-h

t!p+er$ -re&"t #& o;$et the"r t! %"'"%"t"e$.

31.

Double Taxation (1997)

Is double taxation a valid defense against the legality of a

tax measure?

SUGGESTED ANSWER:

No, double taxation standing alone and not being forbidden

by our fundamental law is not a valid defense against the

legality of a tax measure (Pepsi Cola v. Tanawan, 69 SCRA

460). However, if double taxation amounts to a direct

duplicate taxation,

1 in that the same subject is taxed twice when it should be

taxed but once,

2 in a fashion that both taxes are imposed for the same

purpose

by the same taxing authority, within the same jurisdiction

or taxing district,

! for the same taxable period and

" for the same #ind or character of a tax

then it becomes legally objectionable

22

Double Taxation; Indirect Duplicate Taxation (1997)

$hen an item of income is taxed in the %hilippines and the

same income is taxed in another country, is there a case of

double taxation?

SUGGESTED ANSWER:

&es, but it is only a case of indirect duplicate taxation which

is not legally prohibited because the taxes are imposed by

di'erent taxing authorities(

2(

Double Taxation; Methods of Avoiding DT (1997)

$hat are the usual methods of avoiding the occurrence of

double taxation?

SUGGESTED ANSWER:

)he usual methods of avoiding the occurrence of double

taxation are*

1 +llowing reciprocal exemption either by law or by

treaty,

2 +llowance of tax credit for foreign taxes paid,

+llowance of deduction for foreign taxes paid,

and

! -eduction of the %hilippine tax rate(

2!

Double Taxation !hat "onstitutes DT# (199$)

., a lessor of a property, pays real estate tax on the

premises, a real estate dealer/s tax based on rental receipts

and income tax on the rentals( . claims that this is double

taxation? 0ecide(

SUGGESTED ANSWER:

sirdondee@gmail.com 9 of 73

)here is no double taxation( 012345 )+.+)I1N

means taxing for the same tax period the same thing or

activity twice, when it should be taxed but once, by the

same taxing authority for the same purpose and with the

same #ind or character of tax( )he -5+4 56)+)5 )+. is

a tax on property, the -5+4 56)+)5 05+45-/6 )+. is

a tax on the privilege to engage in business, while the

IN7185 )+. is a tax on the privilege to earn an income(

)hese taxes are imposed by di'erent taxing authorities and

are essentially of di'erent #ind

T!e$ re wht -")"%"Be& peop%e p+ for -")"%"Be& $o-"et+. The+ re the %"fe'%oo& of the #t"o#.

Th($, $tt(te$ *r#t"#* t! e!e,pt"o#$ re -o#$tr(e& $tr"-"$$"," .(r"$ *"#$t the t!p+er

#& %"'er%%+ "# f)or of the t!"#* (thor"t+. A -%", of t! e!e,pt"o# ,($t 'e -%er%+ $how#

#& '$e& o# %#*(*e "# %w too p%"# to 'e ,"$tQe#. Otherw"$e $tte&, t!t"o# "$ the

r(%e, e!e,pt"o# "$ the e!-ept"o#. 32 The '(r&e# of proof re$t$ (po# the prt+ -%","#* the

e!e,pt"o# to pro)e tht "t "$ "# f-t -o)ere& '+ the e!e,pt"o# $o -%",e&. 34

T:IRD DIHI6ION

LG.R. No. 122@>D. O-to'er 2, 3>>D.M

SUETON CIT9 #& T:E CIT9 TREA6URER OF SUETON CIT9, pet"t"o#er$, )$. A76-C7N

7ROADCA6TING CORPORATION, re$po#&e#t.

29

Taxpa%er &uit; !hen Allo'ed (199$)

$hen may a taxpayer/s suit be allowed?

SUGGESTED ANSWER

+ taxpayer/s suit may only be allowed when an act

complained of, which may include a legislative enactment,

directly involves the illegal disbursement of public funds

derived from taxation :Pas!"al vs. Se!#e$a#% o& P"'li!

Wo#(s, ))0 P*il. ++);(

2<

(o'er of Taxation )*ual (rotection of the +a'

)xecutive 1rder was issued pursuant to law, granting

tax and duty incentives only to businesses and residents

within the =secured area= of the 6ubic 5conomic 6pecial

>one, and denying said incentives to those who live within

the >one but outside such =secured area=( Is the

constitutional right to e?ual protection of the law violated

by the 5xecutive 1rder? 5xplain( :@;

SUGGESTED ANSWER:

No( 5?ual protection of the law clause is subject to

reasonable classiAcation( 7lassiAcation, to be valid, must

:1; rest on substantial distinctions, :2; be germane to the

purpose of the law, :; not be limited to existing conditions

only, :!; apply e?ually to all members of the same class(

)here are substantial di'erences between big investors

being enticed to the =secured area= and the business

operators outside that are in accord with the e?ual

protection clause that does not re?uire territorial uniformity

of laws( )he classiAcation applies e?ually to all the resident

individuals and businesses within the =secured area=( )he

residents, being in li#e circumstances to contributing

directly to the achievement of the end purpose of the law,

are not categoriBed further( Instead, they are similarly

treated, both in privileges granted and obligations re?uired(

35

+ocal Taxation ,ule of -nifor.it% and )*ualit% (/001)

)he 7ity of 8a#ati, in order to solve the tra'ic problem in

its business districts, decided to impose a tax, to be paid by

the driver, on all private cars entering the city during pea#

hours from C*DD a(m( to E*DD a(m( from 8ondays to

Fridays, but exempts those cars carrying more than two

occupants, excluding the driver( Is the ordinance valid?

5xplain( :C@;

SUGGESTED ANSWER:

)he ordinance is in violation of the -ule of 2niformity and

5?uality, which re?uires that all subjects or objects of

taxation, similarly situated must be treated ali#e in e?ual

footing and must not classify the subjects in an arbitrary

manner( In the case at bar, the ordinance exempts cars

carrying more than two occupants from coverage of the

said ordinance( Furthermore, the ordinance only imposes

the tax on private cars and exempts public vehicles from

the imposition of the tax, although both contribute to the

tra'ic problem( )here exists no substantial standard used

in the classiAcation by the 7ity of 8a#ati(

+nother issue is the fact that the tax is imposed on the

driver of the vehicle and not on the registered owner of the

same( )he tax does not only violate the re?uirement of

uniformity, but the same is also unjust because it places the

burden on someone who has no control over the route of

the vehicle( )he ordinance is, therefore, invalid for violating

the rule of uniformity and e?uality as well as for being

unjust(

D(

(o'er of Taxation ,evocation of )xe.pting &tatutes

(1997)

=.= 7orporation was the recipient in 1EED of two tax

exemptions both from 7ongress, one law exempting the

company/s bond issues from taxes and the other exempting

the company from taxes in the operation of its public

utilities( )he two laws extending the tax exemptions were

revo#ed by 7ongress before their expiry dates( $ere the

revocations constitutional?

SUGGESTED ANSWER:

&es( )he exempting statutes are both granted unilaterally by

7ongress in the exercise of taxing powers( 6ince taxation is

the rule and tax exemption, the exception, any tax exemption

unilaterally granted can be withdrawn at the pleasure of the

taxing authority without violating the 7onstitution :,a!$an

Ce'" -n$e#na$ional Ai#po#$ A"$*o#i$%

+).

(urpose of Taxation; +egislative in 2ature (/003)

)axes are assessed for the purpose of generating revenue to

be used for public needs( )axation itself is the power by

which the 6tate raises revenue to defray the expenses of

government( + jurist said that a tax is what we pay for

civiliBation(In our jurisdiction, which of the following

statements may be erroneous* 1; )axes are pecuniary in

nature( 2; )axes are enforced charges and contributions( ;

)axes are imposed on persons and property within

the territorial jurisdiction of a 6tate( !; )axes are levied by the

executive branch of the government( "; )axes are assessed

according to a reasonable rule of apportionment( Gustify your

answer or choice brieHy( :"@;

SUGGESTED ANSWER

A. 4. Taxes are levied by the executive branch of government( )his

statement is erroneous because levy refers to the act of

imposition by the legislature which is done through the

enactment of a tax law( 4evy is an exercise of the power to

tax which is exclusively legislative in nature and character(

7learly, taxes are not levied by the executive branch of

government( (./PC v. Al'a%, )06 SCRA )90 1)9902).

3

You might also like

- Case Digest Corporation LawDocument18 pagesCase Digest Corporation LawgesalmariearnozaNo ratings yet

- Compiled True or False Questions - Evidence 2014Document20 pagesCompiled True or False Questions - Evidence 2014gesalmariearnozaNo ratings yet

- For Pre-Midterms and The BAR ExamDocument1 pageFor Pre-Midterms and The BAR ExamgesalmariearnozaNo ratings yet

- Corporation CasesDocument20 pagesCorporation CasesgesalmariearnozaNo ratings yet

- Transcription Consti (Finals) From My FriendDocument10 pagesTranscription Consti (Finals) From My FriendgesalmariearnozaNo ratings yet

- Philex Mining Corp v. CirDocument9 pagesPhilex Mining Corp v. CirKcompacionNo ratings yet

- Digest AssignmentDocument8 pagesDigest AssignmentgesalmariearnozaNo ratings yet

- UlpDocument23 pagesUlpgesalmariearnozaNo ratings yet

- Constitutional Provisions On TaxDocument4 pagesConstitutional Provisions On TaxgesalmariearnozaNo ratings yet

- Tax AssignmentDocument16 pagesTax AssignmentgesalmariearnozaNo ratings yet

- Rule 58 One LinerDocument4 pagesRule 58 One LinergesalmariearnozaNo ratings yet

- Labor Code Book 5 For Finals October 20, 2013Document30 pagesLabor Code Book 5 For Finals October 20, 2013gesalmariearnozaNo ratings yet

- Digest in Rule 57Document37 pagesDigest in Rule 57gesalmariearnozaNo ratings yet

- Full Text Aboitiz Vs CotabatoDocument5 pagesFull Text Aboitiz Vs CotabatogesalmariearnozaNo ratings yet

- Civ Pro Digested Cases - As of Jan 2009Document28 pagesCiv Pro Digested Cases - As of Jan 2009gesalmariearnozaNo ratings yet

- Chapter XVII Corporations Andother Juridical EntitiesDocument11 pagesChapter XVII Corporations Andother Juridical EntitiesgesalmariearnozaNo ratings yet

- Rule 3 NotesDocument3 pagesRule 3 NotesgesalmariearnozaNo ratings yet

- Canon 3 CasesDocument18 pagesCanon 3 CasesgesalmariearnozaNo ratings yet

- Rule 8 CasesDocument8 pagesRule 8 CasesgesalmariearnozaNo ratings yet

- PALEDocument69 pagesPALEgesalmariearnozaNo ratings yet

- Chapter XIII Choice of Law in PropertyDocument7 pagesChapter XIII Choice of Law in PropertygesalmariearnozaNo ratings yet

- Chapter XIII Choice of Law in PropertyDocument7 pagesChapter XIII Choice of Law in PropertygesalmariearnozaNo ratings yet

- SC: Courts May Still Receive Petitions For Correction of Clerical Errors in Civil RegistryDocument1 pageSC: Courts May Still Receive Petitions For Correction of Clerical Errors in Civil RegistrygesalmariearnozaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Informal Economy and Employ - Diego ColettoDocument289 pagesThe Informal Economy and Employ - Diego ColettoBenDotseNo ratings yet

- Accounting For Inventory - 1Document4 pagesAccounting For Inventory - 1ZAKAYO NJONYNo ratings yet

- Asset Impairment - 18ADocument24 pagesAsset Impairment - 18ALinh Dang Thi ThuyNo ratings yet

- Reading-Product Standardization or AdaptationDocument20 pagesReading-Product Standardization or AdaptationfarbwnNo ratings yet

- Exam 1Document41 pagesExam 1Yogi BearNo ratings yet

- Financial Statement AnalysisDocument19 pagesFinancial Statement AnalysisRenz BrionesNo ratings yet

- Timothy Morge - Market MapsDocument40 pagesTimothy Morge - Market MapsRaghav Sampath100% (11)

- Business Level StrategyDocument33 pagesBusiness Level StrategyAngelica PagaduanNo ratings yet

- How A Creditcard Is ProcessedDocument5 pagesHow A Creditcard Is Processedkk81No ratings yet

- Case Study AnalysisDocument5 pagesCase Study AnalysisMANDAR KANDGE100% (1)

- Sol Man - Pas 2 InventoriesDocument3 pagesSol Man - Pas 2 InventoriesDaniella Mae ElipNo ratings yet

- Why Are Saving and Investing So Important To Your Financial Plan? For One, Saving orDocument3 pagesWhy Are Saving and Investing So Important To Your Financial Plan? For One, Saving orAsrat AlemuNo ratings yet

- Convetibility of Indian RupeeDocument2 pagesConvetibility of Indian RupeeAmanSharmaNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingHayati AhmadNo ratings yet

- 21072023, 010608 PDFDocument2 pages21072023, 010608 PDFCatalina-Elena100% (1)

- Argus Asia Pacific Products PDFDocument16 pagesArgus Asia Pacific Products PDFshariatmadarNo ratings yet

- Project-Proposal TPB 2021Document6 pagesProject-Proposal TPB 2021Joel ParkNo ratings yet

- A Study On Social Media As A Marketing-1Document14 pagesA Study On Social Media As A Marketing-1barbie gogoiNo ratings yet

- The Role of Blockchain in BankingDocument32 pagesThe Role of Blockchain in BankingHARIHARANNo ratings yet

- Evaluation of Investment PerformanceDocument19 pagesEvaluation of Investment PerformanceFerdyanWanaSaputraNo ratings yet

- Investment and Profolio ManagementDocument7 pagesInvestment and Profolio Managementhearthelord66No ratings yet

- Chapter 6 Mundell Flaming ModelsDocument16 pagesChapter 6 Mundell Flaming ModelsDương Quốc TuấnNo ratings yet

- FN3092 Corporate FinanceDocument2 pagesFN3092 Corporate Financemrudder1999No ratings yet

- Crude Oil SpecsDocument35 pagesCrude Oil SpecsSikenaNo ratings yet

- Mindfluential EbookDocument95 pagesMindfluential EbookAkhil Kotian100% (4)

- Mutual Funds in IndiaDocument8 pagesMutual Funds in IndiaSimardeep SinghNo ratings yet

- 5a. Tutorial 5Document7 pages5a. Tutorial 5Siew Hui En A20A1947No ratings yet

- SocGen End of The Super Cycle 7-20-2011Document5 pagesSocGen End of The Super Cycle 7-20-2011Red911TNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- Scope and Objective For Reliance Jio ProjectDocument1 pageScope and Objective For Reliance Jio ProjectOmkar Dhamapurkar80% (5)