Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

28 viewsDogfight Ryanair

Dogfight Ryanair

Uploaded by

Mukul Kumar Singhry

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Iz-Lynn Chan at Far East Organization Case Study AnswerDocument2 pagesIz-Lynn Chan at Far East Organization Case Study AnswerfahadNo ratings yet

- Dogfight Over Europe Ryanair (A, B & C)Document3 pagesDogfight Over Europe Ryanair (A, B & C)Sachin79% (14)

- SCM RyanairDocument12 pagesSCM RyanairjuttmoholNo ratings yet

- Adolph Coors in The Brewing IndustryDocument2 pagesAdolph Coors in The Brewing Industrysamadabbas00275% (4)

- Southwest Airlines 2002 An Industry Under SiegeDocument8 pagesSouthwest Airlines 2002 An Industry Under SiegeJanelle50% (2)

- CNC Plasma Price Work Sheet All 09132009Document1 pageCNC Plasma Price Work Sheet All 09132009Ifa_Boshe100% (1)

- DogFight-Ryanair AnalysisDocument4 pagesDogFight-Ryanair AnalysisNitya Saxena100% (1)

- RyanairDocument16 pagesRyanairReevu AdhikaryNo ratings yet

- Case Study On Delta AirDocument7 pagesCase Study On Delta AirTasnima Cherry50% (4)

- Airborne Express Cost AnalysisDocument6 pagesAirborne Express Cost AnalysisAndrew NeuberNo ratings yet

- ZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERDocument6 pagesZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERSinem DüdenNo ratings yet

- RyanAir CaseDocument10 pagesRyanAir Casedian ratnasari100% (13)

- Dogfight Over Europe RYANAIRDocument2 pagesDogfight Over Europe RYANAIRjulian montejoNo ratings yet

- Airborne Express Case - 19IB352Document3 pagesAirborne Express Case - 19IB352SRISHTI GWARI-IBNo ratings yet

- Southwest Airlines in BaltimoreDocument3 pagesSouthwest Airlines in Baltimoreandiyoung100% (2)

- Airborne Express CaseDocument3 pagesAirborne Express Casehowlnmadmurphy2No ratings yet

- Minolta Camera Co. LTD: SEPTEMBER 25, 2016Document4 pagesMinolta Camera Co. LTD: SEPTEMBER 25, 2016Prashant Pratap SinghNo ratings yet

- The Black & Decker Corporation Case StudyDocument18 pagesThe Black & Decker Corporation Case StudyAustin Grace Wee0% (1)

- CDMA BhartiAirtel Group23Document7 pagesCDMA BhartiAirtel Group23smriti salhotraNo ratings yet

- Dogfight Over EuropeDocument7 pagesDogfight Over EuropeVishal Bharani100% (2)

- Dogfight Over EuropeDocument3 pagesDogfight Over Europesourav goyalNo ratings yet

- Dogfight Over Europe Ryanair - Case Study Analysis G14Document6 pagesDogfight Over Europe Ryanair - Case Study Analysis G14Senthamizh Kumaran SNo ratings yet

- Ryanair Case Analysis Group 03 Mm01 r1Document24 pagesRyanair Case Analysis Group 03 Mm01 r1cksharma68No ratings yet

- Strategy Ryanair Case StudyDocument12 pagesStrategy Ryanair Case StudyVladimir LosenkovNo ratings yet

- Dogfight Over Europe RyanAirDocument21 pagesDogfight Over Europe RyanAirRISHAB DAS PGP 2020 BatchNo ratings yet

- Delta Airline Relative Cost AnalysisDocument7 pagesDelta Airline Relative Cost AnalysisKumar AbhishekNo ratings yet

- The Spring Field NorDocument25 pagesThe Spring Field Norsuperman80No ratings yet

- Case Study On Southwest AirlinesDocument4 pagesCase Study On Southwest AirlinesPrashankGhimire100% (2)

- Lily-Pad Case StudyDocument3 pagesLily-Pad Case Studymanavdce1986No ratings yet

- Merloni Elettrodomestici Spa: The Transit Point Experiment: Supply Chain ManagementDocument5 pagesMerloni Elettrodomestici Spa: The Transit Point Experiment: Supply Chain ManagementSaumya GautamNo ratings yet

- Cola Wars Continue-QuestionsDocument3 pagesCola Wars Continue-QuestionsKa Hing HauNo ratings yet

- Case Analysis - CumberlandDocument3 pagesCase Analysis - CumberlandShrijaSriv50% (2)

- Global Wine War 2009Document8 pagesGlobal Wine War 2009serapNo ratings yet

- Practice SumsDocument9 pagesPractice SumsThanuja BhaskarNo ratings yet

- Sales Individual Report Assignment 2Document20 pagesSales Individual Report Assignment 2Linh Chi NguyenNo ratings yet

- Dog Fight Case SolutionDocument6 pagesDog Fight Case SolutionJesus Manuel SánchezNo ratings yet

- Ryanair Case Study AnalysisDocument5 pagesRyanair Case Study Analysisbinzidd00767% (3)

- Ryan Air CaseDocument4 pagesRyan Air Casedfglbld0% (1)

- Ryanair's Case StudyDocument2 pagesRyanair's Case StudyVishnu Meena50% (2)

- Case Summary Dog FightsDocument4 pagesCase Summary Dog Fightsdj2oonNo ratings yet

- MKT - Group 7 - Ryanair - Case AnalysisDocument4 pagesMKT - Group 7 - Ryanair - Case AnalysisSwetha PinisettiNo ratings yet

- Dogfight Over EuropeDocument41 pagesDogfight Over EuropeAndrew NeuberNo ratings yet

- Case Study HelpDocument4 pagesCase Study HelpHennrocksNo ratings yet

- Southwest AirlinesDocument17 pagesSouthwest AirlinesShiVek SaiNiNo ratings yet

- KLM's AlliancesDocument20 pagesKLM's Alliancesgidugu50% (2)

- The Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatDocument5 pagesThe Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatAninda DuttaNo ratings yet

- Docslide Us Jet Blue Airways Managing Growth Case SolutionDocument12 pagesDocslide Us Jet Blue Airways Managing Growth Case SolutionprateekNo ratings yet

- Apparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationDocument13 pagesApparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationAnirudh GhoshNo ratings yet

- Phillips India: Bidding For Floodlighting Eden Gardens: DisclaimerDocument3 pagesPhillips India: Bidding For Floodlighting Eden Gardens: DisclaimerShreshtha SinhaNo ratings yet

- Dogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KDocument7 pagesDogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KViswas10000% (1)

- Weikang Pharmaceutical Co. LTD.: Presented By-Abhishek Ghosh Piyush Sharma Prabhakar DeputyDocument11 pagesWeikang Pharmaceutical Co. LTD.: Presented By-Abhishek Ghosh Piyush Sharma Prabhakar DeputyTrishala PandeyNo ratings yet

- SwAir Baltimore Case Study - Home AssignmentDocument6 pagesSwAir Baltimore Case Study - Home AssignmentAnanda HpNo ratings yet

- Southwest Airlines in Baltimore SolutionDocument6 pagesSouthwest Airlines in Baltimore SolutionChanakya KambhampatiNo ratings yet

- Amore Case Group 33Document3 pagesAmore Case Group 33TatineniRohitNo ratings yet

- Case - SWA at Baltimore Section B, Group - 6: Submitted byDocument6 pagesCase - SWA at Baltimore Section B, Group - 6: Submitted byAyush BhatnagarNo ratings yet

- RyanairDocument1 pageRyanairSaurav TripathyNo ratings yet

- WeikingDocument11 pagesWeikingVamsi GunturuNo ratings yet

- Dynamis Fund Case StudyDocument16 pagesDynamis Fund Case StudyEric Yong100% (1)

- Assignment 3 - Group 3 - Section EDocument6 pagesAssignment 3 - Group 3 - Section ESHUBHAM PRASADNo ratings yet

- Ryan AirDocument8 pagesRyan Airstopnaggingme0% (1)

- 2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairDocument2 pages2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairmyenNo ratings yet

- Case Group 6Document7 pagesCase Group 6Israt ShoshiNo ratings yet

- Ryanair Marketing MixDocument3 pagesRyanair Marketing MixAditya D ModakNo ratings yet

- Plenary 2 - Mr. Pedrosa IIIDocument36 pagesPlenary 2 - Mr. Pedrosa IIICalamianes Seaweed Marketing CooperativeNo ratings yet

- Unit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewDocument9 pagesUnit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewAmanuel TesfayeNo ratings yet

- NiveaDocument4 pagesNiveaBavya RajNo ratings yet

- 2014 Trial General Mathematics Year 11 Paper PDFDocument26 pages2014 Trial General Mathematics Year 11 Paper PDFYon Seo Yoo100% (1)

- FAR.3203 Estimating InventoriesDocument4 pagesFAR.3203 Estimating InventoriesMira Louise HernandezNo ratings yet

- Annexure A PDFDocument3 pagesAnnexure A PDFDEEPAK TIWARINo ratings yet

- Question 1 of 8: Fill in The BlanksDocument3 pagesQuestion 1 of 8: Fill in The BlanksPing Ping100% (1)

- Le Maitre Pyroflash PyrotechnicsDocument15 pagesLe Maitre Pyroflash PyrotechnicsRyan HarrisNo ratings yet

- How I Used A PMCC Strategy To 4x The Return From A StockDocument4 pagesHow I Used A PMCC Strategy To 4x The Return From A Stockblackmoon47No ratings yet

- Mural Pricing GuideDocument9 pagesMural Pricing GuideMisha MewNo ratings yet

- Bitcoin Investment TrustDocument3 pagesBitcoin Investment Trusthannahpanaligan7No ratings yet

- IU - FM.Lecture3 2020NCTDocument10 pagesIU - FM.Lecture3 2020NCTÁnh ĐỗNo ratings yet

- 4 - Discussion - Standard Costing and Variance AnalysisDocument2 pages4 - Discussion - Standard Costing and Variance AnalysisCharles TuazonNo ratings yet

- ELECTRICAL INSTALLATION PRACTICE (Preparing A Bill of Quantities)Document12 pagesELECTRICAL INSTALLATION PRACTICE (Preparing A Bill of Quantities)Suubi brianNo ratings yet

- Swedish Match AB V CADocument3 pagesSwedish Match AB V CADebroah Faith PajarilloNo ratings yet

- CMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisDocument85 pagesCMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisNEERAJ GUPTANo ratings yet

- Walmart Marketing StrategyDocument6 pagesWalmart Marketing StrategyAgha Nawaz Ali Khan100% (1)

- Chapter 12Document54 pagesChapter 12Diah ArmelizaNo ratings yet

- Product - Its Nature and SustainabilityDocument76 pagesProduct - Its Nature and SustainabilityAr-jay RomeroNo ratings yet

- Country Capital Currency Embassy WebsiteDocument5 pagesCountry Capital Currency Embassy WebsiteMallappaNo ratings yet

- Marginal Costing MCQs Revision Series CMADocument9 pagesMarginal Costing MCQs Revision Series CMAChayank lohchabNo ratings yet

- Chapter 7 DerrivsDocument7 pagesChapter 7 DerrivsMbusoThabetheNo ratings yet

- MTFX Nas100Document30 pagesMTFX Nas100aa mnjk100% (1)

- Costaccounting 170209080426Document33 pagesCostaccounting 170209080426Samayak JainNo ratings yet

- Marginal Sales, Stocks Levels, Break Even Point and CVPDocument2 pagesMarginal Sales, Stocks Levels, Break Even Point and CVPKiran HasnaniNo ratings yet

- Econ 102Document5 pagesEcon 102Zhanerke NurmukhanovaNo ratings yet

- Venezuela: 1. Mass Migration: Many Venezuelans Have Started Leaving The CountryDocument2 pagesVenezuela: 1. Mass Migration: Many Venezuelans Have Started Leaving The CountryHarjas Sehgal0% (1)

Dogfight Ryanair

Dogfight Ryanair

Uploaded by

Mukul Kumar Singh0 ratings0% found this document useful (0 votes)

28 views4 pagesry

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentry

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views4 pagesDogfight Ryanair

Dogfight Ryanair

Uploaded by

Mukul Kumar Singhry

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Porters Analysis of the British-Irish Airline Industry

1. Suppliers Bargaining Power (Medium)

1.1) The industry has few suppliers of important commodities such as fuel and oil and

hence they can exercise greater bargaining power on the players in the industry (+)

1.2) There are a few plane manufacturers and hence, airline operators do not have much

options to chose from (+)

1.3) The suppliers have a few airline operators to supply to, hence, in order to maintain

relationship with their clients their bargaining power may reduce (-)

2. Buyers Bargaining Power (Medium)

2.1) Buyers have few options of airline operators to choose from (-)

2.2) Premium and frequently used route, hence, the companies may indulge in price war

benefitting the Buyers (+)

2.3) Low service differentiation, hence buyer indifferent about choosing a airline

operator (+)

3. Threat of Substitute (Medium)

3.1) Substitutes such as Rail and ferry available to Buyers at low prices as compared to

air travel (+)

3.2) Considering the sizeable amount of time saved in air travel, threat from these

substitutes looks weak (-)

4. Threat of New Entrants (Low)

4.1) Low barriers to entry as infrastructure such as airport and other utilities readily

available (+)

4.2) Government policies inclined towards nationalization of services and hence inclined

against providing licenses for large aircrafts (-)

4.3) Since this involves high fixed cost, it is not easy to exit the industry (-)

5. Industry Rivalry (low)

5.1) Pooling allowed amongst operators (-)

5.2) Duopoly in the market (-)

5.3) Similar prices offered by operators (-)

Assessment of Ryanair Strategy:

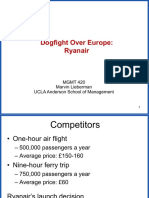

Ryanair is a new entrant into the Airline industry. It has recently acquired the permission to

commence service between Dublin and London. Its main competitors are British Airlines (BA) and

Aer Lingus (AL), who have been in the business for a long time and hence its strategies are aimed at

offering customers better incentives so as to steal them from their competitors.

1. Firstly, Ryanair has decided to increase the bargaining power of the customers. The company is

charging 98 for a simple, single fare ticket without any restrictions. This price is even lower

than the BAs discounted air fare which is 99 but needs to be booked 1 month in advance.

Thus, this decrease in the air fare provides Ryanair with a better edge over its competitors

2. Secondly, Ryanair has decided to run 4 round trips per day with a 44-seat turboprop. This

strategy has dual benefits. First with the increase in frequency of trips, it provides the customer

with greater flexibility of choosing their time of travel. Secondly, with a low-seat aircraft of only

44, it almost guarantees Ryanair a load of 90% as compared to only a load of 67% load for BA

3. Thirdly, Ryanair has decided to land at one of Londons secondary airports, Luton rather than

Heathrow. Since, Heathrow is the busiest airport in London, the landing charges are quite high.

Instead, by choosing to land at a secondary airport, Ryanair will reduce its operating expenses

4. Fourth, its employees would offer first-rate customer services. By offering meals and amenities

comparable to BA and AL, Ryanair has made sure that it is on level ground with its competitors.

Moreover, by offering first-rate services, it is trying to retain its first-time customers

5. Fifth, the low air fare of Ryanair has made it possible for it to get new customers: travelers who

use rail and ferry. With only 40 difference between the air ticket and the ferry ticket (as

compared to about greater than 100 pound difference in the case of BA and AL), Ryanair has

made customers think about which is more important, time or money. With far more

reasonable fares, the customers will have to make a trade-off between 40 excess fee and 8

hours of wasted time.

Thus, the launch strategy applied by Ryanair is highly competitive and will grab the attention of its

competitors. By distinguishing itself from the flag carriers in three of the most important aspects

for customers (price, frequency and service), Ryanair is bound to attract customers.

Expected Response of British Airways and Aer Lingus:

The Dublin-London air route is reputed to be a quite lucrative for both Aer Lingus and British

Airways. It is considered to be a network that avails them a reasonable return on capital. Thus they

are the major players operating at this route. The current prices charged by Aer Lingus and BA

stand at I208. Though discount fares as low as I99 are available but the booking has to be done

one month in advance which is not feasible for the instant travellers. Also three fourths of one

million round trip travellers prefer to go for a nine hours journey by rail and sea ferries rather than

aircraft. This clearly shows that customers are highly price conscious as they prefer paying I55 to

I208. This is probably the reason the total number of air passengers on the route have been

stagnant.

Under these circumstances if a new airline like the Ryanair enters the route with a simple, single

fare of I98 for a ticket then its a great threat to the existing players like the Aer Lingus and the BA.

Though initially Ryanair proposes to run four round trips per day with a 44 seat turboprop i.e.

maximum of 352 travellers in a day, it is optimistic of getting a license for flying bigger jets on the

route. With a low fare the airline targets those 75% travellers who travel through rail and ferries as

the prices for airline ticket are very high. It thus intends to change the traffic flow on the route

which is stagnant for the last 10 years.

Aer Lingus and BA could retaliate by following either the Flank Defence or the Pre-emptive Defense

approach. In Flank Defense BA and AL can start budget airlines to counterattack the rising threat of

Raynair. This shall help them to attract the target segment of Raynair by their already existing

brand image. Further innovation and value addition like increase in safety measures shall help them

to assure that new customers dont trust a new airline. The existing players can protect themselves

by following the marketing approach of defense which leads players to look for unknown and

unmet demand by bringing more and more innovation in their processes. A sudden reduction in

price fare cant be a solution as the economic costs involved can be huge though temporary

measures can be taken to completely eliminate new competition.

BA and AL might also decide to withdraw from the London to Dublin route. International journeys

account for nine-tenths of BAs revenue and BA has already spent UK 700 on 55 new aircrafts

which will be used mostly for service in Europe. Thus, BA might consider withdrawing from the

domestic route and concentrating more on the international journeys. Similarly, AL might decide

that most of its profit is provided by non-airline businesses and it might not be willing to enter a

price war with competitors which would mostly result in losses for the airlines.

Thus, looking at the current situation of BA and AL, it looks more likely that AL will withdraw from

the competition and BA may withdraw or retaliate by using its brand name and reducing air fares to

match Ryanair.

Ryanairs Financial Situation:

Ryanair is an upstart air lines with an innovative approach to the pricing of air travel. Ryanair have

started their service with 14 and 44 seater turboprop airplanes and the tickets are priced at a flat

discounted fare of I98 which is much cheaper than that offered by established airlines like BA and

AL.

With a maximum of only 44 seats to be filled, Ryanair can expect a high occupancy rate. Frequency

is also an advantage for Ryanair, since it offers 4 round trips from Dublin to London per day. This

means that Ryanair has the capacity of providing services to about 175 passengers every day. This

meant that at full capacity, Ryanair would be having a turnover of approximately I17500 every

day.

Ryanair flights would be landing at secondary airports around London such as Gatwick and Luton.

Therefore Ryanair would be saving a considerable amount on landing fee en-route charges as well

as handling fee. Being a small fledgling organization Ryanair has a small- staff size and less selling

expenditure.

Therefore all in all being a low-cost, no frills airlines Ryanair suited the needs of a large section of

airline passengers. Ryanair also focuses on providing first rate customer services comparable to

that offered by BA and AL and this would contribute to retaining customers. Though at first Ryanair

might not be able to generate profit from its present strategy in the long run the return of

investment looks positive and Ryanairs model looks promising in terms of making money.

Analysis of the future prospects of the company can be done by evaluating the present operating

expense break-up of a player in the industry

Revenue and Cost per Passenger (I), 1986

Parameters British Airway at

70% utilization(I)

I I I

Revenue 151.3

Operating Expenses

Staff 32.4

Depreciation &

amortization

7.8

Fuel & Oil 28.9

Engineering and

other aircraft costs

8.9

Selling 16.4

Aircraft Operating

Expenses

Landing fees and en

route charges

Handling charges,

catering and others

Accommodation,

ground equipment

Subtotal

Operating Profit

You might also like

- Iz-Lynn Chan at Far East Organization Case Study AnswerDocument2 pagesIz-Lynn Chan at Far East Organization Case Study AnswerfahadNo ratings yet

- Dogfight Over Europe Ryanair (A, B & C)Document3 pagesDogfight Over Europe Ryanair (A, B & C)Sachin79% (14)

- SCM RyanairDocument12 pagesSCM RyanairjuttmoholNo ratings yet

- Adolph Coors in The Brewing IndustryDocument2 pagesAdolph Coors in The Brewing Industrysamadabbas00275% (4)

- Southwest Airlines 2002 An Industry Under SiegeDocument8 pagesSouthwest Airlines 2002 An Industry Under SiegeJanelle50% (2)

- CNC Plasma Price Work Sheet All 09132009Document1 pageCNC Plasma Price Work Sheet All 09132009Ifa_Boshe100% (1)

- DogFight-Ryanair AnalysisDocument4 pagesDogFight-Ryanair AnalysisNitya Saxena100% (1)

- RyanairDocument16 pagesRyanairReevu AdhikaryNo ratings yet

- Case Study On Delta AirDocument7 pagesCase Study On Delta AirTasnima Cherry50% (4)

- Airborne Express Cost AnalysisDocument6 pagesAirborne Express Cost AnalysisAndrew NeuberNo ratings yet

- ZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERDocument6 pagesZARA Case Study 2 ZARA THE WORLD S LARGEST FASHION RETAILERSinem DüdenNo ratings yet

- RyanAir CaseDocument10 pagesRyanAir Casedian ratnasari100% (13)

- Dogfight Over Europe RYANAIRDocument2 pagesDogfight Over Europe RYANAIRjulian montejoNo ratings yet

- Airborne Express Case - 19IB352Document3 pagesAirborne Express Case - 19IB352SRISHTI GWARI-IBNo ratings yet

- Southwest Airlines in BaltimoreDocument3 pagesSouthwest Airlines in Baltimoreandiyoung100% (2)

- Airborne Express CaseDocument3 pagesAirborne Express Casehowlnmadmurphy2No ratings yet

- Minolta Camera Co. LTD: SEPTEMBER 25, 2016Document4 pagesMinolta Camera Co. LTD: SEPTEMBER 25, 2016Prashant Pratap SinghNo ratings yet

- The Black & Decker Corporation Case StudyDocument18 pagesThe Black & Decker Corporation Case StudyAustin Grace Wee0% (1)

- CDMA BhartiAirtel Group23Document7 pagesCDMA BhartiAirtel Group23smriti salhotraNo ratings yet

- Dogfight Over EuropeDocument7 pagesDogfight Over EuropeVishal Bharani100% (2)

- Dogfight Over EuropeDocument3 pagesDogfight Over Europesourav goyalNo ratings yet

- Dogfight Over Europe Ryanair - Case Study Analysis G14Document6 pagesDogfight Over Europe Ryanair - Case Study Analysis G14Senthamizh Kumaran SNo ratings yet

- Ryanair Case Analysis Group 03 Mm01 r1Document24 pagesRyanair Case Analysis Group 03 Mm01 r1cksharma68No ratings yet

- Strategy Ryanair Case StudyDocument12 pagesStrategy Ryanair Case StudyVladimir LosenkovNo ratings yet

- Dogfight Over Europe RyanAirDocument21 pagesDogfight Over Europe RyanAirRISHAB DAS PGP 2020 BatchNo ratings yet

- Delta Airline Relative Cost AnalysisDocument7 pagesDelta Airline Relative Cost AnalysisKumar AbhishekNo ratings yet

- The Spring Field NorDocument25 pagesThe Spring Field Norsuperman80No ratings yet

- Case Study On Southwest AirlinesDocument4 pagesCase Study On Southwest AirlinesPrashankGhimire100% (2)

- Lily-Pad Case StudyDocument3 pagesLily-Pad Case Studymanavdce1986No ratings yet

- Merloni Elettrodomestici Spa: The Transit Point Experiment: Supply Chain ManagementDocument5 pagesMerloni Elettrodomestici Spa: The Transit Point Experiment: Supply Chain ManagementSaumya GautamNo ratings yet

- Cola Wars Continue-QuestionsDocument3 pagesCola Wars Continue-QuestionsKa Hing HauNo ratings yet

- Case Analysis - CumberlandDocument3 pagesCase Analysis - CumberlandShrijaSriv50% (2)

- Global Wine War 2009Document8 pagesGlobal Wine War 2009serapNo ratings yet

- Practice SumsDocument9 pagesPractice SumsThanuja BhaskarNo ratings yet

- Sales Individual Report Assignment 2Document20 pagesSales Individual Report Assignment 2Linh Chi NguyenNo ratings yet

- Dog Fight Case SolutionDocument6 pagesDog Fight Case SolutionJesus Manuel SánchezNo ratings yet

- Ryanair Case Study AnalysisDocument5 pagesRyanair Case Study Analysisbinzidd00767% (3)

- Ryan Air CaseDocument4 pagesRyan Air Casedfglbld0% (1)

- Ryanair's Case StudyDocument2 pagesRyanair's Case StudyVishnu Meena50% (2)

- Case Summary Dog FightsDocument4 pagesCase Summary Dog Fightsdj2oonNo ratings yet

- MKT - Group 7 - Ryanair - Case AnalysisDocument4 pagesMKT - Group 7 - Ryanair - Case AnalysisSwetha PinisettiNo ratings yet

- Dogfight Over EuropeDocument41 pagesDogfight Over EuropeAndrew NeuberNo ratings yet

- Case Study HelpDocument4 pagesCase Study HelpHennrocksNo ratings yet

- Southwest AirlinesDocument17 pagesSouthwest AirlinesShiVek SaiNiNo ratings yet

- KLM's AlliancesDocument20 pagesKLM's Alliancesgidugu50% (2)

- The Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatDocument5 pagesThe Airline Industry in The United States: Delta Air Lines: The Low-Cost Carrier ThreatAninda DuttaNo ratings yet

- Docslide Us Jet Blue Airways Managing Growth Case SolutionDocument12 pagesDocslide Us Jet Blue Airways Managing Growth Case SolutionprateekNo ratings yet

- Apparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationDocument13 pagesApparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationAnirudh GhoshNo ratings yet

- Phillips India: Bidding For Floodlighting Eden Gardens: DisclaimerDocument3 pagesPhillips India: Bidding For Floodlighting Eden Gardens: DisclaimerShreshtha SinhaNo ratings yet

- Dogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KDocument7 pagesDogfight Over Europe: Ryan Air: Jubin Roy Manju Maria Job Shahana S Kavitha Sreekumar Viswas KViswas10000% (1)

- Weikang Pharmaceutical Co. LTD.: Presented By-Abhishek Ghosh Piyush Sharma Prabhakar DeputyDocument11 pagesWeikang Pharmaceutical Co. LTD.: Presented By-Abhishek Ghosh Piyush Sharma Prabhakar DeputyTrishala PandeyNo ratings yet

- SwAir Baltimore Case Study - Home AssignmentDocument6 pagesSwAir Baltimore Case Study - Home AssignmentAnanda HpNo ratings yet

- Southwest Airlines in Baltimore SolutionDocument6 pagesSouthwest Airlines in Baltimore SolutionChanakya KambhampatiNo ratings yet

- Amore Case Group 33Document3 pagesAmore Case Group 33TatineniRohitNo ratings yet

- Case - SWA at Baltimore Section B, Group - 6: Submitted byDocument6 pagesCase - SWA at Baltimore Section B, Group - 6: Submitted byAyush BhatnagarNo ratings yet

- RyanairDocument1 pageRyanairSaurav TripathyNo ratings yet

- WeikingDocument11 pagesWeikingVamsi GunturuNo ratings yet

- Dynamis Fund Case StudyDocument16 pagesDynamis Fund Case StudyEric Yong100% (1)

- Assignment 3 - Group 3 - Section EDocument6 pagesAssignment 3 - Group 3 - Section ESHUBHAM PRASADNo ratings yet

- Ryan AirDocument8 pagesRyan Airstopnaggingme0% (1)

- 2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairDocument2 pages2017 - MAN 301 - Ex 2 - Internal Analysis - Case Study RyanairmyenNo ratings yet

- Case Group 6Document7 pagesCase Group 6Israt ShoshiNo ratings yet

- Ryanair Marketing MixDocument3 pagesRyanair Marketing MixAditya D ModakNo ratings yet

- Plenary 2 - Mr. Pedrosa IIIDocument36 pagesPlenary 2 - Mr. Pedrosa IIICalamianes Seaweed Marketing CooperativeNo ratings yet

- Unit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewDocument9 pagesUnit 5. Accounting For Joint Products & Byproducts: 5.1 OverviewAmanuel TesfayeNo ratings yet

- NiveaDocument4 pagesNiveaBavya RajNo ratings yet

- 2014 Trial General Mathematics Year 11 Paper PDFDocument26 pages2014 Trial General Mathematics Year 11 Paper PDFYon Seo Yoo100% (1)

- FAR.3203 Estimating InventoriesDocument4 pagesFAR.3203 Estimating InventoriesMira Louise HernandezNo ratings yet

- Annexure A PDFDocument3 pagesAnnexure A PDFDEEPAK TIWARINo ratings yet

- Question 1 of 8: Fill in The BlanksDocument3 pagesQuestion 1 of 8: Fill in The BlanksPing Ping100% (1)

- Le Maitre Pyroflash PyrotechnicsDocument15 pagesLe Maitre Pyroflash PyrotechnicsRyan HarrisNo ratings yet

- How I Used A PMCC Strategy To 4x The Return From A StockDocument4 pagesHow I Used A PMCC Strategy To 4x The Return From A Stockblackmoon47No ratings yet

- Mural Pricing GuideDocument9 pagesMural Pricing GuideMisha MewNo ratings yet

- Bitcoin Investment TrustDocument3 pagesBitcoin Investment Trusthannahpanaligan7No ratings yet

- IU - FM.Lecture3 2020NCTDocument10 pagesIU - FM.Lecture3 2020NCTÁnh ĐỗNo ratings yet

- 4 - Discussion - Standard Costing and Variance AnalysisDocument2 pages4 - Discussion - Standard Costing and Variance AnalysisCharles TuazonNo ratings yet

- ELECTRICAL INSTALLATION PRACTICE (Preparing A Bill of Quantities)Document12 pagesELECTRICAL INSTALLATION PRACTICE (Preparing A Bill of Quantities)Suubi brianNo ratings yet

- Swedish Match AB V CADocument3 pagesSwedish Match AB V CADebroah Faith PajarilloNo ratings yet

- CMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisDocument85 pagesCMA Part 2 Financial Decision Making: Study Unit 8 - CVP Analysis and Marginal AnalysisNEERAJ GUPTANo ratings yet

- Walmart Marketing StrategyDocument6 pagesWalmart Marketing StrategyAgha Nawaz Ali Khan100% (1)

- Chapter 12Document54 pagesChapter 12Diah ArmelizaNo ratings yet

- Product - Its Nature and SustainabilityDocument76 pagesProduct - Its Nature and SustainabilityAr-jay RomeroNo ratings yet

- Country Capital Currency Embassy WebsiteDocument5 pagesCountry Capital Currency Embassy WebsiteMallappaNo ratings yet

- Marginal Costing MCQs Revision Series CMADocument9 pagesMarginal Costing MCQs Revision Series CMAChayank lohchabNo ratings yet

- Chapter 7 DerrivsDocument7 pagesChapter 7 DerrivsMbusoThabetheNo ratings yet

- MTFX Nas100Document30 pagesMTFX Nas100aa mnjk100% (1)

- Costaccounting 170209080426Document33 pagesCostaccounting 170209080426Samayak JainNo ratings yet

- Marginal Sales, Stocks Levels, Break Even Point and CVPDocument2 pagesMarginal Sales, Stocks Levels, Break Even Point and CVPKiran HasnaniNo ratings yet

- Econ 102Document5 pagesEcon 102Zhanerke NurmukhanovaNo ratings yet

- Venezuela: 1. Mass Migration: Many Venezuelans Have Started Leaving The CountryDocument2 pagesVenezuela: 1. Mass Migration: Many Venezuelans Have Started Leaving The CountryHarjas Sehgal0% (1)