Professional Documents

Culture Documents

ADRs, GDRS, FCCBs

ADRs, GDRS, FCCBs

Uploaded by

Shashank VarmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ADRs, GDRS, FCCBs

ADRs, GDRS, FCCBs

Uploaded by

Shashank VarmaCopyright:

Available Formats

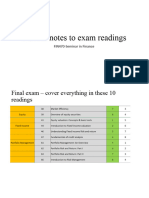

Identifying Opportunities

ADR/GDR/FCCB

Overview of ADR / GDR & FCCB Issuance

GDR

A Global Depositary Receipt or GDR is a

security issued by a Depository Bank, such as

Bank of New York or Deutsche Bank, in place

of the foreign shares (issued by an Indian

issuer such as SBI/Reliance) held in trust by

that bank, thereby facilitating the trading of

those Indian shares in the form of GDRs by

international investors, on global markets,

such as London. "

Equity Options

Foreign

ADR

Issue

GDR

Issue

Visibility is very high

No lock-in for investors

Threshold minimum size & float

Stringent regulatory requirements (e.g.

Sarbanes Oxley)

High issuance costs

Relatively faster

No lock-in for investors

Flexibility to choose specific

investors

Relatively moderate cost

Potential pricing discount

GDR Issue Key Advantages

Parameter Features

Time to completion Accelerated GDR can be completed in 7 - 8 weeks

Pricing

Close to the market price on the day of pricing the issuance, subject to

SEBI floor

Size of the issuance Typically, in the region of US$ 40-250 mn

New Investors

Leading FIIs and global institutional investors can participate in quality GDR

issuances

Lock-in stipulation SEBI lock-in does not apply to shares underlying the GDRs

Visibility for the Company High visibility amongst the international investors

Post Issue Volatility of Stock Price Low due to presence of long only FIIs

Restrictive Covenants None

GDR Principal

Characteristics

Parameter Features

Documentati on

Euro style documentation under UK law (10b(5) legal opinion required)

Form/Structure

GDS represent the tradeable instrument created out of the GDR programme

Settlement

Via Euroclear in Europe through scripless book entry system and via DTC in

USA

Accounts

Prepared according to Indian Accounting Standards, though investors prefer to

see reformatted accounts

Listing

London or Luxembourg

Distribution

International institutions under Reg S and Rule 144A of US Securities, 1933

Documentati on

International standard but less onerous than the SEC - fully acceptable to

international investors

Ongoing disclosure

In line with home market requirements. However new Transparency Obligations

Directives of EU are expected shortly

Follow-on fund raising

There have been a number of successful GDR follow on issues

Time Table

Month 2 Month 1

M

a

r

k

e

t

i

n

g

&

L

a

u

n

c

h

A

g

r

e

e

m

e

n

t

s

O

f

f

e

r

i

n

g

d

o

c

u

m

e

n

t

Illustrative timetable of an offering

Week Starting Wk 2 Wk 3 Wk 4 Wk 5 Wk 6 Wk 7 Wk 1 WK 8

Kickoff meeting (incl. legal counsel, accountants)

Receipt of accounts

Draft prospectus (including due diligence)

Submit first draft to Luxembourg/London Exchange

Receive & reply to Luxembourg/London comments

Finalize and file the red

File the final document with Luxembourg/London Stock Exchange

Discuss and finalize Underwriting agreement

Discuss and finalize Lock up agreement

Discuss and finalize Deposit agreement

Sign the underwriting agreement

Receive signed lock up agreement

Sign the deposit agreement

Management briefings to analysts

Preparation and distribution of research

Black out period

Discussion on various marketing issues

Conference calls/roadshowwith potential investors

Launch andbookbuilding

Pricing

** Finalize allocation to investors

** Bring down due diligence

** Closing, settlement, listing and start of official trading

* Typically within 2 to 3 working days of Pricing

Typical Cost Structure

Based on an assumed issue size of around US$ 75 - 150 million,

set out below is an estimate of the expenses* other than

Underwriting Commissions for the listing of the Companys

GDR :

* Note that the above fees represent our best estimates and actual fee would be based on quotations received. In addition, there would be costs

associated with travel, communication etc.

US$ US$

International Legal Counsel 325,000 - 425,000

Domestic Legal Counsel 30,000 - 50,000

Accountants 80,000 - 120,000

Roadshow Expenses 40,000 - 50,000

Printing fee 15,000 - 20,000

Total 490,000 - 665,000

Marketing Process

u Develop

investment thesis

u Syndicate

Selection and

structure

u Offering structure

u Research

publication

u Sales force

teach-in

u Investor pre-

marketing

u Feedback from

pre-marketing

u Road-show

rehearsal

u Publish

preliminary

prospectus

u Targeted Road-

shows

u Daily Updates

u Book building

u Quality Allocation

u Aftermarket trading

support

u Ongoing research

coverage

u Post Offering

Support

Preparation Education

Road-show &

Book-building

Launch

Pricing &

Aftermarket

There are a number of stages to building international

recognition and momentum in the build-up to the Companys

GDR listing:

Marketing Strategies: Pre-marketing

Objective of pre-marketing: To get feedback

from the potential investors on the company,

pricing and investor appetite

Launch preliminary marketing initiatives &

approach the core investors with definite time

table and offering size

Target valuation/price range with investors

prior to the launch of the transaction, but will

refine the discount range as the book-building

process continues

Pre-marketing

4-5 days

Research Analyst

Foreign Currency Convertible

Bonds (FCCBs)

FCCBs are a type of convertible bonds issued in a currency different than the

issuer's domestic currency.

Main features

FCCBs have to compulsorily denominated in any foreign currency (usually they

are USD denominated)

The Investors have the option to convert these bonds into equity shares/GDRs of

the issuing Company after a stipulated time period at a price determined at the

time of issuing FCCBs

The conversion price is at a premium over the current stock price, or is set

by a formula based on the price at the time of redemption.

The issuer may some times have a call option, generally with a call hurdle,

i e subject to a minimum stock price at the time of call which means,

invariably at the exercise of call, the investors would opt for conversion into

equity.

FCCBs

The convertibility of the bond is akin to a put option to the bondholder, as

he can redeem the bond while opting for conversion.

As an investor in the equity, the bondholder has a call option i.e. he has

the right to buy equity at the set price.

Till the time they are not converted into equity, they have all the regular

features of a bond viz. coupon rate and redemption premium as the two

streams of earnings

Advantages to the Issuer

Low coupon rate

Staggered Dilution

Delayed dilution of EPS

An FCCB timeline is shorter than a domestic IPO or a syndicated loan

No rating required

Bonds need not be secured

FCCB carries fewer covenants as compared to syndicated loans or debentures

Minimum return assured along with an opportunity to share in themarket

upside

FCCB - An indicative Timeline

Days (T+) 4 8 12 20 16 28 32 45 24 36 40

Structuring and Agreement of the Terms

Conduct Financial/Legal Due Diligence

Draft Offering Circular

Circulate Draft Subscription Agreement

Comments and Review of the Offer Circular

Comments on the Subscription Agreement

Draft Legal Opinion & Auditors Comfort

Letter

Finalise Due Diligence

Finalise Legal Opinions & Offering Circular

Obtain In-principle Aproval of Stock

Exchanges

Obtain RBI Loan Registration Number

Finalising the various documents

Pricing of FCCBs and Signing of Documents

Issue Payment Instructions

Closing, payment and Issue of FCCBs

T =Kick Off

Meeting

You might also like

- 12 Tissue Remedies of Shcussler by Boerick.Document432 pages12 Tissue Remedies of Shcussler by Boerick.scientist786100% (8)

- VC ListDocument16 pagesVC ListDavid SavageNo ratings yet

- Capital RisingDocument26 pagesCapital RisingFidel KusumawijayaNo ratings yet

- IPO / Listing Planning: Affan Sajjad - ACADocument35 pagesIPO / Listing Planning: Affan Sajjad - ACAKhalid MahmoodNo ratings yet

- M0000518 SiaxED Ing v2.7Document150 pagesM0000518 SiaxED Ing v2.7mohamed50% (2)

- SERIES 7 EXAM STUDY GUIDE + TEST BANKFrom EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKRating: 2.5 out of 5 stars2.5/5 (3)

- Money MarketDocument25 pagesMoney MarketVaidyanathan RavichandranNo ratings yet

- Printicomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentDocument103 pagesPrinticomm's Proposed Acquisition of Digitech - Negotiating Price and Form of PaymentKunal MehtaNo ratings yet

- Checklist of Potential Risks - Goods and Services Procurement ProcessDocument11 pagesChecklist of Potential Risks - Goods and Services Procurement ProcessDarshit Thakkar100% (1)

- Alarm Management KPI Utilizing IMS in Offshore PlatformsDocument91 pagesAlarm Management KPI Utilizing IMS in Offshore PlatformsbacabacabacaNo ratings yet

- Bond MathsDocument193 pagesBond Mathsmeetniranjan14No ratings yet

- Traditional vs. Modern Teaching Methodology: Swati GuptaDocument7 pagesTraditional vs. Modern Teaching Methodology: Swati GuptaDarshit ThakkarNo ratings yet

- 3 - Long Term Sources of FinanceDocument49 pages3 - Long Term Sources of FinanceChandareshwar SharmaNo ratings yet

- International Source of Finance: Empi Business School, New DelhiDocument28 pagesInternational Source of Finance: Empi Business School, New DelhiVikram MandalNo ratings yet

- Chapter 4 - Fund ManagementDocument38 pagesChapter 4 - Fund Managementngannguyen.31221024512No ratings yet

- ADR (American Depositary Receipt) & GDR (Global Depositary Receipt)Document16 pagesADR (American Depositary Receipt) & GDR (Global Depositary Receipt)Pankaj JainNo ratings yet

- Securities Market: Adarsh SaxenaDocument52 pagesSecurities Market: Adarsh SaxenaAdarsh SaxenaNo ratings yet

- Adr, GDR, and IdrDocument30 pagesAdr, GDR, and IdrMaheshMuraleedharanNo ratings yet

- Sem in Finance-Notes To Final Exam Readings Part 2Document82 pagesSem in Finance-Notes To Final Exam Readings Part 2hantrankha75No ratings yet

- Ch.2-Primary, Secondary & Debt MarketDocument78 pagesCh.2-Primary, Secondary & Debt MarketjaludaxNo ratings yet

- Product in Primary and Secondary MarketDocument12 pagesProduct in Primary and Secondary MarketSheikh YajidulNo ratings yet

- Adrsgdrsfdipptfinal 120827124149 Phpapp02Document29 pagesAdrsgdrsfdipptfinal 120827124149 Phpapp02Chidam BaramNo ratings yet

- Issue of Shares - Unit 2Document31 pagesIssue of Shares - Unit 2BharathNo ratings yet

- Securities Market: An OverviewDocument42 pagesSecurities Market: An OverviewVidhiDesaiDoshiNo ratings yet

- FinalDocument29 pagesFinalapi-3732797No ratings yet

- Securities Markete3Document50 pagesSecurities Markete3Pougajendy SadasivameNo ratings yet

- Investment Banking: Presentation OnDocument56 pagesInvestment Banking: Presentation OnPradeep BandiNo ratings yet

- Presentation On ADR GDR and FCCB - 27.02.09Document29 pagesPresentation On ADR GDR and FCCB - 27.02.09darshan22No ratings yet

- (Ojklsorjnturyurces of Foreign CapitalDocument23 pages(Ojklsorjnturyurces of Foreign CapitalJerome RandolphNo ratings yet

- IPO Process: Listing NormsDocument16 pagesIPO Process: Listing NormsraghuchanderjointNo ratings yet

- Raising Finance From Internation MarketDocument69 pagesRaising Finance From Internation MarketPragati GahlotNo ratings yet

- Adr N GDRDocument106 pagesAdr N GDRcezh92No ratings yet

- 2011012708COM15109GE14Unit 2nd Primary Process Process Different Stages and Intermediariesprimary Market ProcessDocument33 pages2011012708COM15109GE14Unit 2nd Primary Process Process Different Stages and Intermediariesprimary Market ProcessLone AryanNo ratings yet

- Initial Public Offerings (Ipos)Document15 pagesInitial Public Offerings (Ipos)Nitisha SinghNo ratings yet

- Why Does ASHVA Qualify For A PPO?Document13 pagesWhy Does ASHVA Qualify For A PPO?Karan SoniNo ratings yet

- 3 Investment BankingDocument48 pages3 Investment BankingGigiNo ratings yet

- The IB Business of Debt - Fixed IncomeDocument36 pagesThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNo ratings yet

- (Frequently Asked Questions) 77Document8 pages(Frequently Asked Questions) 77Walter KhunNo ratings yet

- LBO Valuation Process. Step by StepDocument46 pagesLBO Valuation Process. Step by Stepharshit.dwivedi320No ratings yet

- Financial MGTDocument1 pageFinancial MGTtuhin khanNo ratings yet

- Leveraged Buyout (LBO) : The LBO Analysis - Main StepsDocument9 pagesLeveraged Buyout (LBO) : The LBO Analysis - Main StepsaminafridiNo ratings yet

- Primary MarketDocument25 pagesPrimary Marketkunaldaga78No ratings yet

- Forex Capital and Eurocurrency MarketDocument35 pagesForex Capital and Eurocurrency MarketNirav TannaNo ratings yet

- Portfolio Management: Dr. Himanshu Joshi FORE School of Management New DelhiDocument25 pagesPortfolio Management: Dr. Himanshu Joshi FORE School of Management New Delhiashishbansal85No ratings yet

- Bond MathsDocument157 pagesBond Mathsnitesh chhutaniNo ratings yet

- Merchant BankingDocument17 pagesMerchant BankingramtejNo ratings yet

- Presentation - Lahore (Final) 4th March 2011 PDFDocument52 pagesPresentation - Lahore (Final) 4th March 2011 PDFsweetkanwal61No ratings yet

- Financial InstrumentsDocument70 pagesFinancial Instrumentsharesh swaminathanNo ratings yet

- International Banking and Foreign Exchange ManagementDocument7 pagesInternational Banking and Foreign Exchange ManagementSolve AssignmentNo ratings yet

- SAPM I Unit Anna UniversityDocument28 pagesSAPM I Unit Anna UniversitystandalonembaNo ratings yet

- Primary MarketDocument27 pagesPrimary MarketMrunal Chetan Josih0% (1)

- Corporate Finance Introduction 2Document21 pagesCorporate Finance Introduction 2Shantanu SinhaNo ratings yet

- Capital Primary MarketDocument45 pagesCapital Primary MarketHarsh ThakurNo ratings yet

- Initial Public Offerings (Ipos)Document19 pagesInitial Public Offerings (Ipos)Shaikh TausifNo ratings yet

- Cash Money Markets: Minimum Correct Answers For This Module: 6/12Document15 pagesCash Money Markets: Minimum Correct Answers For This Module: 6/12Jovan SsenkandwaNo ratings yet

- Initial Public Offer: Jasleen Thind 10809572 RR1809A26Document22 pagesInitial Public Offer: Jasleen Thind 10809572 RR1809A26dont_forgetme2004No ratings yet

- Raising Finance From Intl MktsDocument29 pagesRaising Finance From Intl MktsAshutoshNo ratings yet

- CL AssignmentDocument15 pagesCL Assignmentitika DhawanNo ratings yet

- TTM INVESTMENT BANKING TRAINING Week2Document4 pagesTTM INVESTMENT BANKING TRAINING Week2NidhiNo ratings yet

- Unit III Primary MarketDocument22 pagesUnit III Primary MarketMeghna PurohitNo ratings yet

- Raising Equity Funds: - Public Issue - Rights Issue - Bonus Issue - Private PlacementDocument33 pagesRaising Equity Funds: - Public Issue - Rights Issue - Bonus Issue - Private PlacementPallav KumarNo ratings yet

- Assessment of EXPORT Credit Requirement.Document22 pagesAssessment of EXPORT Credit Requirement.Anantharaman Rajesh0% (2)

- Financial Markets and Institutions Debt MarketsDocument32 pagesFinancial Markets and Institutions Debt MarketsRohit KattamuriNo ratings yet

- Indian Fixed Income MarketDocument27 pagesIndian Fixed Income MarketNitesh GoyalNo ratings yet

- Identity Theft Red Flags Rule TemplateDocument15 pagesIdentity Theft Red Flags Rule TemplateDarshit ThakkarNo ratings yet

- Cycle College Accreditation - CollegelistDocument110 pagesCycle College Accreditation - CollegelistDarshit ThakkarNo ratings yet

- Auction Procedures and RegulationsDocument1 pageAuction Procedures and RegulationsDarshit ThakkarNo ratings yet

- Risk Assessment in Automobile IndustryDocument35 pagesRisk Assessment in Automobile IndustryDarshit ThakkarNo ratings yet

- Auction Procedures and RegulationsDocument1 pageAuction Procedures and RegulationsDarshit ThakkarNo ratings yet

- Connectivity Devices Used in NetworkingDocument17 pagesConnectivity Devices Used in NetworkingDarshit ThakkarNo ratings yet

- How To Conduct An Audit Tender: Appendix 17Document27 pagesHow To Conduct An Audit Tender: Appendix 17Darshit ThakkarNo ratings yet

- Valuation of Risk and Return in Mutual FundDocument23 pagesValuation of Risk and Return in Mutual FundDarshit ThakkarNo ratings yet

- Valuation of Risk and Return in Mutual FundDocument23 pagesValuation of Risk and Return in Mutual FundDarshit ThakkarNo ratings yet

- Nischal Nair - Math IA Draft 1.Document12 pagesNischal Nair - Math IA Draft 1.Karan KalaniNo ratings yet

- E01 GeneratorDocument28 pagesE01 GeneratorvenkateshbitraNo ratings yet

- 100 FilsDocument5 pages100 FilsAthul jithNo ratings yet

- Transformer IIDocument10 pagesTransformer IIPabitraranjan DasNo ratings yet

- Paysliper Template Grid2Document5 pagesPaysliper Template Grid2Jeeva KumarNo ratings yet

- Bituminous Mix DesignDocument9 pagesBituminous Mix DesignAshok Rajanavar100% (1)

- Workbook. Unit 3. Exercises 5 To 9. RESPUESTASDocument3 pagesWorkbook. Unit 3. Exercises 5 To 9. RESPUESTASRosani GeraldoNo ratings yet

- Texapon SFA (OPP)Document1 pageTexapon SFA (OPP)paromanikNo ratings yet

- Global Success 6 Unit 3 No KeysDocument12 pagesGlobal Success 6 Unit 3 No KeysTường Bùi KhắcNo ratings yet

- Review For The Midterm Ii Test Listening Task 1 (TC U7)Document21 pagesReview For The Midterm Ii Test Listening Task 1 (TC U7)Đức Tuấn PhạmNo ratings yet

- Letter of Recommendation: The University of TokyoDocument2 pagesLetter of Recommendation: The University of TokyoSulakx KuruNo ratings yet

- Best AI Essay WriterDocument2 pagesBest AI Essay WriterPeter JhonsonNo ratings yet

- Resume: Peddimsetti Venkatesh Mobile: +91-9014198558Document3 pagesResume: Peddimsetti Venkatesh Mobile: +91-9014198558VenkateshNo ratings yet

- How Does Global Warming Affect Our Living?Document19 pagesHow Does Global Warming Affect Our Living?Minahil QaiserNo ratings yet

- Inspection Cleaning Storage Procedures For 3m Versaflo tr300 tr300 tr600 Technical BulletinDocument8 pagesInspection Cleaning Storage Procedures For 3m Versaflo tr300 tr300 tr600 Technical BulletinJoneAlexNo ratings yet

- Handbook3 VitaminA-1 PDFDocument5 pagesHandbook3 VitaminA-1 PDFJorge Luis RodríguezNo ratings yet

- Your Cookbook For Gaining Keratinized Tissue: Geistlich Mucograft in Open HealingDocument4 pagesYour Cookbook For Gaining Keratinized Tissue: Geistlich Mucograft in Open HealingErdeli StefaniaNo ratings yet

- DigMandarin Grammar Lesson Comparison Sentence With Bi - 1 PDFDocument4 pagesDigMandarin Grammar Lesson Comparison Sentence With Bi - 1 PDFValentina BeltránNo ratings yet

- Tutorial Letter 101/0/2020: Reticulation Design Management (Project)Document31 pagesTutorial Letter 101/0/2020: Reticulation Design Management (Project)sachenNo ratings yet

- PDF El Gran Manual Del Pastelero (Gastronomía Y Cocina)Document1 pagePDF El Gran Manual Del Pastelero (Gastronomía Y Cocina)paola lombanaNo ratings yet

- Chapter Two: Introduction To GrammarsDocument21 pagesChapter Two: Introduction To GrammarsEbisa KebedeNo ratings yet

- Afsc 2W0X1 Munitions SystemsDocument44 pagesAfsc 2W0X1 Munitions SystemsMichael StevensonNo ratings yet

- (D&D 4.0) Manual of The Planes-10Document1 page(D&D 4.0) Manual of The Planes-10Bo SunNo ratings yet

- Applications in Ch4Document7 pagesApplications in Ch4(FU HCM) Trần Thanh HiệpNo ratings yet

- Tutorial 101 - 2020 - 3 - B PDFDocument42 pagesTutorial 101 - 2020 - 3 - B PDFPhoenix Cassidy MotekeNo ratings yet

- Research Group 1 10 Zeus AutosavedDocument11 pagesResearch Group 1 10 Zeus AutosavedJudilyn MateoNo ratings yet