Professional Documents

Culture Documents

Exercise 11-5 Eclipse Sabre Years Amount Years

Uploaded by

carla_cariaga_2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 11-5 Eclipse Sabre Years Amount Years

Uploaded by

carla_cariaga_2Copyright:

Available Formats

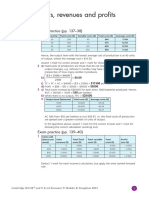

Exercise 11-5

Eclipse Sabre

Years Amount Years

0 (1,400,000) $ 0

1 25,000 $ 1

2 30,000 $ 2

3 30,000 $ 3

4 30,000 $ 4

5 40,000 $ 5

6 40,000 $

7 40,000 $

8 40,000 $

9 40,000 $

10 40,000 $

Rate NPV Rate

12% (1,208,828.86) $ 12%

PV EAC PV

(1,591,171.14) $ (281,613.24) $ (1,010,734.60) $

The company should pick the Sabre model although it has a shorter life as its cost per year of owning and operation over its lifetime is significantly less compared to Eclipse model.

Amount

(800,000) $

50,000 $

50,000 $

60,000 $

60,000 $

80,000 $

NPV

(589,265.40) $

EAC

(280,385.76) $

The company should pick the Sabre model although it has a shorter life as its cost per year of owning and operation over its lifetime is significantly less compared to Eclipse model.

You might also like

- Peter Schiff - Gold Scams ReportDocument15 pagesPeter Schiff - Gold Scams Reporttheinfrangibleiggybank100% (1)

- BEEKEEPING Apiary Unit Model ProjectDocument2 pagesBEEKEEPING Apiary Unit Model ProjectArasu Don50% (2)

- 03-An Anchored VWAP Channel For Congested MarketsDocument6 pages03-An Anchored VWAP Channel For Congested MarketsMarvin ZarkNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Assignment# 3 Magic TimberDocument5 pagesAssignment# 3 Magic TimberASAD ULLAH0% (2)

- CrossFit RedBeard Business PlanDocument42 pagesCrossFit RedBeard Business PlanJeremy_Edwards11100% (7)

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Strategy Sheet - Sachin Deo KumarDocument16 pagesStrategy Sheet - Sachin Deo KumarSACHIN DEO KUMARNo ratings yet

- Scribd Case Digests PDFDocument9 pagesScribd Case Digests PDFcarla_cariaga_2No ratings yet

- Scribd Case Digests PDFDocument9 pagesScribd Case Digests PDFcarla_cariaga_2No ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Real Estate Excel Functions TutorialDocument14 pagesReal Estate Excel Functions Tutorialajohnson79100% (2)

- Glover Lawrence Full Resume For HBRDocument3 pagesGlover Lawrence Full Resume For HBRat3mail100% (1)

- The Study of Dividend Policies of Indian CompaniesDocument41 pagesThe Study of Dividend Policies of Indian CompaniesKushaal Chaudhary67% (3)

- 1 Financial Management IntroductionDocument12 pages1 Financial Management IntroductionJeremyCervantesNo ratings yet

- Bilal Hyder I170743 20-SEPDocument10 pagesBilal Hyder I170743 20-SEPUbaid0% (1)

- Cfa Chapter 9 Problems: The Capital Asset Pricing ModelDocument7 pagesCfa Chapter 9 Problems: The Capital Asset Pricing ModelFagbola Oluwatobi Omolaja100% (1)

- Degaños v. PeopleDocument2 pagesDegaños v. Peoplecarla_cariaga_2100% (5)

- Inventory Valuation TutorialDocument4 pagesInventory Valuation TutorialSalma HazemNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Ex1 Sensitivity AnalysisDocument21 pagesEx1 Sensitivity AnalysisP MarpaungNo ratings yet

- Exam 2 ReviewDocument53 pagesExam 2 ReviewNkeih FidelisNo ratings yet

- Solutions To Chapter 9 ProblemsDocument37 pagesSolutions To Chapter 9 ProblemsMorning KalalNo ratings yet

- Solution Manual Engineering Economy 16th Edition William G. Sullivan, Elin M. Wicks, C. Patrick KoellingDocument15 pagesSolution Manual Engineering Economy 16th Edition William G. Sullivan, Elin M. Wicks, C. Patrick KoellingTrí NhânNo ratings yet

- 3Document4 pages3Deysy ReyesNo ratings yet

- This Study Resource Was: Ayu Nurfitriadi 4111711020Document7 pagesThis Study Resource Was: Ayu Nurfitriadi 4111711020naura syahdaNo ratings yet

- Net Present ValueDocument21 pagesNet Present ValueMatthew LgkaroNo ratings yet

- Payback Period (Corporate Finance)Document3 pagesPayback Period (Corporate Finance)nawal syafiqahNo ratings yet

- Sensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsDocument5 pagesSensitivity Analysis: Enter Base, Minimum, and Maximum Values in Input CellsMatthew HaleNo ratings yet

- Replacement Breakeven AnalysisDocument8 pagesReplacement Breakeven AnalysisZoloft Zithromax ProzacNo ratings yet

- Instruction: Round Your Answers For Average Product of Capital and Average Product of Labor To 2Document17 pagesInstruction: Round Your Answers For Average Product of Capital and Average Product of Labor To 2Fachrizal AnshoriNo ratings yet

- 3.10 An Investment ProblemDocument2 pages3.10 An Investment ProblemJuan Pablo Horn GallardoNo ratings yet

- Chapter 12 AnswersDocument3 pagesChapter 12 AnswersMarisa Vetter100% (1)

- WACC & PaybackDocument9 pagesWACC & PaybackBelle Dela CruzNo ratings yet

- Corporate Finance TDDocument8 pagesCorporate Finance TDThiên AnhNo ratings yet

- Group 2 - Lap3Document12 pagesGroup 2 - Lap3Vũ Lan OfficialNo ratings yet

- What If ChecklistDocument11 pagesWhat If Checklistmohsanmajeed100% (1)

- (827956) Bjmp5023 A202 Chapter 3 Value of Loyal Customer ExerciseDocument6 pages(827956) Bjmp5023 A202 Chapter 3 Value of Loyal Customer ExerciseFatin AtanNo ratings yet

- Case 6Document3 pagesCase 6Farhanie Nordin0% (1)

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- Tutorial Solution EvaluationDocument9 pagesTutorial Solution EvaluationbillNo ratings yet

- EVA Vs NPV and Payback PeriodDocument4 pagesEVA Vs NPV and Payback PeriodAyesha SohailNo ratings yet

- 4.01% Is The 1-Year Spot RateDocument6 pages4.01% Is The 1-Year Spot RatePaulo TorresNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- Revision Questions - Q&ADocument3 pagesRevision Questions - Q&Arosario correiaNo ratings yet

- Replacement AnalysisDocument22 pagesReplacement Analysismercedesferrer100% (1)

- Activity 26Document23 pagesActivity 26Jonathan ZhouNo ratings yet

- Basic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Solutions ManualDocument4 pagesBasic Finance An Introduction To Financial Institutions Investments and Management 11th Edition Mayo Solutions Manualknackishfantigue.63von100% (28)

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Book 111Document6 pagesBook 111Shradha PuroNo ratings yet

- Step 1. Enter Data in White Area (Program Will Do The Rest)Document4 pagesStep 1. Enter Data in White Area (Program Will Do The Rest)MakuanaNo ratings yet

- Figure 10.9: NPV Profile For Multiple IRR ProjectDocument3 pagesFigure 10.9: NPV Profile For Multiple IRR ProjectMichael JohnsonNo ratings yet

- Session 2 (C)Document37 pagesSession 2 (C)Peketi Sai Krishna Vamsi 2027633No ratings yet

- Hilton 11e Chap007PPTDocument53 pagesHilton 11e Chap007PPTNgô Khánh HòaNo ratings yet

- Wind Energy Quiz 3Document5 pagesWind Energy Quiz 3Ivan RozoNo ratings yet

- CFAS - Depreciation Methods - Barcelona, JoyceAnnDocument9 pagesCFAS - Depreciation Methods - Barcelona, JoyceAnnJoyce Ann Agdippa BarcelonaNo ratings yet

- HBS Case LockheedDocument6 pagesHBS Case LockheedEd Ward100% (2)

- Capital Capital Budgeting BudgetingDocument16 pagesCapital Capital Budgeting BudgetingauguimkNo ratings yet

- RevaluationDocument6 pagesRevaluationShaneen AdorableNo ratings yet

- Ch.9 (Dec.08)Document11 pagesCh.9 (Dec.08)JAHANZAIBNo ratings yet

- Assignment 5Document6 pagesAssignment 5Helter SkelterNo ratings yet

- NP EX19 9b JinruiDong 2Document10 pagesNP EX19 9b JinruiDong 2Ike DongNo ratings yet

- Excercises and Answers Chapter 2Document22 pagesExcercises and Answers Chapter 2MerleNo ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Year 0 1 Costs Benefits Cost of Capital Terminal ValueDocument4 pagesYear 0 1 Costs Benefits Cost of Capital Terminal ValueSanjna ChimnaniNo ratings yet

- S16 - Scenario Manager - NPV - ClassDocument11 pagesS16 - Scenario Manager - NPV - ClassABHAY VEER SINGHNo ratings yet

- NPV, Av, IncrementalDocument7 pagesNPV, Av, IncrementalJual BelibarangNo ratings yet

- 05-Running Existing PlantsDocument33 pages05-Running Existing Plantsee400bps kudNo ratings yet

- 1st OutlineDocument1 page1st Outlinecarla_cariaga_2No ratings yet

- Concession Theory - Reciprocity - Commodity Futures Contract - Business Opportunity - Integral/Interval TradingDocument2 pagesConcession Theory - Reciprocity - Commodity Futures Contract - Business Opportunity - Integral/Interval Tradingcarla_cariaga_2No ratings yet

- Midterm CasesDocument6 pagesMidterm Casescarla_cariaga_2No ratings yet

- 4th HWDocument5 pages4th HWcarla_cariaga_2No ratings yet

- Consti (HW #2)Document1 pageConsti (HW #2)carla_cariaga_2No ratings yet

- 9 SALAFRANCA VS. PHILAMLIFE (PAMPLONA) VILLAGE HOMEOWNERS ASSOCIATION, INC. ET. AL. 9p PDFDocument11 pages9 SALAFRANCA VS. PHILAMLIFE (PAMPLONA) VILLAGE HOMEOWNERS ASSOCIATION, INC. ET. AL. 9p PDFcarla_cariaga_2No ratings yet

- PALE - Case Digests - 1 Requirements Before Admission To BarDocument34 pagesPALE - Case Digests - 1 Requirements Before Admission To Barcarla_cariaga_2No ratings yet

- Rule of St. Benedict (Prologues)Document9 pagesRule of St. Benedict (Prologues)carla_cariaga_2No ratings yet

- Scribd Case DigestsDocument9 pagesScribd Case Digestscarla_cariaga_2No ratings yet

- Transpo PART I - CHAPTER IIDocument4 pagesTranspo PART I - CHAPTER IIcarla_cariaga_2No ratings yet

- Gavino OutlineDocument1 pageGavino Outlinecarla_cariaga_2No ratings yet

- Transpo PART I - CHAPTER IDocument5 pagesTranspo PART I - CHAPTER Icarla_cariaga_2No ratings yet

- Rule of St. Benedict CH 2-4Document9 pagesRule of St. Benedict CH 2-4carla_cariaga_2No ratings yet

- Zialcita V PAL (As Cited in PT&T V NLRC)Document1 pageZialcita V PAL (As Cited in PT&T V NLRC)carla_cariaga_2No ratings yet

- To Do For Obli!!!Document1 pageTo Do For Obli!!!carla_cariaga_2No ratings yet

- Transpo PART I - CHAPTER IDocument1 pageTranspo PART I - CHAPTER Icarla_cariaga_2No ratings yet

- Book Ii (Arts. 114-365, RPC) Related SPLS: Crim2 Sy 17-18 2 Sem - Spls Assigned by Judge MendinuetoDocument2 pagesBook Ii (Arts. 114-365, RPC) Related SPLS: Crim2 Sy 17-18 2 Sem - Spls Assigned by Judge Mendinuetocarla_cariaga_2No ratings yet

- Campbell, A. (2007) .Document21 pagesCampbell, A. (2007) .Vita NataliaNo ratings yet

- Examiners Report F9 June 19Document12 pagesExaminers Report F9 June 19Sakeef SajidNo ratings yet

- Ratio Analysis Tirupati Cotton Mills LTDDocument102 pagesRatio Analysis Tirupati Cotton Mills LTDHarish Babu Gundla PalliNo ratings yet

- Software Multiples Normalizing at 6x NTM RevenueDocument16 pagesSoftware Multiples Normalizing at 6x NTM Revenuehad tekNo ratings yet

- Sai Ram Shares & Commodities: Analysis: Nifty (Fut) 7300.6 Follow 7090 SL For Positional Longs On Closing BasisDocument10 pagesSai Ram Shares & Commodities: Analysis: Nifty (Fut) 7300.6 Follow 7090 SL For Positional Longs On Closing Basisapi-237713995No ratings yet

- Page 1of 19Document19 pagesPage 1of 19Ricardo PaduaNo ratings yet

- Financial Ratios Analysis: Nestle VS Engro FoodsDocument36 pagesFinancial Ratios Analysis: Nestle VS Engro FoodsMuaaz WaseemNo ratings yet

- Dividend Decisions Unit 5Document8 pagesDividend Decisions Unit 5md saifNo ratings yet

- Global Insurance Trends Analysis 2016Document29 pagesGlobal Insurance Trends Analysis 2016Rahul MandalNo ratings yet

- Armes Tax ProcdecerDocument87 pagesArmes Tax ProcdecerMuddanaGowdaNo ratings yet

- Chapter 10 Distribution ManagementDocument19 pagesChapter 10 Distribution ManagementJustineMatugasNo ratings yet

- ParCor C-6 Ans. 2022Document11 pagesParCor C-6 Ans. 2022Charles LaspiñasNo ratings yet

- Wall Street - S Contribution To Management Accounting PDFDocument24 pagesWall Street - S Contribution To Management Accounting PDFFabiana YoungNo ratings yet

- Part 1: The International Financial Environment Chapter 4 Exchange Rate DeterminationDocument32 pagesPart 1: The International Financial Environment Chapter 4 Exchange Rate DeterminationAbdelrahman HassanNo ratings yet

- CRG - Junior Analyst JDDocument1 pageCRG - Junior Analyst JDashish.the7353No ratings yet

- Project of Idbi AnkitaDocument71 pagesProject of Idbi AnkitaAnamika Singh33% (3)

- New Venture Creation Important QuestionDocument39 pagesNew Venture Creation Important QuestionSahib RandhawaNo ratings yet

- Assignments Today: MF0010 - Security Analysis and Portfolio ManagementDocument6 pagesAssignments Today: MF0010 - Security Analysis and Portfolio ManagementRuchi PurohitNo ratings yet

- 5000 MCQ of Computer in English PDFDocument200 pages5000 MCQ of Computer in English PDFaman yadavNo ratings yet

- DERIVATIVEDocument7 pagesDERIVATIVEKiên Phạm CôngNo ratings yet

- APV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Document23 pagesAPV and EVA Approach of Firm Valuation Module 8 (Class 37 and 38)Vineet AgarwalNo ratings yet

- Question 929893Document9 pagesQuestion 929893umangchh2306No ratings yet

- MA2 Managing Cost & Finance Notes Complete FileDocument131 pagesMA2 Managing Cost & Finance Notes Complete FileReyilNo ratings yet