Professional Documents

Culture Documents

Sidney, J. (2002) - Balancing Time Frames

Sidney, J. (2002) - Balancing Time Frames

Uploaded by

satishdinakarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sidney, J. (2002) - Balancing Time Frames

Sidney, J. (2002) - Balancing Time Frames

Uploaded by

satishdinakarCopyright:

Available Formats

BALANCING TIME FRAMES

By Jason Sidney

PART ONE:

Identifying equal time frames is a great way to demonstrate order from the apparent

random activity found in markets using the basics of geometry or whats commonly

known as geometric charting. The lesson that follows is a summary of the recent lesson I

gave to Canadian radio station 580 CFRA in Ottawa, Ontario as part of a live interview

for the program they were running at the time on Gann techniques and how they were

applied to financial markets. With the recent anniversary of the September 11 disaster, a

subject on everyones minds at the time. I thought it fitting to compare the recent decline

we have all just witnessed in world markets with the decline that was a direct result of the

September 11 disaster. While the event itself was a catastrophe, the order or balance

that has unfolded in markets since that event has been quiet amazing.

There are four main points on a chart you would look at when trying to identify equal

time frames, and they are the time frames between swing highs and lows. The swing

highs and lows you would look at, are the difference between high to low, low to high,

high to high, and low to low. This can be done on any time frame chart, daily, weekly or

monthly, depending on whether youre trying to determine the short term or long term

trend.

If we were to now look at the S&P 500 cash market and the Dow Jones Industrial average

and compare the run down that occurred during the September 11 disaster with the recent

decline we have all just seen, you would find some interesting examples of equal time

frames. While the S&P 500 cash market and the Dow Jones Industrial average are very

similar markets. The S&P 500 is based on 500 stocks, where as the Dow Jones Industrial

average is only based on 30 stocks. I point this out because although they are similar

markets, the S&P 500 is made up of more stocks and can therefore have a little more

voting power when it comes to determining the direction of the overall American stock

market. If we were to now take a look at the S&P 500 cash market and compare the run

down it had during the September 11 disaster with the recent run down we have all just

witnessed, you will find a good example of an equal time frame.

The high before the September 11 disaster run down was 1316 on the week of 25/5/01, it

then continued to run down to a low of 945-21/9/01. The number of weeks between these

two points is 17 weeks. If we were to now compare the recent run down from the high of

1174-22/3/02 down to the low of 775-26/7/02, you would find the number of weeks

between these two points is 18 weeks. So we have just compared the time frames from

high to low on the two most recent swings going in the same direction, and found the

most recent decline to be almost equal in time to the previous swing going in the same

direction.

If we were to now compare the same declines with the Dow Jones Industrial average we

will find similar alignments in time. Its important to remember the date of the recent

high before the decline on the S&P 500 cash market, because although they are both

similar markets, the S&P 500 cash market actually made its high on a slightly different

date than the Dow Jones Industrial average. As you will soon see the date of this high is

relevant to the Dow Jones Industrial average in identifying equal timeframes.

Looking now at the run down that occurred during the September 11 disaster on the Dow

Jones Industrial average. You can see the high before the decline is 11436-25/5/01 and

the low that follows is 7925-21/9/01, which gives us 17 weeks between these two points.

If we were to now look at the most recent decline on the Dow Jones Industrial average,

the high before the decline is 10729-8/3/02, which then continued down to a low of 7489-

26/7/02. The time frame between these two points is 20 weeks. Not as precise as was

seen on the S&P 500 cash market. You will notice when looking at this high on the Dow

Jones Industrial average, another slightly lower, almost equal high that occurs on the

22/3/02.

The date of this high shown in blue, just happens to occur on the same date as the high on

the S&P 500 cash market. So if we were to now use the date of this new high 22/3/02,

and looked at the difference in time from this date down to the low of 10729-8/3/02 you

would find the time frame between these two points is 18 weeks. This gives us another

good example of an almost equal time frame. So again we have just compared the time

frames from high to low on the two most recent swings going in the same direction and

found the most recent decline to be almost equal in time to the previous swing going in

the same direction.

In the next edition of Analyst Insight, I will take this subject further and look at other

equal time frames and how they relate to the significance of this recent low and the rally

that occurred as a result of it.

Best regards,

Jason Sidney

http://www.marketinsight.com.au

BALANCING TIME FRAMES

By Jason Sidney

PART TWO:

In the previous edition of Analyst Insight we examined equal time frames by comparing

the decline recently seen on world markets, with the decline that occurred as a direct

result of the September 11 disaster. When doing this we found the run down from the

swing high to the swing low during both these events was an almost equal time frame on

both the Dow Jones Industrial Average and the S&P 500 Cash market. This information

helped explain the significance of the recent low of 7489-26/7/02 on the Dow Jones

Industrial Average and the rally that occurred as a result of it.

In this edition of Analyst Insight we will take this subject further and look at the time

frames calculated from high to high and low to low during this period, to see if we can

find a balancing of time frames that also coincide with this recent low.

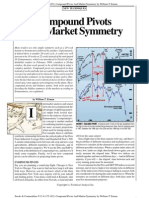

If we were to now take a look at the time frame from high to high shown in green on the

following chart of the Dow Jones Industrial Average. You will notice the time frame

between the high before the September 11 decline of 11436-25/5/01 compared to the high

before our most recent decline of 10723-22/3/02 is 43 weeks. Im using this high because

although it is a slightly lower high, this was also the date of the corresponding high that

occurred on the S&P 500 Cash market, which was previously discussed in part one of the

previous edition of Analyst Insight. If we were to now look at the time frame between

low to low during this same period which is shown in red. You will notice the time frame

between the low that ended the September 11 run down of 7925-21/9/01, and the low of

the most recent decline of 7489-26/7/02 is 44 weeks.

This again makes a good example of an almost equal time frame. The time frame

between high to high was 43 weeks and the time frame from the low of the September 11

decline to the most recent low of 7489-26/7/02 was an almost exact repeat of that time

frame. Not only did it repeat the time frame of 43 weeks previously seen from high to

high, from the low of the September 11 decline. But it also repeated the original time

frame of the September 11 decline from its high to its low during the most recent decline.

Both these time frames align with the recent low of 7489-26/7/02 and help explain why a

rally took place from that point.

While alignments in time can give us an early warning of impending changes in trend,

analysts should always look for other indications the trend is likely to change, to help

back up or confirm the possibility of a change in trend at your important time frame.

In the chart that follows you can see a nice example of divergence on the RSI indicator

aligning with the low of 7489-26/7/02 at our important time frame. You will notice the

recent low of 7489-26/7/02 is actually a lower low than the September 11 decline. But

the low shown on the RSI indicator aligning with this low, is actually higher than the

previous low that aligns with the September 11 decline. This is whats known as

divergence, and when combined with important time frames can produce some powerful

results.

A closer look at the bar that gives us the low of 7489-26/7/02 also reveals further

indications of an impending rally. You will notice even though the low of 7489-26/7/02

was a lower low than the September 11 decline. The closing price on the bar that gives us

the low of 7489-26/7/02 actually closes above the low of the September 11 decline. Some

analysts refer to this as a False Break.

Prices tested new lows but prices at the time didnt like the lower levels, so the start of a

rally began eventually closing above the low of the September 11 decline, giving you a

False Break in that direction. So always try to confirm your time frames with other

indications of a change in trend. There are plenty of examples out there of markets

trading straight through important time frames. Time frames by themselves arent enough

and must always be confirmed by other indications of a change in trend.

While the rally that took place from the low of 7489-26/7/02 was only short lived, the

example outlined in this lesson served its purpose in showing how order can be

identified from what at first glance only appears to be random activity.

Best regards,

Jason Sidney

Managing Director

Market Insight Pty Ltd

http://www.marketinsight.com.au

You might also like

- W D Gann Method of Trading PDFDocument210 pagesW D Gann Method of Trading PDFdhritimohan89% (9)

- Project Proposal TemplateDocument4 pagesProject Proposal TemplateNiyi Adeyemo100% (1)

- Sri M Himalayan Master PDFDocument1 pageSri M Himalayan Master PDFdhritimohan67% (6)

- Trade Executed Solely On RSI Trend LineDocument6 pagesTrade Executed Solely On RSI Trend LineRayzwanRayzmanNo ratings yet

- Company Analysis of Suzlon Energy LimitedDocument24 pagesCompany Analysis of Suzlon Energy Limitedkagiwal27100% (1)

- Pivot BossDocument36 pagesPivot BossJuna Naelga88% (8)

- Delta PhenomenonDocument6 pagesDelta Phenomenondhritimohan67% (3)

- Cancun FantasyDocument82 pagesCancun FantasycaemegNo ratings yet

- GTA Fax 01 - 03 - 12Document8 pagesGTA Fax 01 - 03 - 12boreduscstudentNo ratings yet

- Dales Market Profile CourseDocument13 pagesDales Market Profile CourseCarli Sutanji92% (12)

- 10 "The Rediscovered Benjamin Graham"Document6 pages10 "The Rediscovered Benjamin Graham"X.r. GeNo ratings yet

- Relative Strength RankingDocument12 pagesRelative Strength Rankingscriberone0% (1)

- George Bayer-Turning 400 Years of Astrology To Practical Use & Other Matters (1969) PDFDocument194 pagesGeorge Bayer-Turning 400 Years of Astrology To Practical Use & Other Matters (1969) PDFdhritimohan50% (2)

- Introduction To Commercial Real Estate DebtDocument11 pagesIntroduction To Commercial Real Estate Debtsm1205No ratings yet

- TtoDocument34 pagesTtoParesh Shah100% (1)

- Investment Strategy: 'Tis The Season?Document5 pagesInvestment Strategy: 'Tis The Season?marketfolly.comNo ratings yet

- Pivot Point Analysis in Stock TradingDocument5 pagesPivot Point Analysis in Stock TradingSIightlyNo ratings yet

- Thackray Market Letter 2013 DecemberDocument11 pagesThackray Market Letter 2013 DecemberdpbasicNo ratings yet

- Determining The Trend of The Market by The Daily Vertical ChartDocument22 pagesDetermining The Trend of The Market by The Daily Vertical ChartcarlopanicciaNo ratings yet

- Rice and Olume Racticum: PDF Created With Pdffactory Trial VersionDocument31 pagesRice and Olume Racticum: PDF Created With Pdffactory Trial Versionjohnnyz88No ratings yet

- Volume Rate of ChangeDocument2 pagesVolume Rate of ChangeRitabrata BhattacharyyaNo ratings yet

- Gerald Appel - Opportunity Investing. Time Cycles, Market Breadth, and Bottom-Finding StrategiesDocument26 pagesGerald Appel - Opportunity Investing. Time Cycles, Market Breadth, and Bottom-Finding StrategiesJohn SmithNo ratings yet

- Bollinger Bands - Using Volatility by Matthew ClaassenDocument5 pagesBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesNo ratings yet

- Inner Circle Trader - TPDS 5Document18 pagesInner Circle Trader - TPDS 5Felix Tout Court100% (1)

- MMA Cycle Forecast Special Edition For World Stock MarketDocument25 pagesMMA Cycle Forecast Special Edition For World Stock MarketPhung Luong100% (1)

- 2 StructureDocument9 pages2 StructureDeniss KoroblevNo ratings yet

- LPL Compliance Tracking #1 LPL Compliance Tracking #1-317178Document5 pagesLPL Compliance Tracking #1 LPL Compliance Tracking #1-317178Clay Ulman, CFP®No ratings yet

- Quantifiable Edges Special Report: Can Be Found HereDocument7 pagesQuantifiable Edges Special Report: Can Be Found HereDebashish GhoshNo ratings yet

- The Politico TradeDocument15 pagesThe Politico TradenomeansumNo ratings yet

- Inside Day ReportDocument51 pagesInside Day ReportcakesNo ratings yet

- Determining The Trend of The Market by The Daily Vertical ChartDocument10 pagesDetermining The Trend of The Market by The Daily Vertical ChartThái DươngNo ratings yet

- Lecture 6 ScriptDocument3 pagesLecture 6 ScriptAshish MalhotraNo ratings yet

- Que Se Puede Esperar Del RallyDocument5 pagesQue Se Puede Esperar Del RallyfernandoandresleivaNo ratings yet

- Gold MatketviewsDocument8 pagesGold MatketviewsreadthemallNo ratings yet

- BreadthDocument8 pagesBreadthemirav2No ratings yet

- How To Build A Double Calendar SpreadDocument26 pagesHow To Build A Double Calendar SpreadscriberoneNo ratings yet

- Financial Markets Predict Armageddon.Document16 pagesFinancial Markets Predict Armageddon.alemis9No ratings yet

- Key Financial Terms and RatiosDocument16 pagesKey Financial Terms and RatiosShravan KumarNo ratings yet

- Support and Resistance Trading Method 4Document6 pagesSupport and Resistance Trading Method 4Bv Rao100% (1)

- Trader's JournalDocument5 pagesTrader's JournalAadon PeterNo ratings yet

- Hussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011Document6 pagesHussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011KoalaCapitalSICAVNo ratings yet

- Edition 25 - Chartered 4th March 2011Document8 pagesEdition 25 - Chartered 4th March 2011Joel HewishNo ratings yet

- Lane Asset Management Stock Market Commentary For October 2013Document9 pagesLane Asset Management Stock Market Commentary For October 2013Edward C LaneNo ratings yet

- An Introduction To Lindsay: Special ReportDocument16 pagesAn Introduction To Lindsay: Special ReportEd CarlsonNo ratings yet

- 2014 Market ForecastDocument13 pages2014 Market ForecastJean Paul PNo ratings yet

- Market StrengthDocument7 pagesMarket Strengthsidd2208No ratings yet

- What Happens After A CrashDocument3 pagesWhat Happens After A CrashRamzi FaddoulNo ratings yet

- Saisonalitaet eDocument5 pagesSaisonalitaet ephilippepssb2No ratings yet

- Edition 12 - Chartered 4th August 2010Document6 pagesEdition 12 - Chartered 4th August 2010Joel HewishNo ratings yet

- Consulting Our Technical Playbook: MarketDocument5 pagesConsulting Our Technical Playbook: MarketdpbasicNo ratings yet

- Using The Arms Index in Intraday Applications: by Richard W. Arms JRDocument6 pagesUsing The Arms Index in Intraday Applications: by Richard W. Arms JRsatish s100% (1)

- Weekly Technical Analysis 28TH Oct 2013Document30 pagesWeekly Technical Analysis 28TH Oct 2013Kaushaljm PatelNo ratings yet

- TASC CompoundPivotsDocument11 pagesTASC CompoundPivotsAnkit KabraNo ratings yet

- Stock Volatility Perspective4Document5 pagesStock Volatility Perspective4annawitkowski88No ratings yet

- Stock Volatility PerspectiveDocument6 pagesStock Volatility PerspectiveTadhg NealonNo ratings yet

- Trading Price InterdayDocument20 pagesTrading Price InterdayMarvin ZarkNo ratings yet

- In This Section We Provide A Brief Summary of The Available Historic Evidence On LongDocument7 pagesIn This Section We Provide A Brief Summary of The Available Historic Evidence On LongDuy NguyễnNo ratings yet

- Wyckoff Market Analysis: Charles DowDocument11 pagesWyckoff Market Analysis: Charles Dowmaulik_20_8No ratings yet

- A Quantile Approach To Money FlowDocument18 pagesA Quantile Approach To Money FlowKevin KamauNo ratings yet

- SP500 February 24thDocument11 pagesSP500 February 24thJohn doNo ratings yet

- V3 - 4 The Ultimate OscillatorDocument5 pagesV3 - 4 The Ultimate OscillatorErezwaNo ratings yet

- Macroeconomics and Stock Market TimingDocument31 pagesMacroeconomics and Stock Market Timingjl123123No ratings yet

- Section 2: Important Chart Patterns: Inside/Outside ReversalDocument20 pagesSection 2: Important Chart Patterns: Inside/Outside Reversalancutzica2000No ratings yet

- Beringer Weinstock Group - TA SignalsDocument33 pagesBeringer Weinstock Group - TA SignalsYagnesh PatelNo ratings yet

- Astronomical Algorithms Amended Multi-Millennia CADocument4 pagesAstronomical Algorithms Amended Multi-Millennia CAdhritimohanNo ratings yet

- NOMUS Modem DetailsDocument4 pagesNOMUS Modem DetailsdhritimohanNo ratings yet

- Enlightenment Life The Way It Is SadhguruDocument83 pagesEnlightenment Life The Way It Is Sadhgurushivasun1100% (2)

- Walk in InterviewDocument1 pageWalk in InterviewdhritimohanNo ratings yet

- Channel Name SD/HD LCNDocument11 pagesChannel Name SD/HD LCNdhritimohanNo ratings yet

- YTE MUE Interview PDFDocument3 pagesYTE MUE Interview PDFdhritimohanNo ratings yet

- ATMASphere Sept 2014 PDFDocument25 pagesATMASphere Sept 2014 PDFdhritimohanNo ratings yet

- Dawn of The 7th Day ArticleDocument7 pagesDawn of The 7th Day Articlehyanand0% (1)

- Astrological Transits by Allen EdwallDocument5 pagesAstrological Transits by Allen Edwalldhritimohan100% (1)

- What All Can Be Legally Done by A Microlight AircraftDocument1 pageWhat All Can Be Legally Done by A Microlight AircraftdhritimohanNo ratings yet

- Manly Hall - Astrology and Reincarnation (1960) PDFDocument26 pagesManly Hall - Astrology and Reincarnation (1960) PDFdhritimohan100% (1)

- A Wonderful and Shocking Letter From My Guruji: My Guruji Asks Me To Work For BabajiDocument4 pagesA Wonderful and Shocking Letter From My Guruji: My Guruji Asks Me To Work For BabajidhritimohanNo ratings yet

- W D Gann Method of TradingDocument210 pagesW D Gann Method of TradingdhritimohanNo ratings yet

- Modern Celestial DynamicsDocument364 pagesModern Celestial DynamicsDanielFosterNo ratings yet

- Ferrera - Timing Approach PDFDocument3 pagesFerrera - Timing Approach PDFdhritimohanNo ratings yet

- PlanetDocument3 pagesPlanetdhritimohanNo ratings yet

- Cecil Gupta HoroscopeDocument8 pagesCecil Gupta HoroscopedhritimohanNo ratings yet

- Introduction To Business Notes B.com Part 1Document80 pagesIntroduction To Business Notes B.com Part 1Amjad bbsulkNo ratings yet

- Membership Application Form (PFA)Document3 pagesMembership Application Form (PFA)Angelo CastilloNo ratings yet

- Goldman Sachs India Financials 2020Document38 pagesGoldman Sachs India Financials 2020sidNo ratings yet

- External Commercial Borrowings (ECB'S) : Submitted By-Vivek Rajput PGDM Ib (B) 3 SEMDocument4 pagesExternal Commercial Borrowings (ECB'S) : Submitted By-Vivek Rajput PGDM Ib (B) 3 SEMVivek RajputNo ratings yet

- Investment Incentives For Tourism IndustryDocument27 pagesInvestment Incentives For Tourism Industryqhaibey100% (3)

- More Solved Examples PDFDocument16 pagesMore Solved Examples PDFrobbsNo ratings yet

- Principles of Business Economics Joseph G. NellisDocument134 pagesPrinciples of Business Economics Joseph G. Nellisankur_555in3810No ratings yet

- Icici DmartDocument6 pagesIcici DmartGOUTAMNo ratings yet

- Tax Structure of Pakistan: (A Bird Eye View)Document16 pagesTax Structure of Pakistan: (A Bird Eye View)Kiran AliNo ratings yet

- Meet The Multibagger Expert Manish GoyalDocument4 pagesMeet The Multibagger Expert Manish GoyalhukaNo ratings yet

- Life Insurance Premium CalculationsDocument15 pagesLife Insurance Premium CalculationsVijay AgrahariNo ratings yet

- OCG Details His Concerns Regarding The Proposed Highway 2000 North South Link and The Container Transshipment Hub ProjectsDocument12 pagesOCG Details His Concerns Regarding The Proposed Highway 2000 North South Link and The Container Transshipment Hub ProjectsOG.NRNo ratings yet

- Position Trading Maximizing Probability of Winning TradesDocument91 pagesPosition Trading Maximizing Probability of Winning Tradescarlo bakaakoNo ratings yet

- Reflection BPIM Dubai Kunal BindraDocument12 pagesReflection BPIM Dubai Kunal BindraKunal BindraNo ratings yet

- Questionnaire An Investor S Behavior Analysis FINALDocument8 pagesQuestionnaire An Investor S Behavior Analysis FINALTonmoy ParthoNo ratings yet

- Book ReviewDocument6 pagesBook Reviewapi-3852875No ratings yet

- Module 5 - Understanding The Role of Financial Markets and InstitutionsDocument7 pagesModule 5 - Understanding The Role of Financial Markets and InstitutionsMarjon Dimafilis100% (1)

- Topic: Comprehensive Final Case: Course Code: SemesterDocument14 pagesTopic: Comprehensive Final Case: Course Code: SemesterPranto AhmedNo ratings yet

- AccountingDocument246 pagesAccountingPatrickNo ratings yet

- SaregamaDocument147 pagesSaregamaHarish BahraNo ratings yet

- Profiting With Ichimoku CloudsDocument46 pagesProfiting With Ichimoku Cloudsram100% (2)

- Industry 4.0Document12 pagesIndustry 4.0Ragunathan srinivasanNo ratings yet

- BA Outline 2009Document48 pagesBA Outline 2009EminKENNo ratings yet

- What Is Economic Growth: Sri Lanka GDPDocument5 pagesWhat Is Economic Growth: Sri Lanka GDPAchala JayasekaraNo ratings yet

- XIMB BrochureDocument84 pagesXIMB BrochureNayan KumarNo ratings yet