Professional Documents

Culture Documents

Accounting Is An Art of Analyzing, Recording, Classifying, Summarizing, and Reporting The Economic Events of Business

Accounting Is An Art of Analyzing, Recording, Classifying, Summarizing, and Reporting The Economic Events of Business

Uploaded by

Asjad Rehman0 ratings0% found this document useful (0 votes)

7 views8 pagesAccounts definitions

Original Title

ACOUNTS Definition

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounts definitions

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views8 pagesAccounting Is An Art of Analyzing, Recording, Classifying, Summarizing, and Reporting The Economic Events of Business

Accounting Is An Art of Analyzing, Recording, Classifying, Summarizing, and Reporting The Economic Events of Business

Uploaded by

Asjad RehmanAccounts definitions

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

Accounting is an Art of Analyzing, Recording,

Classifying, summarizing, and reporting the

economic events of business.

Transactions

Accounting Financial Statements

Transaction is an economic event that causes immediate

change in financial position in the business and can be

measured in terms of money.

Assets

Assets are the financial Resources owned or

controlled by entity and are expected to benefit

future operations.

To treat an item as assets, accountants have to

check

It is an resource

Business should have ownership or control over it

It can be measure in terms of money

Liabilities

Claims of outsiders over the assets of business

are liabilities.

Generally speaking these are the providers of

the assets of the business. In foreseeable

future business has to give back their assets

or pay back in cash or any other assets for

their claim.

Capital / Owners Equity

Claims of insiders over the assets of the business is called capital

Generally speaking these are also providers of the assets of the

business. Unlike liabilities, capital has below mentioned distinct

features

Their contribution (assets provided by them ) are not paid back

rather they receive any profit earned by the business.

Their claim is residual. It means that in case of winding up of

business, first liabilities will be paid, and any left over assets , that

may be more then or less then their contribution, will be given to

them.

Any Profit earned by the company goes to equity holders

Any loss suffered by the business, decreases the claim of equity

holders

Financial Statements

Basic responsibility of accountant is the

preparation of Financial statement. Financial

Statements are the key source to provide

information about the business. Financial

statements include

Balance Sheet

Income Statement

Statement of changes in Equity

Cash flow Statement

Balance Sheet states the financial position of

business at any given date. Positions is stated

into three main categories, Assets , Liabilities

and Capital

Income statement states the financial

performance of the business for any given

period. Performance is stated in terms of

revenue earned by the company and expenses

incurred to earn that revenue. Net result is

stated as profit of the business for the period.

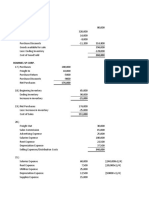

Cash Flow statement states the cash

generated and utilized by the business during

the given period.

Statement of Changes in Equity states the

changes took place in capital. Reason of

changes are additional investment, withdraw

of investment, profit or loss of the business.

In Accrual Basis of accounting, transactions

are recorded when exchange of goods or

services takes places compared to cash basis

where transactions are only recorded on

exchange of cash.

You might also like

- NC-III Bookkeeping ReviewerDocument33 pagesNC-III Bookkeeping ReviewerNovelyn Gamboa93% (56)

- 11 BPI AR Financial Statements FINALDocument59 pages11 BPI AR Financial Statements FINALcamille janeNo ratings yet

- Soal Latihan Sia 20192020 Dagang-JasaDocument3 pagesSoal Latihan Sia 20192020 Dagang-JasaJhoni LimNo ratings yet

- Afw 1000 Final Q s1 2014Document17 pagesAfw 1000 Final Q s1 2014Mohammad RashmanNo ratings yet

- ACC 124 - Assignment 1Document7 pagesACC 124 - Assignment 1RuzuiNo ratings yet

- Module 1-Review of Accounting ProcessDocument49 pagesModule 1-Review of Accounting ProcessJenny Flor PeterosNo ratings yet

- Introduction To Financial Statements and Other Financial ReportingDocument24 pagesIntroduction To Financial Statements and Other Financial ReportingAlina ZubairNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- Introduction To Accounting Gp1 by Professor & Lawyer Puttu Guru PrasadDocument33 pagesIntroduction To Accounting Gp1 by Professor & Lawyer Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Section 1 (Chapter 1)Document10 pagesSection 1 (Chapter 1)may thansinNo ratings yet

- Chapter 3 HandoutsDocument9 pagesChapter 3 HandoutsHonie Jane D. AmerilaNo ratings yet

- Review of Accounting ConceptsDocument9 pagesReview of Accounting ConceptsAngielyn PamandananNo ratings yet

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDocument29 pagesCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNo ratings yet

- Principle of AccountingDocument25 pagesPrinciple of AccountingBaktash Ahmadi100% (1)

- Financial Statement AnalysisDocument51 pagesFinancial Statement AnalysisMULATNo ratings yet

- Introduction To AccountingDocument34 pagesIntroduction To AccountingBianca Mhae De LeonNo ratings yet

- What Is AccountingDocument49 pagesWhat Is AccountingMay Myoe KhinNo ratings yet

- Basic Principles of Accounting: Jay P. Cabrera, Cpa, PH.DDocument50 pagesBasic Principles of Accounting: Jay P. Cabrera, Cpa, PH.DMarielle Mae Burbos100% (1)

- BusFin NotesDocument10 pagesBusFin NotesJeremae EtiongNo ratings yet

- The Four Financial StatementsDocument3 pagesThe Four Financial Statementsmuhammadtaimoorkhan100% (3)

- Financial Statement: José Manuel Rodríguez PérezDocument9 pagesFinancial Statement: José Manuel Rodríguez PérezJOSE RODRIGUEZ PEREZNo ratings yet

- Chapter 2 Elements and Components of The Financial StatementDocument8 pagesChapter 2 Elements and Components of The Financial StatementNOELYN LOVE CABANTACNo ratings yet

- Financial Performance AnalysisDocument106 pagesFinancial Performance AnalysisVasu GongadaNo ratings yet

- Chapter 2 Fundamentals of AccountingDocument29 pagesChapter 2 Fundamentals of AccountingJohn Mark MaligaligNo ratings yet

- Engineering EconomyDocument7 pagesEngineering EconomyhussainNo ratings yet

- CH 2 Accounting TransactionsDocument52 pagesCH 2 Accounting TransactionsGizachew100% (1)

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- Accounting ProcessDocument17 pagesAccounting ProcessDurga Prasad100% (1)

- 5 Financial StatementsDocument8 pages5 Financial StatementsMuhammad Muzammil100% (2)

- Tally Vol-1 - April #SKCreative2018Document34 pagesTally Vol-1 - April #SKCreative2018SK CreativeNo ratings yet

- Basic Accounting TermsDocument36 pagesBasic Accounting TermsNot Going to Argue Jesus is KingNo ratings yet

- PNB Class 6Document55 pagesPNB Class 6sunil routNo ratings yet

- Finance For Non-Financial ManagerDocument23 pagesFinance For Non-Financial ManagerMahrous100% (7)

- Understanding The Financial StatementsDocument59 pagesUnderstanding The Financial StatementsMarc Lewis Brotonel100% (1)

- Safari - 7 Jul 2022 at 3:41 PMDocument1 pageSafari - 7 Jul 2022 at 3:41 PMKristy Veyna BautistaNo ratings yet

- Chapter 12Document8 pagesChapter 12Hareem Zoya WarsiNo ratings yet

- Financial Reporting and Analysis - SIGFi - Finance HandbookDocument12 pagesFinancial Reporting and Analysis - SIGFi - Finance HandbookSneha TatiNo ratings yet

- 1.introduction To AccountingDocument14 pages1.introduction To AccountingBhuvaneswari karuturiNo ratings yet

- Financial Accounting SeminarDocument4 pagesFinancial Accounting SeminarIbrahimm Denis FofanahNo ratings yet

- Accounting Business and Management ABMDocument42 pagesAccounting Business and Management ABMJacky SereñoNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementGokul KulNo ratings yet

- Accounting IntroductionDocument10 pagesAccounting Introductionomer mazharNo ratings yet

- What Are The Parties Interested in Accounting?Document7 pagesWhat Are The Parties Interested in Accounting?Mohammad Zahirul IslamNo ratings yet

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- Introduction To Financial AccountingDocument14 pagesIntroduction To Financial AccountingRakshit DandriyalNo ratings yet

- FM 2Document7 pagesFM 2preetirathi010No ratings yet

- Module 1Document11 pagesModule 1Karelle MalasagaNo ratings yet

- bd4769edd615cbff9a10b93d43ba3972Document17 pagesbd4769edd615cbff9a10b93d43ba3972Tanish HandaNo ratings yet

- Introduction To AccountingDocument27 pagesIntroduction To AccountingVibhat Chabra 225013No ratings yet

- The Role of Accounting in BusinessDocument18 pagesThe Role of Accounting in BusinessJawad AzizNo ratings yet

- Introduction To AccountingDocument25 pagesIntroduction To Accountingvkvivekkm163No ratings yet

- Common Financial Reports: Income StatementDocument2 pagesCommon Financial Reports: Income StatementFiantiayu efandiNo ratings yet

- Lecture - 2: Financial Reporting and AccountingDocument41 pagesLecture - 2: Financial Reporting and AccountingMuhammad Waheed SattiNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- 10 Element of FRDocument12 pages10 Element of FRIloNo ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Accounting: The Language of BusinessDocument13 pagesAccounting: The Language of BusinessSania YaqoobNo ratings yet

- For ACCO 101 - Review of Accounting Concepts and Process (Part 1)Document32 pagesFor ACCO 101 - Review of Accounting Concepts and Process (Part 1)Fionna Rei DeGaliciaNo ratings yet

- 01 Lecture - MT - ch01 - 0607-082023 - Acctg Concepts 01Document22 pages01 Lecture - MT - ch01 - 0607-082023 - Acctg Concepts 01JIM KYRONE GENOBISANo ratings yet

- ReportDocument4 pagesReportEuneze LucasNo ratings yet

- (PDF) The Relevance of Financial Management in Christian Educational InstitutionsDocument8 pages(PDF) The Relevance of Financial Management in Christian Educational InstitutionsEMMANUEL TIMILEYINNo ratings yet

- Kalbe Farma TBK Billingual 31 Des 2021 ReleasedDocument163 pagesKalbe Farma TBK Billingual 31 Des 2021 ReleasedNanda IshermawanNo ratings yet

- IFRS 9 PIR - EFRAG Final Comment Letter - 28 January 2022Document38 pagesIFRS 9 PIR - EFRAG Final Comment Letter - 28 January 2022Mikel MinasNo ratings yet

- Accounting Fundamantals 2Document13 pagesAccounting Fundamantals 2Viren BansalNo ratings yet

- Crew FinalDocument94 pagesCrew FinalSiddharth KumarNo ratings yet

- The Context of Internal Analysis - BistratDocument6 pagesThe Context of Internal Analysis - BistratMattheus BiondiNo ratings yet

- AC Transit Annual Report 1982-1983Document28 pagesAC Transit Annual Report 1982-1983AC Transit HistorianNo ratings yet

- Current Assets:: Nomor Nama AkunDocument4 pagesCurrent Assets:: Nomor Nama AkunYasin Firdaus100% (1)

- Depreciation Chart As Per Sec-32 of The Income Tax Act-1961 (43 of 1961)Document1 pageDepreciation Chart As Per Sec-32 of The Income Tax Act-1961 (43 of 1961)Rajesh ShiralkarNo ratings yet

- AFAR - Standard and PRocess AssessmentDocument7 pagesAFAR - Standard and PRocess AssessmentMary Grace NaragNo ratings yet

- SM01 EmployeeBenefitsDocument1 pageSM01 EmployeeBenefitsJoan Rachel CalansinginNo ratings yet

- Sap Fi S4 Hana Asset Accounting Part 1Document6 pagesSap Fi S4 Hana Asset Accounting Part 1NASEER ULLAHNo ratings yet

- Cash Flow Statement UDpdfDocument18 pagesCash Flow Statement UDpdfrizwan ul hassanNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- ACCT 301B - CH 13 In-Class ExercisesDocument10 pagesACCT 301B - CH 13 In-Class ExercisesJudith Garcia0% (1)

- Spiceland 9e CH 11 UPRRP PDFDocument48 pagesSpiceland 9e CH 11 UPRRP PDFMissy MarieNo ratings yet

- C6-Intercompany Inventory Transactions PDFDocument43 pagesC6-Intercompany Inventory Transactions PDFVico JulendiNo ratings yet

- Common and Preferred StockDocument14 pagesCommon and Preferred StockMuhammad AyazNo ratings yet

- IAS 36 Impairment of AssetsDocument29 pagesIAS 36 Impairment of AssetsziyuNo ratings yet

- Investor Presentation December 2016 (Company Update)Document28 pagesInvestor Presentation December 2016 (Company Update)Shyam SunderNo ratings yet

- Summer Internship ProjectDocument53 pagesSummer Internship ProjectAkansh MukherjeeNo ratings yet

- Balance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Document5 pagesBalance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Raj ChauhanNo ratings yet

- Answer Key - Correction of ErrorsDocument13 pagesAnswer Key - Correction of ErrorsArramaeNo ratings yet

- Qau Memo 2019-03. Pfrs 16 Leases Annex A EntriesDocument2 pagesQau Memo 2019-03. Pfrs 16 Leases Annex A EntriesMikx LeeNo ratings yet

- Budhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesDocument3 pagesBudhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesSanjiv GuptaNo ratings yet

- Asics CorporationDocument6 pagesAsics Corporationasadguy2000No ratings yet

- 6882 - Revised Conceptual FrameworkDocument6 pages6882 - Revised Conceptual FrameworkMaximusNo ratings yet