Professional Documents

Culture Documents

Full Chemalite Solution

Full Chemalite Solution

Uploaded by

Dương Dương0 ratings0% found this document useful (0 votes)

9 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesFull Chemalite Solution

Full Chemalite Solution

Uploaded by

Dương DươngCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

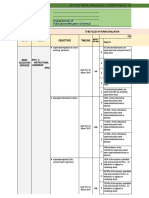

All values are in USD '$'

Net Cash flow from operating activities

Net income 118995

Noncash expenses, revenues, gains and losses in income

Depreciation 61625

Accounts Receivable -70030

Raw Materials Cost -20450

Amortisation 25000

Taxes payable -950

Inventory Finished goods -104680

Depreciation on finished goods 5000

Gain on sale of equipment -24250

Deferred income tax 26730

Prepaid Insurance -65000

Net Cash Flow from operating activities -48010

Cash Flow from investing activities

New equipment bought half paid -300000

New land bought half paid -125000

New Machine bought -520000

Selling of old machine 215500

Net cash flow from investing activities -729500

Cash Flow from Financing activities

Cash dividend paid -10000

Share purchased from investor -26000

Short term debt 200000

Long term debt 510000

Net Cash Flow from financing activity 674000

Net increase or decrease in cash -103510

Roll No: 038epgp11

Name : Swarnabha Seth FRA Assignment 1

Chemlite Cash Flow Statement

All values are in USD '$'

Cash Flow from Operating Activities

Cash collection 1816220

Cash payments (purchases and OPEX)

Materials -473150

Labor -660000

Inventory -99680

Rent -25000

Utilities -82000

Advertising -70000

R&D -63250

Insurance -97500

Selling and administration expense -195750

Interest -58750

Taxes Paid -39150

Total cash payments -1864230

Net cash provided by operating activities -48010

Cash flows from Investing Activities

Purchase of hard assets (machinery) -945000

Sold Existing Equipment 215500

Total Cash flows from investing -729500

Cash flows from Financing Activities

Long-term Debt 510000

Short-term Debt 200000

Stock buyback -26000

Dividents Paid -10000

Total cash flow from financing 674000

Cash Summary

Net Change in Cash -103510

Cash on January 1, 1992 113000

Cash on December 31, 1992 9490

Chemlite Cash Flow Statement

Name : Swarnabha Seth FRA Assignment 1

Roll No: 038epgp11

All values are in USD '$'

What are the main sources and uses of cash?

Sources of cash

Financing activities that is Short term and Long term debt

Investing activities - activities that is Selling of old equipments

Uses of cash

Operating activties - Raw materials

Operating Activities - Inventory of finished goods

Financing Activities - New investments made

Financing activities - cash dividend Paid

What would you recommend to Alexander?

Chemalite is in a situation where cash outflow during the period are higher than the cash inflows

during the same period. As this is a forecasted cashflow, Alexander needs to start worrying about

the cash position towards end of December from now onwards . The uses of cash is on higher side

and mainly due to large investment into inventory.

Chemalite is trying to overcome the situation by arranging long termand short term debt. However,

this might not be

useful since it will result in increase in higher liability and increase in interest payable there of.

Alexander should

adapt a "conservative" approach and cut down on spending in terms of new equipments.As per the

income statement there is a significant increase in revenue so the company is doing well in terms of

generating sales. Now lets see the few ratios: Cash realization ratio = cash generated by

operations/net income = -0.5. The company has to work hard in terms of realizing the cash. Ratio of

cash generated by operations to total debt = -0.8 shows that the company's credit worthiness is not

good and it may not get further loans

Name : Swarnabha Seth FRA Assignment 1

Roll No: 038epgp11

You might also like

- The Three Point Reversal Method of Point & Figure Stock Market Trading by A.W. CohenDocument129 pagesThe Three Point Reversal Method of Point & Figure Stock Market Trading by A.W. CohenSal Cibus92% (26)

- Dispensers of California Case AnalysisDocument10 pagesDispensers of California Case AnalysisAvinash Singh100% (1)

- Cheat Sheet Final - FMVDocument3 pagesCheat Sheet Final - FMVhanifakih100% (2)

- 2010-01 Intravenous Therapy Learning Module PDFDocument41 pages2010-01 Intravenous Therapy Learning Module PDFEvan GunawanNo ratings yet

- Accounting EquationDocument36 pagesAccounting EquationZainon Idris100% (1)

- Basic Postulates For A Transpersonal PsychotherapyDocument19 pagesBasic Postulates For A Transpersonal PsychotherapyAndiiFitriiWahyuniiNo ratings yet

- Statement of Cash FlowsDocument16 pagesStatement of Cash FlowsWeng Torres AllonNo ratings yet

- Sheet1: Indirect Method - Operating Cash Direct Method - Operating CashDocument7 pagesSheet1: Indirect Method - Operating Cash Direct Method - Operating CashJayesh MahajanNo ratings yet

- Cash Flow Statement: Segregation of Cash FlowsDocument7 pagesCash Flow Statement: Segregation of Cash FlowsawedawedNo ratings yet

- Alwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsDocument14 pagesAlwadi International School Accounting Grade 12 Notes: Statement of Cash FlowsFarrukhsgNo ratings yet

- Cash Flow NotesDocument4 pagesCash Flow NotesSana GulNo ratings yet

- Chapter 23 - Worksheet and SolutionsDocument21 pagesChapter 23 - Worksheet and Solutionsangelbear2577No ratings yet

- Chapter 13 - CashFlow - STUDENTSDocument5 pagesChapter 13 - CashFlow - STUDENTSCalvin Fishy SuNo ratings yet

- Lesson 5:: Cash Flow Statement (CFS)Document17 pagesLesson 5:: Cash Flow Statement (CFS)Franz BatulanNo ratings yet

- Cash Flow Statement-2015Document43 pagesCash Flow Statement-2015Sudipta Chatterjee100% (1)

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocument135 pagesCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Hindustan Lever Chemicals Balance Sheet - in Rs. Cr.Document28 pagesHindustan Lever Chemicals Balance Sheet - in Rs. Cr.Lochan ReddyNo ratings yet

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21No ratings yet

- Projected Cash FlowDocument5 pagesProjected Cash FlowSaif Muhammad SazinNo ratings yet

- Cash Flow StatementDocument35 pagesCash Flow StatementShiv Shankar Kumar100% (1)

- Review of Chapter 9/10Document36 pagesReview of Chapter 9/10Dakshin SooryaNo ratings yet

- 2012 Final Exam SolutionDocument14 pages2012 Final Exam SolutionOmar Ahmed ElkhalilNo ratings yet

- Assignment - 2 Cash Flow Analysis: Submitted by Group - 8Document13 pagesAssignment - 2 Cash Flow Analysis: Submitted by Group - 8dheeraj_rai005No ratings yet

- Review of Chapter 8/9Document36 pagesReview of Chapter 8/9BookAddict721100% (1)

- Cummins CashFlowAnalysisDocument1 pageCummins CashFlowAnalysisnishanthNo ratings yet

- Tata India 10 ValuationDocument117 pagesTata India 10 ValuationPankaj GuptaNo ratings yet

- Power Notes: Statement of Cash FlowsDocument63 pagesPower Notes: Statement of Cash FlowsRon ManNo ratings yet

- IAS-7 Cash Flow StatementDocument36 pagesIAS-7 Cash Flow StatementSumon MonNo ratings yet

- Profit and Loss AccountDocument5 pagesProfit and Loss AccountLanston PintoNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Asha E. Thomas Assistant Professor Scms CochinDocument23 pagesAsha E. Thomas Assistant Professor Scms Cochinsureshgpl_1989No ratings yet

- Cash Flow StatementDocument57 pagesCash Flow StatementSurabhi GuptaNo ratings yet

- XM Round 0Document13 pagesXM Round 0Rafaa DalviNo ratings yet

- ACC101-Chapter12new 000 PDFDocument26 pagesACC101-Chapter12new 000 PDFShibasundar Behera100% (1)

- Excel Solutions To CasesDocument38 pagesExcel Solutions To CaseselizabethanhdoNo ratings yet

- Chapter 8Document6 pagesChapter 8Nor AzuraNo ratings yet

- Cash Flow StatementDocument20 pagesCash Flow StatementNishant KhattwaniNo ratings yet

- Cima F1 Chapter 4Document20 pagesCima F1 Chapter 4MichelaRosignoli100% (1)

- Ratio Analysis: S Liabilitie Current Assets CurrentDocument8 pagesRatio Analysis: S Liabilitie Current Assets Currentpunte77No ratings yet

- Cash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesDocument6 pagesCash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesCross MatricNo ratings yet

- FABM2 - SCF COMPRESSED PrintDocument28 pagesFABM2 - SCF COMPRESSED PrintJasy Nupt GilloNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- FIN3702 SummaryDocument26 pagesFIN3702 SummaryQuentin SchwartzNo ratings yet

- Financial Statement Analysis Questions We Would Like AnsweredDocument9 pagesFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodNo ratings yet

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisRaijo PhilipNo ratings yet

- Financial Management: Short-Term Financial PlanningDocument23 pagesFinancial Management: Short-Term Financial PlanningRao786No ratings yet

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocument40 pagesAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraNo ratings yet

- IAS 7 Statement of Cash FlowsDocument28 pagesIAS 7 Statement of Cash FlowsEynar MahmudovNo ratings yet

- Hero Motocorp: Previous YearsDocument11 pagesHero Motocorp: Previous YearssalimsidNo ratings yet

- Solution To Y Guess Jeans:: Item 1. Consolidated Financial StatementsDocument7 pagesSolution To Y Guess Jeans:: Item 1. Consolidated Financial StatementsAbuBakarSiddiqueNo ratings yet

- Chapter 12 Cash FlowsDocument6 pagesChapter 12 Cash FlowsgoerginamarquezNo ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Unit 1Document13 pagesUnit 1disss8989No ratings yet

- Statement of Cash FlowsDocument30 pagesStatement of Cash FlowsNocturnal Bee100% (1)

- Principles of Accounting Chapter 13Document43 pagesPrinciples of Accounting Chapter 13myrentistoodamnhigh100% (1)

- Cash Flow - Fund Flow - Cash ForecastsDocument22 pagesCash Flow - Fund Flow - Cash ForecastsAkhil Vashishtha100% (1)

- Damodaran On Valuation PDFDocument102 pagesDamodaran On Valuation PDFmanishpawar11No ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanNo ratings yet

- BalanceDocument2 pagesBalanceArham AyazNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- 886 - English Tenses Advanced Level Mcqs Test With Answers 3Document7 pages886 - English Tenses Advanced Level Mcqs Test With Answers 3Наталья ГончароваNo ratings yet

- Interdisciplinary Course in Political ScienceDocument26 pagesInterdisciplinary Course in Political ScienceMatthew JohnsonNo ratings yet

- Name of Employee: Position: Review Period: Bureau/Center/Service/DivisionDocument25 pagesName of Employee: Position: Review Period: Bureau/Center/Service/DivisionPAUL GONZALES90% (10)

- CPT7 Study Guide Section 4Document7 pagesCPT7 Study Guide Section 4AdasNo ratings yet

- Anatomy 10 YrsDocument10 pagesAnatomy 10 YrsAwantika RanjanNo ratings yet

- A Critique of John Mbiti's Undestanding of The African Concept of TimeDocument13 pagesA Critique of John Mbiti's Undestanding of The African Concept of Timerodrigo cornejoNo ratings yet

- Sample Qualitative PHD ThesisDocument5 pagesSample Qualitative PHD ThesisFindSomeoneToWriteMyPaperSingapore100% (2)

- 11Document55 pages11Nindi nindongNo ratings yet

- Sale of Goods ActDocument3 pagesSale of Goods Actعبداللہ یاسر بلوچNo ratings yet

- Language and Society - QuestionsDocument2 pagesLanguage and Society - QuestionsMihai Ovidiu100% (2)

- Soal UAS Bahasa Inggris Kelas 1 SD Semester 1 (Ganjil) Dan Kunci JawabanDocument5 pagesSoal UAS Bahasa Inggris Kelas 1 SD Semester 1 (Ganjil) Dan Kunci JawabanCandra Maulana100% (1)

- 02.levels of ManagementDocument18 pages02.levels of Managementgosaye desalegn0% (1)

- The Pineapple (Pinyasan) FestivalDocument3 pagesThe Pineapple (Pinyasan) FestivalChristian SeveroNo ratings yet

- Instant Download Child Development An Active Learning Approach Third Edition PDF Version PDF ScribdDocument41 pagesInstant Download Child Development An Active Learning Approach Third Edition PDF Version PDF Scribdstanley.rodriquez278100% (42)

- Amethyst Fairy Orb: - 1 - © Healingartforms - Nicole LanningDocument0 pagesAmethyst Fairy Orb: - 1 - © Healingartforms - Nicole LanningTina SarupNo ratings yet

- DLL - Aug 28-Sept 1Document6 pagesDLL - Aug 28-Sept 1Benes Salamanca BolascoNo ratings yet

- M C M C M C: Recycled Language: Animals Vocabulary, Colours Vocabulary, Action VerbsDocument7 pagesM C M C M C: Recycled Language: Animals Vocabulary, Colours Vocabulary, Action VerbsNor' AfrahNo ratings yet

- ĐỀ CƯƠNG PPGDTA 2Document48 pagesĐỀ CƯƠNG PPGDTA 2thomha2001100% (1)

- Cultural Identity in Monica Ali - S Brick Lane A Bhabhian PerspectiveDocument16 pagesCultural Identity in Monica Ali - S Brick Lane A Bhabhian PerspectiveMahdokht RsNo ratings yet

- Draft Motion Quash - Sandiganbayan-2 InformationDocument10 pagesDraft Motion Quash - Sandiganbayan-2 Informationkei baligodNo ratings yet

- Grade 10 Module 4 - MathDocument2 pagesGrade 10 Module 4 - MathJvnRodz P GmlmNo ratings yet

- Give Me Your Sorrows: Rajinder Singh BediDocument23 pagesGive Me Your Sorrows: Rajinder Singh BediwriterhariNo ratings yet

- Bishop - Pattern Recognition and Machine Learning - Springer 2006Document6 pagesBishop - Pattern Recognition and Machine Learning - Springer 2006Thilini NadeeshaNo ratings yet

- English CommDocument17 pagesEnglish CommastuanahNo ratings yet

- Codependency Caring Until It HurtsDocument1 pageCodependency Caring Until It HurtsJessica King100% (1)

- Guide To NIRDocument24 pagesGuide To NIRtvijayak4150% (2)

- Mother Country Catherine HallDocument7 pagesMother Country Catherine HallStephen BeckerNo ratings yet