Professional Documents

Culture Documents

3df3fe00-fbfc-4f2a-ba8d-4c239fc0b5b3

3df3fe00-fbfc-4f2a-ba8d-4c239fc0b5b3

Uploaded by

GVKevinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3df3fe00-fbfc-4f2a-ba8d-4c239fc0b5b3

3df3fe00-fbfc-4f2a-ba8d-4c239fc0b5b3

Uploaded by

GVKevinCopyright:

Available Formats

Dear Clients,

Since the start of our operations in the Asia Pacific region, we have temporarily suspended performance fee

charges as a promotion to encourage growth in the region. This fee will be reinstated beginning 2

nd

December

2013. Below is an explanation of how our performance fee charges are done and how it differs from the

market.

There are many types of performance fee charges in the market. Below are some of the common fees to

expect.

1) An initial fee when you make the purchase/investment.

This potentially means your fund invested initially is lesser than what you actually paid for. Therefore,

you start off with a deficit.

2) Costs incurred to manage your portfolio.

This type of fee has the highest potential to incur the highest costs as you will need to pay for legal,

custodial, auditing and marketing fees.

3) Performance of your portfolio

This fee is charged if your portfolio maintains a pre-determined performance level.

4) Annual administrative charges

This fee is charged on a yearly basis.

As you can see the list can go on. It is also common practice for companies to have multiple fees in place.

However, at FX Zenith, we only have ONE fee and this fee is determined by YOU. We do not charge you any

fee for maintaining your deposit. Neither do we charge you when we perform well in the forex market. Your

charges are based on the amount of profits you withdraw from your F.A.S.T. account and this is reset on a

weekly basis.

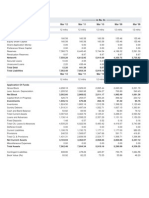

Please refer to the table below:

Illustrations:

Example 1:

Accumulated amount of transfer from F.A.S.T. to Cash within a week: US$2,500

Performance fee charge from 1

st

tier: 3%x US$2,500 =US$75

Amount receivable in Cash account: US$2,500 US$75 =US$2,425

Example 2:

Accumulated amount of transfer from F.A.S.T. to Cash within a week: US$7,500

Performance fee charge from 1

st

tier: 3%x US$3,000 =US$90

Performance fee charge from 2

nd

tier: 6%x US$3,000 =US$180

Performance fee charge from 3

rd

tier: 9%x US$1,500 =US$135

Amount receivable in Cash account: US$7,500 US$90 US$180 US$135 =US$7,095

Example 3:

Accumulated amount of transfer from F.A.S.T. to Cash within a week: US$12,000

Performance fee charge from 1

st

tier: 3%x US$3,000 =US$90

Performance fee charge from 2

nd

tier: 6%x US$3,000 =US$180

Performance fee charge from 3

rd

tier: 9%x US$3,000 =US$270

Performance fee charge from 4

th

tier: 12%x US$3,000 =US$360

Amount receivable in Cash account: US$12,000 US$90 US$180 US$270 US$360 =US$11,100

*Performance fee charge is reset on the following Monday when F.A.S.T. account is locked for trading

With this method, we ensure that your returns can be maximized as your investment will never be charged

until you decide otherwise.

Management

FX Zenith Investments Limited

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- High Probability Trading Setups For The Currency MarketDocument102 pagesHigh Probability Trading Setups For The Currency Marketrichardsonfx90% (29)

- High Probability Trading Setups For The Currency MarketDocument102 pagesHigh Probability Trading Setups For The Currency Marketrichardsonfx90% (29)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Discriminatory Access To Loans, CreditDocument118 pagesDiscriminatory Access To Loans, CreditScutty StarkNo ratings yet

- Ecos StudyGuide1 UnisaDocument284 pagesEcos StudyGuide1 UnisaShaunrumble100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Governance of SOE - A Tool Kit PDFDocument391 pagesCorporate Governance of SOE - A Tool Kit PDFAhmad RifaiNo ratings yet

- The Five Stages of Business GrowthDocument2 pagesThe Five Stages of Business GrowthRachel Honey100% (2)

- Boroden Carolyn - Introduction To Fibonacci Price Clusters and Timing On The Cbot Mini-Sized DowDocument44 pagesBoroden Carolyn - Introduction To Fibonacci Price Clusters and Timing On The Cbot Mini-Sized DowRachel HoneyNo ratings yet

- Boroden Carolyn - Introduction To Fibonacci Price Clusters and Timing On The Cbot Mini-Sized DowDocument44 pagesBoroden Carolyn - Introduction To Fibonacci Price Clusters and Timing On The Cbot Mini-Sized DowRachel HoneyNo ratings yet

- Exc CH 5Document34 pagesExc CH 5Syafiah Khairunnisa33% (3)

- Train The Trainer From Training JournalDocument49 pagesTrain The Trainer From Training JournalDr. Wael El-Said100% (7)

- IncomeTax Banggawan2019 Ch12Document15 pagesIncomeTax Banggawan2019 Ch12Noreen Ledda0% (1)

- Manajemen Investasi - Modul (IBN)Document130 pagesManajemen Investasi - Modul (IBN)Fajar Ariesman100% (1)

- Topgrading Bradford SmartDocument52 pagesTopgrading Bradford SmartRachel HoneyNo ratings yet

- FinDefense-Panel 7Document103 pagesFinDefense-Panel 7Bing BlanzaNo ratings yet

- HRM587..Home Depot Vs LowesDocument6 pagesHRM587..Home Depot Vs LowesKatina Marie JohnsonNo ratings yet

- Ikea IndiaDocument11 pagesIkea IndiaVico Ling100% (6)

- ICAAPDocument84 pagesICAAPjugokrst4246100% (1)

- Dailyfx Research: Dollar Tries To Form A Bottom As SPX 500 Hovers Near 2013 TopDocument5 pagesDailyfx Research: Dollar Tries To Form A Bottom As SPX 500 Hovers Near 2013 TopRachel HoneyNo ratings yet

- ANU Syllabus Mba 1617Document37 pagesANU Syllabus Mba 1617razaraviNo ratings yet

- The - Faber.report CNBSDocument154 pagesThe - Faber.report CNBSWilly Pérez-Barreto MaturanaNo ratings yet

- Jharkhand Draft Industrial Policy 2010Document22 pagesJharkhand Draft Industrial Policy 2010IndustrialpropertyinNo ratings yet

- ASMAITHA Financials 02 PDFDocument58 pagesASMAITHA Financials 02 PDFthrigunNo ratings yet

- Ghana Off-Grid Solar Farm & Water System DevelopmentDocument1 pageGhana Off-Grid Solar Farm & Water System DevelopmentDaniel NguyenNo ratings yet

- Leverage: Dr. Sonia Baghla Assistant Professor Baba Farid College BathindaDocument37 pagesLeverage: Dr. Sonia Baghla Assistant Professor Baba Farid College Bathindadr. soniaNo ratings yet

- The World BankDocument30 pagesThe World BankBhagirath AshiyaNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- ATI Environmental ManualDocument45 pagesATI Environmental ManualThan TunNo ratings yet

- Unit 2: Accounting Concepts and Trial BalanceDocument12 pagesUnit 2: Accounting Concepts and Trial Balanceyaivna gopeeNo ratings yet

- Natural Food Colours 16Document6 pagesNatural Food Colours 16psandeep_elementsNo ratings yet

- Brit Films 1927-39Document171 pagesBrit Films 1927-39jeanpierreborgNo ratings yet

- Chapter 2 Business StrategyDocument28 pagesChapter 2 Business StrategyChitrakSawadiyawalaNo ratings yet

- © Air Costa 2014: Promoted byDocument19 pages© Air Costa 2014: Promoted byRudra MitraNo ratings yet

- 01 Market Organization and Structure PDFDocument23 pages01 Market Organization and Structure PDFNgân Hà Nguyễn0% (1)

- Jayden WorkDocument6 pagesJayden WorkAnthonio MaraghNo ratings yet

- Bimbo - AR 2005Document60 pagesBimbo - AR 2005Trish DattaNo ratings yet

- KRISHI BANK Cash Written Math Solution by SI SOHELDocument5 pagesKRISHI BANK Cash Written Math Solution by SI SOHELAaryaAustNo ratings yet

- Cowman Letter - Cease and Desist 4.23.08-2Document3 pagesCowman Letter - Cease and Desist 4.23.08-2justiceseeker75No ratings yet

- Determinants of Price Earnings RatioDocument13 pagesDeterminants of Price Earnings RatioFalguni ChowdhuryNo ratings yet