Professional Documents

Culture Documents

Advantage of Disinvestment

Advantage of Disinvestment

Uploaded by

HarishYadav0 ratings0% found this document useful (0 votes)

14 views9 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views9 pagesAdvantage of Disinvestment

Advantage of Disinvestment

Uploaded by

HarishYadavCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 9

Advantage of disinvestment

For the PSU

1. Listing leads to better and timely disclosures, bringing in greater transparency and

professionalism, thus protecting the interest of the investors

2. Greater efficiency by way of being accountable to thousands of shareholders

3. Listing provides an opportunity to raise capital to fund new projects/undertake

expansions/diversifications and for acquisitions. An initial listing increases a company's ability

to raise further capital through various routes like preferential issue, rights issue, Qualified

Institutional Placements and ADRs/GDRs/FCCBs, and in the process attract a wide and varied

body of institutional and professional investors.

4. Listing raises a company's public profile with customers, suppliers, investors, financial

institutions and the media. A listed company is typically covered in analyst reports and may

also be included in one or more of indices of the stock exchanges.

Need help? 0115 966 7955

Search

UK Essays

Services

Instant Price

Order Now

Essays

Dissertations

Quality

Contact

Account

You are here: UK Essays Essays Economics Impact Of Disinvestment For Indian Economy

Economics Essay

Print Email Download Reference This Send to Kindle Reddit This

IMPACT OF DISINVESTMENT FOR

INDIAN ECONOMY

Public sector undertakings were established in India as a part of mixed economy with the

objective of providing necessary infrastructure for the fast growth of economy & to safeguard

against monopoly of industrialist community. However, the entire mechanism did not turn out as

efficient as it ought to be, all thanks to the prevailing hierarchy and bureaucracy.

To illustrate the trailing scenario, the average return on capital employed (ROCE) by PSUs have

been way too low as compared to the cost of borrowing. For instance, between 1940 and 2002,

the average ROCE was 3.4% as against 8.6% average cost of borrowing. PSE survey by NCAER

shows that PAT has never exceeded 5% of sales for or 6% of capital employed. The government

pays a higher interest though, by at least 3 percentage points.

As per an NCAER study report the cost structure of PSES is much more than the private sector

(the following table shows a comparative scale) :

PSES

Private sector

POWER& FUELS/NET SALES

19.5

5

Wages/net sales

23.3

6.5

Interest/net sales

11.7

4.7

Lack of autonomy, political interference, nepotism & corruption has further deteriorated the

situation. For instance, the head of a PSU is appointed by the Government, who in turn appoints

all employees who play major roles in the organization. So directly or indirectly the Government

itself controls the appointment of all manpower in these organizations. It is not the business of

the Government to do business, i.e. it is best controlled by experts and professional managers.

To quote some figures, on 31.3.1997, there were 242 central public sector enterprises with a total

investment of Rs.1,93,121 crores. At the end of the fiscal year 2000-01, PSEs had a total

investment of Rs.274,114 crores. Of these, 104 were loss-making enterprises and about 53

chronically sick enterprises. If we exclude the profit making enterprises, mostly restricted to a

few sectors like petroleum and allied sectors, which basically enjoy a position of State

monopoly, the total loss of the 104 loss making units was a mind boggling Rs. 58,620 crores as

on 31.3.1997. As the losses continue, there is an increasing dependence on direct budgetary

support, and such losses are continuing to be a recurring draft on the budget.

Due to the current revenue expenditure on items such as interest payments, wages and salaries of

Government employees and subsidies, the Government is left with hardly any surplus for capital

expenditure on social and physical infrastructure. Additionally, the continued existence of the

PSEs is forcing the Government to commit further resources for the sustenance of many non-

viable PSEs. The Government continues to expose the taxpayers' money to risk, which it can

readily avoid. To top it all, there is a huge amount of debt overhang, which needs to be serviced

and reduced before money is available to invest in infrastructure. All this makes Disinvestment

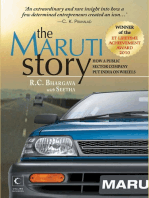

of the Government stake in the PSEs absolutely imperative. Disinvestment of the Maruti Udyog

Ltd.will work as a beacon for future.

In an era of globalization, liberalization and dissolution of boundaries between nations, industrial

competitiveness has especially assumed an important role, necessitating privatization or

disinvestment of PSUs. Though it is claimed by many that ownership isnt all that an important

indicator of an organizations functioning as is its management, it has been proven by an ample

number of examples that private controls of an organization bring about drastic changes in its

effectiveness. This is especially true today when competitiveness is essential not only for leading

the industry but for mere survival.

Get help with your essay

Read more about our Essay Writing Service >

Looking for examples of OUR work?

Click here to see our Essay Writing Examples >

Want to know more about our services?

Take a look at our Writing & Marking Service Index >

Bureaucracy has been an inherent part of PSUs and attempts to overcome it have been

unsuccessful if not inadequate. Private management has proven to be a panacea in most such

cases, including VSNL and Delhi Vidyut Board. The success of these organizations after

privatization has been evident by turning from red to black within a short span of time. PSUs no

longer enjoy the privileges as they did in past times in terms of reputation and awe, on the

contrary are stigmatized by the lack of efficiency and social considerations of past times.

Despite huge injection of funds in the past decades the functioning of many public sector units

(PSUs) has traditionally been characterized by poor management, slow decision making

procedures, lack of accountability, low productivity, unsatisfactory quality of goods, excessive

manpower utilization, labor intensive units, lack of technological up gradation, inadequate

attention to R&D, inadequate human resource development and low rate of return on capital.

However, with increasing privatization, disinvestment or change of control into hands of

professional managers, many organizations have seen the tables turn. Some examples are IRCTC

and CRIS to facilitate the functioning of Indian Railways etc.

Inefficient PSUs were largely responsible for the macro-economic crisis faced by India during

1980s. Although they were set up for the purpose of providing employment and the same time

generate revenue surplus. But they could not stand to expectations. Hence steps for

disinvestment had to be taken. Experts are of the opinion that disinvestment is unavoidable for

the success of second generation reforms. Health of the stock market is essential with the

progress of economic reforms.

We have seen every socialist country adopt industrialization, rather efficient industrialization, for

appropriate growth, be it China or Russia. We preferred Russias old model. Now that we have

seen even the social countries succeed with privatization and fail without it, it is high time we

implement it too in major respects.

Implications of Disinvestment on Indian

Economy:

If India wants a continuous increased growth, it has to scale to the next level of performance.

This is not an option but a necessity and disinvestment is a tool to get there. Increased

population, unemployment, and poverty levels are main reasons why India needs to scale. The

cost of not scaling to the next level will see India eclipsed by China and other South East Asian

aspirants leaving India to its internal chaos. It needs a 10% rate of growth every year in its GDP

to continue to be competitive with China and potential emergent nations in South East Asia.

In the context of macroeconomics, time has shown us how countries like Chile ,UK, China , New

zealand ,Poland successfully used disinvestment to achieve new economic heights. Many

countries used disinvestment as a sure means of restoring budgetary balance & to revive growth

on a sustainable basis after facing economic crisis in 80s.Analysis of these countries before &

after disinvestment shows that market-driven economies are more efficient than the state-planned

economies

At the micro level, the change in ownership will increase domestic competition, hence

efficiency; and encourage public participation in domestic stock market all of which will

promote popular capitalism that rewards risk taking and private initiative, that is expected to

yield superior economic outcomes. Disinvestment shows that govt means business which will

attract FDI, FII to finance projects in India.

Get help with your essay

Read more about our Essay Writing Service >

Looking for examples of OUR work?

Click here to see our Essay Writing Examples >

Want to know more about our services?

Take a look at our Writing & Marking Service Index >

Disinvestment will be extremely positive for the Indian equity markets and the economy. It will

draw lot of foreign and domestic money into the markets. It will allow PSU to raise capital to

fund their expansion plans and improve resource allocation in the economy. It will allow the

government to stimulate the economy while resorting to less debt market borrowing. Private

borrowers wont be crowded out of the markets by the government and will have to pay less to

borrow from the open market. Disinvestment will allow government to have much better control

over the market economy without upsetting norms of market behavior.

In future disinvestment will assume the role of a major instrument of policy intervention by

government as 48 PSUs listed on BSE as of February 8, 2010, account for close to the 30% of

the total market cap of the exchange. This is significant as a total of 4,880 odd companies were

listed on the exchange. As of February 8, 2010, the BSE PSU index had a total market cap of Rs

17,14,466.96 crore.

As certain no. of shares are reserved for retail investors & Splitting the stocks of some big PSUs

,will attract more retail investors. Market cap of PSUs can go higher in future & can provide

extra money in the kitty of govt. 5% Reservation for employees will work as an incentive & will

keep momentum going. This will be true democratization of capital. Disinvestment would

encourage citizens participation in management of public enterprises and improve the

capitalization of stock markets. Listing of enterprises on the bourse adds certain economic and

financial benefits to the economy. This is known as financial deepening, a term used by

development economists. Financial deepening improves the efficiency of the financial system as

well as contributes to GDP growth.

Latest loan bribery case(in LIC,PNB etc.) has shown the wrongdoing, loopholes & drawbacks in

the working of PSUs. If India has to become a economic super power, working way of PSUs

have to be changed. PSUs contribute about more than 1/4th in the GDP of India & a large chunk

of working population is employed in PSUs .Economic super power dream is not possible

without PSUs coming at par with private sector.

Print Email Download Reference This Send to Kindle Reddit This

0 comments

Sign in or Post as Guest

1 person listening

+ Follow

Share

Post comment as...

Newest | Oldest | Top Comments

Share This Essay

To share this essay on Reddit, Facebook, Twitter, or Google+ just click on the buttons below:

submit

Request Removal

If you are the original writer of this essay and no longer wish to have the essay published on the

UK Essays website then please click on the link below to request removal:

Request the removal of this essay.

More from UK Essays

Free Essays Index - Return to the FREE Essays Index

More Economics Essays - More Free Economics Essays (submitted by students)

Economics Essay Writing Service -find out more about how we can help you

Example Economics Essays - See examples of Economics Essays (written by our in-

house experts)

Writing Services

Essay writing

Dissertation writing

Assignment writing

All Services

Free Content

Essay Help

Referencing Guides

All Free Resources

About UK Essays

About Us

Is this cheating?

Contact Us

ORDER NOW

INSTANT PRICE

Search UK Essays

Search

Order Now Instant Price

Copyright 2003 - 2014 - UK Essays is a trading name of All Answers Ltd. All Answers Ltd is a company registered in

England and Wales Company Registration No: 4964706. VAT Registration No: 842417633. Registered Data Controller No:

Z1821391. Registered office: Venture House, Cross Street, Arnold, Nottingham, Nottinghamshire, NG5 7PJ.

Fair Use Policy

Terms & Conditions

Privacy Policy

Cookies

Complaints

Fraud

About us

Free Resources

Sitemap

Language

Join us on Google+

Find us on Facebook

Follow us on Twitter

Find out more from UK Essays

here: http://www.ukessays.com/essays/economics/impact-of-disinvestment-for-

indian-economy-economics-essay.php#ixzz3E9ltjAEpf

You might also like

- Need For The Slow Pace of PrivatizationDocument5 pagesNeed For The Slow Pace of PrivatizationSanchit Garg0% (3)

- Sme Research ReportDocument15 pagesSme Research ReportRajesh ChavanNo ratings yet

- Concept of BusinessDocument2 pagesConcept of BusinessHarishYadav100% (1)

- Ecoshastra - 2014 - Disinvestment Policy of Indian Government - Scope and Limitations - TabishAltafDocument4 pagesEcoshastra - 2014 - Disinvestment Policy of Indian Government - Scope and Limitations - TabishAltaftabish_altafNo ratings yet

- Disinvestment in IndiaDocument32 pagesDisinvestment in IndiaDixita ParmarNo ratings yet

- Paper-II (Part-2)Document3 pagesPaper-II (Part-2)focusahead.broNo ratings yet

- Disinvestment Synopsis ImpDocument10 pagesDisinvestment Synopsis ImpSarita GautamNo ratings yet

- Eco AssignmentDocument9 pagesEco AssignmentJigar ParmarNo ratings yet

- Economics Project 2020-2021: By: - G. Kishore Ganapathi Roll Number: - 12410Document22 pagesEconomics Project 2020-2021: By: - G. Kishore Ganapathi Roll Number: - 12410Itisme ItisnotmeNo ratings yet

- RSTV The Big Picture Privatisation of Public Sector EnterprisesDocument4 pagesRSTV The Big Picture Privatisation of Public Sector EnterprisesAbhishekNo ratings yet

- Competition LawDocument18 pagesCompetition Lawmuhammed farzinNo ratings yet

- Disinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CityDocument12 pagesDisinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CitySid SharmaNo ratings yet

- Indian Mutual FundsDocument28 pagesIndian Mutual FundsRamesh HKNo ratings yet

- IntroDocument4 pagesIntromuhammed farzinNo ratings yet

- STD 12 Economics (Project 2)Document45 pagesSTD 12 Economics (Project 2)SkottayyNo ratings yet

- Disinvestment and Privatization of Public Sector Units in IndiaDocument4 pagesDisinvestment and Privatization of Public Sector Units in IndiaDr. ShwetaNo ratings yet

- Final Frontier GS 3 SolutionsDocument25 pagesFinal Frontier GS 3 SolutionsAkshay BoradkarNo ratings yet

- 3 Theoritical FrameworkDocument21 pages3 Theoritical FrameworkAnshu9999No ratings yet

- Disinvestment of Public Sector UndertakingsDocument3 pagesDisinvestment of Public Sector UndertakingsNiyati AnandNo ratings yet

- Venture Financing in India PDFDocument12 pagesVenture Financing in India PDFChandni Makhijani100% (1)

- VIJAYALAXMIDocument23 pagesVIJAYALAXMIMohmmed KhayyumNo ratings yet

- SSRN Id4442920Document13 pagesSSRN Id4442920karsiv28No ratings yet

- Disinvestment Policy of IndiaDocument7 pagesDisinvestment Policy of Indiahusain abbasNo ratings yet

- Causes of PrivatisationDocument9 pagesCauses of PrivatisationNipunNo ratings yet

- Marcoz 2 CompleteDocument50 pagesMarcoz 2 Completemaaz bangiNo ratings yet

- Research Paper On Micro Small and Medium EnterprisesDocument5 pagesResearch Paper On Micro Small and Medium EnterprisesvvjrpsbndNo ratings yet

- Competition LawDocument6 pagesCompetition Lawmuhammed farzinNo ratings yet

- TLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayDocument10 pagesTLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayShivran RoyNo ratings yet

- Ijarm: International Journal of Advanced Research in Management (Ijarm)Document13 pagesIjarm: International Journal of Advanced Research in Management (Ijarm)IAEME PublicationNo ratings yet

- Sabari Final ProjectDocument54 pagesSabari Final ProjectRam KumarNo ratings yet

- Disinvestment An OverviewDocument8 pagesDisinvestment An OverviewRavindra GoyalNo ratings yet

- Financial Management (II) MFM Sem IV: Disinvestment As A StrategyDocument4 pagesFinancial Management (II) MFM Sem IV: Disinvestment As A Strategypriyankaoza22No ratings yet

- Business Env.. PrivatizationDocument8 pagesBusiness Env.. Privatizationklair_deepika5602No ratings yet

- Unit 5Document22 pagesUnit 5ShubhamkumarsharmaNo ratings yet

- Grant Thornton-Startups ReportDocument52 pagesGrant Thornton-Startups ReportMahesh PanigrahyNo ratings yet

- Disinvestment in IndiaDocument19 pagesDisinvestment in IndiaNikita MaskaraNo ratings yet

- Why Disinvest in SecuritiesDocument2 pagesWhy Disinvest in SecuritiesVibhuti SharmaNo ratings yet

- Privitisation and Disinvestment of PsusDocument11 pagesPrivitisation and Disinvestment of Psusnarasimaa100% (1)

- Section IDocument4 pagesSection ISoumya JainNo ratings yet

- Thesis On Small and Medium Enterprises in IndiaDocument5 pagesThesis On Small and Medium Enterprises in Indiacourtneypetersonspringfield100% (2)

- Chapter - 2 Disinvestment and Public Sector Undertakings in IndiaDocument24 pagesChapter - 2 Disinvestment and Public Sector Undertakings in Indiamohd sheerafNo ratings yet

- Venture Capital in IndiaDocument32 pagesVenture Capital in IndiasumancallsNo ratings yet

- Privatization of Public Sector in IndiaDocument4 pagesPrivatization of Public Sector in IndiaRadhika WaliaNo ratings yet

- Privatization of GOVERNMENT ASSETS: Good or BadDocument21 pagesPrivatization of GOVERNMENT ASSETS: Good or BadProf. R V SinghNo ratings yet

- 10 Joint Sector in IndiaDocument17 pages10 Joint Sector in IndiaAkash JainNo ratings yet

- Role That CA's Can Play in Growth of Indian EconomyDocument3 pagesRole That CA's Can Play in Growth of Indian EconomySwarna LathaNo ratings yet

- Test - 8 SynopsisDocument8 pagesTest - 8 SynopsisNitinKumarNo ratings yet

- Advantages of Financial GlobalizationDocument6 pagesAdvantages of Financial Globalizationdeepak100% (2)

- 23474july2011journal 62 PDFDocument5 pages23474july2011journal 62 PDFpathan1990No ratings yet

- Disinvestment and Its Impact On The Performance of CPSEsDocument7 pagesDisinvestment and Its Impact On The Performance of CPSEsEditor IJTSRDNo ratings yet

- Model Answer Key Economics-IiDocument17 pagesModel Answer Key Economics-Iisheetal rajputNo ratings yet

- Tunrayo 1-3Document34 pagesTunrayo 1-3Ibrahim AlabiNo ratings yet

- MSME Issues and Challenges 1Document7 pagesMSME Issues and Challenges 1Rashmi Ranjan PanigrahiNo ratings yet

- Role of Public SectorDocument13 pagesRole of Public SectorPrince RathoreNo ratings yet

- SME ExchangeDocument14 pagesSME ExchangeDebasish MaitraNo ratings yet

- Disinvestments of Public SectorDocument25 pagesDisinvestments of Public Sectordinabandhu_bagNo ratings yet

- Investopedia ExplainsDocument28 pagesInvestopedia ExplainsPankaj JoshiNo ratings yet

- Ecomonic Project PDFDocument15 pagesEcomonic Project PDFGarv RathiNo ratings yet

- Disinvestment in Public SectorDocument7 pagesDisinvestment in Public SectorRajs MalikNo ratings yet

- The Maruti Story: How A Public Sector Company Put India On WheelsFrom EverandThe Maruti Story: How A Public Sector Company Put India On WheelsRating: 3 out of 5 stars3/5 (1)

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- 9 Basics of Capital Expenditure DecisionsDocument37 pages9 Basics of Capital Expenditure DecisionsHarishYadavNo ratings yet

- Capital ExpenditureDocument24 pagesCapital Expenditureamol_patil591278No ratings yet

- "Marketing Strategy of Itc Company": Job Costing & Process Costing System 1Document30 pages"Marketing Strategy of Itc Company": Job Costing & Process Costing System 1HarishYadavNo ratings yet

- Marginal CostingDocument22 pagesMarginal CostingbelladoNo ratings yet

- Indian EconomyDocument20 pagesIndian EconomyHarishYadavNo ratings yet

- Marketing Strategies Adopted by Reliance Mart & Vishal Mega MartDocument84 pagesMarketing Strategies Adopted by Reliance Mart & Vishal Mega Martvivek_gupta290893% (14)

- All PracticeDocument2 pagesAll PracticeHarishYadavNo ratings yet

- Aarti PractceDocument23 pagesAarti PractceHarishYadavNo ratings yet