Professional Documents

Culture Documents

Accounting For Branches

Accounting For Branches

Uploaded by

anggandakonoh0 ratings0% found this document useful (0 votes)

23 views12 pages:)

Original Title

101825545 Accounting for Branches

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document:)

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views12 pagesAccounting For Branches

Accounting For Branches

Uploaded by

anggandakonoh:)

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 12

CHAPTER 4

ACCOUNTING FOR BRANCHES;

COMBINED FINANCIAL STATEMENTS

HIGHLIGHTS OF THE CHAPTER

1. A branch is a unit of a business enterprise located some distance from the home office. A branch

generally caries a stock of merchandise obtained from the home office, makes sales, approves

customers credit, and makes collections on trade accounts receivable.

2. The merchandise of a branch may be obtained exclusively from the home office, or a portion may

be purchased from outside suppliers. The cash receipts of the branch may be deposited in a bank

account of the home office; branch expenses then are paid from an imprest cash fund provided by

the home office. The imprest cash fund is replenished periodically by the home office. Alternatively,

a branch may maintain its on bank account.

!. "ertain units or segments of a business enterprise may be operated as divisions. A division may

consist of either a series of branches or one or more corporations. #hen a segment is operated as a

corporation, it is knon as a subsidiary of the parent company.

$. "osts of organi%ing a ne branch and operating losses during the initial period of operations

should be recogni%ed as expenses, not as deferred charges, per A&"'A SOP 98-5.

(. The accounting records for branches may be centralized in the home office or may be

decentralized so that each branch maintains a complete set of accounting records. &f the

accounting records are centrali%ed in the home office, each branch prepares daily reports and

documents that are used as sources for )ournal entries in the accounting records of the home office.

&f a branch maintains its on accounting records, some transactions or events relating to the

branch may be recorded by the home office. 'eriodic financial statements are provided by the

branch to the home office so that combined statements may be prepared.

*. The accounting records of a branch include a +ome ,ffice ledger account that is credited for assets

and services provided by the home office, and for branch net income. The +ome ,ffice account is

debited for any assets and services provided by the branch to the home office or to other branches,

and for branch net losses. The +ome ,ffice account thus is an onership e-uity.type account

representing the net investment of the home office in the branch.

/. A home office maintains a reciprocal ledger account, &nvestment in 0ranch, hich is debited for

the assets and other services provided to a branch, and for net income of the branch; it is credited

for the assets and services received from the branch, and for branch net losses.

1. A home office generally charges its branches for expenses 2such as insurance, interest, property

taxes, advertising, and depreciation3 incurred for the benefit of the branch. 4uch expenses must be

allocated to branch operations to measure the profitability of each branch.

5. 6erchandise shipped by a home office to branches may be billed at home office cost, at home

office cost plus a markup, or at branch retail selling price. A shipment of merchandise to a branch

is not a sale. 0illing at home office cost attributes the entire gross profit on merchandise sold by a

branch to the branch. #hen merchandise is billed at a price above home office cost 2or at branch

retail selling price3, the valuation assigned to branch inventory at the end of the accounting period

must be reduced to cost hen combined financial statements are prepared.

17. &f merchandise is billed to a branch at a price above home office cost and the perpetual inventory

system is used, the home office debits &nvestment in 0ranch for the billed price of the merchandise,

credits &nventories for the cost of the merchandise, and credits Alloance for ,vervaluation of

&nventories8 0ranch for the excess of the billed price over cost. The branch debits &nventories and

credits +ome ,ffice at billed prices of merchandise; sales by the branch are debited to "ost of

9oods 4old and credited to &nventories at billed prices.

11. A separate income statement and balance sheet for each branch may be prepared for use by

enterprise management. The income statement has no unusual features if merchandise is billed to a

The McGraw-Hill Companies, Inc., 2003

Study Guide !/

branch at home office cost. +oever, if merchandise is billed at a price above cost, the branch trial

balance must be ad)usted by the home office so that cost of the merchandise sold by the branch is

stated at cost to the home office.

12. A combined balance sheet for home office and branch shos the financial position of the business

enterprise as a single entity. &n the orking paper for combined financial statements, the assets and

liabilities of the branch are substituted for the &nvestment in 0ranch ledger account included in the

ad)usted trial balance of the home office. This is accomplished by elimination of the balances of the

+ome ,ffice and &nvestment in 0ranch reciprocal ledger accounts.

1!. &f a home office and branch use the periodic inventory system, the home office debits &nvestment

in 0ranch for the billed price of the merchandise shipped, credits 4hipments to 0ranch for the home

office cost of the merchandise shipped, and credits any excess of billed price over cost to

Alloance for ,vervaluation of &nventories8 0ranch. The branch debits 4hipments from +ome

,ffice and credits +ome ,ffice at billed price. At the end of the accounting period, the home office

reduces 2debits3 Alloance for ,vervaluation of &nventories8 0ranch for the amount of

overvaluation applicable to the branchs cost of goods sold and credits the amount of the reduction

to the :eali%ed 9ross 'rofit8 0ranch 4ales ledger account.

1$. At the end of an accounting period, the balance of the &nvestment in 0ranch ledger account may not

agree ith the balance of the +ome ,ffice account. &n such cases the reciprocal ledger accounts

must be reconciled and brought up to date before combined financial statements are prepared.

1(. &f the home office operates more than one branch, certain transactions, such as merchandise

shipments, may take place beteen branches. 4uch interbranch transactions usually are cleared

through the +ome ,ffice ledger account. ;or example, if Arlo 0ranch ships merchandise ith a

cost of <$77 to 0oone 0ranch and the periodic inventory system is used, the folloing )ournal

entries 2explanations omitted3 are re-uired8

ccounting records of rlo !ranch"

+ome ,ffice $77

4hipments from +ome ,ffice $77

ccounting records of !oone !ranch"

4hipments from +ome ,ffice $77

+ome ,ffice $77

ccounting records of home office"

&nvestment in 0oone 0ranch $77

&nvestment in Arlo 0ranch $77

1*. The transfer of merchandise from one branch to another does not )ustify increasing the carrying

amount of inventories by the additional freight costs incurred because of the indirect routing.

=xcess freight costs incurred as a result of such transfers are recogni%ed as operating expenses of

the home office because the home office makes the decision to transfer the merchandise.

The McGraw-Hill Companies, Inc., 2003

!1 Modern d!anced ccountin", #$e

QUESTIONS

#rue or $alse

;or each of the folloing statements, circle the # or the $ to indicate hether the statement is true or false.

# $ 1. &n a centrali%ed accounting system for branches, the branch accounting records are maintained

by the home office.

# $ 2. 0oth the +ome ,ffice ledger account and the &nvestment in 0ranch account are displayed in

the combined financial statements for the home office and the branch.

# $ !. The combined net income for the home office and branches ould be the same hen the home

office bills merchandise to branches at home office cost as hen the home office bills branches

at amounts above home office cost.

# $ $. &n most cases, a branch is operated more as a cost center than as a profit center.

# $ (. A branch imprest cash fund is displayed under the heading &nvestments in the combined

balance sheet of the home office and the branch.

# $ *. The &nvestment in 0ranch ledger account is displayed as a noncurrent asset in the separate

balance sheet of the home office, and the +ome ,ffice account is displayed as a long.term

liability in the separate balance sheet of the branch.

# $ /. The fiscal year for the home office must coincide ith the fiscal year for the branch to facilitate

the preparation of combined financial statements.

# $ 1. A net loss reported by a branch is recorded by the home office by a debit to the &nvestment in

0ranch ledger account.

# $ 5. &f branch trade accounts receivable are carried in the home office accounting records, doubtful

accounts expense of the branch is recorded by the home office by a debit to 0ranch >oss and a

credit to &nvestment in 0ranch.

# $ 17. &f merchandise is billed to a branch at a price above home office cost, the net income reported

to the home office by the branch is overstated.

# $ 11. 4eparate financial statements for an enterprises home office and branches generally are

prepared for use by creditors and government agencies.

# $ 12. &n a orking paper for combined financial statements of a home office and branches, the

balance of the 4hipments to 0ranch ledger account is eliminated against the balance of the

+ome ,ffice account.

# $ 1!. &n a separate balance sheet for a home office, the balance of the Alloance for ,vervaluation

of &nventories8 0ranch ledger account is deducted from the balance of the &nvestment in 0ranch

ledger account.

# $ 1$. The beginning inventories of a branch are reduced to home office cost in the orking paper for

combined financial statements by a debit to Alloance for ,vervaluation of &nventories8

0ranch and a credit to beginning inventories hen the periodic inventory system is used.

# $ 1(. The perpetual inventory system is impractical for a home office ith many branches.

The McGraw-Hill Companies, Inc., 2003

Study Guide !5

# $ 1*. &f a remittance of cash by a branch has not been recorded by the home office, the balance of the

branchs +ome ,ffice ledger account exceeds the balance of the home offices &nvestment in

0ranch account.

# $ 1/. ;reight costs on merchandise shipments from "ody 0ranch to ?ana 0ranch in excess of

normal freight costs from the home office to ?ana 0ranch should be recogni%ed as operating

expenses of ?ana 0ranch.

# $ 11. &f a ne branch is expected to be profitable starting ith the second year of operations, a loss

incurred by the ne branch in the first year should be deferred and recogni%ed as expense over

a period of three to five years.

Completion Statement

;ill in the necessary ords or amounts to complete the folloing statements.

1. A @@@@@@@@@@@@@@@@@@@@ is a unit of a business enterprise that sells merchandise at a location

some distance from the @@@@@@@ @@@@@@@@@@@@@@@@@@@@. A branch generally is operated as a

@@@@@@@@@@@@@@@@@@@@ of the home office; hoever, a @@@@@@@@@@@@@@@@@@@@ may be

organi%ed as a subsidiary corporation.

2. The +ome ,ffice ledger account and the &nvestment in 0ranch ledger account are

@@@@@@@@@@@@@@@ ledger accounts hose balances must be @@@@@@@@@@@@@@@ hen

@@@@@@@@@@@@@@@ financial statements for the home office and branch are prepared.

!. &f a home office bills merchandise to branches at a price above home office cost, the markup on the

unsold merchandise is not @@@@@@@@@@@@@@@@@@@@ and is eliminated for combined financial

statements for the home office and its branches.

$. &f the Aorco 0ranch remits cash to the home office of >epore "ompany and a decentrali%ed

accounting system is used, the Aorco 0ranch debits the @@@@@@@@@@ @@@@@@@@@@ ledger account

and credits "ash; the home office debits "ash and credits the @@@@@@@@@@@@@@@@@@@@ @@@@@@@

@@@@@@@@@@@@@@@@@@@@ account.

(. 4ome operating expenses incurred by the home office relate to branch operations and are

@@@@@@@@@@@@@@@ to the branch by a debit to the @@@@@@@@@@@@@@@@@@@@ @@@@@@@

@@@@@@@@@@@@@@@@@@@@ ledger account and a credit to the @@@@@@@@@@@@@@@@@@@@

@@@@@@@@@@@@@@@@@@@@ account in the accounting records of the home office.

*. &f shipments of merchandise by a home office to branches are billed at !! 1B!C above home office

cost, @@@@@@@C of the amount of the ending inventories of the branch is reported in the Alloance

@@@@@@@ @@@@@@@@@@@@@@@@@@@@ @@@@@@@ @@@@@@@@@@@@@@@@@@@@8 @@@@@@@@@@@@@@@@@@@@

ledger account in the accounting records of the home office.

The McGraw-Hill Companies, Inc., 2003

$7 Modern d!anced ccountin", #$e

M!ltiple C"oi#e

"hoose the best anser for each of the folloing -uestions and enter the identifying letter in the space

provided.

@@@@ 1. &n accounting for branch transactions, it is improper for the home office to8

a. "redit cash received from a branch to the &nvestment in 0ranch ledger account.

b. 6aintain "ommon 4tock and :etained =arnings ledger accounts for only the home office.

c. ?ebit shipments of merchandise to the branch from the home office to the &nvestment in

0ranch ledger account.

d. "redit shipments of merchandise to the branch to the 4ales ledger account.

@@@@ 2. The +ome ,ffice ledger account in the accounting records of the Tahoe 0ranch had a credit

balance of <12,777 at the end of April, and the &nvestment in 0ranch account in the accounting

records of the home office had a debit balance of <1(,777. The most likely reason for the

discrepancy in the to ledger account balances is8

a. 6erchandise shipped by the home office to the branch had not been recorded by the

branch.

b. The home office had not recorded the branch net income for April.

c. The branch had )ust collected home office trade accounts receivable in the amount of

<!,777.

d. The branch had not yet recorded the home office net income for April.

@@@@ !. Dayhak "ompany has numerous branches in the state of Eansas. The home office purchases

merchandise and makes shipments to branches from a central arehouse at the re-uest of

branch managers. #hich of the folloing ould be an improper accounting practiceF

a. The &nvestment in 0ranch ledger account is debited in the accounting records of the home

office hen merchandise is shipped to a branch, and the 4hipments to 0ranch account is

credited 2assume use of the periodic inventory system3.

b. The home office debits Trade Accounts :eceivable and credits 4ales hen merchandise is

shipped to a branch.

c. "ash received from a branch is credited to the &nvestment in 0ranch ledger account by the

home office.

d. ,nly the home office maintains a "ommon 4tock ledger account and a :etained =arnings

account.

@@@@ $. Aeither the 'almer 0ranch nor the home office of :upert "ompany had completed any

intracompany transactions during the last half of 6ay, yet the credit balance of the branchs

+ome ,ffice ledger account on 6ay !1 as larger than the debit balance of the home offices

&nvestment in 'almer 0ranch account. The most likely reason for this discrepancy is8

a. The home office reported a net loss for the month of 6ay.

b. The branch reported a net loss for the month of 6ay.

c. The branch returned merchandise to the home office.

d. The branch reported a net income for the month of 6ay.

@@@@ (. #hich of the folloing ledger accounts is displayed in the combined financial statements for a

home office and branchF

a. 4hipments to 0ranch

b. +ome ,ffice

c. ?ividends ?eclared

d. Alloance for ,vervaluation of &nventories8 0ranch

@@@@ *. The home office of &rby "ompany bills merchandise to branches at 2(C above home office cost.

&nformation taken from the accounting records of Eipp 0ranch is as follos8

0eginning inventories 2at billed prices3 <1/,777

The McGraw-Hill Companies, Inc., 2003

Study Guide $1

4hipments from home office 2at billed prices3 $2,(77

=nding inventories 2at billed prices3 27,777

Aet loss for accounting period 1,(77

The net income or net loss of Eipp 0ranch, based on home office cost of branch merchandise,

is8

a. </,577 net income

b. <5,$77 net loss

c. <*,$77 net income

d. </,777 net income

e. 4ome other amount

SHORT E$ERCISES

1. 0elo is a partial list of ledger accounts of the Gista 0ranch of 4antee "ompany, folloed by a

series of transactions. 0y placing the appropriate account number in the space provided, indicate

the accounts that are debited and credited in the accounting records of the branch to record each

transaction. The branch uses the perpetual inventory system.

1 "ash * 4ales

2 Trade Accounts :eceivable / "ost of 9oods 4old

! &nventories 1 ,perating =xpenses

$ Trade Accounts 'ayable 5 &ncome 4ummary

( +ome ,ffice 17 All other ledger accounts

#ransactions

%ista

!ranch

ledger

accounts

debited

%ista

!ranch

ledger

accounts

credited

a. :eceived cash from home office.

b. :ecogni%ed operating expenses 2paid in cash3 for the accounting

period.

c. 4ales ere made on account for the accounting period; recogni%ed cost

of goods sold for the period.

d. "ollections on trade accounts receivable ere made.

e. 'ayments by branch to suppliers ere made.

f. 0ranch remitted cash to home office.

g. :evenue and expense ledger accounts ere closed at the end of the

accounting period. 2'repare a )ournal entry and assume that total

revenue exceeds total expenses.3

h. "losed &ncome 4ummary ledger account and notified home office that

a net income as earned in the latest accounting period.

2. The home office of Huilly "ompany bills >eone 0ranch at 2(C above home office cost for all

merchandise shipped to the branch. ?uring Danuary, 2772, the home office shipped merchandise to

the branch at a billed price of <2$,777. The branch inventories on Danuary 1 and Danuary !1, 2772,

ere as follos8

&an. ' &an. ('

6erchandise received from home

office 2at billed prices3 <2/,*77 <!2,777

6erchandise purchased from 12,$77 12,777

The McGraw-Hill Companies, Inc., 2003

$2 Modern d!anced ccountin", #$e

outsiders

Total branch inventories <$7,777 <$$,777

The home office uses the periodic inventory system.

&n the space belo, prepare all )ournal entries 2including ad)ustments3 in the accounting records of

the home office for Danuary, 2772 to record the foregoing information.

)uilly *ompany +ome Office

&ournal ,ntries

2772

!. The &nvestment in 4ubble 0ranch ledger account of the home office of ?arcy "ompany and the

+ome ,ffice account of the branch for the month of Danuary, 2772, are belo and on page $$.

-nvestment in Subble !ranch

0alance, Dan. 1

4hipment of

merchandise

=xpenses

allocated to

branch

*1,777

*,277

1,1(7

"ash received

from branch

"ollection of

branch note

receivable

$,(77

2,777

+ome Office

"ash remitted to

home office

6erchandise

returned to home

office

$,(77

15(

0alance, Dan. 1

4hipment of

merchandise

"ollection of

home office trade

account receivable

*1,777

*,277

117

a. "omplete the reconciliation of the reciprocal accounts in the space belo.

-nvestment in Subble

!ranch ledger account

.in home office

accounting records/

+ome Office ledger

account .in branch

accounting records/

The McGraw-Hill Companies, Inc., 2003

Study Guide $!

0alances prior to ad)ustment < <

Add8

>ess8

Ad)usted balances < <

b. &n the spaces belo, prepare a single )ournal entry for both the home office and the branch to

bring each set of accounting records up to date 2assume that both use the perpetual inventory

system3.

0arcy *ompany +ome Office

&ournal ,ntry

2772

Dan. !1

Subble !ranch

&ournal ,ntry

2772

Dan. !1

The McGraw-Hill Companies, Inc., 2003

$$ Modern d!anced ccountin", #$e

CASE

&n your audit of the financial statements of #allis "ompany, hich has a single branch in &oa, for the

fiscal year ended Danuary !1, 2772, you revie the folloing home office ledger account8

llo1ance for Overvaluation of -nventories" -o1a !ranch

0ate ,2planation 0ebit *redit !alance

2772

Dan. 2 4hipment of merchandise costing <17,777 at a 27C markup

on billed price, to stock the branch for its opening. 2,777 2,777 cr

1* 4hipment of merchandise costing <$7,777 at a 27C markup

on billed price, to replenish the branch inventories. 1,777

17,777

cr

!1 :eduction of balance by unreali%ed markup in the branchs

ending inventories of <!,777 at billed prices. *77 5,$77 cr

a. ?escribe the errors in the )ournal entries posted to the foregoing ledger account.

b. ?escribe, but do not prepare, the )ournal entry re-uired to correct the foregoing ledger account

on Danuary !1, 2772.

The McGraw-Hill Companies, Inc., 2003

Study Guide $(

SOLUTIONS TO QUESTIONS% SHORT E$ERCISES% AND CASE& CHAPTER 4

)3,S#-O4S

#rue or $alse

1. T 2. ; !. T $. ; (. ; *. ; /. T 1. ; 5. ; 17. ; 11. ; 12. ; 1!. T 1$. T 1(. ; 1*. ;

1/. ; 11. ;

*ompletion Statements

1. 0ranch, home office, profit center, division. 2. :eciprocal, eliminated, combined. !. :eali%ed. $.

+ome ,ffice, &nvestment in 0ranch. (. Allocated, &nvestment in 0ranch, ,perating =xpenses. *.

2(C, for ,vervaluation of &nventories8 0ranch.

5ultiple *hoice

1. d 2. a !. b $. d (. c *. c I2<!5,(77 x 7.273 J <1,(77 K <*,$77L

S+O6# ,7,6*-S,S

1.

#ransactions

%ista

!ranch

ledger

accounts

debited

%ista

!ranch

ledger

accounts

credited

a. :eceived cash from home office. 1 (

b. :ecogni%ed operating expenses 2paid in cash3 for the accounting period. 1 1

c. 4ales ere made on account for the accounting period; recogni%ed cost of

goods sold for the period. 2, / *, !

d. "ollections on trade accounts receivable ere made. 1 2

e. 'ayments by branch to suppliers ere made. $ 1

f. 0ranch remitted cash to home office. ( 1

g. :evenue and expense ledger accounts ere closed at the end of the

accounting period. 2'repare a )ournal entry and assume that total revenue

exceeds total expenses.3 * /, 1, 5

h. "losed &ncome 4ummary ledger account and notified home office that a net

income as earned in the latest accounting period. 5 (

The McGraw-Hill Companies, Inc., 2003

$* Modern d!anced ccountin", #$e

2. )uilly *ompany +ome Office

&ournal ,ntries

2772 &nvestment in >eone 0ranch 2$,777

4hipments to >eone 0ranch 15,277

Alloance for ,vervaluation of &nventories8 >eone 0ranch $,177

To record shipments to branch at 2(C above home office cost.

Alloance for ,vervaluation of &nventories8 >eone 0ranch !,527

:eali%ed 9ross 'rofit8 >eone 0ranch 4ales !,527

To reduce alloance amount by hich ending inventories exceed

home office cost.

!illed

price *ost 5ar8up9

0eginning inventories <2/,*77 <22,717 < (,(27

Add8 4hipments from home office 2$,777 15,277 $,177

Available for sale <(1,*77 <$1,217 <17,!27

>ess8 =nding inventories 2!2,777 3 22(,*77 3

2*,$773

"ost of goods sold <15,*77 <1(,*17 < !,527

MA markup of 2(C on cost is e-ual to a markup of 27C on billed price.

!. a. -nvestment in Subble

!ranch ledger account

.in home office

accounting records/

+ome Office ledger

account .in branch

accounting records/

0alances prior to ad)ustment <*1,1(7 <*2,*1(

Add8 "ollection of home office

trade account receivable

by branch 117

=xpenses allocated to branch

by home office 1,1(7

>ess8 6erchandise returned to

home office by branch 215(3

"ollection of branch note

receivable by home office 22,7773

Ad)usted balances <*1,1!( <*1,1!(

b. 0arcy *ompany +ome Office

&ournal ,ntry

2772

Dan. !1 &nventories 15(

Trade Accounts :eceivable 117

&nvestment in 4ubble 0ranch 1(

To ad)ust &nvestment in 4ubble 0ranch ledger account.

The McGraw-Hill Companies, Inc., 2003

Study Guide $/

Subble !ranch

&ournal ,ntry

2772

Dan. !1 ,perating =xpenses 1,1(7

+ome ,ffice 1(7

Aotes :eceivable 2,777

To ad)ust +ome ,ffice ledger account.

*S,

a. The to credits to the Alloance for ,vervaluation of &nventories8 &oa 0ranch are of

incorrect amount. A 27C markup on billed price is a 2(C markup on home office cost;

therefore, the Danuary 2, 2772, credit should be <2,(77 2<17,777 x 7.2( K <2,(773, and the

Danuary 1* credit should be <17,777 2<$7,777 x 7.2( K <17,7773. The Danuary !1 )ournal

entry should be a debit of <11,577, or 27C of branch cost of goods sold of <(5,(77 2<17,777

N <2,(77 N <$7,777 N <17,777 J <!,777 K <(5,(773.

b. The ending balance of the Alloance for ,vervaluation of &nventories8 &oa 0ranch should be

<*77 2<!,777 x 7.27 K <*773. Therefore, the Danuary !1, 2772, )ournal entry to correct the

balance of that account is a debit to &nvestment in &oa 0ranch, <2,(77 2the aggregate

understatement of the billed prices of the to merchandise shipments to the branch8 <(77 N

<2,777 K <2,(773; a debit to Alloance for ,vervaluation of &nventories8 &oa 0ranch, <1,177

2<5,$77 J <*77 K <1,1773; and a credit to :eali%ed 9ross 'rofit8 &oa 0ranch 4ales, <11,!77

2<11,577 J <*77 K <11,!773.

The McGraw-Hill Companies, Inc., 2003

$1 Modern d!anced ccountin", #$e

You might also like

- 08 Home Office Branch AccountingDocument4 pages08 Home Office Branch AccountingMila Casandra CastañedaNo ratings yet

- Comprehensive Problem 1Document9 pagesComprehensive Problem 1Johanes Wilfrid Pangihutan Purba. S.E.100% (2)

- Laras Gifts v. MidtownDocument4 pagesLaras Gifts v. MidtownKyle DionisioNo ratings yet

- Acctg 10 Midterm Lesson Part .1Document21 pagesAcctg 10 Midterm Lesson Part .1NANNo ratings yet

- 2 Branch AccountingDocument3 pages2 Branch AccountingLeo FrostNo ratings yet

- Numerical Reasoning Practice TestDocument14 pagesNumerical Reasoning Practice TestlordaiztrandNo ratings yet

- CostDocument18 pagesCostlordaiztrandNo ratings yet

- The "Exorbitant Privilege" - A Theoretical ExpositionDocument25 pagesThe "Exorbitant Privilege" - A Theoretical ExpositionANIBAL LOPEZNo ratings yet

- Chapter 4 Accounting For Branches Combined Financial Statements Highlights of The Chapter PDFDocument12 pagesChapter 4 Accounting For Branches Combined Financial Statements Highlights of The Chapter PDFCarlo VillanNo ratings yet

- Home Branch Accounting QuzzierDocument9 pagesHome Branch Accounting QuzzierYander Marl BautistaNo ratings yet

- Larsen Chapter 4 SummaryDocument2 pagesLarsen Chapter 4 SummaryMarina LaurenNo ratings yet

- Home Office Comprehensive DiscussionDocument8 pagesHome Office Comprehensive DiscussionGleamuel Hanz Joseph BacerraNo ratings yet

- Chapter 13 14 Afar PDF FreeDocument13 pagesChapter 13 14 Afar PDF FreeNiki HanNo ratings yet

- Accounting For Branches Combined Financial Statements: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/IrwinDocument43 pagesAccounting For Branches Combined Financial Statements: ©the Mcgraw Hill Companies, Inc. 2006 Mcgraw Hill/IrwinMarina LaurenNo ratings yet

- Punzalan Chapter 3Document5 pagesPunzalan Chapter 3calypso greyNo ratings yet

- 02-08-2022 CRC-ACE - AFAR - Week 06 - Home & Branch AccountingDocument10 pages02-08-2022 CRC-ACE - AFAR - Week 06 - Home & Branch Accountingjohn francisNo ratings yet

- Unit One: Branch AccountingDocument91 pagesUnit One: Branch AccountingawlachewNo ratings yet

- Branch AccountingDocument43 pagesBranch AccountingDK LohiaNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Accounting For Home Office and BranchDocument12 pagesAccounting For Home Office and BranchJohn Rey LabasanNo ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- Chapter 4 Branch Accounting@editedDocument18 pagesChapter 4 Branch Accounting@editedsamuel debebeNo ratings yet

- Chapter 04 Modern Advanced AccountingDocument31 pagesChapter 04 Modern Advanced AccountingPhoebe Lim81% (21)

- Branch AcctDocument20 pagesBranch Acctasnfkas100% (1)

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Advance Chapter OneDocument15 pagesAdvance Chapter OneAhmedNo ratings yet

- HOBA - General Procedures-DLSAUDocument25 pagesHOBA - General Procedures-DLSAUJasmine LimNo ratings yet

- Agency of SaleDocument30 pagesAgency of SaleYalew WondmnewNo ratings yet

- Chapter 4 Branch AccountingDocument17 pagesChapter 4 Branch Accountingkefyalew TNo ratings yet

- Chap 4 Adva Answers PDFDocument31 pagesChap 4 Adva Answers PDFRebecca Fady El-hajjNo ratings yet

- Home Office Chap. 2Document13 pagesHome Office Chap. 2Rei GaculaNo ratings yet

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- Lesson 4 Accounting For Home OfficeDocument8 pagesLesson 4 Accounting For Home OfficeheyheyNo ratings yet

- 545151Document10 pages545151Nayeon LimNo ratings yet

- 8 Branch AccountsDocument62 pages8 Branch AccountsAnilNo ratings yet

- Advance Chapter 4Document17 pagesAdvance Chapter 4abel habtamuNo ratings yet

- Home Office and Branch Accounting Testbankpdf PDF FreeDocument18 pagesHome Office and Branch Accounting Testbankpdf PDF Freekris mNo ratings yet

- Home Office and Branch AccountingDocument2 pagesHome Office and Branch AccountingPixie CanaveralNo ratings yet

- CMPC 221 Punzalan PDFDocument9 pagesCMPC 221 Punzalan PDFRialeeNo ratings yet

- Chapter 1 Branch Accounting LEcDocument16 pagesChapter 1 Branch Accounting LEcDawit AmahaNo ratings yet

- Home Office & Branch Lecture NotesDocument32 pagesHome Office & Branch Lecture NotesDrehfcieNo ratings yet

- ADVANCE Chapter 2Document8 pagesADVANCE Chapter 2Fasiko AsmaroNo ratings yet

- APrE04 01E Home-Office and BranchDocument6 pagesAPrE04 01E Home-Office and BranchMendoza Ron NixonNo ratings yet

- Chapter Two Accounting For Sales Agency and Principal Head Office and Branch 2.1. Distinction Between Sales Agency and BranchDocument19 pagesChapter Two Accounting For Sales Agency and Principal Head Office and Branch 2.1. Distinction Between Sales Agency and Branchliyneh mebrahituNo ratings yet

- Httpsstatic - Careers360.mobimediauploadsfroala EditorfilesAccounting For Branches Including Foreign Branches - PDF 2Document90 pagesHttpsstatic - Careers360.mobimediauploadsfroala EditorfilesAccounting For Branches Including Foreign Branches - PDF 2Dipen AdhikariNo ratings yet

- Afa-Ii CH-3Document38 pagesAfa-Ii CH-3Benol MekonnenNo ratings yet

- Chap 4Document43 pagesChap 4Ramez Ahmed100% (2)

- Adv ch-2Document16 pagesAdv ch-2Prof. Dr. Anbalagan ChinniahNo ratings yet

- CH 12 Branch AccountingDocument34 pagesCH 12 Branch AccountingKamel HassounNo ratings yet

- Accounting For Branch Operations SolutionsDocument62 pagesAccounting For Branch Operations SolutionsMUNIKA SULISTIAWATINo ratings yet

- Appendix 1A: The Basics of Branch/Division AccountingDocument10 pagesAppendix 1A: The Basics of Branch/Division AccountingdomingasNo ratings yet

- Home Office - Branch and Agency AccountingDocument30 pagesHome Office - Branch and Agency AccountingJenina Diaz82% (11)

- HO, B & A AcctgDocument15 pagesHO, B & A AcctgCarolina Fortez Dacanay71% (7)

- Chapter 9 Home Office, Branch and Agency Accounting-PROFE01Document5 pagesChapter 9 Home Office, Branch and Agency Accounting-PROFE01Steffany RoqueNo ratings yet

- Advance Ch2Document127 pagesAdvance Ch2zekariyas melleseNo ratings yet

- Advanced FA All Chapters Teaching MaterialDocument58 pagesAdvanced FA All Chapters Teaching MaterialKirub WerqeNo ratings yet

- Branch AccountDocument20 pagesBranch AccountGamer BoyNo ratings yet

- Home Office and Branch AccountingDocument1 pageHome Office and Branch AccountingSheena ClataNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- BUS COM NotesDocument15 pagesBUS COM NotesJanielle NaveNo ratings yet

- Advanced FA I&IIDocument99 pagesAdvanced FA I&IItame kibruNo ratings yet

- Home Office and Branch ReviewerDocument1 pageHome Office and Branch ReviewerSheena ClataNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Civil Service Exam - Philippine Constitution, General Information, Current EventsDocument13 pagesCivil Service Exam - Philippine Constitution, General Information, Current EventslordaiztrandNo ratings yet

- Paragraph Organization Civil Service Test ExamplesDocument5 pagesParagraph Organization Civil Service Test Exampleslordaiztrand100% (3)

- English Grammar and Correct Usage Sample TestsDocument10 pagesEnglish Grammar and Correct Usage Sample Testslordaiztrand100% (1)

- Cpa ReviewDocument31 pagesCpa ReviewlordaiztrandNo ratings yet

- Civil Service Exam Reviewer Clerical OperationsDocument9 pagesCivil Service Exam Reviewer Clerical OperationslordaiztrandNo ratings yet

- AP-5903 - PPE & IntangiblesDocument10 pagesAP-5903 - PPE & Intangiblesxxxxxxxxx100% (1)

- Correct SpellingDocument5 pagesCorrect SpellinglordaiztrandNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Chapter 2Document15 pagesChapter 2lordaiztrandNo ratings yet

- Civil Service Exam Reviewer For Analogy and LogicDocument8 pagesCivil Service Exam Reviewer For Analogy and LogiclordaiztrandNo ratings yet

- Bank ReconciliationDocument2 pagesBank ReconciliationlordaiztrandNo ratings yet

- Audit of PpeDocument35 pagesAudit of Ppelordaiztrand50% (2)

- Accounting Skills and KnowledgeDocument1 pageAccounting Skills and KnowledgelordaiztrandNo ratings yet

- Lordino B. Saligumba VDocument2 pagesLordino B. Saligumba VlordaiztrandNo ratings yet

- Welcome To The Kingdom of MenDocument1 pageWelcome To The Kingdom of MenlordaiztrandNo ratings yet

- TaxationDocument33 pagesTaxationlordaiztrand100% (1)

- Banks Start WarsDocument21 pagesBanks Start WarsShochetaaNo ratings yet

- 35-Principles of Accounting I WorksheetDocument6 pages35-Principles of Accounting I WorksheeteyoyoNo ratings yet

- E0027 Assets and Liabilities Management HDFCDocument48 pagesE0027 Assets and Liabilities Management HDFCwebstdsnrNo ratings yet

- ADIB Bank - AEDDocument4 pagesADIB Bank - AEDTehseenNo ratings yet

- Translate Into Vienamese What Is A Bookkeeping Journal? What Is A Daybook?Document4 pagesTranslate Into Vienamese What Is A Bookkeeping Journal? What Is A Daybook?Minh HoàngNo ratings yet

- Revenue Recognition Ifrs 15 ModelDocument4 pagesRevenue Recognition Ifrs 15 ModelAbdulhameed Babalola0% (1)

- Mba 3 SemDocument3 pagesMba 3 SemyashwanttrivediNo ratings yet

- Essay - Role of RBI in Controlling InflationDocument1 pageEssay - Role of RBI in Controlling InflationPrincy Verma100% (2)

- Fae3e SM ch04 060914Document23 pagesFae3e SM ch04 060914JarkeeNo ratings yet

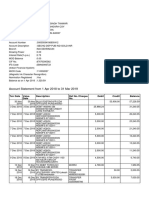

- Account Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Apr 2018 To 31 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhishek JainNo ratings yet

- Way2Wealth Daily Trading Bites Apr1Document3 pagesWay2Wealth Daily Trading Bites Apr1Srikanth RamakrishnaNo ratings yet

- Quiz #3Document4 pagesQuiz #3Jenny BernardinoNo ratings yet

- Financial Analyst in Philadelphia PA Resume Brian MurphyDocument2 pagesFinancial Analyst in Philadelphia PA Resume Brian MurphyBrianMurphyNo ratings yet

- Fiona ResumeDocument1 pageFiona Resumeapi-571217132No ratings yet

- BillDocument1 pageBillRavindrababu BanothuNo ratings yet

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2018/FAR270Document4 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/OCT 2018/FAR270NUR INTAN AZZAHANA BALQIS MOHD JEFRINo ratings yet

- AWN TheBRICSAreReadyDocument21 pagesAWN TheBRICSAreReadynorbert.ryekerNo ratings yet

- Assignment Front Sheet Course Code NoDocument3 pagesAssignment Front Sheet Course Code NoAbd JabbarNo ratings yet

- Damodaran KDDocument65 pagesDamodaran KDEduardo El Khouri BuzatoNo ratings yet

- Mayoral Dispute Resolved: Beginning A New YearDocument16 pagesMayoral Dispute Resolved: Beginning A New YearelauwitNo ratings yet

- Schedule of Charges For MTB Credit CardsDocument4 pagesSchedule of Charges For MTB Credit CardsRana BabuNo ratings yet

- Tugas Essay Boy SatyaDocument4 pagesTugas Essay Boy SatyaBoy satyaNo ratings yet

- 27 Fil EstateDocument1 page27 Fil EstateDonvidachiye Liwag CenaNo ratings yet

- Questionnaire: Analysis On Non Performing AssetsDocument4 pagesQuestionnaire: Analysis On Non Performing AssetsSimar DhillonNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsRahul PuriNo ratings yet

- PartnershipDocument5 pagesPartnershipjohnNo ratings yet

- Greystar PressKit Investment 3Q2018 010419Document2 pagesGreystar PressKit Investment 3Q2018 010419David BriggsNo ratings yet